Global Markets Recap - Week of Dec 4, 2023

1. What Moved the Markets?

Europe

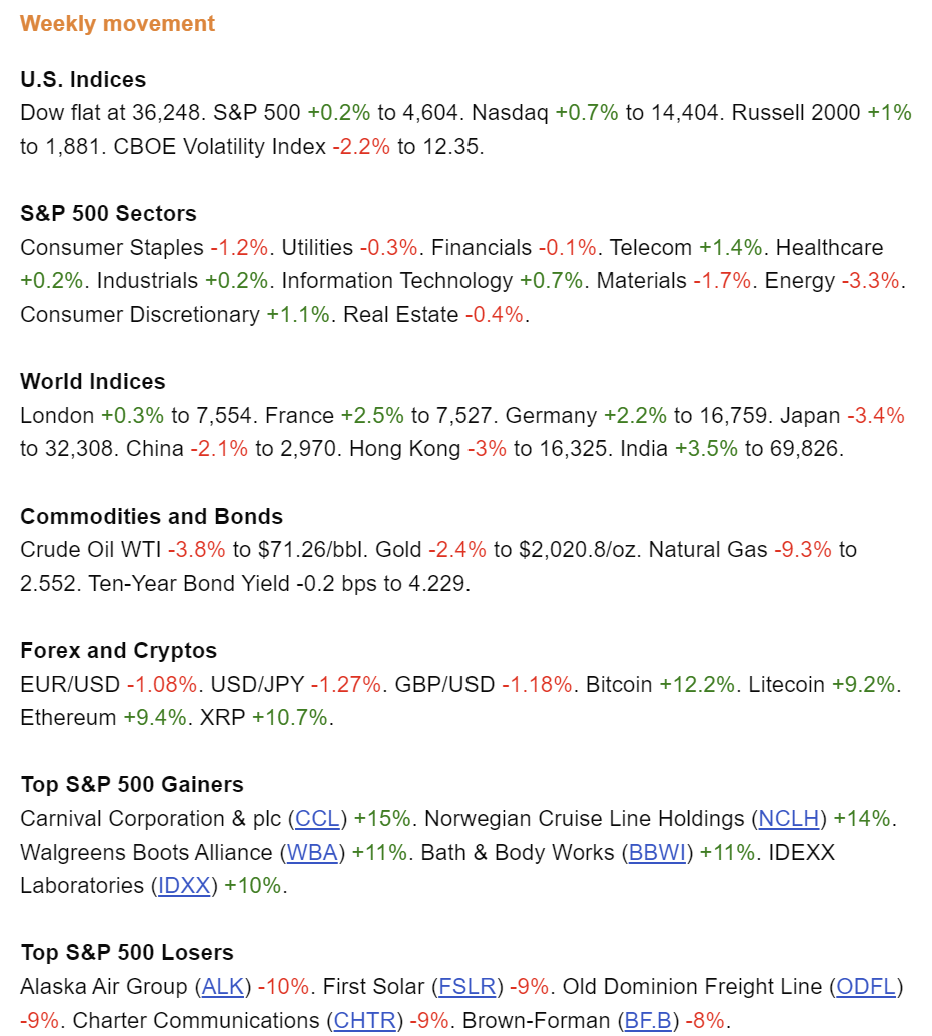

🏈 Bottom Line: European stocks and major indexes advanced due to expectations of central bank rate cuts amid slowing inflation and economic challenges, while government bond yields fell and the ECB signaled a dovish shift.

- European Stocks Advance: The STOXX Europe 600 Index rose for the fourth consecutive week, ending 1.30% higher, driven by expectations of potential central bank interest rate cuts next year.

- Major European Indexes Gain: France’s CAC 40 (+2.46%), Germany’s DAX (+2.21%), Italy’s FTSE MIB (+1.59%), and the UK’s FTSE 100 (+0.33%).

- European Government Bond Yields Decrease: Yields broadly fell, with the 10-year German bond yield approaching yearly lows and Italian bond yields also declining. In the UK, the 10-year government bond yield dropped below 4% for the first time since mid-May.

- ECB Policymakers Signal Possible Rate Cuts: ECB Executive Board member Isabel Schnabel indicated a dovish shift, suggesting a further rate increase is unlikely. Governing Council member Francois Villeroy de Galhau noted that disinflation is happening faster than expected, raising the possibility of rate cuts in 2024.

- German Economic Challenges: Industrial output fell 0.4% in October, marking the fifth consecutive month of decline. Factory orders dropped 3.7%, and the unemployment rate rose to 5.9% in November.

- UK Housing Market Weakens: The construction sector in the UK continued to decline, with a significant drop in homebuilding activities in November, as reported by the Purchasing Managers’ Index.

US

🏈 Bottom Line: U.S. stocks showed mixed performance, with small-caps leading the way and technology stocks benefiting from AI enthusiasm, while consumer optimism grew despite a cooling labor market, and bond markets saw varied activity with yields ending relatively unchanged.

- U.S. Stocks Mixed, Small-Caps Rally: Major indexes ended flat to modestly higher, with the Russell 2000 outperforming the S&P 500 for the third time in four weeks, reducing its year-to-date underperformance. Dow flat at 36,248. S&P 500 +0.2% to 4,604. Nasdaq +0.7% to 14,404. Russell 2000 +1% to 1,881. CBOE Volatility Index -2.2% to 12.35.

- Growth Stocks vs. Value Shares: Growth stocks increased their lead over value shares. Within the S&P 500, energy stocks lagged as oil prices fell below USD 70 per barrel for the first time since June.

- AI Enthusiasm Boosts Tech Stocks: Alphabet's shares rose over 5% after unveiling AI model Gemini. Advanced Micro Devices' shares surged nearly 10% with the launch of new AI chips. Apple's market cap reached USD 3 trillion again.

- Employment Data Surprises Positively: Nonfarm payrolls added 199,000 jobs in November, exceeding expectations of 180,000. Unemployment fell to 3.7%, and average hourly earnings rose 0.4%.

- Consumer Sentiment Rises: The University of Michigan's consumer sentiment index in December hit its highest level since August. Inflation expectations dropped to 3.1%, the lowest since March 2021.

- Mixed Economic Data: Services sector activity picked up in November, but October job openings dropped to 8.73 million, the lowest since March 2021. October factory orders also fell more than expected.

- Bond Market Dynamics: Long-term interest rates fluctuated, with the 10-year U.S. Treasury yield hitting 4.10% on Thursday. Tax-exempt municipal bonds remained supported by technical conditions.

- Corporate Bond Market Weakens: The investment-grade corporate bond market softened early in the week. High yield bond demand was strong, especially for BB rated bonds. The bank loan market saw active refinancing and repricing.

Japan

🏈 Bottom Line: Japan's stock markets declined amid speculation of an early shift in the Bank of Japan's monetary policy, leading to a contraction in the economy and a rise in government bond yields, while the yen strengthened against the U.S. dollar.

- Japanese Stocks Decline: The Nikkei 225 Index (-3.4%) and the broader TOPIX Index (-2.4%).

- Bank of Japan (BoJ) Comments Spur Speculation: Officials' comments led to speculation about an early end to negative interest rates, negatively impacting riskier assets.

- Economic Contraction in Japan: Japan's economy shrank more than initially estimated in Q3, contracting by 2.9% on an annualized basis.

- Japanese Government Bond Yields Rise: The yield on the 10-year JGB increased to 0.77%, influenced by a weaker-than-expected 30-year JGB auction.

- Yen Strengthens Amid Policy Normalization Speculation: The yen reached its highest in nearly four months against the U.S. dollar, fueled by expectations of BoJ policy shifts and reduced interest rate differentials with the U.S.

- Potential Early Shift in BoJ Monetary Policy: Investors interpreted comments by BoJ officials as indicating a possible earlier-than-expected change in monetary policy.

- BoJ Deputy Governor Suggests Benefits from Policy Shift: Deputy Governor Ryozo Himino noted that exiting ultra-loose policy could be beneficial, but cautioned careful handling.

- BoJ Governor Anticipates Tougher Policy Handling: Governor Kazuo Ueda highlighted the increasing challenges in monetary policy for the upcoming year, emphasizing the need to monitor the wage and price cycle.

China

🏈 Bottom Line: Chinese equities declined following Moody's downgrade of China's sovereign debt outlook to "negative," amid concerns over debt-laden local governments and a faltering economy, despite mixed signals in service sector activity and a slight improvement in trade data.

- Chinese Equities Drop: The Shanghai Composite Index (-2.05%), and the CSI 300 (-2.4%), reaching its lowest in nearly five years. Hong Kong's Hang Seng Index (-2.95%).

- Moody’s Downgrades China’s Debt Outlook: The rating was changed from "stable" to "negative," highlighting risks from debt-laden local governments and state firms.

- Economic Challenges in China: The downgrade reflects ongoing issues, including a property market downturn and weak consumer and business confidence, despite Beijing's pro-growth measures.

- Mixed Signals in Service Sector Activity: The Caixin/S&P Global services activity index rose to 51.5 in November, indicating expansion, but investors remained bearish due to broader economic concerns.

- Contrasting PMI Data: The positive Caixin/S&P Global survey result contrasted with the official nonmanufacturing PMI, which showed contraction for the first time in a year.

- Trade Data Shows Mixed Results: November exports increased by 0.5%, recovering from a decline, while imports unexpectedly fell by 0.6%. The overall trade surplus rose to USD 68.39 billion.

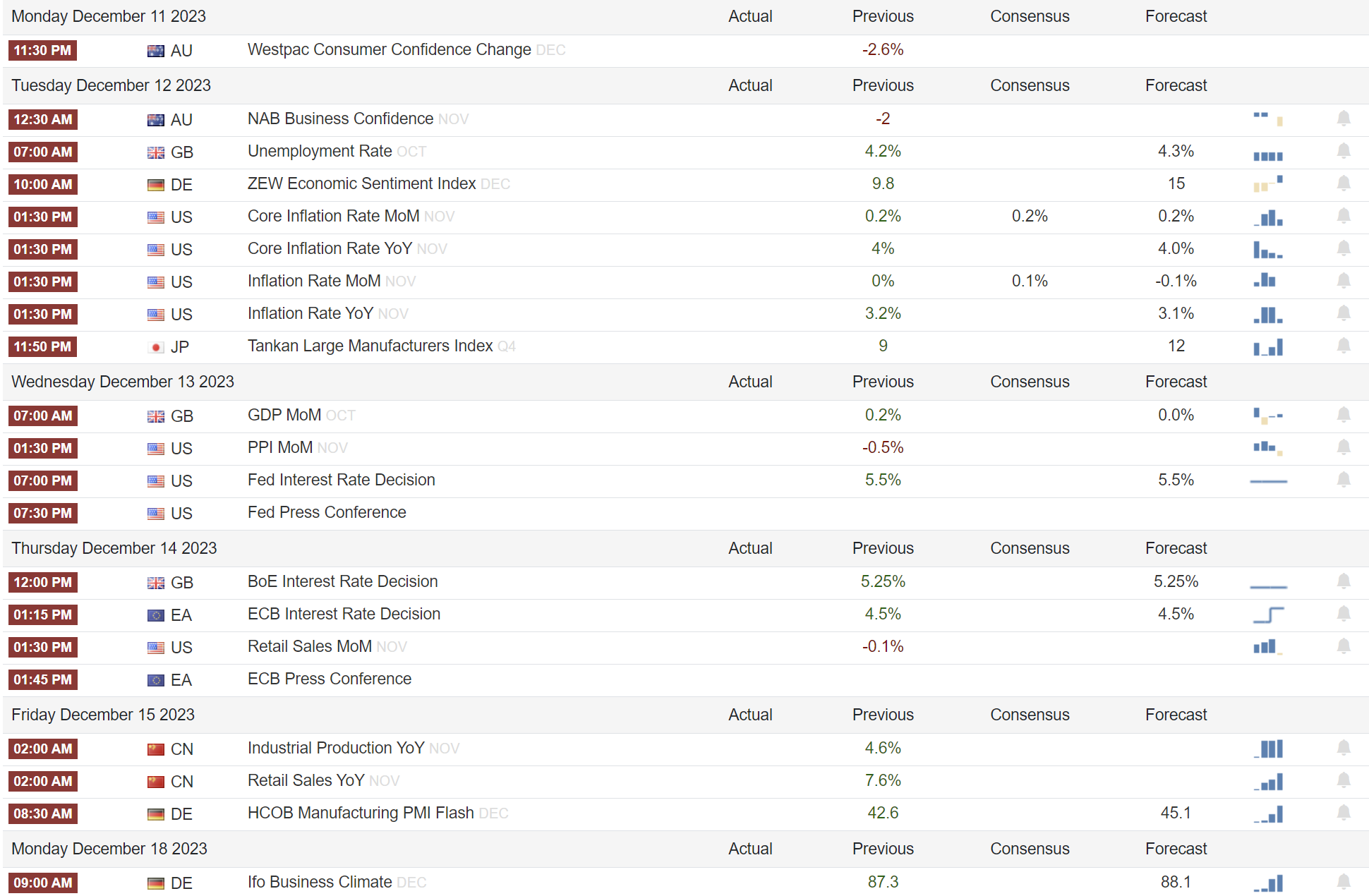

2. Week Ahead

We have some major economies' inflation prints and rate decisions (Fed/BOE/ECB) this week.