Global Markets Recap - Week of Nov 27, 2023

1. What Moved the Markets?

Europe

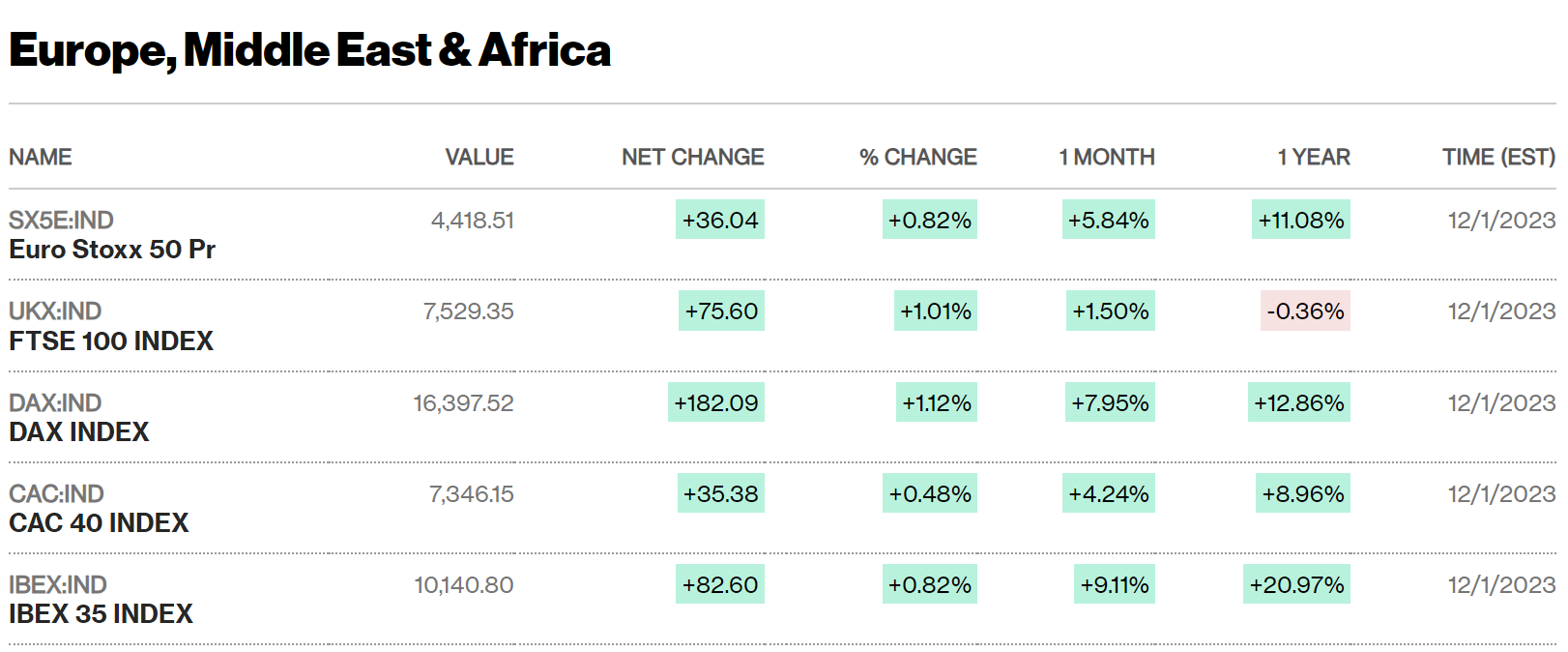

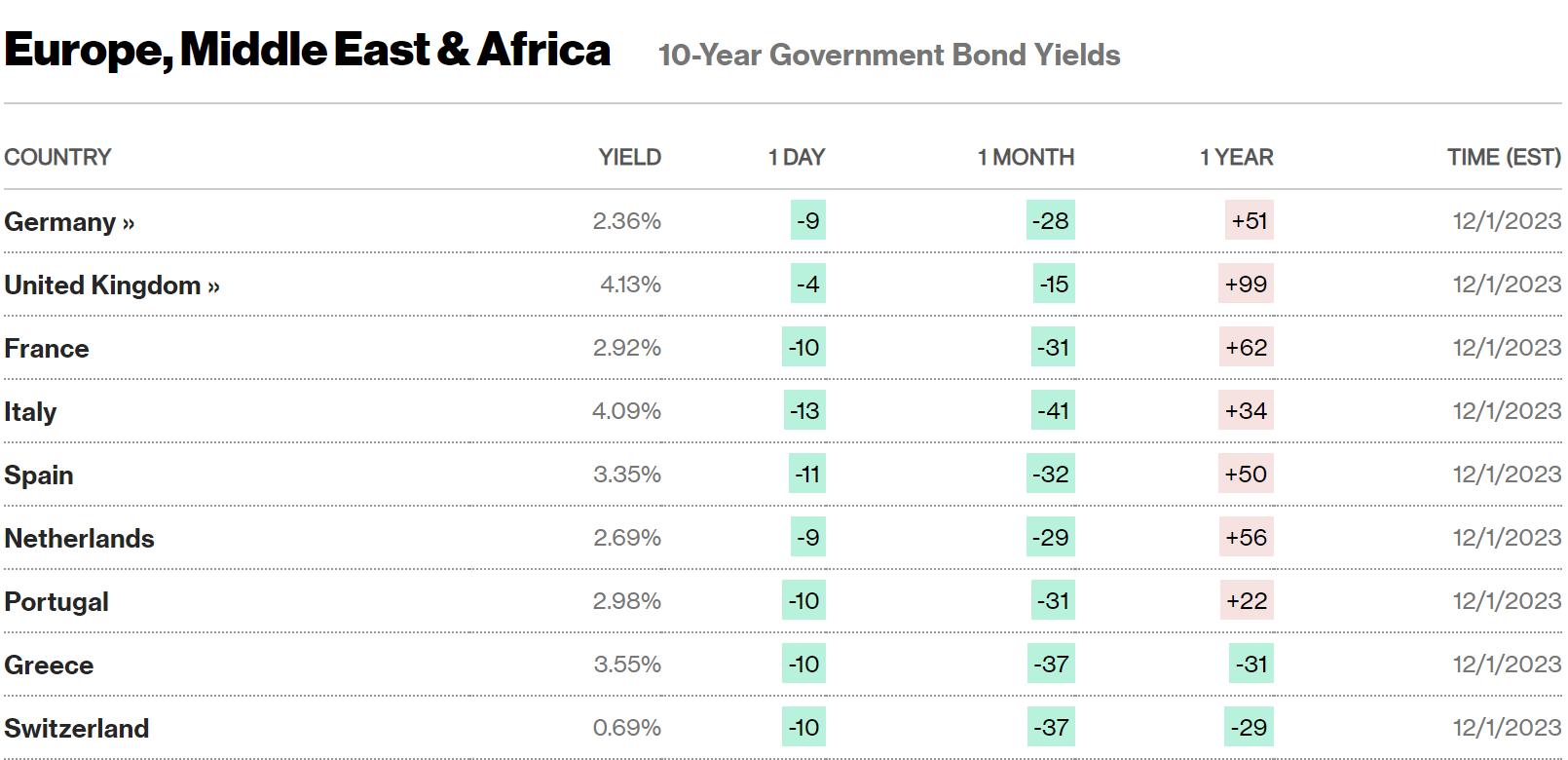

🏈 Bottom Line: European stock markets rallied and government bond yields fell, driven by a significant drop in Eurozone inflation and hawkish central bank responses, with Germany experiencing a rise in unemployment and the UK showing signs of housing market stabilization.

- The pan-European STOXX Europe 600 Index (+1.35%) per steep inflation decline. Germany’s DAX (+2.30%), Italy’s FTSE MIB (+1.69%), and France’s CAC 40 Index (+0.73%). The UK’s FTSE 100 Index (+0.55%).

- European Government Bond Yields Decrease: German and Italian 10-year bond yields fell, reflecting lower-than-expected inflation data and speculation about the ECB potentially reducing interest rates in the upcoming year.

- Eurozone Inflation Slows: Eurozone annual consumer price growth dropped to 2.4% in November, below expectations and a decline from October's 2.9%, signaling a more significant than anticipated slowdown in inflation.

- ECB's Hawkish Stance on Rates: Despite lower inflation, ECB President Christine Lagarde and other policymakers maintained a stance for high-interest rates to manage inflation.

- Rise in German Unemployment: Germany's unemployment rate increased to 5.9% in November, the highest since 2021, though retail sales growth surpassed expectations, indicating improved consumer confidence.

- Bank of England's Firm Stance: Governor Andrew Bailey ruled out interest rate cuts, focusing on achieving the 2% inflation target.

- UK Housing Market Stabilizing: The UK housing market showed signs of stabilization, adapting to the prevailing economic environment.

US

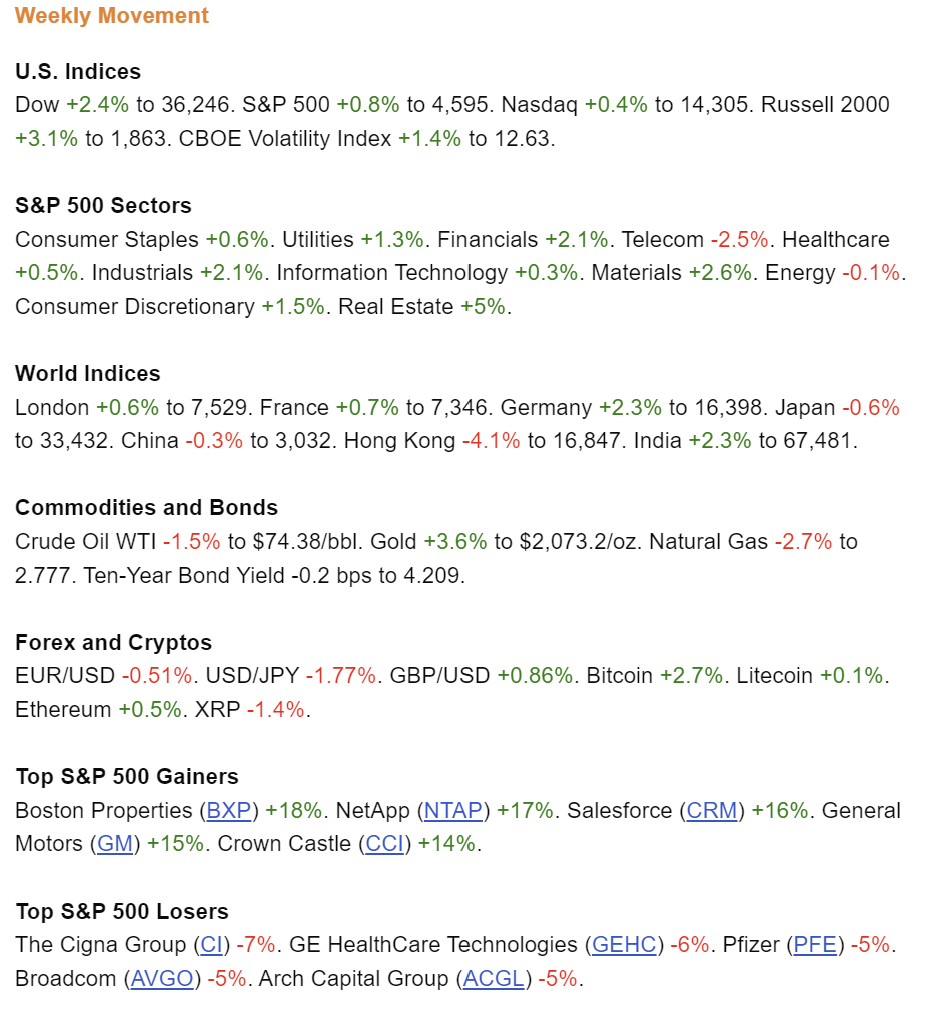

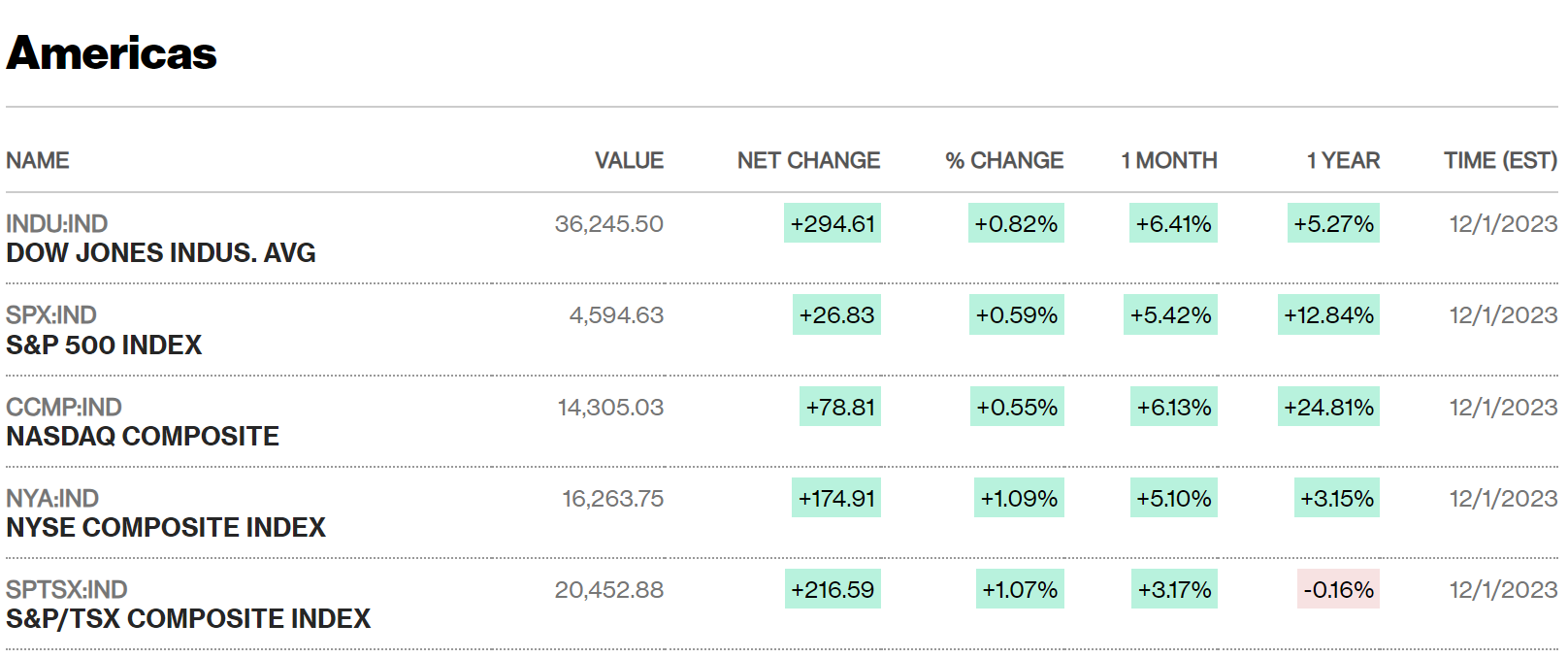

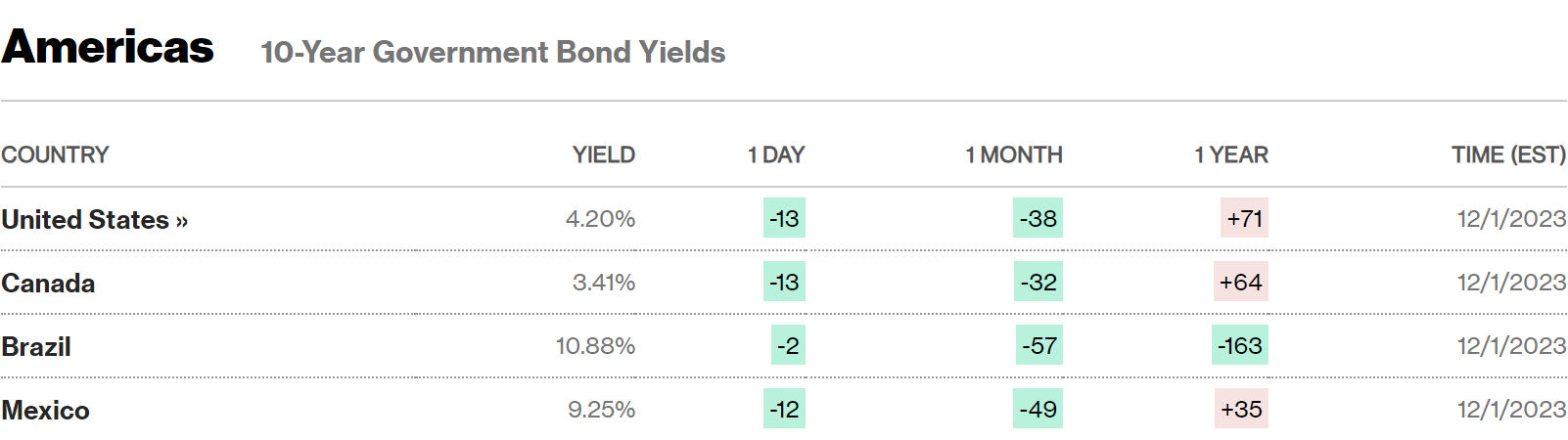

🏈 Bottom Line: The U.S. stock and bond markets experienced a rally, buoyed by signs of cooling inflation and Federal Reserve indications of a potentially softer approach to interest rate hikes. Dow +2.4% to 36,246. S&P 500 +0.8% to 4,595. Nasdaq +0.4% to 14,305. Russell 2000 +3.1% to 1,863. CBOE Volatility Index +1.4% to 12.63.

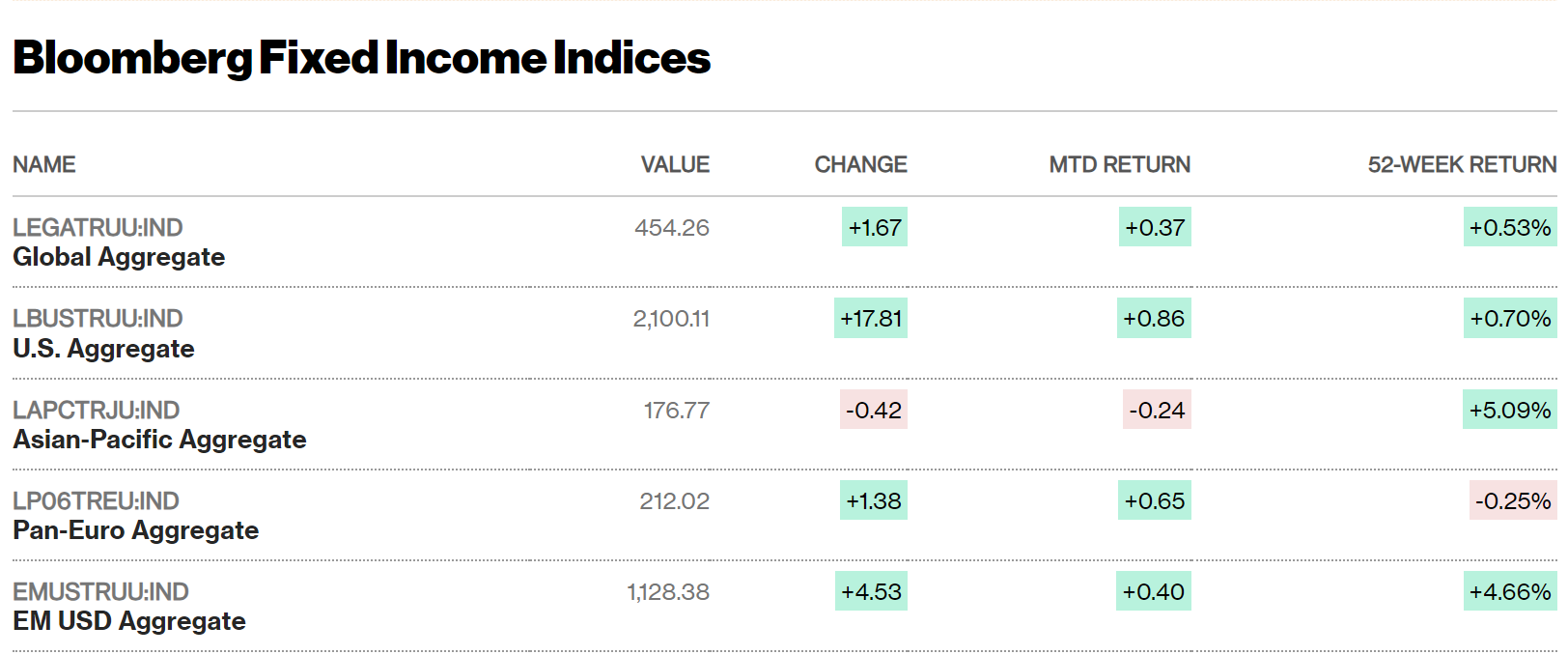

- Stock and Bond Market Gains: The S&P 500 and Nasdaq recorded their best monthly gains since July 2020, up 8.9% and 10.7% respectively, fueled by falling Treasury yields.

- Inflation Cooling: The core PCE price index rose only 0.2% in October, with its annual increase at 3.5%, the lowest since April 2021, indicating a slowdown in inflation.

- Federal Reserve's Optimism: Fed Board Member Christopher Waller suggested the possibility of lowering policy rates in the coming months if inflation continues to moderate.

- Impact of Fed Chair's Comments: Jerome Powell's remarks about restrictive interest rates and the potential for further hikes influenced both stock and bond markets.

- Mixed Economic Indicators: Personal spending increased by 0.2%, incomes rose at the same rate, housing starts underperformed, and continuing jobless claims hit a two-year high of 1.93 million.

- Balanced Economic Outlook: The Fed's Beige Book reported a split in economic activity across districts, half growing and half contracting, suggesting a "Goldilocks" scenario.

- 10-Year Treasury Yield Drops: The yield on the 10-year Treasury note reached a nearly three-month low of 4.21%.

- Corporate Bond Market Activity: All issues in the investment-grade corporate bond market were oversubscribed, with high-yield bonds performing well due to expectations of tighter liquidity in the future.

Japan

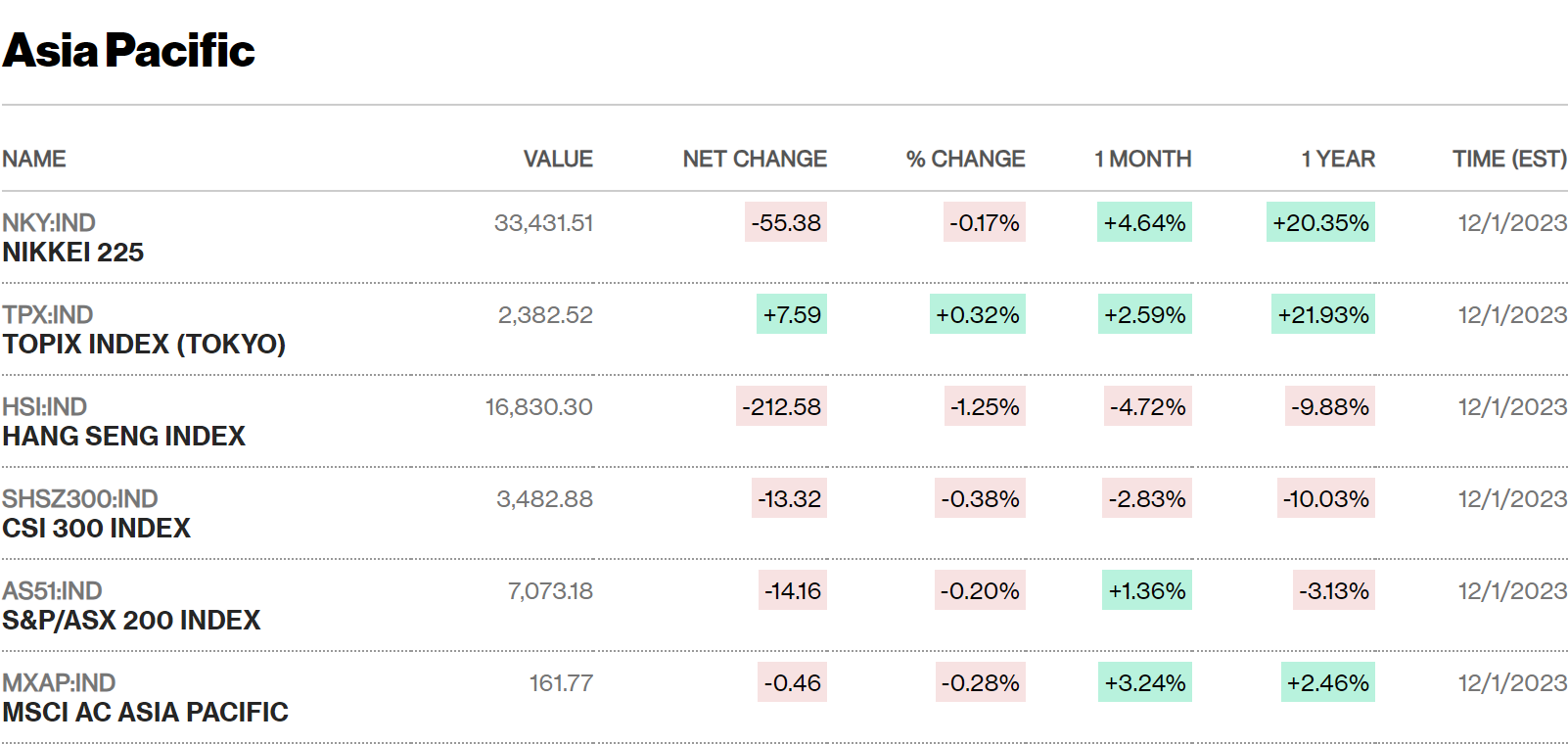

🏈 Bottom Line: Japanese stock markets experienced a slight decline amid profit-taking, with the yen strengthening and the government implementing measures to address inflation, while the Bank of Japan maintained its dovish monetary policy stance.

- Decline in Japanese Stock Markets: The Nikkei 225 (-0.6%) and TOPIX indexes (-0.4%) fell over the week, influenced by profit-taking after a rally in November, strong corporate earnings, and a weakening yen.

- Japanese Government Bond Yields Decreased: The yield on the 10-year Japanese government bond fell to 0.71%, reflecting a decline in U.S. bond yields due to dovish Federal Reserve policies and signs of slowing economic activity.

- Yen Strengthens Against Dollar: The yen appreciated to the high-147 range versus the U.S. dollar, influenced by the dollar's general weakness and anticipation of potential Federal Reserve rate cuts in the coming year.

- Japanese Government's Inflation Measures: Prime Minister Fumio Kishida announced an economic stimulus package over USD 110 billion, including tax cuts and cash handouts for low earners, to combat inflation.

- Extra Budget for Fiscal Stimulus: Japan’s parliament passed an additional budget for the current business year to support the fiscal stimulus package.

- Bank of Japan's Dovish Monetary Policy: The Bank of Japan board maintained its dovish stance, focusing on continued monetary easing and acknowledging challenges in meeting the 2% inflation target in the near term.

China

🏈 Bottom Line: Chinese equities declined as the Shanghai Composite Index dropped 0.31% and the CSI 300 fell 1.56%, with mixed economic data showing the official manufacturing PMI at 49.4 and a 2.7% growth in industrial profits, amidst a 29.6% drop in new home sales by top developers, highlighting the challenges in China's fragile economic recovery.

- Decline in Chinese Equities: The Shanghai Composite Index fell by 0.31%, the CSI 300 lost 1.56%, and Hong Kong's Hang Seng Index declined 4.15%.

- Mixed Economic Data: China's official manufacturing PMI dropped to 49.4, signaling contraction, while the nonmanufacturing PMI slipped to 50.2. However, the Caixin/S&P Global manufacturing PMI rose to an above-forecast 50.7.

- Beijing's Financial Support Plan: The government unveiled a 25-point plan to bolster the private sector, focusing on enhancing access to financial channels such as loans, bonds, and equity financing.

- People’s Bank of China's Monetary Policy Focus: The central bank's report highlighted a shift in its lending strategy from volume to improving the efficiency and structure of loans.

- Industrial Profits Growth Slows: October saw a 2.7% year-over-year increase in industrial profits, a slowdown from September’s 11.9% rise. Year-to-date profits decreased by 7.8%.

- Continued Property Sector Slump: The value of new home sales by top 100 developers in China fell by 29.6% in November year-over-year, exacerbating the ongoing downturn in the property market.

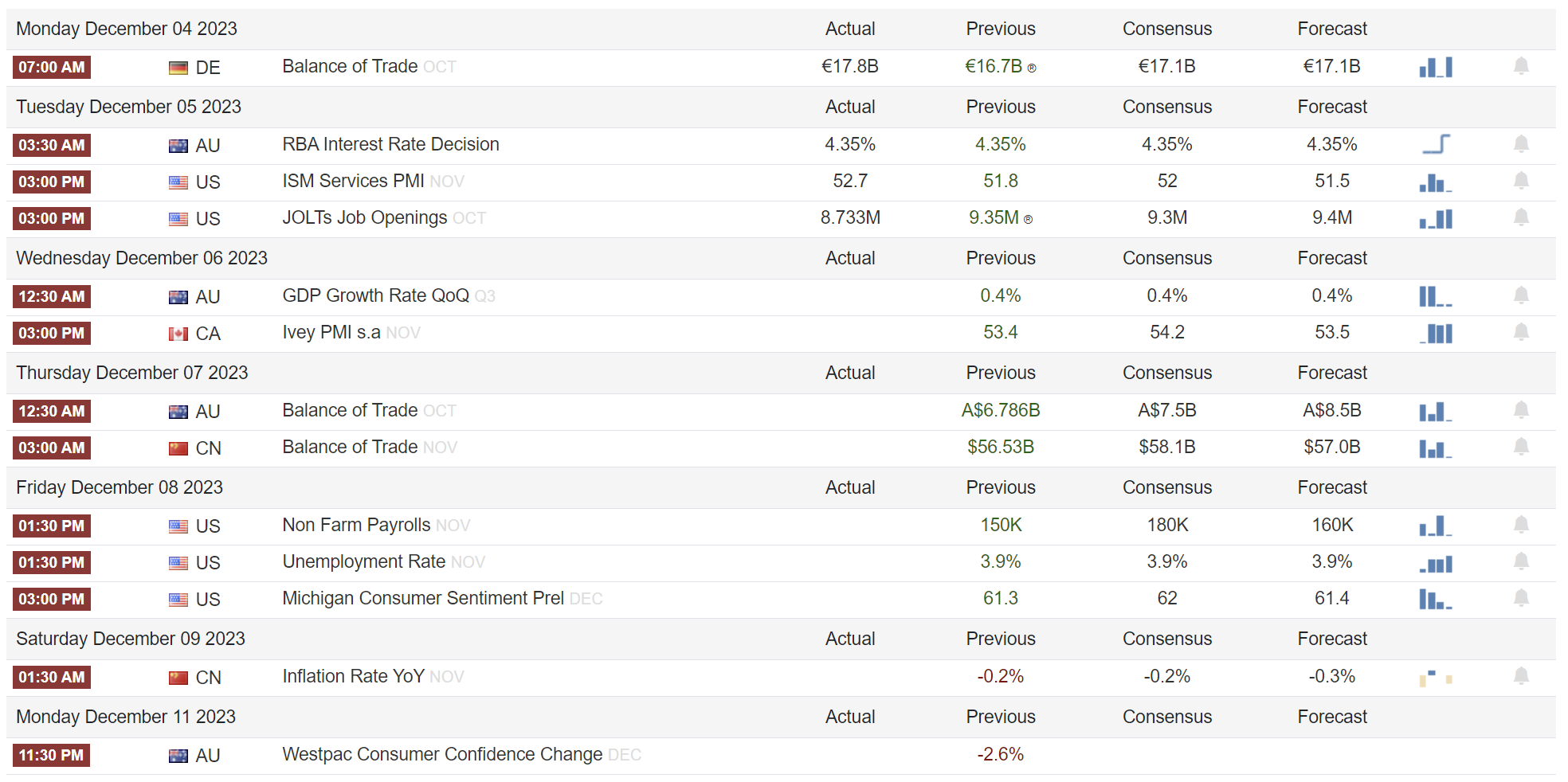

2. Week Ahead