March 17, 2023

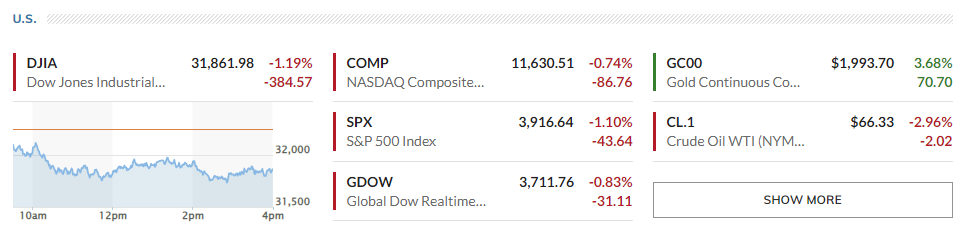

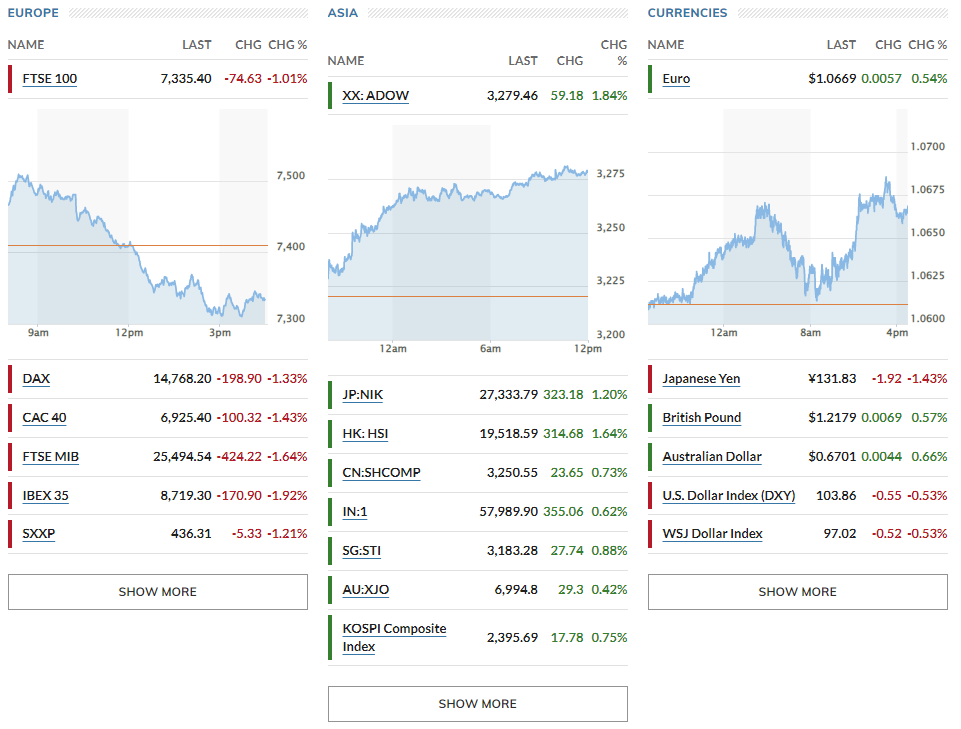

European stocks all down between -1 ~ -1.9%/ US Stocks fell = S&P500 -1.10%, Nasdaq -0.74%/ Asian stocks up +0.4 ~ +1.84%

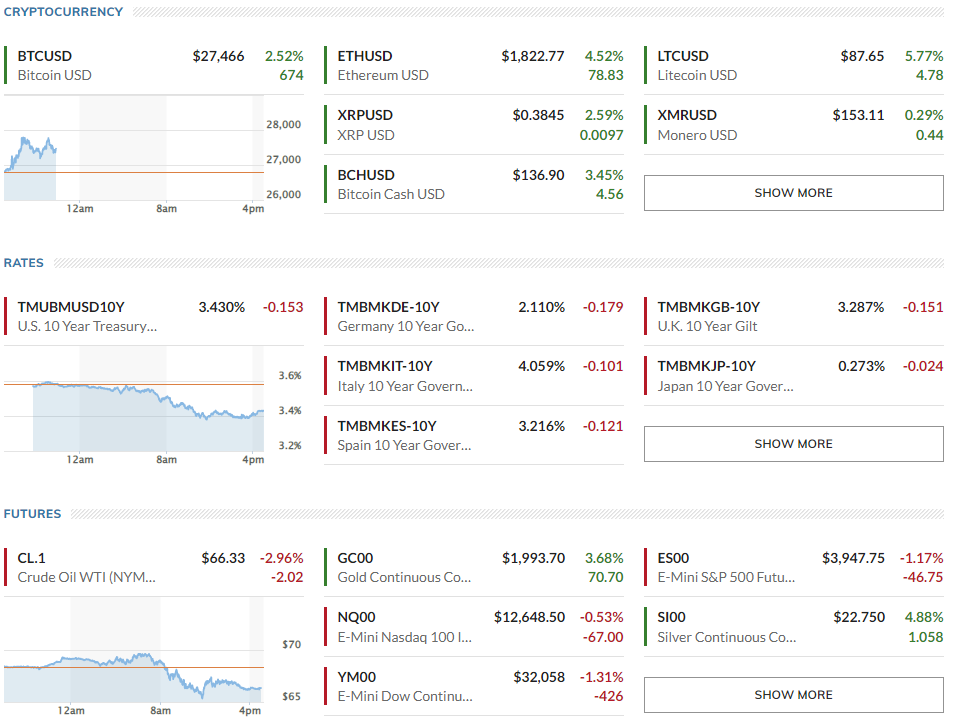

Interest rates plummeted = 10-year U.S. Treasury note 3.430% (-15.3 basis points)

Oil prices plummeted = $66.74 per barrel WTI (-2.36%) / USD -0.53%

*Key points

1. Re: Credit Suisse & First Republic Bank

2. Economic data only added to recession fears

3. FOMC next week

4. Larry Summers' take on the Fed

5. US - Russia - China's Love Triangle

6. Global Market snapshots

1. Re: Credit Suisse & First Republic Bank

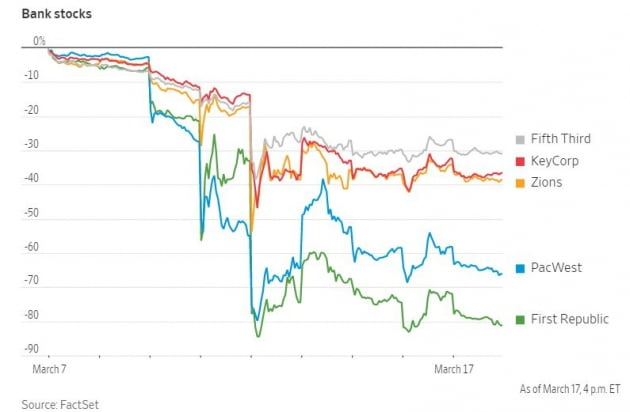

🏈Bottom line: It's been a historic week. The banking turmoil continued. Credit Suisse borrowed money from the Swiss National Bank, and First Republic Bank in the U.S., which had been billed as the "next Silicon Valley Bank" (SVB), received a $30 billion deposit infusion from JPMorgan and others, but the market decided it wasn't enough. On the 17th, their stocks plunged again, and other bank stocks fell with them, as well - temporary liquidity, but not the underlying financial strength that comes with capital infusions.

If the banking turmoil continues, a recession looks increasingly likely. Goldman Sachs and JP Morgan have already cut their U.S. growth forecasts by small increments as banks cut back on lending, which in turn reduces business investment and hiring.

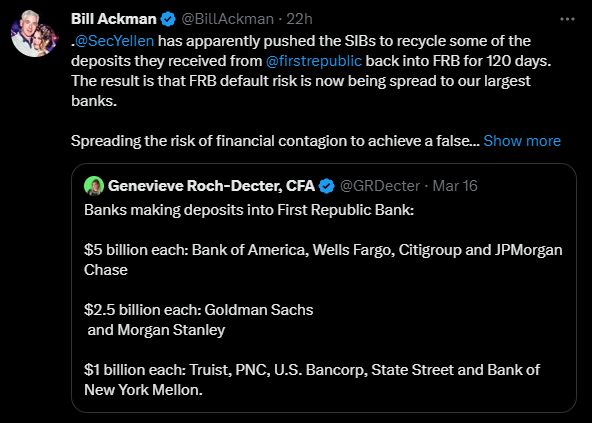

- Bill Ackman: It appears that Treasury Secretary Janet Yellen pressured the big banks to bring back some of the deposits that flowed out of First Republic for another 120 days. As a result, the risk of First Republic's failure is spreading to the big banks. Spreading contagion risk to secure First Republic's false confidence is bad policy. The announcement of $30 billion in deposits raises more questions than it answers. In a crisis of trust, half-measures don't work.

- Piper Sandler, Goldman Sachs: The $30 billion in deposits is much-needed liquidity to respond to short-term deposit outflows in an orderly fashion, but it is uncertain if it is a long-term solution and has the potential to significantly impair earnings. While the $30 billion liquidity injection should help ease investor concerns, First Republic's profits could take a hit given that the funds were backed by higher interest rates. In fact, First Republic had announced the previous afternoon that it was suspending its dividend.

- Wells Fargo: changed its forecast for the U.S. economy to enter a recession starting in the third quarter. Previously, the company saw a recession starting in the fourth quarter and a mild downturn through the first quarter of next year, but now it sees a downturn lasting three quarters, from the third quarter of this year to the first quarter of next year. The uncertainty will likely cause corporate bond spreads to widen further and many banks to tighten their lending standards, at least in the short term, which will lead to slower business growth and a headwind for U.S. gross domestic product (GDP). Wells Fargo expects companies to reduce fixed investment spending and rein in hiring plans starting next quarter. Tighter financial conditions will lead to slower growth, which in turn will lead to further tightening and slower growth, setting in motion a vicious cycle. It is projecting a 1.2% contraction in real GDP by the end of this year and early 2024. These assumptions are based on the assumption that financial authorities will use their tools to stem the crisis. Their unwillingness or inability to use these tools could have more severe economic consequences than we expect.

- Note) Stocks didn't do too badly back in September 2008, when the possibility of a global financial crisis was looming. On September 7, 2008, Fannie Mae and Freddie Mac went into government conservatorship; on the 15th, Lehman Brothers went bankrupt; and on the 16th, the acquisition of AIG was announced. The S&P500 was at 1243.31 on September 5, and on September 16 it was at 1213.60. It didn't go down that much; it even rebounded to 1255.08 on the 19th. A Wall Street insider said, "As financials faltered, expectations for a Fed put (supportive policy) grew. However, as the recession became more apparent, the downward trend began in earnest in October."

2. Economic data only added to recession fears

🏈Bottom line: The indicators all pointed to a slowdown, and in a normal world, the markets would have cheered. But now nervous about the ongoing financial turmoil, markets interpreted it as a sign that a recession was looming.

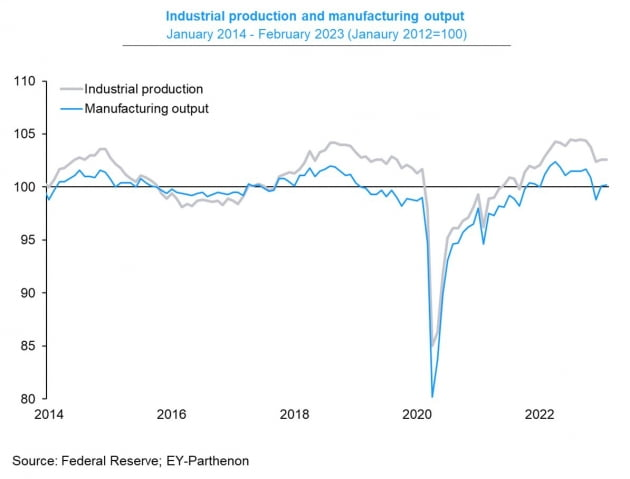

- US Industrial production was flat in February, lower than January (up 0.3% vs. expected +0.2%). Manufacturing production, the largest component, rose 0.1%, but was offset by declines in mining (-0.6%) and utilities (-0.5%) production. Capacity utilization was 77. Markets expect Industrial production to slow further in March as credit supply tightens due to recent financial market turmoil.

- The Conference Board's Leading Economic Index (LEI) fell 0.3% MoM to 110 in February, which was in line with expectations. It has fallen for 11 consecutive months and is down 6.5% YoY. What's more, these numbers were taken before the recent banking turmoil, including the SVB debacle. The Conference Board said, "The recent banking turmoil is not reflected in the index. "The combination of rising interest rates and slowing consumption is likely to push the U.S. economy into recession sooner rather than later," the Conference Board said.

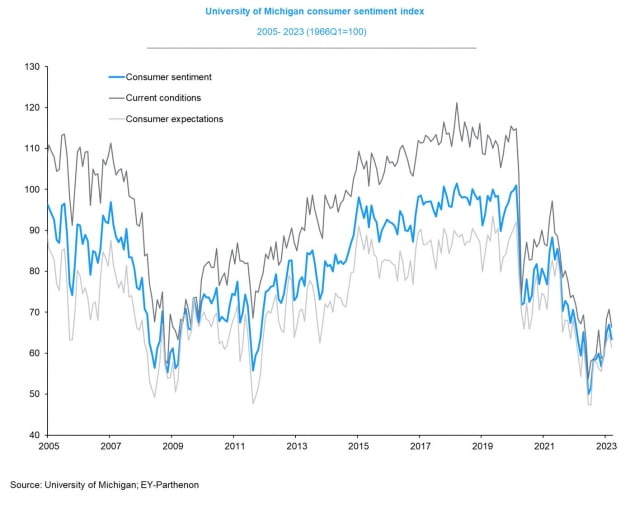

- The University of Michigan Consumer Sentiment Index (preliminary) for March came in at 63.4, down 3.6 points from the previous month (67.0), the first decline in four months. The current conditions index fell 4.3 points from the previous month to 66.4, while the expectations index, a measure of future outlook, fell 3.2 points to 61.5. As the indexes fell, so did inflation expectations. One-year inflation expectations fell to 3.8%, down from 4.1% in February. This is the lowest level since April 2021. Five-year inflation expectations slowed to 2.8% from 2.9% in February. The University of Michigan noted that "85% of the survey had already been completed before the SVB burst. There was plenty of downward momentum even before then. The decline in consumer sentiment was concentrated among lower-income, less-educated, younger consumers and the wealthiest third who own a lot of stock. Expected inflation is likely to remain unstable in the coming months amid financial sector turmoil."

- Market reactions: Rates rallied as safe-haven sentiment grew. 10Y Treasury note fell 15.3 basis points to 3.430%. The two-year was down 36.2 basis points to 3.825%. In the case of the two-year, slowing economic and inflation expectations have added to expectations that the Fed will hike next week. According to the Chicago Mercantile Exchange's (CME) Fed Watch market, the odds of a March hike have climbed back to 41%, up from 20.3% the day before. Bets on a 25 basis point hike fell from 79.7% to 59%. US equity markets opened on a weak note. As economic data poured in at 10 am, the downward spiral intensified. In the end, the Dow lost 1.19%, the S&P500 fell 1.10%, and the Nasdaq closed down 0.74%.

- It's not just stocks that are down today. Many assets are down. Oil prices are a prime example. The price of West Texas Intermediate (WTI) crude, the U.S. benchmark, closed at $66.33 per barrel, down 2.96% from the previous session. This is the lowest since December 3, 2021. It's down 12.96% this week alone, and 16.24% in the last two weeks. Even the dollar is down -0.53%. Only bond prices and gold (+2.60%) are up.

3. FOMC next week

🏈Bottom line: Market attention has now turned to the FOMC meeting next week on the 21st and 22nd - what will Chair Jerome Powell do, and will he act like European Central Bank (ECB) President Christine Lagarde, who stood firm and raised rates by 50 basis points this week in the face of the Credit Suisse debacle?

A Reuters survey of economists out today shows 76 of 82 expect a 25 basis point hike. Five predict a hold, and only one economist at Nomura predicts a 25 basis point cut. Bank of America, JPMorgan and others expect a 25bp hike, while Goldman Sachs and Wells Fargo see a freeze. There's not much confidence. "It's a close call (25bp or zero) because it depends on where the market is when the Fed meets next week," says Bank of America economist Ethan Harris. Nick Timiraos, a Wall Street Journal reporter who has been called "the Fed's unofficial spokesman," said, "The decision on whether to raise rates by 25 basis points or leave them unchanged at next week's meeting may depend on what happens next.

4. Larry Summers' take on the Fed

🏈Bottom line: In his interview today, he expressed concern about the Federal Reserve's potential dominance over the market. He emphasized that the Fed should not prioritize the banking system over the need to raise interest rates promptly, noting a 25bps rate hike will be appropriate. Overall, he believes that policymakers should prioritize the fight against inflation while being mindful of the impact on the financial system.

Although the banking turmoil may slow credit creation, he argued that the amount of Fed tightening removed from market prices would have a more significant impact. If the Fed reacts too strongly to the banking turmoil and changes the path of interest rates, it could lead to investors losing confidence. On the other hand, if the Fed backs off, it could fuel inflation expectations.

Given the current conditions, he thinks a 25 basis point rate hike is appropriate, despite the rapidly changing situation. He also praised the European Central Bank's decision to raise rates by 50 basis points and commended its president, Christine Lagarde, with an A+ for her clear message that different tools can be used to address inflation and financial stability.

5. US - Russia - China's Love Triangle

🏈Bottom line: March 20th and 21st - Chinese President Xi Jinping will be visiting Russia. He'll meet with Putin over two days. Some are hoping that Chinese mediation could lead to a ceasefire between Russia and Ukraine, just as it did between Iran and Saudi Arabia when they suddenly made peace. It's unlikely, but if it happens, China's influence could grow in Europe after the Middle East. The US is nervous. White House National Security Council Coordinator John Kirby said, “We do not believe that this (China's mediation) is a step towards a just and endurable peace...A ceasefire now is effectively the ratification of Russian conquest."

6. Global Market snapshots

![Obsidian Brief] When Money Becomes Software: AI, Stablecoins & Bitcoin — Implications for Sustainable and Impact Investing](https://images.unsplash.com/photo-1657408056887-c8c627f7574a?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDF8fHN0YWJsZWNvaW58ZW58MHx8fHwxNzY0NzM0MTExfDA&ixlib=rb-4.1.0&q=80&w=720)

![Finance | Leadership] Breaking into Finance: A Real-World Guide for Students and Future Leaders (technical and behavioral tips: lessons learned from a 15-year journey in Wall Street & City of London) - Part 5/5: Analyst level Deep-dive career guides](https://images.unsplash.com/photo-1537211568975-f95f2101c8f5?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDE1fHxtb250JTIwYmxhbmN8ZW58MHx8fHwxNzY0NTU3NzQ1fDA&ixlib=rb-4.1.0&q=80&w=720)

![Finance | Leadership] Breaking into Finance: A Real-World Guide for Students and Future Leaders (technical and behavioral tips: lessons learned from a 15-year journey in Wall Street & City of London) - Part 4/5: Interview Prep Tips](https://images.unsplash.com/photo-1605128005752-d1714260611e?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDF8fG1vbnQlMjBibGFuY3xlbnwwfHx8fDE3NjQ1NTc3NDV8MA&ixlib=rb-4.1.0&q=80&w=720)