Global Markets Recap - Week of Oct 9, 2023

1. What Moved the Markets?

Europe

🏈 Bottom Line: The STOXX Europe 600 Index managed to break a three-week streak of losses, ending the week with a 0.95% gain. This rebound was primarily driven by a combination of dovish comments from Federal Reserve policymakers and indications that China was considering additional economic stimulus measures. Despite this positive overall trend, major European stock indexes showed a mixed performance, reflecting various regional economic dynamics.

- STOXX Europe 600 Rebounds: The STOXX Europe 600 Index, representing a broad spectrum of European stocks, posted a 0.95% increase, signaling a return to positive territory after enduring three consecutive weeks of losses. This reversal in fortunes was partly attributed to notable factors on both the global and regional fronts.

- Mixed Performances in Major Markets: Within the European continent, individual stock markets displayed varying performances. Italy's FTSE MIB (+1.53%), Germany's DAX (-0.28%), France's CAC 40 (-0.80%) and the UK's FTSE 100 Index (+1.41%).

- Bond Market Moves: European government bond yields fell during the week due to increased demand for safe-haven assets amid Middle East tensions. Strong U.S. inflation data partly offset the yield decline, with the 10-year German bond yield ending the week near 2.75%.

- ECB Rate Hike Decision: Minutes from the European Central Bank's (ECB) September meeting offered insights into the central bank's decision-making process. A "solid majority" of ECB policymakers voted to raise the key deposit rate to a record high of 4.0%. Notably, this decision was deemed a close call due to "considerable uncertainty." The minutes underscored the importance of maintaining the ECB's determination, particularly when headline and core inflation remained above 5%.

- German Economic Outlook: Germany, one of Europe's economic powerhouses, revised its economic forecast significantly downward. The country now anticipates a 0.4% contraction in its economy for the year. This adjustment is primarily attributed to higher energy prices and weakened demand from key markets such as China. Earlier estimates in April had projected Germany's economy to grow by 0.4%. The German Economy Ministry remains hopeful for an economic resurgence at the beginning of the next year, driven by an anticipated recovery in consumer demand.

- UK Economic Snapshot: The United Kingdom witnessed a bounce-back in its economy during August, with Gross Domestic Product (GDP) expanding by 0.2% sequentially. This positive momentum was driven by growth in professional services and education. However, it's worth noting that the construction and production sectors experienced contractions during the same period. Additionally, there were signs of stabilization in the UK's housing market, potentially indicating a steadying trend in the country's property sector.

US

🏈 Bottom Line: The major stock indexes ended the week with mixed results as investors assessed inflation data alongside dovish signals from Federal Reserve officials. Large-cap value stocks outperformed, driven by strong earnings reports from major banks benefitting from higher interest rates. Geopolitical tensions in the Middle East also influenced stock performance.

- Stock Market Mixed: The major stock indexes showed mixed performance during the week, influenced by various factors. Large-cap value stocks performed well, thanks to strong earnings reports from major banks like Citigroup, Wells Fargo, and JPMorgan Chase. These banks benefited from the rise in interest rates. Geopolitical concerns, especially the potential for an escalating conflict in the Middle East due to Hamas attacks on Israel, also had an impact on stock performance. Additionally, dialysis provider DaVita experienced a significant drop in its stock price following reports that Novo Nordisk's new dialysis drug, initially designed for obesity treatment, showed promise in treating kidney disease.

- Dovish Fed Signals: Market sentiment received a boost early in the week following comments from Federal Reserve officials. Fed Vice Chair Philip Jefferson acknowledged the impact of rising long-term bond yields on future rate hikes and stressed the importance of balancing policy risks. Dallas Fed President Lorie Logan, typically viewed as hawkish, suggested that the need for a rate hike might be reduced due to higher yields while emphasizing the necessity of maintaining elevated rates. The release of minutes from the Fed's September meeting further supported the idea of potential policy adjustments in response to higher yields, with discussions revolving around shifting communication from the pace of rate increases to their duration. Futures markets reflected reduced expectations of a rate hike at the next Fed meeting in November, likely influenced by both inflation data and geopolitical uncertainties.

- Inflation Data: Inflation data brought mild surprises, but their impact on investor expectations for the Federal Reserve's future actions remained limited. Core producer prices in September rose slightly more than anticipated, resulting in a 2.7% year-over-year increase, the highest recorded since May, partly due to revisions. In line with expectations, core consumer price index (CPI) data revealed a 4.1% annual increase ending on September 30, marking its slowest pace in two years. These figures provided insights into the inflation landscape, yet overall, they did not significantly alter the prevailing sentiment regarding the Fed's upcoming decisions.

- Bond Markets: During the week, both Treasury and tax-exempt municipal bond yields declined, a result of dovish statements from the Federal Reserve and a flight to safety triggered by rising geopolitical tensions in the Middle East. Longer-maturity municipal bonds experienced increased demand due to limited supply of attractive bond structures. Investment-grade corporate bond issuance was front-loaded and well-received by investors, with many issues oversubscribed. The high-yield bond market also performed solidly despite geopolitical concerns. In the bank loan market, demand remained robust, particularly for higher-quality secured bonds, as cash balances resulting from recent paydowns supported a favorable market environment.

Japan

🏈 Bottom Line: Japan's stock markets saw gains during the week, with the Nikkei 225 Index up 4.3% and the TOPIX Index rising 2.0%, largely attributed to the historic weakness in the yen, which traded at around JPY 149.6 against the U.S. dollar.

- Despite geopolitical tensions in the Middle East providing some support for the yen as a safe-haven currency, Japanese authorities have not shown evidence of intervening to stem the yen's decline.

- Speculation continues about when the Bank of Japan (BoJ) might further normalize its monetary policy, as the yield on the 10-year Japanese government bond (JGB) fell to 0.76% from 0.80%.

- BoJ Board member Asahi Noguchi suggested that the central bank has room for policy adjustments before reaching its yield curve control (YCC) cap of 1.0%, indicating no immediate need for YCC policy changes.

- The International Monetary Fund (IMF) revised up its growth forecast for Japan in 2023 to 2.0%, citing factors like pent-up demand, increased tourism, accommodative monetary policy, and easing supply chain constraints.

- The IMF also increased its forecast for Japan's consumer inflation to 3.2% for the year, with the Bank of Japan expected to follow suit in raising its inflation projections in October due to broader price hikes, rising oil prices, and yen depreciation.

China

🏈Bottom Line: Chinese financial markets declined during the week, reflecting concerns over the economy potentially slipping back into deflation.

- China's Consumer Price Index (CPI) remained unchanged in September year-on-year, mainly due to weaker food prices following a slight rise in August.

- Producer prices fell by 2.5% from a year ago, a more significant drop than expected but easing compared to the previous month's 3% decline.

- Trade data showed overseas exports fell by 6.2% in September, an improvement from the 8.8% drop in August, while imports also shrank by 6.2%.

- New bank loans increased to RMB 2.31 trillion in September, higher than August's RMB 1.36 trillion, suggesting some stabilization in parts of China's economy.

- Regulatory news included a ban on domestic brokerages and their overseas units from accepting new mainland clients for offshore trading, as well as plans for a state-backed stabilization fund to support China's stock markets.

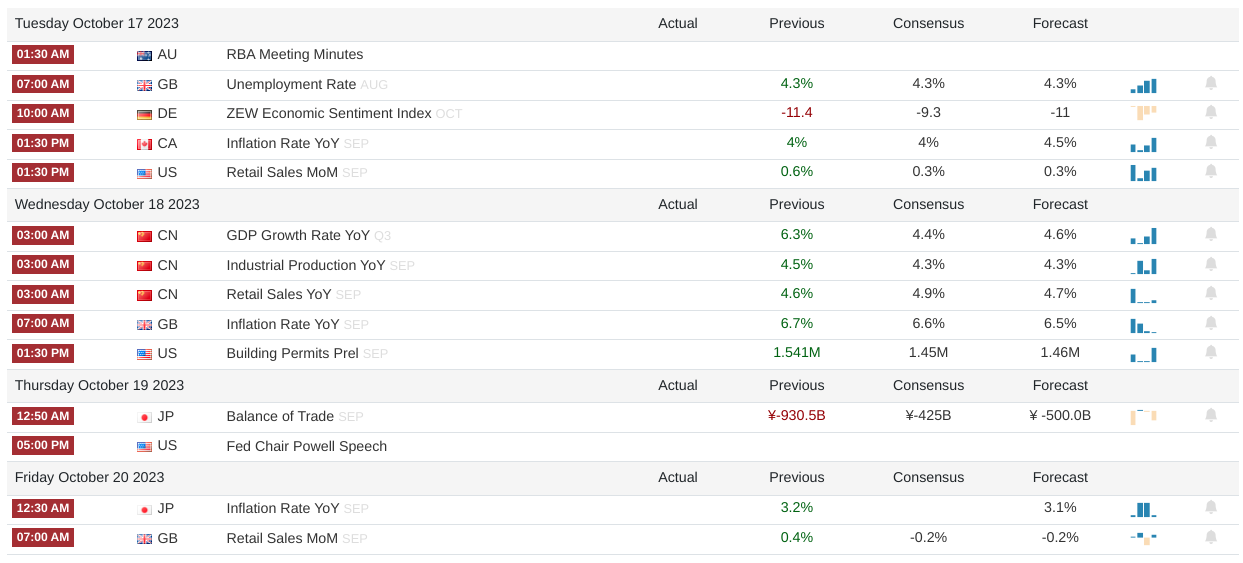

2. Week Ahead

![Obsidian Brief] When Money Becomes Software: AI, Stablecoins & Bitcoin — Implications for Sustainable and Impact Investing](/content/images/size/w720/2025/12/Gemini_Generated_Image_dppem0dppem0dppe.png)

![Leadership] AI Is Changing Everything — How a CEO Managing $1.6 Trillion Stays Ahead, ft. Jenny Johnson from Franklin Templeton](/content/images/size/w720/2025/12/Screenshot-2025-12-03-060128.png)

![AI] The Future of Work, Robotics & AI Infrastructure (Elon's bold predictions: work will be optional & currency could be irrelevant)](/content/images/size/w720/2025/11/Screenshot-2025-11-22-074621.png)