Education | Ultimate Fixed Income 101: What is Fixed Income? & Time Value of Money

After a decade on Wall Street and in London, I share fixed income lessons I wish I knew earlier—covering what bonds are, market size, Bloomberg functions, and Time Value of Money. A finance 101 guide for students and future investors.

Hi All,

Why I Started This Series

I was inspired to create this series after more than a decade working in global finance—on Wall Street and in the City of London—as a multi-asset portfolio manager and asset allocator. My career began at BlackRock as a member of the 2013 Analyst Class in NYC, which itself was founded as a mortgage and fixed income house in NYC, so it’s fair to say that my own “bone structure” in investing was built on fixed income. My humble beginning started out in the fixed income portfolio management internship in New York and later moved to London to join the multi-asset allocation team as a portfolio manager, where I worked across fixed income, equities, and private assets.

Looking back, there are concepts I wish I had understood earlier in my career—principles that would have saved me time, confusion, and mistakes. This series is my way of sharing those lessons in a way I hope is practical, clear, and encouraging.

I dedicate these posts to my mentees, and also to one moment that has always stayed with me: during my internship in investment banking (M&A) on Wall Street, I watched a colleague who was a DCF model expert explain the mechanics of valuation to another banker over a sandwich at lunch. His passion was contagious. I barely knew anything about finance at the time, but I remember thinking: one day, I’d like to be able to share knowledge with the same kind of joy and generosity.

This series is a small step in fulfilling that promise.

*Book & Course recommendation: For fixed-income 101, my recommended book is Fabozzi’s ‘The Handbook of Fixed Income Securities.’ As a fixed-income hub, this is the ultimate classic that I was given as an analyst by my manager and all of the new analysts were expected to read the book cover to cover upon joining. I also highly recommend the Bloomberg Market Concept course (I am not paid or sponsored to say this) if you want to get familiar with the key capital market concepts and Bloomberg functions 101 that people use in the capital market. The course can be helpful esp. if you don't have access to the BBG terminal yet but still want to learn the functions, because it shows the BBG terminal screen.

*Next, as a follow-up, I will write more deep-dive posts on the key concepts with example calculations in excel and additional Bloomberg (BBG) shortcut keys.

Today’s Key Concepts

- What is Fixed Income?

- Market size + BBG functions

- TMV (Time Value of Money)

☘️ 1. What is Fixed Income?

Fixed Income refers to an investment that provides regular income payments, typically in the form of interest, to the investor. Fixed income investments are generally considered less risky than equity investments because they offer a fixed stream of income, unlike stocks whose value can fluctuate widely over time.

Importance of Fixed Income in investing: Fixed income investments are essential components of an investment portfolio because they provide diversification and help to reduce overall portfolio risk. The regular income payments also provide a reliable source of income for investors, particularly those who are retired or seeking a low-risk investment strategy.

💡 2.1. Interesting facts: Market size - fixed income vs. public equity

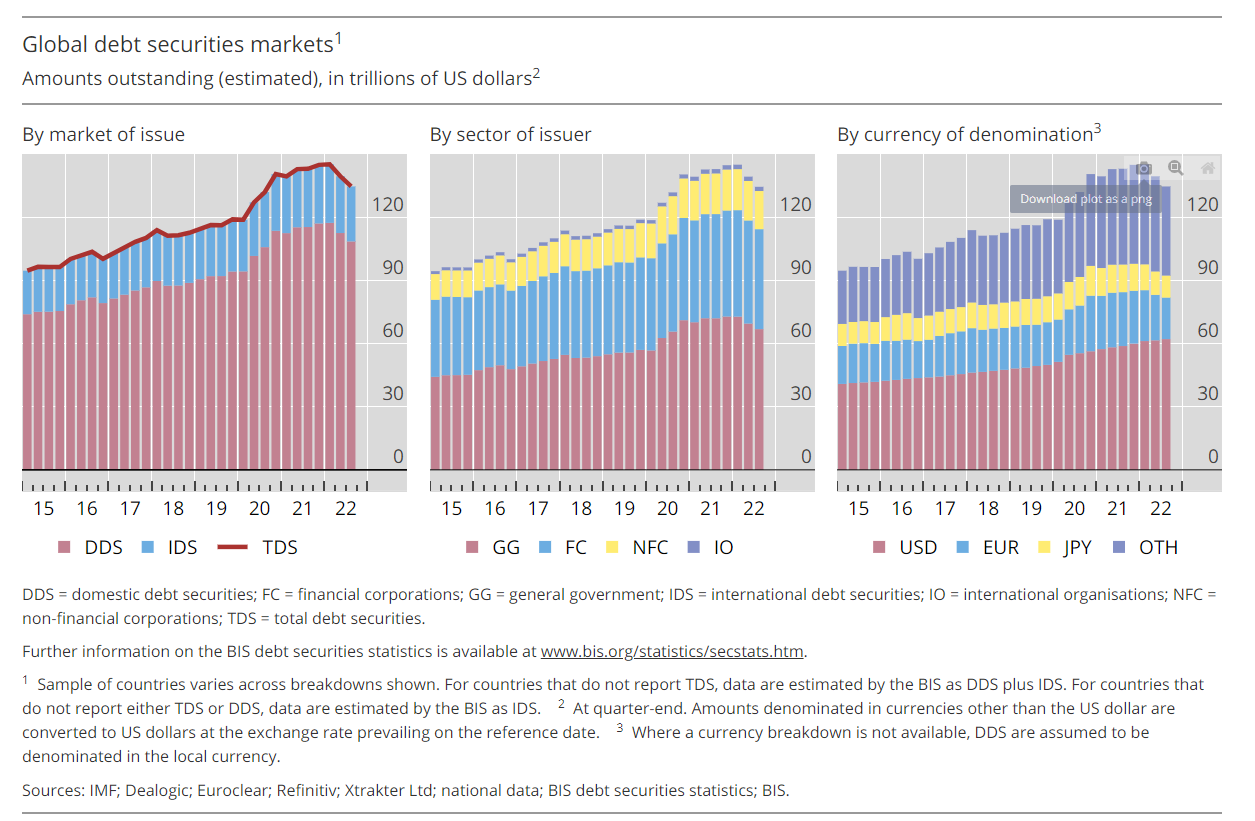

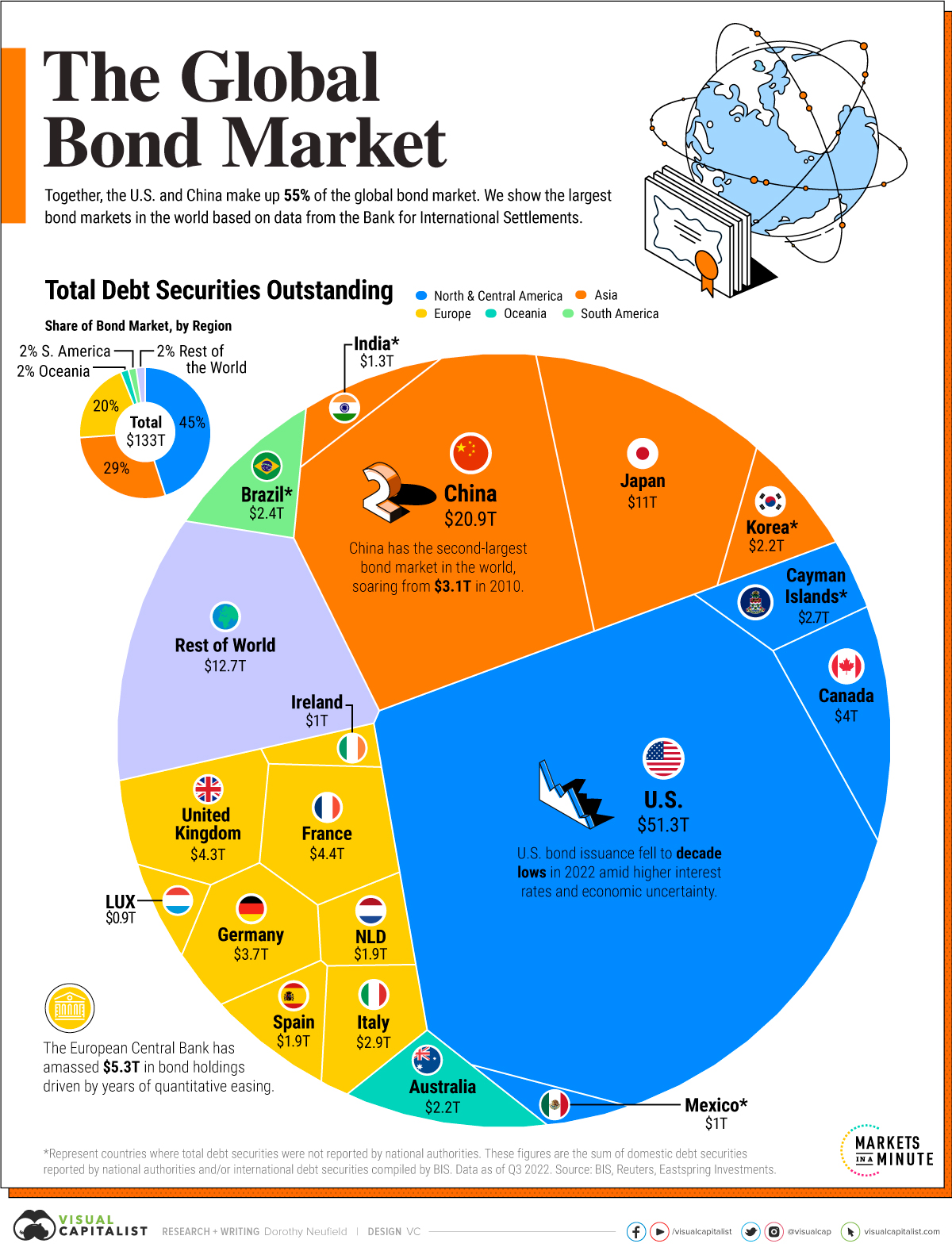

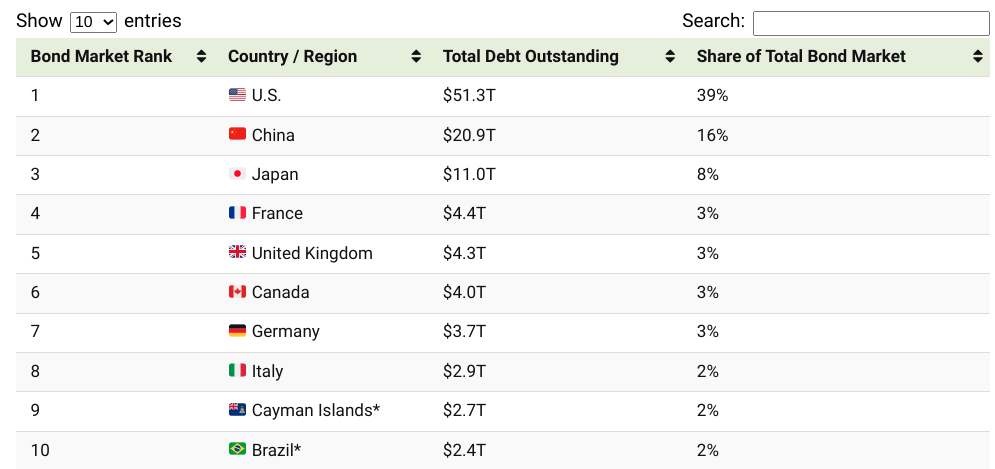

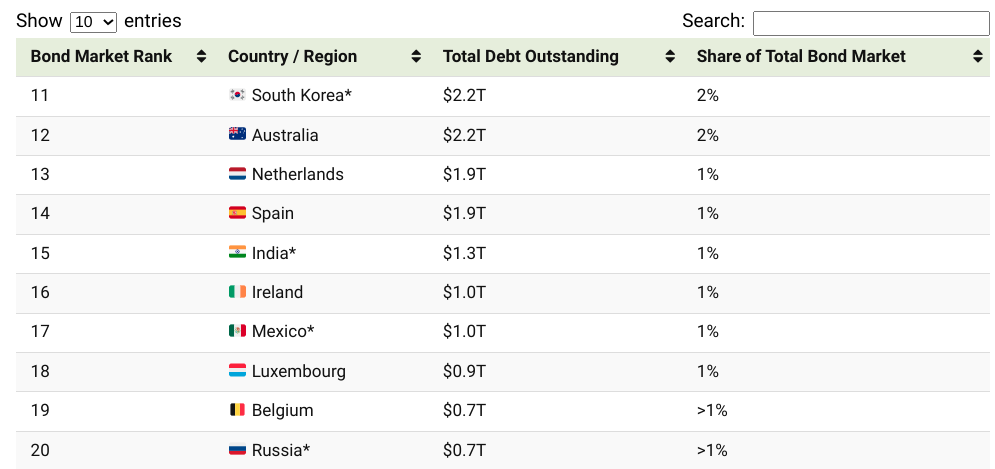

- Fact 1: As of Q2 2022, the size of the global fixed income market is significantly larger than the global public equity market. According to data from the Bank for International Settlements (BIS), the size of the global bond market was around $133 trillion, while the size of the global stock market was around $105 trillion.

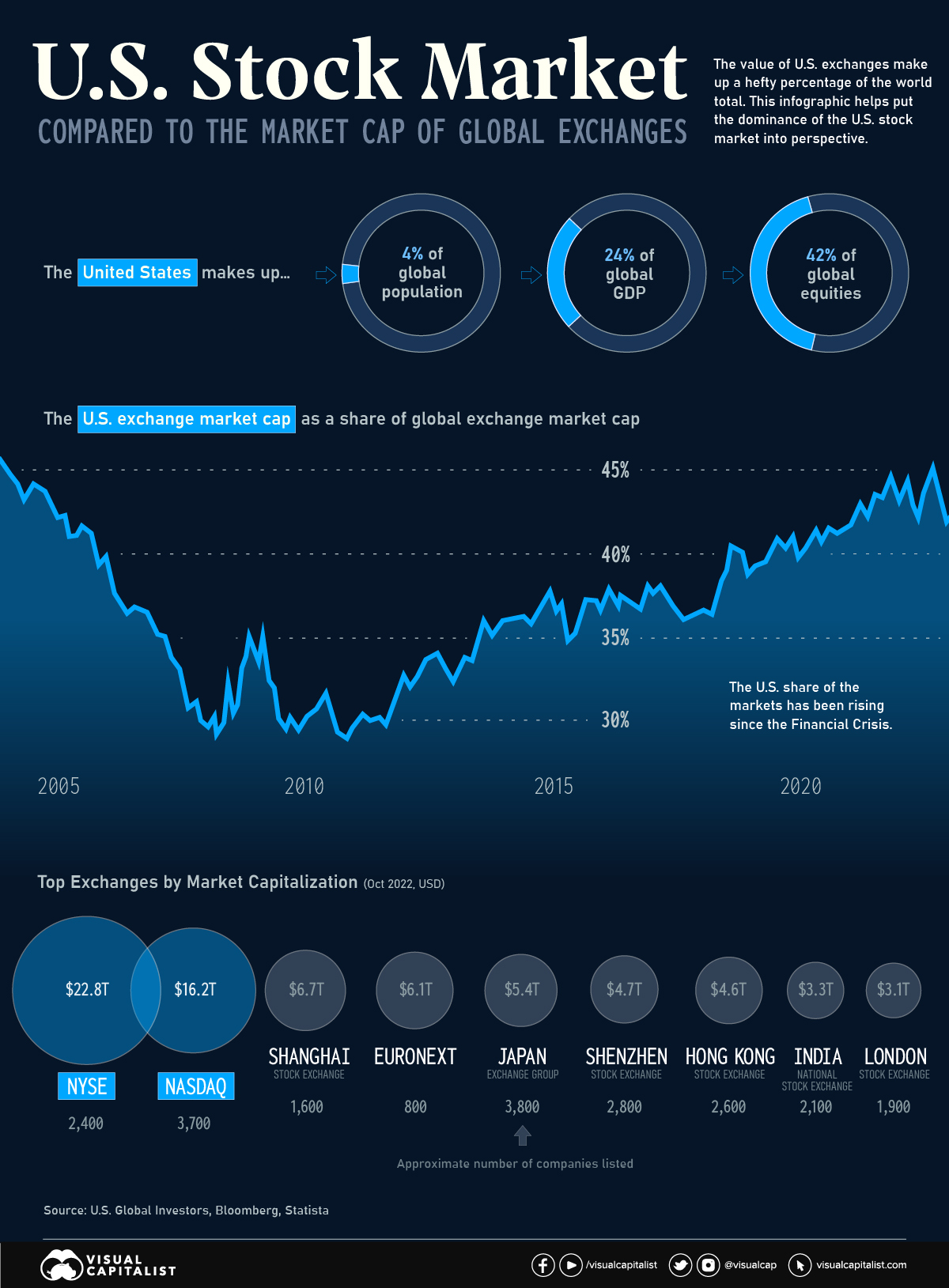

- Fact 2: The US market dominates and accounts for about 39% of the market. USD-denominated government and corporate bonds play an important role in ‘liquidity.’ This is the reason why there is USD centricity in the FX markets.

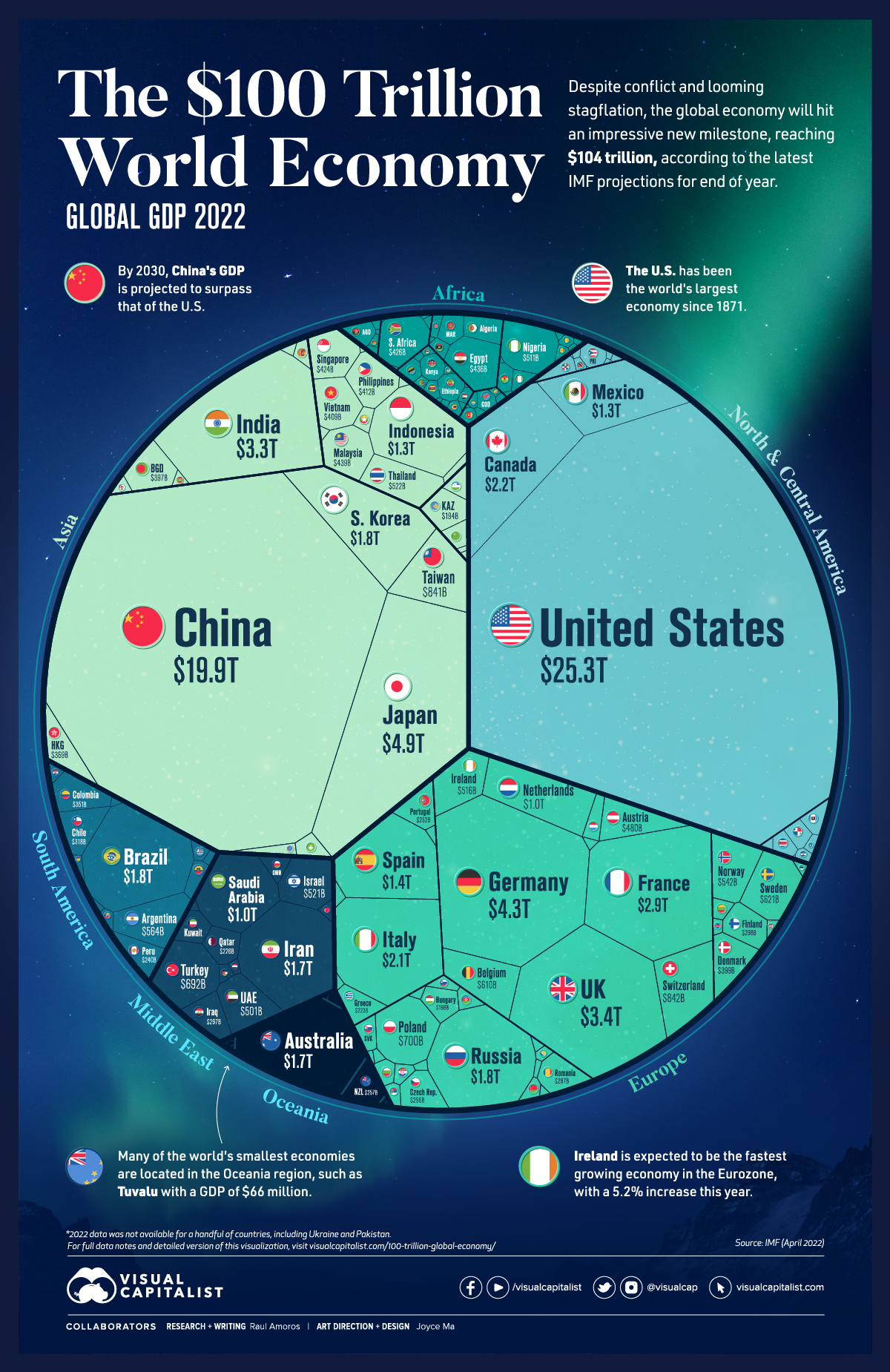

- Fact 3: The size of the global bond market is bigger than the world’s $103 trillion GDP (2022).

This can be attributed to several factors, including the fact that bonds are typically issued by a wider range of entities than stocks, including governments, corporations, and other institutions. In addition, bonds are often used as a means of financing large-scale projects or other initiatives, which can contribute to their overall size.

It's worth noting that the size of these markets can fluctuate over time based on a variety of factors, including changes in market conditions, economic factors, and shifts in investor sentiment.

As always, Visual Capitalist has the best charts to put things into perspective!

To put this into context, sharing the US stock market size data.

The world's economy is surpassing the $104 trillion mark vs. $94 trillion in 2021 according to the IMF projection!

🍭2.2. Bloomberg Functions

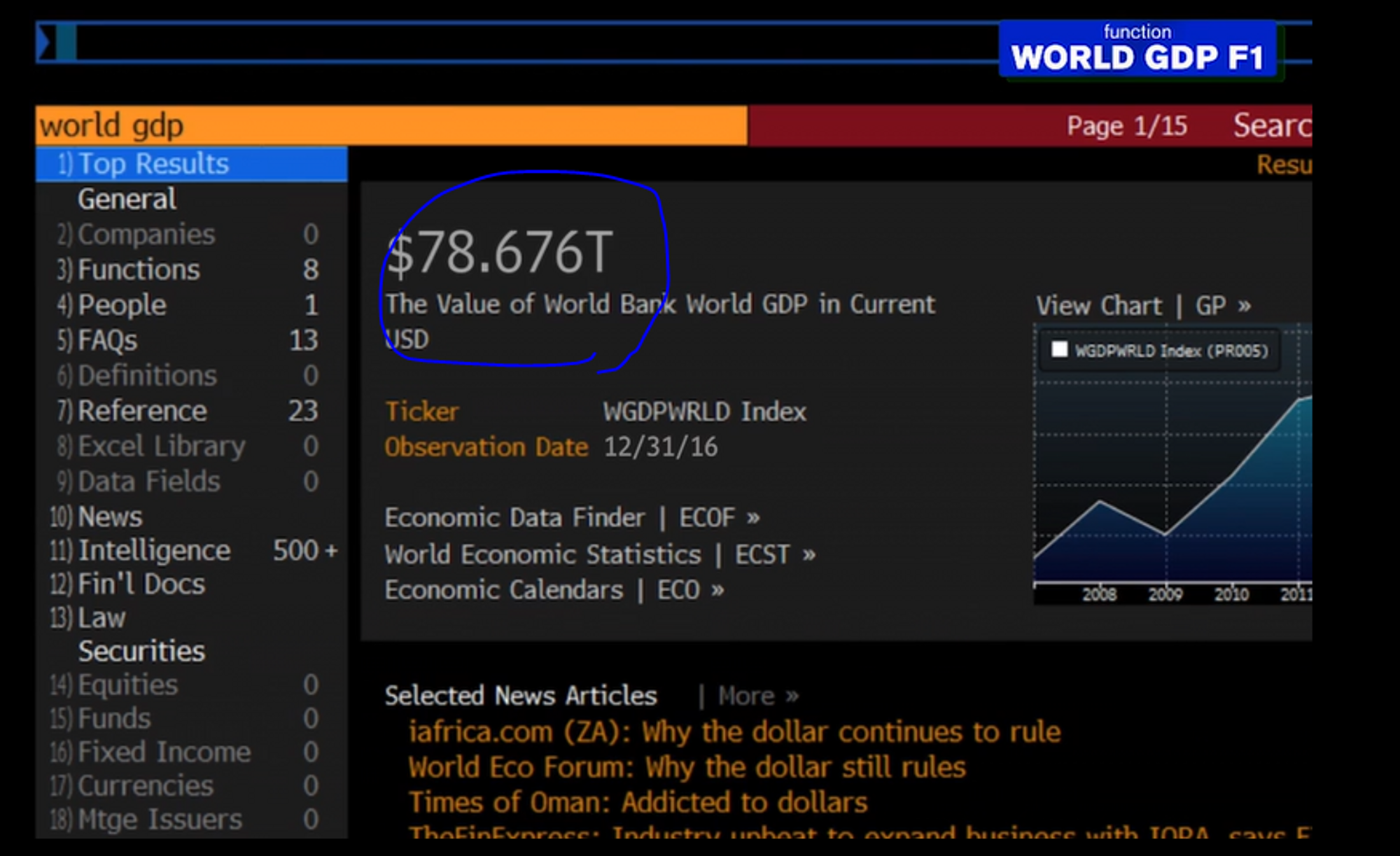

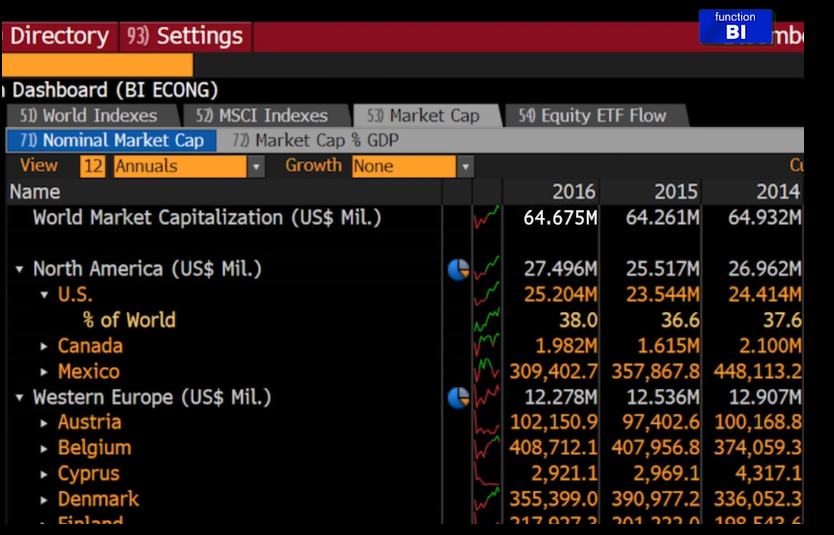

Note, the Bloomberg screenshots are from the Bloomberg Market Concept course. Please bear in mind that the screenshot dates are as of 2016 so the numbers shown are outdated. If you have access to the Bloomberg Terminal, you can try the functions yourself! 😃

To find the world’s GDP: WORLD GDP FI

To find the world’s equity market cap: BI

To find the world’s bond market size: SRCH > add up the ‘Amt Out (MM)’ numbers you see

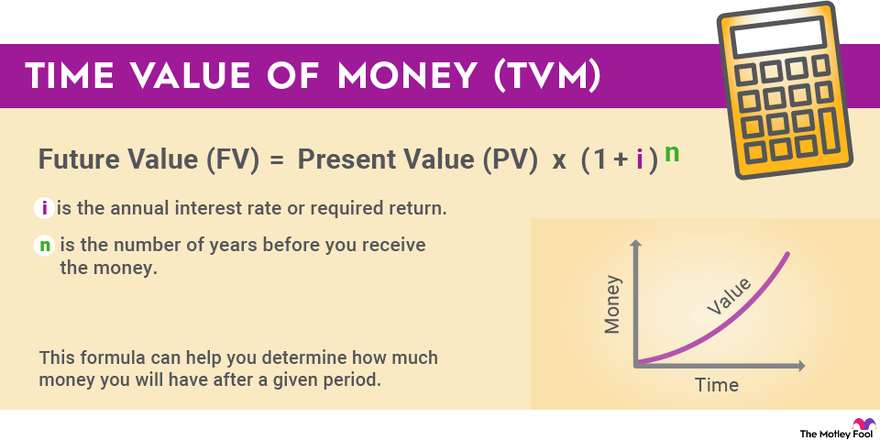

😍 3. Time Value of Money (TVM)

is a fundamental concept in finance esp. in fixed income that recognizes the value of money changes over time. This is because of the effects of 1) inflation and 2) interest rates. The concept of Time Value of Money is based on the idea that money available today is worth more than the same amount of money at some point in the future. The concept is important for fixed income investments because bond prices and interest rates are heavily influenced by changes in inflation and interest rates.

By understanding the Time Value of Money, investors can make informed decisions about their fixed income investments. They can calculate the present value of future cash flows from fixed income securities to determine their true value today, which can help them make better investment decisions. Additionally, investors can use the concept of Time Value of Money to determine the appropriate duration for their fixed income investments and to understand the impact of inflation and interest rates on their portfolio returns.

Here, Investopedia further explains TMV.

![Finance Education] Breaking into Finance: A Real-World Guide for Students and Future Leaders (technical and behavioral tips) - Part 5/5: Analyst level Deep-dive career guides](https://images.unsplash.com/photo-1537211568975-f95f2101c8f5?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDE1fHxtb250JTIwYmxhbmN8ZW58MHx8fHwxNzY0NTU3NzQ1fDA&ixlib=rb-4.1.0&q=80&w=720)

![Finance Education] Breaking into Finance: A Real-World Guide for Students and Future Leaders (technical and behavioral tips): Part 4/5: Interview Prep Tips](https://images.unsplash.com/photo-1605128005752-d1714260611e?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDF8fG1vbnQlMjBibGFuY3xlbnwwfHx8fDE3NjQ1NTc3NDV8MA&ixlib=rb-4.1.0&q=80&w=720)

![Finance Education] Breaking into Finance: A Real-World Guide for Students and Future Leaders (technical and behavioral tips): Part 3/5: On Being a Woman & Minority in Finance](https://images.unsplash.com/flagged/photo-1549874491-97ed9de96e1a?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDMwfHxtb3VudGFpbiUyMGV2ZXJlc3R8ZW58MHx8fHwxNzY0MDU4MjIwfDA&ixlib=rb-4.1.0&q=80&w=720)