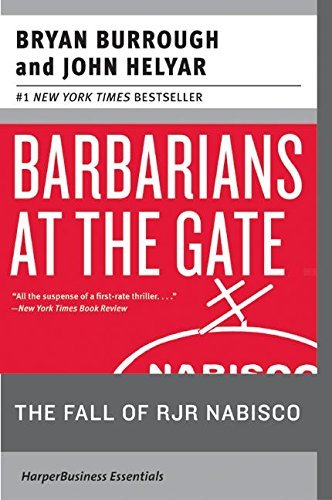

Book] Investing | Barbarians at the gate - Bryan Burrough & John Helyar (1989)

![Book] Investing | Barbarians at the gate - Bryan Burrough & John Helyar (1989)](https://images.unsplash.com/photo-1593013820725-ca0b6076576f?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=MnwxMTc3M3wwfDF8c2VhcmNofDJ8fGJhcmJhcmlhbnMlMjB8ZW58MHx8fHwxNjc3Nzk5MTM3&ixlib=rb-4.0.3&q=80&w=1200)

🐵 I. One-sentence summary:

Barbarians at the Gate is a gripping and comprehensive account of the RJR Nabisco LBO, exploring the personalities, motivations, and strategies of the key players involved and providing valuable insights into the world of corporate finance and M&A transactions.

This is the book one of my friends/YouTubers who is an ex-invest-banker-turned-hedge-fund manager at Wall Street recommended. She worked in the industry for 10+ years and started her own investment firm recently. She told me this is the ‘classic’ to read similar to how Fabozzi’s ‘The Handbook of Fixed Income Securities’ is a classic for fixed income investors. I learned about the history of LBO at University, but reading about the actual events brought everything to life. Hope you enjoy it!

1: "The New Law of the Jungle"

- The chapter provides a background on leveraged buyouts (LBOs) and the rise of private equity firms in the 1980s.

- It introduces Kohlberg Kravis Roberts & Co. (KKR), the private equity firm that would eventually acquire RJR Nabisco.

- Examples: The LBO of Storer Communications in 1985 by Kohlberg Kravis Roberts & Co. and the increasing popularity of the "greenmail" strategy.

- The chapter opens with a discussion of the history of leveraged buyouts (LBOs), tracing their origins back to the 1960s and the development of the junk bond market by Michael Milken and Drexel Burnham Lambert. It notes that the 1980s saw a surge in LBO activity, as private equity firms began using junk bonds to finance increasingly large and complex deals.

- The chapter then introduces Kohlberg Kravis Roberts & Co. (KKR), one of the leading private equity firms of the era. It describes KKR's approach to LBOs, which involved taking over companies using large amounts of debt, selling off non-core assets, and then either taking the company public again or selling it to another buyer for a profit.

- The chapter also introduces the concept of "greenmail," a strategy in which a hostile acquirer buys a stake in a company and then threatens to take over the company unless the target company buys back the stake at a premium price. Greenmail was a controversial strategy in the 1980s, with some critics arguing that it allowed corporate raiders to make quick profits at the expense of target companies and their shareholders.

- Finally, the chapter discusses the broader economic and political context of the 1980s, noting the deregulation of the financial industry under President Reagan and the growing popularity of free-market ideology. It argues that these factors created an environment in which LBOs and other aggressive financial strategies could thrive.

- Overall, Chapter 1 sets the stage for the rest of the book by providing a comprehensive overview of the economic and cultural forces that contributed to the rise of the LBO in the 1980s. It introduces KKR, the main protagonist of the book, and provides a glimpse into the controversial and often cutthroat world of private equity finance.

2: "The Smoke-Filled Room"

- This chapter describes the first meeting between RJR Nabisco CEO F. Ross Johnson and investment banker Henry Kravis, who proposed a potential LBO of the company.

- It explores the role of investment bankers in facilitating LBOs.

- Examples: The history of LBOs and how they have evolved over time.

- Chapter 2 focuses on the initial meeting between F. Ross Johnson, the CEO of RJR Nabisco, and Henry Kravis, the co-founder of Kohlberg Kravis Roberts & Co. (KKR), in a "smoke-filled room" at the Pierre Hotel in New York City. Kravis proposed the idea of a leveraged buyout (LBO) of RJR Nabisco to Johnson, suggesting that KKR could take the company private by using large amounts of debt to finance the acquisition.

- The chapter describes the dynamics of the meeting, noting Johnson's initial skepticism and Kravis's persistence in pitching the idea. It also explores the role of investment bankers in facilitating LBOs, describing the various financial tools and strategies that bankers use to structure deals and make them attractive to buyers.

- The chapter then delves into the history of LBOs, tracing their evolution from the early days of leveraged finance in the 1960s to the large, complex deals of the 1980s. It notes that LBOs had become increasingly common by the time of the RJR Nabisco deal, with private equity firms like KKR and Forstmann Little leading the way in using debt to finance acquisitions.

- Overall, Chapter 2 provides a fascinating glimpse into the world of high finance, showing how investment bankers and private equity firms use financial engineering to structure deals and maximize profits. It introduces the central players in the RJR Nabisco deal and sets the stage for the drama and intrigue that will unfold over the course of the book.

3: "The Winner's Curse"

- This chapter explains how the bidding process for RJR Nabisco began, with multiple parties vying for the company.

- It explores the concept of the "winner's curse," where the winning bidder overpays for the company and ends up regretting the acquisition.

- Examples: The bidding war for Gulfstream Aerospace in 1985 and the LBO of Beatrice Companies in 1986.

- Chapter 3 describes the start of the bidding process for RJR Nabisco, which began in late 1988 with a number of potential buyers expressing interest in the company. The chapter notes that RJR Nabisco was an attractive target for LBO firms like KKR because of its strong cash flow and valuable brands, including Nabisco and Ritz.

- The chapter introduces the concept of the "winner's curse," which refers to the tendency of winning bidders to overpay for companies in the heat of a bidding war. The chapter explains that in the context of an LBO, the use of debt to finance the acquisition can make the winner's curse particularly dangerous, as high debt levels can put significant strain on the company's finances.

- To illustrate the risks of the winner's curse, the chapter provides examples of other high-profile deals from the era, including the bidding war for Gulfstream Aerospace in 1985 and the LBO of Beatrice Companies in 1986. In both cases, the winning bidders ended up regretting the acquisition and struggling to manage the companies they had acquired.

- Overall, Chapter 3 sets the stage for the intense bidding war that will take place over the course of the book. It introduces the concept of the winner's curse and shows how it can play out in the context of an LBO, providing important context for the drama that will unfold in later chapters.

4: "The First Gamble"

- This chapter covers the first round of bidding for RJR Nabisco, with KKR submitting the highest bid at $75 per share.

- It explores the tactics used by KKR and the other bidders to gain an advantage.

- Examples: The role of debt financing in LBOs and the use of poison pills by target companies to deter hostile takeovers.

- Chapter 4 covers the first round of bidding for RJR Nabisco, which took place in early 1989. KKR emerged as the highest bidder in this round, offering $75 per share for the company, or a total of $17 billion. The chapter explores the tactics used by KKR and the other bidders to gain an advantage in the bidding process.

- The chapter notes that KKR's bid was significantly higher than the market price for RJR Nabisco's stock, which was trading at around $55 per share at the time. The chapter explains that KKR's bid was made possible by the use of debt financing, which allowed the firm to leverage its equity investment and make a large offer for the company.

- The chapter also explores the tactics used by the other bidders, including the management team of RJR Nabisco itself, which was interested in taking the company private. The chapter notes that RJR Nabisco implemented a poison pill defense to deter hostile takeovers, which made it more difficult for bidders to acquire a controlling stake in the company without the approval of the board of directors.

- Overall, Chapter 4 provides a detailed look at the first round of bidding for RJR Nabisco, showing how the different bidders used financial tactics and strategies to gain an advantage in the process. It introduces the concept of debt financing and the role it plays in LBOs, as well as the use of poison pills and other takeover defenses by target companies.

5: "Bidding Up"

- This chapter covers the second round of bidding for RJR Nabisco, with the highest bid increasing to $90 per share.

- It explores the tactics used by the bidders to drive up the price.

- Examples: The use of leverage to increase returns for investors and the role of junk bonds in financing LBOs.

- Chapter 5 covers the second round of bidding for RJR Nabisco, which took place in April 1989. In this round, the highest bid for the company increased to $90 per share, or a total of $20 billion. The chapter explores the tactics used by the bidders to drive up the price of the company.

- The chapter notes that KKR and the other bidders used a variety of strategies to increase the value of their bids, including the use of leverage. The chapter explains that leverage allows LBO firms to amplify the returns on their equity investment by using debt to finance a large portion of the purchase price. However, the use of leverage also increases the risk of the investment, as higher levels of debt can put pressure on the company's finances.

- The chapter also explores the role of junk bonds in financing LBOs. Junk bonds, which are high-yield, high-risk bonds issued by companies with lower credit ratings, became popular in the 1980s as a way to finance LBOs. The chapter notes that KKR and other LBO firms used junk bonds to finance a significant portion of the RJR Nabisco acquisition, allowing them to make larger offers for the company than they would have been able to with traditional bank financing.

- Overall, Chapter 5 provides a detailed look at the tactics used by the bidders to drive up the price of RJR Nabisco in the second round of bidding. It introduces the concept of leverage and its role in amplifying returns for investors, as well as the use of junk bonds in financing LBOs.

6: "Fierce Resistance"

- This chapter covers the resistance from RJR Nabisco's board of directors to the LBO.

- It explores the arguments made by both sides and the impact of the resistance on the bidding process.

- Examples: The role of corporate governance in protecting shareholders and the use of defensive tactics by target companies.

- Chapter 6 covers the resistance faced by KKR and the other bidders from RJR Nabisco's board of directors. The board was initially skeptical of the LBO and concerned about the impact it would have on the company's employees and stakeholders.

- The chapter explores the arguments made by both sides in the debate over the LBO. KKR and the other bidders argued that the LBO would allow them to improve the company's performance and create value for shareholders, while the board of directors argued that the LBO would lead to significant job losses and other negative consequences.

- The chapter also explores the impact of the resistance from the board of directors on the bidding process. The board's reluctance to accept the LBO led to delays and uncertainty, which in turn led to higher bids from KKR and the other bidders. The chapter notes that the board's resistance ultimately had little impact on the outcome of the bidding process, as KKR was able to secure the necessary financing and make the highest offer for the company.

- The chapter also introduces the concept of corporate governance and its role in protecting shareholders. It notes that the board of directors has a fiduciary duty to act in the best interests of shareholders and that this duty can sometimes conflict with other considerations, such as the interests of employees or other stakeholders.

- Finally, the chapter explores the use of defensive tactics by target companies to deter hostile takeovers. These tactics can include measures such as poison pills, which make the company less attractive to potential bidders by diluting the value of its shares. The chapter notes that RJR Nabisco used defensive tactics in response to the LBO bid, but ultimately they had little impact on the outcome of the bidding process.

7: "The Next Move"

- This chapter covers the decision by KKR to increase their bid to $109 per share.

- It explores the reasons behind the increase and the impact on the other bidders.

- Examples: The role of strategic planning in LBOs and the importance of valuation in determining a company's worth.

- Chapter 7 covers the decision by KKR to increase their bid for RJR Nabisco to $109 per share. The chapter explores the reasons behind the increase, including KKR's belief that the company was undervalued and their confidence in their ability to improve its performance.

- The chapter also discusses the impact of the increased bid on the other bidders. Some of the other bidders, such as the management team of RJR Nabisco, were discouraged by the high price and chose to drop out of the bidding process. However, other bidders, such as the investment firm Forstmann Little, remained in the running and continued to submit higher bids.

- The chapter explores the role of strategic planning in LBOs, noting that KKR's decision to increase their bid was based on their analysis of the company's strengths and weaknesses and their ability to create value through restructuring and cost-cutting measures. The chapter also emphasizes the importance of valuation in determining a company's worth, noting that KKR's bid was based on their assessment of the company's future earnings potential and their ability to generate returns for investors.

- Finally, the chapter notes that KKR's increased bid put pressure on the other bidders to come up with even higher offers, leading to a highly competitive bidding process. However, despite the high bids, some analysts questioned whether the eventual winner of the bidding war would be able to generate enough returns to justify the high price paid for the company.

8: "The Godfather"

- This chapter covers the role of KKR's co-founder, Jerome Kohlberg Jr., in the LBO.

- It explores Kohlberg's background and the influence he had on KKR's strategy.

- Examples: The importance of leadership in private equity firms and the role of experience in making investment decisions.

- Chapter 8 covers the role of Jerome Kohlberg Jr., co-founder of KKR, in the RJR Nabisco LBO. The chapter explores Kohlberg's background and the influence he had on KKR's strategy. Kohlberg had a reputation as a savvy investor with a keen eye for undervalued companies. He was known for his conservative approach to investing and his emphasis on thorough analysis and due diligence.

- The chapter highlights Kohlberg's importance as a leader within KKR, noting that he played a key role in shaping the firm's investment philosophy and approach to risk management. He was also instrumental in developing KKR's relationships with institutional investors, such as pension funds and endowments, which provided a source of capital for the firm's investments.

- The chapter explores the role of experience in making investment decisions, noting that Kohlberg's decades of experience in the industry gave him a unique perspective on the LBO market. His experience helped KKR to identify undervalued companies and to structure deals that would generate high returns for investors.

- Finally, the chapter notes that Kohlberg's conservative approach to investing was a significant factor in KKR's success in the RJR Nabisco LBO. By conducting thorough due diligence and carefully analyzing the company's financials and market position, KKR was able to make an informed investment decision and to structure a deal that generated significant returns for its investors.

9: "The Battle for the Soul of the Company"

- This chapter covers the competing visions for RJR Nabisco between F. Ross Johnson and KKR.

- Key points from the chapter include:

- F. Ross Johnson's vision for RJR Nabisco was centered around growth and diversification, while KKR's vision focused on cost-cutting and maximizing profits.

- Johnson was eager to pursue acquisitions and expand RJR Nabisco's portfolio, while KKR sought to streamline the company and focus on core businesses.

- The chapter covers the negotiation process between Johnson and KKR, including the back-and-forth over the terms of the deal and the concessions made by each side.

- Ultimately, KKR prevailed and acquired RJR Nabisco, but not before significant tensions arose between the two sides.

- Examples from the chapter include:

- Johnson's push to acquire Nabisco Brands, which KKR opposed as too expensive and not strategically aligned with RJR Nabisco's core businesses.

- The differing views on the value of RJR Nabisco's international operations, with Johnson seeing them as a growth opportunity and KKR viewing them as a potential liability.

- The negotiation process between Johnson and KKR, including Johnson's attempts to retain some control over the company and KKR's efforts to secure financing for the deal.

10: "The Decision"

- This chapter covers the decision by RJR Nabisco's board of directors to accept KKR's bid of $109 per share.

- Examples: The importance of due diligence in M&A transactions and the role of shareholder activism in corporate decision-making.

- The chapter begins by describing how KKR and RJR Nabisco's management team had reached an agreement on the terms of the LBO.

- The board of directors was initially hesitant to accept KKR's bid, as they believed that the company was worth more than $109 per share. However, the pressure from shareholders and the threat of a lawsuit pushed them to reconsider.

- The board also considered the possibility of a higher bid from a rival bidder, but ultimately decided that it was too risky to wait for one.

- The chapter explores the emotions and tensions that arose during the board's decision-making process, including F. Ross Johnson's disappointment and frustration.

- The chapter concludes by discussing the impact of the decision on RJR Nabisco and the broader business world.

- Examples of concepts covered in this chapter include:

- The importance of due diligence in M&A transactions: RJR Nabisco's board of directors had to carefully consider KKR's bid and weigh the risks and benefits of accepting it. They conducted extensive due diligence to understand the implications of the LBO for the company and its shareholders.

- The role of shareholder activism in corporate decision-making: The pressure from shareholders played a significant role in the board's decision to accept KKR's bid. This reflects the growing influence of activist investors in corporate governance in the 1980s and beyond.

- The risks and rewards of M&A transactions: RJR Nabisco's board had to weigh the potential benefits of the LBO against the risks, including the possibility of a higher bid from a rival bidder. Ultimately, they decided that the benefits outweighed the risks and accepted KKR's offer.

11: "An Unholy Alliance"

- This chapter covers the alliance between KKR and tobacco giant Philip Morris, which would provide financing for the LBO.

- It explores the controversial nature of the alliance and the impact it would have on the LBO.

- Examples: The role of strategic partnerships in M&A transactions and the importance of managing conflicts of interest.

- Philip Morris was formed to finance the LBO of RJR Nabisco. The alliance was controversial due to the negative public perception of tobacco companies and their products, and it was seen as a potential conflict of interest for KKR.

- The chapter explains that the alliance provided KKR with access to significant financing, which was crucial for the success of the LBO. However, it also came with a number of challenges. For example, Philip Morris was subject to significant regulatory scrutiny and potential legal liabilities, which could have impacted the financing of the LBO.

- The chapter also explores the impact of the alliance on the other bidders for RJR Nabisco. Some bidders, such as Forstmann Little, were critical of the alliance and argued that it gave KKR an unfair advantage. However, others saw the alliance as a sign of KKR's strength and credibility, and it ultimately helped KKR secure the necessary financing to complete the LBO.

- Examples of similar alliances in M&A transactions include the partnership between Dell and Silver Lake Partners in the acquisition of Dell, and the alliance between Comcast and NBC Universal in the acquisition of NBC Universal. These alliances can provide significant benefits in terms of financing and expertise, but they also require careful management to avoid conflicts of interest and regulatory issues.

12: "D-Day"

- Chapter 12, "D-Day," is the culmination of the bidding war for RJR Nabisco. The chapter covers the events of the day when the final bids were due, including the drama and tension that unfolded.

- The day began with both KKR and Forstmann Little submitting their final bids. KKR submitted a bid of $112 per share, while Forstmann Little submitted a bid of $108 per share. The two bids were very close, and the tension was high as everyone waited for the outcome.

- The RJR Nabisco board of directors met to review the bids and make a decision. The board members were split between KKR and Forstmann Little, with some members favoring KKR's higher bid and others preferring Forstmann Little's focus on keeping the company intact.

- As the board deliberated, rumors began to circulate that KKR had secretly agreed to sell off parts of the company to Philip Morris, which would violate the board's stipulation that the company should not be broken up. This added even more tension to the situation.

- In the end, the board chose KKR's bid of $112 per share. The decision was controversial, as some board members felt that Forstmann Little's bid was a better fit for the company's long-term interests. However, the pressure from shareholders to accept the higher bid was too great.

- The chapter also covers the aftermath of the decision, including the reactions of Forstmann Little and the other bidders, as well as the impact of the LBO on RJR Nabisco and the private equity industry as a whole.

13: "The White Knight"

- This chapter covers the role of rival bidder Forstmann Little in the LBO and their failed attempt to acquire RJR Nabisco.

- It explores the tactics used by Forstmann Little and the impact of their bid on the final outcome.

- Examples: The use of alternative strategies in M&A transactions and the role of competition in driving up the price of a target company.

- In this chapter, "The White Knight," the book describes the entrance of Forstmann Little into the RJR Nabisco bidding war. Forstmann Little, led by Theodore Forstmann, was a private equity firm that had a reputation for taking a more conservative approach to deals than KKR. Forstmann Little was seen as the "white knight" in this scenario because they were considered a more ethical alternative to KKR.

- Forstmann Little initially bid $112 per share for RJR Nabisco, higher than KKR's bid of $109 per share. However, KKR quickly responded with a counteroffer of $115 per share. Forstmann Little decided not to raise their bid, and instead attempted to create doubt about KKR's ability to finance the deal.

- Forstmann Little's strategy ultimately failed, and KKR was able to secure the acquisition of RJR Nabisco for $109 per share. The chapter explores the tactics used by Forstmann Little, as well as the impact of their bid on the final outcome. It also touches on the different approaches to deal-making between KKR and Forstmann Little, and the potential consequences of a Forstmann Little acquisition of RJR Nabisco. Overall, the chapter provides insight into the role of competition and alternative strategies in M&A transactions

14: "The Fall of F. Ross Johnson"

- In chapter 14, the book outlines the aftermath of the RJR Nabisco LBO, including the departure of CEO F. Ross Johnson. Johnson, who had been one of the key players in the LBO, was ousted from the company amid controversy over his compensation package and his role in the buyout.

- The chapter explores the reasons behind Johnson's departure, including his contentious relationship with the board of directors and the backlash from shareholders and the media over his lavish compensation package. The book also discusses the impact of the LBO on the company and its employees, including layoffs and restructuring.

- The chapter provides an example of the importance of leadership in M&A transactions, as well as the potential risks and consequences of such deals. It also highlights the role of human resources in managing the impact of a deal on employees and the importance of communication and transparency throughout the process.

15: "The Battle for the Board"

- Chapter 15 of "Barbarians at the Gate" describes the intense proxy battle between KKR and Forstmann Little for control of RJR Nabisco's board of directors after the LBO was completed. The chapter highlights the tactics used by both sides to secure enough votes to control the board, including making deals with institutional investors and using aggressive advertising campaigns to sway individual shareholders.

- KKR, which had successfully completed the LBO, had the upper hand in the proxy battle as they had already established a relationship with many of the company's institutional investors. However, Forstmann Little, which had lost the bidding war for RJR Nabisco, saw the proxy battle as a way to exert some control over the company and potentially gain a foothold in the tobacco industry.

- The chapter also covers the impact of the proxy battle on the company and its shareholders. The uncertainty caused by the battle led to a decline in RJR Nabisco's stock price, and many shareholders expressed frustration with the situation. Ultimately, KKR was able to secure control of the board, but the proxy battle served as a reminder of the importance of strong corporate governance and the need for transparency in M&A transactions.

- Examples of key takeaways from this chapter include the importance of corporate governance in M&A transactions, the role of institutional investors in determining the outcome of proxy battles, and the potential impact of proxy battles on a company's stock price and shareholder sentiment.

16: "The Endgame"

- This chapter covers the resolution of the proxy battle and the final outcome of the LBO.

- It explores the impact of the LBO on RJR Nabisco and the legacy of the deal.

- Examples: The importance of post-merger integration in M&A transactions and the impact of large-scale deals on the broader economy.

- Chapter 16, "The Endgame," is the final chapter of "Barbarians at the Gate." It covers the resolution of the proxy battle between KKR and Forstmann Little and the final outcome of the LBO.

- After the proxy battle, KKR gained control of RJR Nabisco's board of directors, and the company officially accepted KKR's bid of $109 per share. The LBO was completed in early 1989, making it the largest leveraged buyout in history at the time.

- The chapter explores the impact of the LBO on RJR Nabisco and its employees. Despite the huge amount of debt taken on by the company in the LBO, RJR Nabisco was able to generate significant profits in the years following the acquisition, and KKR was able to sell off some of the company's non-core assets to pay down debt.

- The chapter also discusses the legacy of the deal, which has been the subject of much debate over the years. Some have argued that the LBO led to job losses and the dismantling of a once-great company, while others have pointed to the profits generated by the deal and the boost it gave to the private equity industry.

- Overall, Chapter 16 highlights the importance of post-merger integration in M&A transactions and the impact of large-scale deals on the broader economy. It also emphasizes the need for companies and investors to carefully consider the long-term consequences of their actions and to prioritize the interests of all stakeholders involved.

17: "The Final Hours"

- Chapter 17, "The Final Hours," describes the last stages of the RJR Nabisco LBO deal. The chapter highlights the tense negotiations between KKR and its financing partners to finalize the financing terms. The chapter also highlights the critical role of lawyers and accountants in the final hours of the deal.

- The chapter discusses the various concerns raised by the financing partners about the high debt load of the LBO, which was a record-breaking $25 billion. The financing partners included investment banks, commercial banks, and insurance companies. The banks were concerned about the high level of debt and demanded higher interest rates, shorter maturities, and more restrictive covenants. The insurance companies were worried about their exposure to the junk bonds issued to finance the deal.

- The chapter also discusses the critical role of lawyers and accountants in closing the deal. Lawyers were responsible for drafting the legal documents, including the purchase agreement and the financing agreements. Accountants were responsible for reviewing the financial statements and ensuring that the financial covenants were met. The chapter describes the intense scrutiny and pressure that lawyers and accountants faced in the final hours of the deal.

- The chapter concludes with the successful closing of the LBO and the celebration of the KKR team. The chapter ends with a reflection on the significance of the RJR Nabisco LBO and its impact on the private equity industry.

18: "Epilogue: The Aftermath"

- This chapter covers the aftermath of the LBO and the impact it had on RJR Nabisco and the broader business world.

- It explores the lessons learned from the LBO and the changes it brought about in the world of corporate finance.

- Examples: The impact of the LBO on the tobacco industry and the legacy of the deal for KKR and its founders.

- In Chapter 18, the author reflects on the aftermath of the RJR Nabisco LBO and the lasting impact it had on the business world. The chapter explores the lessons learned from the LBO and the changes it brought about in the world of corporate finance. Some of the key takeaways include:

- The rise of shareholder activism: The RJR Nabisco LBO was one of the first major deals to attract significant attention from shareholder activists. The deal demonstrated the power of shareholders to influence corporate decision-making and paved the way for a new era of shareholder activism.

- The limits of leverage: The RJR Nabisco LBO was also a cautionary tale about the dangers of excessive leverage. The massive debt load taken on by the company ultimately proved unsustainable, and the company struggled to meet its debt obligations in the years following the LBO.

- The impact on the tobacco industry: The RJR Nabisco LBO had a significant impact on the tobacco industry, which was facing increased regulatory scrutiny and declining sales at the time. The deal helped to reshape the industry, with companies focusing more on international markets and diversifying into other areas, such as food and beverages.

- The legacy of KKR: The RJR Nabisco LBO solidified KKR's reputation as one of the top private equity firms in the world. The deal also helped to establish the private equity industry as a major player in corporate finance, with many other firms following KKR's lead in pursuing large-scale leveraged buyouts.

- Overall, the RJR Nabisco LBO was a defining moment in the history of corporate finance. The deal demonstrated the power of financial engineering and leverage, while also highlighting the risks and complexities involved in such transactions.

19: "The Lessons of RJR Nabisco"

- Chapter 19 of "Barbarians at the Gate" focuses on the key lessons that can be drawn from the RJR Nabisco LBO and their broader implications for the world of business. Some of the lessons highlighted in this chapter include:

- Strategic planning is essential: The RJR Nabisco LBO demonstrated the importance of careful strategic planning in M&A transactions. In particular, the deal showed how a lack of clear strategic objectives can lead to confusion and conflict among stakeholders, ultimately undermining the success of the transaction.

- Due diligence is critical: The RJR Nabisco LBO also highlighted the importance of thorough due diligence in M&A transactions. The due diligence process helps to identify potential risks and issues that may impact the success of the deal and allows acquirers to make more informed decisions about the target company.

- Leadership is key: The success of the RJR Nabisco LBO was heavily influenced by the leadership of the key players involved. In particular, the book emphasizes the role of RJR Nabisco CEO F. Ross Johnson in driving the transaction forward, as well as the leadership of KKR's Henry Kravis and George Roberts in structuring the deal and managing the many challenges that arose.

- Risk management is crucial: The RJR Nabisco LBO demonstrated the importance of effective risk management in M&A transactions. In particular, the deal highlighted the risks associated with high levels of debt and the need to carefully manage leverage ratios to avoid default.

- Shareholder activism can have a significant impact: The RJR Nabisco LBO also showed how shareholder activism can play a powerful role in corporate decision-making. The pressure from shareholder groups ultimately played a key role in pushing RJR Nabisco to accept KKR's bid, highlighting the need for companies to engage with and respond to their shareholders' concerns.

- Overall, Chapter 19 emphasizes that M&A transactions are complex and challenging endeavors that require careful planning, due diligence, leadership, and risk management to succeed. By learning from the lessons of the RJR Nabisco LBO, companies can improve their chances of executing successful deals in the future.

20: "The Players"

- In "The Players," the author provides a detailed summary of the major players involved in the RJR Nabisco LBO, including Kohlberg Kravis Roberts (KKR), F. Ross Johnson, and Forstmann Little. The chapter explores the backgrounds and motivations of these players, and how they impacted the outcome of the LBO.

- KKR, a private equity firm founded by Jerome Kohlberg, Henry Kravis, and George Roberts, was one of the main players in the RJR Nabisco LBO. The chapter delves into KKR's history, its approach to private equity investing, and the role it played in the LBO. The author discusses KKR's reputation as a tough negotiator and its ability to structure complex deals. The chapter also explores the personal backgrounds of the three KKR founders and how their experiences shaped the firm's approach to investing.

- F. Ross Johnson, the CEO of RJR Nabisco at the time of the LBO, is another major player discussed in the chapter. The author provides an overview of Johnson's career prior to the LBO, including his rise to the top of RJR Nabisco. The chapter also explores Johnson's motivations for pursuing the LBO, including his desire for personal wealth and his desire to create a lasting legacy.

- Forstmann Little, a rival private equity firm, is also discussed in the chapter. The author explores the background of the firm's founder, Ted Forstmann, and his motivations for getting involved in the LBO. The chapter also explores the tactics used by Forstmann Little to try to outbid KKR for RJR Nabisco, including the use of a "Pac-Man" defense.

- Overall, the chapter provides valuable insight into the key players involved in the RJR Nabisco LBO and how their motivations and strategies impacted the outcome of the deal. It highlights the importance of understanding the backgrounds and motivations of key players in M&A transactions, and how their personal relationships can impact business deals.

21: "The Context"

- This chapter provides a broader historical and economic context for the RJR Nabisco LBO, including the rise of leveraged buyouts in the 1980s and the impact of financial deregulation.

- It explores the social and cultural factors that contributed to the popularity of LBOs and the controversies surrounding them.

- Examples: The impact of government policy on corporate finance and the role of public opinion in shaping business practices.

- In "The Context," the author provides a broader historical and economic context for the RJR Nabisco LBO. The chapter explores the rise of leveraged buyouts in the 1980s and the impact of financial deregulation. The author discusses how LBOs became a popular strategy for corporate finance during this time due to the availability of cheap debt, relaxed regulations, and a favorable tax environment.

- The chapter also examines the social and cultural factors that contributed to the popularity of LBOs and the controversies surrounding them. The author discusses the portrayal of Wall Street in popular culture, including movies such as "Wall Street" and "The Bonfire of the Vanities," and how this affected public opinion of LBOs. The chapter also explores the criticism that LBOs were focused on short-term gains at the expense of long-term growth and the impact of this criticism on the industry.

- The author also examines the role of government policy in shaping corporate finance during this time, including the repeal of the Glass-Steagall Act in 1999 and the impact of this on financial regulation. The chapter discusses the impact of government policies on the growth of the LBO industry and the controversies surrounding the industry.

- Overall, the chapter provides valuable insight into the broader historical and economic context that led to the popularity of LBOs in the 1980s and the controversies surrounding them. It highlights the impact of government policies on corporate finance and the role of public opinion in shaping business practices.

22: "The Legacy"

- This chapter explores the legacy of the RJR Nabisco LBO and its impact on the world of corporate finance.

- It looks at the changes that have occurred in the world of business since the LBO and the lessons that can be learned from it.

- Examples: The impact of the LBO on the financial industry and the role of business ethics in shaping corporate behavior.

- "The Legacy," provides an overview of the lasting impact of the RJR Nabisco LBO on the world of corporate finance. The chapter highlights how the deal transformed the business world and how its legacy is still felt today.

- The chapter explores the changes that have occurred in the financial industry since the LBO, including the rise of private equity and the increased role of financial engineering in business deals. It also discusses the impact of the LBO on corporate governance, with a focus on the increased scrutiny of corporate executives and the greater emphasis on shareholder value.

- The author also discusses the lessons that can be learned from the RJR Nabisco LBO, including the importance of transparency and ethical behavior in business dealings. The chapter explores the impact of the LBO on public perceptions of business and the need for companies to balance their financial goals with their social responsibilities.

- Overall, the chapter provides a thought-provoking analysis of the lasting impact of the RJR Nabisco LBO on the world of corporate finance. It highlights the need for businesses to learn from the mistakes of the past and to strive for greater transparency, accountability, and ethical behavior in the future.

💯 II. Key takeaways

Overall, "Barbarians at the Gate" provides a detailed and compelling account of one of the most famous business deals in history. Through its comprehensive exploration of the RJR Nabisco LBO, the book sheds light on the complexities of M&A transactions and the broader social and economic forces that shape the world of business.

- The RJR Nabisco LBO was a landmark event in the history of corporate finance that highlighted the rise of private equity firms and the impact of financial deregulation on the corporate world.

- The book provides a detailed account of the strategies and tactics used by different parties involved in the LBO, including KKR, F. Ross Johnson, and Forstmann Little, highlighting the importance of strategic planning, due diligence, and leadership in M&A transactions.

- The book highlights the social and cultural factors that contributed to the popularity of LBOs in the 1980s, including the rise of shareholder activism, the emphasis on short-term gains, and the changing attitudes towards corporate greed and excess.

- The book also explores the controversies surrounding the RJR Nabisco LBO, including the impact of the deal on the employees and the communities affected by it, and the ethical implications of pursuing wealth at any cost.

- Overall, the book provides valuable insights into the world of corporate finance and the lessons that can be learned from the RJR Nabisco LBO, including the importance of understanding the motivations and strategies of key players in M&A transactions, the role of government policy in shaping business practices, and the impact of business decisions on wider society.

![Book] Leadership | What It Takes - Stephen Schwarzman](/content/images/size/w720/2025/10/photo-1760464864365-2188cd2afcde.jpeg)

![Book] Leadership | Principles – Ray Dalio](/content/images/size/w720/2025/10/photo-1585717175593-e65a9cdd68b3.jpeg)

![Obsidian Memo]📚 Summer recap & Reading List 2025: Leadership, AI, Sustainability & Resilience](/content/images/size/w720/2025/09/WhatsApp-Image-2025-08-14-at-15.15.55_e4fabdce-1.jpg)