Global Markets Recap - Week of Sep 18, 2023

1. What Moved the Markets?

Europe

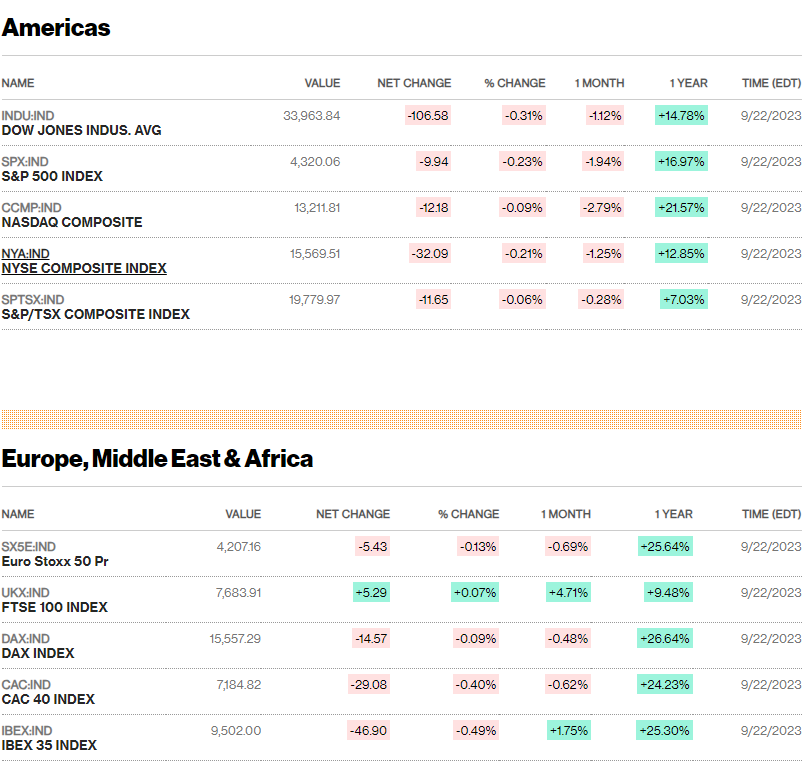

🏈 Bottom line: European equities declined due to central bank rate signals and economic concerns, with the STOXX Europe 600 Index falling 1.98%, while central banks like the BoE and SNB surprised markets by holding rates, and deteriorating Eurozone PMI data indicated continued contraction in the private sector.

- European Equities and Economy: Pan-European STOXX Europe 600 (- 1.98%). Key driving factors: Central banks hinting at prolonged high-interest rates, elevated oil prices, and disappointing business activity data. France’s CAC 40 (-2.67%), Germany’s DAX (-2.26%), Italy’s FTSE MIB (-1.13%), UK’s FTSE 100: Stable, largely due to a depreciated UK pound benefiting multinationals with overseas revenues.

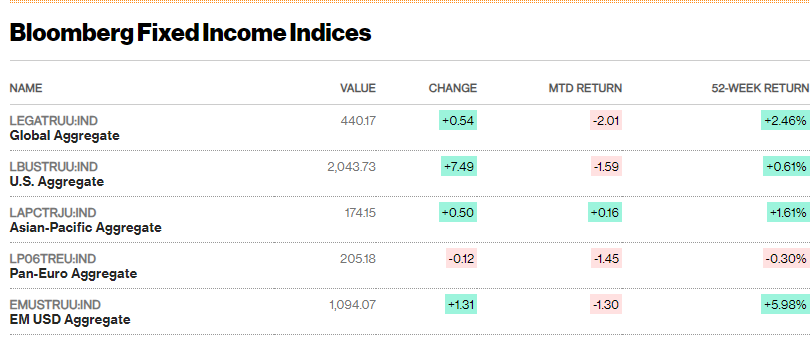

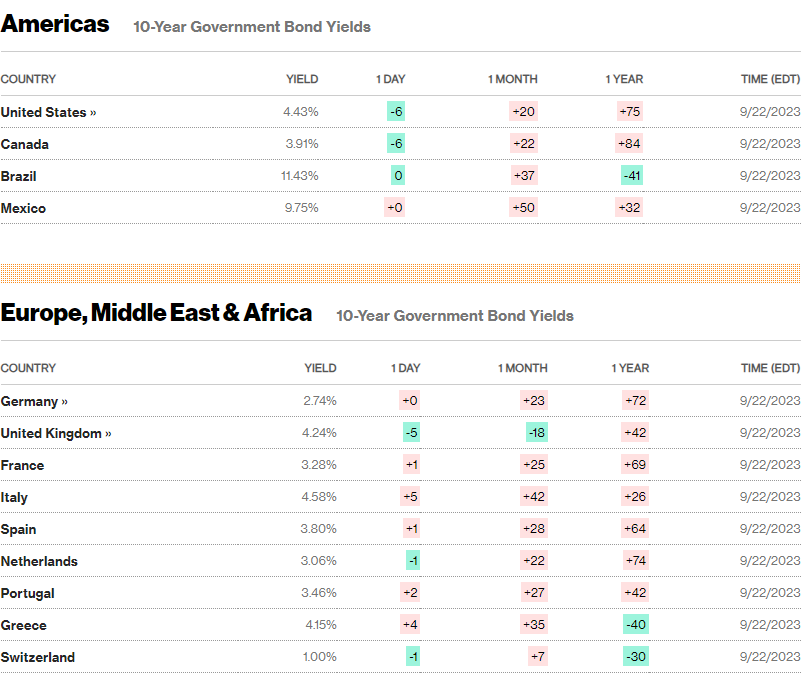

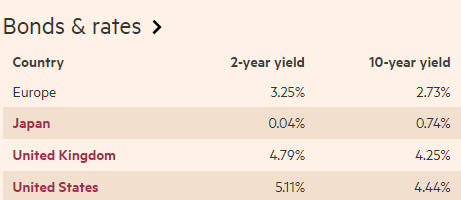

- Bond Yields: Eurozone government bond yields initially increased due to ECB comments and the Fed's indications, but later moderated after the BoE's surprise rate hold and weak eurozone PMI data. UK gilt yields showed a decline, especially at shorter-maturity ends.

- Bank of England (BoE) held the key interest rate at 5.25%, marking the first pause since December 2021. Inflation in the UK slowed to 6.7% in August from 6.8% in July, but underlying inflationary pressures remained elevated. The BoE's target is 2%.

- Swiss National Bank (SNB): Unexpectedly maintained its key interest rate at 1.75%, marking the first non-hike since March 2022. Indicated potential rate hikes for future price stability.

- Sweden's Riksbank: Raised its policy rate by a quarter percentage point to 4.00%. Open to another potential increase in November.

- Economic Indicators: Eurozone PMI data - orders experienced the most significant drop in nearly three years. Private sector output contracted for the fourth straight month. The HCOB Flash Eurozone Composite PMI Output Index for September was 47.1 (up from 46. 7 in August), indicating contraction. Manufacturing faced the most significant contraction, while services sector activity decreased for the second consecutive month.

US

🏈 Bottom Line: U.S. equities faced a decline influenced by the Federal Reserve's hawkish stance and surging Treasury yields, with the S&P 500 marking its worst drop in six months, while jobless claims improved and the bond market remained active amidst rising yields and robust demand for high yield bonds.

- U.S. Equity Performance: Major U.S. equity benchmarks saw a decline this week, influenced by the Federal Reserve's hawkish forecasts and a surge in U.S. Treasury yields. The S&P 500 Index marked its most significant one-day drop in six months, resulting in its third consecutive weekly loss. Other market pressures included concerns over the United Auto Workers’ strike, potential U.S. government shutdown, and tax-loss harvesting as some investors approached their fiscal year-end.

- Federal Reserve Outlook: The Fed retained its short-term lending benchmark at a target range of 5.25% to 5.50%. While one more rate hike is anticipated in 2023, the outlook for 2024 rates surpassed expectations, and rates for 2025 also saw an upward revision. The Fed has also upgraded its growth forecast, highlighting the economy's resilience.

- Economic Indicators: A subdued week for economic news, but weekly initial jobless claims were lower than anticipated, dropping to their lowest since January, indicating a robust labor market.

- U.S. Treasury & Bond Movements: Longer-term U.S. Treasury yields climbed, with the 10-year U.S. Treasury yield hitting a 16-year peak. AAA rated municipal bond yields also rose significantly, reacting to the Treasury market's fragility. Despite the equity market's risk-off environment, the yield premiums in the investment-grade corporate bond market relative to Treasuries remained stable. The high yield bond primary market remained active, with more deals anticipated due to high demand for new issues.

Japan

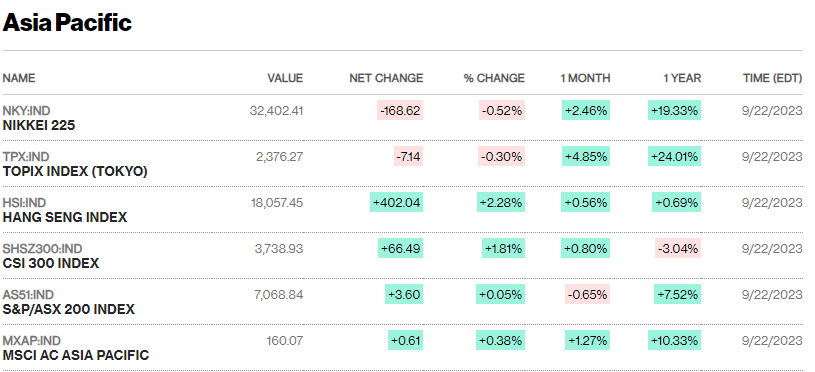

🏈 Bottom line: Japan's stock markets were negatively impacted by the U.S. Federal Reserve's interest rate stance, while the BoJ maintained its dovish monetary policy, leading to a weakened yen and concerns about future inflation trends.

- Japan's stock markets declined: Nikkei (- 3.4%), TOPIX (-2.2%). The Fed's hawkish intent to maintain high interest rates affected market sentiment.

- The Bank of Japan (BoJ) maintained its monetary policy, quashing expectations of an exit from negative interest rates.

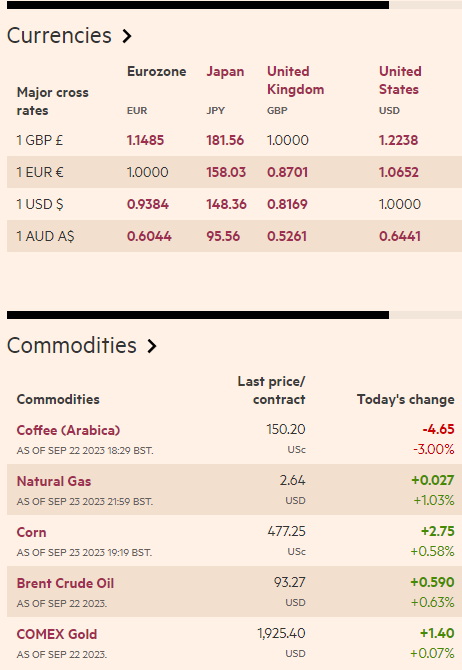

- The yen weakened against the U.S. dollar due to contrasting monetary policies between the Fed and BoJ. Finance Minister Shunichi Suzuki suggested potential interventions to stabilize the yen.

- BoJ's stance remains dovish, with no immediate plans to tighten policy.

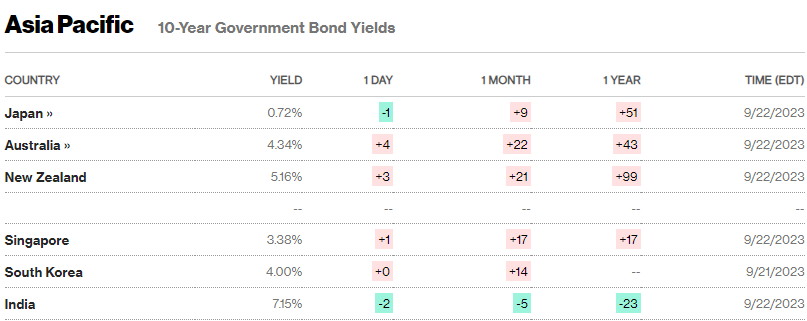

- 10-year JGB yield rose from 0.70% to 0.74% over the week.

- Japan's core consumer price index (CPI) increased by 3.1% YoY in August, yet core inflation is slowing.

- BoJ's outlook: CPI rise rate to slow down, then moderately pick up as economic conditions improve.

China

🏈Bottom line: While Chinese equities saw mixed results, economic stabilization signs emerged, with the State Council and PBOC taking proactive measures to bolster recovery amidst concerns over capital outflows and a weakening yuan.

- Mixed Chinese equities performance: Shanghai Composite (+ 0.47%), CSI 300 (+0.81%), and Hang Seng (-0.7%).

- Economic indicators: No major economic indicators were released during the week, but prior data showed signs of economic stabilization.

- China's State Council: expressed commitment to support economic growth in 2024, emphasizing the historical trend of long-term improvement.

- China witnessed capital outflows of USD 49 billion in August, the largest since December 2015, leading to a 16-year low for the yuan against the U.S. dollar.

- Beijing introduced pro-growth measures, focusing on stimulating consumption and rejuvenating the property market.

- The PBOC reduced its reserve requirement ratio for the second time this year. Both one- and five-year loan prime rates remained unchanged by Chinese banks, following the PBOC's decision to keep its medium-term lending facility rate steady. Zou Lan of the PBOC indicated substantial policy space to back China's economic revival, hinting at potential further easing in the future.

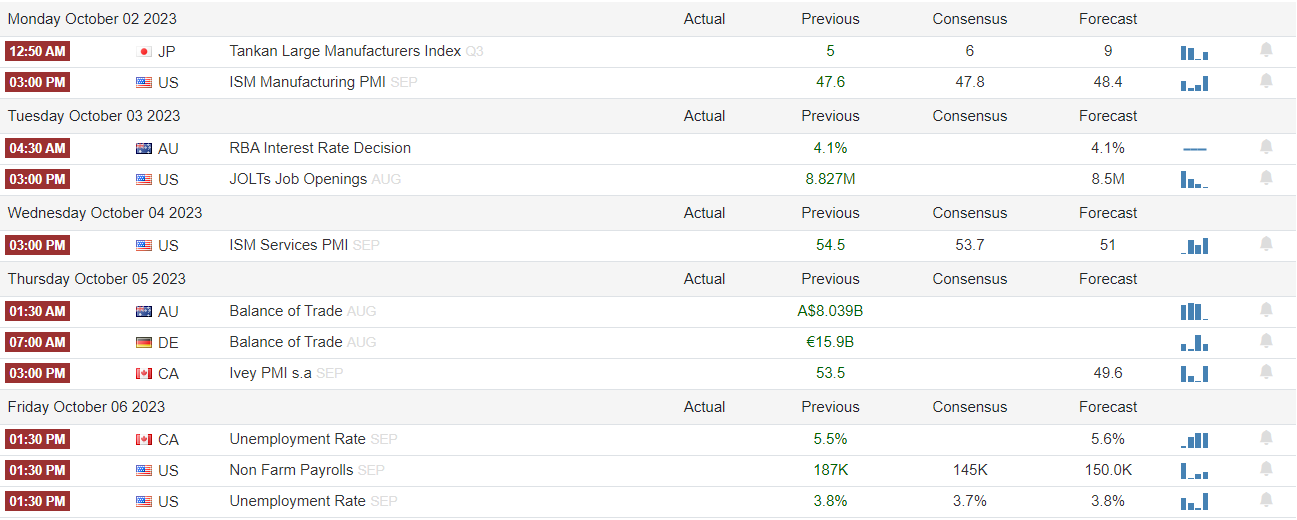

2. Week Ahead