March 21, 2023

▶US Stocks up = S&P500 +1.30%, Nasdaq +1.58, Dow +1%,

▶Rising interest rates = 10-year U.S. Treasury note 3.607% (+12.2 basis points)

▶Oil prices rose = $67.64 per barrel of WTI (+1.35%)

*Key points

- Markets overview

- US Macro data

- Bank of America's March Fund Manager Survey Results

- Goldman Sachs trading desk (Brain Bingham)'s take on the Fed

1. Markets Overview

Markets have calmed down a bit after the banking crisis of the past two weeks. Stocks and oil prices rose, while bond prices and gold fell, as risk appetite returned.

The market is clearly recovering from the banking crisis. Bond markets were rattled over the weekend by the Swiss government's write-down of AT1 bonds as part of the UBS and Credit Suisse merger. Yesterday afternoon, the European Central Bank and the Bank of England reassured investors that shareholders will still suffer losses before AT1 bond investors which should calm fears.

Bloomberg reported that the U.S. Treasury is considering a proposal to fully insure deposits at banks of more than $250,000, easing fears surrounding local banks. The call comes from the Mid-Continent Bankers Association (MBCA), which noted all deposits are funneling into the four largest banks and risking further panic.

"Our intervention was necessary to protect the broader U.S. banking system. And similar actions could be warranted if smaller institutions suffer deposit runs that pose the risk of contagion," U.S. Treasury Secretary Janet Yellen said in a speech / video to the American Bankers Association that was released in advance at 7 am EST. The speech was released to the press at 7 am EST., three hours ahead of the bankers association event scheduled for 10 am EST. The implication is that she wants to stabilize the markets before the opening bell. Yellen didn't explicitly say that she would fully cover deposits of $250,000 or more, but she made it sound like she would, because that would require a large budget and congressional approval.

In Europe, shares of UBS rose 12.12% and banking stocks like Deutsche Bank (+6.5%) and BNP Paribas (4.15%) saw a modest recovery. Major bourses in Germany (DAX +1.7%), the U.K. (FTSE +1.79%), and France (CAC +1.42%) all rose sharply. Sovereign bond yields, which had been falling on the prospect of a banking crisis, also rose sharply. The sentiment carried over to the U.S. as well. In the New York bond market, rates continued to rise throughout the day. By 4:50 p.m., the two-year Treasury note was trading at 4.171%, up 18.0 basis points from the previous day, and the 10-year note was trading at 3.607%, up 12.2 basis points.

In the end, the Dow was up 0.98%, the S&P500 was up 1.3%, and the Nasdaq jumped 1.58%. The S&P500 closed at 4002.87, breaking through the 4000 mark again. The volatility index (VIX), which at one point last week was above 30, dropped 11.47% to close at 21.38.

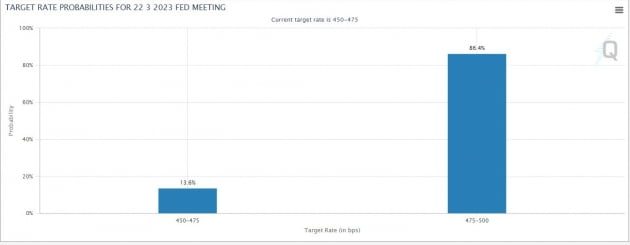

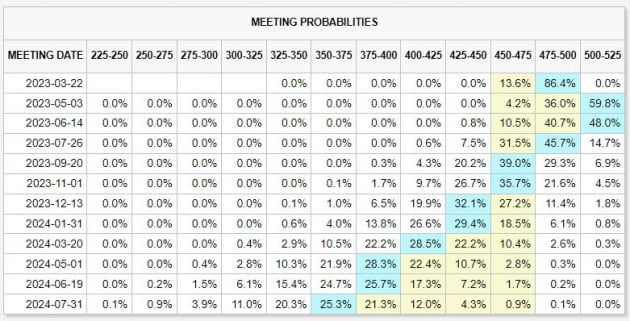

Still, there wasn't a lot of FOMC anxiety in the markets today - the banking turmoil has certainly made the Fed cautious about further tightening, and we won't be hearing any more of Jerome Powell's rhetoric about "leaving the door open for a 50 basis point hike". In fact, the FedWatch market now expects a 25 basis point hike this month (86.4%) and a 25 basis point hike in May (59.8%) to raise the fed funds rate to 5.0-5.25%, followed by a pause in June (48.0%) and a 25 basis point cut starting in July (45.7%), leaving the fed funds rate at 4.25-4.5% by year-end (32.1%). While the final rate expectations are decidedly higher than they were earlier in the week, it's the flip side of the crisis fading.

Not surprisingly, the dollar (ICE Dollar Index), which reflects monetary policy, fell 0.06% today to 103.22, its fourth straight day of losses (and eight of the last nine) and its lowest level in a month.

2. US Macro data

- Existing home sales increased 14.5% MoM to an annualized rate of 4.58 million in February, according to the National Association of Realtors (NAR). Not only did it break a 13-month streak of declines, but it was also the largest increase since July 2020. It also significantly beat Wall Street expectations (up 5.0%). What's more, the median sale price in February was down 0.2% from a year earlier to $363,000. It was the first drop in nearly 11 years (131 months) since February 2012.

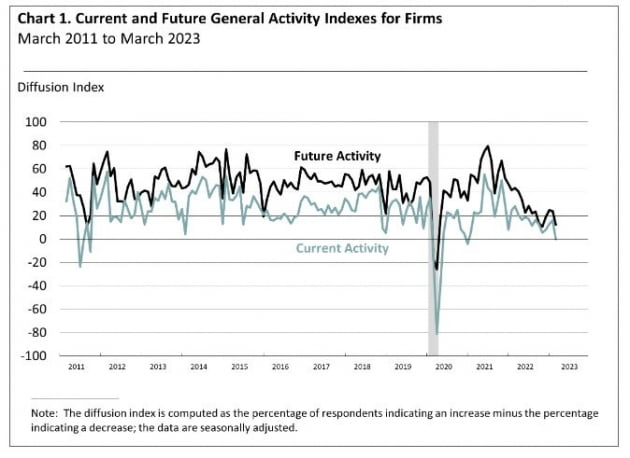

- The Federal Reserve Bank of Philadelphia's Non-Manufacturing Activity Index for March came in at -12.8, a significant drop from the previous month (3.2), indicating a contraction. New orders fell 22 points to -15.4, employment fell 13 points to 3.2, and prices fell 11 points to 37.9. For the Fed, these were positive signs of a slowing economy.

- Canada's February consumer price index (CPI) rose 0.4% MoM, below expectations (0.6%). Compared to a year earlier, it was also up 5.2%, slower than in January (5.9%) or expected (5.4%).

3. Bank of America's March Fund Manager Survey Results

Note) The survey ran from Oct. 10-16 and included 212 people managing $548 billion in assets, so it's worth noting that it was conducted a week or so ago.

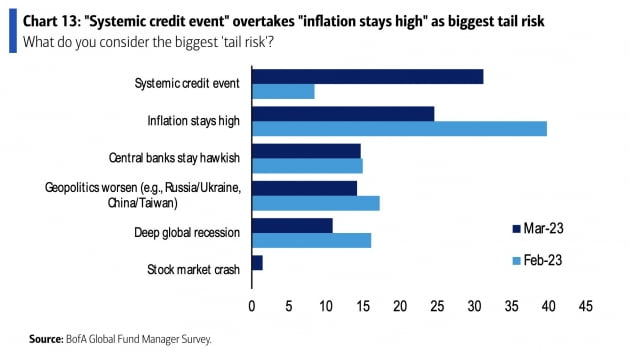

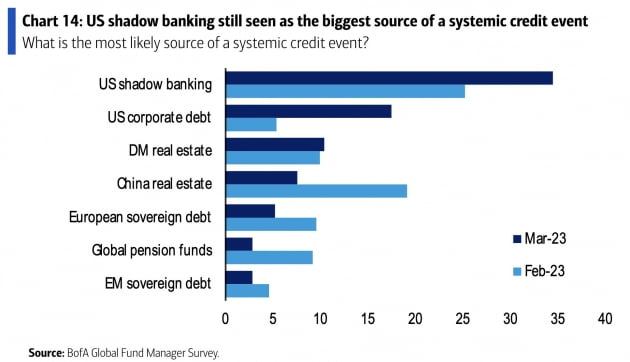

Fund managers see a systemic credit crisis (31% voted this) as the biggest risk and not inflation (24% voted this). The most likely source of a credit crisis is shadow banking or shadow finance in the US. That's hedge funds, private equity, investment banking, derivatives, etc. Corporate debt in the US and real estate markets in developed countries were next. China's real estate market dropped to fourth place.

In addition to credit risk, investors are concerned about the economy. The likelihood of a recession has risen again since November, with a net 42% of participants expecting a downturn in the next 12 months.

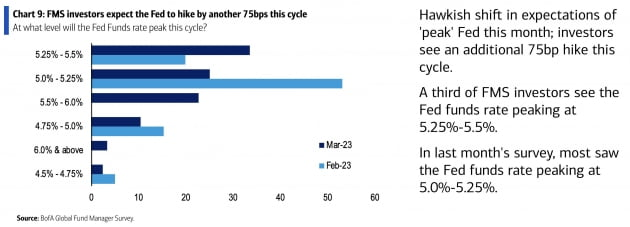

Expectations for the eventual interest rate range from 5.25 to 5.5%, 25 basis points higher than in last month's survey.

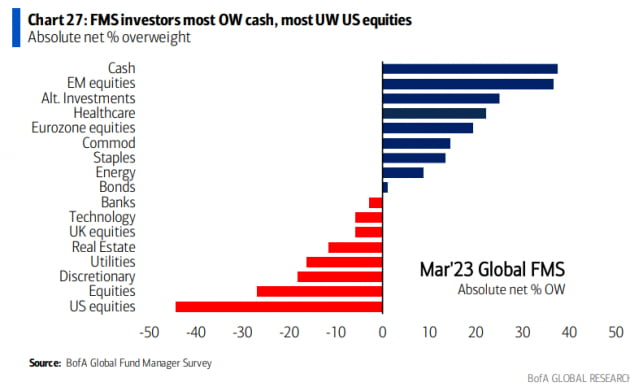

The most crowded trades were long European stocks, long the dollar, and long Chinese stocks, with most respondents saying they would be overweight Europe over the US since October 2017.

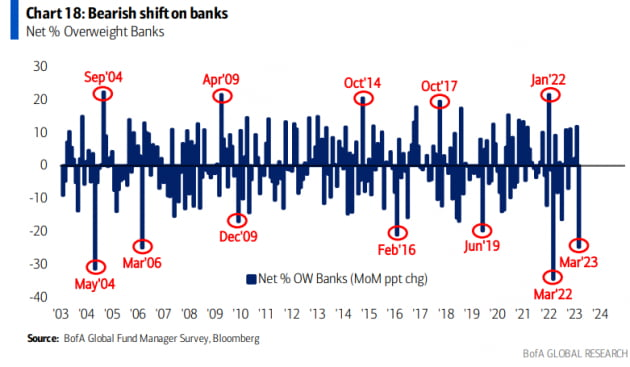

They maintained their underweight on the bank, with 25% more saying they are underweight than not, the highest since Russia's invasion of Ukraine last year.

People were also overweight cash, emerging market equities, alternative investments, and healthcare stocks, and underweight US stocks, equities, and consumer discretionary stocks, relative to historical averages. In terms of stocks, people were overweight healthcare, consumer staples, and industrials, and underweight consumer discretionary, utilities, technology, and banks.

4. Goldman Sachs trading desk (Brian Bingham)'s take on the Fed

Economists at Goldman Sachs have been calling for a freeze. However, a report came out today from Goldman's trading desk pointing to a 25 bps hike.

▷ Rate hike of 25 bps

The baseline scenario is for the Fed to hike 25 basis points. If they weren't planning on a 25 basis point hike, they would have given the market guidance via the Wall Street Journal (reporter Nick Timiraos).

▷ Maintaining a "data-dependent" stance

The focus of this meeting should be on how to give forward guidance. The Fed said in May that it would rely on data and the base case is to keep rates unchanged. Brian thinks that we could see a rate cut by the middle of the year if regional banks start to see a reduction in lending.

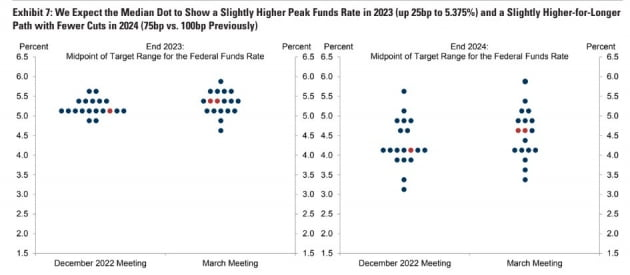

▷Dot plot

For the final rate on the dot plot, we'll see a hike to 5.375% from 5.1%, which will give the Fed more options heading into May and June.

▷Quantitative tightening (QT)

The consensus is that QT will remain unchanged at this meeting.