April 5, 2023

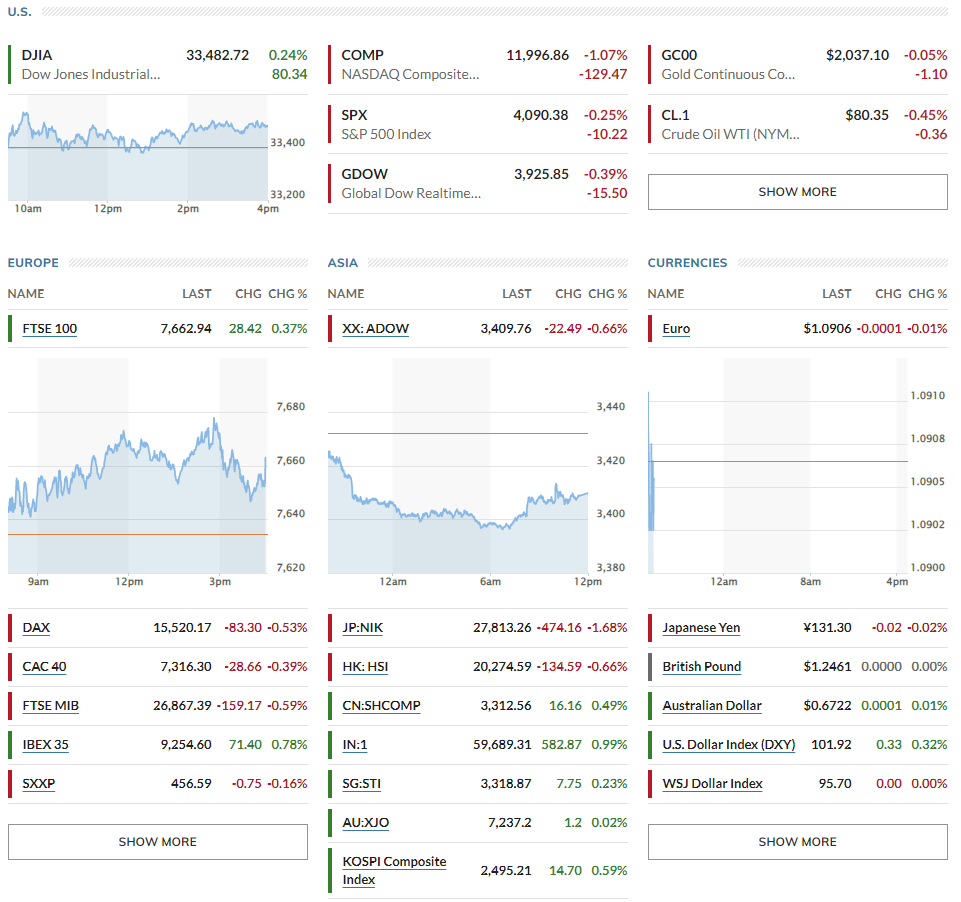

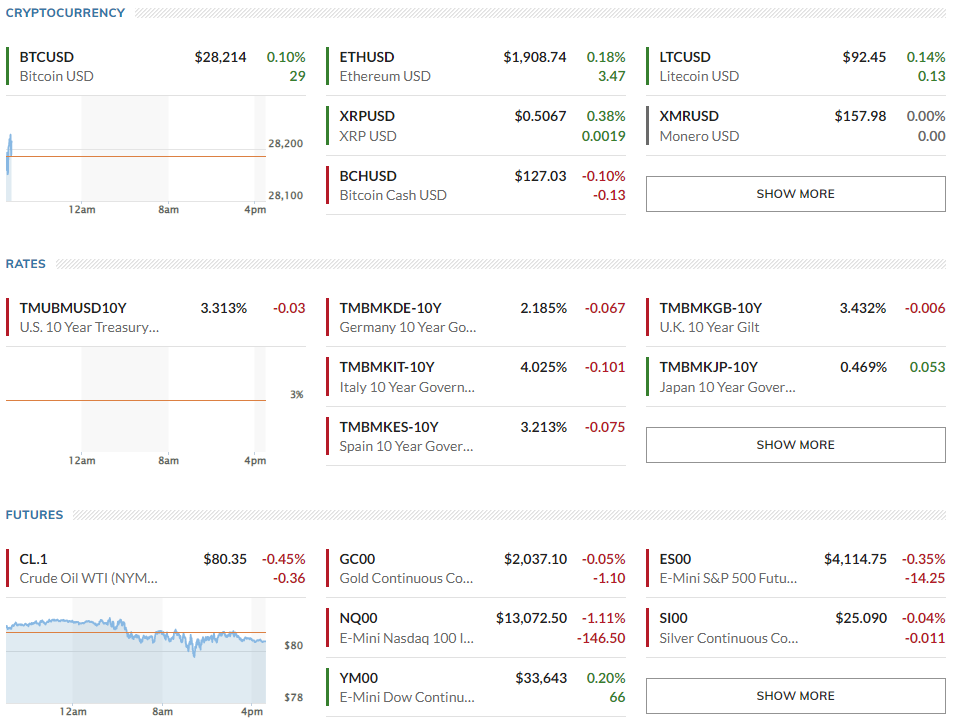

▶US Stocks were mixed= Dow +0.24%, Nasdaq -1.07%, S&P500 -0.25% // European stocks were mixed: London’s FTSE 100 +0.37%, Germany’s Dax -0.53%, Paris' CAC 40 -0.39%, Stoxx 600 -0.16% // Asian stocks were mixed: Japan’s Topix -1.68%, Hong Kong’s Hang Seng index -0.66%, China’s CSI 300 +0.49%, Australia’s S&P/ASX 200 +0.02%, and South Korea’s Kospi +0.59%.

▶US rates = 10-year U.S. Treasury note 3.313% (- 3bps), Germany 10Y at 2.185% (-6.7 bps), Italy 10Y at 4.025% (-10.1 bps), UK 10Y at 3.432% (-0.6 bps), Japan 10Y at 0.469% (+5.3 bps)

▶Oil prices = $80.35 per barrel of WTI (-0.45%), Brent crude -0.14% $81.36 // USD +0.31% at 101.91// Gold -0.05% at $2,037.10

*Key points

1. Is the US economy slowing? Macroeconomic data releases

2. DM Central Banks Are Turning Hawkish

3. Fed's Hawk Lorreta Mester (no FOMC voting power) Spoke but Markets shrugged her off, Betting on a Recession

4. Recession Trades & De-Dollarization Risk?

5. ESG News

6. Global Markets snapshots

The long waited series of economic indicators came out today in New York. Investors had been waiting anxiously as concerns about an economic slowdown grew.

1. Is the US economy slowing? Macroeconomic data releases

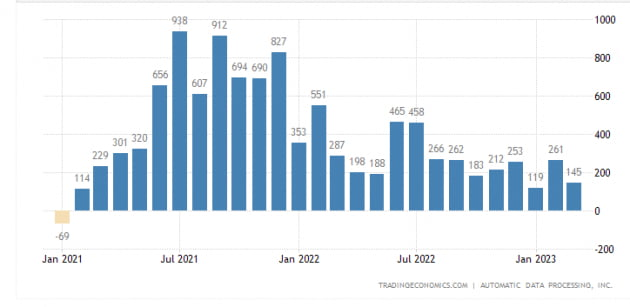

1) March Private Payroll → Significantly below expectations

🏈Bottom line: Another economy slowing sign. The March private payroll numbers from the employment agency ADP came in below expectations: only 145,000 jobs were added, well below the 210,000 forecast. Wage growth also slowed to 6.9% this month from 7.2% in the previous month, and the rate for job leavers fell to 14.2% from 14.4%.

It was also down significantly from February's gain of 261,000. ADP economist Nella Richardson noted the March data is one more sign that the economy is slowing. Businesses are taking a step back from the strong hiring they've been doing, and wage growth is slowing a bit.

- Market reaction: After the ADP data was released, the markets went wild. In the New York bond market, Treasury rates, which had risen slightly before the release, plunged sharply. The 10-year Treasury rate broke the 3.3% mark, falling from the 3.35% level to 3.29% momentarily. The 2-year rate also dropped from 3.82% to 3.75%. In fact, Treasury rates have rarely reacted so severely to ADP data in the past. That's because the ADP data usually diverges from the Labor Department's official employment report, which is released two days later, and is, therefore, less reliable. But today was different. Investors have become very sensitive this week after a string of bad economic data.

Investors have shifted their focus away from the banking turmoil in March and back to consumption and the risk of a recession. Indeed, after the ISM March manufacturing purchasing managers' index (PMI) dropped to 46.3 on Monday, and yesterday's Labor Department's Job Openings and Labor Turnover Report (JOLTS) showed the number of job openings dipping below 10 million for the first time in nearly two years, investors are being forced to contemplate an ominous thought: a recession. Add to that the ongoing banking turmoil throughout March, which has increased the likelihood of lending curtailments, OPEC+'s sudden announcement of production cuts last weekend, and worries about a slowdown have only increased.

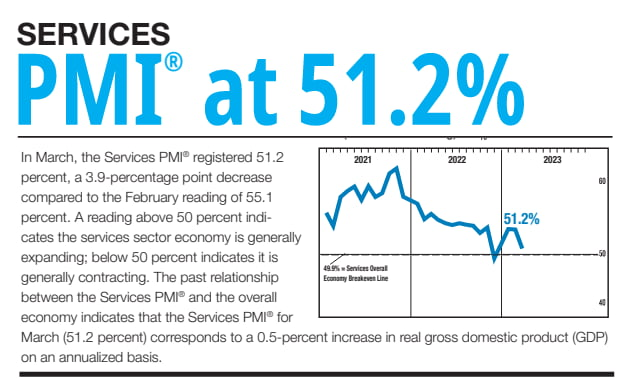

2) Service industry →Closely avoided contraction

🏈Bottom line: The ISM Services PMI for March came in at 51.2, above 50 and still in expansionary territory, but well below analysts' expectations and down from 55.1 in February.

The services industry accounts for 70% of the US economy. Luckily the data came above 50, but growth in the service sector continues to be subdued due to a slowdown in new order growth and mixed hiring conditions across industries.

- Deep-dive: The sub-indices were also bad: new orders fell from 62.6 to 52.2 in February, production from 56.3 to 55.4, employment from 54.0 to 51.3, prices paid from 65.6 to 59.5, and order backlog from 52.8 to 48.5. Employment narrowly avoided contraction (below 50). The good news is that prices paid fell below 60 for the first time since late 2020. Services inflation may also be slowing, but services prices are sensitive to oil prices. If oil prices rise due to OPEC+ production cuts, the disinflationary effects of a slowing economy could be offset. Oil prices remained flat today, even as fears of a recession grew. The price of West Texas Intermediate (WTI) crude oil settled at $80.61 per barrel, down 0.12% from the previous session.

- Market reaction: Interest rates took another dip after the ISM services PMI came out, and stocks also turned to the downside.

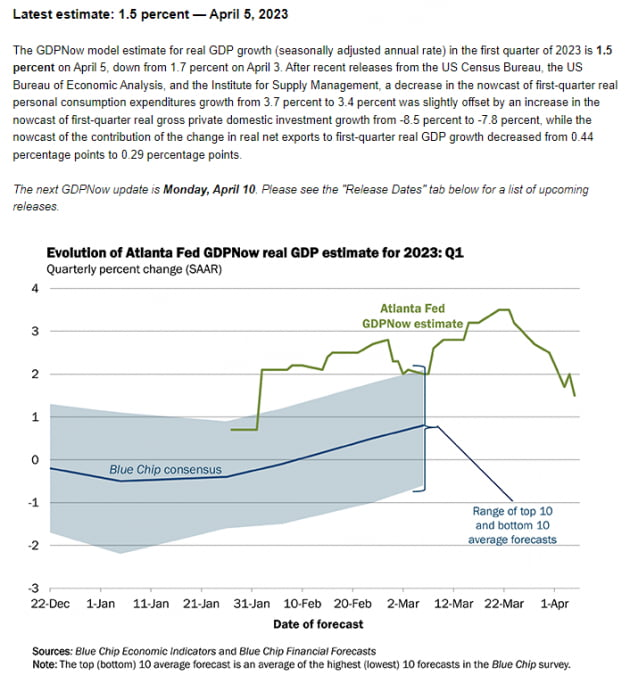

3) Fewer exports, fewer mortgage applications

🏈Bottom line: There were two more economic data releases, and they weren't pretty either. The Commerce Department reported that the trade balance (goods + services) deficit in February was $70.5 billion, up $1.9 billion (2.7%) from the previous month. It was the third consecutive month of widening and the largest deficit in four months. Exports in February were $251.2 billion, down $6.9 billion from January, while imports were $321.7 billion, down $5.0 billion. The decline in exports is a negative for the U.S. first-quarter gross domestic product (GDP) growth rate.

The Mortgage Bankers Association's (MBA) weekly mortgage application index fell 4.1%. Purchase applications were down 4% and refinance applications were down 5%. Despite a 5 basis point drop in mortgage rates during the period, the number of applications declined.

In the wake of these data, GDPNow's estimate of first-quarter growth, compiled by the Federal Reserve Bank of Atlanta, fell to 1.5%. Ten days earlier, it was at 3.2%. Estimates have been falling as the economy continues to slow.

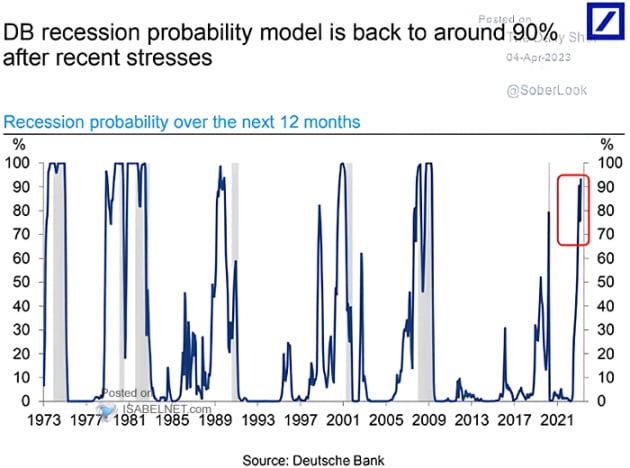

- DB: now estimating a 90% probability of a recession in 12 months.

2. DM Central Banks Are Turning Hawkish

🏈Bottom line: In fact, hawkishness from central banks seemed to be in vogue today. The Reserve Bank of New Zealand (RBNZ) shocked markets by raising its benchmark interest rate by 50 basis points, against expectations of a 25 basis point hike. The hawkish decision was made on the basis of high consumer price inflation (CPI) of 7.2% in the fourth quarter, despite GDP contracting by 0.6% in the fourth quarter of last year. The New Zealand dollar rose by more than 1% in the immediate aftermath of the announcement, but quickly turned lower, as market bets increased that a recession was coming. "Just because we've stopped raising rates doesn't mean we're done," said Reserve Bank of Australia Governor Philip Lowe, who yesterday signaled that further tightening was unlikely.

Elsewhere in Japan, former Bank of Japan (BOJ) economist Kazuo Moma said that "falling global bond yields have created favorable conditions for the BOJ to scrap yield curve control (YCC) as early as this month," pushing rates and the yen higher.

3. Fed's Hawk Lorreta Mester (no FOMC voting power) Spoke but Markets shrugged her off, Betting on a Recession

🏈Bottom line: Against this backdrop, Fed "hawk" Loretta Mester, president of the Federal Reserve Bank of Cleveland, said in her Bloomberg interview today that to bring inflation down to a stable 2%, the Fed will need to raise the key rate to above 5% this year and keep it there for some time. She added that she doesn't expect to cut the key rate this year. Mester also said she was "very comfortable" with the 25 basis point hike in March despite the banking turmoil. The response from the Fed and others is stabilizing. She also added it was too early to know if the Fed would need to raise its benchmark rate at its next policy meeting in early May.

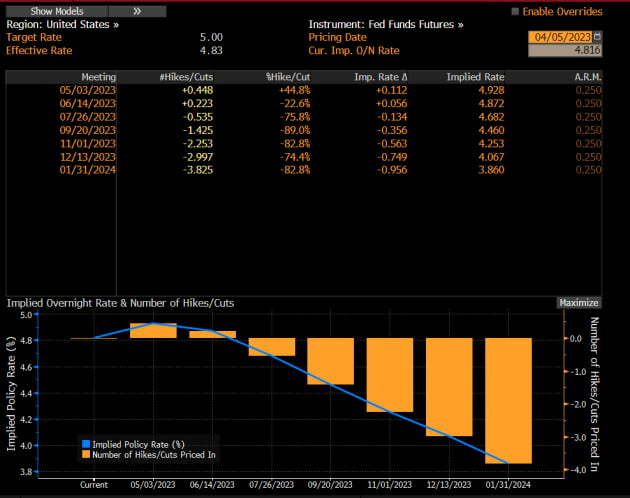

- Market Reaction: The market shrugged off Mester's words. Investors watching the data have begun to price in four rate cuts later this year. The Chicago Board of Trade's FedWatch market is keeping bets at the level of a 6: 25 basis point hike by the Federal Open Market Committee (FOMC) in May. That means they could hike in May, but they're betting that they'll start cutting rates at the July meeting, bringing the fed funds rate down to 4 to 4.25% by the end of the year. That's a level that would require four cuts if they hiked 25 basis points in May. Mester isn't even a voting member of the FOMC this year.

4. Recession Trades & De-Dollarization Risk?

🏈Bottom line: the dominant feature of the week, and today, was the "recession trade": instead of tech stocks (-1.3%), which have been leading the market so far, and defensive stocks like industrials (-1.3%) and discretionary (-2.0%), which gained last week, we're seeing defensive stocks like utilities (+2.6%), health care (+1.7%), and consumer staples (+0.6%). Among tech stocks, shares of Nvidia are down 2.08%. Alphabet's disclosure that its semiconductors are faster and use less power than Nvidia's A100 chips in AI training was a factor. Also negative was news that insiders at Apple (-1.13%), including CEO Tim Cook, and Tesla (-3.67%), including its CFO, were selling shares.

As the economy falters, the price of the safe haven asset gold remains strong. It rose to $2049 an ounce intraday, close to the all-time high of $2075 set in August 2022. Gold's recent rally has been fueled by expectations that central banks such as the Fed will soon stop tightening, adding that holding gold becomes more attractive as interest rates fall. Citi recently offered $2300 as a price target for gold, while Bank of America said it expects it to reach $2200 by the fourth quarter.

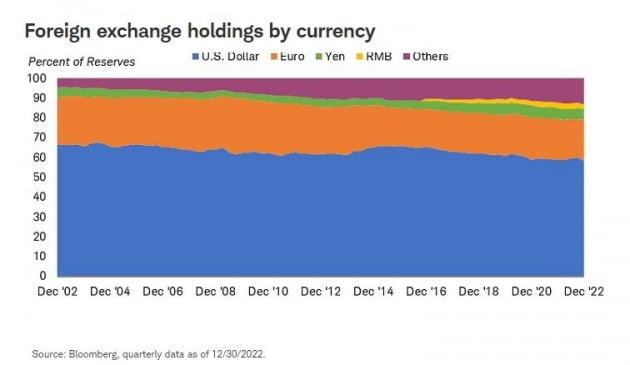

Meanwhile, the dollar, also considered a safe haven, has continued to weaken. According to the Federal Reserve Bank of Boston, when a recession hits the US, global risk aversion rises, causing investors to hold on to dollar-denominated assets. This usually strengthens the dollar, but it's fallen more than 3 percent in the past month, which some blame on the fact that the petrodollar has been called into question as China, Saudi Arabia, Russia, and others have opted to trade in yuan, euros, and other currencies instead of the greenback. The reason the dollar has become the world's reserve currency is that it's used to buy oil (the petrodollar), and that's faltering.

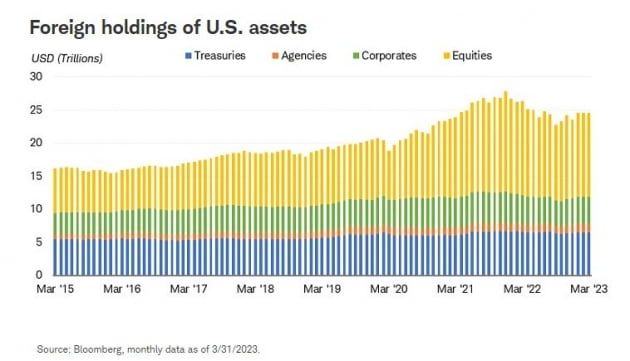

- Kathy Jones, a fixed income strategist at Charles Schwab: the idea of de-dollarization, which means the removal of the dollar from global trade and investment, is being exaggerated. Even though there may be some currency diversification, de-dollarization is not possible. She mentioned that the dollar is still near 10-year highs and foreign investors' holdings of U.S. Treasuries have increased over the past few years, indicating strong demand. Furthermore, there are no viable alternatives to the dollar as a reserve currency. While the dollar may weaken further in 2023, it does not signal a significant change in the global monetary order.

Besides, the trade volume between China, Russia, and the Middle East is increasing, but it still only makes up 2% of global trade. Most trade continues to occur between countries that are allied with the United States and is denominated in dollars. Additionally, China, Russia, and the Middle East have large current account surpluses, which is a disadvantage in becoming a reserve currency as such a currency needs to be able to run current account deficits due to high global demand. For a currency to become a reserve currency, it must be easily and cheaply used around the world, and there is currently no viable alternative to the dollar. Even if a currency with these characteristics existed, it would have to overcome the strong network effects that support the dollar's global dominance. Anyways, this is something we should continue to monitor in this new post-post-cold-war era with the rising rivalry between the US and China.

5. ESG News

Carbon dioxide removal is not a current climate solution – we need to change the narrative

🏈Bottom line: David Ho, a professor of oceanography at the University of Hawaii at Manoa, argues that deploying carbon dioxide removal (CDR) technologies to remove CO2 from the atmosphere is pointless until society has almost completely eliminated its polluting activities.

Although he supports the need to develop CO2 removal methods, he believes that humanity has never removed an atmospheric pollutant at a global, continental, or even regional scale, and that we have only ever shut down the source and let nature take care of clearing it up. He warns that we must be prepared for CDR to be a failure and rely on the environment to stabilize atmospheric CO2 over thousands of years, which reinforces the argument for rapid decarbonization.

Munich Re quits Net-Zero Insurance Alliance

🏈Bottom line: Munich Re, a global reinsurer, has withdrawn from the Net-Zero Insurance Alliance (NZIA), citing antitrust risks as limiting the scope of its decarbonisation goals. The NZIA is a group of 30 insurers and reinsurers who aim to transition their underwriting portfolios to net-zero greenhouse gas emissions by 2050. Munich Re CEO, Joachim Wenning, explained that he views the Alliance as restrictive to the company's climate targets and that it is more effective to pursue its climate ambition to reduce global warming individually. Munich Re assured that it would stick to its climate goals outside of the NZIA. This includes reducing greenhouse gas emissions related to its investment portfolio by 29% by the end of 2025, and successively bringing them down to net-zero by 2050. The company plans to reduce thermal-coal-related exposure in its direct and facultative insurance business by 35% group-wide by 2025, before eliminating it altogether by 2040. It also plans to not insure projects involving new oil and gas fields or new midstream oil infrastructure as of April 2023.

6. Global Markets snapshots

![Obsidian Memo] 1929 — Lessons from the 1929 Crash & A Reminder That Craft Still Wins (ft. Andrew Ross Sorkin's London Talk)](/content/images/size/w720/2026/01/WhatsApp-Image-2026-01-18-at-11.51.11-1.jpeg)

![Leadership] FII - the Board of Changemakers Summary: Geo-Economics 2025: AI Power, Tokenized Finance, and the New Capital Map](/content/images/size/w720/2025/10/Screenshot-2025-10-31-130048.png)

![Leadership] The new face of wealth: The rise of the female investor (ft. McKinsey Report)](https://images.unsplash.com/photo-1618662062577-1e1483c7b6c4?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDN8fGNhcGl0YWx8ZW58MHx8fHwxNzU5MzQ4ODIwfDA&ixlib=rb-4.1.0&q=80&w=720)

Comments ()