March 10, 2023 - US Market

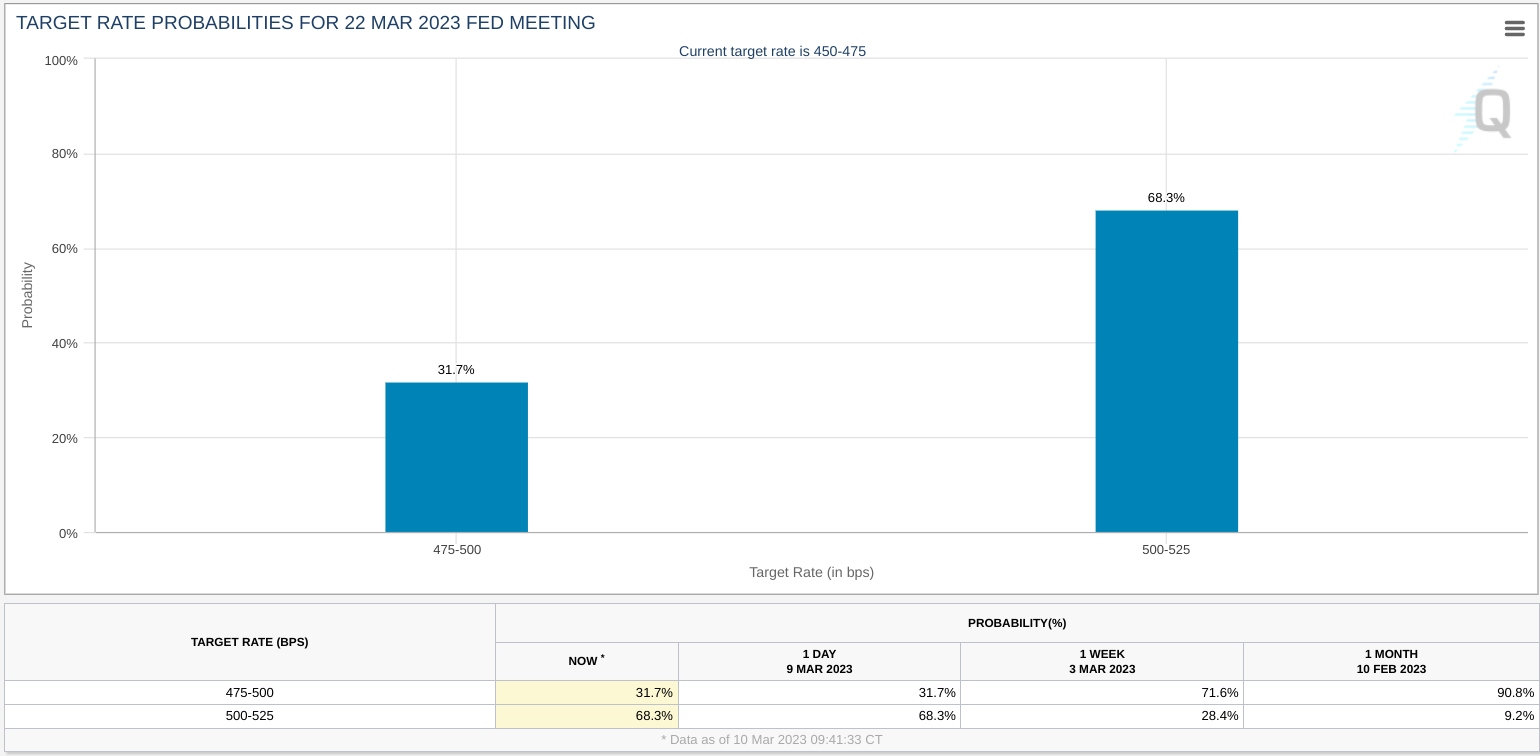

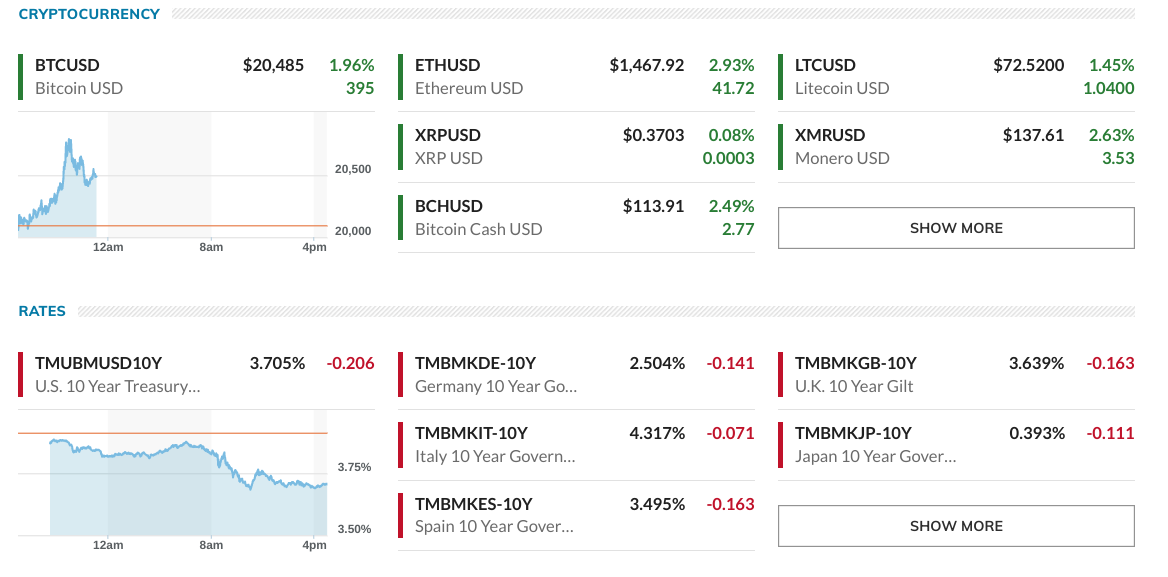

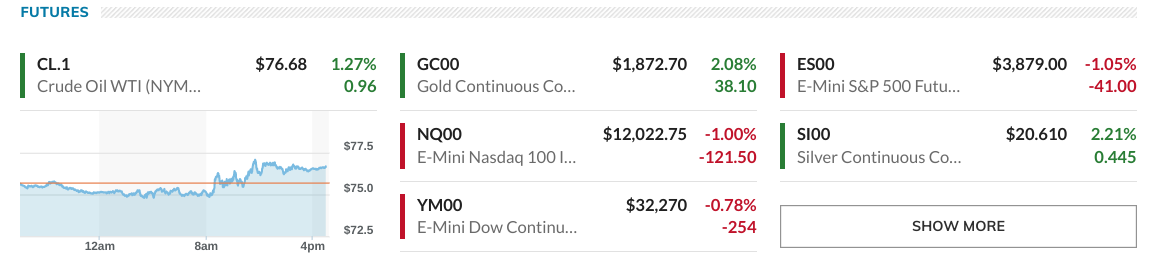

Shortly after the jobs report was released, interest rates in the New York bond market fell sharply and the dollar fell as well. The probability of a 50-basis-point hike in March fell to the low 30s on the Chicago Mercantile Exchange (CME) FedWatch market. Stock index futures, which had been flat, recovered to strongly positive levels.

At 9:30 AM, the major indices on the New York Stock Exchange opened slightly lower, thanks to reports that Silicon Valley Bank (SVB Financial), the bank that sparked yesterday's banking stock selloff, had failed to raise capital and was not open for business. SVB Financial's trading was halted, and sentiment worsened. Several other regional banks followed suit, including First Republic Bank (-14.79%), Western Alliance Bank (-20.92%), PacWest (-37.91%), and Signature Bank (-22.87%), raising fears that the crisis was contagious. The jobs report was no longer the focus. As safe-haven sentiment grew, so-called low-quality stocks - tech stocks that weren't making money, stocks that were heavily shorted, and so on - began to get hammered.

During the day, California financial regulators took over SVB, shut it down, and turned over its assets to the Federal Deposit Insurance Corporation (FDIC). The major indices even managed to turn positive, but only briefly.

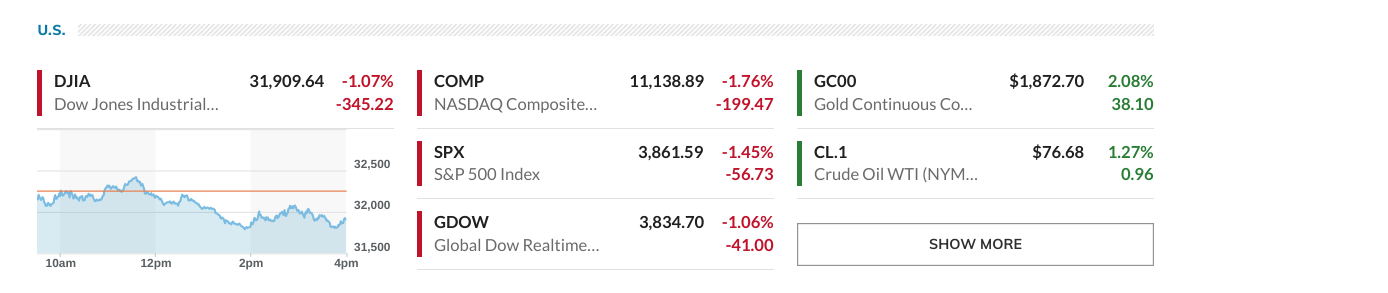

In the end, the Dow lost 1.07%, the S&P500 1.45%, and the Nasdaq ended the day down 1.76%. All of the indices are now back below their 200-day moving averages, and the volatility index (VIX) is above 28.

Macro data

1) February employment was better than expected

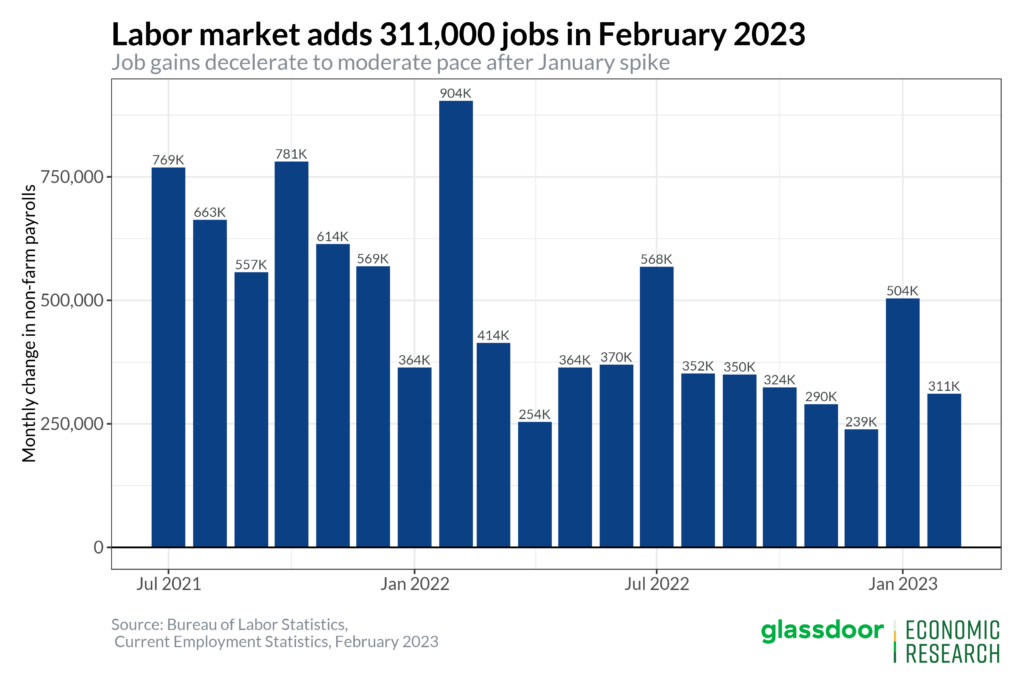

February payrolls came in at 310,000, well above Wall Street expectations of 225,000.

Note) The February employment data is one piece of data that will matter most when the U.S. Central Bank (Fed) decides how much to raise interest rates on Feb. 22. Released at 8:30am EST.

2) Barely revised January employment

This is lower than the January employment number that surprised everyone. The January number was revised downward to 504k from 517k. Some expected this to be a significant drop, but it wasn't. It's not that the stats are wrong or anything. Over the past three months, employment has averaged 351k per month.

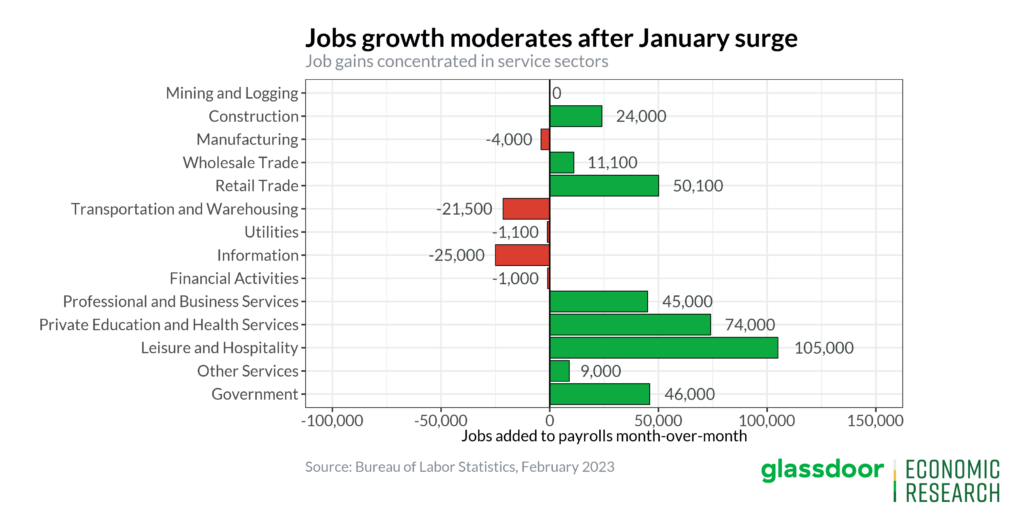

Service industries continued to lead hiring, including leisure and hospitality and education and health care. 240,000 were gained here, but IT was followed by job losses in logistics, manufacturing, utilities, and finance.

3) Slower wage growth

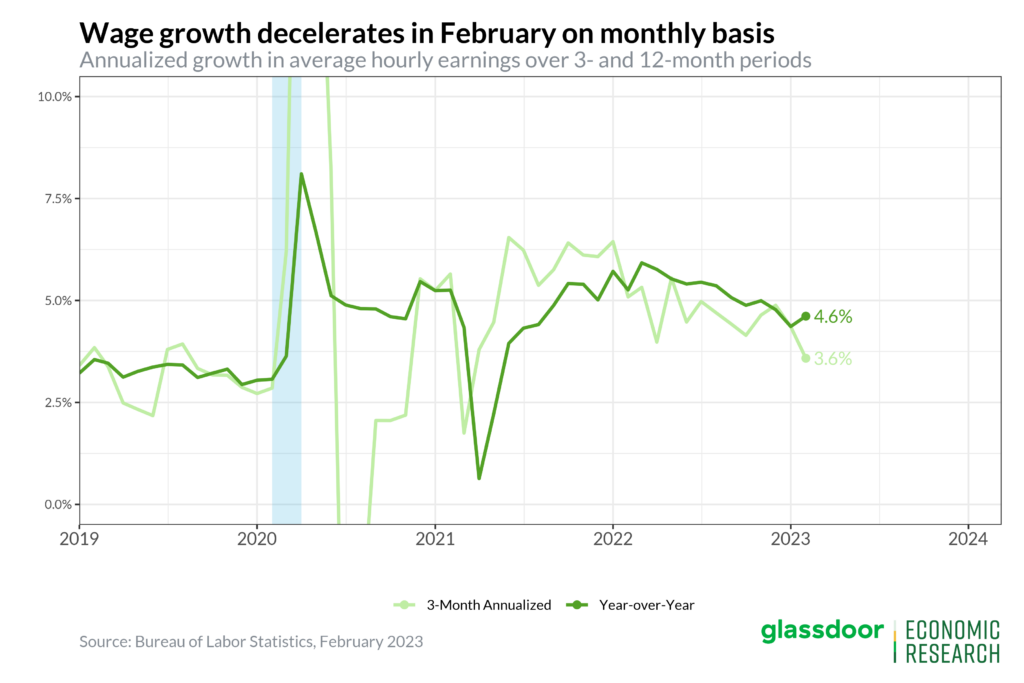

The good news is that average hourly earnings rose just 0.2% in February from the previous month, indicating that wage pressures have slowed. In January, they rose 0.3%, and Wall Street expectations were for a 0.3% increase. Nominal wages are up 4.6% from a year ago. "Average hourly earnings grew at an annualized rate of 3.6% over the past three months, a strong but sustainable level that may not push inflation higher," said Nick Bunker, an economist at employment agency Indeed. In addition, the average private sector workweek decreased by 0.3% from the previous month, having increased by 0.6% in January.

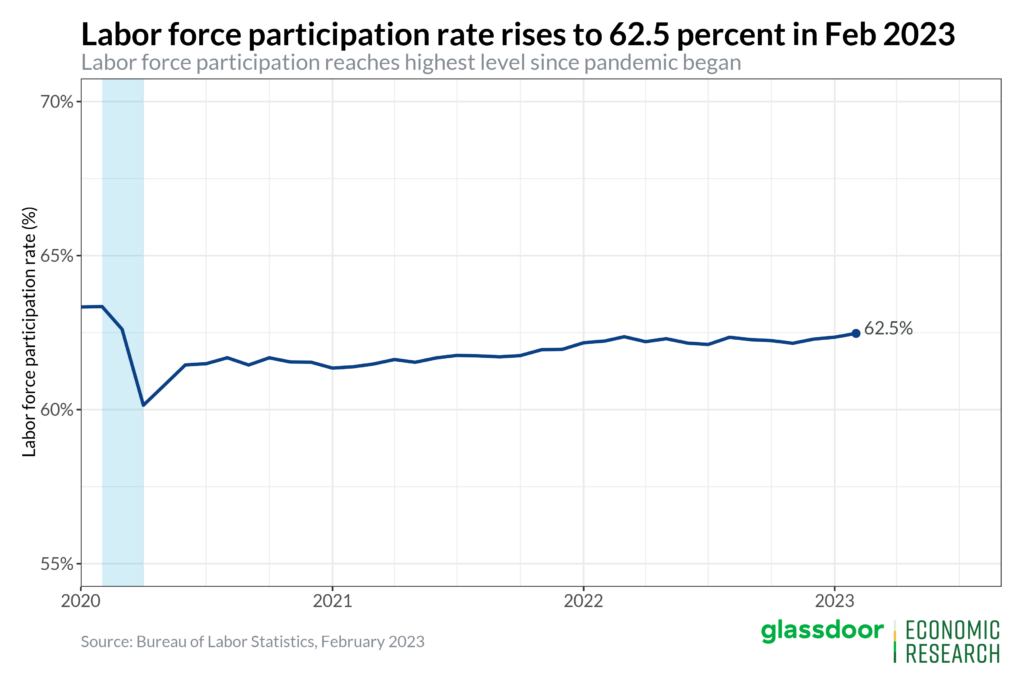

4) Economic participation rate rises

The labor force participation rate rose to 62.5%, up 0.1 percentage points from the previous month. The participation rate for the working-age population aged 25-54 rose to 83.1%, surpassing the pre-pandemic (February 2020) level for the first time. More people entering the labor force is the best way to keep wage pressures down.

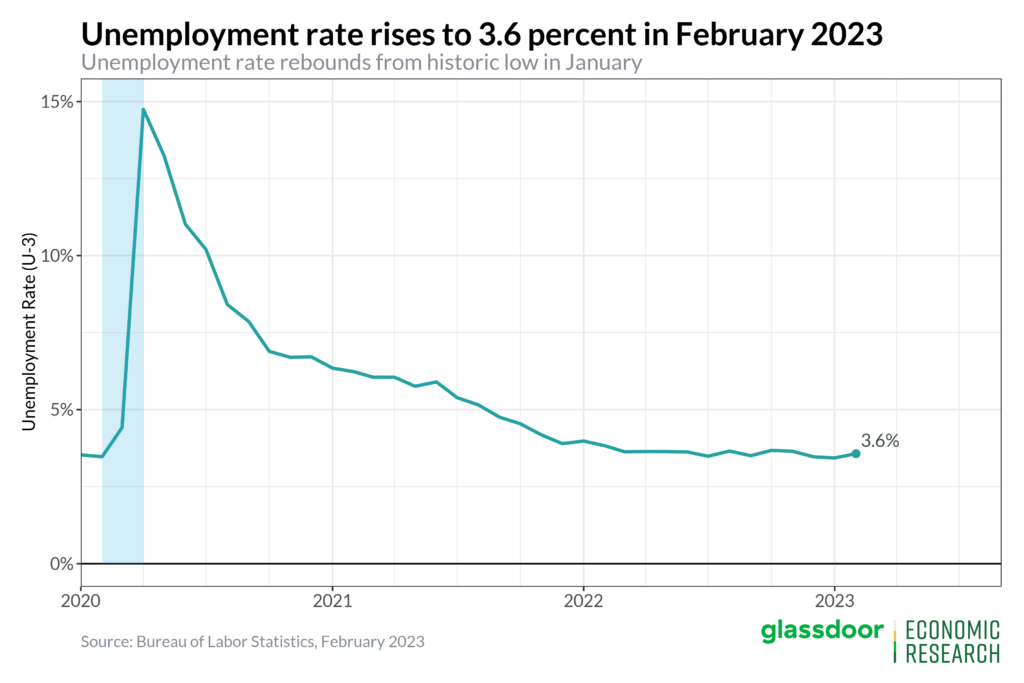

5) Rising unemployment rate

The unemployment rate was 3.6%, 0.2 percentage points higher than in the previous quarter, mainly due to an increase in labor market participation.

Analysts’ reactions to the US job report:

- Mark Zandi, economist at Moody's Analytics: "The February jobs report was good overall. The 310,000 job gain is still too strong, but hours worked declined and labor supply increased, leading to an increase in the labor force participation rate and unemployment rate, and modest wage growth."

- Mike Peroli, economist at JPMorgan: "Job growth is strong, but wage growth has slowed and the unemployment rate is higher. A mixed bag of good and bad."

- Jason Furman, Harvard professor who served on the Council of Economic Advisers during the Obama administration: "300,000 jobs were added, well above the 75,000 monthly hiring rate, which is a level that doesn't affect inflation. I don't believe this is going to bring inflation down to 2-3%. It should be 50 basis points higher. The February jobs report does not change my view."

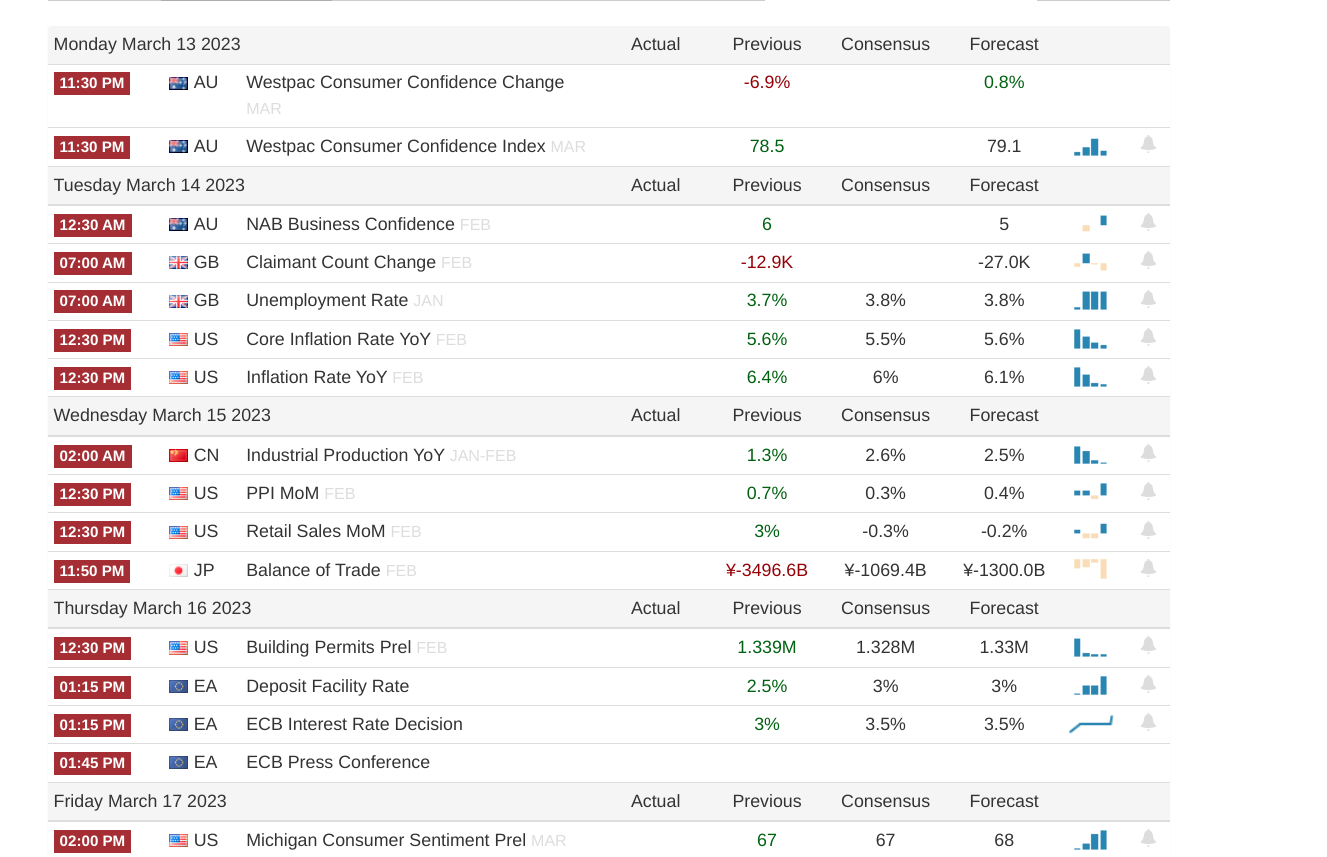

Key data to watch next week:

- The February CPI release on Tuesday (Feb. 14). According to FactSet, Wall Street expects February CPI to rise 0.4% month-over-month and 6% on an annualized basis. That would be a slowdown from January's 0.5% and 6.4%. February PPI also comes out on Wednesday.

- Fed’s Blackout period: Starting tomorrow, a blackout (silence) period for Fed speakers begins. Next week there will be no remarks.

What does this mean for the March FOMC meeting?

Given the mixed data, analysts’ opinions are mixed.

- Barclays changed its forecast to a 50 basis point hike in March after the jobs report. Goldman Sachs, Bank of America and others maintained their 25 basis point hike forecasts.

- Jan Hechtius, Goldman's economist: "We're seeing a better and better balance of supply and demand in the labor market. We maintain our forecast of 25 basis points from the next meeting through July."

- Bank of America: "The overall employment data was a little more dovish than we expected. We are maintaining our 25 basis point hike forecast."

- Given the mixed data, many said to keep an eye on the February Consumer Price Index (CPI), which is due out next week.

- BMO: "New hiring was strong, but the unemployment rate rose and wage growth moderated. It's unclear if the Fed will continue to hike 25bp. We think the Fed will stick with a 25bp hike, but if next week's CPI shows more than a 0.4% rise in core inflation, it could tilt towards 50bp."

Note) According to Bianco Research, there have been five other times in the past when the two-year rate fell more than 45 basis points in two days. They are: October 20, 1987, the day after Black Monday (a -22% drop in one day); October 13, 1989, dubbed "Mini-Crash Day"; September 14, 2001, shortly after 9-11; and September 15, 2008, the day of the Lehman Brothers bankruptcy that triggered the global financial crisis. These are all scary days.

Will the Silicon Valley banking debacle trigger a major financial crisis?

Not many on Wall Street see it that way.

- Morgan Stanley: "The SVB situation is very unique. It should not be viewed as a crisis for regional banks as a whole. We do not believe the banking industry is facing a liquidity crunch or crisis. The headwind for the banking industry is rising funding costs, which is a headwind for net interest margins, revenue, and earnings per share (EPS)…We do not believe the other large banks we cover will need to raise capital. We do not anticipate a similar level of deposit withdrawals as the Silicon Valley banks."

- Mike Mayo, banking analyst at Wells Fargo: "An SVB bankruptcy is a worst-case scenario. The key was the lack of diversity in funding. Almost all of its deposits came from venture capital. Other banks, especially large banks, have more diversified sources of funding."

- Treasury Secretary Janet Yellen: "The banking system is resilient and the authorities have effective tools to deal with what happened with Silicon Valley banks."

- In fact, JPMorgan rebounded 2.5% today, and most of the big bank stocks didn't lose much ground.

But there's a lot of anxiety in the market.

- Jim Reed, Deutsche Bank: "Something always breaks badly during the Fed's rate hike cycle. It's hard to say whether this is a small wobble or the start of something bigger, but I'd be very surprised if there aren't more casualties this cycle than there are now."

- Bill Eckerman, hedge fund manager: "If Silicon Valley Bank fails, the risk of deposit losses could cause a domino effect for venture capitalists, startups, and others" and argued that the government should consider bailing out the bank because if it goes bad, it could destroy an important long-term growth engine for the US economy.

Note) Silicon Valley Bank is 40 years old and has $210 billion in assets. It's the 16th largest bank in the U.S. and the second largest bank to fail. It's the largest since the 2008 financial crisis. The bank's customers are very few ordinary people and consist of venture capitalists, startups, and founders. With $161 billion in deposits and only 2.7% of customers holding less than $250,000, more than 97% of deposits are not insured. The bank had been investing 55% of its deposits in securities (stocks and bonds) and went under when interest rates rose.

On the Fed’s next move - 25 or 50 bps hike?

As the sense of crisis grew, there were arguments all over the place that the Fed shouldn't have raised rates by 50 basis points in this situation, that a larger increase would trigger a crisis when things were already shaky enough. In fact, it was a spike in interest rates that shook Silicon Valley banks.

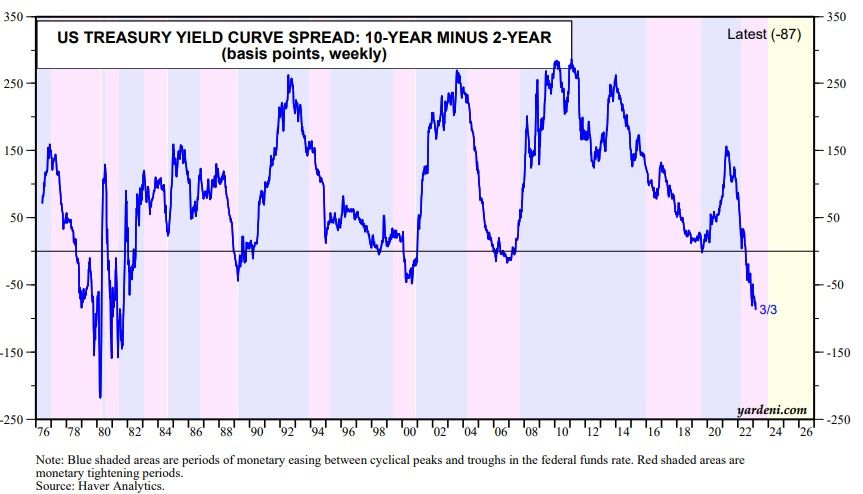

- Aneta Makowska, Jefferies economist: *"The SVB bankruptcy is evidence that the effects of austerity are long and severe. Many of the effects of austerity have yet to be felt in the economy, meaning **there is more pain to come…*An inverted yield curve has been signaling that something could break in the financial system if the Fed continues to tighten the purse strings. The SVB bankruptcy is a warning to the Fed, which has been hastily raising interest rates since last year. As a result of rising rates, people have pulled money out of deposits and into money markets. In other words, the Fed should only raise rates by 25 basis points this time and then pause."

- Yardemi research: The inverted yield curve has been signaling that something could break in the financial system if the Fed continues to tighten the purse strings. The SVB bankruptcy is a warning to the Fed, which has been hastily raising interest rates since last year. As a result of rising rates, people have pulled money out of deposits and into money markets. In other words, the Fed should only raise rates by 25 basis points this time and then pause.

- Goldman Sachs mentioned growing risk of a crisis as a reason for maintaining its 25 basis point hike forecast. Some have argued that the Fed should halt or slow down its quantitative tightening (QT) program, which is reducing its balance sheet by $95 billion a month, as liquidity has deteriorated.

- Gerard Cassidy, RBC Capital Markets analyst: "QT is draining excess liquidity out of the banking system. As a result, banks without a strong retail deposit base will find funding more expensive."

However, many believe this will not sway the Fed's decision.

- Lindsey Pieza, an economist at Stifel: "I think the Fed will see this as an isolated event and will not affect its monetary policy decision in two weeks. The SVB bankruptcy is not indicative of financial market turmoil or a broader crisis. With today's jobs report, we still expect inflation to be hot in February. If we see higher-than-expected numbers in CPI or PPI next week, the Fed will continue to raise rates, leaving the door open for a 50-basis point hike."

- Bank of America: "A year ago, the Fed Funds rate was 0%, and since then, global central banks have raised rates 290 times. This is not a prelude to 'Goldilocks,' but a prelude to a hard landing and credit crisis. So far, the S&P500 has been trading like a gyroscope in a range between 3800 and 4200 due to the Fed's data-dependent stance, but if we get a barrage of data pointing to a recession and a deepening yield curve inversion, that range trading will end and stocks will fall further."