April 4, 2023

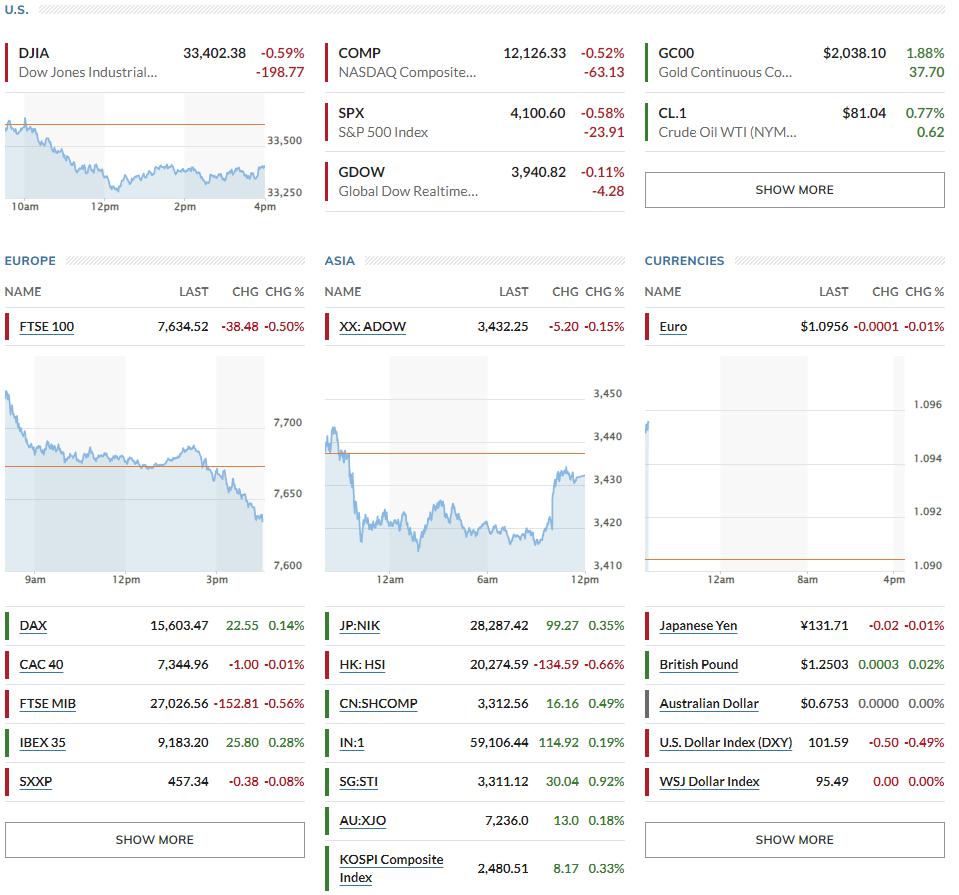

▶US Stocks were down = Dow -0.59%, Nasdaq -0.52%, S&P500 -0.58% // European stocks were mixed: London’s FTSE 100 -0.50%, Germany’s Dax +0.14%, Paris' CAC 40 -0.01%, Stoxx 600 -0.08% // Asian stocks were mixed: Japan’s Topix +0.35%, Hong Kong’s Hang Seng index -0.66%, China’s CSI 300 +0.49%, Australia’s S&P/ASX 200 +0.18%, and South Korea’s Kospi +0.33%.

▶US rates up= 10-year U.S. Treasury note 3.342% (- bps), Germany 10Y at 2.252% (-2 bps), Italy 10Y at 4.126% (+3.2 bps), UK 10Y at 3.438% (+0.6 bps), Japan 10Y at 0.416% (- bps)

▶Oil prices up= $81.04 per barrel of WTI (+0.77%), Brent crude +0.32% $85.266 // USD -0.5% at 101.58// Gold +1.88% at $2,028.10

*Key points

1. Slowing inflation pressures and Australia + Canada's rate hike pauses

2. Jamie Dimon's Annual Letter

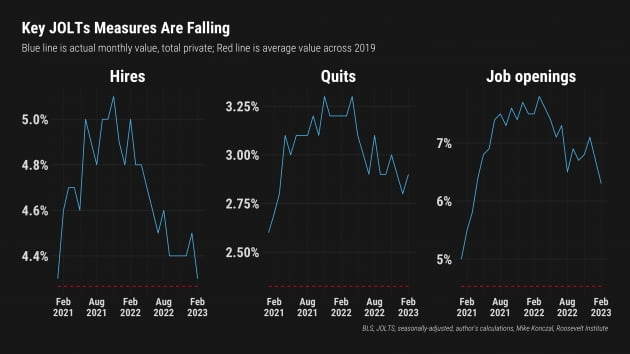

3. JOLTS: Relatively weak US jobs data that could ease pressure on the Federal Reserve to continue lifting interest rates

4. ESG News

5. Global Markets snapshots

1. Slowing inflation pressures and Australia + Canada's rate hike pauses

🏈Bottom line: The Reserve Bank of Australia (RBA) decided to keep its benchmark interest rate unchanged at 3.6%, following Canada's rate hike pause. Eurozone's PPI also fell 0.5%, showing the slowing inflation pressure. Investors expect the Fed to follow suit - with the possibility of the last rate hike in May.

This decision marked the end of a series of 10 rate hikes that started in May last year. This move came shortly after Canada, another member of the G7, stopped raising rates for the first time last month. RBA Governor Philip Lowe stated that he expects inflation to ease in the coming months. According to analyst Oh Anda, the decision to hold rates steady was widely expected, but Lowe's comments were even more dovish than anticipated, indicating a weakening willingness for further tightening of monetary policy.

According to a survey by the European Central Bank (ECB), expected consumer inflation has decreased, and the eurozone's producer price index (PPI) fell 0.5% from the previous month in February.

Wall Street predicts that the Federal Reserve's (Fed) future path will follow Canada and Australia, with the possibility of the last rate hike in May's Federal Open Market Committee (FOMC) meeting.

- Market reaction: Although St. Louis Fed President James Bullard stated that the US economy is strong and rates should be raised, short-term interest rates fell in the New York bond market. The six-month yield on US Treasury bills closely tied to the benchmark interest rate hit its lowest point since November last year, and investors now expect a rate cut within the next six months.

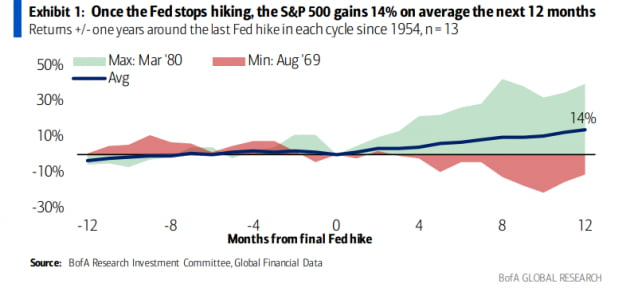

- According to Bank of America analysis, after periods of tightening cycles since 1954, if the Fed stops raising interest rates, the S&P 500 index has historically risen by 14% in the following 12 months.

2. Jamie Dimon's Annual Letter

🏈Bottom line: In his 43-page annual message, JP Morgan's CEO Jamie Dimon noted the current banking crisis is not yet over and will have repercussions for years to come. Of course, this message dragged the banking stock performance down.

He noted the situation is causing fear in the markets and leading banks and lenders to adopt a more conservative stance, resulting in a tightening of financial conditions. The likelihood of an economic slowdown in the market is increasing. He also added that the uncertainty of the banking system is uncertain as to when it will end. However, he drew a line when it comes to the possibility that this banking confusion could lead to a global financial crisis like the one in 2008, stating that there are far fewer financial firms involved and fewer problems to be solved compared to 2008, when numerous major financial institutions were entangled in subprime mortgages.

3. JOLTS: Relatively weak US jobs data that could ease pressure on the Federal Reserve to continue lifting interest rates

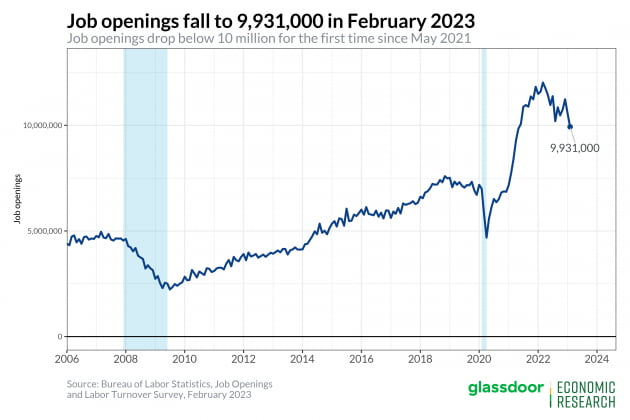

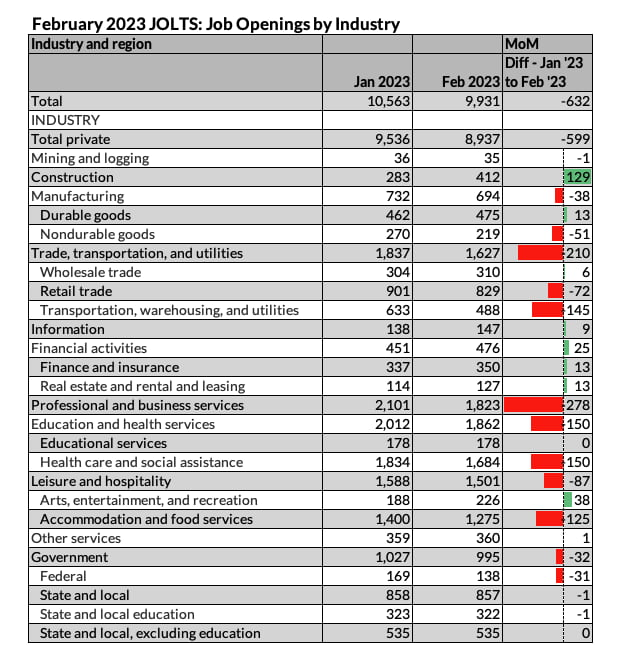

🏈Bottom line: The Job Openings and Labor Turnover Survey (JOLTS) report by the Department of Labor showed the number of job openings fell below 10 million in February, to 9.93 million. This represents a decrease of about 632,000 from the previous month (10.56 million) and is lower than Wall Street's estimate of 10.5 million. It is also the lowest level since May 2021.

Investors are waiting for the ISM's March Services PMI release which will come out tomorrow. The March Employment Report will be released on Friday, a day on which the NYSE will be closed for "Good Friday." This could potentially cause traders to close out their positions after analyzing Wednesday's ISM Services PMI to have a significant influence. So, the March Services PMI will be more important than usual.

Re: JOLTS, revisions to previous data indicate a decline of 1.3 million job openings. As a result, the number of job openings per unemployed person fell from 1.9 in January to 1.67 in February, the lowest level since November 2021. The decline in job openings was observed in industries such as professional and business services, education and health, trade, transportation and utilities.

When looking closely at the JOLTS data, it doesn't necessarily indicate a one-sided economic downturn. The number of job openings per unemployed person fell to 1.67, which is still higher than pre-pandemic levels of around 1.2. Additionally, the number of job openings in February was still high at 9.93 million. Hires remained stable at 6.2 million, and voluntary quits increased by 146,000 to 4 million, indicating confidence in the labor market. Meanwhile, layoffs decreased by 215,000 to 1.5 million. The Wall Street Journal suggests that job losses could be a welcome signal for the US economy, as employers are rehiring laid-off workers and the decrease in job openings is helping to cool the labor market without increasing unemployment.

4. ESG News

🏈Bottom line: The GIIN published a new guidance for achieving positive impact in the listed equities. It was developed with input from over 100 investors and based on the GIIN's Core Characteristics of Impact Investing, and the guidance provides a framework for asset owners and managers seeking to deliver intentional and measurable impacts in listed equities. You can Download the Guidance for Pursuing Impact in Listed Equities.

Summary:

- The Theory of Change is a framework used by impact investors to articulate their impact goals and how their investments will contribute towards progress on those goals.

- It helps guide investors on which companies to invest in, how to engage with them, and what indicators to assess impact.

- A Theory of Change for impact investing in listed equities should include the following components:

=> Specific problem(s) being targeted and change desired

=> Beneficiaries who would benefit from the investment

=> Changes or contributions expected from investee companies

=> How the investor will contribute to that change

=> Non-financial targets that will play a material role in equity selection and evaluation of performance

- Developing a Theory of Change for listed equities portfolios has implications for investment strategy, including: Size (market capitalization) / Diversification

Objectives and returns / Specificity of beneficiaries / Shareholder rights (voting and engagement)

5. Global Markets snapshots

![Obsidian Brief] When Money Becomes Software: AI, Stablecoins & Bitcoin — Implications for Sustainable and Impact Investing](/content/images/size/w720/2025/12/Gemini_Generated_Image_dppem0dppem0dppe.png)

![Leadership] AI Is Changing Everything — How a CEO Managing $1.6 Trillion Stays Ahead, ft. Jenny Johnson from Franklin Templeton](/content/images/size/w720/2025/12/Screenshot-2025-12-03-060128.png)

![AI] The Future of Work, Robotics & AI Infrastructure (Elon's bold predictions: work will be optional & currency could be irrelevant)](/content/images/size/w720/2025/11/Screenshot-2025-11-22-074621.png)