Global Markets Recap - Week of Dec 18, 2023

1. What Moved the Markets?

Europe

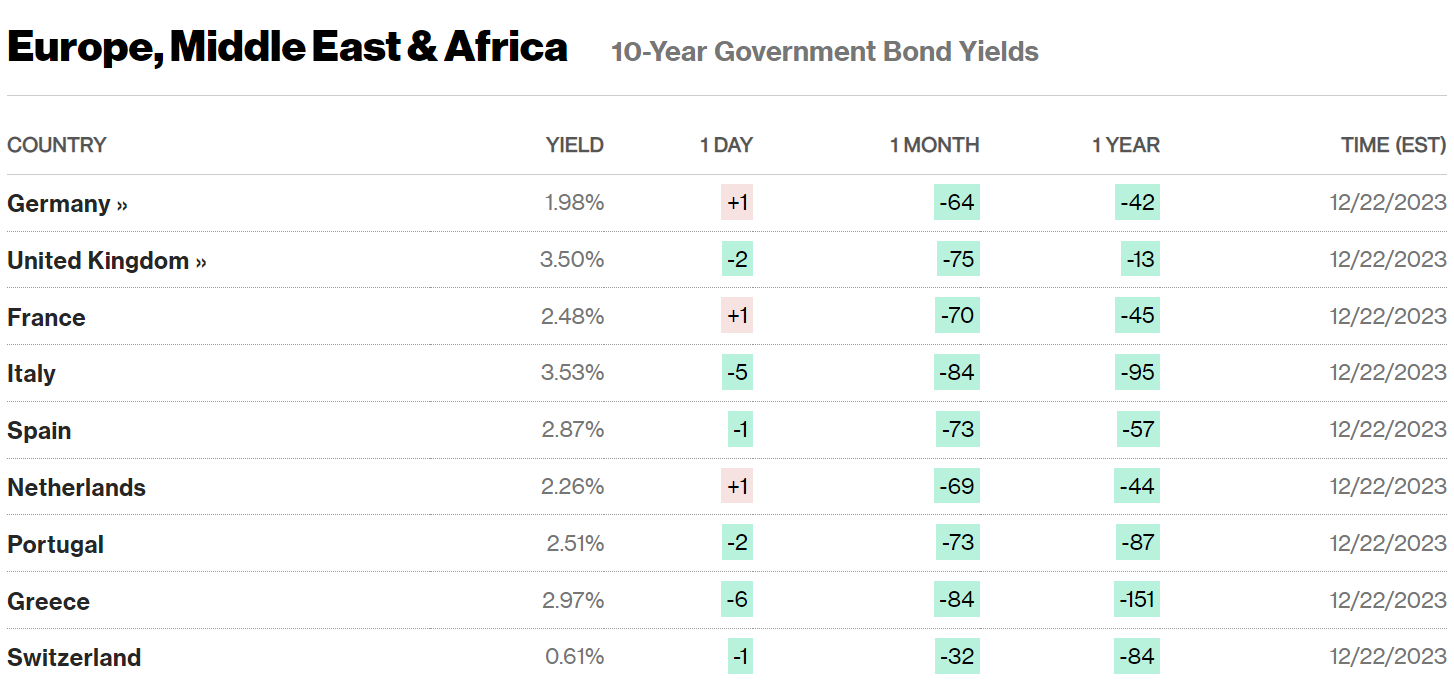

🏈 Bottom Line: European stocks showed mixed performance with the STOXX Europe 600 near a one-year high, while the UK economy faces inflation slowdown and potential recession, and German business sentiment worsens, with European Central Bank officials indicating interest rates will remain high for the foreseeable future.

- European Stock Markets: STOXX Europe 600 Index (+0.21%), near a one-year high. France's CAC 40 (-0.37%), Germany's DAX (-0.27%), Italy's FTSE MIB (slight decline), UK's FTSE 100 (+1.60%).

- UK Economic Indicators: Headline inflation slowed to 3.9% year-on-year in November, down from 4.6% in October. Core and services inflation at 5.1% and 6.3%, respectively, above the 2% target. GDP revisions: Q2 unchanged (from 0.2% growth), Q3 shrank by 0.1%. Bank of England Deputy Governor suggests interest rates to remain high.

- German Business Climate: Ifo business climate index decreased to 86.4 in December from 87.2 in November. Downturn in manufacturing sentiment, with worsening current business situations and shrinking order books.

- ECB Rate Policy: ECB's Yannis Stournaras states inflation must stabilize below 3% by mid-2024 before rate cuts.

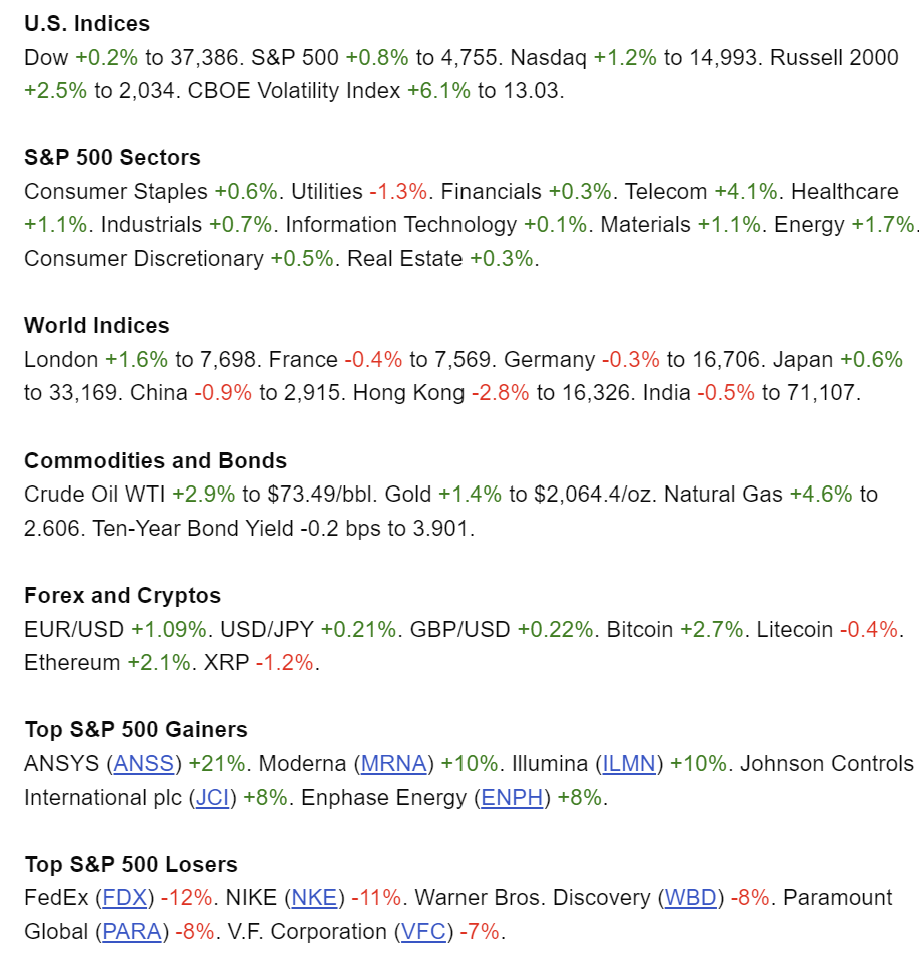

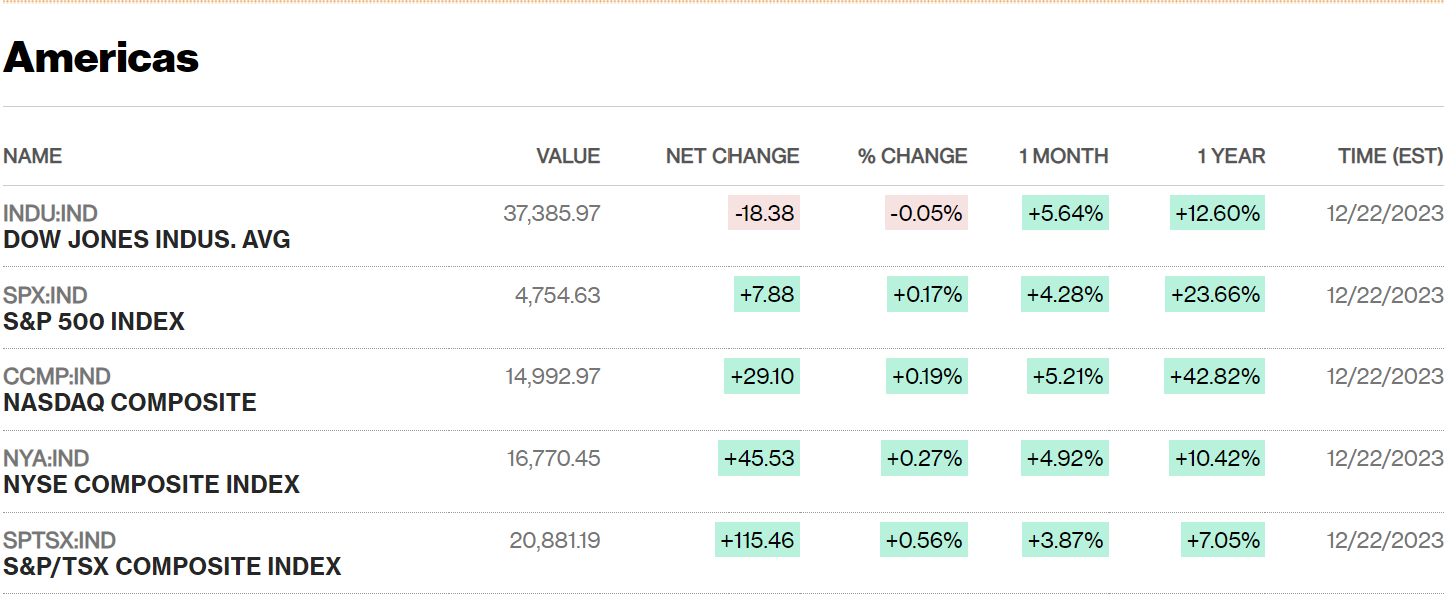

US

🏈 Bottom Line: The U.S. stock market, including Nasdaq 100 and Dow, reached new records amid positive economic indicators and growing investor confidence in avoiding a recession, coupled with expectations of significant Federal Reserve rate cuts in the coming year.

- Stock Market Performance: Dow +0.2% to 37,386. S&P 500 +0.8% to 4,755. Nasdaq +1.2% to 14,993. Russell 2000 +2.5% to 2,034. CBOE Volatility Index +6.1% to 13.03.Nasdaq 100 and Dow Jones set new records. S&P 500 Index briefly approached within 0.84 percentage points of its all-time high. Communication services stocks in the S&P 500, including Alphabet and Meta Platforms, led gains. Energy shares outperformed due to rising oil prices amid Red Sea shipping concerns.

- Federal Reserve Insights: San Francisco Fed President Mary Daly suggested short-term rates remain restrictive, even with potential cuts next year. Richmond Fed President Tom Barkin noted positive data trends but continued focus on inflation. Atlanta Fed President Raphael Bostic warned of slow inflation decline over the next six months.

- Economic Data Highlights: Core PCE index rose only 0.1% in November; headline PCE index fell 0.1%, first decline in 21 months. Housing starts surged 14.8% in November. Existing home sales also increased. Consumer confidence index reached 110.7 in November, the highest since July. Durable goods orders jumped 5.4% in November, the most significant increase since July 2020. Orders for non-defense capital goods excluding aircraft rose 4.7%, the largest rise since 2004.

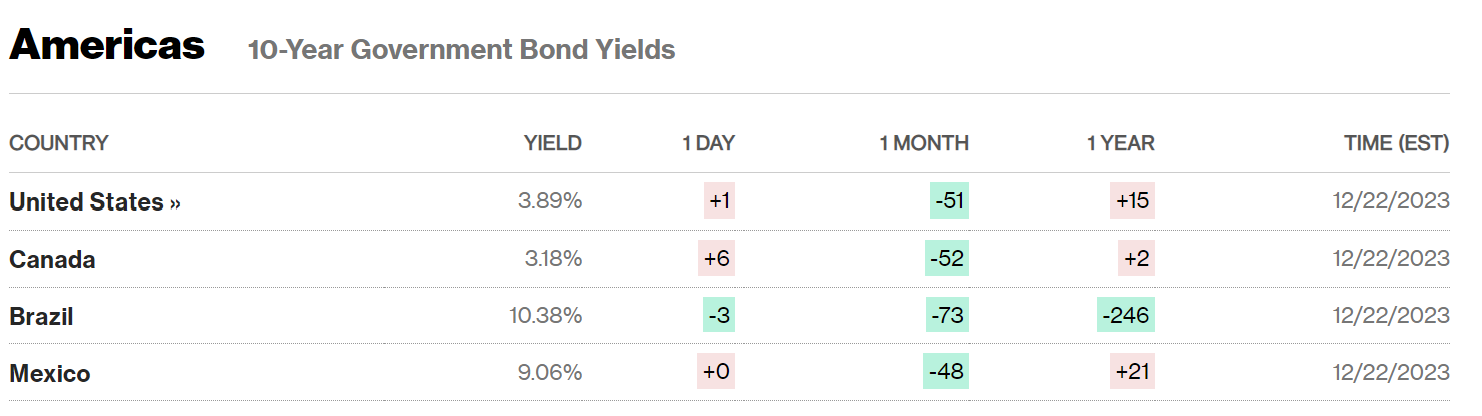

- Interest Rate and Bond Market: Futures markets indicated an 82.1% chance of at least 100 basis points in rate cuts by year-end, up from 59.6% the previous week. Short-term bond yields decreased, steepening the Treasury yield curve. Bond market activity was quiet ahead of the holiday weekend, with focus on high yield issuers related to M&A activity.

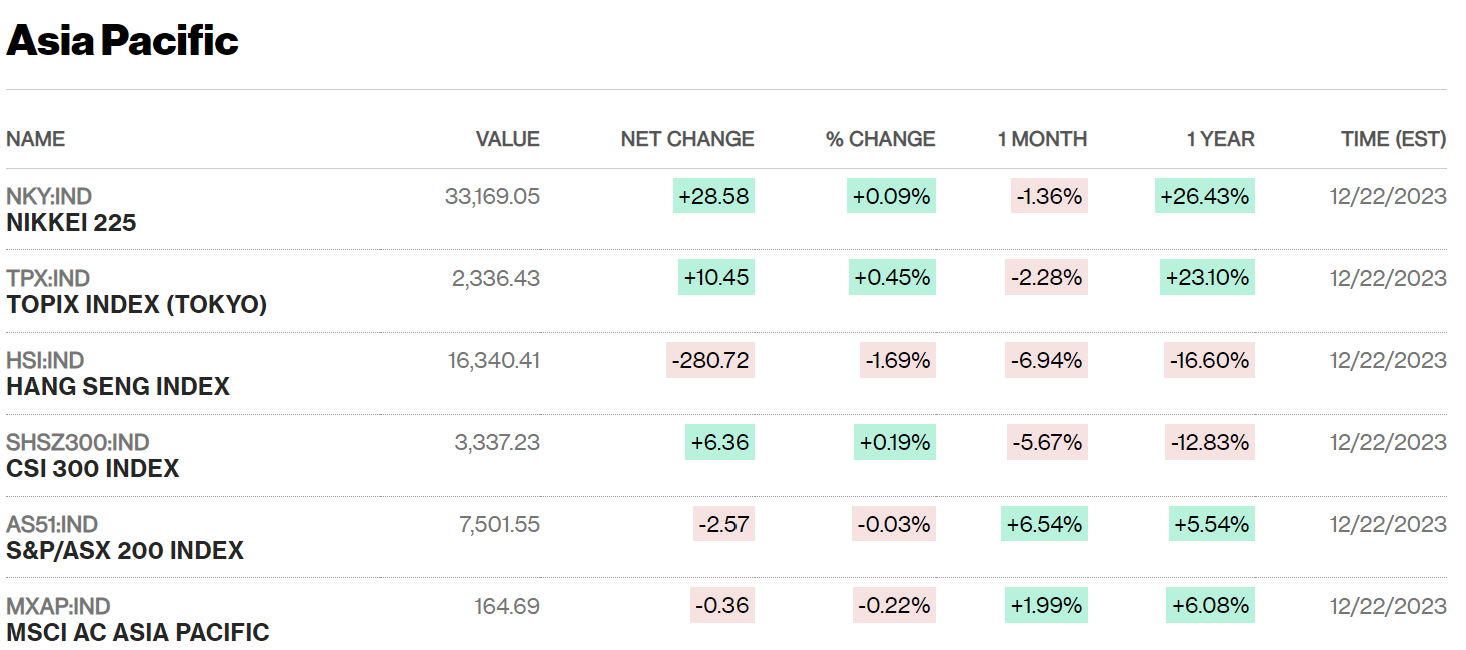

Japan

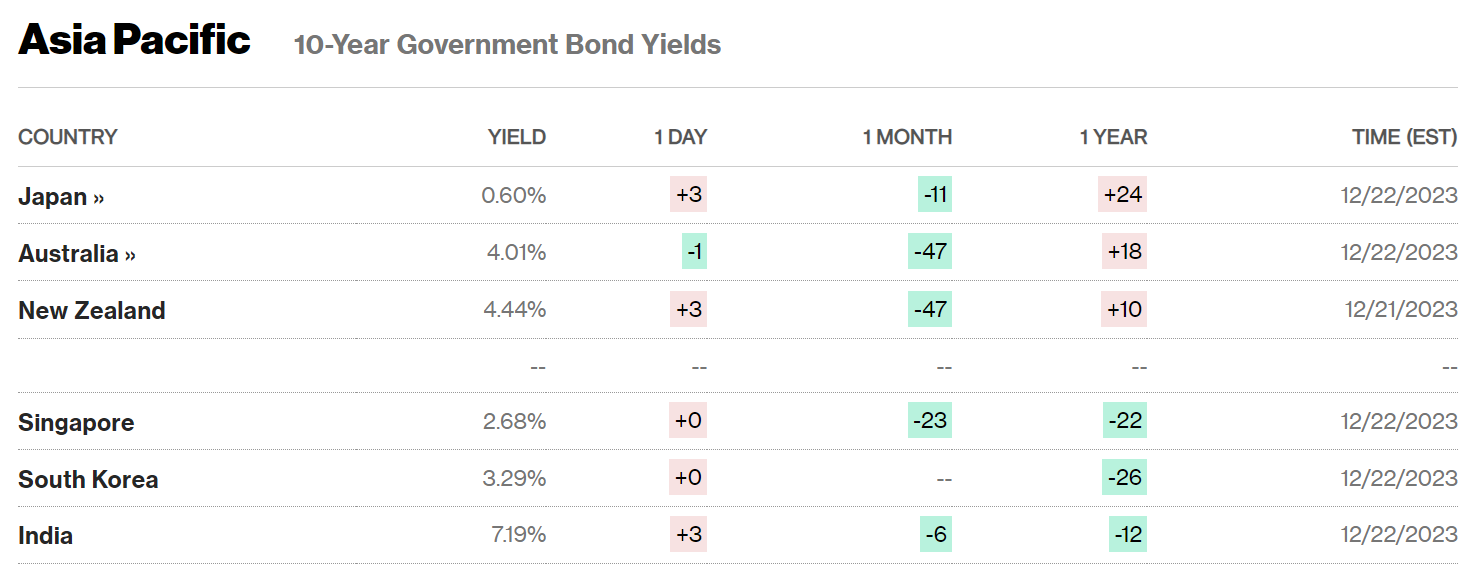

🏈 Bottom Line: Japan's stock market registered modest gains, buoyed by the Bank of Japan's persistent dovish monetary stance and expectations against near-term interest rate hikes.

- Stock Market: Nikkei 225 rose 0.6%, TOPIX up 0.2%, supported by the Bank of Japan's (BoJ) dovish stance.

- Monetary Policy: BoJ maintained its ultra-accommodative stance, with short-term interest rate target at -0.1% and yield curve control policy.

- Interest Rate Expectations: BoJ Governor Kazuo Ueda signaled no near-term rate hikes, pushing back against market expectations.

- Bond Yields and Currency: 10-year JGB yield fell to 0.62%; yen remained broadly unchanged at the low end of the JPY 142 range against the U.S. dollar.

- Inflation Data: Japan's core consumer price index rose 2.5% year-on-year in November, a decrease from the previous month's 2.9%.

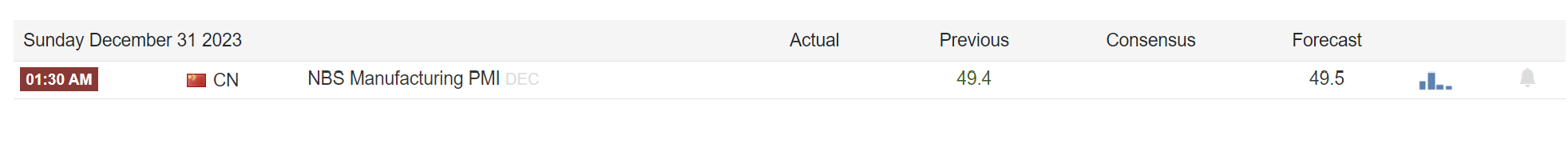

China

🏈 Bottom Line: China's stock market faced declines following new gaming sector restrictions and amid forecasts of the People's Bank of China maintaining a looser monetary policy into 2024.

- Stock Market: Shanghai Composite fell 0.94%, CSI 300 down 0.13%, Hang Seng Index lost 2.69%.

- Gaming Sector Regulations: New rules proposed to curb online video game spending and rewards, leading to a significant market value drop in gaming companies.

- Tech Clampdown: Continuation of regulatory actions from 2021, with recent easing of restrictions in 2023.

- Loan Prime Rates: Chinese banks kept one- and five-year loan prime rates unchanged following the PBOC's decision.

- Monetary Policy Outlook: PBOC expected to maintain looser policy into 2024, with potential further easing due to deflationary pressures.

2. Week Ahead

Quiet holiday week.