Global Markets Recap - Week of Oct 16, 2023

1. What Moved the Markets?

Europe

🏈 Bottom Line: European stocks faced significant headwinds, ending the week in the red due to uncertainty about interest rates, escalating Middle East conflict, and disappointing earnings reports.

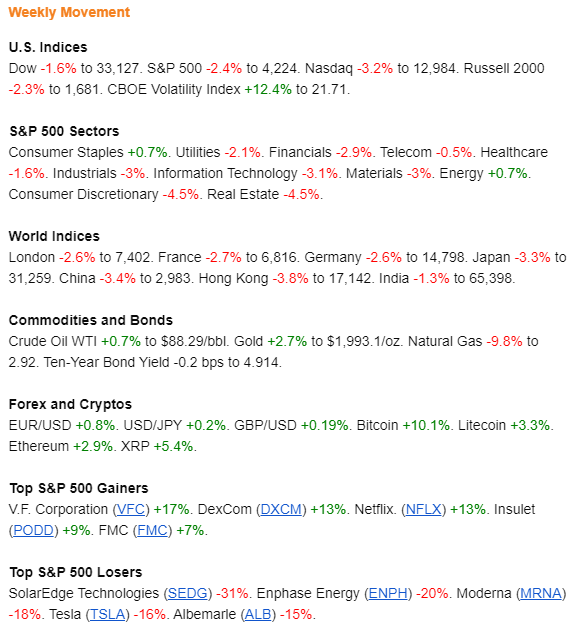

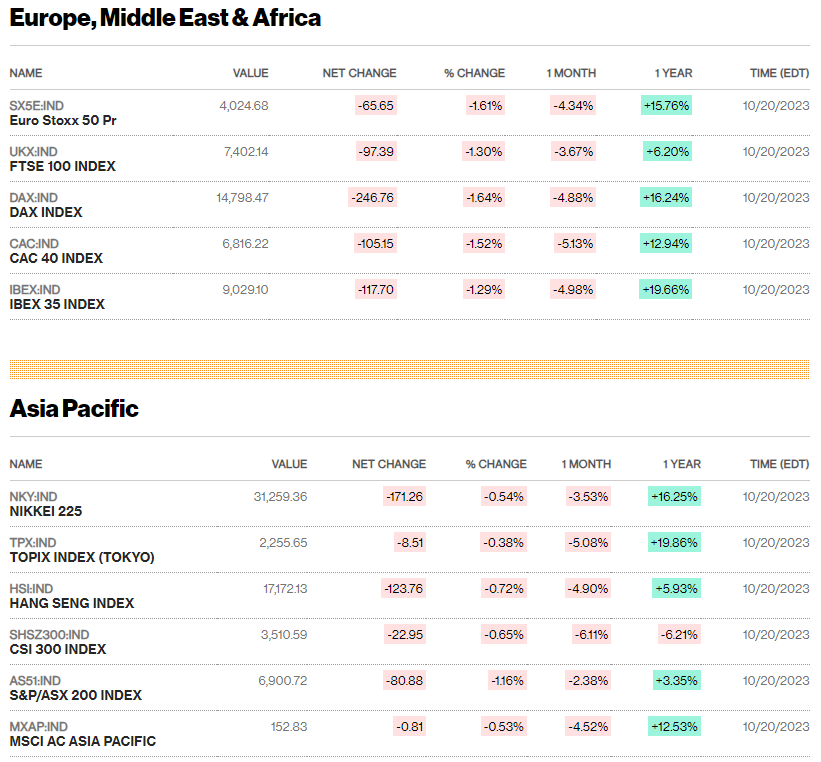

- Stock Performance: The STOXX Europe 600 (-3.44%), driven by concerns about interest rates, Middle East tensions, and disappointing earnings. Major Continental stock indexes followed suit, with Italy’s FTSE MIB (-3.12%), Germany’s DAX (-2.56%), France’s CAC 40 (-2.67%), and the UK’s FTSE 100 Index (-2.60%).

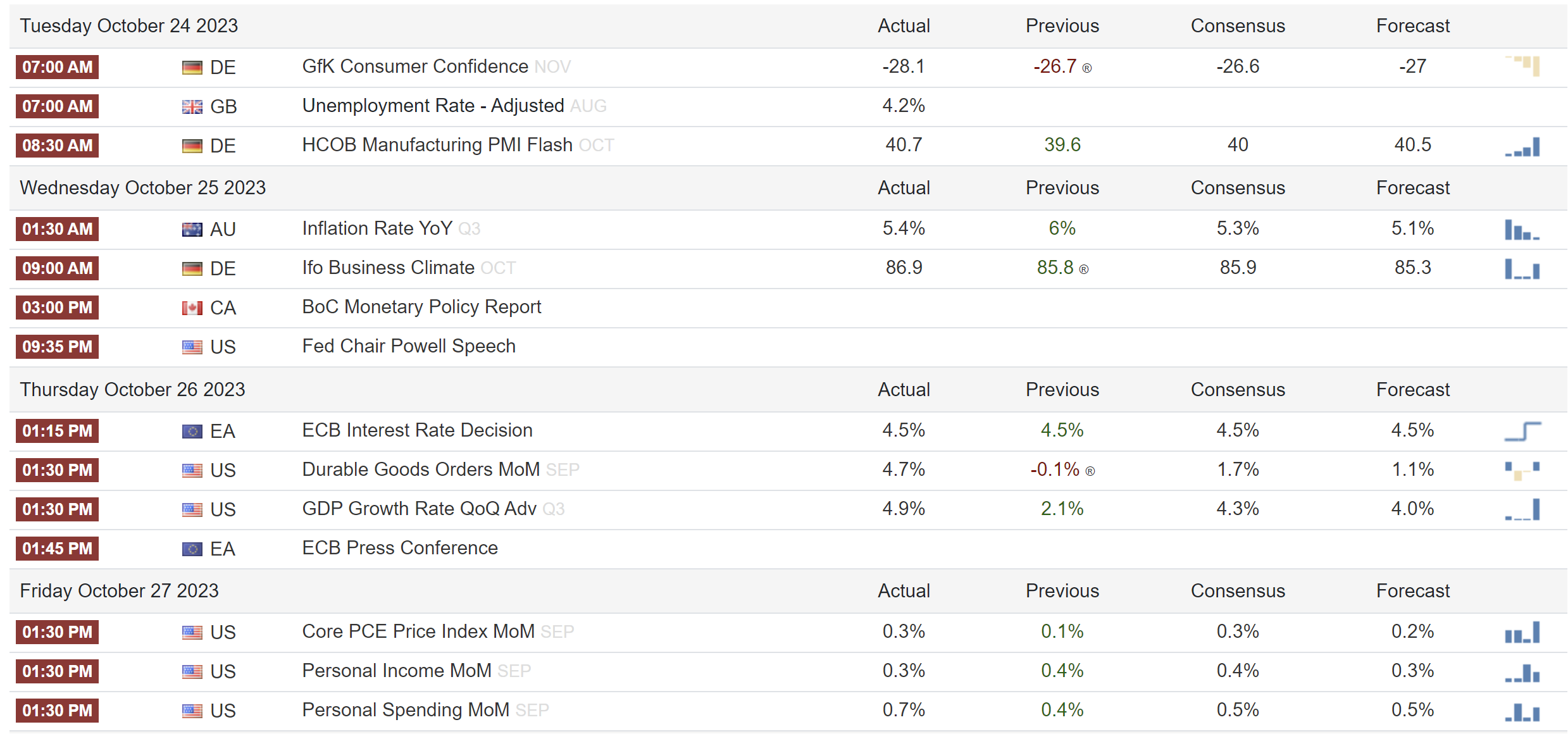

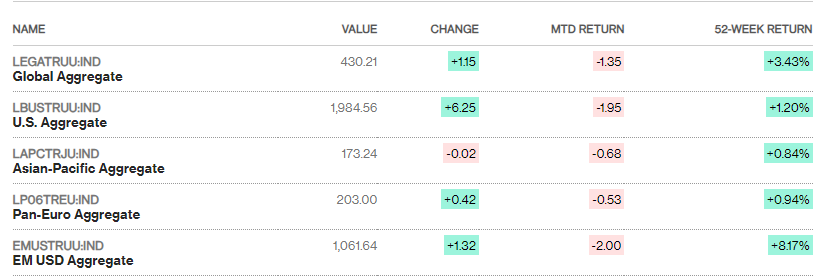

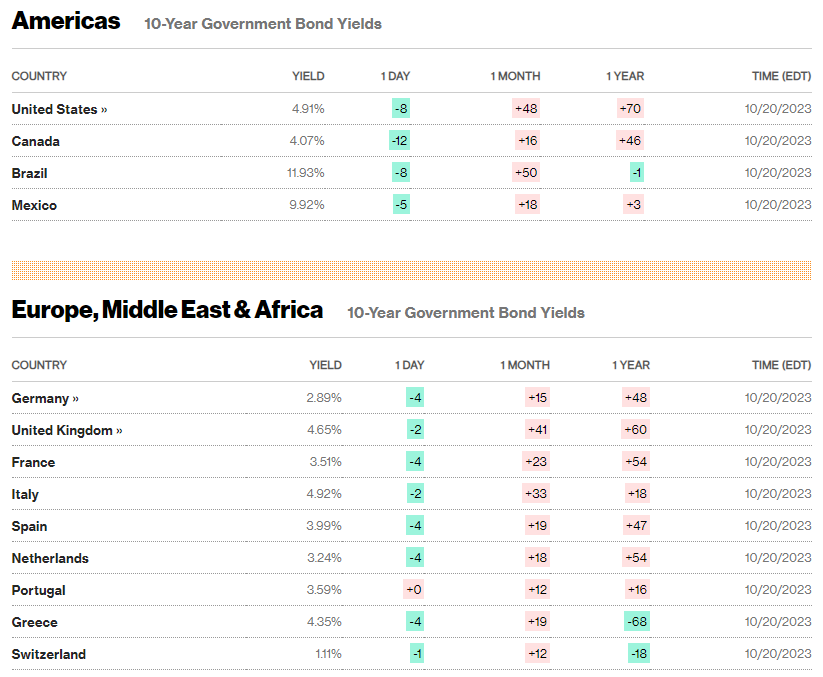

- Bond Yields: European government bond yields rose as investors considered the possibility of prolonged higher interest rates due to sticky inflation. Germany’s 10-year bond yield ended the week near 2.9%, and Italian bond yields increased, leading to a wider yield differential with Germany. In the UK, the benchmark 10-year government bond yield rose following unchanged inflation data.

- ECB Outlook: ECB policymakers expressed concern about inflation risks driven by rising oil prices due to Middle East conflict. Some suggested that they may need to wait until spring to be confident about inflation returning to the 2% target. Price pressures were seen as persistently high in the eurozone.

- UK Inflation and Wage Growth: UK inflation remained at 6.7% in September, driven by higher gasoline prices, while services inflation accelerated. Wage growth, excluding bonuses, reached 7.8% year over year, close to a record high. The Bank of England acknowledged the need to work towards its 2% inflation target.

- German and French Sentiment: German investor sentiment improved in October due to expectations of declining inflation and stable interest rates in the eurozone. Conversely, French business confidence worsened across various sectors in the same month.

US

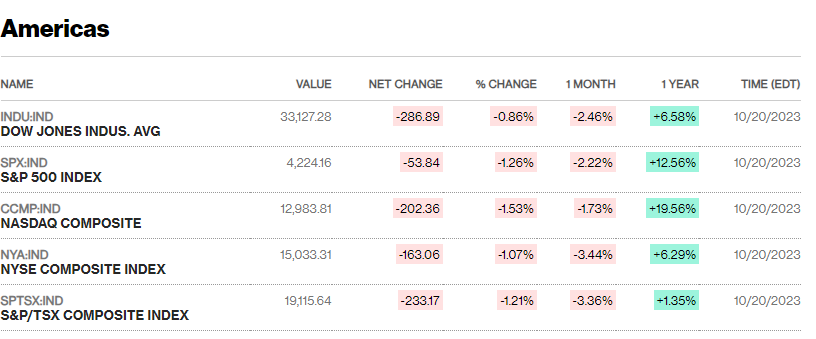

🏈 Bottom Line: Concerns related to geopolitical tensions, Federal Reserve comments, and surging long-term bond yields contributed to a significant weekly decline in the S&P 500, with the Nasdaq Composite nearing bear market territory. Dow -1.6% to 33,127. S&P 500 -2.4% to 4,224. Nasdaq -3.2% to 12,984. Russell 2000 -2.3% to 1,681. CBOE Volatility Index +12.4% to 21.71.

- Geopolitical Concerns and Sentiment: Geopolitical tensions and hawkish comments from Fed officials dampened market sentiment. Reports of a U.S. Navy destroyer shooting down a cruise missile and a drone attack on a U.S. base in Iraq further weighed on sentiment.

- Fed's Stance: Richmond Fed President Thomas Barkin expressed skepticism about cooling inflation, and Fed Chair Jerome Powell noted a tightening in financial conditions, causing uncertainty about the Fed's stance on rates.

- Economic Data: Some economic surprises suggested rates could stay elevated. Retail sales exceeded expectations in October, but industrial production remained weak. Housing starts rose, but building permits fell, reflecting the impact of rising rates and labor supply constraints.

- Bond Yields: The 10-year U.S. Treasury yield neared 5%, the highest since 2007, impacting various bond markets. The municipal bond market weakened, especially in higher-rated bonds, while the high-yield market experienced pressure amid Middle East tensions.

- Corporate Bond Market: Banks dominated investment-grade corporate bond issuance, causing only slight spread widening. The bank loan market remained stable, with strong demand for collateralized loan obligations and limited issuance.

Japan

🏈Bottom Line: Japanese stock markets faced a decline during the week, with the Nikkei 225 Index falling by 3.3% and the TOPIX Index down by 2.3%. The focus was on wage growth amid emerging signs of increased pay demands for the coming year.

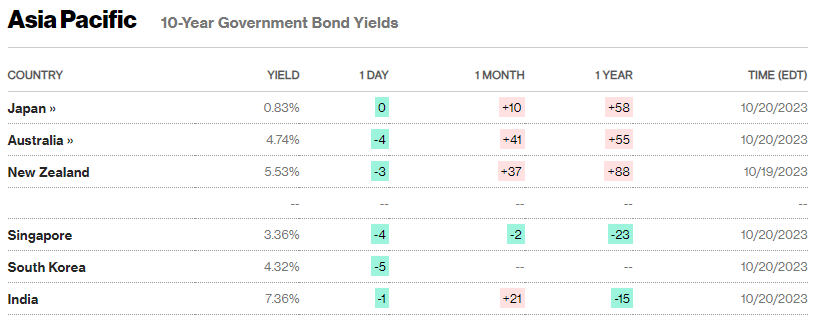

- Fed's Impact on Bond Yields: The U.S. Federal Reserve's communication about maintaining higher interest rates for a prolonged period led to a surge in bond yields. The yield on the 10-year Japanese government bond reached 0.83%, a 10-year high, from 0.76% the previous week. The Bank of Japan (BoJ) intervened to slow the pace of these increases with an unscheduled bond-purchase operation.

- Yen's Exchange Rate: The yen traded near the upper end of the JPY 149 against the U.S. dollar range, close to the JPY 150 threshold that could trigger intervention from Japanese authorities. The government reaffirmed its readiness to intervene if exchange rates exhibit excessive swings that could harm the real economy.

- Inflation Trends: Japan's inflation rate slowed in September, with the core consumer price index rising by 2.8% year on year, down from 3.1% in August. Despite the slowdown, prices remained above the BoJ's 2% target for the 18th consecutive month. The BoJ is expected to revise its inflation forecasts upward in its October meeting.

- Focus on Wage Growth: The key focus is on wage growth and potential pay demands for the next year, which could signify changing wage-setting behavior and growing confidence in the BoJ nearing its inflation target. Rengo, the Japanese Trade Union Confederation, plans to demand at least a 5% wage hike in the 2024 "shunto" labor-management negotiations, a factor the BoJ considers crucial for achieving its inflation target.

China

🏈 Bottom Line: Chinese stock markets faced significant declines as deepening issues in the property sector outweighed optimism generated by better-than-expected GDP figures. The Shanghai Composite Index fell by 3.4%, while the CSI 300 dropped by 4.17%, erasing earlier gains. Hong Kong's Hang Seng Index also fell by 3.6%.

- Property Market Woes: China's property sector faced growing problems, with Country Garden, a former leading developer, indicating its inability to meet offshore debt payments. The company's missed dollar bond interest payment suggests a looming default, highlighting the real estate market's troubles. Home price data indicated that the property market slump continued, with new home prices in major cities falling by 0.3% in September, marking the third consecutive monthly decline.

- GDP Report: Despite property sector concerns, a robust GDP report revealed that China's economy grew by 4.9% in the third quarter compared to the previous year, surpassing expectations. However, this marked a slowdown from the 6.3% growth recorded in the second quarter. On a quarterly basis, the economy expanded by 1.3%, an improvement from the second quarter's 0.5% growth.

- Stabilizing Indicators: Some economic indicators suggested stabilization in parts of China's economy. Retail sales increased by 5.5% in September year-on-year, up from 4.6% in August. Industrial production growth remained unchanged from August, and urban unemployment saw a slight decrease.

2. Week Ahead