March 14, 2023

*Market snapshots

Stocks↑=S&P500 +1.65%, Nasdaq +2.14%.

Bond Rates↑=10-year U.S. Treasury note 3.678% (+10.1bp)

Oil Price↓=WTI $71.33 per barrel (-4.64%)

*Key points

- Post-SVB

- US February CPI

- Fed’s next move: So, what does this all mean for the Fed’s Rate Hike? - 25bps hike camp vs. freeze camp

- Buying Opportunity or Bear Sterns moment?

- What’s up with Oil?

1. Post-SVB…

Since last night, the market jitters from the regional banking row have largely dissipated, partially thanks to Citadel's announcement yesterday that it has acquired a 5.3% stake in faltering Western Alliance Bank. In after-hours trading, most bank stocks were up, including First Republic Bank (FRC), which has been considered the second largest SVB. In intraday trading, First Republic (+26.98%), PacWest (+33.85%), and Western Alliance (+14.36%) all jumped more than 50%, causing trading to be halted. Big banks like JPMorgan Chase (+2.6%) and Wells Fargo (+4.6%) also made big gains. There were also reports that large private equity firms including Blackstone, KKR, and Apollo Management were interested in buying SVB's loan notes.

Rates rose as fears of a banking crisis spreading eased, and then rose further after a hot inflation report this morning. With these market stability conditions (for a 25 basis point hike) seemingly being met**, the 2-year US Treasury rate, which is a good reflection of monetary policy, jumped last night.** By 4:15 pm EST, the two-year note was trading at 4.230%, up 24.5 basis points from the previous day, and the 10-year note was up 10.1 basis points at 3.678%.

2. US February CPI

🏈Bottom line: February consumer prices (CPI) came out in line with the analyst's expectations and were a bit slower than January.

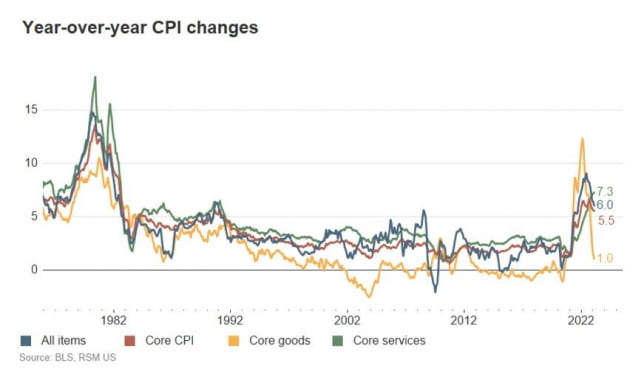

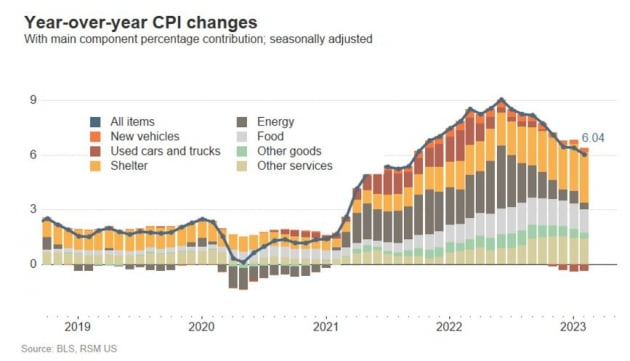

1) CPI in line with expectations

In February, headline CPI rose 6.0% from YoY (6.0% expected, 6.4% in January) and 0.4% MoM (0.4% expected, 0.5% in January). The 6% reading was the lowest since September 2021. Excluding energy and food, core CPI rose 5.5% YoY (5.5% expected, 5.6% in January) and 0.5% MoM (0.4% expected, 0.4% in January). The all-important month-over-month reading for core prices came in at 0.5%, which was higher than the 0.4% expected, but the actual reading was 0.45%, which was rounded up, so it is not too concerning.

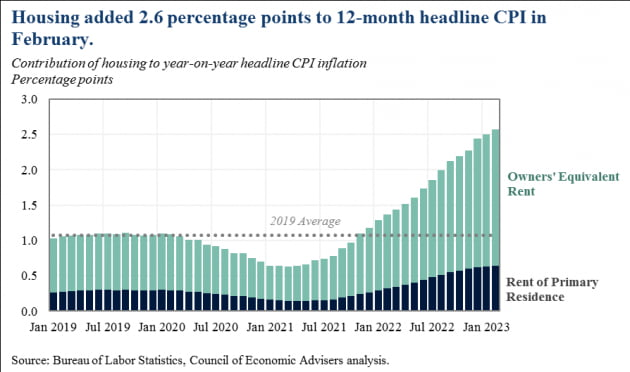

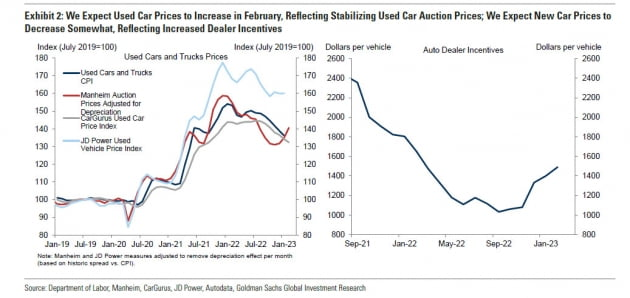

2) Housing costs continue to rise, and used car prices unexpectedly fall

Energy prices fell 0.6%, thanks to a 1% increase in gasoline and an 8% drop in natural gas. This was offset by a 0.4% rise in food prices. At the core, housing costs were responsible for 70% of the increase, rising 0.8% in a month, accelerating from 0.7% last month. Chairman Jerome Powell said housing costs would slow over time, but they haven't yet. Meanwhile, used car prices dragged CPI down a lot, falling 2.8%. This was a bit of a surprise, given that the Mannheim Used Car Index has been rebounding since late last year.

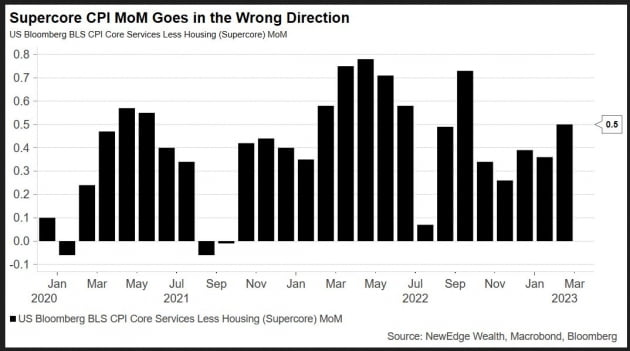

3) Rebound in the super-core

Chairman Powell has consistently stated that he is watching "services inflation excluding housing" - that goods prices are coming down, and that housing costs will slow over time. This services inflation excluding housing (super-core inflation) rose 0.5% MoM in February, up from 0.36% in January. This is considerably higher than the pre-pandemic average of a 0.2% rise.

4) The headlines are slowing, but the underlying...

Monthly numbers are volatile, so Wall Street analysts look at trends by annualizing the three-month numbers. If we annualize the headline month-over-month numbers for the last three months (December, January, and February), CPI rose 4.1%, which is slower than the 4.5% in the three months before that (September, October, and November). But when it comes to the underlying numbers, the latest three-month number is 5.2%, which is higher than the 5.0% in the three months before that.

5) Declining real wages

With prices up 6% from the previous month, real average hourly earnings came in at -1.3% YoY. Hourly wages had risen 4.7% in the last employment report. The decline in wages is a positive for the Fed as it fights inflation. It's a negative because it could cause consumption to decline.

The still-high 6% inflation rate, higher core inflation, and acceleration in super-core inflation are concerns. Core services inflation, which excludes housing, or so-called super-core inflation, is reaccelerating month-over-month and this is what the Fed is watching.

There were some positives, including a decline in real wages, which some interpreted as higher housing cost inflation. The argument is that it will soon fall in line with the cooling housing market, and when it does, CPI will fall steeply. Used car prices are also rising, with the Mannheim index based on auction prices rebounding, but JD Power and CarGurus used car indexes are flat or falling. Used car inventories are also rising. This means that the downtrend could continue.

3. Fed’s Next Move: So, what does this all mean for the Fed’s Rate Hike?

🏈Bottom line: Overall, by the majority of analysts, the Feb CPI numbers were interpreted as justifying a 25 basis point hike by the Federal Open Market Committee (FOMC) next week.

- The Wall Street Journal (WSJ) noted, "The collapse of SVB and Signature Bank gave the Fed a good reason to hold off on raising rates at next week's meeting. But the latest CPI data reminded them why they had planned to keep raising rates until last week."

- The 'data-dependent' Fed is keeping an eye on employment and inflation. Today, the National Federation of Independent Business (NFIB) reported its February small business index at 90.9, which was not only above expectations (90) but also slightly higher than January (90.3). What's more, the number of small businesses reporting difficulty filling jobs increased by 2 percentage points from January.

📈The ‘25bps hike’ camp - not raising rates would undermine confidence in the Fed:

- Jefferies Economist: the February CPI pretty much seals the deal for a 25bp hike next week. There's no reason for the Fed to hold off on a hike, and no reason to go to 50bp. In his congressional testimony last week, Chairman Powell expressed concern about core service prices excluding housing and there is no relief here.

- Harvard professor Jason Furman: the Fed's pause will exacerbate financial stability risks, which could lead to more rate hikes later. It could lead to more rate hikes later, create a dangerous disconnect with market expectations, and raise inflation expectations.

- Rabobank: The Fed could pivot this time, but if they do, don't expect me to take anything they say seriously in the future.

- Michael Geffen, economist at Bank of America: The Fed still has more work to do. If the Fed succeeds in containing recent market volatility and insulating the traditional banking sector from the spread of the crisis, it could continue to raise rates gradually until monetary policy becomes sufficiently constrained.

- Priya Misra, fixed income analyst at TD Securities: Inflation remains hot. I think the Fed will hike 25 basis points next week. I don't think today's data will change that. The Fed set up a pretty big facility (Bank Term Funding Program-BTFP) for nervous banks last Sunday and I think that has staved off concerns of a liquidity crisis.

- Wells Fargo: which had joined the freeze camp the night before said the failures of SVB and Signature Bank have created a lot of uncertainty in the economic outlook. But now has reversed course, saying "with a week to go until the FOMC meeting, there is still a distinct possibility of a 25bp hike if financial stresses ease."

❄️ The ‘freeze’ camp - The aggressive rate hiking could exacerbate banks’ problems and financial stability:

- Goldman Sachs economist Jan Hetzius: He is ****one of the first to call for a rate hike freeze. He said the Fed members will be reluctant to take the risk that a rate hike will exacerbate banks' problems and run counter to financial stability.

Note) In fact, the Fed has paused tightening in the past during financial turmoil. Former Fed Chairman Paul Volcker did so in 1981, and when the UK pension crisis erupted last October, the Bank of England delayed quantitative tightening (QT) and briefly bought government bonds before starting QT a month later.

- Deutsche Bank: doesn't see a March hike, but has lowered its final rate forecast to 5.1% from 5.6%. Tightening financial conditions and financial stability risks suggest that sufficiently constrained rates are already in sight, and substantially lower.

4. Buying Opportunity or Bear Sterns moment?

Team Yes: Yes, it is a buying opportunity…

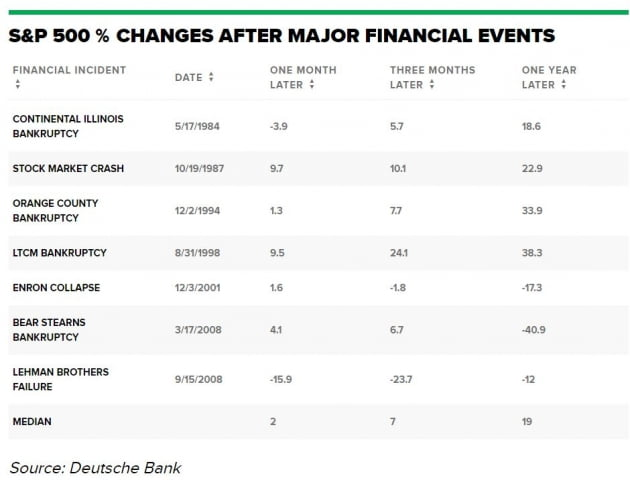

🏈Bottom line: Deutsche Bank recently analyzed that the S&P500 has risen an average of 19% over the past year following major financial market shocks and that these events have typically provided investors with good stock-buying opportunities as interest rates have fallen.

Strategist Alan Ruskin said, "Stocks show significant weakness as a crisis unfolds. But after one to three months, they rebalance and rise. The 2008 financial crisis was an exception to this rule.”

Team No: No, a crisis like the one in 2008 is coming.

🏈Bottom line: The idea is that as stress builds from continued austerity, high inflation will force the Fed to keep raising rates, and eventually a crisis or recession will hit.

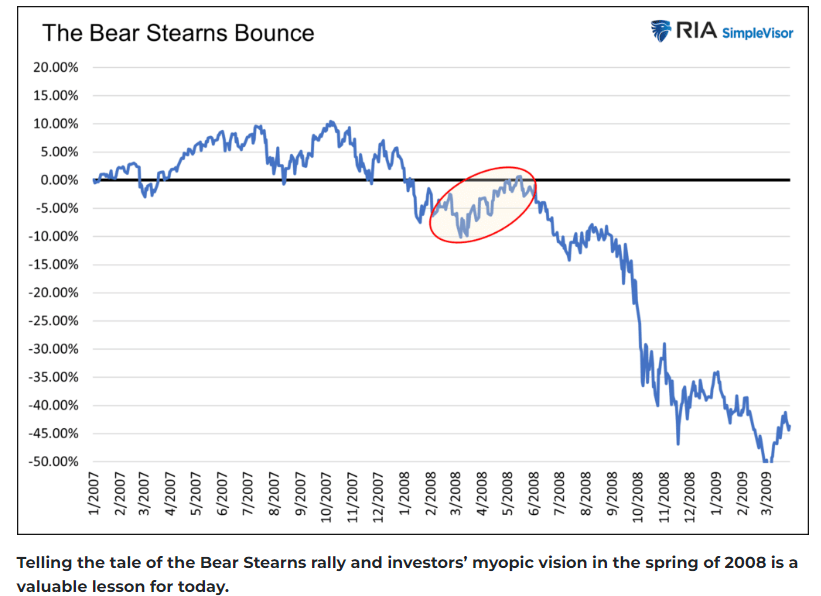

RIA recently released a report called The Bear Sterns Bounce. Bear Sterns was the first of the Wall Street financial firms to collapse in March 2008 due to its investments in subprime mortgage bonds. At the time, the Fed agreed to provide a bailout for Bear Stearns, which was in a liquidity crisis, but eventually collapsed and was sold to JPMorgan. At the time, Fed Chairman Ben Bernanke said, "We decided to support Bear Stearns, which was on the verge of bankruptcy, to prevent a failure that could have had serious consequences for the U.S. economy. Economic growth should resume in the second half of the year." But that wasn't the end of the crisis. Bear Stearns was the beginning, and the crisis spread to Fannie Mae, Freddie Mac, AIG, Countrywide, and others, until the global financial crisis erupted in September of that year. The RIA noted at the time that after Bear Stearns was acquired by JPMorgan, the S&P500 was up 15% by that summer, but eventually collapsed after the crisis erupted.

5. What’s up with Oil?

While the possibility of a bank run has been averted, international oil prices have continued to plummet yesterday.

The price of West Texas Intermediate (WTI) crude oil fell $3.47, or 4.64%, to close trading at $71.33 per barrel, its lowest since December 9th of last year. The price fell 6.98% in two days, inching closer to the $70 mark.

🏈 Bottom line: How will oil prices move? According to Morgan Stanley, "Energy markets are currently facing an unusual situation. Typically, oil and natural gas prices move in similar directions, but right now they have very different outlooks." Here is their podcast on this topic.

They said the center of gravity for natural gas has been Europe over the past 12 months. In August last year, gas prices in Europe reached €300 per megawatt hour, more than 20 times normal levels. Since then, there has been a dramatic reversal. First of all, the demand disruption was much larger than expected - the warm weather helped, but it was certainly not the main driver. At the same time, LNG imports into Europe have risen to levels that seemed impossible at this time last year. European gas prices have already fallen significantly, but energy imports continue to rise. At this rate, natural gas stocks will be full by summer. This is putting downward pressure on prices.

However, the oil market is a very different story. Oil prices gave up much of their gains late last year on recession fears.

But while 70% of Wall Street economists expect a recession, Brent crude hasn't fallen much below $80 per barrel. The oil market is currently somewhat oversupplied, which is not unusual for this time of year, but there are a few tailwinds going forward.

The first is the continued recovery of the aviation sector, which will drive jet fuel consumption.

The second is China's economic reopening. While there are some concerns in other markets, there have been positive signs so far in the crude oil market.

Finally, there are supply risks from Russia. Taken together, it is likely that oil prices will be balanced in the second quarter and that we will see a supply shortage once again in the third and fourth quarters. Inventories are already low and are expected to fall further in the second half of the year. OPEC's spare capacity is still very limited and investment levels have been low in recent years. Oil prices are likely to rise again. In inflation-adjusted terms, the average oil price over the past 15 years is $93 per barrel. The market is not looking for oil prices to fall below this historical average. We see the opposite.

![Obsidian Brief] When Money Becomes Software: AI, Stablecoins & Bitcoin — Implications for Sustainable and Impact Investing](/content/images/size/w720/2025/12/Gemini_Generated_Image_dppem0dppem0dppe.png)

![Leadership] AI Is Changing Everything — How a CEO Managing $1.6 Trillion Stays Ahead, ft. Jenny Johnson from Franklin Templeton](/content/images/size/w720/2025/12/Screenshot-2025-12-03-060128.png)

![AI] The Future of Work, Robotics & AI Infrastructure (Elon's bold predictions: work will be optional & currency could be irrelevant)](/content/images/size/w720/2025/11/Screenshot-2025-11-22-074621.png)