What Are Green, Social, Sustainability, Sustainability-linked (GSSS) Bonds? & Key Bloomberg Shortcut Keys for Practitioners!

Learn about green, social, sustainable, and sustainability-linked (GSSS) bonds - an investment option for aligning values with investments. Discover history, analysis tips, and the current industry landscape.

Hi All,

Today, I wanted to talk about green bonds and other sustainable-themed bonds. As the world grapples with the consequences of climate change, there is an increasing demand for sustainable solutions to address its consequences. This has led to a surge in sustainable investing as more investors look to align their values with their investments and support positive social and environmental outcomes. One way to do this in fixed income is through investing in green, social, sustainable, and sustainability-linked bonds.

According to Bloomberg Intelligence (2022), sustainable debt cumulative historical issued surpassed $5 trillion in 2022, with $1.6 trillion issued in 2021 alone. Global ESG assets surpassed $35 trillion in 2020 and are on track to reach $50 trillion by 2025 - one-third of the projected $140 trillion in total assets under management globally.

There are also regulatory backdrops - the European Central Bank (ECB) announced in July 2022 that they view climate change as part of their mandate and will prioritize corporate bonds purchasing from issuers with better climate performance. The ECB acknowledged the crucial role of green bonds in financing the transition to a more sustainable future and may offer preferential treatment to such bonds in its primary market bidding behavior, subject to specific conditions. FAQ link.

Today's Key Concepts

1. What are Green, Social, Sustainability, and Sustainability-linked (GSSS) Bonds?

2. Greenium - Source of Alpha?

3. The Current GSSS Bonds Landscape

4. Key BBG Shortcut Keys for Your 'GSSS (Green, Social, Sustainability, and Sustainability-linked) Bonds' Analysis!

I. What are Green, Social, Sustainability, and Sustainability-linked (GSSS) Bonds?

1) Definitions

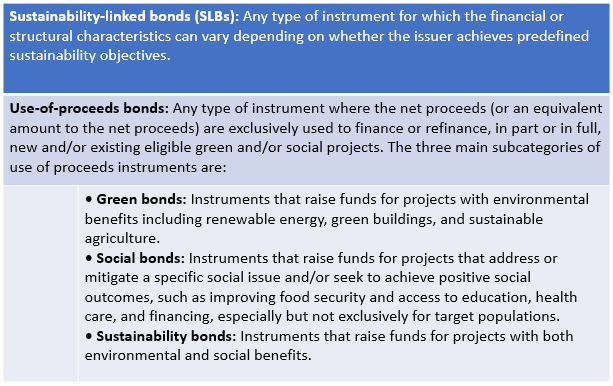

First, it is important to make a distinction between 'use-of-proceeds' bonds that are project-based and 'sustainability-linked' bonds that do not finance particular projects but rather tie the interest rate of the bond to the issuer's explicit sustainability performance. The latter is the newest addition to the market.

- Green bonds: are debt instruments issued by governments, corporations, and other organizations to fund projects that support climate change mitigation, adaptation, and other environmental objectives. These bonds are typically classified as "use-of-proceeds" or asset-linked bonds, meaning that the proceeds raised from their issuance are earmarked for green projects, such as renewable energy, clean transportation, and sustainable agriculture.

- Social Bonds: Social bonds, on the other hand, are designed to finance projects that have a positive social impact, such as affordable housing, healthcare, and education. These bonds are often issued by governments, development banks, and non-profit organizations, and are also subject to external review to ensure that they meet social impact criteria.

- Sustainable Bonds: Sustainable bonds are broader in scope than both green and social bonds, as they can finance projects that have both environmental and social benefits. They can also fund projects that promote sustainable development, such as clean water and sanitation, sustainable agriculture, and biodiversity conservation.

- Sustainability-Linked Bonds: Sustainability-linked bonds are a newer type of bond that are designed to incentivize issuers to achieve sustainability goals by tying the interest rate of the bond to the issuer's sustainability performance. For example, if the issuer fails to meet certain sustainability targets as defined in UN SDGs, the interest rate on the bond may increase.

2) History of Green Bonds

In 2007, the first-ever green bond was issued by the European Investment Bank and the World Bank, setting the foundation for the entire green bond market.

The story behind this new innovation is in 2007, the U.N. Intergovernmental Panel for Climate Change (IPCC) published a report linking human activity to global warming, which further strengthened the mounting evidence on the subject. In response to the risks highlighted by the report, institutions such as Swedish pension funds and SEB bank, along with climate change experts like CICERO (the Centre for International Climate and Environmental Research), collaborated to create a framework for debt markets to contribute to sustainable solutions. This involved the establishment of eligibility criteria to ensure that investment and capital-raising efforts were directed towards projects with tangible environmental benefits.

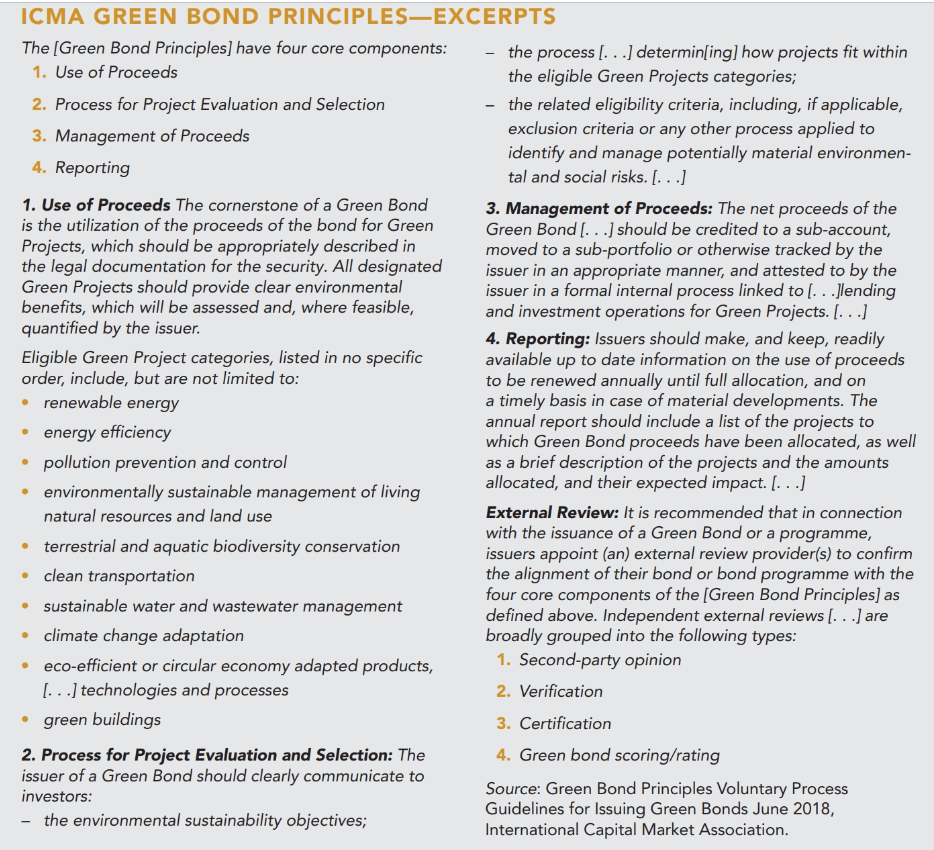

When the first green bond was issued, the issuance included a second opinion from CICERO, which set a precedent for the use of external reviews. The success of the first green bond paved the way for the International Capital Market Association (ICMA) to establish the Green Bond Principles (GBPs).

Since the first green bond issuance in 2007, the green bond market has grown significantly. In 2020, the cumulative amount of green bonds issued surpassed $1 trillion, with annual issuance almost doubling in 2021 compared to the previous year.

3) Not All Green Bonds Are the Same: CICERO's 'Shades of Green' example

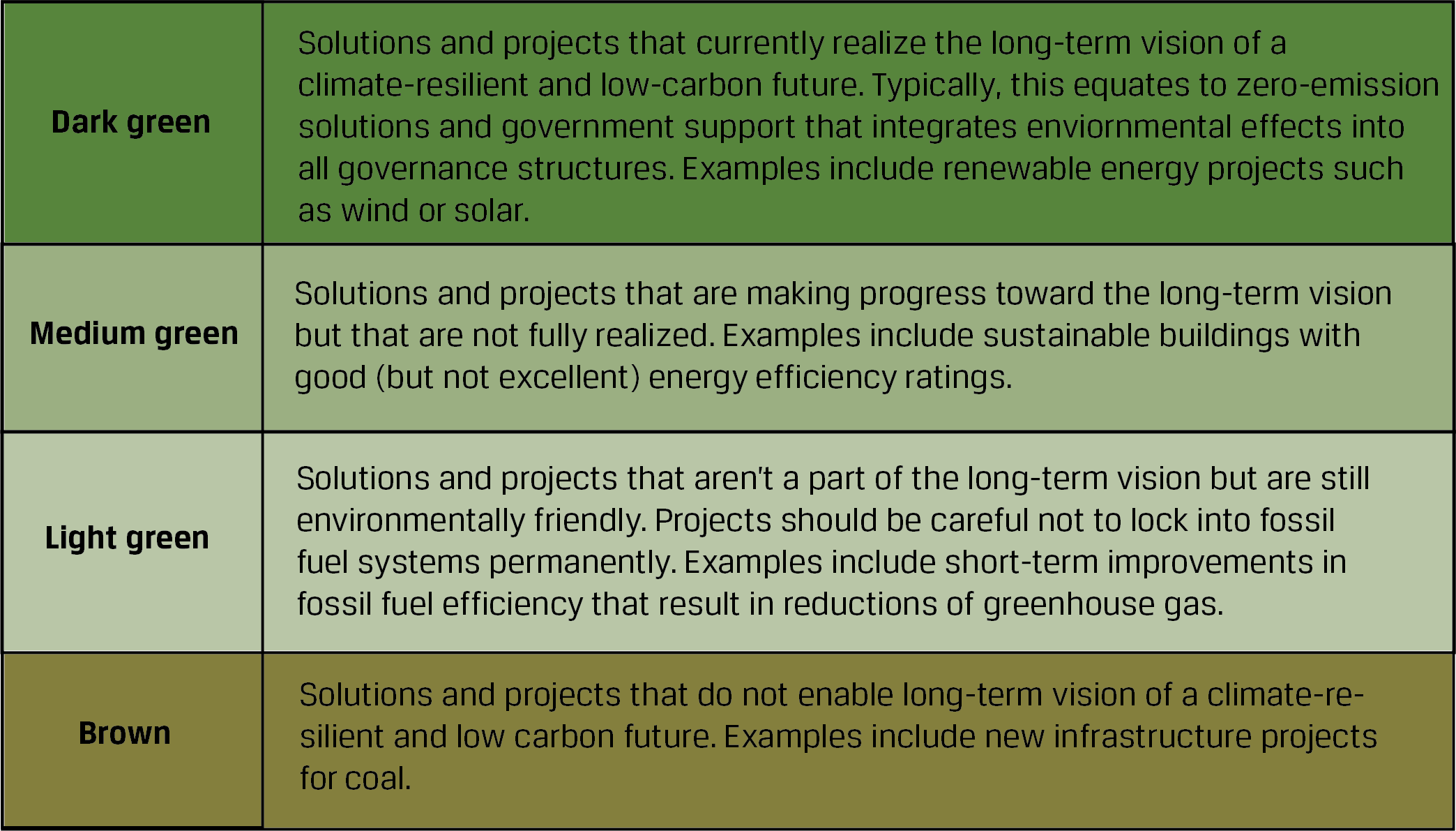

Given the subjective 'self-identification' nature of green bonds by issuers, the methodology was developed by the Center for International Climate Research (CICERO) to provide second-party opinions that determine how a green or sustainability bond aligns with a low-carbon resilient future in 2015.

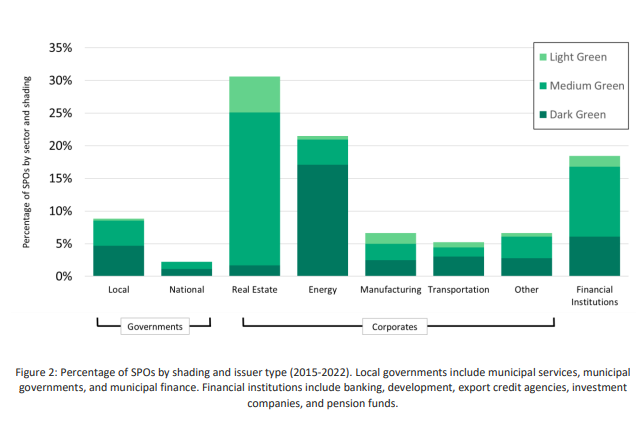

CICERO noted in their latest report, since 2015, over 360 frameworks have been assigned green shades based on their contribution to a low-carbon and climate-resilient future, with darker shades indicating greater alignment. Of all the frameworks shaded, 39% achieved a 'Dark Green', 50% a 'Medium Green', and 11% a 'Light Green' shading. Since 2018, there has been a strong increase in 'Light Green' shaded frameworks, signaling a welcomed focus on harder-to-abate elements of the economy. The project categories most assessed are renewable energy, green buildings and energy efficiency, and clean transportation.

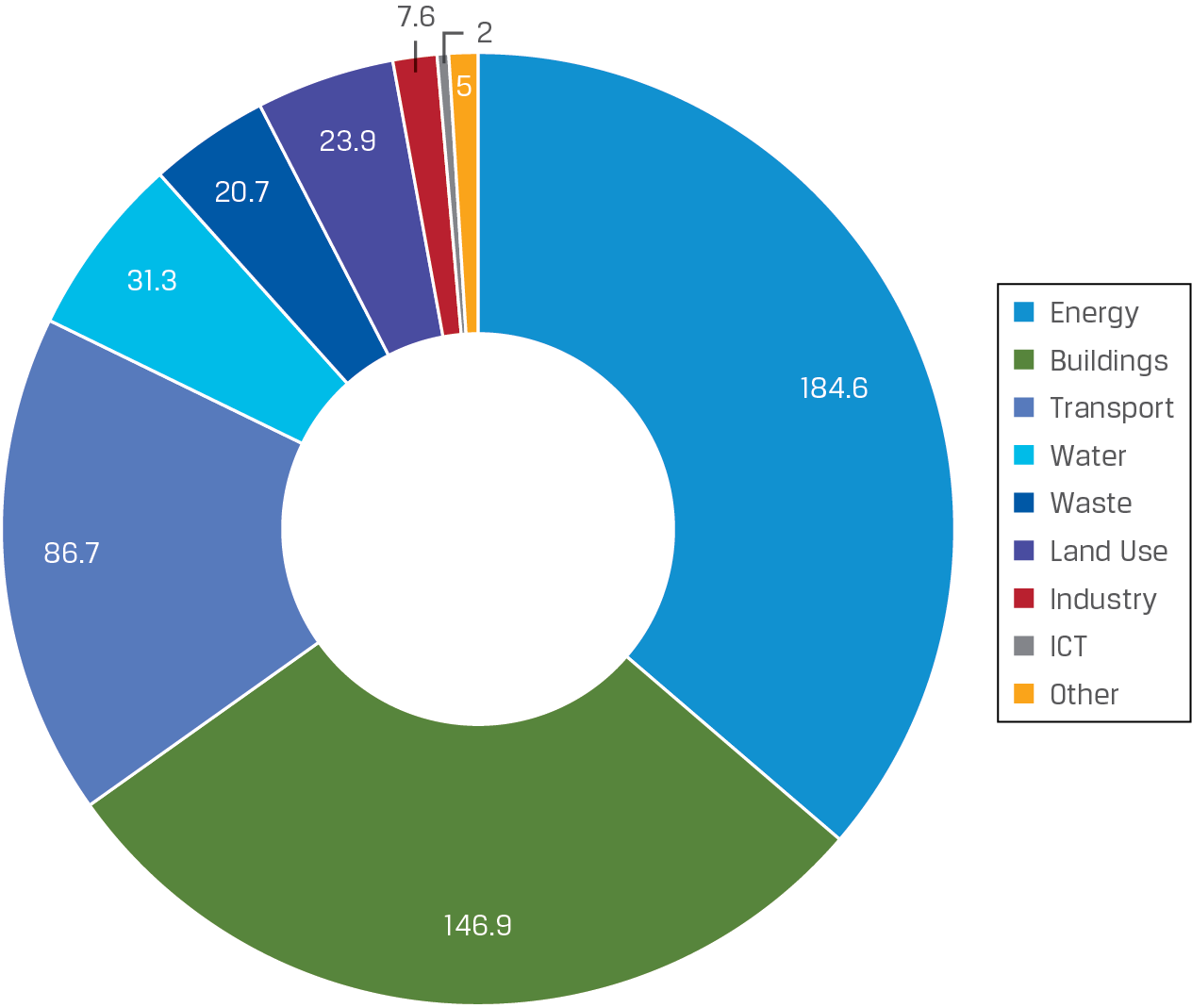

4) Green Bond's 'Use of proceeds' breakdown (2021)

While clean energy and low-carbon building investment continue to dominate allocations, funding for low-carbon transport has increased dramatically and issuers from the information and communications technology (ICT) and manufacturing sectors have entered the green bond market.

5) The growth of Green, Social, Sustainability, Sustainability-linked (GSSS) Bonds

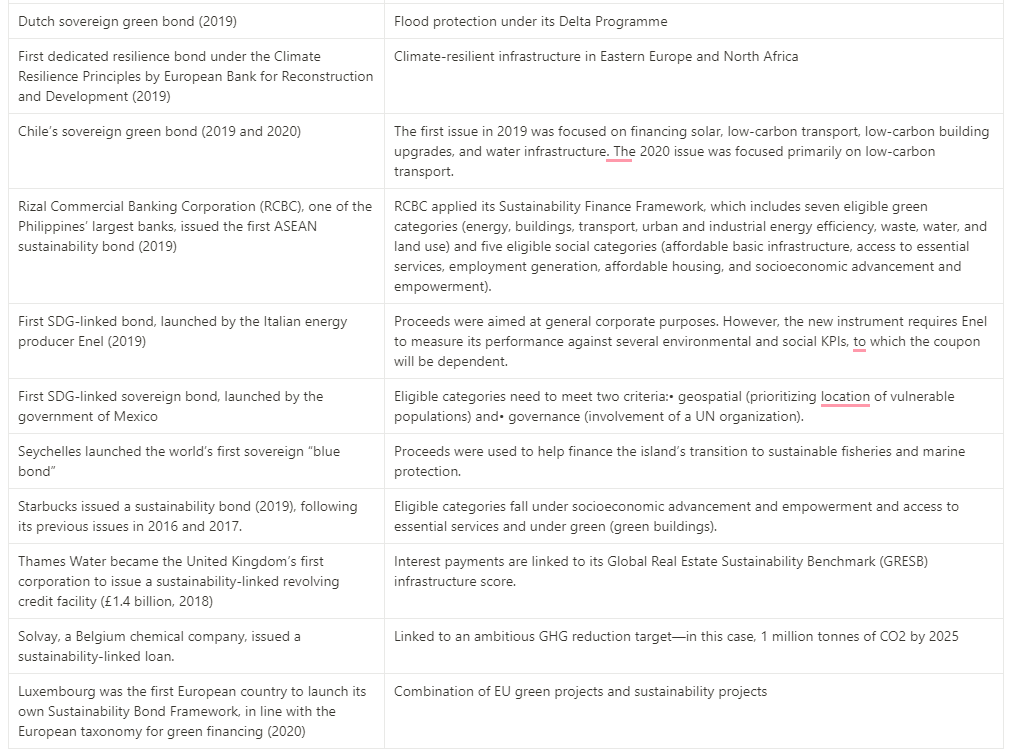

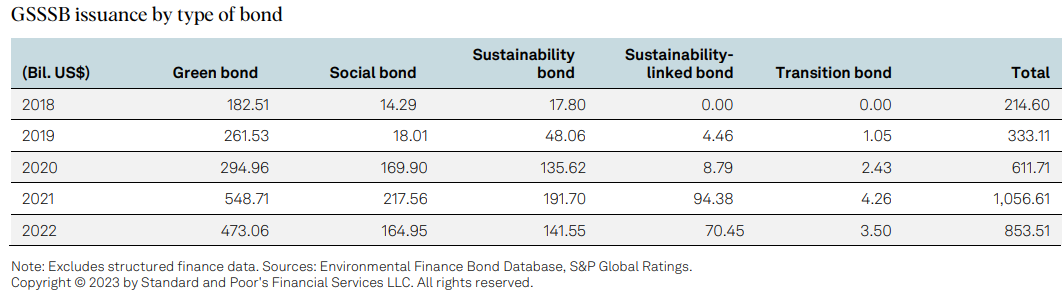

Apart from green bonds, which specifically target climate change solutions, there has been a rise in the issuance of other labeled debt, as depicted in the table below. This includes primarily green and sustainability loans, which link financing terms to climate or environmental performance metrics. For instance, investors may receive a higher coupon on the bond if the company fails to meet certain targets.

6) Benefits of GSSS Bonds

GSSS bonds provide several benefits, both for issuers and investors. For issuers, GSSS bonds can offer access to a new pool of investors interested in sustainability and can help to enhance their reputation as a socially responsible organization. For investors, GSSS bonds offer an opportunity to align their investments with their values and contribute to positive environmental outcomes

From an investment perspective, as the supply of green or ESG-related products continues to grow, it is important to note that what may be considered green or sustainable for one investor may not be so for another. Therefore, investors need to have a clear framework by which to assess these assets. The following are some of the considerations:

- the eligibility of assets and criteria to meeting their green, ESG, or SDG-related objectives,

- the use of proceeds effectively allocated to eligible projects,

- the transparency and reporting requirements and key measures of impacts, and

- the issuer or borrower has a clear sustainability and ESG strategy.

Examples of sustainable financing transactions (LS: Issuer and Type / RS: Use of proceeds)

II. Greenium - Source of Alpha?

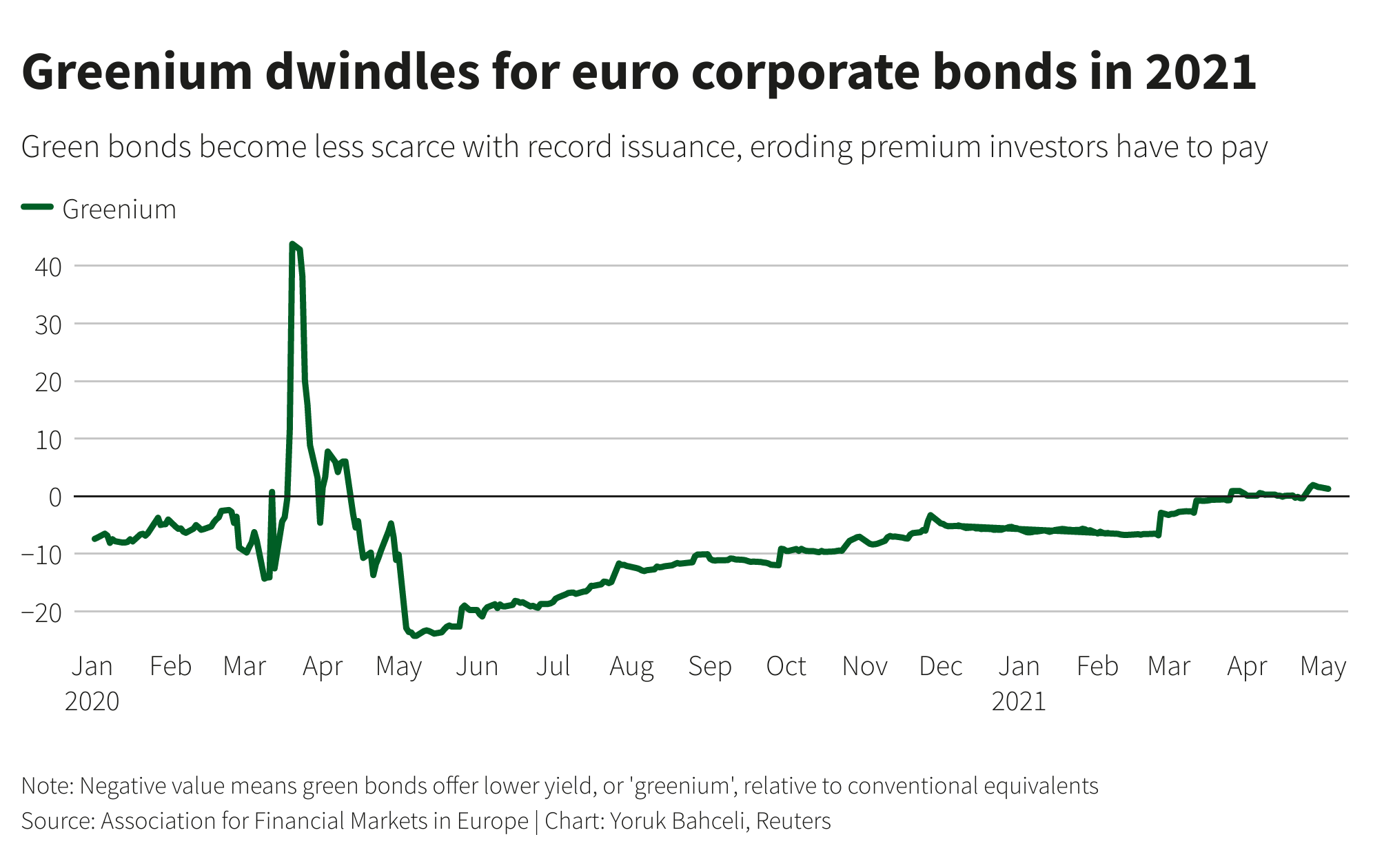

What is a Greenium?: Historically, green bonds have tended to command higher prices and lower yields than conventional bonds (i.e. twin plain-vanilla bonds). Issuers enjoy slightly lower financing costs. Depending on the methodology, the size of the greenium can vary.

In fact, a recent study by the Fed in 2022 looked at global green and conventional bonds and found that green bonds have an average yield spread of 8 bps lower than conventional bonds at issuance (i.e. 8bps of greenium). The study found greenium is typically linked to 1) bond oversubscription and 2) bond index inclusion, and that 3) it's unevenly distributed to large, investment-grade issuers primarily within the banking sector and developed economies. This cost advantage emerged in 2019 and coincided with the growth of the sustainable asset management industry following EU regulations. However, some say greenium is shrinking fast esp. in Europe with the supply bonanza, and also negligent as transaction costs would have a bigger impact on alpha and return potentials than greenium. This peaked in 2021 with greenium coming down to almost zero vs. 20bps in 2020 (see the chart below). The ECB also published the analysis in 2022 looking at the euro area from 2016 to 2021 data and came to a similar conclusion.

However, the important thing to remember is the greenium is not consistent across regions or time periods. This means that active investors may find alpha opportunities in the market. Additionally, green bonds have demonstrated historically lower duration-adjusted volatility, making them a more defensive investment option. They have also shown similar duration-adjusted returns compared to traditional bonds.

III. The Current GSSS Bonds Landscape

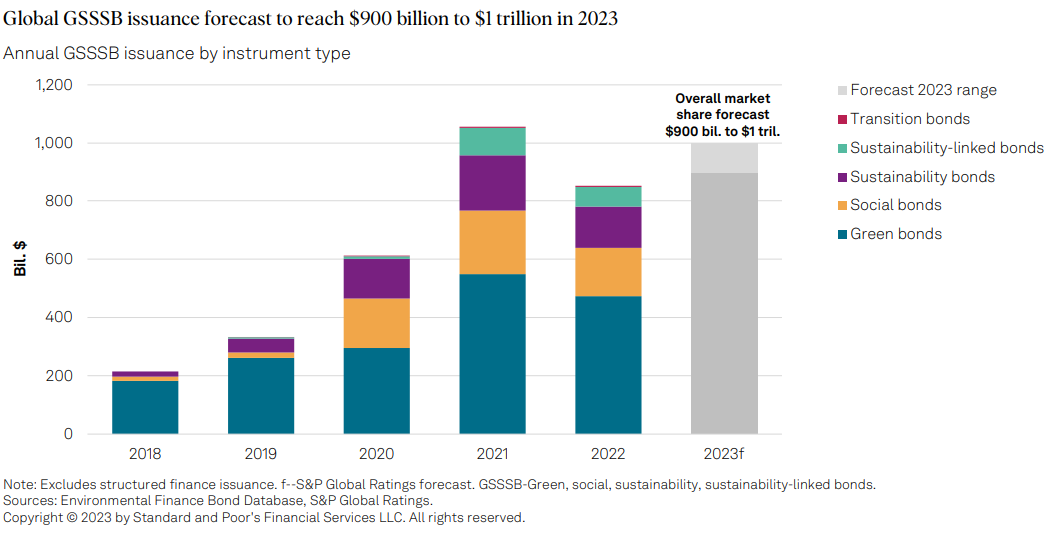

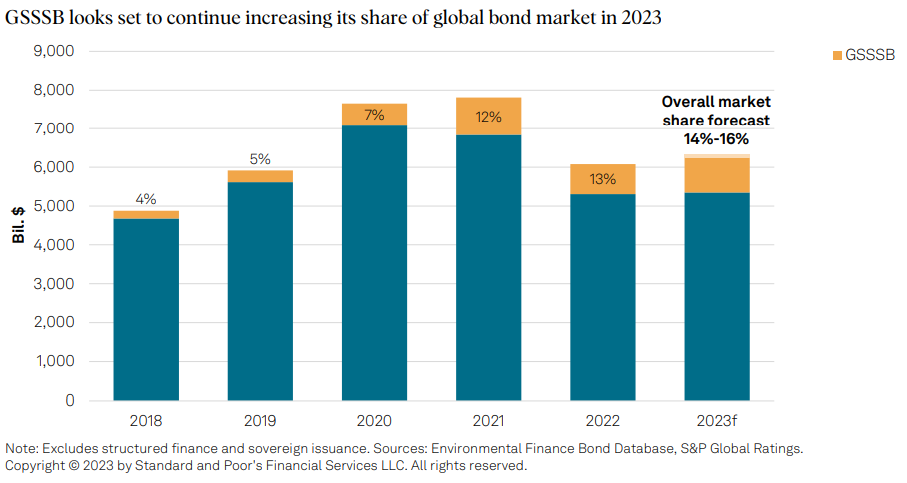

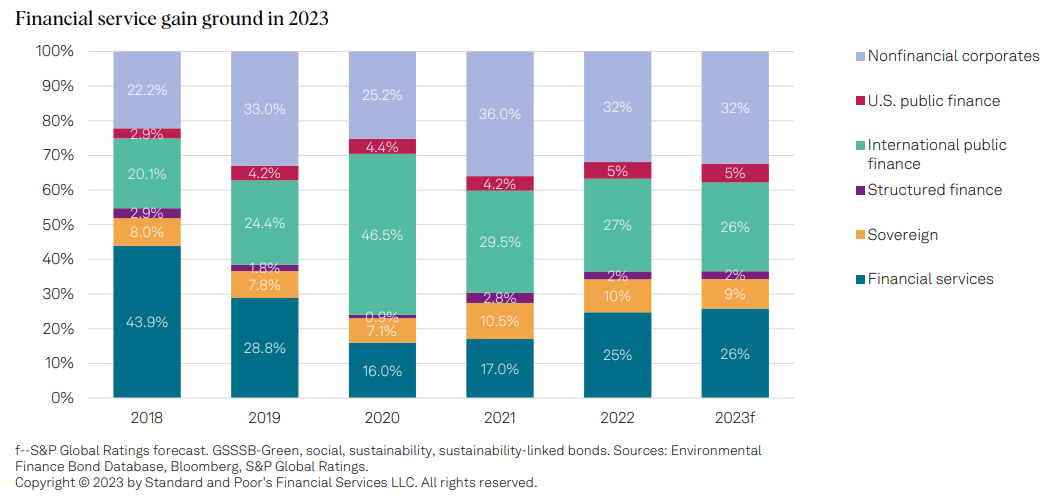

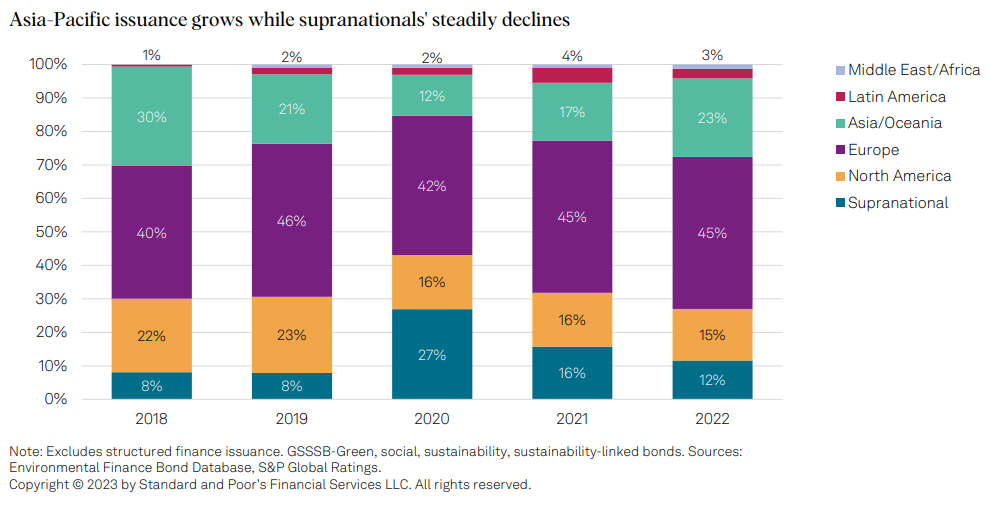

Following its issuance bonanza during the COVID-19 in 2021, sustainable debt issuance dipped in 2022 on the back of increasing concerns around 'green washing' and a rising interest rates macroeconomic backdrop.

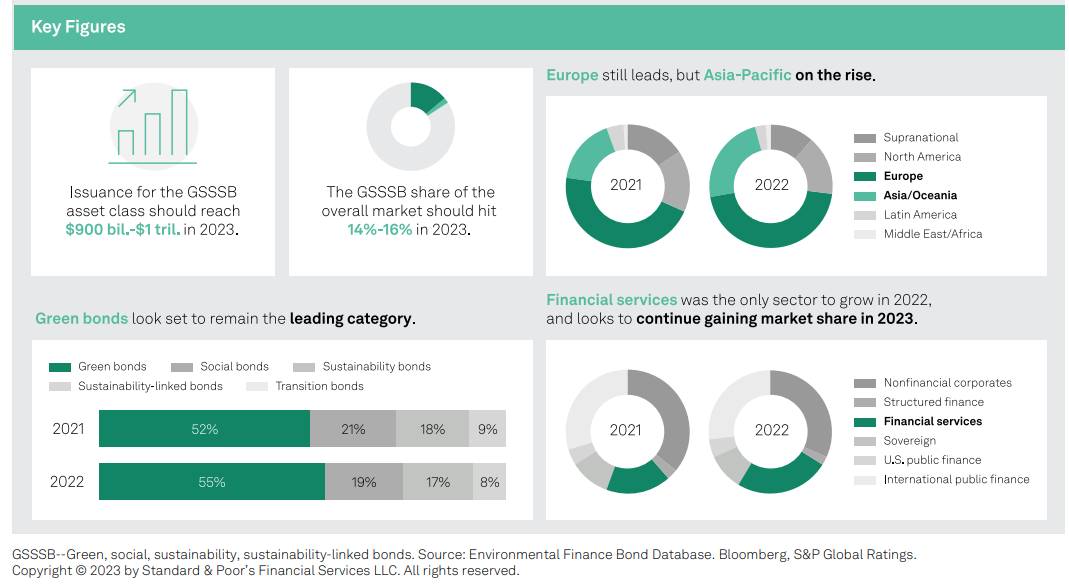

However, S&P expects the GSSSB issuance to grow 5%-17% in 2023. See the report entitled 'Sustainable Bond Issuance Will Return To Growth In 2023' for more.

Here are some key takeaways from S&P's 2023 GSSSB outlook report:

We believe in 2023, global GSSSB issuance will return to growth, reaching $900 billion-$1 trillion, nearing the record $1.06 trillion in 2021. This follows a 2022 in which contractionary monetary policy and macroeconomic uncertainty pulled down global bond issuance.

- Three factors that could drive growth or drag it down are: 1) policy initiatives (e.g. the US Inflation Reduction Act, the EU Taxonomy, SFDR, TCFD, etc.), 2) levels of investment in climate adaptation and resilience, and 3) the ability of issuers to address concerns about the credibility of certain types of GSSSB debt.

- Green bonds will likely continue to dominate at around 40%. Issuers across sectors are likely to look to finance projects that allow them to align themselves with nationally determined contributions (NDCs) and individual net-zero commitments. However, sustainability bonds to become more prevalent.

- Meanwhile, sustainability-linked bonds (SLBs) are at an inflection point. Skepticism and questions around the credibility of the asset class’s ability to achieve meaningful sustainability targets are increasing, weighing on the minds of investors and issuers.

- Re: New issuance, total global bond issuance will grow only moderately (circa 2.5%) in 2023. However, the faster growth for GSSSB issuance will lead to a larger market share for this asset class across all regions and sectors. Europe will still lead, but APAC is catching on. The most growth is coming from financial issuers per regulatory backdrop. The GSSSB issuance from nonfinancial corporates, financial services, and the U.S. and international public finance sectors is likely to comprise 14%-16% of all bond issuance in 2023.

Conclusion

Green, social, sustainable, and sustainability-linked bonds are an increasingly popular way for investors to align their investments with their values and contribute to positive social and environmental outcomes. By investing in these bonds, we can all play a role in creating a more sustainable future for ourselves and future generations. As the market for sustainable bonds continues to grow, it is important to maintain transparency and accountability to ensure that these investments truly support sustainability goals.

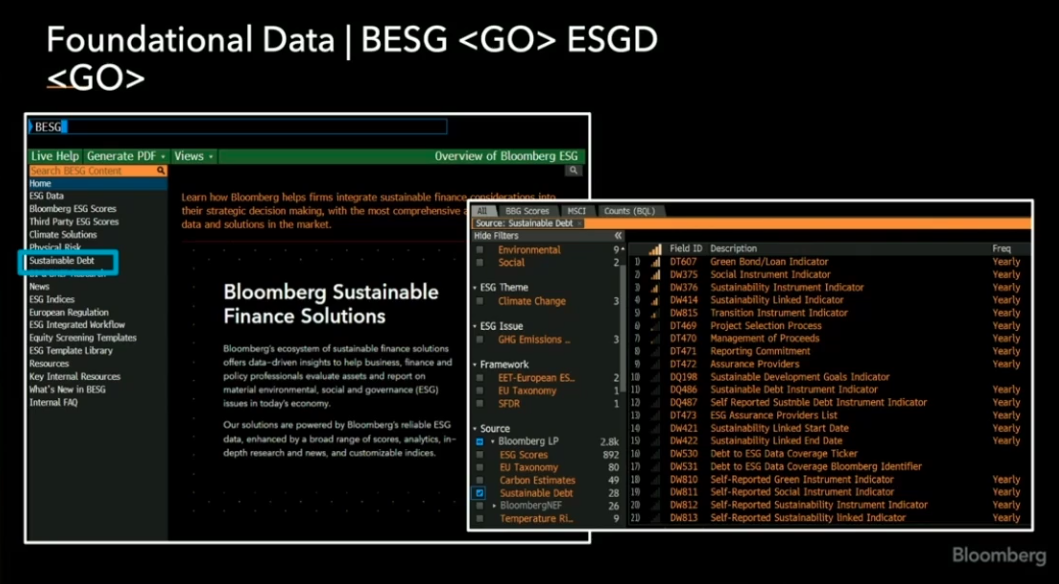

IV. Key BBG Shortcut Keys for Your 'GSSS (Green, Social, Sustainability, and Sustainability-linked) Bonds' Analysis!

Bloomberg created a dedicated dashboard called 'Sustainability Debt' for the GSSS bonds analysis. Here are some shortcut keys you might want to save down.

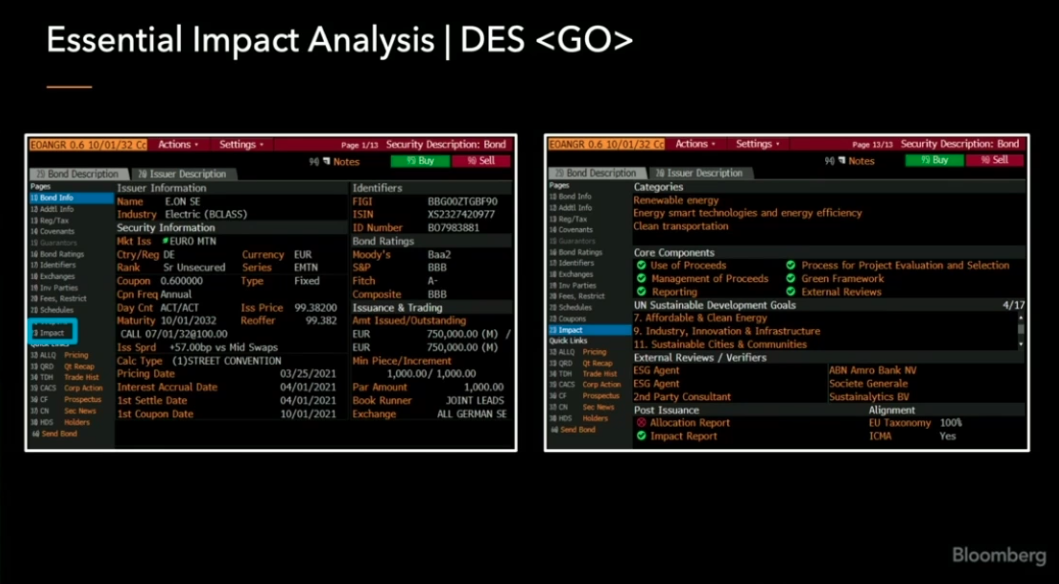

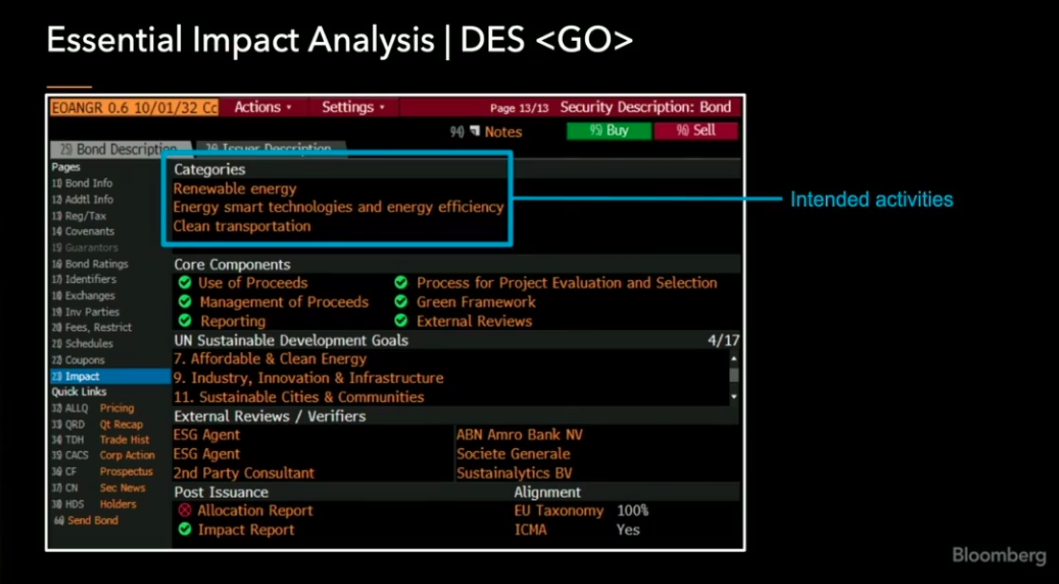

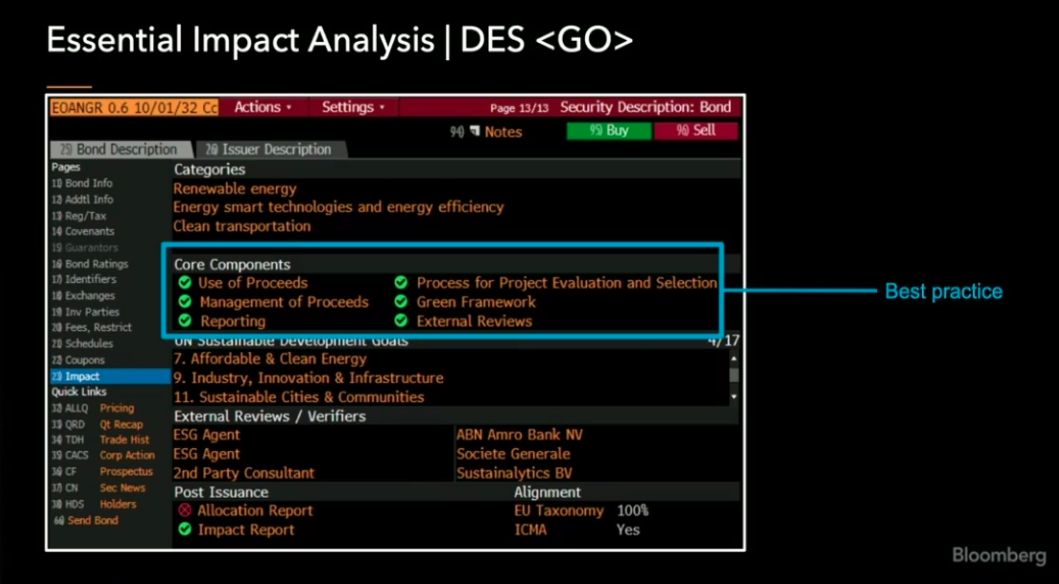

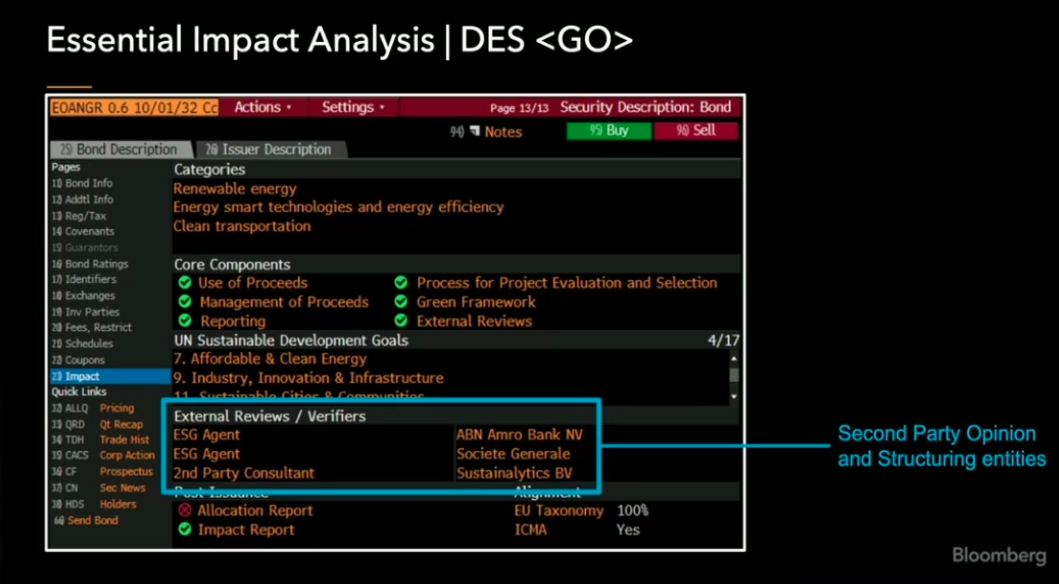

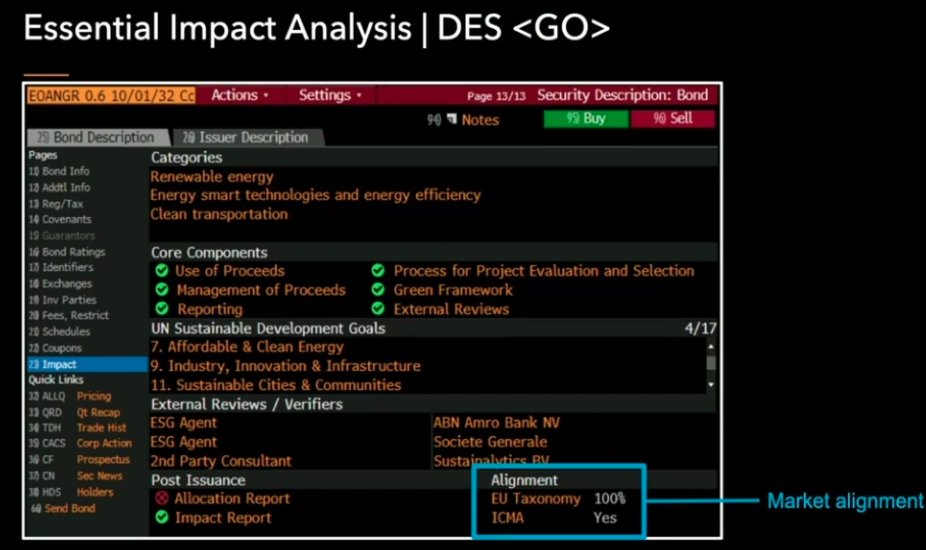

Impact analysis: You can check out the 'impact' tab in the typical credit analysis dashboard for the security-level ESG information.

Use of proceeds: In the 'Impact' section, you can access the information about the GSS bonds' use of proceeds. For example, under Renewable Energy, more granular sub-set categories are available: Solar, wind, and hydrogen.

Core components for best practices: The page also provides more transparency into the use of proceeds - if they are aligned w/ ICMA's principles, if there is there a commitment to annual reporting, if there is a governance re: project valuation, what kind of external reviews take place, etc.

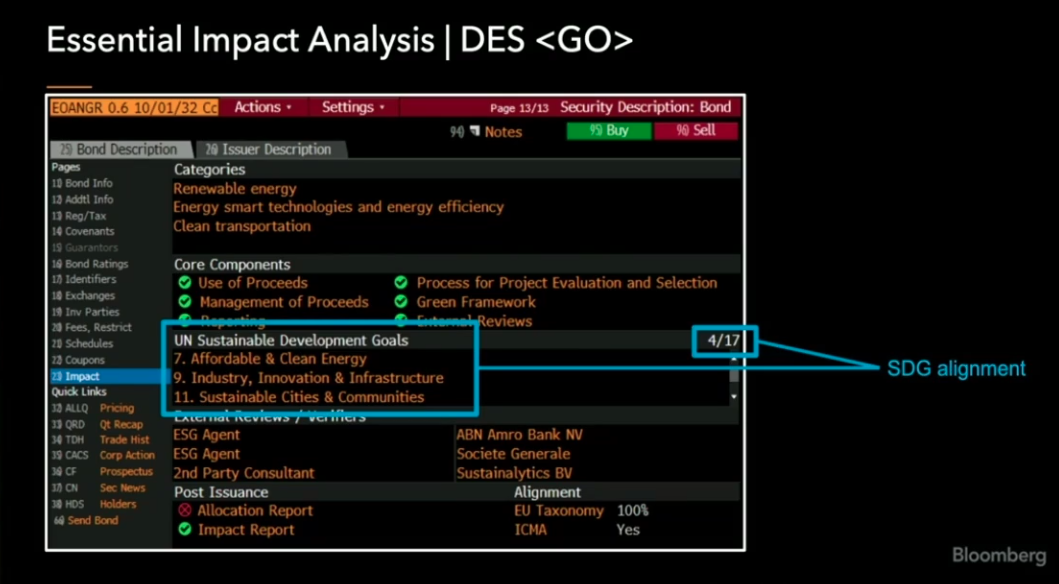

SDG alignment: UN SDG classification that the issuer communicates in their framework is also captured along with the second party's assessment of the use of proceeds as shown below.

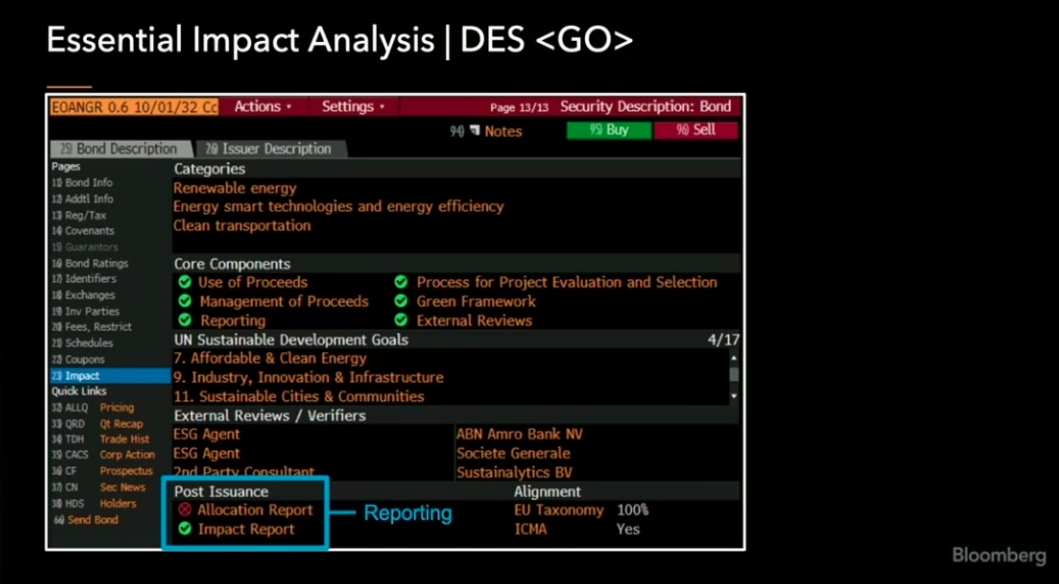

Reporting by issuers: In terms of the impact analysis, it is very specific around KPIs. e.g. how much new wind energy was produced over a period. Also, it shows if there is an allocation or impact report from the issuer - both or neither.

EU Taxonomy & ICMA: The alignment re: ICMA's best practice principles is a judgment call made by Bloomberg analysts based on the issuer's core components + post data points made available such as the ongoing annual impact reports publication from the issuer. The 'Yes' tag will change to 'No' if the issuer stops producing the annual impact report. Issuer's self-identified 'EU taxonomy' alignment information is also available.

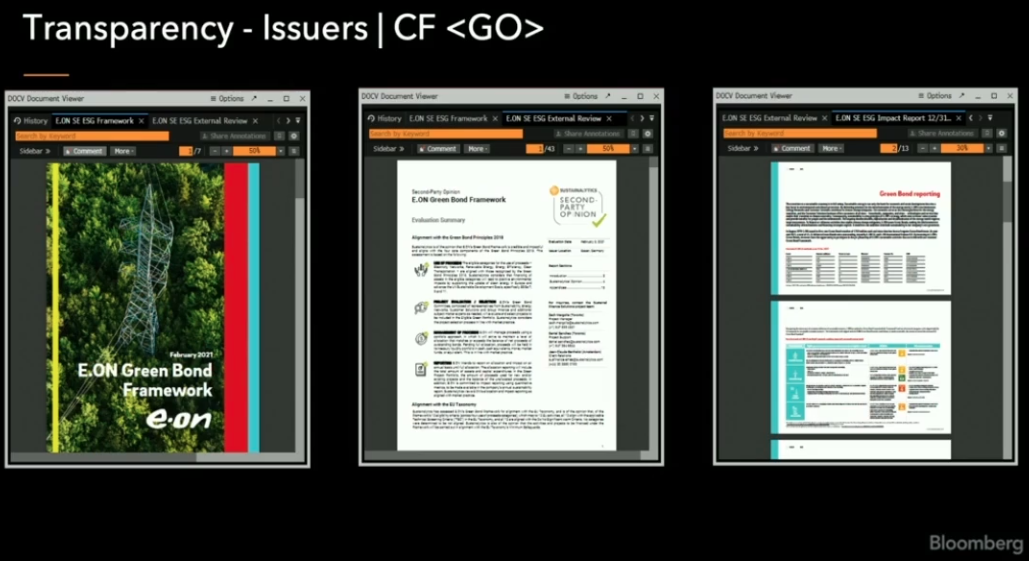

Note) You can access the issuer's annual impact report directly from the terminal.

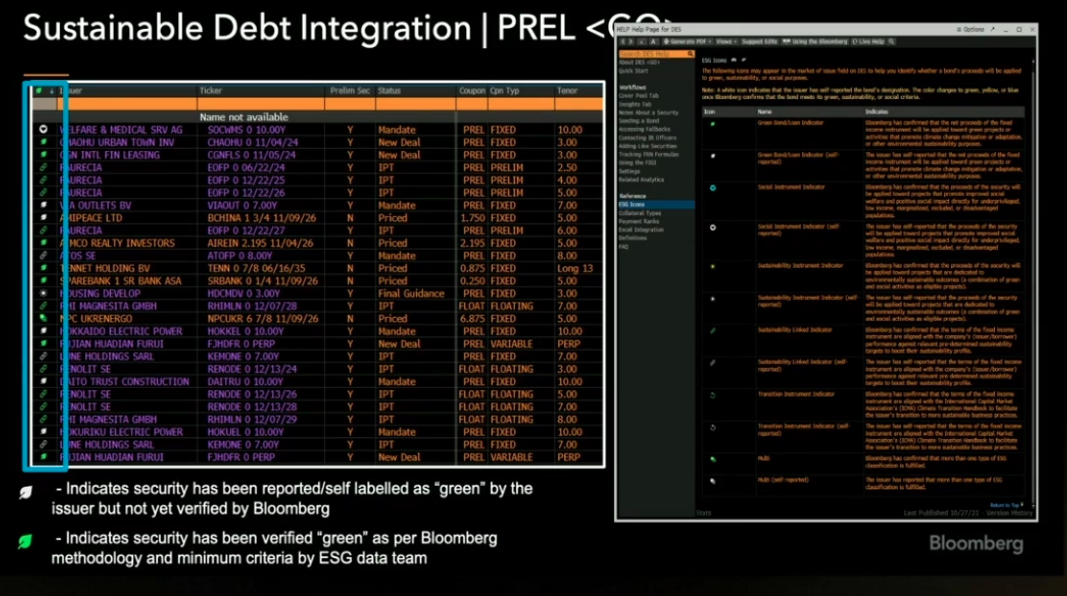

Consistent GSS bond tagging: The tagging is available throughout the platform.

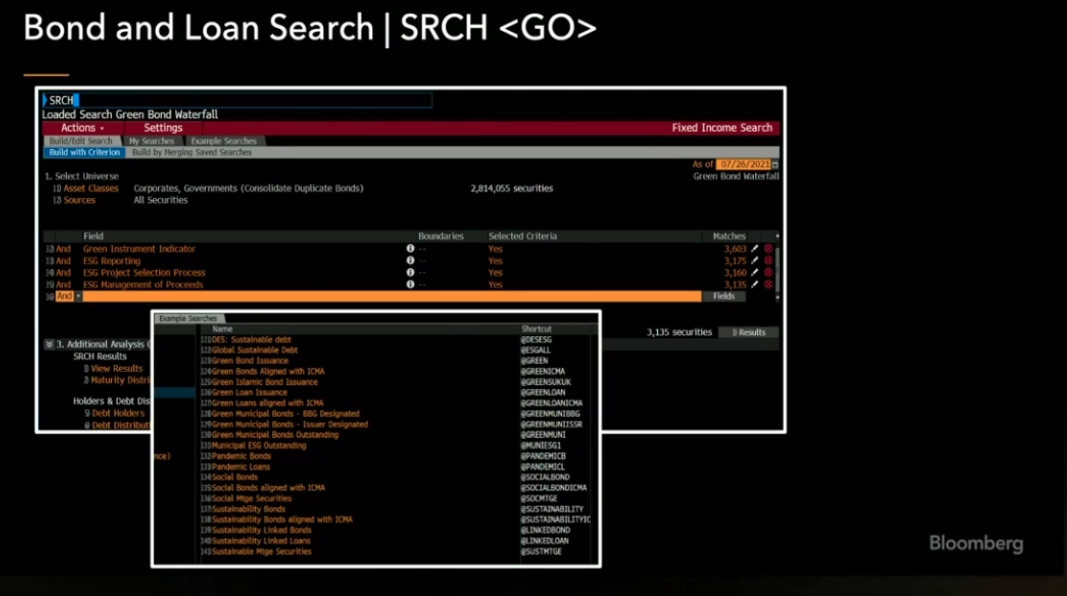

GSSB issuance universe & size: Via the gateway into the fixed income analysis SRCH > filter for 'impact' to see the universe of GSSB issuers. For example, as of Nov 2022, there were 45k issuers associated with GSS tags in the Bloomberg terminal.

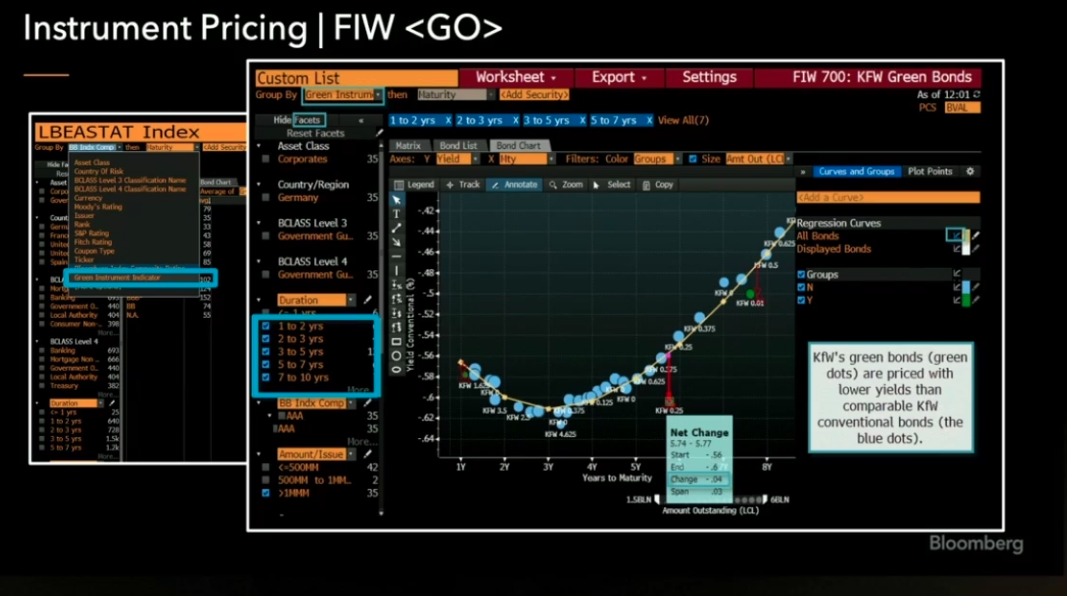

Pricing action & checking greenium level: If you want to compare the pricing actions of green bonds vs. non-green bond equivalents, the conventional curve vs. green curve comparison is available. In this case below, the green curve is slightly outside the conventional curve i.e. green bonds are priced with lower yields than comparable conventional bonds for the same issuer with similar credit, coupon and maturity characteristics.

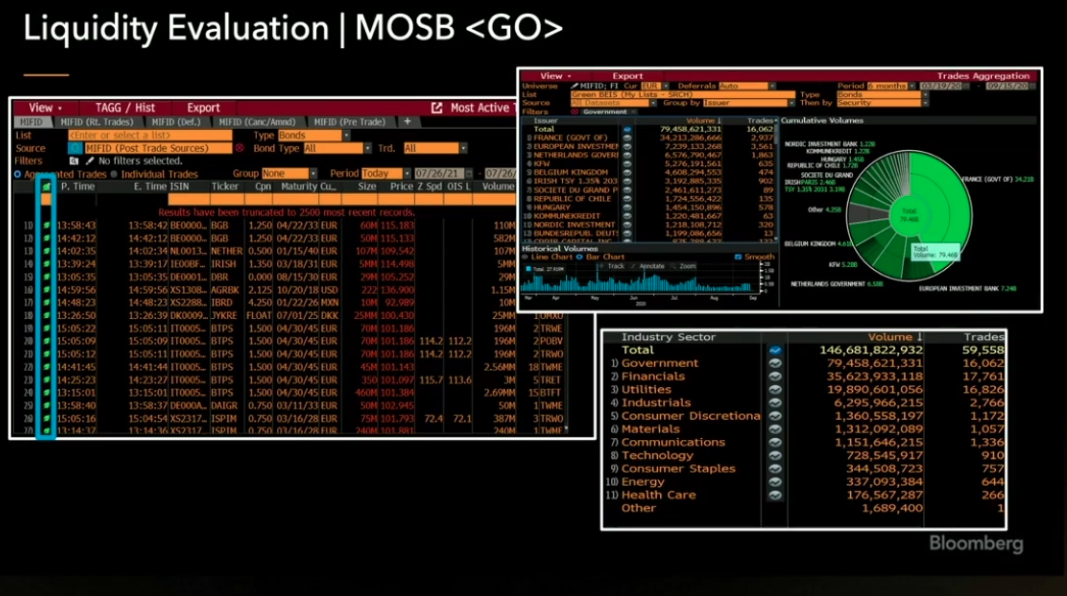

Liquidity: You can also check and compare the liquidity of the issuance.

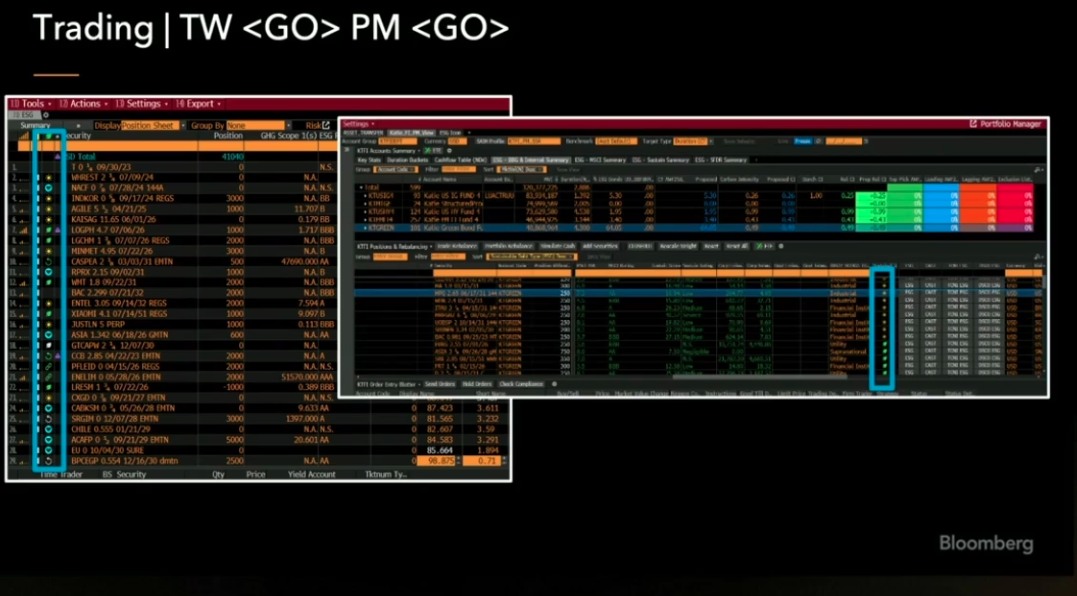

Traders can also see the green bond tagging in their 'TW' and 'PM' dashboards.

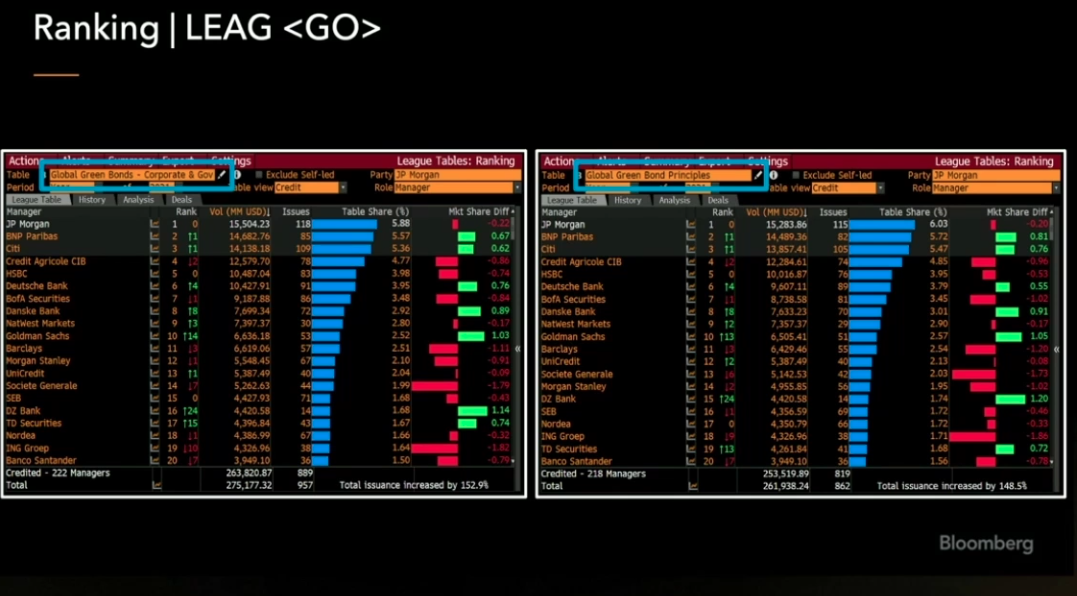

GSSB issuance league table: Check each issuer's GSSB issuance status and size.

Source: Sustainable Indices: Introducing Bloomberg’s Fixed Income Green, Social & Sustainability Bond Indices (Nov 2022).

![Sustainable/Impact Investing] Regulations Cheatsheet - State of Play (December 2025)](/content/images/size/w720/2025/12/Screenshot-2025-12-08-073043.png)

![Obsidian Brief] When Money Becomes Software: AI, Stablecoins & Bitcoin — Implications for Sustainable and Impact Investing](/content/images/size/w720/2025/12/Gemini_Generated_Image_dppem0dppem0dppe.png)

![Sustainable/Impact Investing] Building for Planetary Renewal - Urban Sequoia (A lecture by Mina Hasman, Sustainability Director at SOM)](/content/images/size/w720/2025/10/Screenshot-2025-10-30-221501.png)