April 3, 2023

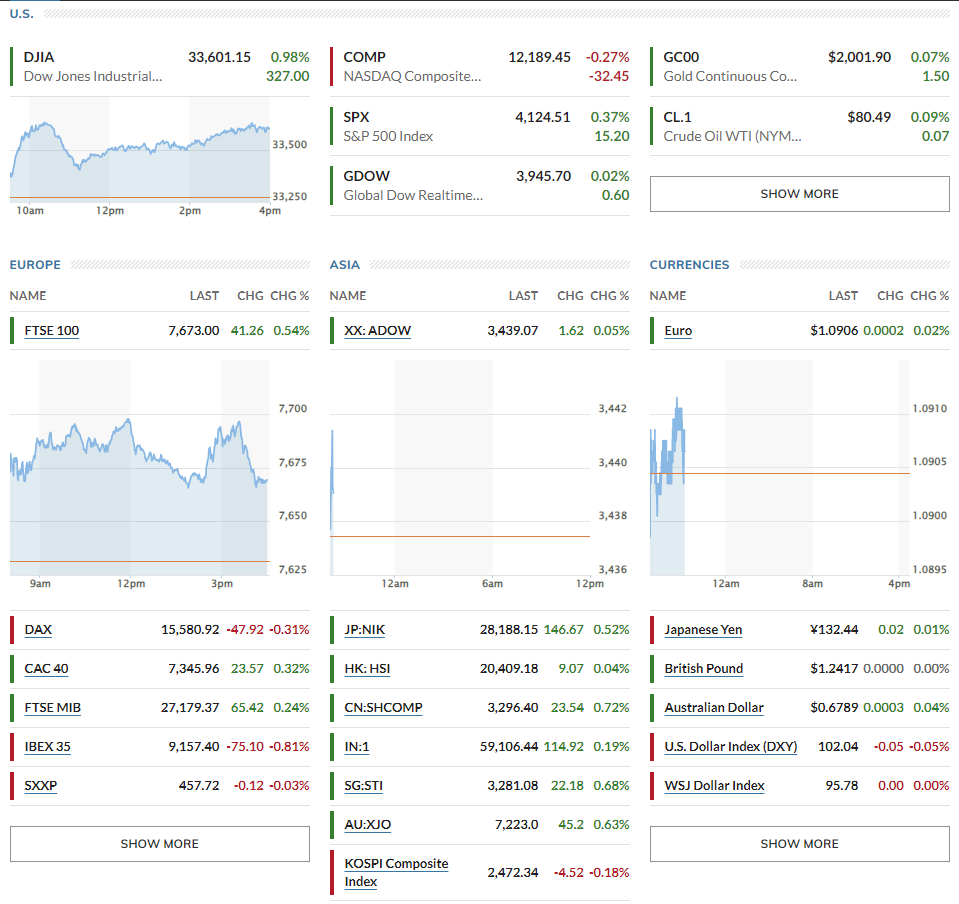

▶US Stocks were mixed = Dow +0.98%, Nasdaq -0.27%, S&P500 +0.37% // European stocks were mixed: London’s FTSE 100 +0.54%, Germany’s Dax -0.31%, Paris' CAC 40 +0.32%, Stoxx 600 -0.03% // Asian stocks were up: Japan’s Topix +0.18%, Hong Kong’s Hang Seng index +0.04%, China’s CSI 300 +0.72%, Australia’s S&P/ASX 200 +0.13%, and South Korea’s Kospi +0.60%.

▶US rates up= 10-year U.S. Treasury note 3.428% (+1.0 bps), Germany 10Y at 2.254% (-4 bps), Italy 10Y at 4.094% (-1.3 bps), UK 10Y at 3.432% (-6 bps), Japan 10Y at 0.376% (+0.5 bps)

▶Oil prices up= $80.61 per barrel of WTI (+0.22%), Brent crude +0.15% $85.04 // USD -0.05% at 102.04// Gold +0.01% at $2,000.60

*Key points

1. OPEC's surprising production cut

2. US Macroeconomy

3. Global Markets snapshots

1. OPEC's surprising production cut

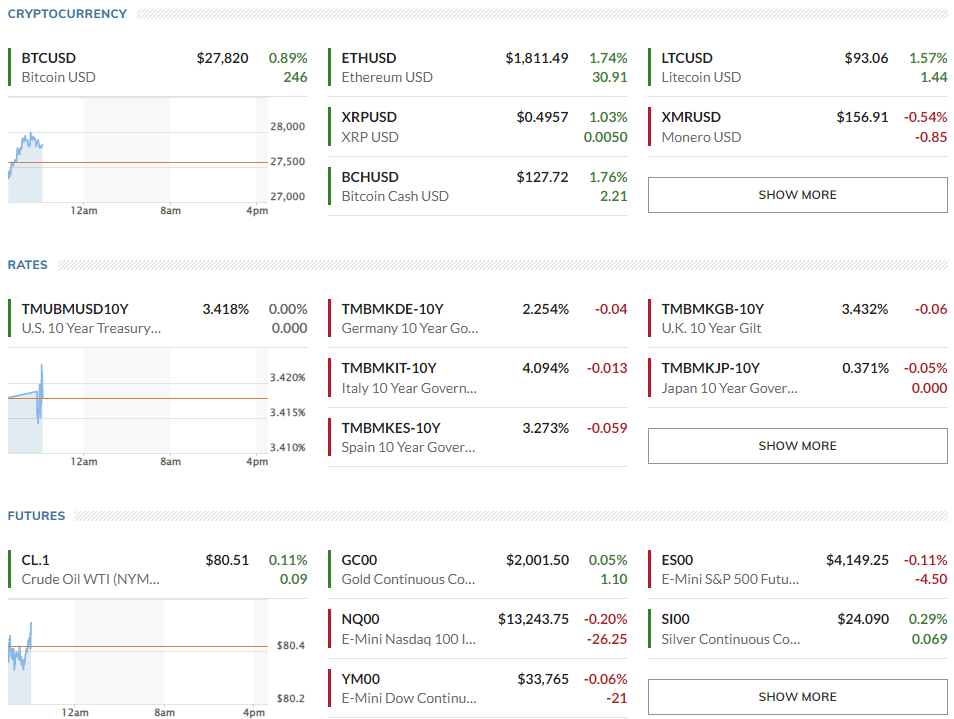

🏈Bottom line: OPEC announced a surprise production cut: nine countries, including Saudi Arabia by 500,000 barrels and Russia by 500,000 barrels, said they would cut 1.66 million barrels from May.

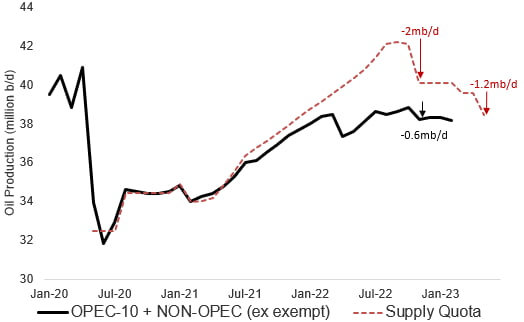

Russia has already cut 500,000 barrels so far this year in response to Western sanctions, so they're actually cutting 1.16 million barrels - just over 1% of global oil demand. (RBC Capital Markets estimates that the actual cut could be the opposite, 700,000 barrels, given what these countries have been unable to produce.) It's another cut seven months after last October's 2 million barrel cut.

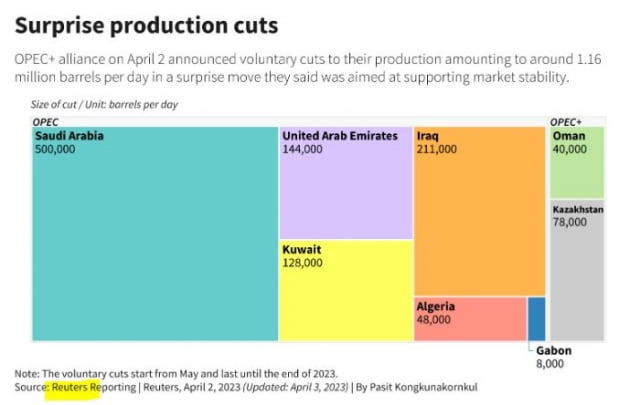

- Market reaction: International oil prices reacted by surging as much as 8%. Eventually, West Texas Intermediate (WTI) crude soared 6% to $80.24 per barrel from the previous trading day, and Brent crude closed at $84.45 per barrel, up 5.7%. These were the biggest gains in more than a year for WTI since April 12 last year and for Brent since March 21 last year.

UBS predicts that Brent crude oil will reach $100 per barrel by June for three reasons: 1) the recent banking unrest that caused a sharp fall in oil prices has subsided; 2) China's oil imports are expected to increase, possibly exceeding the government's 5% growth target; and 3) Russia's oil production will be limited. Additionally, the upcoming end of the U.S. vacation season in August, which coincides with the end of the driving season, will further tighten the oil market, potentially pushing Brent crude oil prices up to $110 per barrel this summer.

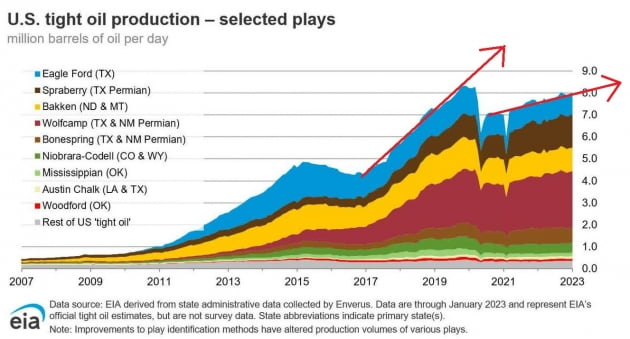

Saudi Arabia's recent announcement to support oil prices has strengthened the claim that prices may reach $100 per barrel. The country is capable of implementing surprise production cuts at any time if oil prices drop. This is crucial for Saudi Arabia, as it is currently undertaking large-scale projects, such as Neom City, led by Crown Prince Mohammed bin Salman. Goldman Sachs has stated that strategic petroleum releases by the US and France, along with the announcement that the US will not refill its strategic petroleum reserve in fiscal year 2023, likely triggered the production cuts. Unlike during the peak of the shale revolution, there is less concern now that OPEC will lose market share due to slower shale production increases.

2. US Macroeconomy

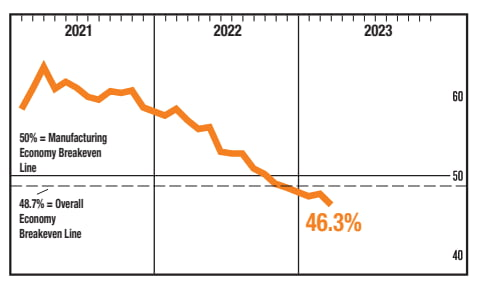

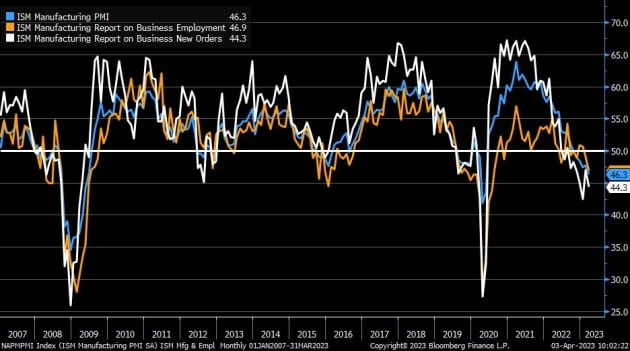

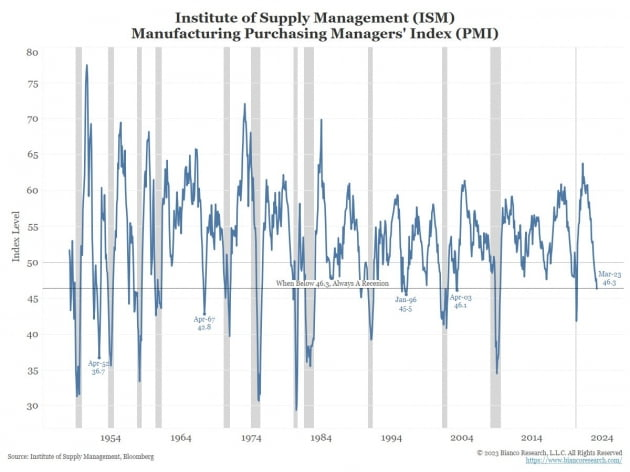

🏈Bottom line: The PMI for March was 46.3, much lower than the previous month (47.7) and lower than Wall Street's expectations (47.3). It's also the lowest level since May 2020, when the pandemic began. Excluding the pandemic, it's about where it was in 2009 during the global financial crisis.

Note) The PMI is used to measure economic expansion or contraction, and a reading of 50 indicates no expansion or contraction. Manufacturing has been in contraction for four consecutive months, with all sub-indices falling below 50. This hasn't happened since 2009.

All the sub-indices have fallen below 50. This is the first time since 2009. The new orders index fell to 44.3, while the production index improved to 47.8, better than the previous month, but still in contraction. Prices paid fell back to 49.2, worse than the previous month (51.3). The employment index also contracted, coming in at 46.9.

According to Bianchi Research, since the PMI survey began in 1946, there have been 16 times when the index has fallen below 46.3. And 12 of those times, the economy has fallen into recession, meaning there is a 75% chance of a recession at this level.

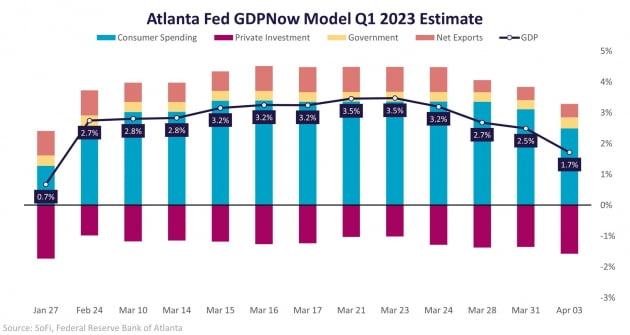

The GDPNow of the Federal Reserve Bank of Atlanta lowered its estimate for Q1 GDP growth from 2.5% to 1.7%. The market reacted with lower interest rates and a weaker dollar. Stocks remained flat, but important economic data, such as the PMIs for the service sector and the employment report, will be released later in the week.

3. Global Markets snapshots