Global Markets Recap - Week of Nov 6, 2023

1. What Moved the Markets?

Europe

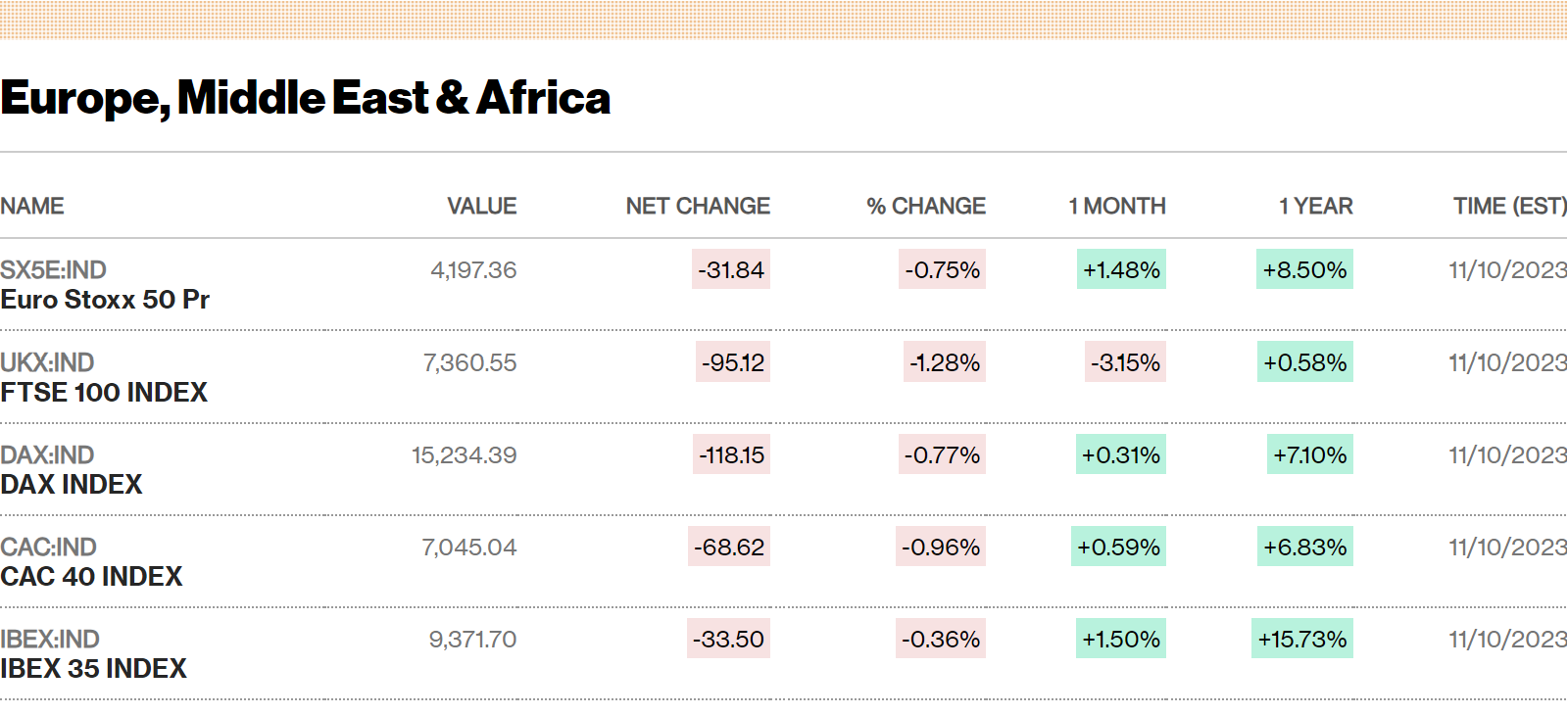

🏈 Bottom Line: In Europe, mixed stock market performances and rising government bond yields reflected growing concerns about prolonged high-interest rates, while various economic indicators suggested a sluggish economy.

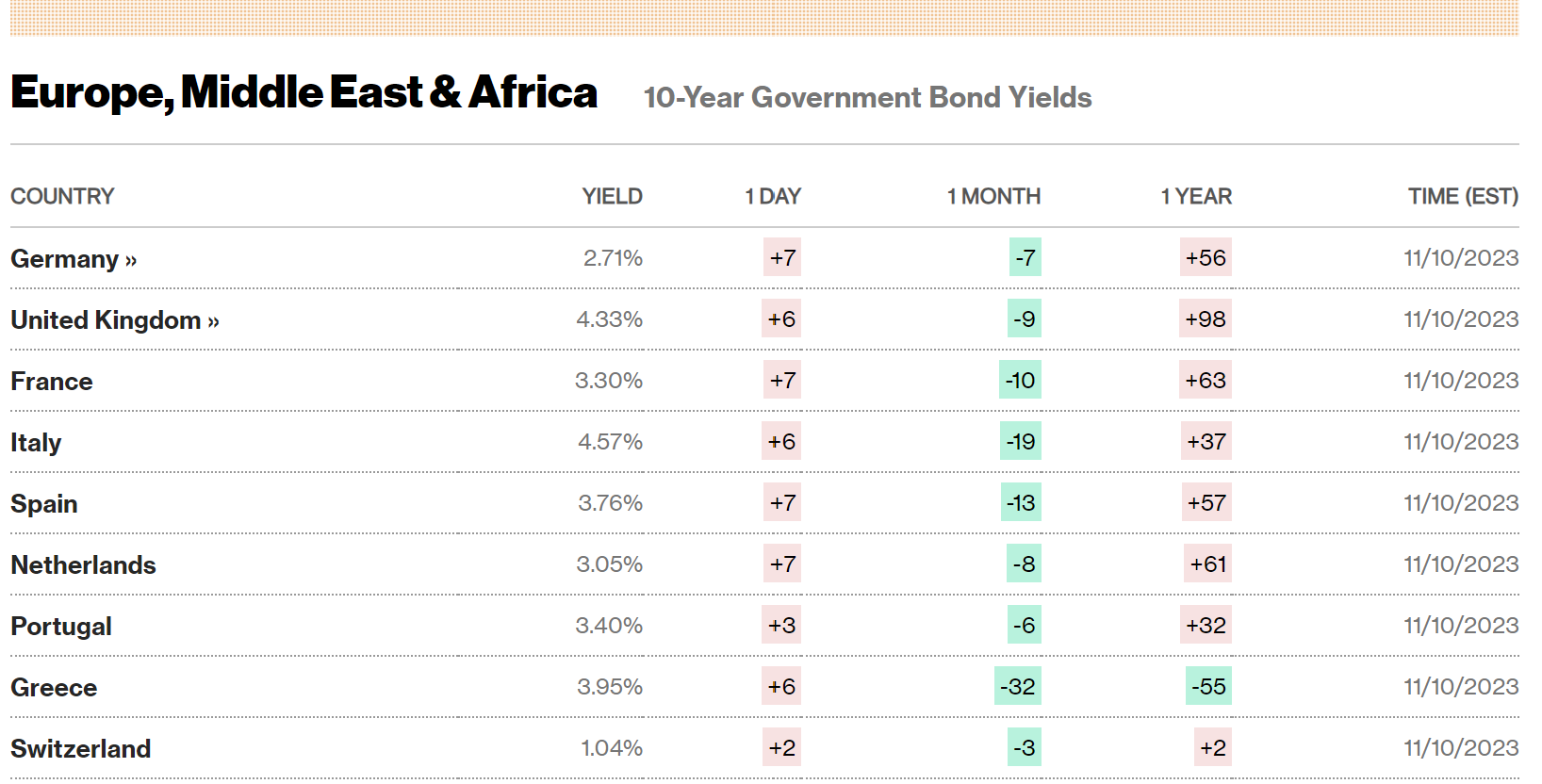

- European Stock Markets: The STOXX Europe 600 Index (-0.21%), reflecting dimmed optimism about a peak in interest rates. France's CAC 40 (flat), Germany's DAX (+0.30%), Italy's FTSE MIB (-0.59%), UK's FTSE 100 (- 0.77%).

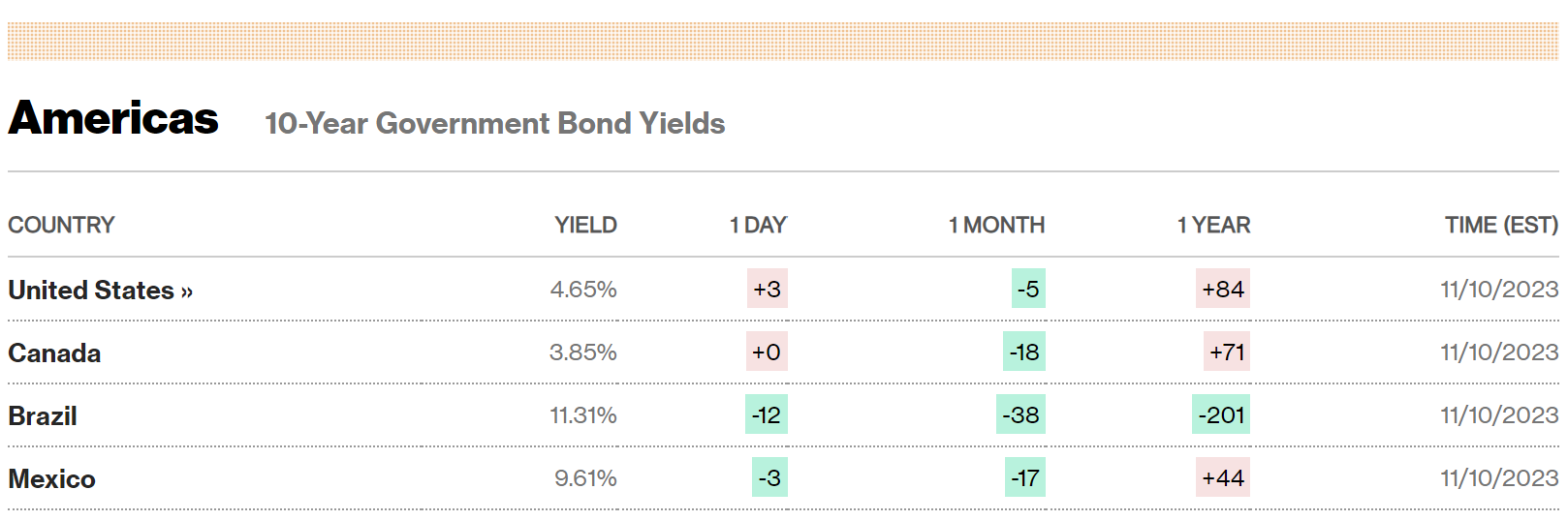

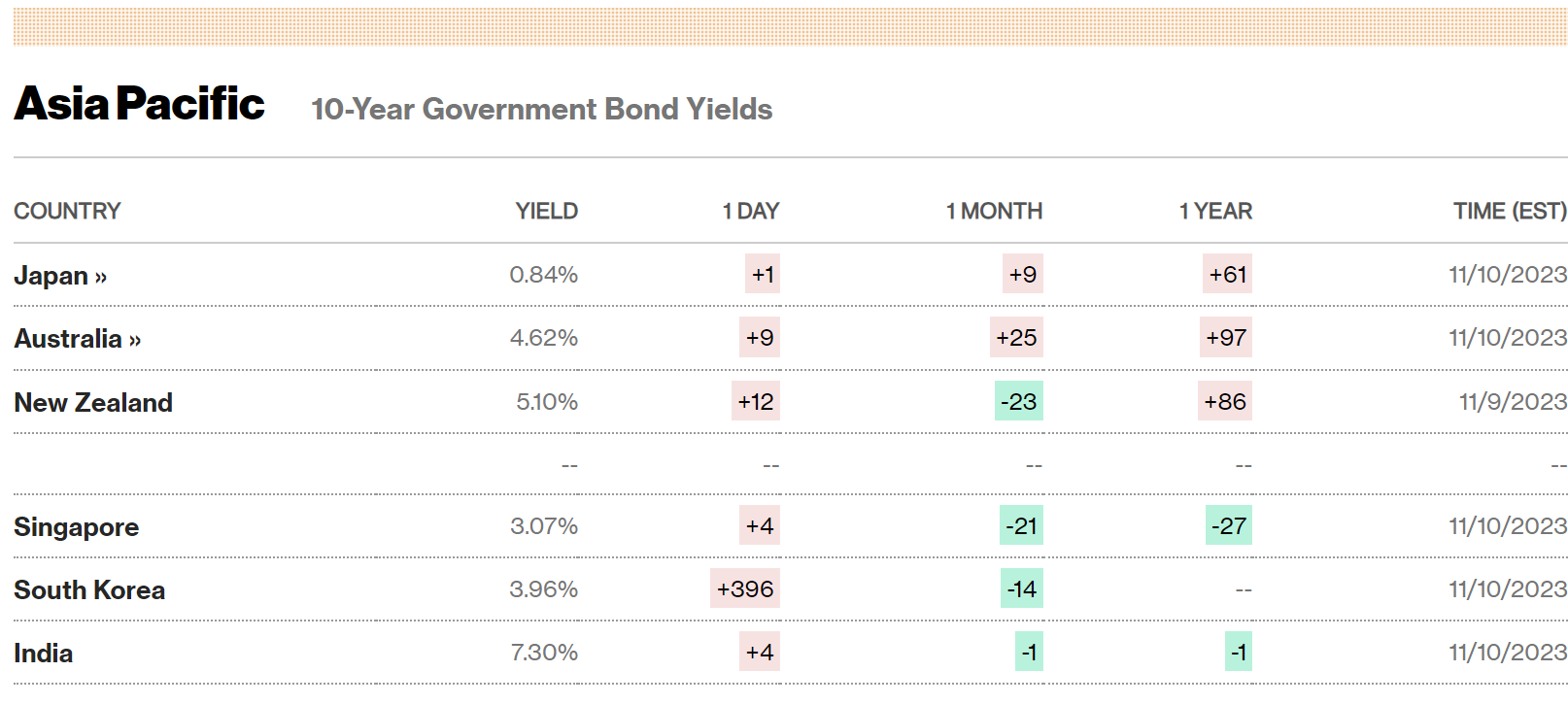

- European Government Bond Yields: There was an overall increase in yields amidst speculation of sustained high interest rates. ECB President Christine Lagarde had indicated that rate cuts wouldn't occur for several quarters. Germany's 10-year government bond yield had risen above 2.7%. Italian bond yields also increased. UK bond yields had experienced volatility following stagnant economic growth in Q3.

- BoE and UK Economic Outlook: BoE Governor Andrew Bailey had dismissed early discussions of rate cuts. BoE Chief Economist Huw Pill had hinted at a potential rate cut in August next year. UK GDP had shown zero growth in Q3, aligning with BoE forecasts, following a 0.2% expansion in Q2. Monthly GDP in September was up by 0.2%, with August's growth revised down to 0.1%. Growth drivers included expansion in engineering, health care sales, and machinery leasing.

- Eurozone Retail Sales and Industrial Output: Eurozone retail sales had declined by 0.3% in September, following a 0.7% drop in August. Economic sentiment had improved slightly to -18.6 in November, from -21.9 in the previous month. Germany's industrial production had decreased by 1.4% in September, after no change in August. German manufacturing orders had risen by 0.2%, a significant decrease from the 1.9% growth in the previous month. Industrial output in France and Italy remained flat in September.

- Political Development in Portugal: Portugal was set for a snap election in March 2024 following the resignation of Prime Minister Antonio Costa amid a corruption probe.

US

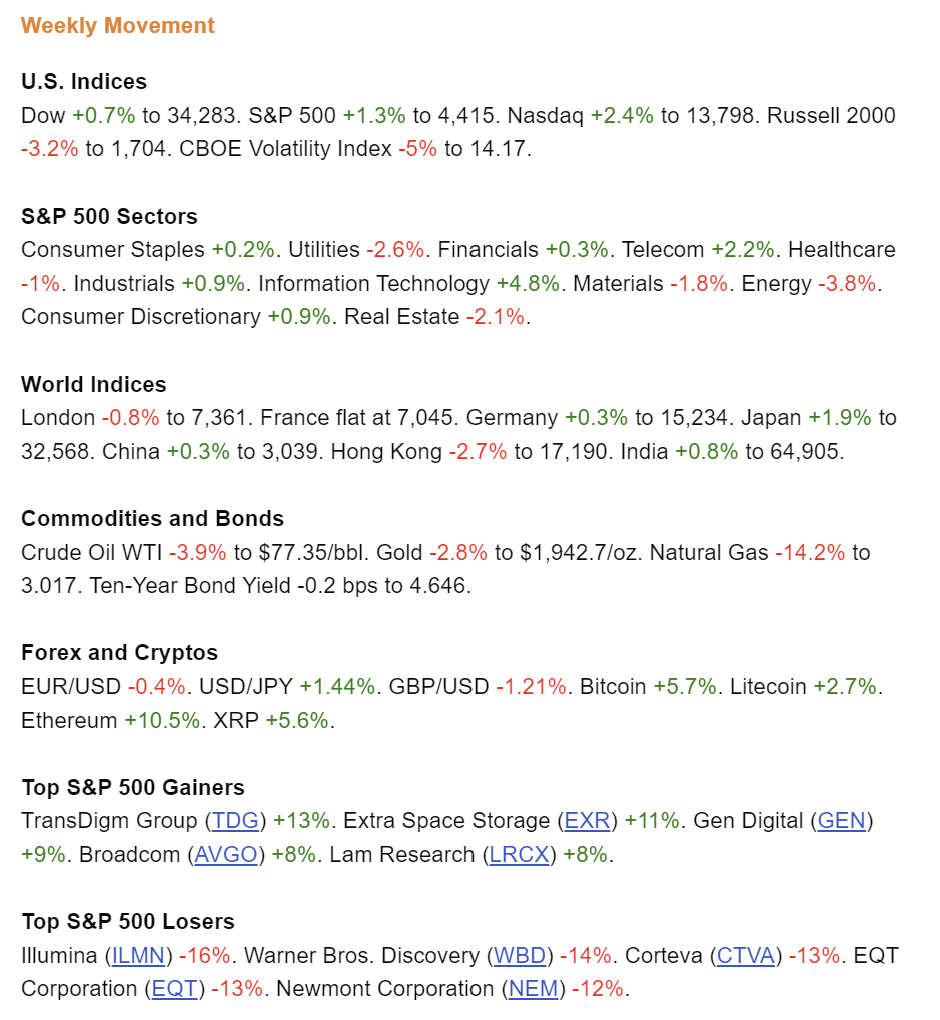

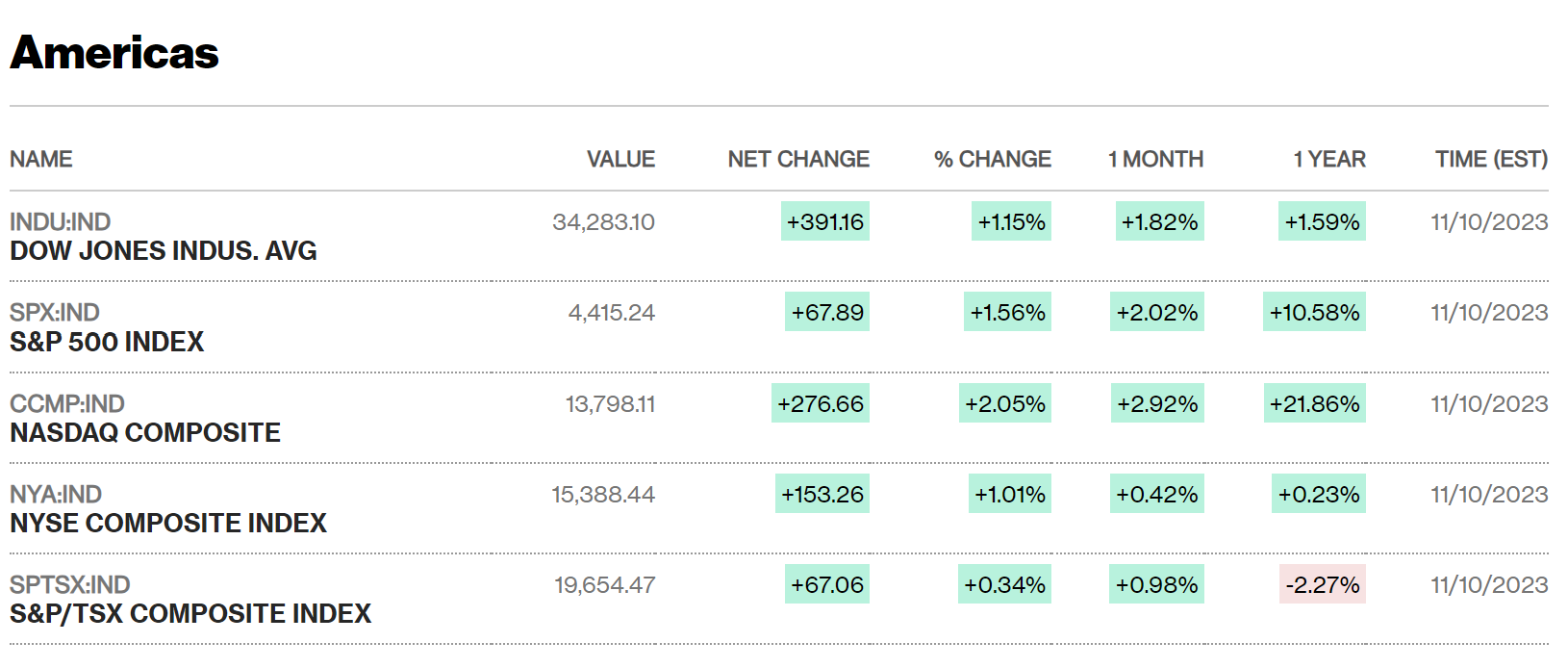

🏈 Bottom Line: Stocks ended their winning streak amidst mixed market indicators, with the S&P 500 nearly matching a two-decade record before declining due to factors including weak Treasury bond auctions and varying economic data. Dow (+0.7%) to 34,283. S&P 500 (+1.3%) to 4,415. Nasdaq (+2.4%) to 13,798. Russell 2000 (-3.2%) to 1,704. CBOE Volatility Index (-5%) sto 14.17.

- Mixed Performance in Major Indexes: The S&P 500 nearly matched its longest winning streak in 20 years, recording eight straight gains. The Nasdaq Composite Index marked its ninth consecutive gain. Discrepancy noted with equally weighted S&P 500 lagging its market-weighted version by 190 basis points (1.90%), and Russell 1000 Value Index trailing its growth counterpart by 404 basis points, the largest margin since March.

- Third-Quarter Corporate Earnings: Final weeks of major Q3 corporate earnings concluded. Upside surprises from tech-oriented firms, particularly software stocks. Datadog's stock surged 28% following strong earnings, influencing the market.

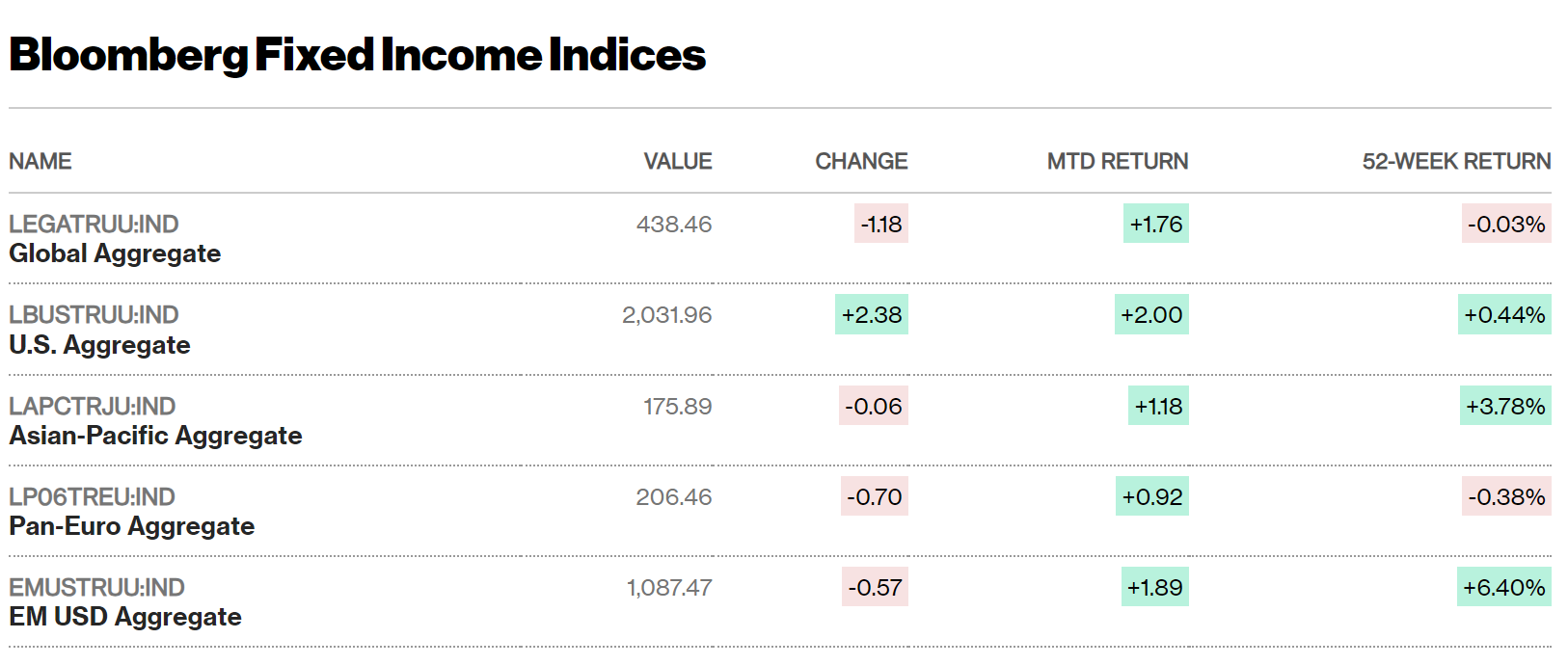

- Treasury Auctions Impact: Treasury debt auctions significantly influenced equity and bond markets. Positive reception for three-year and 10-year Treasury notes. Weak demand for 24 billion 30-year U.S. Treasury bonds, the weakest in two years, signaled concerns about the government’s borrowing needs on the back of a rising debt ceiling.

- Economic Data Releases: Most data were in line with expectations, except for the University of Michigan’s consumer sentiment index. Consumer sentiment fell unexpectedly to a six-month low, influenced by international conflicts and concerns over interest rates and inflation.

- Treasury Yields and Bond Market Reactions: Treasury yields decreased initially but increased after the weak 30-year bond auction. Fed Chair Jerome Powell expressed doubts about achieving a restrictive monetary policy to control inflation. The municipal market was impacted by higher yields but saw heavy oversubscription in new deals. IG corporate bond markets saw heavy issuance and healthy demand. HY bonds showed selective buying, while high-quality bank loans maintained solid demand.

Japan

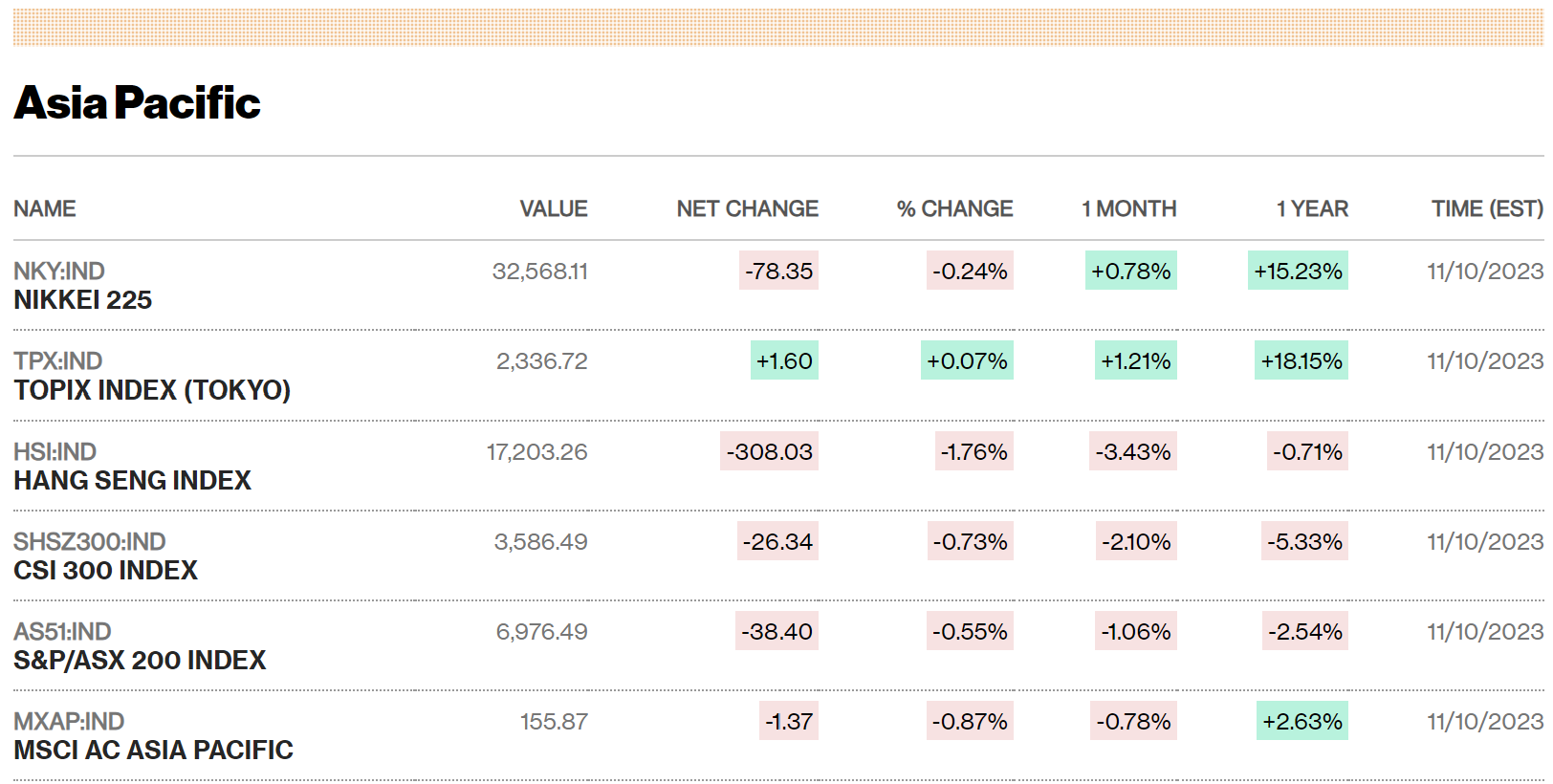

🏈 Bottom Line: Japan's stock markets rose, buoyed by strong corporate earnings and economic stimulus plans, but global monetary policy concerns tempered investor sentiment.

- Japanese Stock Market Performance: Nikkei 225 (+1.9%), TOPIX (+0.6%), Yen weakened past 151 vs. U.S. dollar, a 33-year low.

- Global Monetary Policy Influence: Fed Chair Jerome Powell's hawkish comments raised concerns about prolonged high interest rates.

- Bank of Japan's (BoJ) Outlook: BoJ Governor Kazuo Ueda warned of challenges in normalizing short-term interest rates.

- Japanese Government Bond (JGB) Yields: 10-year JGB yield fell to 0.85%. BoJ's yield curve control policy adjustments kept yields elevated.

- Economic Stimulus Measures: Japan approved a stimulus package worth over $110 billion. Measures aim to alleviate inflation impact and support wage increases.

China

🏈 Bottom Line: Chinese equities experienced mixed results amidst deflation concerns and a fragile economic landscape, highlighted by fluctuating trade data and government efforts to stimulate demand.

- Chinese Stock Market Movement: Shanghai Composite (+0.27%), CSI 300 (+0.07%), Hang Seng Index in Hong Kong (-2.61%).

- Inflation Data: Consumer Price Index (CPI) fell 0.2% year-over-year in October. Producer Price Index (PPI) dropped 2.6% from a year ago, continuing a 13-month decline.

- Trade Data Insights: Exports declined 6.4% year-over-year in October. Imports unexpectedly rose by 3%, marking the first year-on-year growth since September 2022. Overall trade surplus decreased to $56.5 billion, down from September's $77.71 billion.

- Economic Outlook: The data highlighted China's economic fragility and ongoing deflation concerns. Further stimulus measures from the government to counter deflationary pressures are anticipated.

2. Week Ahead

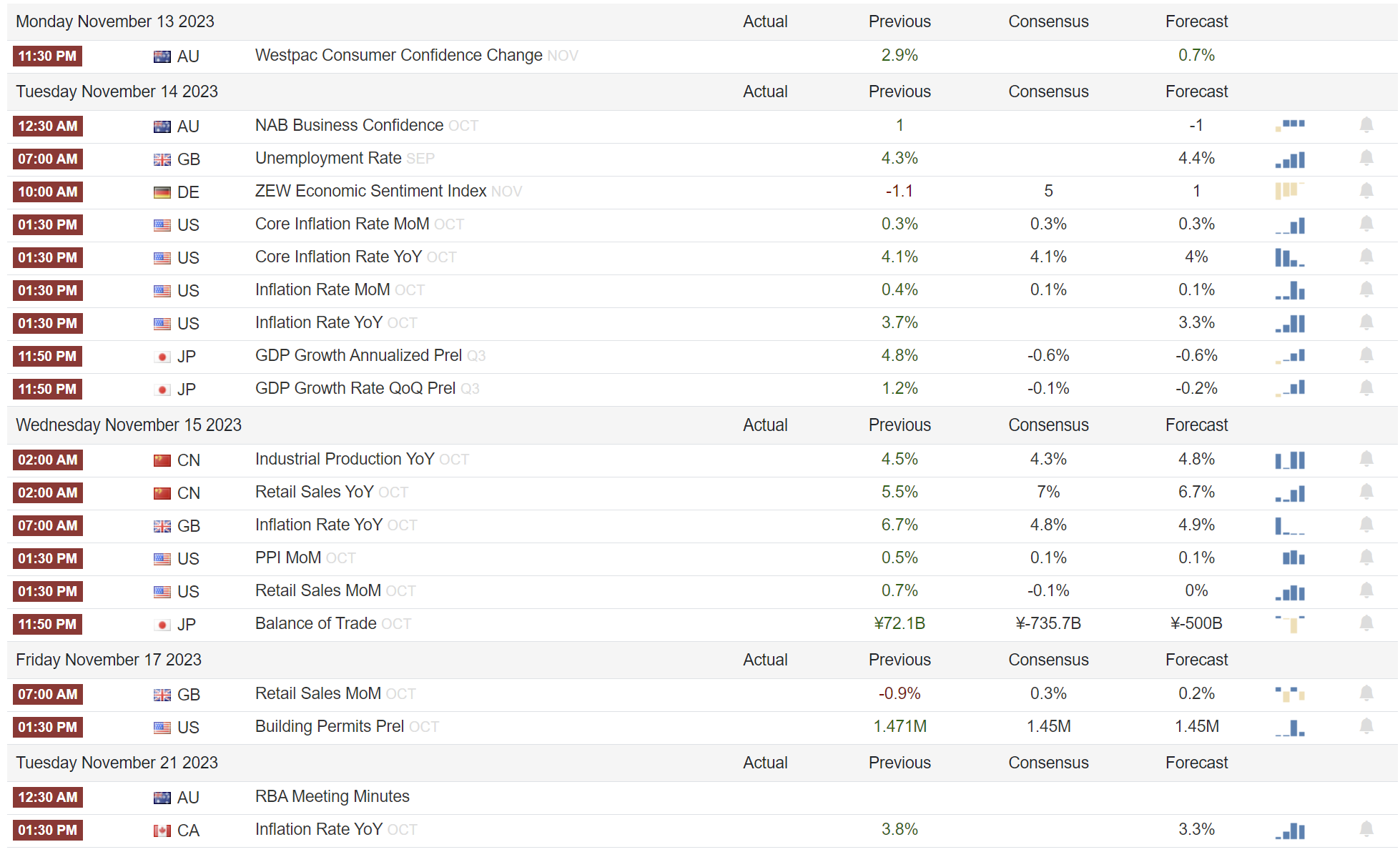

US inflations (MoM/YoY) & PMI + US/UK retail sales + UK unemployment rate will be out.

![Obsidian Brief] When Money Becomes Software: AI, Stablecoins & Bitcoin — Implications for Sustainable and Impact Investing](/content/images/size/w720/2025/12/Gemini_Generated_Image_dppem0dppem0dppe.png)

![Leadership] AI Is Changing Everything — How a CEO Managing $1.6 Trillion Stays Ahead, ft. Jenny Johnson from Franklin Templeton](/content/images/size/w720/2025/12/Screenshot-2025-12-03-060128.png)

![AI] The Future of Work, Robotics & AI Infrastructure (Elon's bold predictions: work will be optional & currency could be irrelevant)](/content/images/size/w720/2025/11/Screenshot-2025-11-22-074621.png)