April 6, 2023

Some announcements:

** Markets are closed tomorrow in the US and until next monday in Europe in light of the Easter holiday. Hope you guys have a relaxing week whether you observe the tradition or not and wherever you are in the world! You can also check out my other post re: Easter traditions around the world. **

*** Now that the banking crisis has subsided, from now on, I will change the format of the market updates to be weekly along with ESG news and insights. As always, appreciate your feedback and suggestions! :) ***

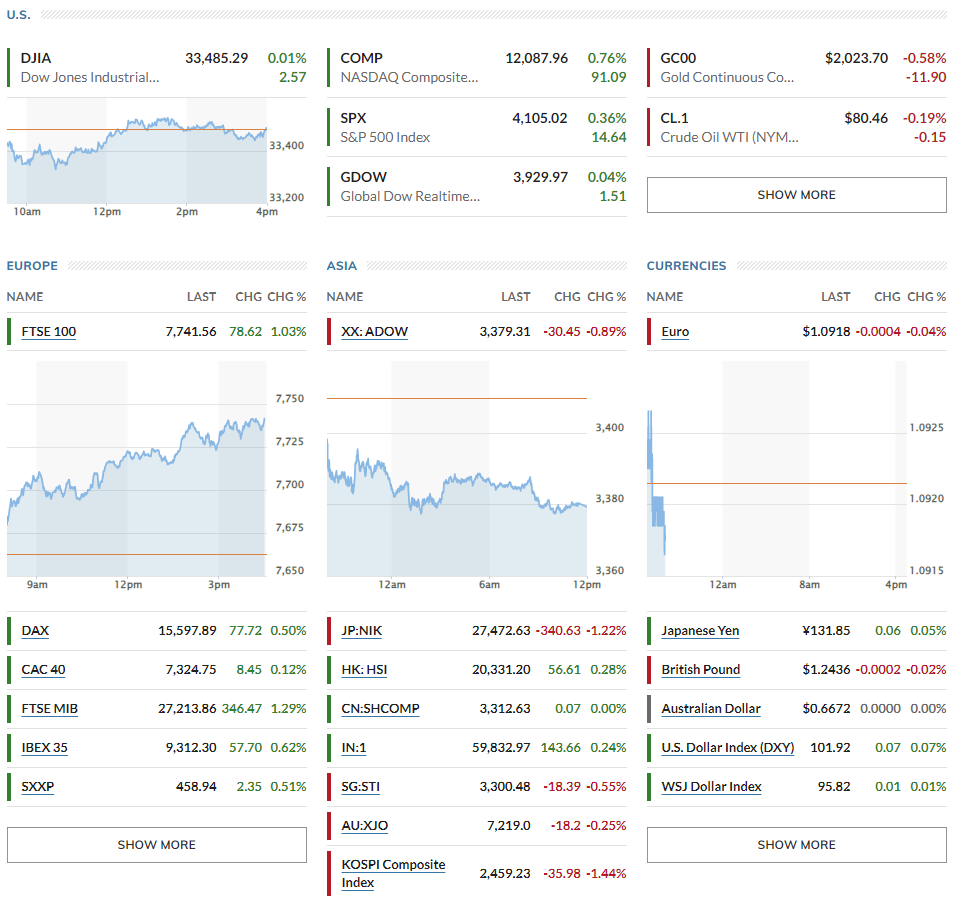

▶US Stocks were up = Dow +0.01%, Nasdaq +0.76%, S&P500 +0.36% // European stocks were up: London’s FTSE 100 +1.03%, Germany’s Dax +0.50%, Paris' CAC 40 +0.12%, Stoxx 600 +0.51% // Asian stocks were mixed: Japan’s Topix -1.22%, Hong Kong’s Hang Seng index +0.28%, China’s CSI 300 +0.00%, Australia’s S&P/ASX 200 -0.25%, and South Korea’s Kospi -1.44%.

▶US rates = 10-year U.S. Treasury note 3.307% (- 0.6 bps), Germany 10Y at 2.186% (+0.1 bps), Italy 10Y at 4.027% (+0.2 bps), UK 10Y at 3.433% (+0.1 bps), Japan 10Y at 0.471% (+0.1 bps)

▶Oil prices = $80.46 per barrel of WTI (-0.19%), Brent crude -0.21% $84.94 // USD +0.07% at 101.92// Gold -0.58% at $2,023.70

*Key points

1. Jobless claims up

2. FOMC's Hawk Bullard Spoke and Markets Liked It

3. What's Ahead Next Week

4. Pessimists vs. Optimistic Views on Market Outlook

5. Earnings season kicks off next week

6. Global Markets snapshots

1. Jobless claims up

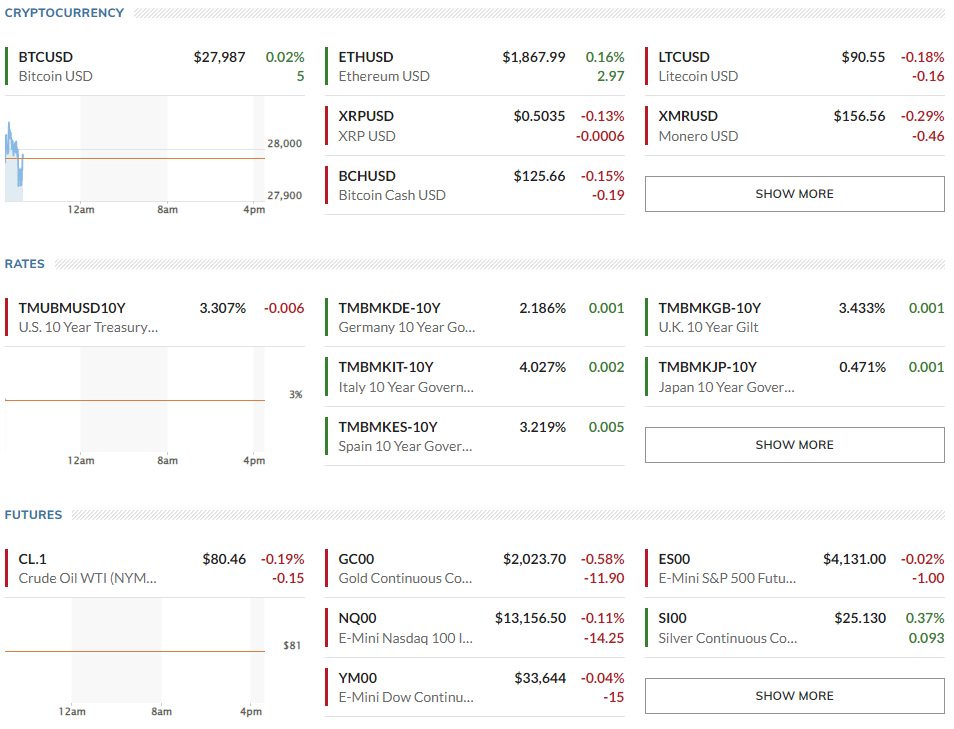

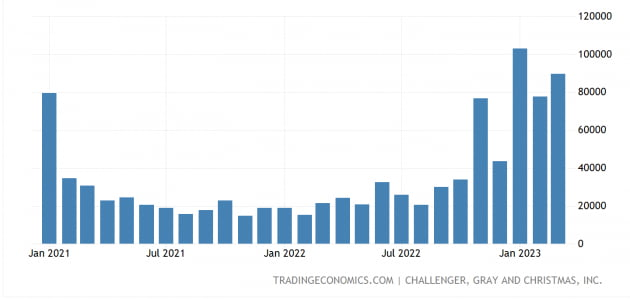

🏈Bottom line: US Rates plunged again on the back of the data from employment firm Challenger Gray & Christmas (CG&C) that showed corporate layoff plans for March reached 89,703, up 15% from last month and 319% from the same month last year. For the quarter as a whole, the number was 274,416, the highest since the first quarter of 2020. The tech and financial industries led the layoffs. CG&C said that if Q1 trends continue, layoffs in the tech industry this year could surpass those seen during the dot-com bubble burst in 2001.

This has stoked anxiety ahead of tomorrow's release of the Labor Department's March employment report, even though the economy has been pointing to a deterioration in recent days, from the Institute for Supply Management's (ISM) March manufacturing purchasing managers' index (PMI) on Monday, to the number of job openings in Tuesday's Job Openings and Labor Turnover Report (JOLTS), to ADP's March private payroll data and the ISM hospitality PMI on Wednesday.

The 2-year rate dropped more than 10 basis points at one point to 3.679%, the fifth straight day of declines. The 10-year fell to 3.261%, the lowest since early September last year.

🏈Bottom line: Goldman Sachs also warned not to be surprised if initial jobless claims jump last night - they estimated claims will jump to 240,000 vs. well above Wall Street's 200,000 forecast and the previous week's 198,000. And indeed, it came true: Jobless claims came in at 228,000 last week (~1). But that wasn't all. The Labor Department revised up and re-released all numbers since June 2021, saying it had adjusted for seasonal adjustment factors that had been messed up by the pandemic.

As a result, the previous week's figure was revised upward to 246,000 (+48,000), and last week's claims were actually down by 18,000. It's not just the previous week that's changed - the numbers are mostly up across the board. In mid-March, we were already approaching 250,000, which is 50,000 more than the previous release, and we've seen nine consecutive weeks of claims above 200,000.

Continuing claims (~March 25), the number of people filing for unemployment benefits, also rose to 1.823 million. This is the highest level since December 2021. The previous week's estimate was 1.689 million, which was revised to 1.817 million. With the revised data, continuing claims have been above 1.8 million for three consecutive weeks.

CG&C believes that laid-off workers will find new jobs relatively quickly. They expect the reduction in labor demand to result in fewer job openings instead of increased layoffs. Nevertheless, Goldman Sachs cautioned against overanalyzing the change in seasonally adjusted jobless claims, stating that the higher number is due to the end of a technical distortion rather than an actual surge in the number of claims.

2. FOMC's Hawk Bullard Spoke and Markets Liked It

For the first time in a long time, "hawkish" St. Louis Federal Bank President James Bullard had a positive impact on the markets. James Bullard, the president of the Federal Reserve Bank of St. Louis, discussed recent developments that have led to volatile trading in banking equities and increases in measures of financial stress. He noted that real economic data was stronger than expected during the first quarter and that inflation is still too high, calling for continued rate hikes to a range of 5.5 to 4.75 percent. His full speech is available here: “Financial Stress and the Economy” (PDF)

*Key takeaways from the speech:

- Financial stress and financial conditions metrics remain low compared to levels observed during the Global Financial Crisis or during the onset of the pandemic.

- Bullard said the Fed has been raising the policy rate over the last year to combat the highest inflation in the U.S. since the early 1980s.

- Incoming U.S. economic data during the first quarter of 2023 have generally been stronger than expected. GDP growth improved in the second half of 2022.

Labor market performance remains strong, which bodes well for consumption expenditures, the largest component of GDP. - Inflation remains too high, but it has declined recently. Measures of inflation that strip out volatile price movements have also declined but by less than the headline measure.

- Market-based measures of inflation expectations are now relatively low in part due to front-loaded Fed policy during 2022. This bodes well for the disinflationary process in 2023.

- Financial stress can be harrowing, but one corresponding effect of note is that it tends to reduce the level of interest rates, which in turn tend to be a bullish factor for the macroeconomy.

Overall, markets were cautious today, with a wait-and-see attitude, and trading volumes were down, as we don't know what the March employment data will look like tomorrow, especially since the New York Stock Exchange will be closed for the Easter holiday for three days starting tomorrow. Europe is closed until Monday. Many people had already taken their vacations.

3. What's Ahead Next Week

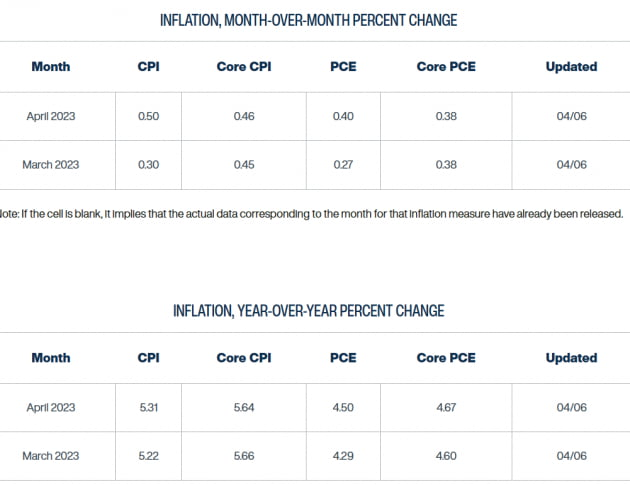

Additionally, next week will see the release of March Consumer Price Index (CPI) and March Producer Price Index (PPI). ING noted if headline CPI rises by more than 0.4% month-over-month, expectations for a May rate hike will strengthen. Minutes from the March FOMC meeting, which was one of the most intense rate decisions Fed members have had to make in the wake of the banking crisis, will also be released.

4. Pessimists vs. Optimistic Views on Market Outlook

Pessimism and optimism continue to battle it out on Wall Street.

🏈Bottom line: Pessimists argue that the market is still too narrow. They say it's hard for the overall market to keep rising when tech stocks are on their own. Apollo Asset's economist Thorsten Slok noted the S&P500's rise so far this year has been driven by 20 stocks, including big tech. The market capitalization of those 20 stocks has increased by $1.98 trillion, while the market capitalization of the other 480 stocks has barely increased at all (+$170 billion).

🏈Bottom line: On the other hand, Yadeni research argues that despite only a small number of stocks experiencing a rally this year, such as 8 or 20, when looking back to last year's low on October 12, all stocks are actually up; the rally is still a rally. The tech sector has experienced the largest gain of 26.9%, while the S&P500 has increased by 14.4%, and even the financial sector is up by 5.4%, despite the regional banks' decline. Most stocks have risen by at least 10%, with a majority up by 20%, and only a few have decreased.

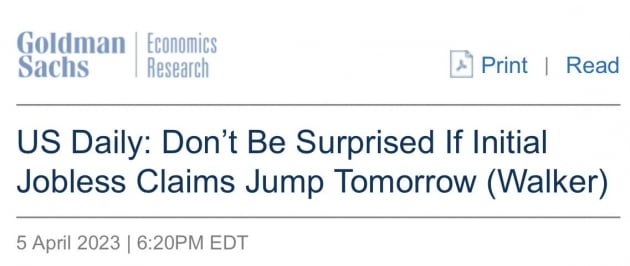

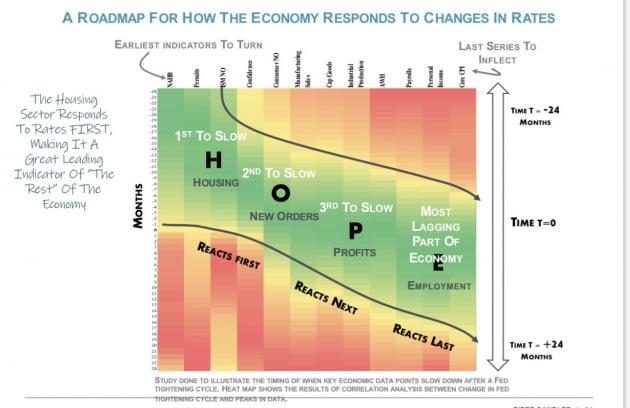

There's something everyone talks about when discussing market direction. It's corporate profits. According to Piper Sandler, when the Fed starts tightening, the impact is felt in the order: H (housing market) → O (new orders in the PMI) → P (corporate profits) → E (employment). The housing market is already in a downturn, and new orders in the PMI are plummeting. Yesterday's big drop in the services PMI was due to a plunge in new orders from 62.6 in February to 52.2 in March. And corporate profits showed a -3.5% year-over-year decline in the fourth quarter of last year for the first time since the pandemic. And now the employment data is starting to falter.

5. Earnings season kicks off next week

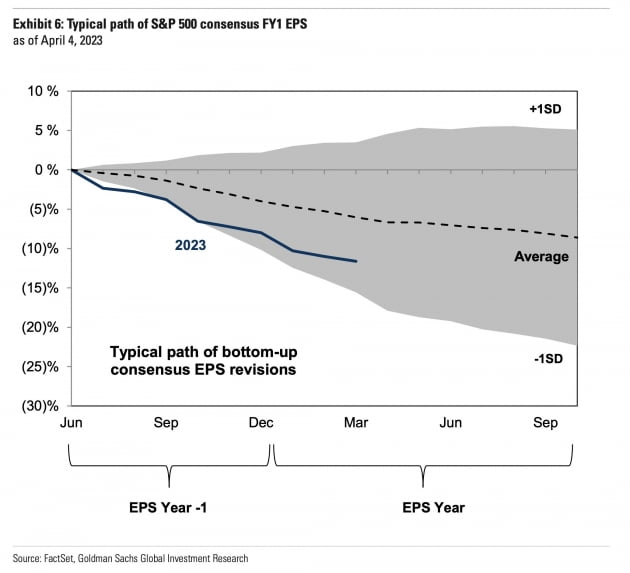

🏈Bottom line: The Q1 banking earnings season starts on April 14 with JPMorgan's earnings report. However, there are concerns that the earnings season may result in an even bigger drop in profits, which could be a headwind for the stock if underlying profits decline more than expected.

Goldman Sachs notes this upcoming earnings season could be the bleakest since the pandemic began, with analysts expecting a 7.1% decline in S&P500 profits from a year ago. Margins are also expected to shrink more than revenue due to several headwinds such as higher interest rates, stress in the banking system, and slowing demand. Goldman Sachs recommends keeping an eye on four things during the earnings season: an outlook for future margins, mentions of artificial intelligence, a slowdown in the use of cash on hand, and an upside from the reopening of China's economy.

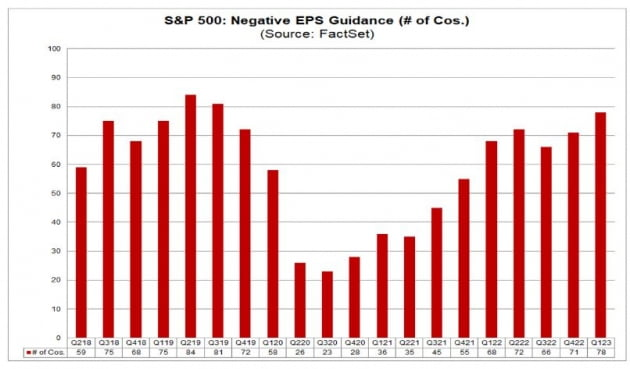

🏈Bottom line: To date, 106 S&P500 companies have issued Q1 earnings guidance, with 78 of them forecasting a decline in earnings per share (EPS) and 28 issuing a positive EPS outlook, FactSet analyzed. The number of companies issuing negative guidance before earnings season is well above the five-year average of 57 and the 10-year average of 65.

Earnings results will also vary by industry: banks probably performed worse due to deposit flight. Small and medium-sized businesses may have been more affected by the banking turmoil than larger companies. Tech is the industry expected to see the biggest drop in profits. But they were the first to lay off workers and engage in strong cost-cutting, so it remains to be seen how much of that will pay off. Costco saw its stock drop 2.24% today after the company said U.S. same-store sales for the five weeks ended April 2 were down 1.5% from the same period last year. UBS noted Costco's March sales results will be a sign of broader pressures in the retail sector, and not unique to Costco. Bank of America pointed out the energy sector could continue to do well. US refiners are preparing to report record first-quarter profits as fuels like gasoline and diesel are priced higher than crude oil.

Next, Big banks including JPMorgan, Citigroup, etc. will be among companies to kick off the quarterly reporting season next week. Analysts on average expect aggregate S&P 500 company earnings for the first quarter to have fallen 5% year-over-year.

6. Global Markets snapshots