Global Markets Recap - Week of Oct 30, 2023, incl. FOMC key takeaways

1. What Moved the Markets?

November FOMC key takeaways:

*Chair Jerome Powell's press conference recording. Press conference transcript.

*What changed from the September statement in November?

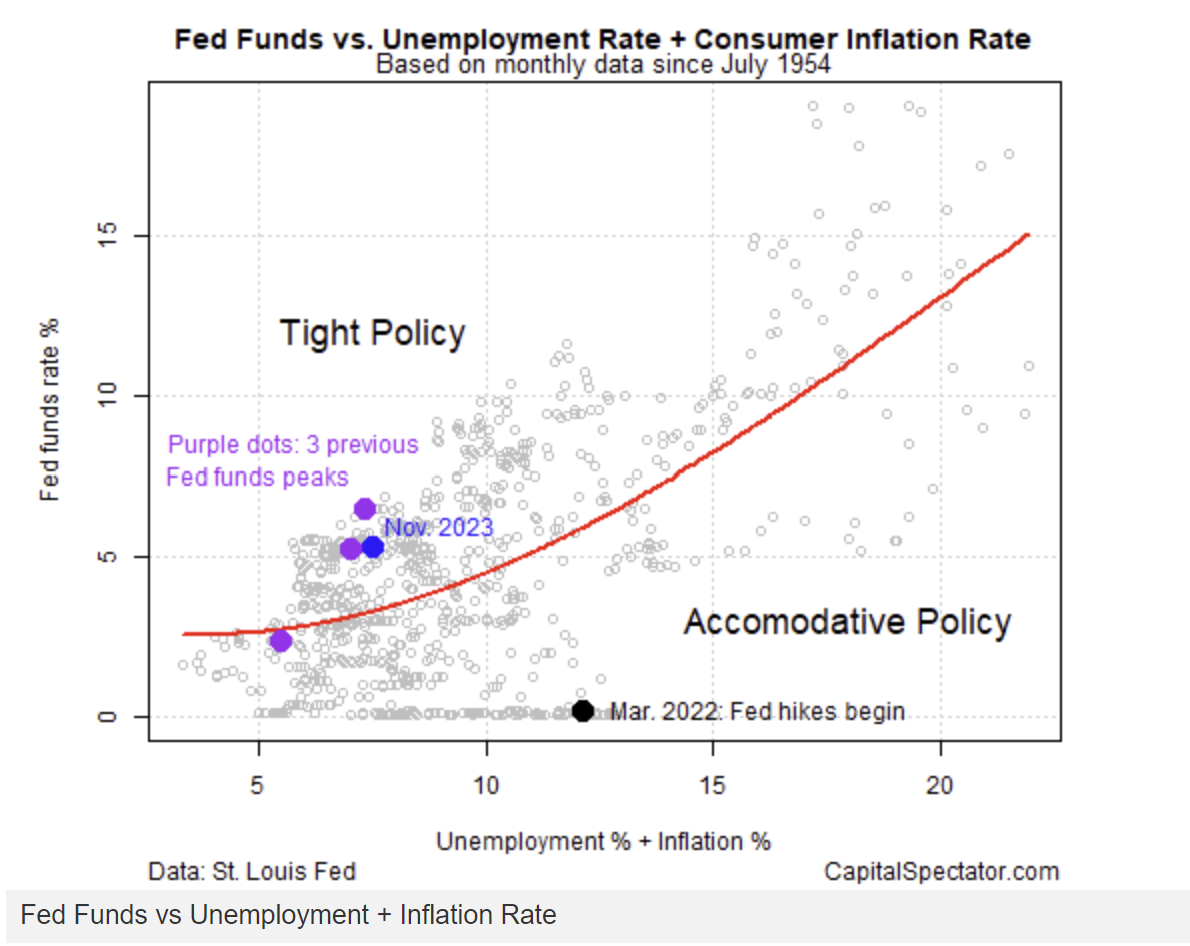

🏈 Bottom line: It was considered a non-market moving event by many, and as expected, the Fed put a pause on the rate hike (5.25-5.50%). It's to be seen if the rate hike cycle has peaked. Below word changes indicate a slightly more positive outlook (i.e. dovish) on economic activity in November compared to September, but a consistent or perhaps increased concern regarding job gains and credit conditions.

*What changed in the statement?

- Economic Activity: In September, economic activity was described as expanding at a "solid pace" whereas in November it was described as expanding at a "strong pace".

- Job Gains: In September, it was noted that job gains had "slowed in recent months" while in November, job gains were described as having "moderated since earlier in the year".

- Credit Conditions: In September, "tighter credit conditions" were mentioned, while in November, it was expanded to "tighter financial and credit conditions".

*Market reactions:

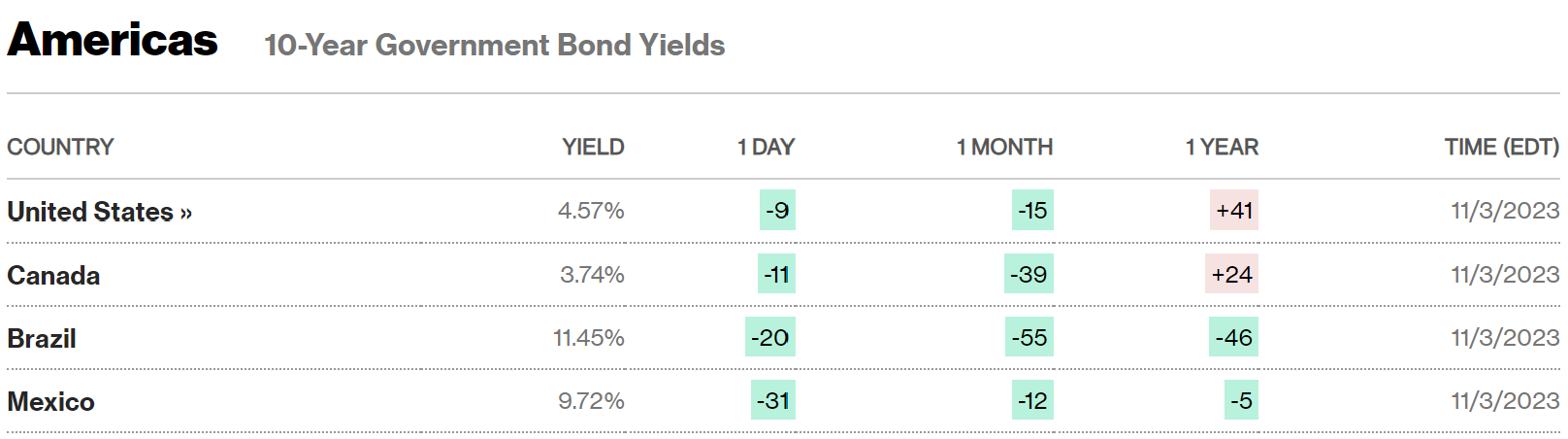

The Fed's acknowledgment of a tightening in financial conditions due to higher long-term Treasury yields and a subtle shift in language from "solid" to "strong" economic growth buoyed the market sentiment. Bond yields slid following the rate decision and after the Treasury shared its bond sale plans, boosting equities. The 10-year Treasury yield fell below the 4.8% level on Wednesday, after a move above 5% in October that spooked markets. Meanwhile, the 2-year Treasury yield dipped under 5%. The Dow advanced 221.71 points, or 0.67%, to 33,274.58. The S&P 500 climbed 1.05% to 4,237.86, briefly crossing its 200-day moving average. The Nasdaq Composite added 1.64% to 13,061.47.

*What next?

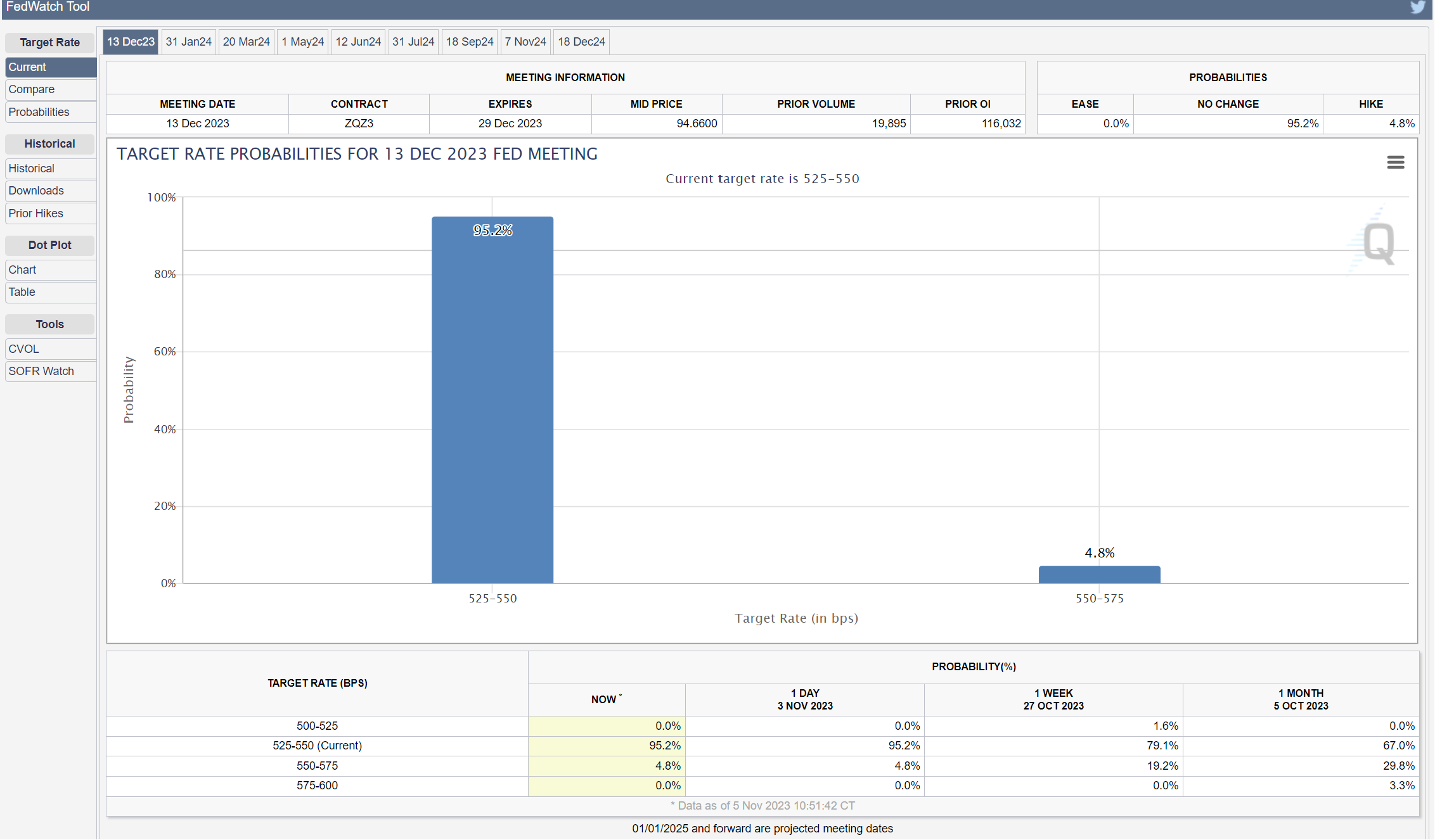

Futures markets for federal funds persist in the expectation that the present target rate range of 5.25% to 5.50% will represent the peak for this cycle. There is a 95.2% chance, as indicated by market pricing, that the central bank will maintain the current interest rates at the forthcoming FOMC meeting on December 13th.

*Here is what Larry Summers said on the FOMC

Key takeaways:

- Former Treasury Secretary Summers cautions that the U.S. Federal Reserve's battle against inflation might not be finished, despite a recent jobs report showing a slight slowdown in employment growth, which could be favorable for controlling inflation.

- Summers questions the Fed's view that higher long-term interest rates should be met with easier monetary policy, especially if the increase is due to expectations of expanded fiscal policy or stronger investment demand.

- He criticized the management of national debt by the Treasury and the Fed, especially during 2021 when the opportunity to issue long-term debt at low rates was missed, leading to significant market value losses in the Fed's portfolio. Note) the Treasury and the Federal Reserve continued to favor short-term debt instruments, which, due to subsequent market losses, have diminished the value of the Fed's portfolio and reduced its remittances to the Treasury. He likens this mismanagement to a corporate treasurer who, by moving towards more floating-rate debt in a rising-rate environment, would have surprised and potentially disappointed their CEO. This misstep, according to Summers, indicates poor debt management, as it has not been cost-effective in the long run and does not reflect well on the fiscal prudence of those at the helm during that period.

- Summers argued that cutting the IRS budget to fund new initiatives, like aid to Israel, is counterproductive as it would likely increase the deficit and benefit tax-evading affluent individuals, thus exacerbating inequality.

- Summers argues that cutting the IRS budget to fund new initiatives, like aid to Israel, is counterproductive as it would likely increase the deficit and benefit tax-evading affluent individuals, thus exacerbating inequality.

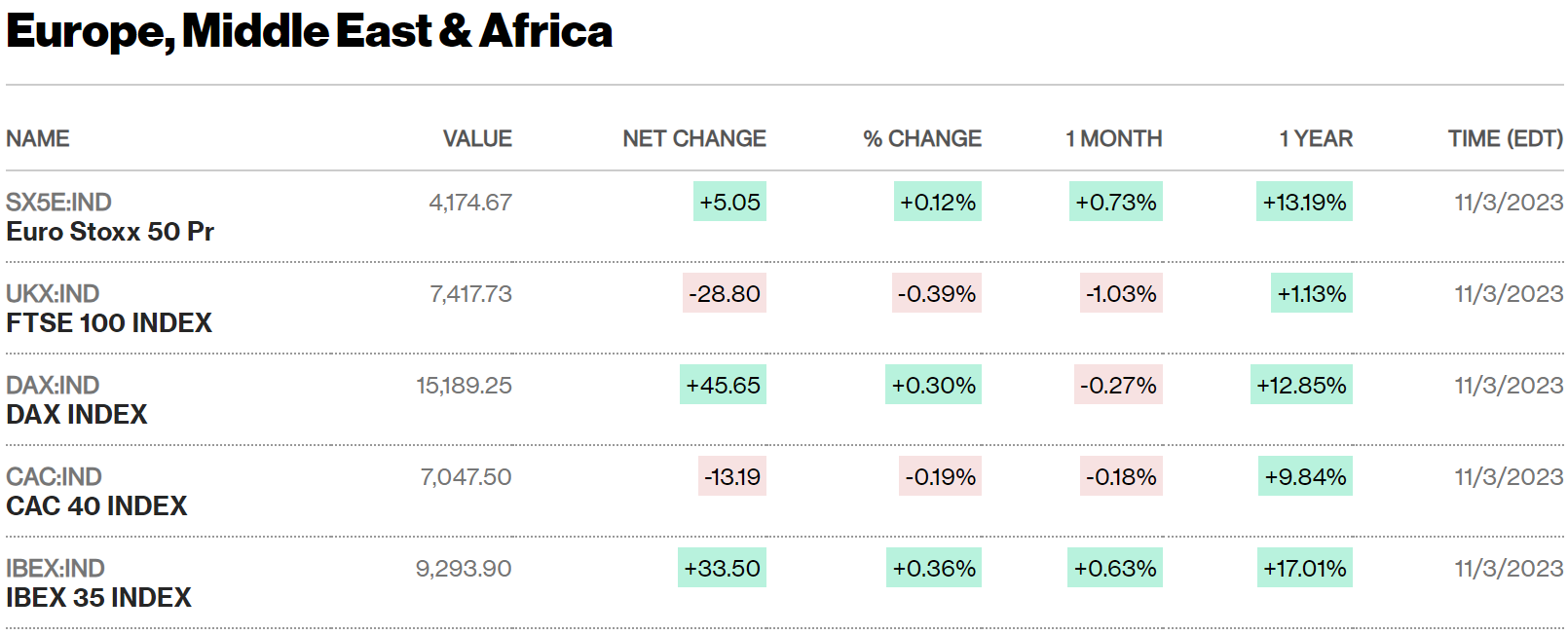

Europe

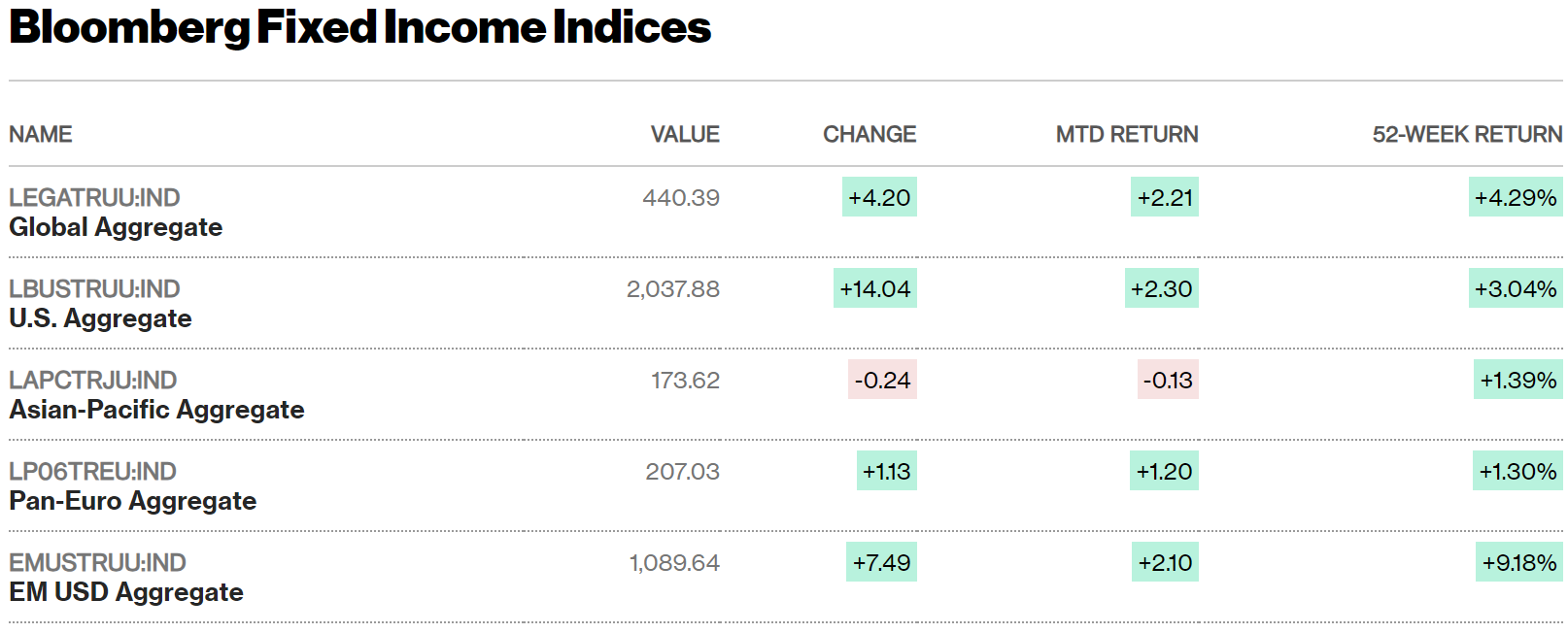

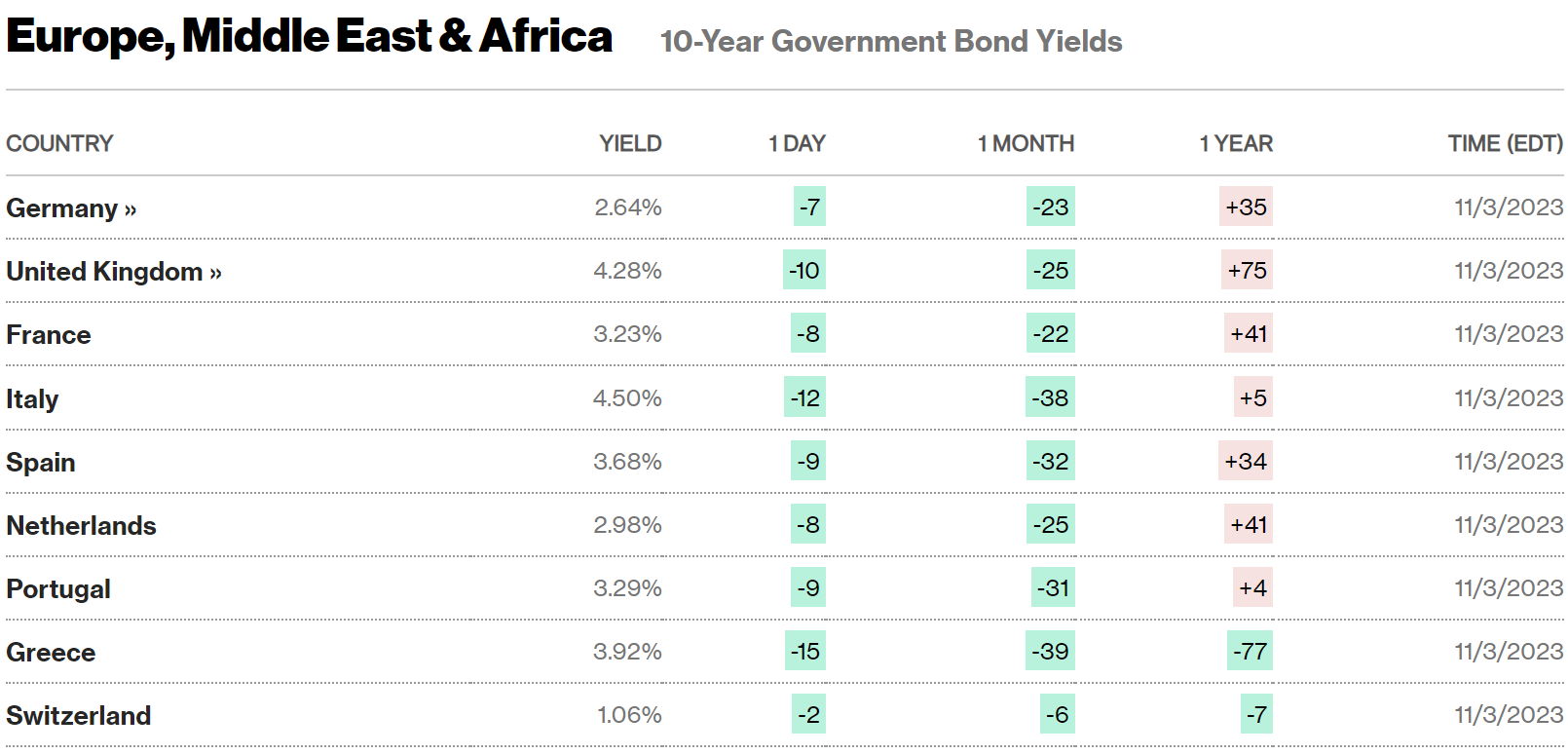

🏈 Bottom Line: The STOXX Europe 600 Index saw a significant recovery, rising by 3.41%, amidst investor expectations that central banks might pause interest rate hikes. European bond yields, including the 10-year German bond which hit a two-month low, fell amid growing expectations that central banks might halt their cycle of monetary policy tightening. French and Swiss 10-yr yields followed suit.

- Equity Markets Rally: Italy's FTSE MIB (+5.08%), France's CAC 40 (+3.71%), Germany's DAX (+3.42%), and the UK’s FTSE 100 (+1.73%).

- Bond Yield Decreases: German 10-year bond yields hit their lowest in over two months, signaling a decrease in borrowing costs. Other European bond yields, including those of Swiss, French, and UK government bonds, followed a downward trend.

- BOE's rate unchanged at 5.25%: Interest rates remained at a 15-year peak of 5.25% as per the Bank of England's decision. The BoE signals interest rates might stay high for an extended period to manage inflation.

- Economic Forecasts: The Bank of England's inflation projection is set to half by the year-end and go below 2% by the end of 2025. It estimates the UK economy to have a marginal growth of 0.1% this year and no growth in 2024.

- Mortgage Activity in the UK: September saw only 43,328 mortgages approved in the UK, the lowest number since January.

- Eurozone Inflation and Employment: The eurozone annual inflation rate dropped significantly to 2.9% in October. The eurozone’s GDP contracted slightly by 0.1% in Q3, with Germany mirroring this contraction. Germany’s jobless rate increased to a higher-than-expected 5.8% in October.

- Norwegian Central Bank’s Decision: Norges Bank maintained its interest rate at 4.25%, with potential adjustments flagged for December based on inflation data.

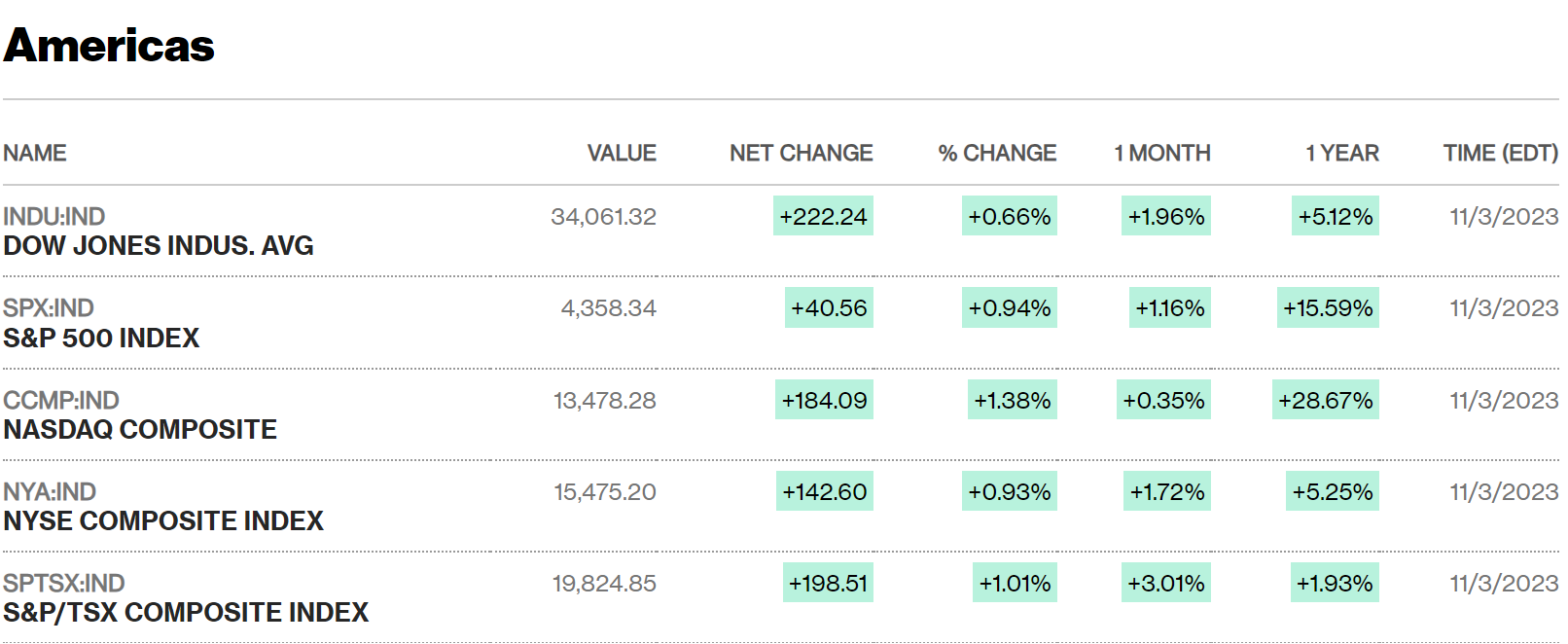

US

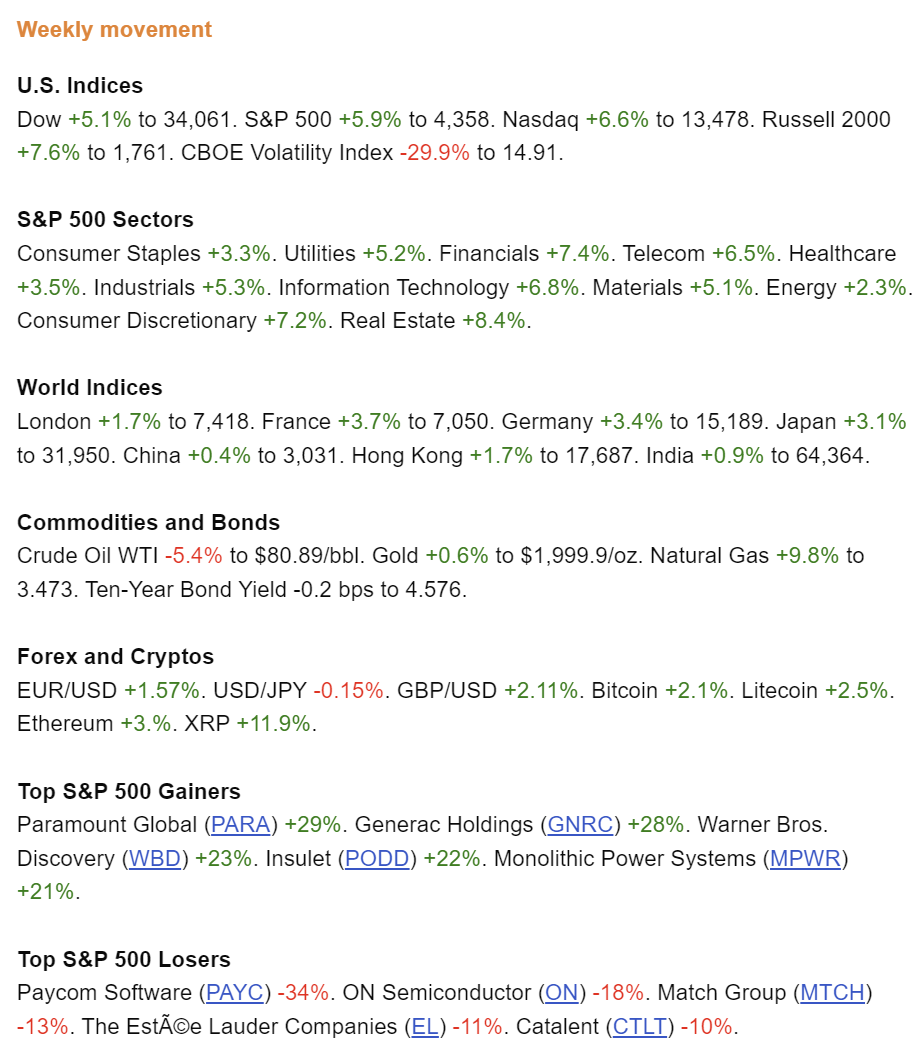

🏈 Bottom Line: S&P 500 saw its best weekly gain since November 2022, on the back of a slowing economy, dovish FOMC statements, and decreasing long-term bond yields. The rally was broad-based, with notable performance from growth stocks, the Nasdaq, and particularly the small-cap Russell 2000. Dow +5.1% to 34,061. S&P 500 +5.9% to 4,358. Nasdaq +6.6% to 13,478. Russell 2000 +7.6% to 1,761.

- Market Surge on Fed's Dovish Stance: The Federal Reserve's policy meeting concluded with steady rates, which investors found encouraging. The Fed's acknowledgment of a tightening in financial conditions due to higher long-term Treasury yields and a subtle shift in language from "solid" to "strong" economic growth buoyed the market sentiment.

- Earnings Season Impacts: It was the second-busiest week for earnings, influencing market movements. Trades by institutional investors for tax losses recognition and Oct month-end portfolio rebalancing contributed to the market's performance.

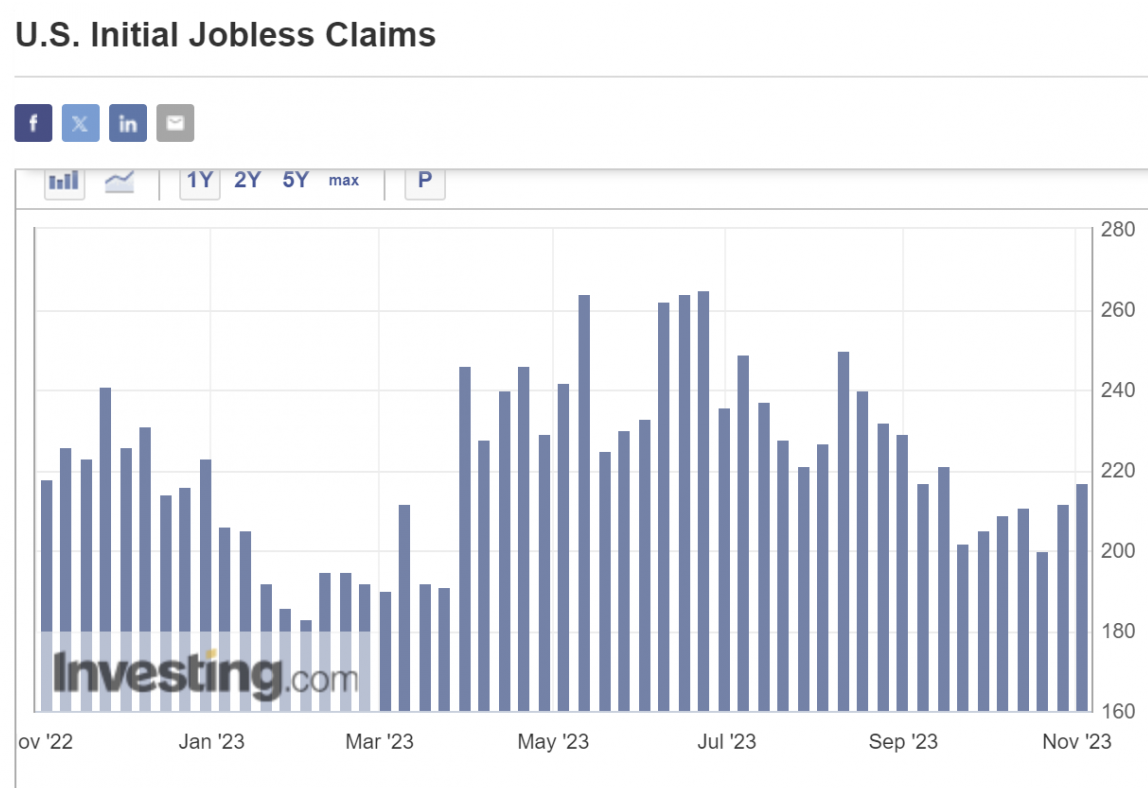

- US job market & wage growth cooled; unemployment rose to 3.9%: The U.S. job market cooled with only 150,000 jobs added in October, and the unemployment rate increased to 3.9%. Wage growth was lower than expected, which could align with the Federal Reserve's inflation targets.

- Treasury and Bond market rally: U.S. Treasury's announcement of selling a slightly reduced amount of long-term securities eased concerns over Treasury demand and supply balance. Long-term Treasury yields fell significantly, benefiting the bond markets, especially municipal and credit-sensitive sectors.

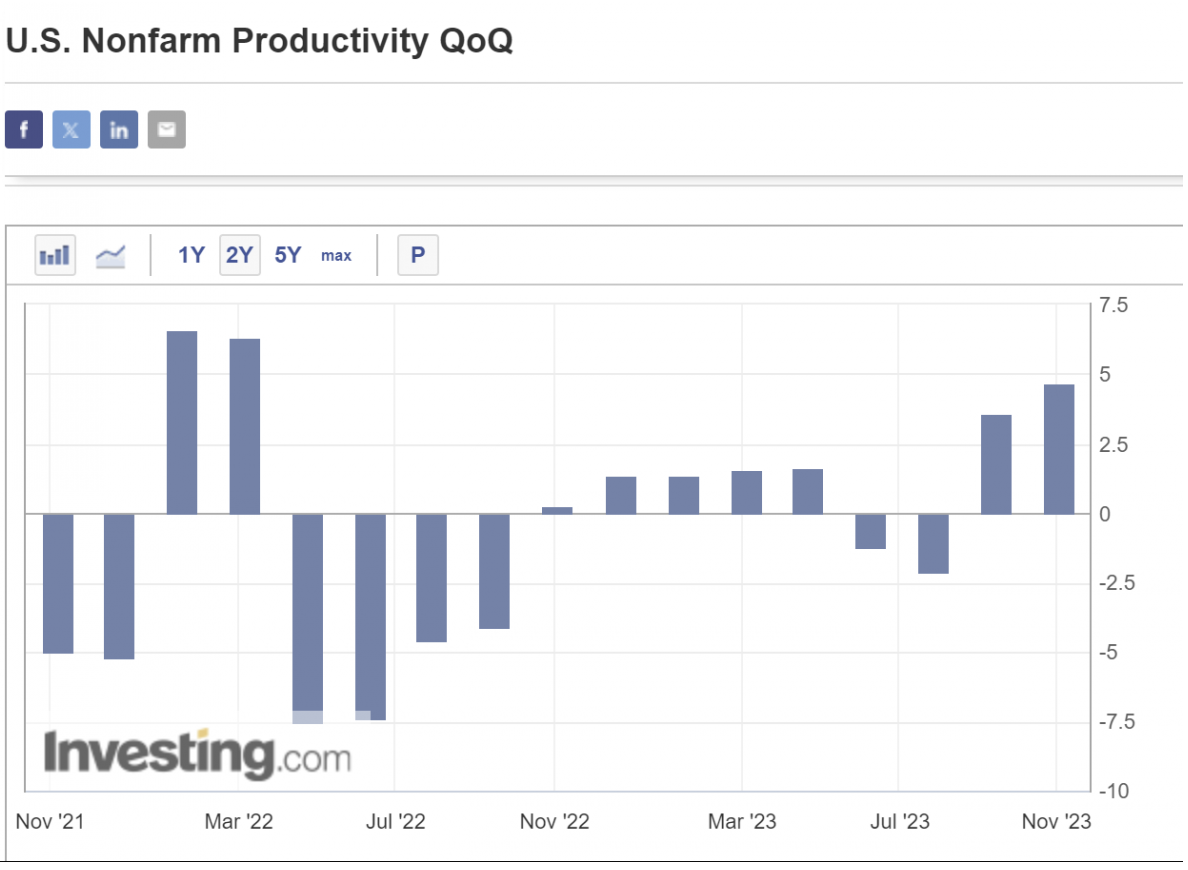

- Productivity and Wage Trends: Preliminary estimates showed a 4.7% increase in productivity, the highest since the initial stages of the pandemic reopening, indicating a positive trend for economic efficiency. Despite a modest uptick in the employment cost index, the growth in average hourly earnings decelerated, potentially easing inflationary pressures.

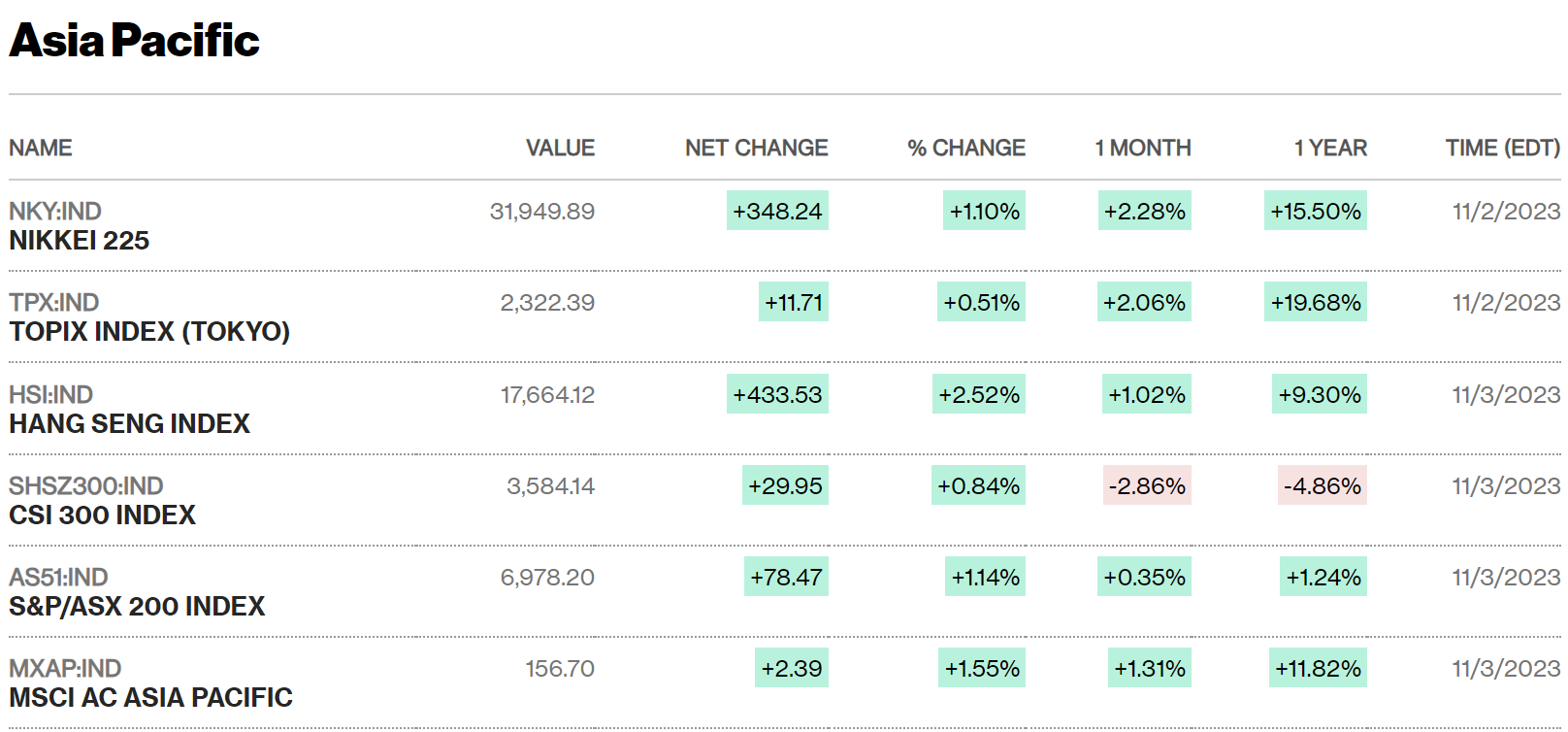

Japan

🏈 Bottom Line: Japanese markets showed gains with the Nikkei 225 and TOPIX indexes both increasing by around 3%, influenced by the Bank of Japan's continuation of an ultra-loose monetary policy, despite tweaks to its yield curve control framework.

- Bank of Japan’s Policy Adjustments: Short-term interest rate: Unchanged at -0.1%. Yield curve control: Modified to allow 10-year JGB yields to rise more freely, treating the 1.0% ceiling as a reference point rather than a strict cap. 10-year JGB yield: Increased to 0.91% from 0.87%

- Inflation Outlook: CPI forecasts for FY 2023 and 2024: Raised to 2.8% year on year, surpassing the BoJ's 2% target

- Yen Depreciation: Japanese yen: Weakened past the 151 level against the U.S. dollar, influenced by Japan-U.S. interest rate differentials

- Fiscal Stimulus Announcement: New stimulus package - worth over USD 110 billion, including tax cuts and cash handouts to mitigate rising living costs and to stimulate growth

- Political Climate - declining voter support: Current government under scrutiny due to the public’s concern over inflation’s impact on living standards

China

🏈 Bottom Line: Despite China's economic challenges, stock indices rose with the Shanghai Composite up by 0.43%, CSI 300 by 0.61%, and Hong Kong’s Hang Seng by 1.53%, on speculation of a peak in U.S. interest rates.

- Manufacturing and Services Sector Slowdown: Official Manufacturing PMI: Decreased to 49.5 in October from 50.2 in September. Non-Manufacturing PMI: Dropped to 50.6 from 51.7 in September. Caixin/S&P Global Manufacturing PMI: Fell to 49.5 in October from 50.6. Caixin/S&P Global Services PMI: Rose marginally but was below consensus expectations.

- Real Estate Sector Downturn: Top 100 developers' new home sales: Down 27.5% year-on-year in October. Real estate loans: Dropped to RMB 53.19 trillion in September, marking a RMB 100 billion decline from the previous year.

- Economic Growth Projections and Concerns: China’s GDP growth target for 2023: 5%. Potential GDP growth slowdown in a bear case scenario: As low as 2.9% in 2023, with property sales possibly falling up to 25% from 2022 levels.

2. Week Ahead

Relatively quiet week ahead.

![Obsidian Brief] When Money Becomes Software: AI, Stablecoins & Bitcoin — Implications for Sustainable and Impact Investing](https://images.unsplash.com/photo-1657408056887-c8c627f7574a?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDF8fHN0YWJsZWNvaW58ZW58MHx8fHwxNzY0NzM0MTExfDA&ixlib=rb-4.1.0&q=80&w=720)

![Finance | Leadership] Breaking into Finance: A Real-World Guide for Students and Future Leaders (technical and behavioral tips: lessons learned from a 15-year journey in Wall Street & City of London) - Part 5/5: Analyst level Deep-dive career guides](https://images.unsplash.com/photo-1537211568975-f95f2101c8f5?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDE1fHxtb250JTIwYmxhbmN8ZW58MHx8fHwxNzY0NTU3NzQ1fDA&ixlib=rb-4.1.0&q=80&w=720)

![Finance | Leadership] Breaking into Finance: A Real-World Guide for Students and Future Leaders (technical and behavioral tips: lessons learned from a 15-year journey in Wall Street & City of London) - Part 4/5: Interview Prep Tips](https://images.unsplash.com/photo-1605128005752-d1714260611e?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDF8fG1vbnQlMjBibGFuY3xlbnwwfHx8fDE3NjQ1NTc3NDV8MA&ixlib=rb-4.1.0&q=80&w=720)