Global Markets Recap - Week of Oct 2, 2023

1. What Moved the Markets?

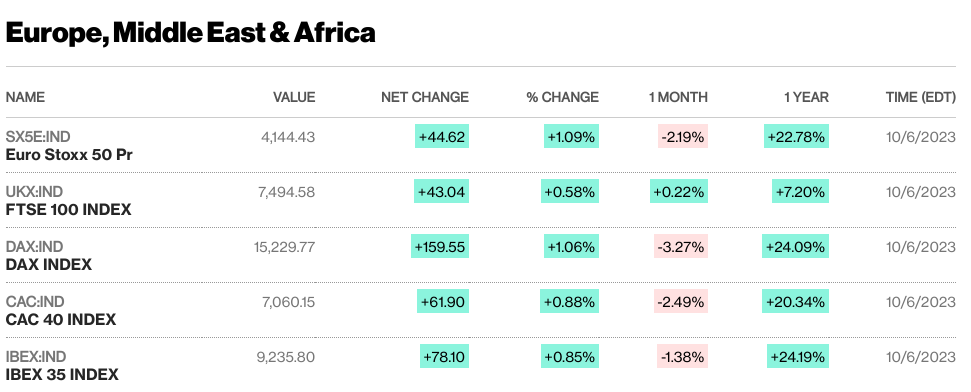

Europe

🏈Bottom Line: The pan-European STOXX Europe 600 Index concluded the week with a 1.18% decline, primarily driven by surging bond yields and concerns about prolonged higher interest rates. Major European stock indexes, including Italy's FTSE MIB (-1.53%), Germany's DAX (-1.02%), France's CAC 40 (-1.05%), and the UK's FTSE 100 (-1.49%)also declined.

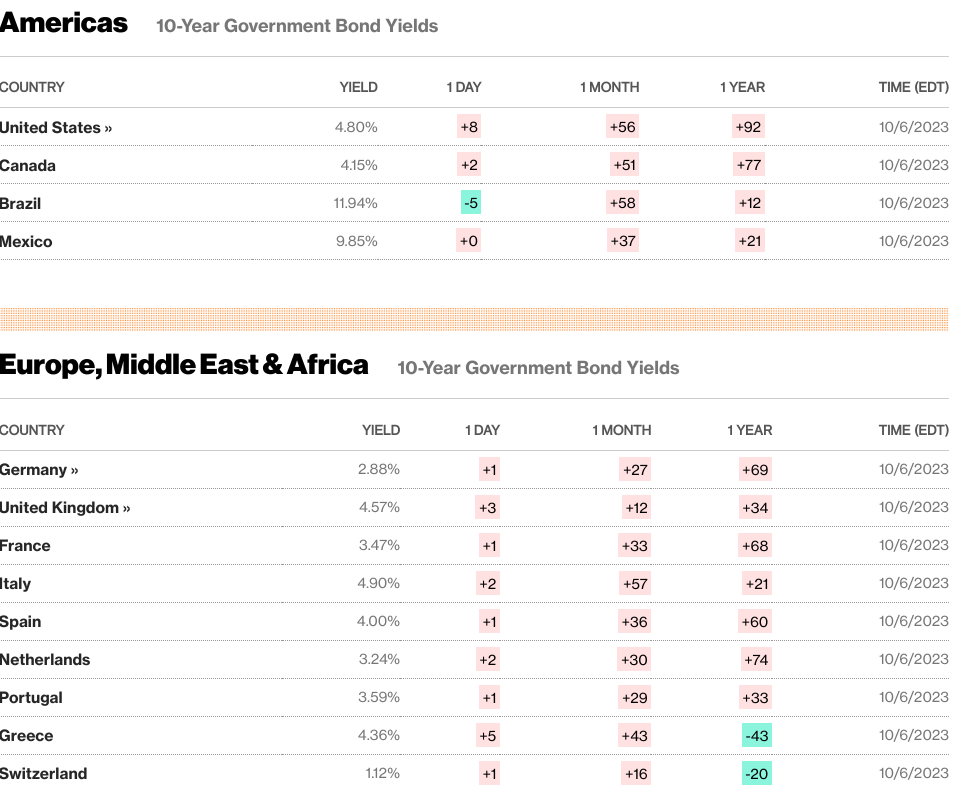

- European Bond Markets: Bond yields surged in European markets, contributing to the STOXX Europe 600 Index's decline. Germany's 10-year government bond yield slipped below 3% but remained near a decade-plus high. French and Italian bond yields ticked up, reflecting cautious sentiment. In the UK, the 10-year government bond yield held near its highest levels since August 2008, driven by indications of persistent inflationary pressures.

- Eurozone Economic Data: Both official and private-sector data indicated that the eurozone economy likely struggled in the third quarter. The final Composite Purchasing Managers' Index (PMI) from S&P Global showed a fourth consecutive monthly contraction with a reading of 47.2 in September (PMI readings below 50 indicate shrinking business output). Eurozone retail sales fell more than expected in August, declining by 1.2% sequentially, driven by drops in gasoline, mail orders, and internet shopping.

- German Economic Indicators: German industrial orders rebounded by 3.9% on a month-over-month basis in August, following a significant drop of 11.7% in July. Exports, however, fell by 1.2% sequentially in August, more than forecast, due to weak global demand.

- UK Economic Indicators: UK house prices continued to decline for the sixth consecutive month in September, with a 0.4% sequential decrease according to mortgage lender Halifax. Nationwide Building Society reported no change in house prices for September, following a 0.8% reduction in August. Homebuilding's rapid decline led to a sharp contraction in construction industry activity in September, according to an S&P Global/CIPS survey of construction purchasing managers, marking the fastest pace of decline in over three years.

US

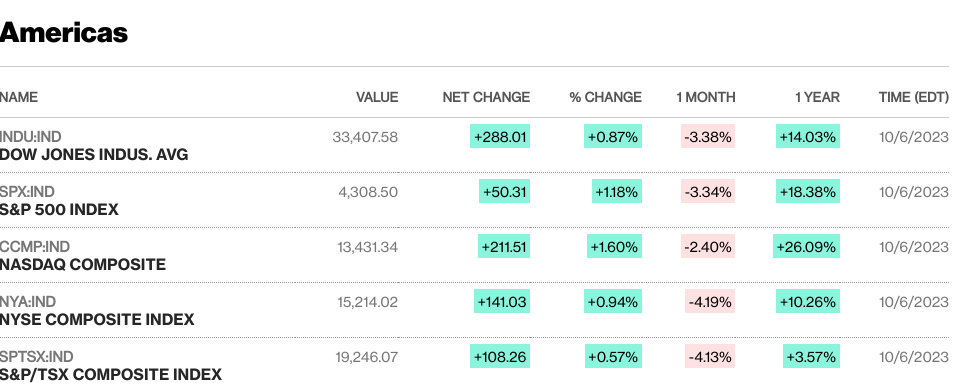

🏈Bottom Line: Stocks ended the week with mixed performance, initially reacting negatively to a surprising surge in jobs data but rebounding as nuanced details in the report suggested a more benign inflationary environment, and other economic signals calmed fears about growth and inflation. Treasury yields continued to rise to 16-year highs, impacting various bond markets.

- Stock Market: Major indexes experienced mixed performance during the week, characterized by top-heavy trading where large-cap growth stocks, especially in the technology and internet sectors, outperformed the broader market. An equally weighted version of the S&P 500 Index underperformed its market-weighted counterpart by the most significant margin since March. Large-cap growth stocks outperformed value stocks according to Russell indexes, and the S&P 500 outperformed the small-cap Russell 2000 by a considerable margin.

- Jobs Data: Investors eagerly awaited the nonfarm payrolls report, hoping for data that might influence Federal Reserve decisions on rate hikes. The Labor Department reported a surprise addition of 336,000 nonfarm jobs in September, double consensus estimates, leading to an initial negative market reaction. However, nuanced details in the report, such as modest wage growth and a steady workforce participation rate, suggested that increasing labor supply, rather than excessive demand, was driving the labor market, easing inflationary concerns.

- Economic Signals: Several economic signals during the week calmed fears of a strong rebound in growth and inflation. While manufacturing activity showed slight improvement, the services sector indicated a significant slowdown since August. ADP's private sector payroll report indicated a modest increase in jobs, contrasting with the strong nonfarm payroll data.

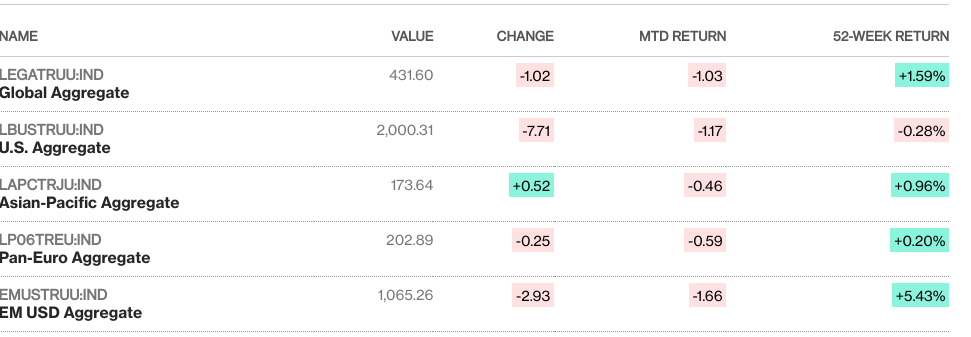

- Treasury Yields: The yield on the 10-year U.S. Treasury note reached a 16-year high of approximately 4.89%, impacting various bond markets. Munis outperformed early in the week, and the primary market was quiet. Spreads widened, and high yield bonds faced pressure as rates rose, with issuance expected to remain subdued until volatility eases. Collateralized loan obligations (CLO) managers remained active in the bank loan market, although they exercised caution given the macroeconomic backdrop.

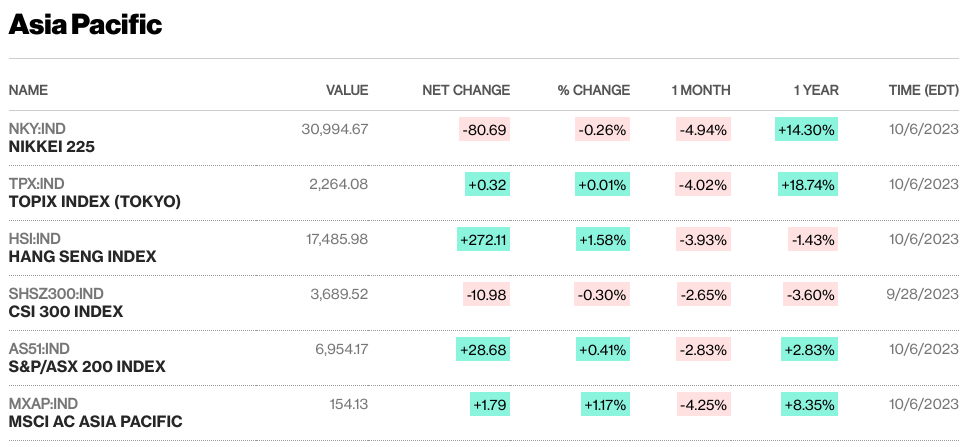

Japan

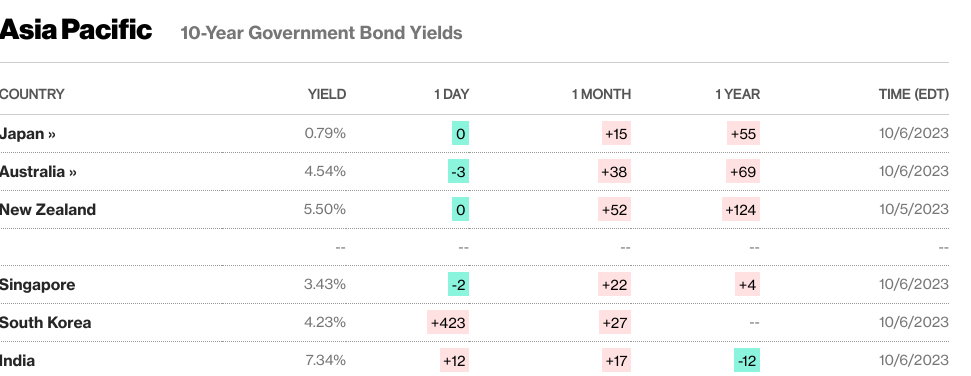

🏈Bottom Line: Japanese stocks faced a challenging week, with the Nikkei 225 Index declining by 2.7%, and the broader TOPIX Index falling by 2.6%. These losses were primarily attributed to surging U.S. bond yields and concerns that central banks would maintain a hawkish stance for an extended period. Additionally, economic data indicated falling real wages and consumer spending in Japan during August, further affecting market sentiment. However, the Bank of Japan's Tankan survey reported that a weak yen had positively impacted business sentiment among Japanese companies.

- Japanese Stock Market: The Nikkei 225 Index dropped by 2.7%, while the TOPIX Index fell by 2.6% during the week. Concerns about rising U.S. bond yields and expectations of prolonged central bank hawkishness contributed to the stock market's decline. Economic data revealed declines in real wages and consumer spending in Japan during August, which further dampened market sentiment.

- Yen's Performance and Speculation: Speculation arose that Japan's Ministry of Finance (MoF) intervened in the foreign exchange market to stabilize the yen's value. The yen experienced a sharp rebound after briefly reaching the JPY 150 against the U.S. dollar level, a potential trigger for authorities to intervene. While MoF officials did not confirm intervention, they emphasized their readiness to act against excessive currency volatility. The yen finished the week stronger, hovering around JPY 149 against the U.S. dollar.

- Japanese Government Bond Yields: The yield on the 10-year Japanese government bond (JGB) reached a 10-year high of 0.80% from 0.76% at the previous week's close. Despite the Bank of Japan's unscheduled purchases of JGBs with maturities between five and ten years, yields increased. This was attributed to the U.S. Treasuries sell-off and growing expectations of monetary policy normalization by the Bank of Japan.

- Purchasing Managers' Index (PMI) Data: The services sector in Japan showed solid expansion in September, driven by sustained customer demand after the lifting of pandemic restrictions earlier in the year. However, the expansion moderated compared to the previous month, with the services PMI falling to 53.8 from 54.3 in August (readings above 50 indicate expansion). In contrast, manufacturing conditions deteriorated further in September, with the manufacturing PMI declining to 48.5 from 49.6 in the prior month, marked by significant drops in both output and new orders.

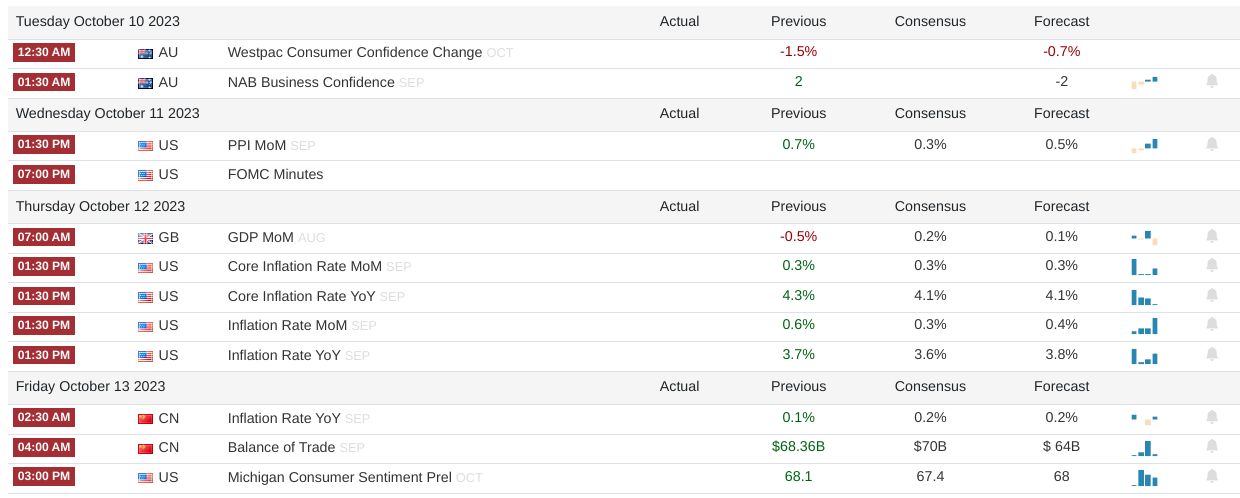

2. Week Ahead

![Obsidian Brief] When Money Becomes Software: AI, Stablecoins & Bitcoin — Implications for Sustainable and Impact Investing](/content/images/size/w720/2025/12/Gemini_Generated_Image_dppem0dppem0dppe.png)

![Leadership] AI Is Changing Everything — How a CEO Managing $1.6 Trillion Stays Ahead, ft. Jenny Johnson from Franklin Templeton](/content/images/size/w720/2025/12/Screenshot-2025-12-03-060128.png)

![AI] The Future of Work, Robotics & AI Infrastructure (Elon's bold predictions: work will be optional & currency could be irrelevant)](/content/images/size/w720/2025/11/Screenshot-2025-11-22-074621.png)