Global Markets Recap - Week of Dec 11, 2023

1. What Moved the Markets?

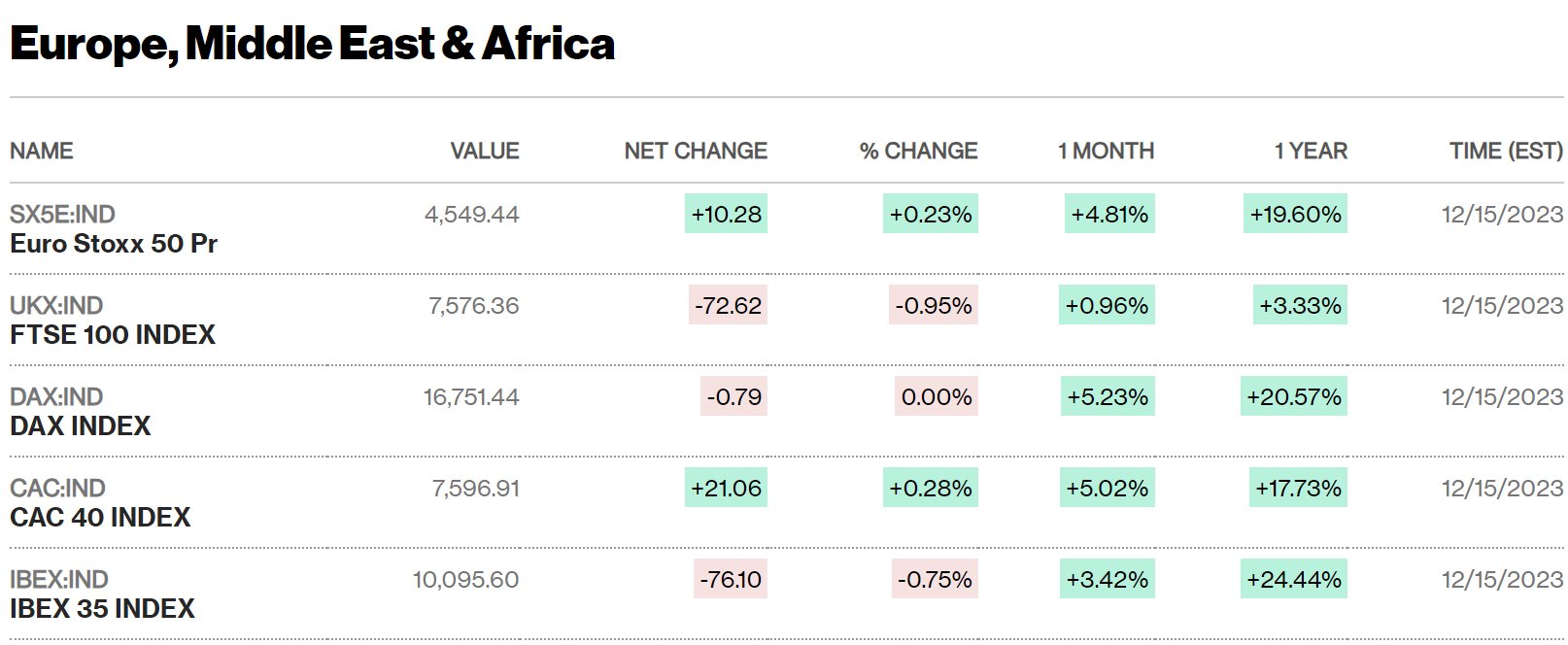

Europe

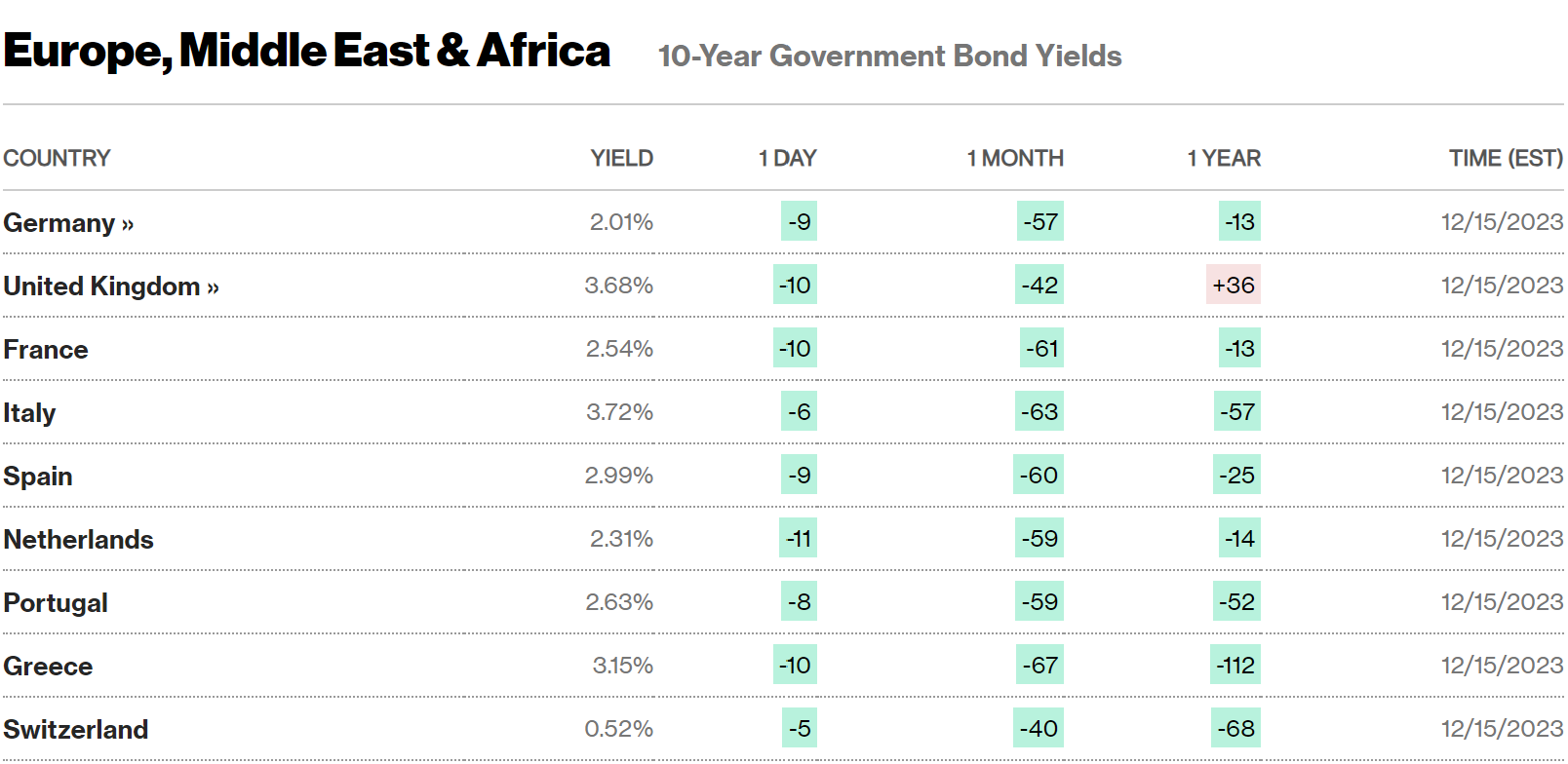

🏈 Bottom Line: In Europe, financial markets had a mixed week as the STOXX Europe 600 Index rose, the European Central Bank left its record-high deposit rate unchanged at 4% but adjusted down inflation and growth projections, the Bank of England maintained its rate (5.25%), and Norges Bank raised rates in Norway (4.25%), while the Swiss National Bank kept rates (1.75%) steady and lowered inflation forecasts.

- STOXX Europe 600 Index: The index rose by 0.92% during the week, reflecting market expectations of potential central bank interest rate cuts in 2024. Major European stock indexes had mixed performance, with France's CAC 40 (+0.93%), Germany's DAX (-0.1%) and Italy's FTSE MIB slightly lower, UK's FTSE 100 (+0.29%).

- European Central Bank (ECB): The ECB maintained its key deposit rate at 4.0% but adjusted its inflation and growth forecasts downward for 2023 and 2024, signaling the possibility of future rate reductions. It anticipates inflation slightly below its 2% target by 2026 and lowered growth projections to 0.6% for the current year and 0.8% for 2024. The ECB also announced plans to phase out reinvestment in its pandemic program securities by late 2024.

- Eurozone Business Activity: Business activity in the eurozone contracted in December, with a Purchasing Managers' Index (PMI) of 47.0, marking the seventh consecutive month below the 50-point threshold indicating contraction.

- Bank of England: The Bank of England kept its benchmark interest rate at 5.25% in November but reiterated its readiness to raise rates further if persistent inflation materializes.

- UK Economy: The UK's GDP contracted by 0.3% sequentially in October after a 0.2% rise in September, with a flat performance compared to the three-month period ending in July.

- Norges Bank (Norway): Norway's central bank increased its key interest rate by 25 basis points to 4.5%, the 13th hike in the current cycle. While rates are expected to remain unchanged until the fall of the following year, future adjustments are not ruled out.

- Swiss National Bank: The Swiss National Bank maintained its policy rate at 1.75%, as expected. It also adjusted inflation forecasts to 1.9% in 2024 and 1.6% in 2025.

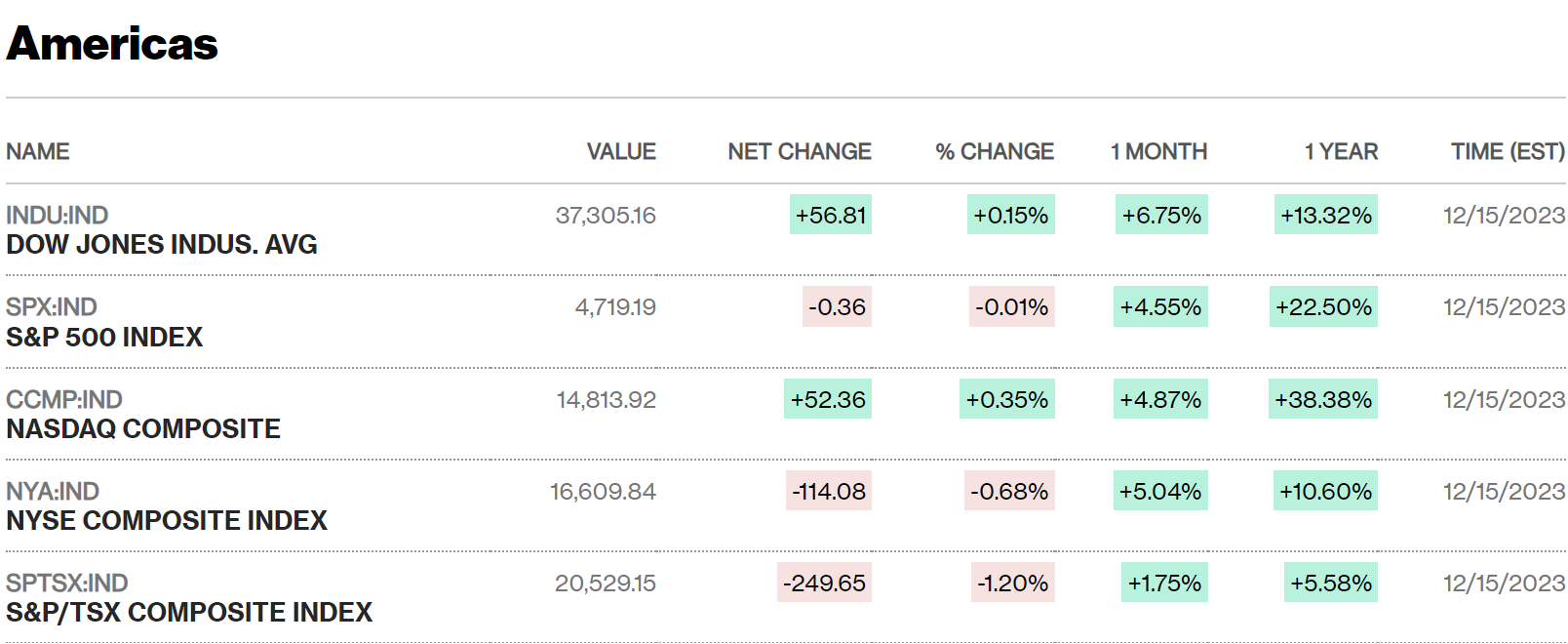

US

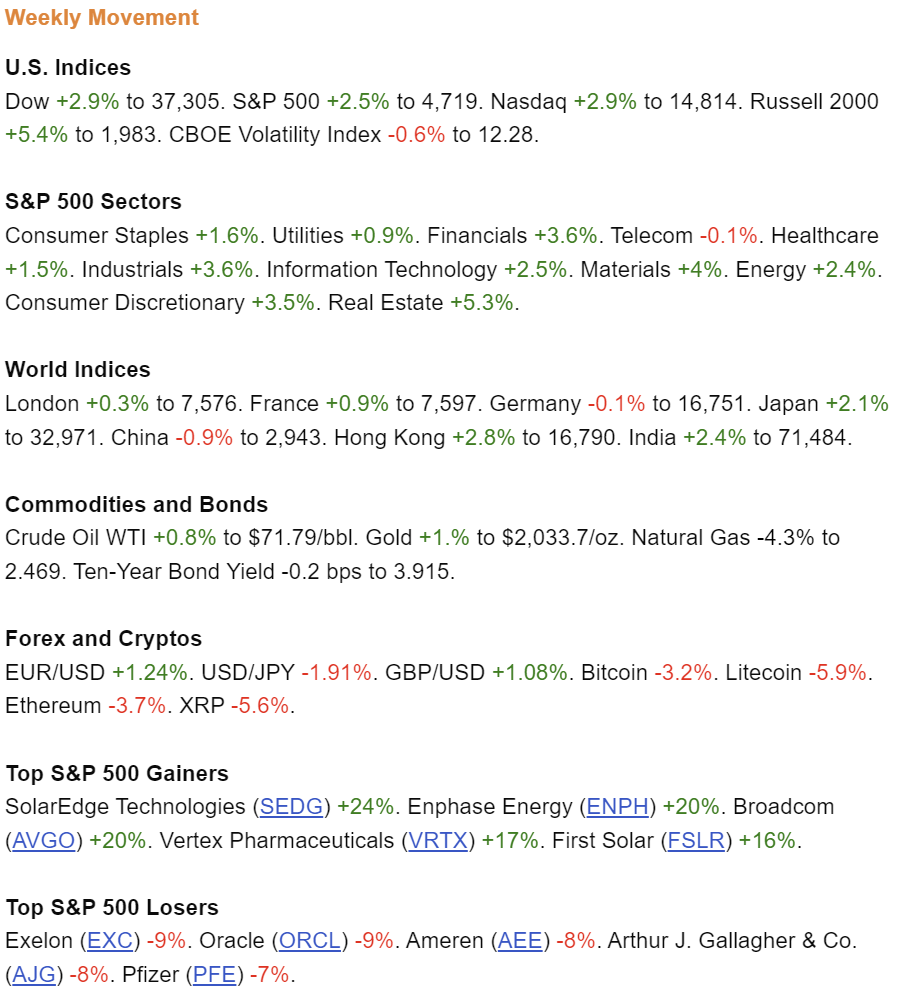

🏈 Bottom Line: The U.S. financial markets saw record highs, extended winning streaks (Dow +2.9%, S&P +2.5%, Nasdaq +2.9%, Russell 2000 +5.4%, VIX -0.6), and declining bond yields amid signs of a more benign inflation environment, while the Federal Reserve signaled potential rate cuts in 2024, with both investment-grade and high-yield corporate bonds experiencing varying performance trends.

- S&P 500, Nasdaq, and Dow on 7-week winning streak: The S&P 500 Index, Nasdaq, and Dow Jones Industrial Average (record high) all experienced seven consecutive weeks of gains. This is notable because it marks the longest winning streak for the S&P 500 since 2017.

- Russell 2000 Index surges 5.55% and exits bear market territory: The Russell 2000 Index, composed of small-cap stocks, experienced a substantial surge of 5.55%, taking it out of bear market territory, which is typically defined as a decline of 20% or more, for the first time in over 20 months.

- Trading volumes hit a new high for 2023: Trading volumes in the market were elevated, reaching a new high for the year 2023. This indicates increased activity in the stock market.

- Cboe Volatility Index (VIX) at its lowest level in the post-COVID era: The VIX, often referred to as the "fear gauge" on Wall Street, reached its lowest level since the COVID-19 pandemic began. A low VIX suggests decreased market volatility and increased investor confidence.

- Producer prices rise at the slowest pace in nearly three years: Producer prices, which measure the cost of goods and services at the wholesale level, increased at their slowest rate in almost three years.

- Core inflation at 4.0% for consumer prices: Core consumer price inflation, which excludes food and energy prices, remained steady at a year-over-year rate of 4.0%. This is an important indicator of inflationary pressures in the economy.

- Core inflation at 2.0% for producer prices: Core producer price inflation, which also excludes food and energy prices, surprised by running at a lower rate of 2.0% for the year. This was slightly below expectations and marked its lowest level since January 2021.

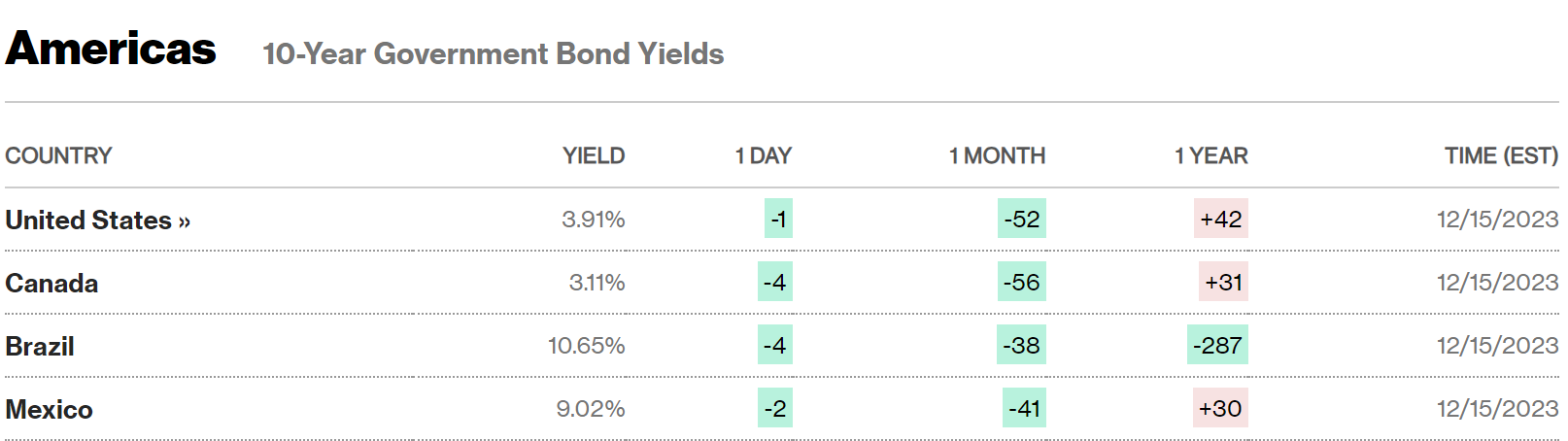

- Fed signals potential 75 basis points of rate cuts in 2024: During the Federal Reserve's policy meeting, it was indicated that the median projection for 2024 includes the possibility of a total of 75 basis points (0.75%) of rate cuts. This was an increase from the previous projection of 50 basis points.

- Retail sales rise unexpectedly by 0.3% in November: Retail sales unexpectedly increased by 0.3% in November. This was a positive sign for the holiday shopping season, especially when combined with a revised lower decline in October.

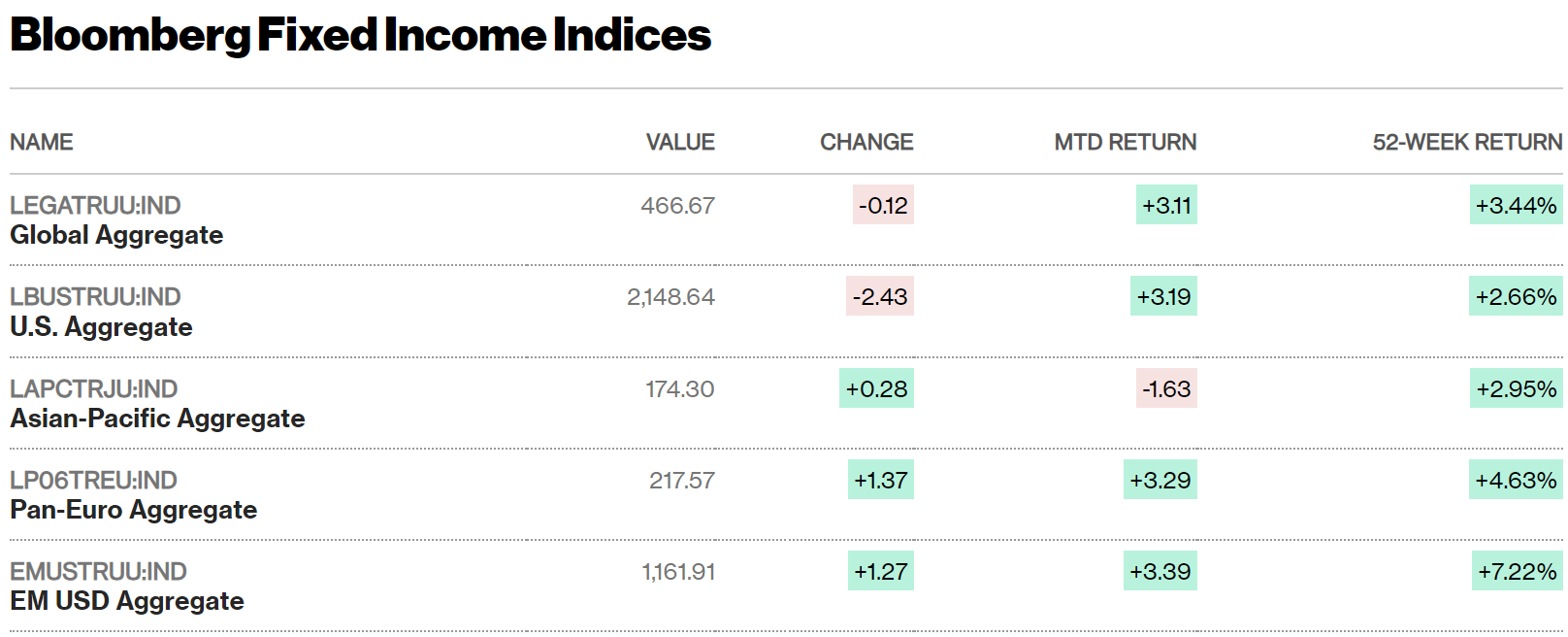

- Long-term U.S. Treasury yields fall: In response to the inflation data and the Fed's signals, long-term U.S. Treasury yields decreased significantly. Specifically, the yield on the benchmark 10-year U.S. Treasury note fell below 4% for the first time since July.

- Investment-grade corporate bonds initially underperform, then outperform: Investment-grade corporate bonds initially performed worse than Treasuries before the Fed meeting. However, following the Fed's dovish pivot, they outperformed in a risk-on environment.

- High-yield corporate bonds perform well after the Fed meeting: High-yield corporate bonds performed well in the wake of the Fed meeting, indicating investor confidence in riskier assets.

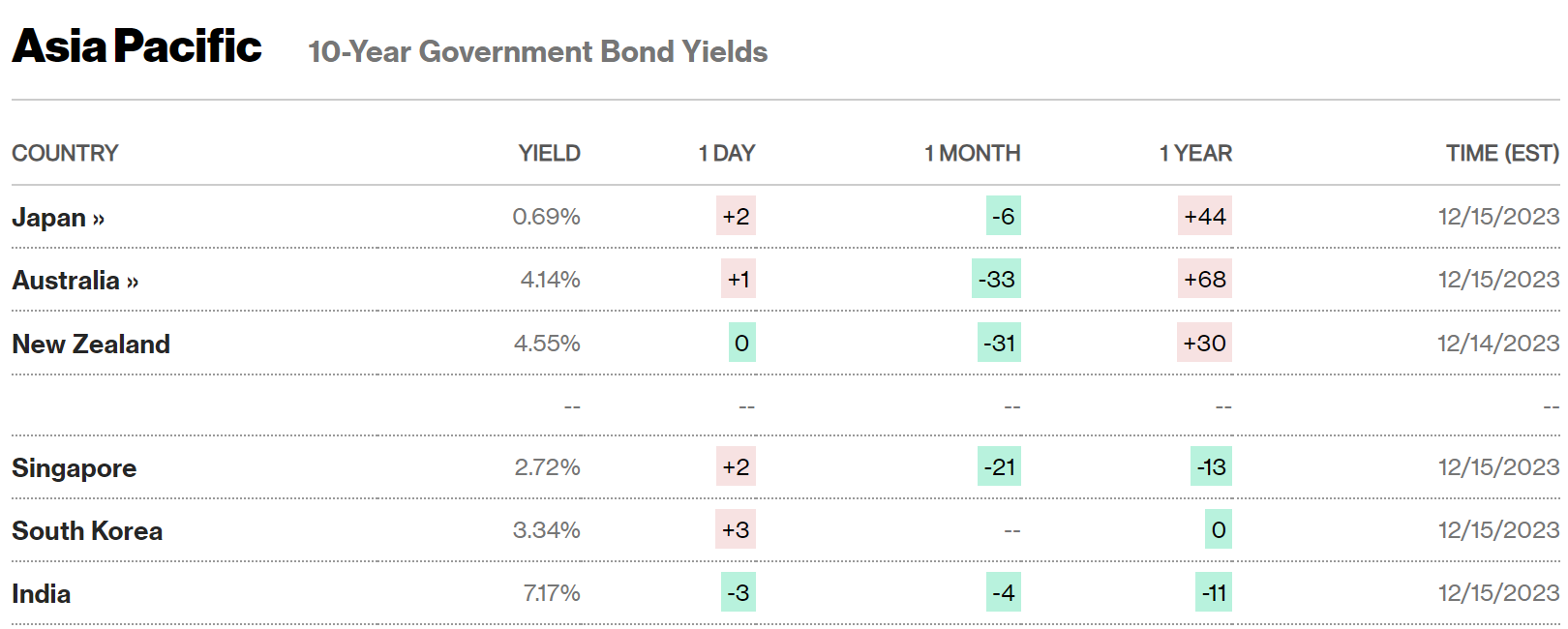

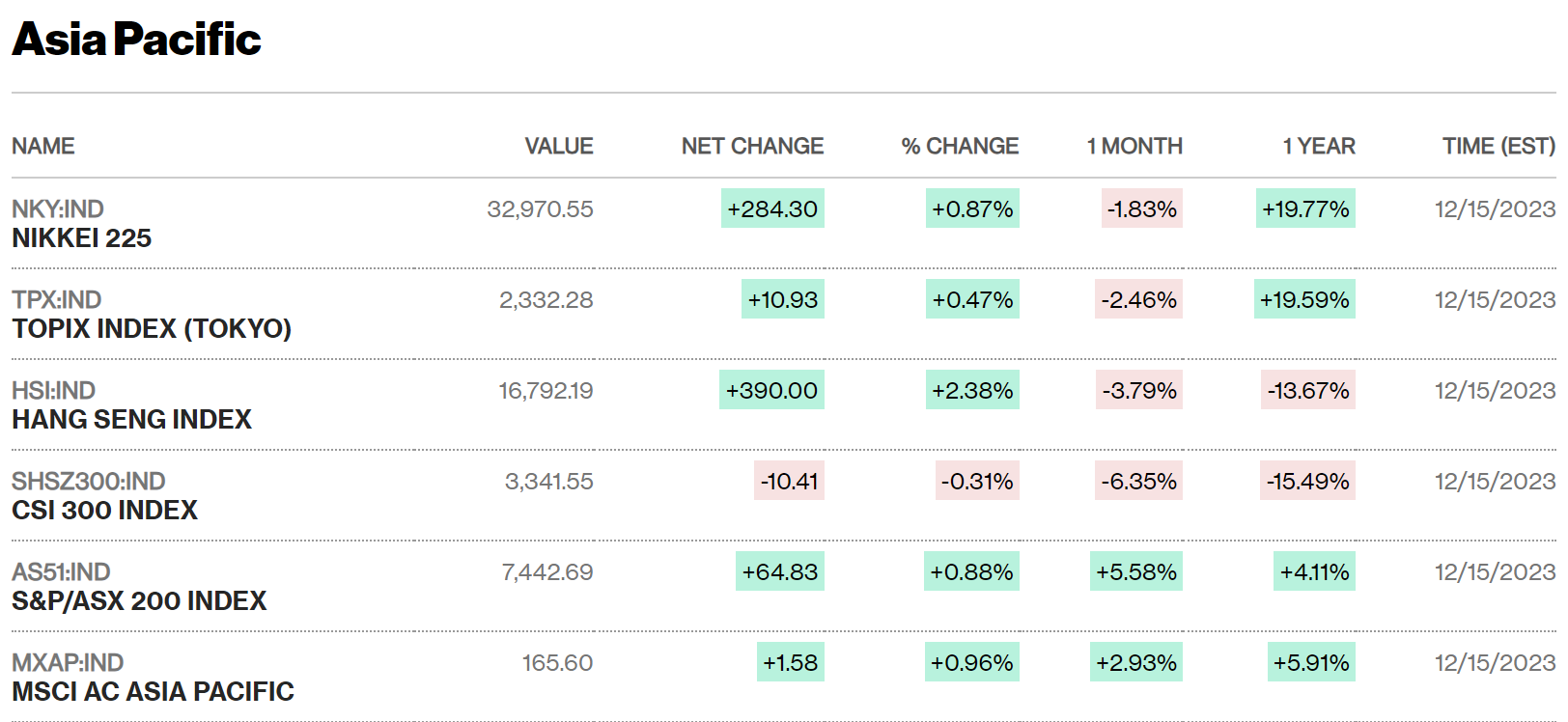

Japan

🏈 Bottom Line: Japan's stock markets rose on the back of the U.S. Federal Reserve's policy shift, while bond yields fell, the yen strengthened, and mixed economic data emerged, but political scandal impacted Prime Minister Fumio Kishida's popularity.

- Japan's stock markets rose, with the Nikkei 225 up 2.1% and TOPIX up 0.3%, driven by the U.S. Federal Reserve's indication of a shift away from tightening monetary policy.

- The 10-year Japanese government bond yield fell to 0.70%, while the yen strengthened to JPY 141 against the U.S. dollar due to expectations of narrower U.S.-Japan interest rate differences.

- December PMI data showed a mild expansion in Japan's private sector, driven by stronger services offsetting a manufacturing contraction.

- The BoJ's quarterly "tankan" survey indicated growing optimism among large manufacturers, potentially leading to wage hikes.

- Prime Minister Fumio Kishida's popularity suffered due to a political funds scandal within the ruling Liberal Democratic Party, leading to resignations and a corruption probe.

China

🏈 Bottom Line: In China, equities declined amid persistent deflationary pressures, while the Hong Kong Hang Seng Index rose, and economic data showed a mixed picture, with concerns over deflation prompting ongoing policy support from the People's Bank of China in preparation for 2024.

- Chinese equities fell due to deflationary pressures, with the Shanghai Composite Index down 0.91% and the CSI 300 declining by 1.7%.

- Hong Kong's Hang Seng Index rose 2.8% in a global stock rally following the Fed's decision to keep interest rates steady.

- China's consumer price index (CPI) dropped 0.5% in November, driven by lower pork prices, while the producer price index (PPI) fell by 3%, marking the 14th consecutive monthly decline, raising concerns of deflation.

- Economic data for November showed mixed results: industrial production grew by 6.6%, retail sales increased by 10.1% but missed expectations, and fixed asset investment grew weaker than forecast at 2.9% for the first 11 months of the year.

- The urban unemployment rate remained steady at 5%, and the People's Bank of China (PBOC) injected RMB 1,450 billion into the banking system through its medium-term lending facility.

- Policy measures for 2024 aim to boost domestic consumption and investment to counter weak consumer confidence and a property sector downturn.

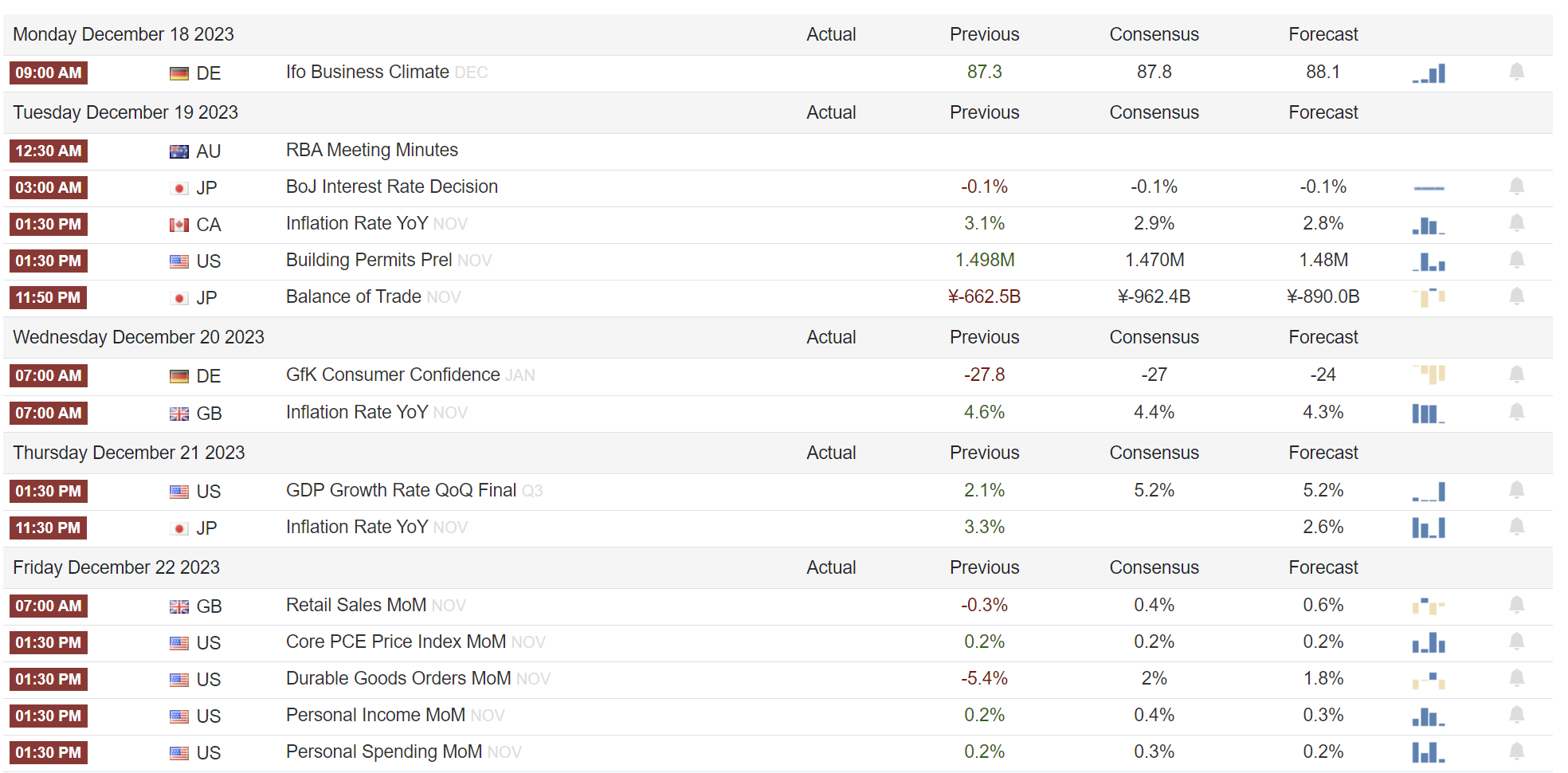

2. Week Ahead

![Obsidian Brief] When Money Becomes Software: AI, Stablecoins & Bitcoin — Implications for Sustainable and Impact Investing](https://images.unsplash.com/photo-1657408056887-c8c627f7574a?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDF8fHN0YWJsZWNvaW58ZW58MHx8fHwxNzY0NzM0MTExfDA&ixlib=rb-4.1.0&q=80&w=720)

![Finance | Leadership] Breaking into Finance: A Real-World Guide for Students and Future Leaders (technical and behavioral tips: lessons learned from a 15-year journey in Wall Street & City of London) - Part 5/5: Analyst level Deep-dive career guides](https://images.unsplash.com/photo-1537211568975-f95f2101c8f5?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDE1fHxtb250JTIwYmxhbmN8ZW58MHx8fHwxNzY0NTU3NzQ1fDA&ixlib=rb-4.1.0&q=80&w=720)

![Finance | Leadership] Breaking into Finance: A Real-World Guide for Students and Future Leaders (technical and behavioral tips: lessons learned from a 15-year journey in Wall Street & City of London) - Part 4/5: Interview Prep Tips](https://images.unsplash.com/photo-1605128005752-d1714260611e?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDF8fG1vbnQlMjBibGFuY3xlbnwwfHx8fDE3NjQ1NTc3NDV8MA&ixlib=rb-4.1.0&q=80&w=720)