Great Minds | Market Comments: Ray Dalio + Howard Marks + Warren Buffet.

Hi All,

Today, I wanted to create a separate special 'great minds' edition yet again re: commentary on recent markets - namely, Ray Dalio, Howard Marks, and Warren Buffet.

*My favorite investor of all time - Ray Dalio - posted 'Where We Are in the Big Cycle: On the Brink of a Period of Great Disorder' on LinkedIn (April 19, 2023). The key takeaway is basically we are doomed if we don't take the right actions and manage the risks now - actions should be collaborative ones for 'the collective' and not just for the selfish benefit/gains of ones (elected politicians). It's a race to the bottom otherwise.

I've been thinking about the same thing since the pandemic and he brilliantly summarizes my thoughts much better than I can possibly do - so I urge you to take a read!

Based on his study of the rises and declines of reserve currencies and the countries behind them over the last 500 years and the rises and declines of China’s dynasties over the last 2,000 years, he realized that the same things happen over and over again for pretty much the same reasons and to make a model of these changes (I suppose humans are pathetically stupid - we cannot get over ourselves :)).

He describes his model of the "Big Cycle" which consists of five big forces that drive and have driven just about everything:

1) Markets: the credit/debt/market/economic cycle

=> Enormous amounts of debt bought by central banks via their printing of money and buying the debt (i.e., monetizing debt)—in other words, the government financing itself in a big way by both borrowing a lot and printing a lot of money.

2) Politics: the internal peace/conflict cycle that shapes the domestic order,

=> Big conflicts within countries (now most importantly the US) - left vs. right division and fights

3) International Relations & World Order: the external peace/conflict cycle that shapes the international order,

=> Rise of China and subsequent changing world order - most importantly, the American world order -> losing its 'supremacy' and 'hegemony'.

4) Climate Change: acts of nature (e.g., droughts, floods, and pandemics), and

5) Human inventiveness/technology: AI

He explains that these forces interact to drive just about everything in the Big Cycle and that we are on a path toward a period of great disorder that includes financial turbulences and great conflicts within and between countries.

Key takeaways:

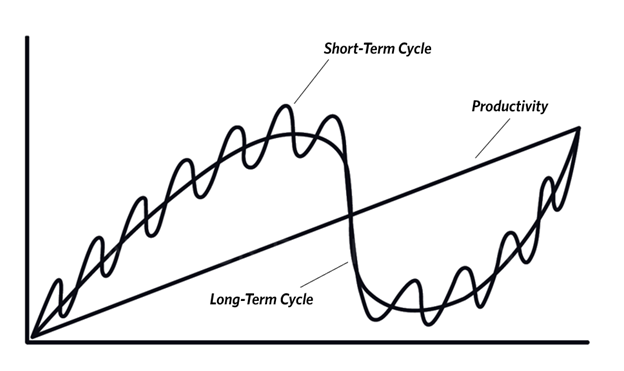

- The Big Cycle refers to the evolutionary advances in knowledge and technologies represented by the upward-sloping line in a chart.

- The two wavy lines represent the short-term debt cycle and the long-term debt cycle that have accompanied financial/economic changes, political changes within countries, and geopolitical changes between countries.

The wavier line represents the short-term debt cycle that in the past has lasted about seven years on average give or take about three years, and the bigger one represents the long-term debt cycle that has lasted about 75 years on average give or take about 50 years. These financial/economic changes have been accompanied by political changes within countries and geopolitical changes between countries.

More specifically, the smaller, short-term cycle represented by the wavier line is primarily due to the short-term credit/debt/market/economic cycle (also known as the business cycle) and the political changes that accompany it

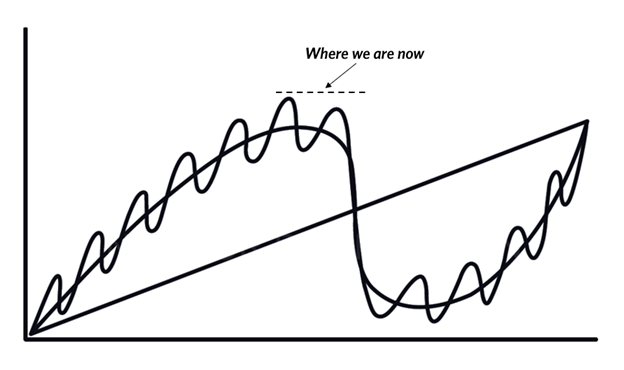

- Dalio believes that the existing world order is on the brink of three to five painful seismic shifts. "The last big seismic change in the world order took place in the 1930-45 period of depression and war. Soon after it ended, the new world monetary, political, and geopolitical orders began."

- Since 1945 there have been 12 and a half credit/debt/market/economic cycles and associated political cyclical swings. We are now about halfway through the 13th short-term debt cycle.

- If these shifts happen, they will disrupt domestic and world orders in ways that we have never seen in our lifetimes but have happened many times before in history.

- Next, he will provide more in-depth examinations of how the credit/debt/market/economic cycle and the great power conflict force (focusing on the US-China conflict) are unfolding in subsequent posts.

*Howard Mark's memo (April 17, 2023) - 'Lessons from Silicon Valley Bank' also came out and you can listen to his podcast here (Spotify link or the platform of your choice): The Memo by Howard Marks

The bottom line is...

No one knows whether banks will suffer losses on their commercial real estate loans, or what the magnitude will be. But we’re very likely to see mortgage defaults in the headlines, and at a minimum, this may spook lenders, throw sand into the gears of the financing and refinancing processes, and further contribute to a sense of heightened risk. Developments along these lines certainly have the potential to add to whatever additional distress materializes in the months ahead.

Key takeaways:

- One-off or a Harbinger of Things to Come?: Singular event. Silicon Valley Bank's failure due to investment losses and subsequent bank run was a unique case caused by factors specific to the bank, such as heavy concentration in a volatile sector and region, a surge in deposits from investors, and investments in long-dated securities, and does not suggest widespread problems in the US banking system.

- What Did SVB Have in Common with Other Banks?: The common elements shared by most banks are an asset/liability mismatch, high leverage, and reliance on trust, which all require skilled management in order to retain the trust of depositors, who are critical to banks' activities. Banks operate with skinny returns on assets and employ heavy leverage, which means that any modest decline in asset prices can wipe out a bank's equity, making it insolvent. In addition, depositors' trust in banks' ability to meet withdrawals is paramount, as there is no offsetting reason for them to leave their money on deposit if a bank's safety is questioned.

- Was SVB’s Collapse Inevitable?: SVB's collapse was not inevitable, but was caused by a combination of factors including the bank's large bond investments with long maturities, the Fed's interest rate hikes, and mass withdrawals by depositors, with the flawed decision-making behind its bond purchases standing out as the primary cause.

- Comparisons to the GFC: There are some similarities between the 2008 Global Financial Crisis (GFC) and the recent banking problems, but the differences are more significant. The GFC was caused by excessive faith in subprime mortgages, which were lacking in substance, and investors' naivety regarding their viability. However, there is nothing highly analogous to subprime mortgages in the current situation, and the most glaring market excesses have been corrected. Additionally, the failure of SVB is unlikely to pose the same risk as the failure of systemically important banks during the GFC. Finally, policymakers were able to come up with rescue plans during the GFC, and the Fed's response to SVB's problems should prevent an irreversible financial crisis.

- A Word on Regulation: The cyclical nature of financial regulation is regulations are implemented after financial crises but then dismantled when the economy improves. Despite criticisms of current regulations, major US banks are stronger than before the 2008 financial crisis, but there are questions about whether regulators could do a better job with fewer banks to monitor. However, it is unlikely that there will be a major change due to the influence of private parties in government.

- Moral Hazard: Government solutions like the "Greenspan put" can create moral hazard, where players engage in high-risk behavior knowing they will be bailed out if they fail, and a government guarantee of all deposits may lead to poorly run banks staying in business; therefore, deposit insurance is necessary to prevent banking from grinding to a halt, but management and shareholders should not be bailed out to encourage prudence in the future.

- AT1s: AT1s, or Alternative Tier 1 bonds, are debt securities that offer bond-like yields and promise repayment at maturity, but also carry debtholder status and can be written down to zero if the bank's common equity tier 1 capital ratio falls below a certain threshold, making them a hybrid security that investors often misunderstand as being senior to equity when they are actually closer to equity in nature.

"Were the investors misled? To me, the answer is no. In this regard, let’s consider the way the prospectus for one such Credit Suisse issuance – “a $2 billion US dollar 7.5% AT1 issued in 2018” – was labeled (per Matt Levine): “7.500 per cent. Perpetual Tier 1 Contingent Write-down Capital Notes.” There shouldn’t have been much doubt about their riskiness when “write-down capital notes” was in the title."

- Psychological Ramifications of the SVB Collapse: The recent crises at SVB, Signature Bank, First Republic, and Credit Suisse, while not necessarily connected, have the potential to impact investors' and depositors' confidence and contribute to a credit crisis, leading to reduced credit availability, increased scrutiny of regional and community banks, and tougher times for property owners and developers. The failures of these banks may bring stricter scrutiny to banking and fewer easy-money opportunities in the future, but they also present opportunities for bargain hunters and providers of capital.

*Warren Buffet had a 2 hr 30 min interview with CNBC (April 12, 2023). Here is the transcript.

Key takeaways:

- Warren Buffett believes there could be more bank failures down the road, but depositors should not ever be worried.

- “We’re not over bank failures, but depositors haven’t had a crisis,” the Berkshire Hathaway chairman and CEO told CNBC’s Becky Quick on “Squawk Box” Wednesday from Tokyo.

- “Banks go bust. But depositors aren’t going to be hurt.”