Climate Science 101: Climate Risk Scenarios and Net Zero for Investors (Part 2)

Learn about climate risk management through Transition and Physical Risk Scenario Analysis. Explore NGFS scenarios, IAMs, and physical climate models.

Hi All,

Today, I wanted to talk about some important concepts in climate risk management that you should know about. We'll cover two types of scenario analysis: Transition Risk Scenario Analysis and Physical Risk Scenario Analysis.

As always, welcome feedback and contributions! Always looking for collaborators and inspiration for the next topic to cover.

Today's Key Concepts

1. Transition and Physical Risk Scenario Analysis (ft. NGFS Example)

2. What is 'Transition Risk Scenario Analysis'?

3. What is 'Physical Risk Scenario Analysis'?

4. Conclusion

Note) The Climate Value at Risk (CVaR) + BOE and ECB's climate risk stress testing will be covered in Part 3.

I. Transition and Physical Risk Scenario Analysis (ft. NGFS Example)

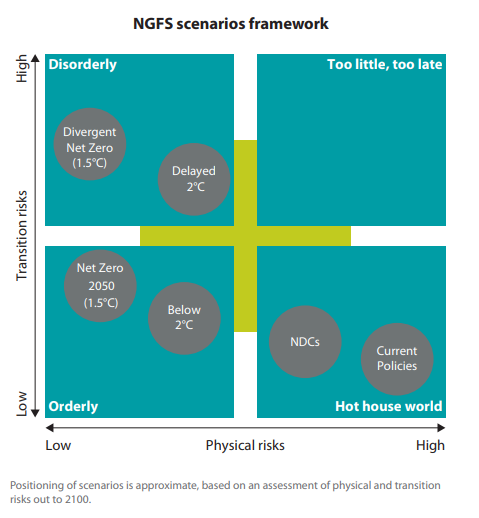

🏈 Bottom line: The NGFS scenarios explore a set of six scenarios which are consistent with the NGFS framework (see figure below) published in the First NGFS Comprehensive Report covering the following dimensions:

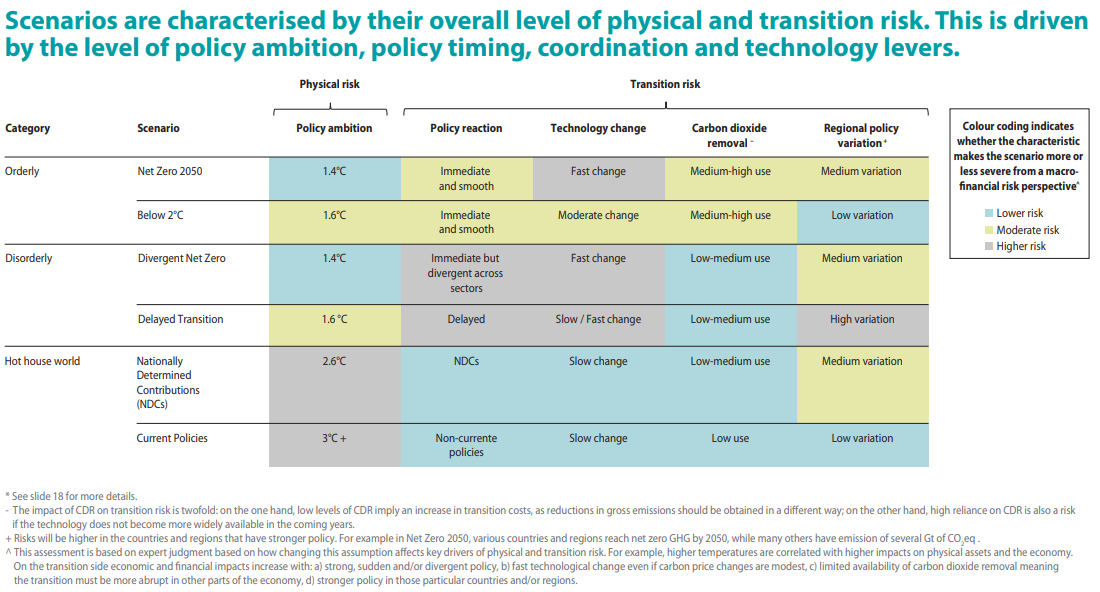

- Orderly scenarios assume climate policies are introduced early and become gradually more stringent. Both physical and transition risks are relatively subdued.

- Disorderly scenarios explore higher transition risk due to policies being delayed or divergent across countries and sectors. For example, carbon prices are typically higher for a given temperature outcome.

- Hot house world scenarios assume that some climate policies are implemented in some jurisdictions, but globally efforts are insufficient to halt significant global warming. The scenarios result in severe physical risk including irreversible impacts like sea-level rise.

II. What is 'Transition Risk Scenario Analysis'?

🏈 Bottom line: Transition risk scenario analysis is very closely and directly tied to emissions scenarios, whether the RCPs, IEA scenarios, or custom-made emissions scenarios. After all, transition risk results directly from the speed, pace, and scale of the low-carbon transition.

Transition risk is higher when emissions are cut more drastically (net-zero emissions by 2050 scenario versus a current policies or business-as-usual scenario), and when emissions cuts are more abrupt (disorderly versus orderly transition). Typically, transition risk analysis for a corporation or financial institution involves evaluating whether its own operations, supply chains, and portfolios are aligned with sector-specific and/or global, macroeconomic emissions trajectories.

What are 'Integrated Assessment Models (IAMs)'?

🏈 Bottom line: Transition risk scenario analysis can make use of integrated assessment models (IAMs), which are economic models that also consider societal and environmental phenomena and sector-specific decarbonization pathways.

Integrated assessment models (IAMs) are broad-spectrum models designed to allow analysis of how societal and economic choices affect each other and the natural world, including the causes of climate change. Used extensively by the IPCC, they are also frequently used by academics and sometimes by policymakers and corporations. The most basic IAMs compare the costs and benefits of avoiding a certain level of warming using highly simplified equations. However, most IAMs in use are far more complex, and they include representations of relevant interactions both among a number of important human systems (e.g., energy use, agriculture, trade) and physical processes (e.g., the carbon cycle). IAMs are most heavily rooted in economics and economic models, meaning they typically assume fully functioning markets and competitive market behavior, and they are calibrated to optimize outcomes as measured by minimizing the aggregate economic costs involved.

IAMs can answer both general questions and specific ones. For instance, “What will the world look like with no climate policy action?” and “What will the world look like if all countries impose a USD 200 tax per ton of CO2 emissions in 2025?”

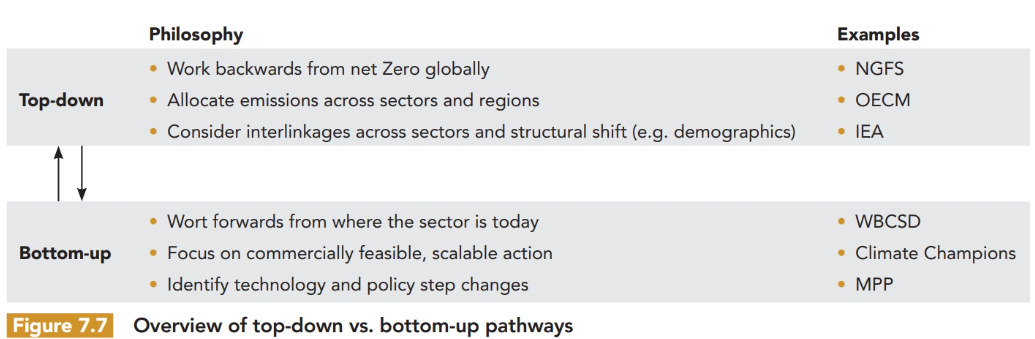

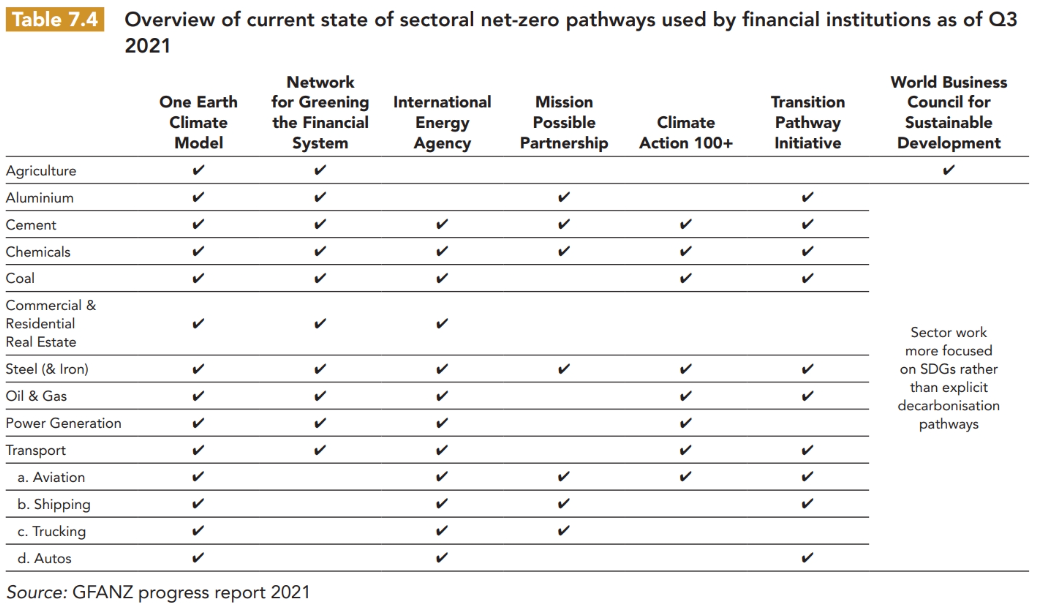

For most sectors, or for firms exposed to multiple sectors (such as banks or institutional investors), sector decarbonization pathways are a highly useful way of gauging transition risk. Many of these exist, including those laid out by the IEA, the Deep Decarbonization Pathways Project, the Transition Pathway Initiative, Mission Possible Partnership (MPP), or the Science-Based Targets Initiative. These kinds of decarbonization pathways are constructed to be compatible with Paris targets, so a firm making use of these to gauge Paris alignment can mainly restrict itself to the question of gauging whether it is possible for the firm to align with the trajectory (although as with anything, some understanding of underlying assumptions and any model uncertainties will still be helpful and necessary).

There are also external bodies evaluating alignment with various scenarios. For example, the Transition Pathway Initiative, a collaboration between academia and industry, grades publicly listed companies on their level of alignment with Paris-compliant sector trajectories. These assessments can then be used by stakeholders or investors in various ways.

Finally, a lot of transition risk scenario analysis is done by commercial data providers such as Carbon Delta, Car-bone 4, Oliver Wyman, WTW, Ortec Finance, NGOs such as 2 Degrees Investing Initiative, and consortiums such as Climatewise, which is part of the Cambridge Institute for Sustainability Leadership. Most of these entities provide detailed data on different asset classes by scenario (RCP) and time horizon for firms to be able to do in-house analysis.

A final, ambitious approach to transition risk scenario analysis is to build fully original emissions trajectories. Building bottom-up global models of energy demand and emissions, similar to the IPCC or IEA pathways, typically only makes sense for large fossil fuel and commodity firms whose fortunes are closely tied to global changes in the energy mix. Shell, for instance, constructs and periodically updates its own climate and energy scenarios.

III. What is 'Physical Risk Scenario Analysis'?

🏈 Bottom line: Physical risk scenario analysis, on the other hand, uses physical climate models, but it can also benefit from resilience planning. The physical impacts of climate change will be relatively similar between now and 2050 under any plausible emissions trajectory, which is why short-term scenario planning is more about preparedness than the variation between trajectories.

Today, corporations, both financial and non-financial, use scenario analysis for strategy and stakeholder communication with investors and regulators. Scenario analysis is also useful for resilience planning. Financial firms, in addition, use scenario analysis for portfolio risk management and stress testing as well as pre-emptively in portfolio selection.

Important things to understand about physical climate models

Physical climate models were originally developed to help scientists understand the functioning and operation of the Earth’s climate system. Now, they are an important tool for scenario analysis on physical risk.

The relationship between physical climate models and emissions scenarios goes in both directions. On the one hand, physical climate models are used to calibrate emissions scenarios to make sure that the amount of radiative forcing resulting from the posited emissions corresponds roughly to certain temperature targets for global average temperature rise. But on the other hand, these emissions trajectories can then be re-inputted into models to gain an estimate of various hazards.

The growing sophistication of newer climate models allows them to present forecasts with greater granularity, including at the regional level, and for a greater range of phenomena, ranging from heat waves to precipitation patterns.

Both because of the lag in the Earth’s climate system and because of the way the physical models are designed, these models give the best accuracy on decadal timescales. Emissions trajectories do make a significant difference in predicting physical impacts in the second half of the twenty-first century, which can matter for very long-term planning, such as for physical infrastructure that is generally expected to last decades. And by 2100, the differences in physical risks between RCPs are very significant.

Another important difference that makes physical risk scenario planning very distinct from transition risk is that physical risk always starts at the facility level. Physical impacts affect specific processes and sites—a flooded factory, a wildfire-ravaged warehouse, an overheated office building—and then these effects cumulate upward through ownership supply and investment chains. Thus, as far as facilities are concerned, both non-financial firms and financial ones are forced to consider physical risk as an operational risk. For transition risk, industrial firms can principally examine their own facilities or compare performance to sector benchmarks, and even financial firms can use emissions data for just a few key emissions-intensive sectors to get an estimate portfolio alignment. Meanwhile, for physical risk, all sectors and a wide range of assets and facilities are potentially affected.

IV. Conclusion

Scenario analysis is a valuable tool in climate risk management for both financial and non-financial firms. Transition risk scenario analysis can help firms evaluate whether their operations align with sector-specific or global emissions trajectories, while physical risk scenario analysis uses physical climate models to prepare for the physical impacts of climate change. Understanding these key concepts is crucial in developing a comprehensive climate risk management strategy that addresses both transition and physical risks. Part 3 of this blog series will cover Climate Value at Risk (CVaR) and the BOE and ECB's climate risk stress testing, so please stay tuned!.

![Sustainable/Impact Investing] Regulations Cheatsheet - State of Play (December 2025)](/content/images/size/w720/2025/12/Screenshot-2025-12-08-073043.png)

![Obsidian Brief] When Money Becomes Software: AI, Stablecoins & Bitcoin — Implications for Sustainable and Impact Investing](/content/images/size/w720/2025/12/Gemini_Generated_Image_dppem0dppem0dppe.png)

![Sustainable/Impact Investing] Building for Planetary Renewal - Urban Sequoia (A lecture by Mina Hasman, Sustainability Director at SOM)](/content/images/size/w720/2025/10/Screenshot-2025-10-30-221501.png)