Global Markets Recap - Week of Oct 23, 2023

1. What Moved the Markets?

Europe

🏈 Bottom Line: European markets edged lower amid interest rate, economic, and geopolitical concerns, while the ECB held rates steady to address inflation, amidst declining business activity across the Eurozone and a rise in UK unemployment, reflecting a challenging economic outlook.

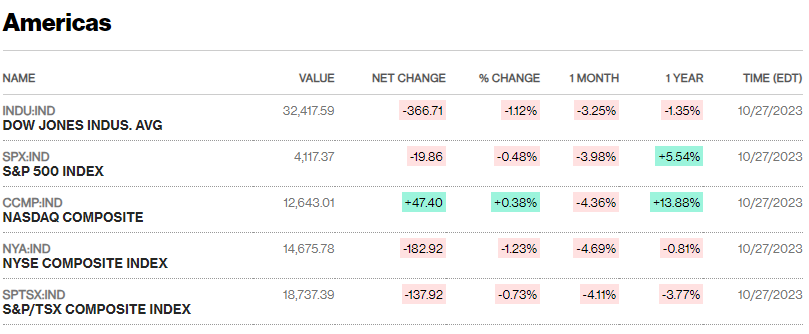

- Stock Index Decline: European stock indexes experienced a decline with the STOXX Europe 600 Index falling by 0.96% due to uncertainties surrounding interest rates, the economy, and Middle Eastern conflicts. Germany’s DAX (-0.75%), France’s CAC 40 (-0.31%), Italy’s FTSE MIB (-0.25%), and the UK’s FTSE 100 (- 1.50%).

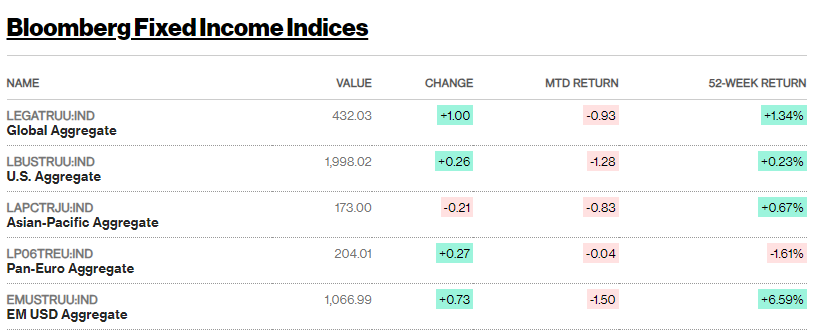

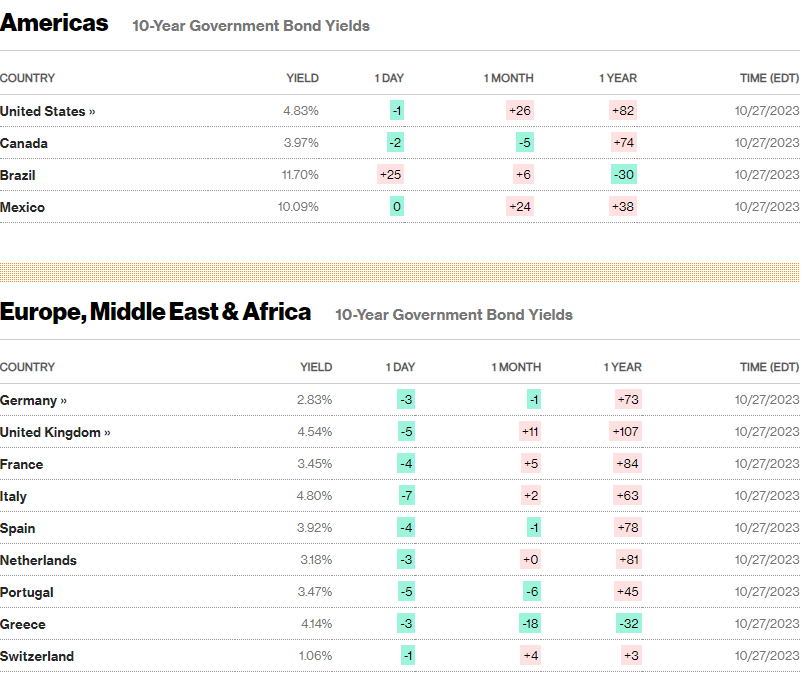

- Eurozone Bond Yields: Eurozone government bond yields slightly eased with the 10-year German bund yield falling to around 2.84%, while the 10-year Italian government bond yield slipped to around 4.81% following the ECB's decision to keep short-term interest rates unchanged.

- ECB Rate Decision: The ECB maintained its key deposit rate at 4.0% to help achieve its medium-term inflation target of 2%, acknowledging the previous rate hikes were significantly impacting financing conditions and demand.

- Business Activity Decline: The decline in Eurozone business activity accelerated at the start of the fourth quarter with the HCOB Eurozone Composite PMI falling more than expected to 46.5 from 47.2 in September, marking a 35-month low.

- Economic Challenges in Germany and the UK: Notably, Germany’s economic indicators and the UK's rising unemployment rate of 4.2%, along with continued contraction in private sector business activity, signal a challenging economic environment across Europe.

US

🏈 Bottom Line: U.S. stock benchmarks declined for a second week due to mixed tech earnings and higher interest rate concerns, although the economy showed robust Q3 growth; mixed inflation signals persist but no rate change is expected in the upcoming Federal Reserve policy meeting, amidst a cautious bond market scenario with the 10-year U.S. Treasury yield retreating from the 5% level.

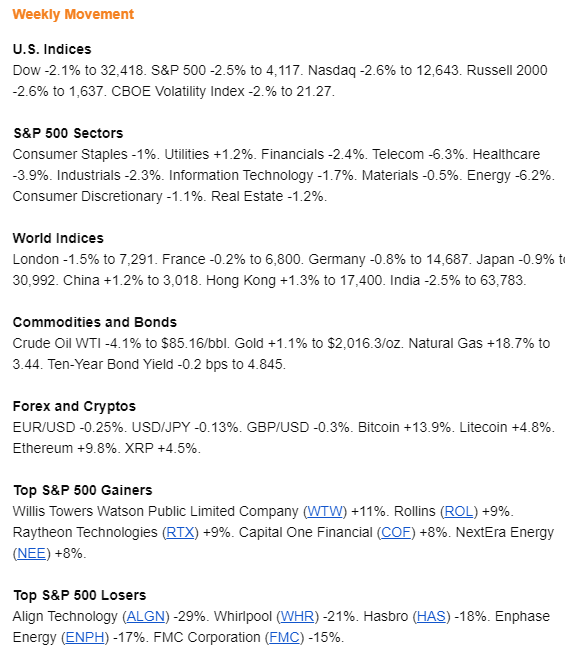

- Stock Market Performance: U.S. stock indices dropped for the second week as mixed corporate earnings and higher interest rate fears dented market sentiment. Dow -2.1% to 32,418. S&P 500 -2.5% to 4,117. Nasdaq -2.6% to 12,643. Russell 2000 -2.6% to 1,637. CBOE Volatility Index -2.% to 21.27.

- Tech Giants' Earnings: Mixed results in quarterly earnings from tech behemoths with market sentiment being affected by signs of rising expenses, despite most metrics showing solid growth. Amazon's earnings were well-received, rallying shares on Friday.

- Economic Growth: U.S. economy grew at a rate of 4.9% in Q3 2022, with consumer spending being a significant contributor. Home sales hit a 19-month high, and the flash U.S. Composite PMI showed an uptick.

- Inflation and Federal Reserve: Mixed signals from the core PCE price index on inflation trends, yet inflation remains above the Fed's 2% goal. The Fed is expected to maintain rates in the upcoming policy meeting.

- Bond Market Trends: 10-year U.S. Treasury yield dropped post breaching 5% level earlier in the week. Activity in the investment-grade, high yield, and municipal bond markets displayed varying levels of investor engagement amidst market volatility.

Japan

🏈 Bottom Line: Amidst a mixed economic landscape, Japan's stock markets slightly eased, speculation of monetary intervention arose due to fluctuating foreign exchange and bond markets, while PM Fumio Kishida unveiled significant tax cut measures to provide economic support.

- Stock Market Performance: Japanese stock markets saw a decrease with the Nikkei 225 Index down by 0.86% over the week, though the broader TOPIX Index remained largely unchanged amidst rising bond yields and geopolitical tensions which were later offset by a tech stock rebound and Chinese economic stimulus.

- Potential Monetary Intervention: Speculation of possible intervention by authorities and adjustments to the yield curve control policy by the Bank of Japan (BOJ) arose due to movements in foreign exchange and bond markets alongside a pickup in inflation.

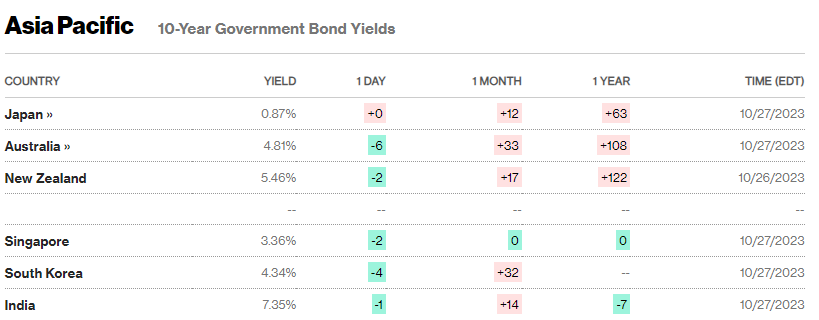

- JGB Benchmark Yield: The yield on the 10-year Japanese government bond hit a 10-year high of 0.87%, nearing the BOJ's upper bound of 1.0%, prompting an unscheduled bond-purchase operation by the BOJ to curb rising yields, highlighting market speculation about potential policy adjustments.

- Yen Weakness: The yen's depreciation past the 150 level against the U.S. dollar ignited fears of possible intervention, with Finance Minister Shunichi Suzuki warning speculators of a continuous authoritative response to currency market movements.

- Inflation and Business Activity: Tokyo's core inflation rate accelerated to 2.7% in October, while the au Jibun Bank of Japan Composite PMI dropped to 49.9 from 52.1 in September, indicating a contraction in business output primarily due to manufacturing sector weaknesses.

- Tax Cut Measures: Prime Minister Fumio Kishida introduced tax cut measures totaling JPY 5 trillion, including a potential reduction of JPY 40,000 per person by next June and a JPY 70,000 handout for low-income households possibly by the end of 2023, as part of economic support initiatives.

China

🏈 Bottom Line: China's equities experienced a boost with Shanghai Composite Index advancing 1.16%, CSI 300 gaining 1.48%, and Hang Seng Index adding 1.32%, driven by an 11.9% rise in industrial profits for September, although economic challenges persist with a 9% fall in profits year-on-year for the first nine months of 2023, and notable property developers like Country Garden Holdings facing financial distress amidst an ongoing housing market crisis.

- Equity Market Uptick: Chinese equities rose with Shanghai Composite Index up by 1.16%, CSI 300 by 1.48%, and Hang Seng Index by 1.32% due to improved industrial profits hinting at economic stabilization.

- Industrial Profits Increase: Industrial firms saw an 11.9% profit increase in September year-on-year, though profits for the first nine months of 2023 fell by 9%, showing a slight improvement from earlier months.

- Government Fiscal Measures: China's government authorized RMB 1 trillion in additional sovereign debt for disaster relief and construction, and raised the fiscal deficit ratio to about 3.8% for 2023 to support the economy.

- Country Garden Holdings Default: Country Garden Holdings defaulted on offshore debt payments for the first time, highlighting financial distress amidst the housing market slump, as it seeks offshore debt restructuring.

- Ripple Effect of Property Developer Defaults: The default at Country Garden follows China Evergrande's 2021 default, showcasing the ongoing ripple effects of the housing market downturn on high-profile property developers and the broader economy.

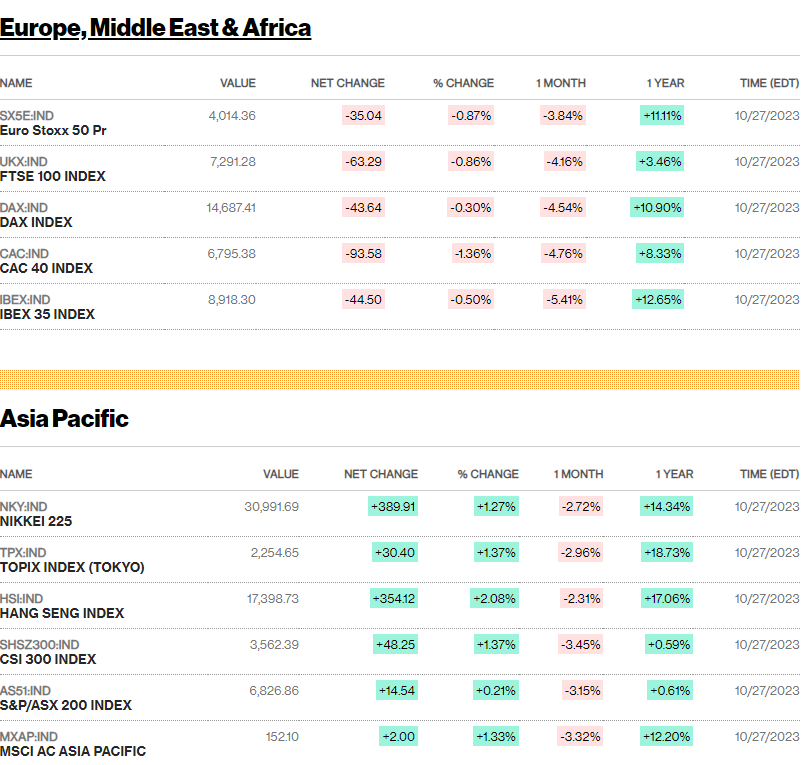

2. Week Ahead

![Markets | Leadership] The new face of wealth: The rise of the female investor (ft. McKinsey Report)](https://images.unsplash.com/photo-1618662062577-1e1483c7b6c4?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDN8fGNhcGl0YWx8ZW58MHx8fHwxNzU5MzQ4ODIwfDA&ixlib=rb-4.1.0&q=80&w=720)

![Markets | Leadership] Bloomberg Women, Money & Power 2025 event in London (Oct 1, 2025)](/content/images/size/w720/2025/10/Screenshot-2025-10-01-201840.png)

![Personal Finance/Market Insights] Tech Power vs Financial Power: A Battle Reshaping the Future, ft. Peter Thiel](https://images.unsplash.com/photo-1504805572947-34fad45aed93?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDQ3fHxjaGFuZ2V8ZW58MHx8fHwxNzU2NDY4NTk2fDA&ixlib=rb-4.1.0&q=80&w=720)