Global Markets Recap - Week of Sep 25, 2023

1. What Moved the Markets?

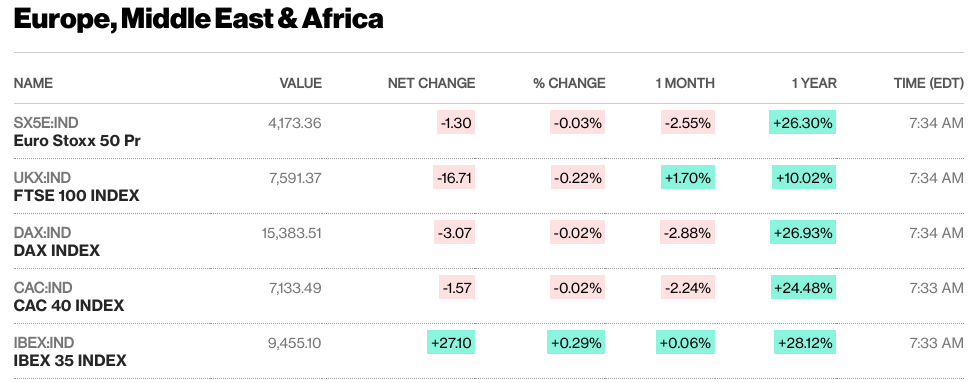

Europe

🏈Bottom line: European stock markets declined amid concerns about higher interest rates and a weakening Chinese economy, with major indices posting losses; European government bond yields rose, and Eurozone inflation eased in September, while the UK's GDP growth was revised upward, but its property market slowdown continued.

- European stock markets, including the STOXX Europe 600 Index, declined due to concerns about prolonged higher interest rates and a weakening Chinese economy. France's CAC 40 (-0.69%), Germany's DAX (-1.10%), Italy's FTSE MIB (-1.16%), and the UK's FTSE 100 (-0.99%).

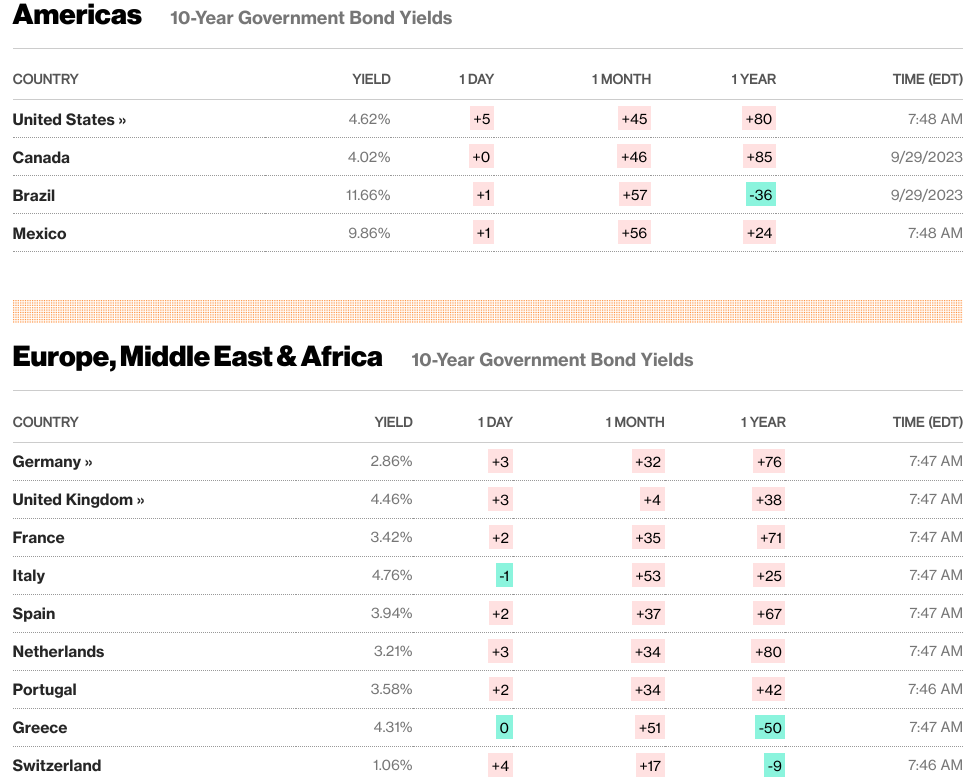

- European Government Bonds: European government bond yields increased broadly due to concerns about higher interest rates. Germany's 10-year government bond yield rose to nearly 3%, a level not seen in over a decade. Italian bond yields also advanced on concerns of increased debt issuance to finance a larger deficit. In the UK, the yield on the benchmark 10-year bond climbed above 4.5% before retreating slightly.

- European Central Bank (ECB) Actions: ECB officials, including Christine Lagarde and Philip Lane, committed to maintaining a restrictive monetary policy to address inflation and bring it back to the 2% target. ECB Executive Board member Frank Elderson indicated that rates might not have peaked, with future decisions based on incoming data. Austrian central bank Governor Robert Holzmann suggested the possibility of further rate hikes due to persistent inflationary pressures.

- Eurozone Inflation: Eurozone consumer prices increased by 4.3% annually in September, weaker than expected and the slowest pace in about two years. This was an improvement from the 5.2% inflation rate in August. The core inflation rate, which excludes certain items, declined to 4.5% from 5.3%.

- UK Economic Data: Revised figures for the UK's GDP showed first-quarter growth at 0.3%, higher than the previous estimate of 0.1%. Second-quarter GDP growth remained unchanged. The property market in the UK continued to slow, with a decrease in the number of mortgages approved for house purchases in August compared to July, according to Bank of England data.

US

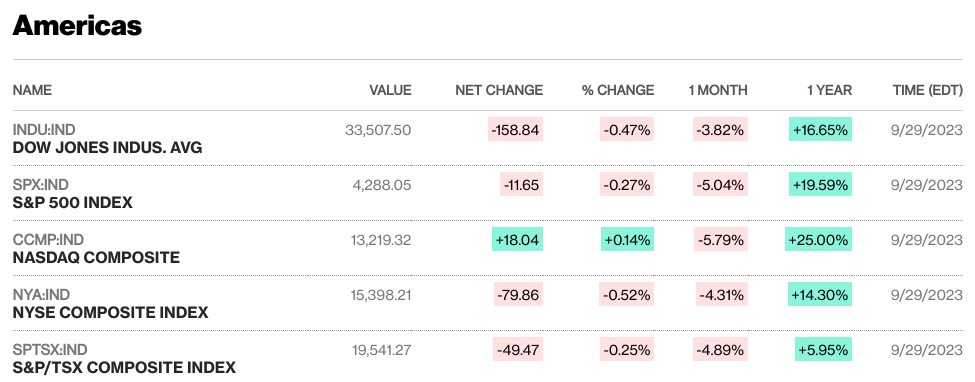

🏈Bottom line: Higher oil prices raised concerns about inflation and led to a bond sell-off. The possibility of a U.S. government shutdown also weighed on investor sentiment. The 10-year U.S. Treasury yield reached above 4.6% before moderating. Tax-exempt municipal bonds and high yield bonds faced selling pressure. The S&P 500 Index had its fourth consecutive weekly decline, with utilities leading the losses, while energy stocks outperformed. Small-cap indices, S&P MidCap 400 and Russell 2000, saw slight gains.

- Bond Market: 10-year U.S. Treasury yield peaked above 4.6% during the week. Bond prices and yields move inversely, so rising yields indicate bond price declines. Encouraging eurozone and U.S. inflation data caused 10-year Treasury yields to tick slightly lower.

- Inflation: Core PCE (Personal Consumption Expenditures) inflation for August increased by 3.9% YoY. This is the lowest annual inflation rate in about two years but still below the Federal Reserve's 2% target. Core PCE inflation decreased from the revised 4.3% rate in July. Monthly inflation, including all items, rose to 0.4% from 0.2% in July, primarily due to higher energy prices.

- Durable Goods Orders: In August, durable goods orders increased by 0.2%, contrary to expectations of a decline. Excluding transportation, durable goods orders rose by 0.4% from July. This indicator suggests some resilience in the economy despite recent manufacturing weakness.

- Consumer Confidence: The Conference Board's U.S. consumer confidence index declined to 103.0 in September. This reading was below expectations and lower than the previous month's revised figure of 108.7. Weakness was particularly evident in the expectations component, which fell to 73.7.

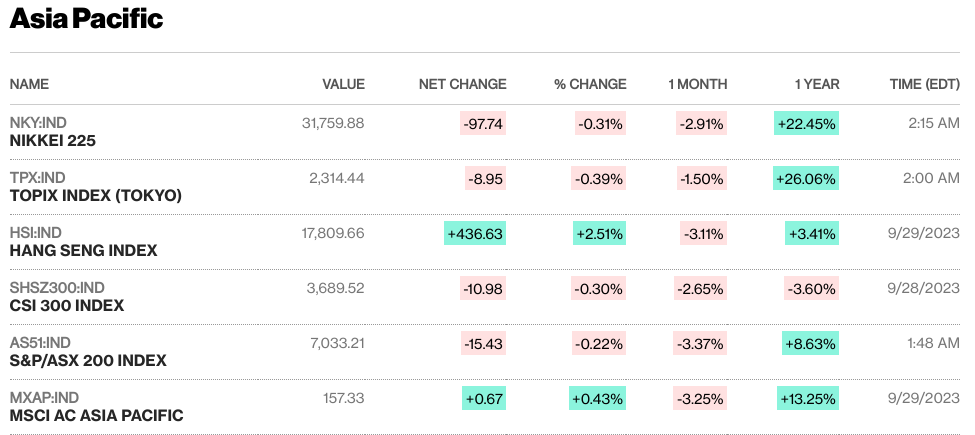

Japan

🏈Bottom line: Japan's stock markets experienced declines, with the Nikkei down 1.7% and the broader TOPIX Index declining 2.2%, primarily due to concerns about sustained higher U.S. interest rates and rising oil prices; however, the announcement of a new economic stimulus plan by the Japanese government provided some optimism. Additionally, slowing core inflation in the Tokyo area underscored the Bank of Japan's strong commitment to its ultra-accommodative monetary policy stance, aligning with its inflation target.

- Japanese stock markets: including the Nikkei and TOPIX Index, saw declines of 1.7% and 2.2%, respectively, driven by worries about enduring high U.S. interest rates and surging oil prices.

- Japanese authorities hinted at potential intervention in the foreign exchange market as the yen weakened to an 11-month low against the USD, although no specific trigger level for intervention was confirmed.

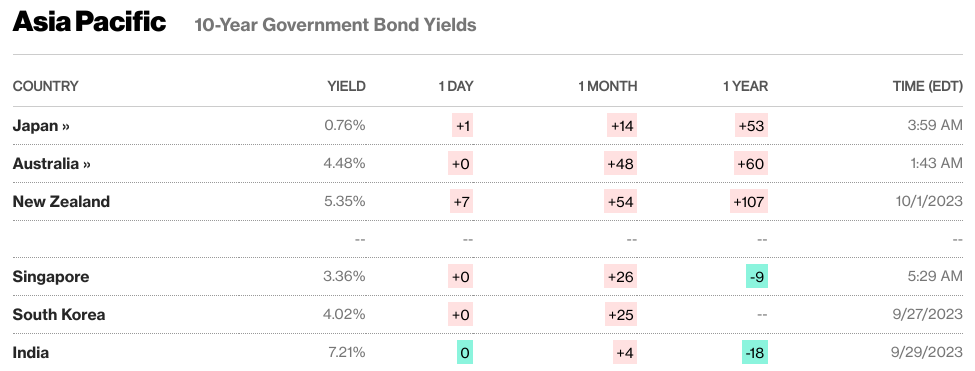

- Japanese bond markets: The yield on the 10-year Japanese government bond (JGB) reached a more than decade-high of 0.76%, despite the Bank of Japan's intervention in purchasing JGBs with maturities between five and 10 years.

- New economic stimulus plan: Prime Minister Fumio Kishida unveiled a new economic stimulus plan to be finalized in October, funded by a supplementary budget. The plan aims to foster capital investment, wage growth, and investment in key sectors like semiconductors, batteries, and biotechnology. It also considers extending subsidies to address soaring energy prices into the following year.

China

🏈Bottom line: Chinese stocks experienced a decline during a holiday-shortened week, marked by a lack of positive economic news that dampened investor sentiment. Both the CSI 300 Index and Shanghai Composite Index saw losses, while the Hang Seng Index in Hong Kong also fell. However, a private survey indicating price recovery in China eased concerns of prolonged deflation, with the all-sector price index reaching a 14-month high in September. This suggests a more positive outlook for Chinese economic growth and a potential bottoming out of the economy following a post-lockdown recovery in the first quarter.

- Chinese stock markets: including the CSI 300 Index and Shanghai Composite Index, registered losses during the holiday-shortened week, with no significant positive economic news to bolster investor confidence. Mainland Chinese stock markets were closed on Friday, marking the beginning of a 10-day holiday for the Mid-Autumn Festival and National Day, and are set to reopen on Monday, October 9. In Hong Kong, the Hang Seng Index also fell 1.37% for the week.

- Macro data: While no official economic indicators were released during the week, a private survey conducted by World Economics indicated a recovery in prices in China, dispelling fears of prolonged deflation. The all-sector price index reached a 14-month high in September, suggesting a more optimistic outlook.

- Macro outlook: This survey aligns with recent data points that suggest China's economy may have bottomed out after a period of declining momentum following a brief post-lockdown recovery in the first quarter. Official data for August, released earlier in September, indicated signs of stabilization in the Chinese economy, including growth in industrial production and retail sales, a drop in unemployment, but slightly weaker fixed-asset investment growth, driven by a decline in property investment.

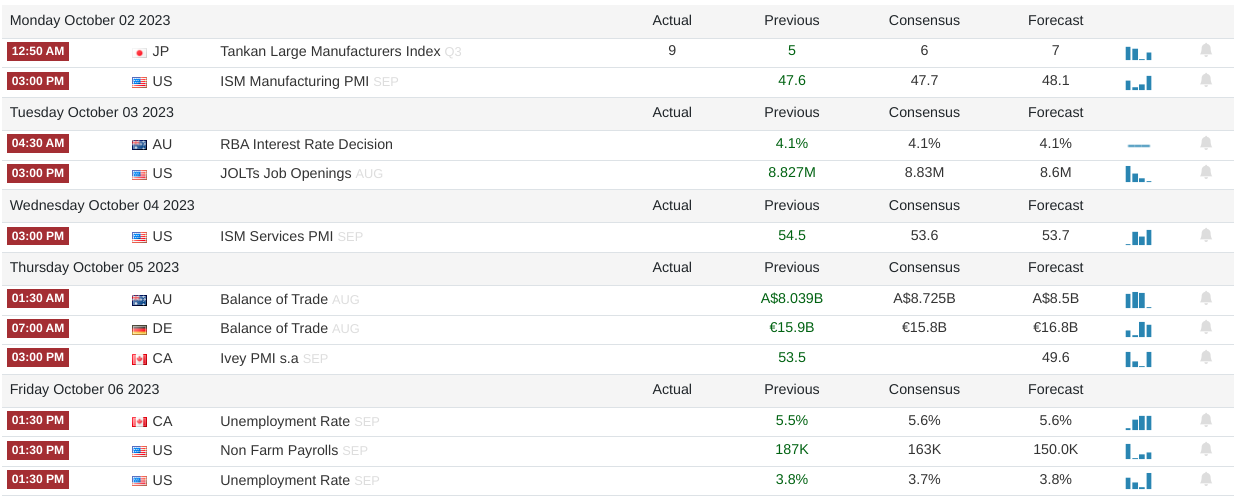

2. Week Ahead

![Obsidian Brief] When Money Becomes Software: AI, Stablecoins & Bitcoin — Implications for Sustainable and Impact Investing](/content/images/size/w720/2025/12/Gemini_Generated_Image_dppem0dppem0dppe.png)

![Leadership] AI Is Changing Everything — How a CEO Managing $1.6 Trillion Stays Ahead, ft. Jenny Johnson from Franklin Templeton](/content/images/size/w720/2025/12/Screenshot-2025-12-03-060128.png)

![AI] The Future of Work, Robotics & AI Infrastructure (Elon's bold predictions: work will be optional & currency could be irrelevant)](/content/images/size/w720/2025/11/Screenshot-2025-11-22-074621.png)