March 15, 2023

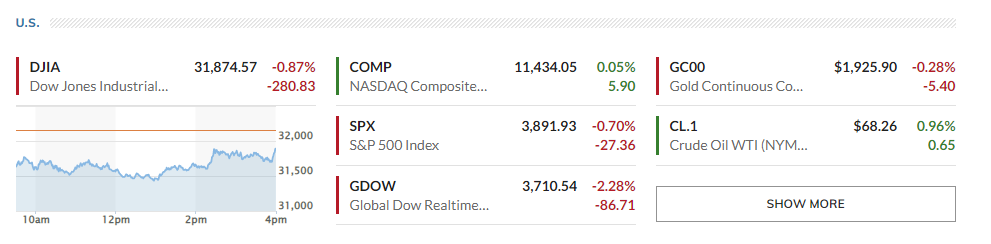

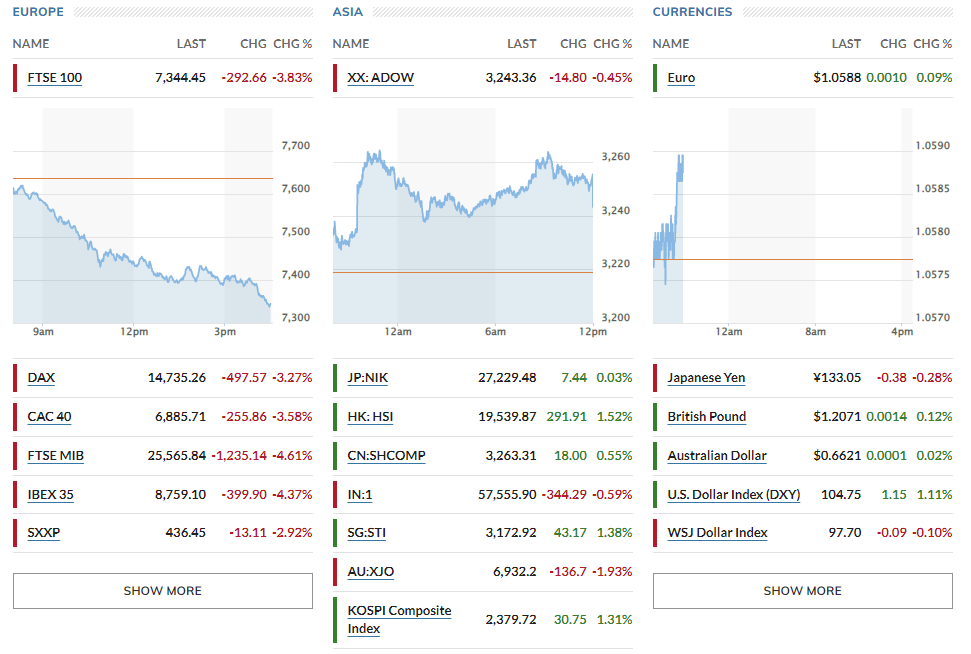

European stocks up +3%, US Stocks are mixed=S&P500 -0.70%, Nasdaq +0.05%, Dow -0.87%, Asian stocks mixed

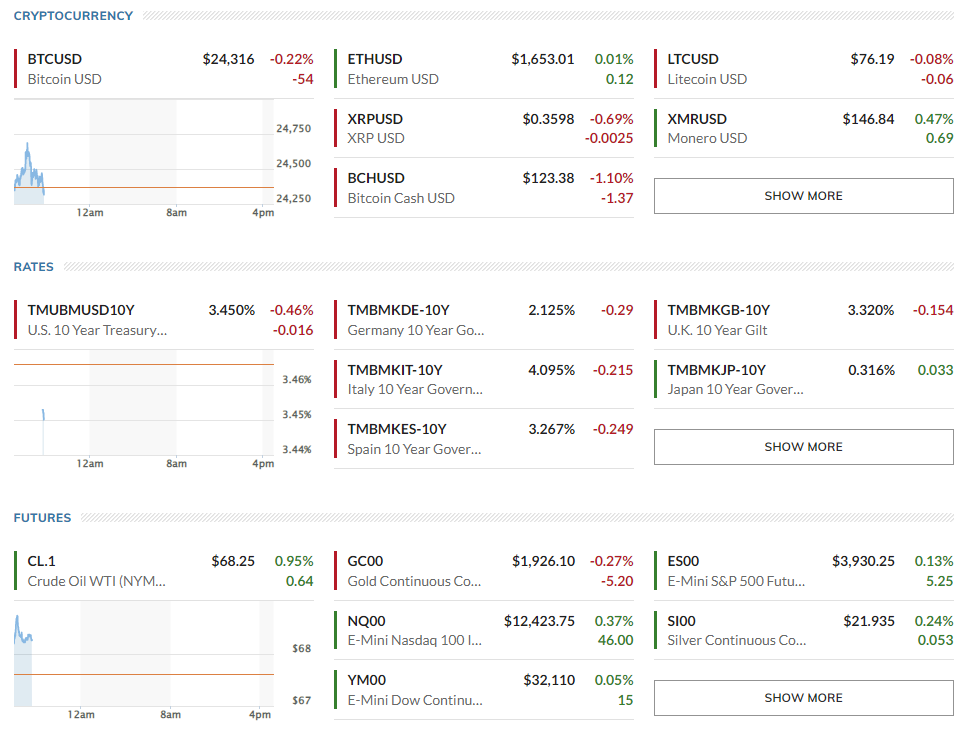

Bond rates ↓ plummet = 10-year Treasury note 3.474% (-21.7 basis points)

Oil prices ↓ plummet = $67.61 per barrel WTI (-5.2%), USD = +1.11%

*Key points

- Credit Suisse

- US Retail sales slowed

- Significant drop in US producer prices (PPI)

- All eyes on ECB

- Global Market snapshots

1. Credit Suisse

🏈Bottom line: Credit Suisse is one of the "globally systemically important banks" (G-SIBs). If it were to collapse, the impact would be different from SVB's: it has nearly 3x the assets at CHF 530 billion ($573 billion). Credit Suisse has been losing deposits due to years of bad investments and losses, and was recently cited by the U.S. Securities and Exchange Commission (SEC) for filing its financial statements late last year.

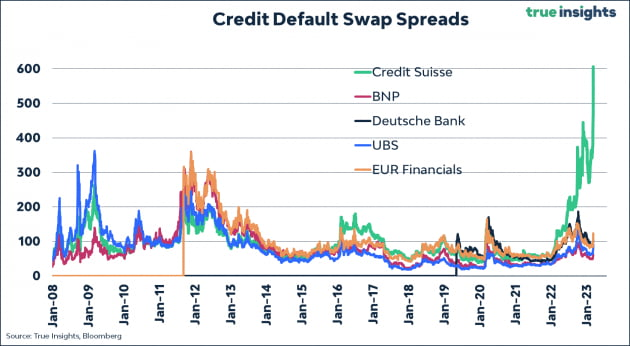

While the US banking crisis seemed to be under control, in Europe, Credit Suisse shares plunged 30% at one point, raising the possibility of a financial crisis. Other European banks, including BNP Paribas, Commerzbank, and UniCredit, followed suit.

Nowhere have these recession fears been better reflected than in the price of oil. West Texas Intermediate (WTI) crude oil fell 5.2% to $67.61 per barrel, its lowest price since Dec. 3, 2021, and the first time it has breached the $70 per barrel mark in more than a year and four months. Brent crude oil also plunged nearly 5% to $73 per barrel.

Meanwhile, safe havens gold and the dollar were equally in demand, rising 1.1%. Interestingly, the Swiss franc, usually a safe haven, fell more than 2% against the US dollar. The impact of Credit Suisse.

Today's plunge was triggered by Saudi National Bank (SNB) Chairman Amar al-Qudairi, Credit Suisse's largest shareholder (9.9% stake), saying in a Bloomberg TV interview that the bank was not considering further capital infusions into Credit Suisse - it can't buy more than a 10% stake in another bank because of legal rules. In response, one-year credit default swaps (CDS), which hedge the risk of Credit Suisse defaulting, jumped nearly 1000 basis points (10%).

This has had an impact on US markets as well. The 10-year U.S. Treasury note fell nearly 20 basis points to 3.50% this morning, and the 2-year note dropped more than 30 basis points to 3.97%, as investors continue to worry that the banking crisis that started in the U.S. could be contagious.

*If Credit Suisse collapses, will U.S. banks falter?

Wells Fargo analyst Mike Mayo: Given that the Credit Suisse issue is not new news, U.S. banks have been preparing for a potential eventuality, and if something were to happen, JPMorgan would be the strongest, with Citi being a relative beneficiary. It has been reported that large US banks' exposure to Credit Suisse appears to be manageable.

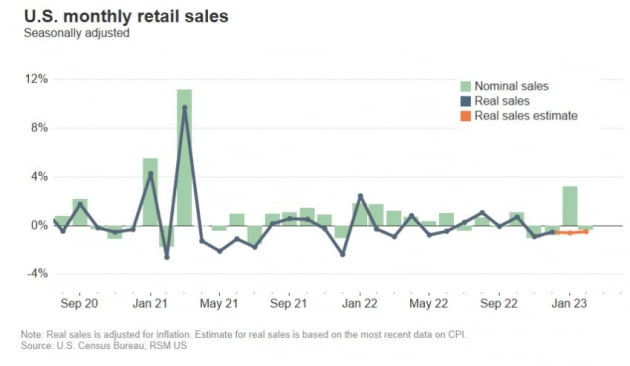

2. US Retail sales slowed

🏈Bottom line: Retail sales fell 0.4% in February MoM. This was in line with expectations, which is very good news for the Fed as it wants to slow the economy.

The January number, which surprised the market, was revised higher to a 3.2% increase from the original 3.0% increase. That's a jump from December's 1.1% decline. The decline in February retail sales included a -1.8% drop in autos, -2.5% in furniture, -4% in department stores, and -2.2% in eating out. However, excluding autos, February retail sales were only down 0.1% from the previous month, and excluding autos and gasoline, they were flat. Notably, the "control group" of items, which excludes volatile factors like motor gasoline, building materials, and eating out, rose 0.5% in February, following a 2.3% gain in January. This is indicative of the underlying strength of consumer spending."

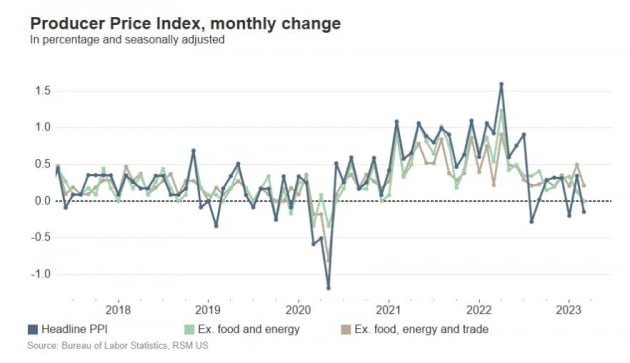

3. Significant drop in US producer prices (PPI)

🏈Bottom line: February's Producer Price Index (PPI) also fell 0.1% MoM, but it was significantly below expectations (up 0.3%).

January's figure was also revised down from a 0.7% rise to a 0.3% rise. The drop was largely driven by a 2.2% drop in food prices, as soaring egg prices reduced demand for final goods by 0.2%. On a YoY basis, it was up 4.6% in February (5.7% in January). Excluding energy and food, core PPI rose 0.2% MoM (up 0.5% in January) and 4.4% YoY (up 5% in January).

Some point to the 0.8% drop in "trading service" prices in February, following a 1.1% drop in January, which is a proxy for margins at retailers. A positive sign for slowing inflation, but potentially a threat to corporate margins.

Elsewhere, the Federal Reserve Bank of New York's Empire Manufacturing Index for March fell 18.8 points from the previous month to -24.6, much worse than expected (-7.8). In January, business inventories fell 0.1%, the first decline in two years. The National Association of Home Builders' (NAHB) March Housing Market Index (HMI) came in at 44, two points higher than the previous month, and mortgage applications increased 7.3% last week.

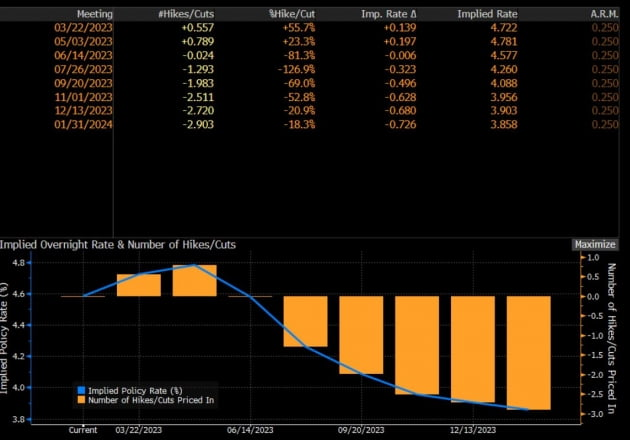

The Fed's final rate forecast has come down to the same 4.7% level as it is now (4.5-4.75%), and the betting is that it will start lowering rates in June and cut 100 basis points by the end of the year.

*What does this mean for the Fed?

🏈Bottom line: Based on market rates and price changes in the fed funds futures market, the market now believes the Fed is done tightening, or that next week's 25 basis point hike is the last.

- Goldman Sachs revised its forecast for U.S. GDP growth this year by 0.3% to 1.2%, citing the banks' deposit withdrawals. They assume that small and medium-sized banks will reduce new lending by about 40%.

- Thorsten Slock, Apollo Asset's economist: first raised the no-landing scenario. "When the facts change, my view changes. The no-landing is turning into a hard landing due to the credit crunch. Small banks, which account for 30% of all U.S. loans, are now likely to spend several quarters tending to their balance sheets. This will mean much tighter lending standards for businesses and households, even when the Fed starts cutting rates later this year. The Fed will not raise rates next week, and we have likely already seen the peak in both short- and long-term rates.

4. All eyes on ECB

🏈Bottom line: The European Central Bank's (ECB) March monetary policy meeting is tomorrow. 50bps rate hike most likely. ECB's decision can help investors infer the FOMC outcome next week.

The ECB has been calling for a 50 basis point hike in March, because inflation is so high. But after the Credit Suisse debacle, former ECB Executive Board member and Societe Generale President Lorenzo Vini Smaggi argued that they should keep rates on hold. That would increase financial market anxiety. In fact, the market was expecting a 50 basis point hike yesterday, but today they cut it to 30 basis points. What will the ECB do in this situation? It will be a good indication of how central bankers view the current banking crisis.

5. Global Market snapshots

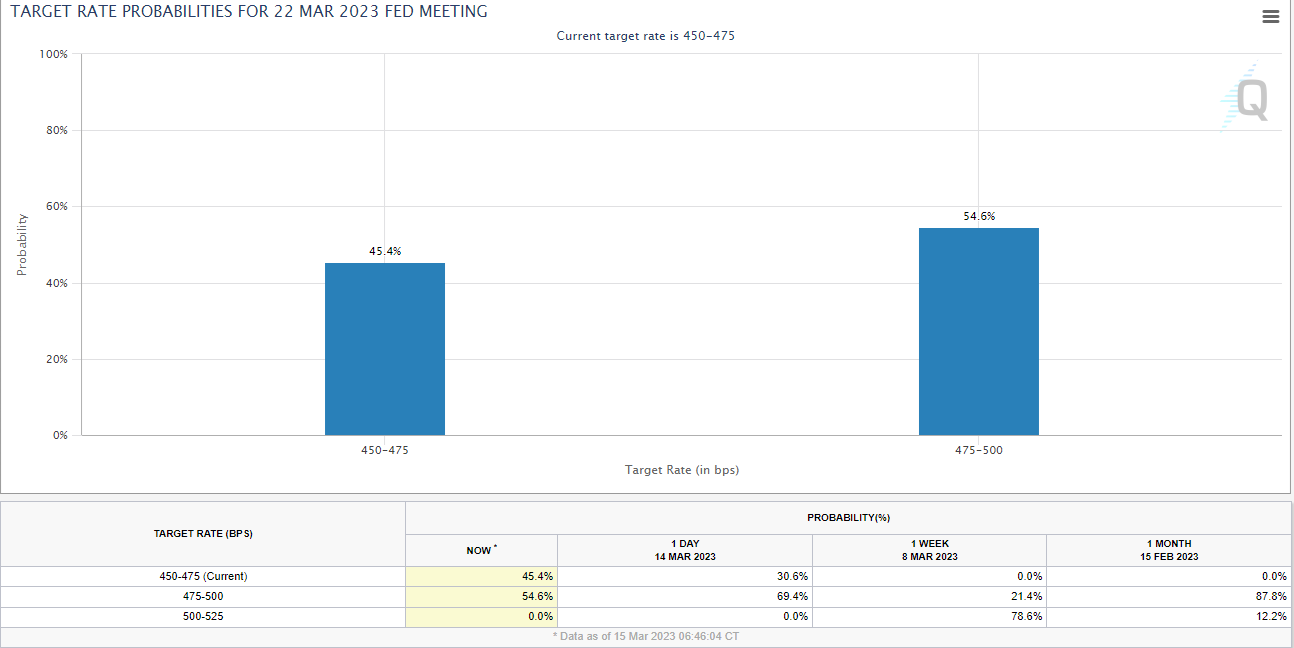

Expectations for a March hike on the Chicago Mercantile Exchange (CME) Fed Watch market were as high as 70% at one point. In the end, it traded around 50% - a 50/50 chance of a hike or a 25 basis point hike. As of 11:30pm London time on March 15, it reads 54.6% for 4.75-5.00% vs. 45.4% for 4.50-4.75.