March 16, 2023

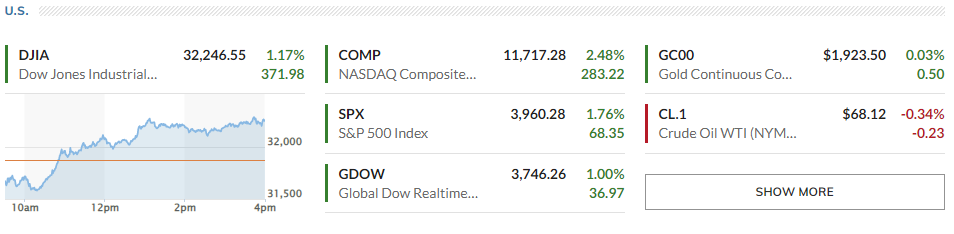

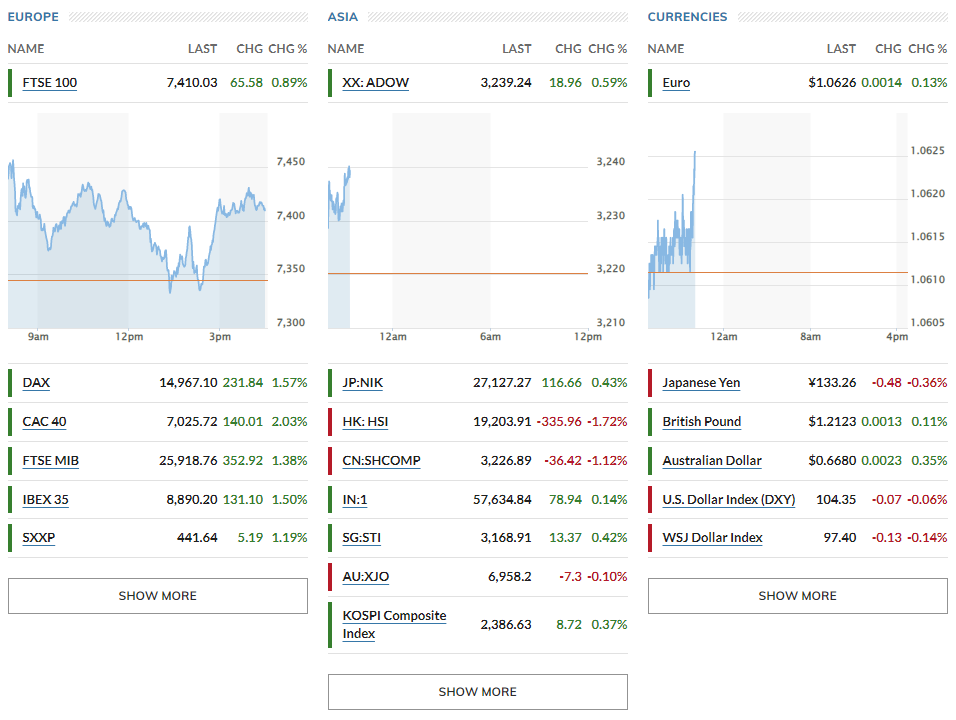

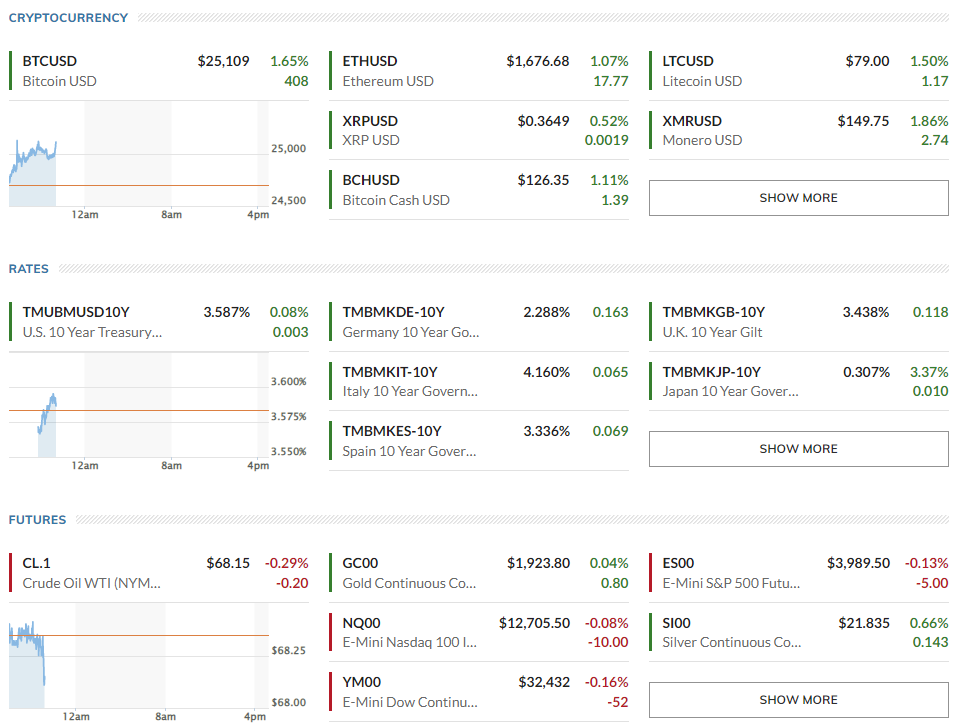

European stocks up around 1-2%/US stocks surge=S&P500 up 1.8%, Nasdaq up 2.5%, Dow up 1.2%/Asian stocks mixed.

Interest rates spike=10-year U.S. Treasury note 3.580% (+11.4 basis points), Bund 10Y up by 0.163 to 2.288%, UK 10Y, up by 0.118 to 3.438%, JP 10Y at 0.307%.

Oil prices rose = $68.1 per barrel of WTI (+0.7%), USD -0.06%, JPY -0.36%

*Key points

1. Credit Suisse - a profitability problem, not an asset quality problem

2. ECB's 50bps rate hike

3. Mixed US economic data release

4. Project White Night for First Republic

5. Fed's balance sheet has grown!

6. What sell-side research is saying

7. Global Market snapshots

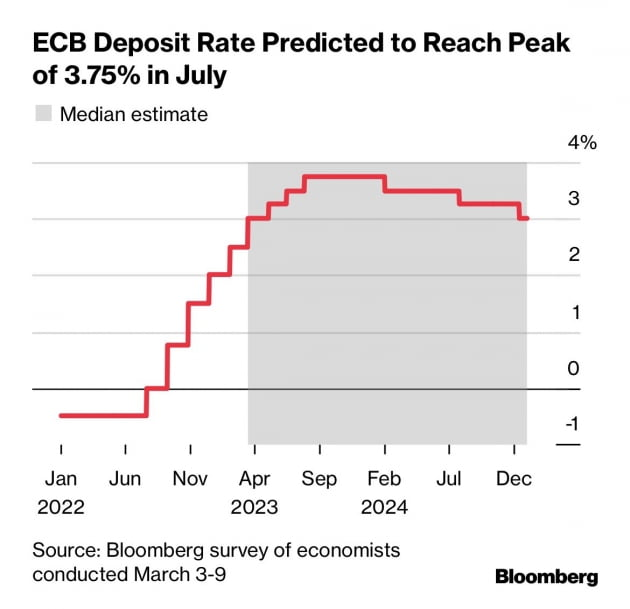

After the ECB's rate decision, sovereign bond yields across Europe plummeted, because it was seen as "dovish." The 10-year German bund yield fell from 2.193% before the announcement to 2.145% after the announcement.

European equity markets regained strength, with Germany's DAX up 1.57% and France's CAC up 2.03% to end the day.

In the New York bond market, the 2-year U.S. Treasury yield rose and the 10-year fell. The ECB's move was attributed to the growing expectation that the Fed will also raise rates at its Federal Open Market Committee (FOMC) meeting next week, so the two-year yield rose to reflect tighter monetary policy and the 10-year fell on fears of a deeper recession. The Chicago Mercantile Exchange's FedWatch market also increased the odds of a 25 basis point hike in March to more than 70%.

1. Credit Suisse - a profitability problem, not an asset quality problem

🏈Bottom line: On the night of the 15th, Credit Suisse urgently announced that it had agreed to borrow up to 50 Bn Swiss francs from the Swiss National Bank (SNB). This came just hours after the SNB said it would "provide liquidity to the bank if needed." It also agreed to buy back $3.2 Bn worth of senior bonds. Its stock price, which had plummeted the day before, rose over 19% on the 16th. Other European banks also recovered.

- JP Morgan: The status quo at Credit Suisse is untenable and there are three scenarios. Scenario 1) a takeover by fellow Swiss bank UBS. (Bloomberg reported this afternoon that Credit Suisse has opposed a forced merger with UBS.) Scenario 2) is for the Swiss National Bank to inject capital, a sort of nationalization and restructuring. Scenario 3) is for the bank to shut down on its own, which could increase market anxiety.

Their harsh assessment of Credit Suisse comes on the heels of a number of "busts" over the past few years, including involvement in drug money laundering in Bulgaria and corruption in Mozambique, which resulted in large fines and reputational damage, as well as an internal executive spying scandal. It's also been criticized for having lousy internal controls, having been involved in the bankruptcy of fintech Greensil in 2011 and Bill Huang's Arkegos Capital, which blew $8 billion, so it's not making money.

2. ECB's 50bps rate hike

🏈Bottom line: Despite the banking turmoil, the ECB went ahead with a 50 bps hike, making it three big steps in a row after December and February. But there was a difference: last month's 50 bps hike included clear forward guidance in the statement, saying "we will raise rates by 50 basis points in March." This time around, they took that out. Instead, it reads, "The banking sector is resilient and the ECB has the means to provide sufficient liquidity to support the financial system if necessary."

Governor Christine Lagarde acknowledged that "there is still a lot of work to be done," but qualified that "that's assuming the current baseline outlook is sustained (no financial shocks)." Lagarde explained that three or four members disagreed with the decision, "they wanted to take time to see what was going on."

3. Mixed economic data release

- Weekly jobless claims (~March 11) came in at 192k, lower than the previous week (212k) or Wall Street expectations (205k). We're back below 200k again.

- Employment is still holding up, and the housing market also showed signs of rebounding. Housing starts in February were up 9.8% from the previous month, and building permits were up 13.8% from the previous month

4. Project White Night for First Republic

🏈Bottom line: Just before the close, 11 banks, including JPMorgan, deposited $30 billion in First Republic. Wall Street took note of JPMorgan's leading role.

Note) JPM had stepped in as a white knight when Bear Stearns was in crisis in March 2008 and agreed to buy it for $2 per share, ended up paying $10 per share after a backlash from Bear Stearns shareholders and a lawsuit. Jamie Dimon, CEO of JPMorgan, has said many times since that he would "never participate in a government-led bailout deal again." Today, he's back as a white knight, only this time, because of that bad experience, he's taking deposits rather than injecting capital to buy the bank. First Republic is soaring in regular trading, but it's crashing again in after-hours trading. It's been pointed out that the injection of deposits rather than capital may have been a stopgap measure.

5. Fed's balance sheet has grown!

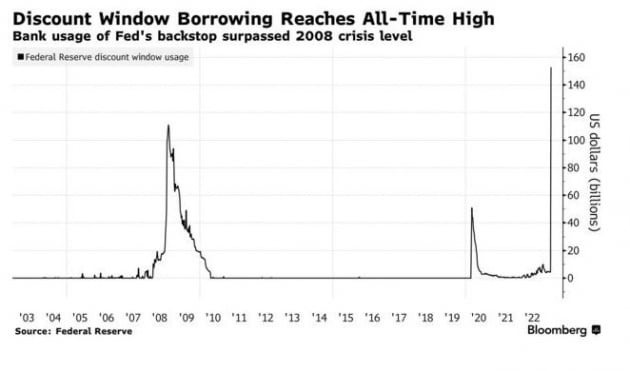

🏈Bottom line: Statistics released by the Fed show that its balance sheet grew by $297 Bn over the past week, with $142.8 billion lent to BridgeBank, which was created by closing Silicon Valley Bank and Signature Bank, and $11.9 Bn already lent from the Bank Term Funding Program (BTFP), which it announced last Sunday it would establish.

Funds supplied through the existing rediscount window also surged to $152.8 Bn, up from $4.6 Bn a week earlier. In the midst of quantitative tightening (QT), money is being released to clean up the banking mess, and this has to be a positive for the markets. This morning, JPMorgan analyzed that up to $2 trillion of liquidity could be released through the BTFP.

6. What sell-side research is saying

1. If the banking turmoil subsides, will recession fears go away?

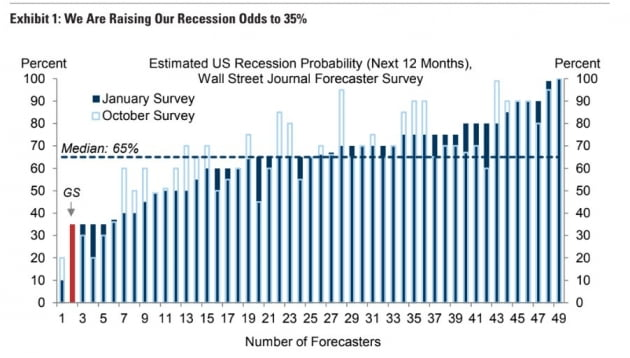

No. The probability of a recession that Wall Street expects has certainly increased after this turmoil. The observation is that many banks, seeing the liquidity crisis at other banks, will tighten their belts and tighten the reins on lending, which will slow the economy.

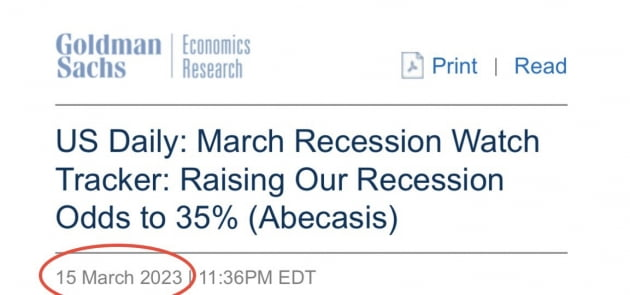

Goldman Sachs this morning raised the probability of a U.S. economic recession over the next 12 months to 35% again, citing increased near-term uncertainty due to stressed small and medium-sized banks. The bank, which has been at 35% since last year, lowered it to 25% a month ago, on February 15, and then raised it again. Of course, it's still below the Wall Street consensus of 60%. Yesterday, Goldman revised its forecast for U.S. GDP growth this year by 0.3 percentage points to 1.2%, saying, "We expect small and mid-sized banks to reduce new lending by as much as 40%." JP Morgan also said the slowdown in loan growth at small and mid-sized banks has the potential to reduce GDP by 0.5 to 1% in a year or two.

2. Bank stocks are rebounding after a sharp decline. Is it time to buy low?

🏈Bottom line: It's time to sell. The banking industry is facing pressures on multiple fronts, which will lead to disappointing profit growth and long-term underperformance.

Even if the turmoil doesn't turn into a financial crisis, BCA Research recommends selling bank stocks as they bounce back. BCA Research cited central banks' tightening monetary policy as the main reason, noting that it reduces banks' loan demand while triggering deposit withdrawals, exacerbating the mismatch of assets and liabilities. They also believed that the economic slowdown caused by the tightening would lead to higher loan delinquencies and more defaults; net interest margins would be squeezed as banks would have to pay higher interest on deposits in line with rising market rates; and corporate finance would contract as even healthy companies cut back on mergers and acquisitions.

It also estimated that the crisis would lead to higher deposit insurance premiums and increased regulation, requiring more capital.

7. Global Market snapshots

![Obsidian Brief] When Money Becomes Software: AI, Stablecoins & Bitcoin — Implications for Sustainable and Impact Investing](https://images.unsplash.com/photo-1657408056887-c8c627f7574a?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDF8fHN0YWJsZWNvaW58ZW58MHx8fHwxNzY0NzM0MTExfDA&ixlib=rb-4.1.0&q=80&w=720)

![Finance | Leadership] Breaking into Finance: A Real-World Guide for Students and Future Leaders (technical and behavioral tips: lessons learned from a 15-year journey in Wall Street & City of London) - Part 5/5: Analyst level Deep-dive career guides](https://images.unsplash.com/photo-1537211568975-f95f2101c8f5?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDE1fHxtb250JTIwYmxhbmN8ZW58MHx8fHwxNzY0NTU3NzQ1fDA&ixlib=rb-4.1.0&q=80&w=720)

![Finance | Leadership] Breaking into Finance: A Real-World Guide for Students and Future Leaders (technical and behavioral tips: lessons learned from a 15-year journey in Wall Street & City of London) - Part 4/5: Interview Prep Tips](https://images.unsplash.com/photo-1605128005752-d1714260611e?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDF8fG1vbnQlMjBibGFuY3xlbnwwfHx8fDE3NjQ1NTc3NDV8MA&ixlib=rb-4.1.0&q=80&w=720)