Global Markets Recap - Week of Sep 11, 2023

Hi All,

Hope your 'back-to-school' week has gone well! The New Yorker in me couldn't help but share the crazy double-rainbow pics that have been circulating on the internet since Sep 11 this year. The Universe is a magical place indeed!

1. What Moved the Markets?

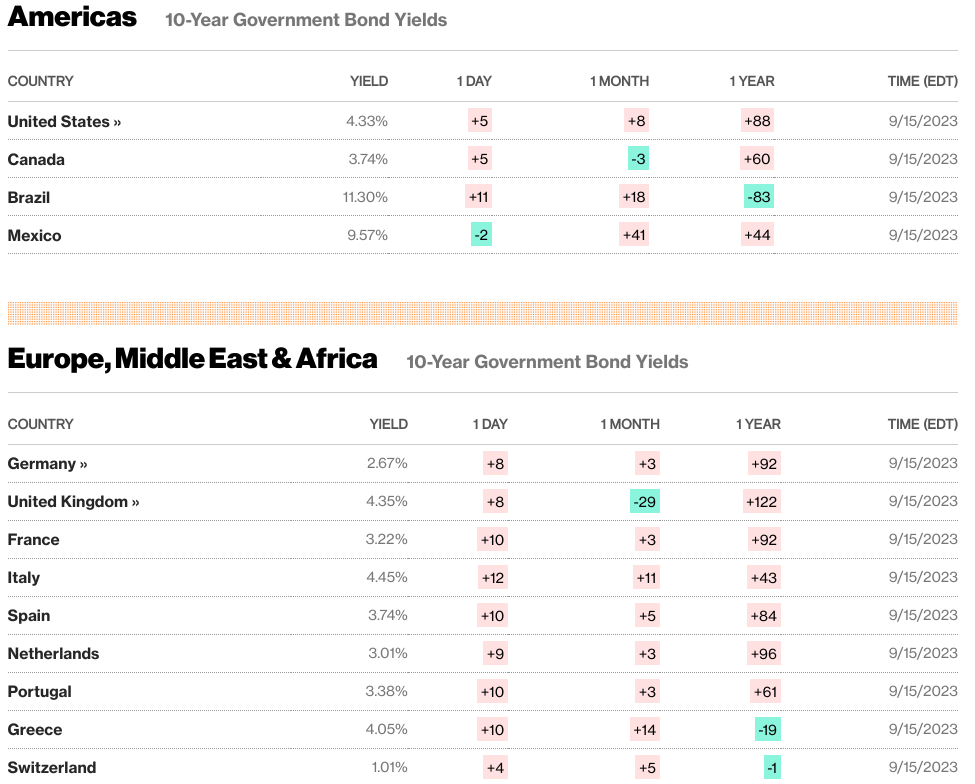

Europe

🏈 Bottom line: European stock markets had mixed results due to ECB rate hikes, economic data, and currency movements, while European bond yields dropped. The UK saw economic contraction, but wage growth exceeded expectations.

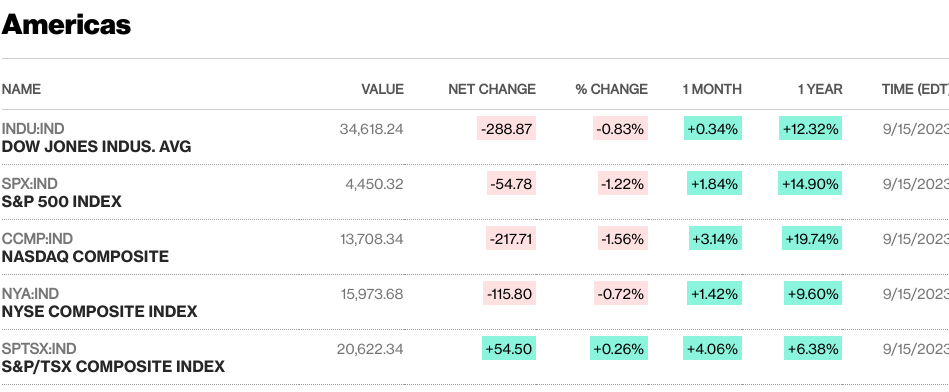

- Mixed stock market performances: European stock market indices, including the STOXX Europe 600 Index (+1.60%), Germany’s DAX (+0.94%), France’s CAC 40 Index (+1.91%), Italy’s FTSE MIB (+2.35%), and the UK’s FTSE 100 Index (+3.12%), had mixed performance with some indices posting gains after the European Central Bank's rate hike and signals of a potential peak in borrowing costs, while others reacted positively to better economic data and currency movements.

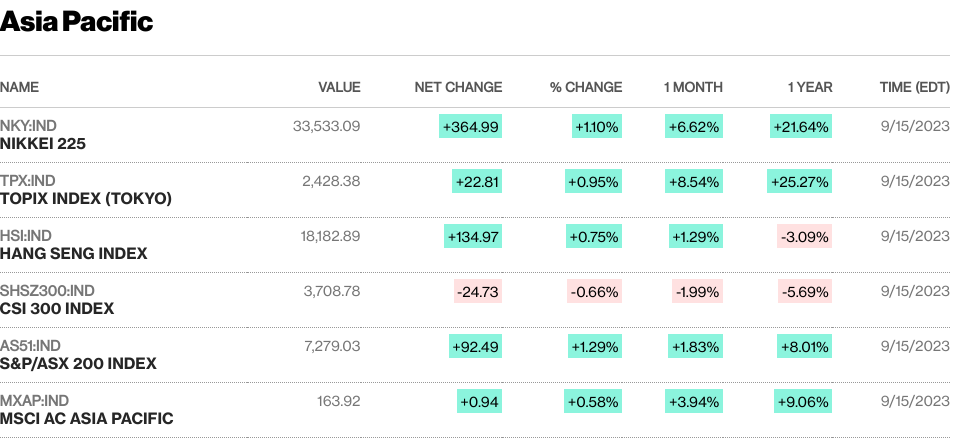

- European Bond Yields and Economic Trends: European government bond yields declined amid hopes of a potential end to the ECB's rate hikes. UK bond yields weakened following a larger-than-expected drop in July's monthly gross domestic product (GDP).

- Eurozone Industrial Output and Growth Forecast: Eurozone industrial production in July saw a sharper-than-anticipated decline of 1.1% sequentially, attributed to substantial drops in durable consumer and capital goods output. The European Commission (EC) revised down its 2023 gross domestic product growth forecast for the eurozone to 0.8% from 1.1% and projected a 0.4% contraction in Germany's economy, a significant shift from its prior estimate of 0.2% expansion.

- UK Economic Performance: The UK economy contracted more rapidly than anticipated in July due to factors such as worker strikes, adverse weather conditions, and increased borrowing costs. GDP declined by 0.5% sequentially, contrasting with the previous month's 0.5% growth. Nonetheless, the rolling three-month growth rate showed a 0.2% increase, driven by expansions across services, production, and construction. Unexpectedly, UK unemployment rose to 4.3% in the three months through July, surpassing the Bank of England's 4.1% forecast for the third quarter. Notably, total wage growth for the three months through July accelerated year-over-year to reach 8.5%, exceeding expectations.

US

🏈 Bottom Line: U.S. markets experienced mixed equity performance driven by value stocks and influenced by Apple's product event. Economic data showcased inflation dynamics and consumer spending, with an overall outlook supporting steady interest rates. U.S. Treasury yields saw mild upticks, and bond markets exhibited activity across various sectors.

- Mixed Equity Finish Led by Value Stocks: U.S. equity indexes had a mixed week, with value stocks taking the lead. Notably, West Texas Intermediate oil prices surpassed $90 per barrel, favoring value stocks. Large-cap shares outperformed small caps.

- Tech Sector Dampened by Apple Product Reviews: Technology and growth stocks faced headwinds following Apple's product event, which introduced the iPhone 15 with a price hike. Mixed reviews of Apple's products impacted the tech sector sentiment. However, a significant initial public offering by a UK microchip designer buoyed broader market sentiment.

- Economic Data Sparks Soft Landing Hopes: The release of the August consumer price index (CPI) data garnered attention. While the CPI showed the largest monthly increase since August 2022, mostly due to higher gasoline prices, the core CPI, excluding food and energy, slightly exceeded expectations. Retail sales remained robust, indicating continued consumer spending. The data supported the outlook for the Federal Reserve to maintain steady rates, fostering hopes for a soft landing scenario.

- Modest U.S. Treasury Yield Uptick: U.S. Treasury yields saw modest increases across various maturities. In the municipal bond market, prices remained stable in the secondary market, with a focus on primary market activity. Investment-grade corporate bonds saw higher-than-anticipated issuance, primarily in shorter-maturity bonds. High yield bonds centered on a busy primary calendar, while the bank loan market concentrated on new issuances.

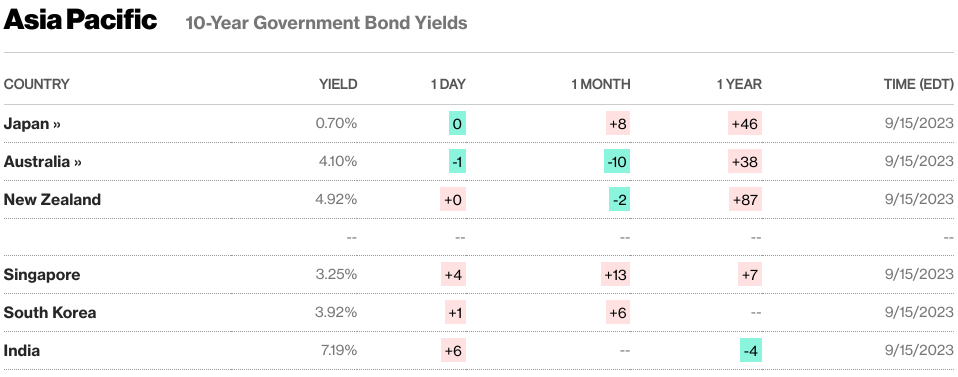

Japan

🏈 Bottom line: Japan's market performance and policy outlook seemed influenced by both domestic and global factors, with the trajectory of monetary policy and economic stimulus remaining key points of interest for investors.

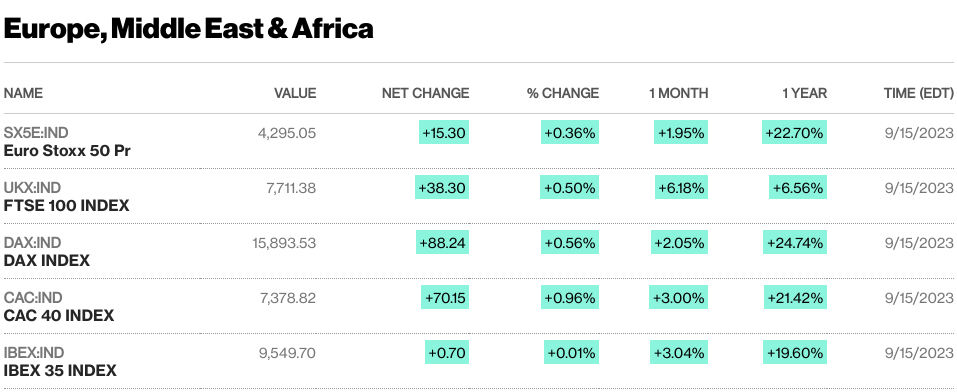

- Japanese Stock Market Gains: Japan's stock markets had a positive week, with Nikkei 225 Index (+2.8%) and TOPIX Index (+2.9%). This uptrend was largely thanks to the encouraging Chinese economic data. Investors appeared cautiously optimistic that China's stimulus measures were yielding positive results for both its economy and global markets. Additionally, the strength of U.S. stocks and a weaker yen further supported sentiment, especially benefiting Japan's export-oriented companies.

- BoJ Governor's Hawkish Remarks: Bank of Japan (BoJ) Governor Kazuo Ueda's comments during the week sparked interest and briefly impacted currency markets. He suggested that the BoJ might have enough data by the end of the year to assess whether wage growth, a critical factor in achieving the central bank's 2% inflation target, would continue to rise. While Ueda emphasized that any policy normalization was still a distant prospect, his remarks were seen as somewhat hawkish. Some investors interpreted this as verbal intervention in response to the yen's historic weakness. As a result, the yen briefly strengthened in the aftermath of his comments but ultimately remained broadly unchanged, hovering near its lowest levels in approximately three decades due to the interest rate differential between Japan and the United States.

- Japanese Government Bond (JGB) Market Reaction: Speculation regarding potential monetary policy normalization by the BoJ had a notable impact on the JGB market. JGB prices declined, causing the yield on the 10-year JGB to rise to 0.70%, its highest level since 2013. This shift in JGB yields reflects market expectations and sentiment surrounding the potential future direction of Japan's monetary policy.

- Cabinet Reshuffle and Economic Policy: Prime Minister Fumio Kishida conducted a cabinet reshuffle during the week, a move that had been widely anticipated. Importantly, he retained his core economic policy team, which plays a pivotal role in introducing new stimulus measures scheduled for October. Kishida highlighted the importance of continued gasoline subsidies, given the ongoing challenge of rising prices eroding households' purchasing power, particularly as wage growth has not kept pace. He emphasized his commitment to ensuring that wage growth consistently outpaces inflation by a significant margin and expressed a determination to guide Japan out of deflationary pressures.

China

🏈 Bottom line: China's equity markets responded to diverse economic indicators. These indicators, spanning from economic stabilization signs to inflation shifts and proactive monetary policy, reflect the dynamic landscape influencing China's financial markets.

- Mixed Chinese Equity Performance: Chinese equities saw mixed results amid conflicting economic signals. The Shanghai Composite Index remained stable, while the CSI 300 Index dipped (-0.83%) slightly. The Hang Seng Index in Hong Kong also experienced a minor decline (-0.1%).

- Economic Stabilization Evidence: Official August data showed positive signs of economic stabilization. Industrial production and retail sales exceeded expectations, and unemployment declined. However, fixed asset investment lagged due to weaker real estate spending. Notably, new bank loans surged, mainly driven by corporate demand.

- Inflation Rebound: Inflation data revealed a turnaround, with consumer prices rising 0.1% YoY in August after a July decline. The producer price index fell as expected but at a slower rate. These trends suggest a potential economic rebound, prompting recent stimulus measures.

- PBOC's Monetary Policy Adjustments: The People's Bank of China (PBOC) cut the reserve ratio requirement for banks by 25 basis points, injecting liquidity. The PBOC also infused RMB 591 billion into the banking system. Further easing is expected as China seeks to boost its post-pandemic economy.

2. Week Ahead

![Obsidian Brief] When Money Becomes Software: AI, Stablecoins & Bitcoin — Implications for Sustainable and Impact Investing](/content/images/size/w720/2025/12/Gemini_Generated_Image_dppem0dppem0dppe.png)

![Leadership] AI Is Changing Everything — How a CEO Managing $1.6 Trillion Stays Ahead, ft. Jenny Johnson from Franklin Templeton](/content/images/size/w720/2025/12/Screenshot-2025-12-03-060128.png)

![AI] The Future of Work, Robotics & AI Infrastructure (Elon's bold predictions: work will be optional & currency could be irrelevant)](/content/images/size/w720/2025/11/Screenshot-2025-11-22-074621.png)