March 22, 2023

▶US Stocks down = S&P500 -1.65%, Nasdaq -1.60, Dow -1.63%, Asian stocks declined between -0.3 ~ -2.3%. Europe-wide stocks were broadly down. Stoxx 600 -0.7 %, Germany’s Dax -0.6%, the CAC 40 -0.4%. London’s FTSE 100 -0.9%. Japan’s Topix -0.3% and Australia’s S&P/ASX 200 -0.7%. Hong Kong’s Hang Seng index +2.3% while China’s CSI 300 +1% and South Korea’s Kospi +0.3%.

▶US rates also extended their decline = 10-year U.S. Treasury note 3.444% (-16.5 basis points), 2-yr plunged as the end of the tightening cycle began to be seen, and Yellen's comments raised fears of a bank run, which pushed 10-year yields down significantly.

▶Oil prices down= $70.36 per barrel of WTI (-0.8%), Brent crude fell 0.6% $76.23

*Key points

1. UK's Feb Inflation reversed back

2. US regional banks turmoil continues

3. FOMC - 25bps rate hike as expected

4. Janet Yellen's comments overshadowed Powell's

5. Fun Fact: What is the market impact of the FOMC meeting?

1. UK's Feb Inflation reversed back

UK consumer price inflation (CPI) came in at 10.4% YoY in February, which was not only above expectations (9.9%) but also higher than January (10.1%), reversing a three-month downward trend. Core inflation, which excludes energy and food, also accelerated to 6.2% from January (5.8%). UK government bond yields jumped as speculation intensified that the Bank of England will hike rates by another 25 bps ahead of tomorrow's monetary policy meeting (12pm UK time). European rates also rose, with European Central Bank (ECB) President Christine Lagarde saying today in Frankfurt, Germany, "Since July last year we have raised interest rates by 350 basis points. However, inflation is still high, and uncertainty around its path ahead has increased. This makes a robust strategy going forward essential."

2. US regional banks turmoil continues

First Republic Bank, the US regional bank, is still being sorted out. Bloomberg reported that JP Morgan and others are seeking government support to sell the bank. Guarantees for unrealized losses, flexible capital rules, and easing of equity restrictions are reportedly being discussed. It's unclear if the government will provide such assistance. PackWest, another regional bank that has been the subject of crisis speculation, announced that it had lost $6.8 billion, or about 20% of its deposits, so far this year and had $27 billion in deposits as of March 8. It added that 65% of those were covered by deposit insurance. It also said it had $11.4 billion in cash on hand through the Fed's rediscount window ($10.5 billion), the Bank Term Funding Program (BTFP) ($2.1 billion), the Federal Home Loan Bank ($3.7 billion), and investment firm Atlas Partners ($1.4 billion). Shares of PacWest began trading down more than 10%, while First Republic Bank shares were down more than 5%.

3. FOMC - 25bps rate hike as expected

🏈Bottom line: Analysts mostly characterized the statement as "dovish." After Powell's negative comments about rate cuts, QE, etc., stock indices rose slightly and Treasury yields fell significantly, but then started to plunge at 2:52pm per Yellen's comments (see for more below). Shortly after the dot plot came out, the FedWatch market increased the odds of a 25 basis point hike in May to nearly 80%. But after Yellen's comments, the odds dropped to 61%, the same level as yesterday. If there's a bank run, there's no way they're going to raise rates in May.

Note) 2pm EST, the monetary policy statement and dot plot came out first, 30 min prior to Jerome Powell's press conference. Here is the full official transcript, conference video, FOMC projection materials - summary of economic projections and in pdf.

*Key takeaways:

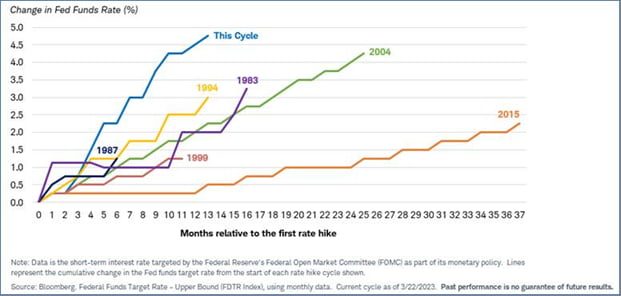

1. 25 basis point rate hike

The FOMC raised rates by 25 bps as expected. The decision was unanimous. This brings the benchmark rate to 4.75-5.0%. He noted "inflation remains too high, and the labor market continues to be very tight" and SVB was a unique case and there is no reason to think the problems are systematic. This is the same level as in late 2007, just before the global financial crisis. The Fed has now raised rates nine times in a row in the year since March of last year. It also hiked nine times in the previous tightening cycle (2015-2018), but then it did so over three years. So we're tightening at a tremendous pace.

2. Banking instability → higher interest rates

Regarding banking turmoil, the statement acknowledged that "we will closely monitor incoming data and carefully assess the actual and expected effects of tighter credit conditions on economic activity, the labor market, and inflation, and our policy decisions will reflect that assessment."

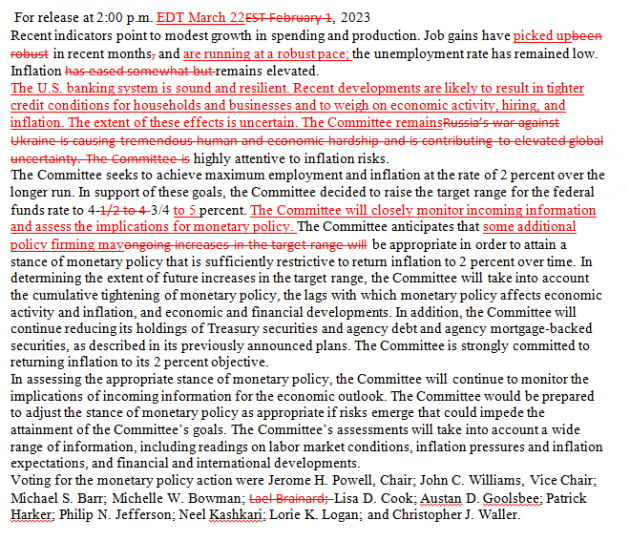

3. One more hike and it's over?

There was one big change in the statement: the phrase "ongoing increases in interest rates will be appropriate" which had been used a total of eight times leading up to the last statement, was replaced with "some additional policy firming may be appropriate." The implication is not that they will keep raising rates, but that they will raise them a bit more.

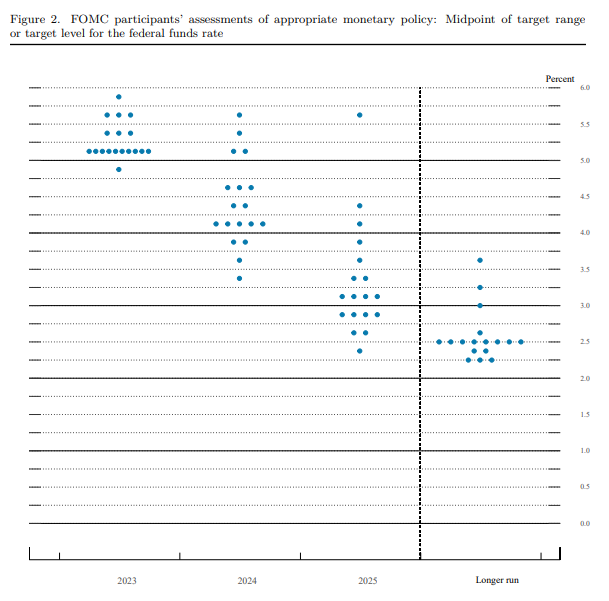

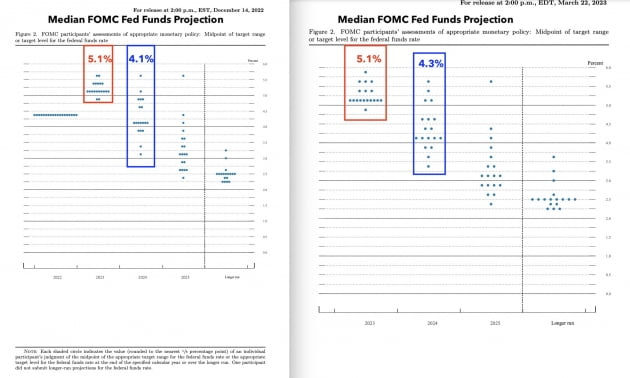

This was confirmed in the dot plot. The Fed members' projections for the final rate remained unchanged at 5.1%, which means one more hike in May to reach the final rate.

In response, Powell said, "The credit crunch could weigh on business investment and household consumption. That's why I no longer use the phrase 'continued hikes are appropriate'. Instead, I said, 'some additional policy accommodation may be appropriate.'" He also noted in particular, "I would draw attention to the words 'may' and 'some' that I used in place of 'ongoing tightening.'" He added, "The banking issues are new, there is a lot of uncertainty, and this reflects that uncertainty." There's a lot of uncertainty, so they're being vague about future hikes, which is a dovish way of saying they're not sure they're going to hike.

4. "A freeze was considered"

Powell also said that "we considered a pause in rate hikes" due to the banking turmoil. "Tighter financial conditions work the same way as a rate hike," he said. You can think of it as a 25 basis point rate hike or more. The way to get back to 2% inflation is not necessarily by raising rates, but by tightening financial conditions." "Prior to the recent bank failures, we had even considered raising rates by 50 basis points in light of two months of strong economic data," Powell added.

However, he said it was unclear how much the banking turmoil would tighten credit. "The question is, how severe is this credit crunch going to be," Powell said, adding, "We think it's potentially quite real, although it's kind of a guess right now."

5. Disinflation, but not enough

"There's still disinflation," Powell said, again explaining the three types of inflation: disinflation in goods, which he said he expects to see, and housing, which he said he expects to see. Together, they account for 44% of core personal consumption expenditures (PCE), the Fed's inflation benchmark. "But we're not yet seeing disinflation in the services sector, excluding housing, which accounts for 56%," Powell said.

6. Rate cut later this year? Negative

Powell said, "If the market is expecting a rate cut, it is completely wrong. We expect to see a gradual decline in inflation as growth slows and labor market supply and demand rebalances. In that most likely case, meeting participants do not see a rate cut this year." Rather, it was also stated that "if we need to raise rates further, we will do so."

7. QT remains unchanged

The Fed is now reducing its balance sheet by $95 billion per month. This is quantitative tightening (QT). There was an expectation on Wall Street that the Fed would adjust QT now that the crisis has forced it to resume liquidity. Morgan Stanley said it would "evolve its QT program in light of future uncertainties."

But that didn't happen. Powell acknowledged that "recent liquidity injections into banks have enlarged their balance sheets," but said that "the intent and effect is very different from quantitative easing (QE)." He explained that this is a time of extraordinary liquidity needs, whereas QE is the Fed's intention to change the stance of policy by lowering interest rates." He added, "I don't see any evidence to change QT.

8. Soft landing - less likely?

"There is still a way to go to achieve a soft landing or lower inflation without stagnation," he said, but "it's too early to tell if the recent banking turmoil will affect that outlook." The problem is that it's too recent to assess the impact yet.

Noting that the Fed lowered its forecast for gross domestic product (GDP) at the end of the year to 0.4% in today's Supplemental Economic Projections (SEP), 0.1 percentage point lower than the previous forecast. The Federal Reserve Bank of Atlanta's GDPNow currently estimates first-quarter GDP growth at a 3.2% annualized rate.

4. Janet Yellen's comments overshadowed Powell's

Bank stocks plummeted after Yellen's comments at a Senate hearing at 2:30 pm EST. Yellen's comments 'I have not considered or discussed anything to do with blanket insurance or guarantees of deposits', which came out at the same time, overshadowed Powell's. The deposit outflows from regional banks could continue, and stocks reacted to that. First Republic Bank plunged 15.5% and PacWest plunged 12.2%. Big banking stocks like Bank of America (-3.32%), Wells Fargo (over -3.3%), Citigroup (-3%), and UBS (-3.09%) also fell. Big tech stocks like Apple (-0.91%) and Amazon (-1.90%), which had rallied intraday, also closed lower.

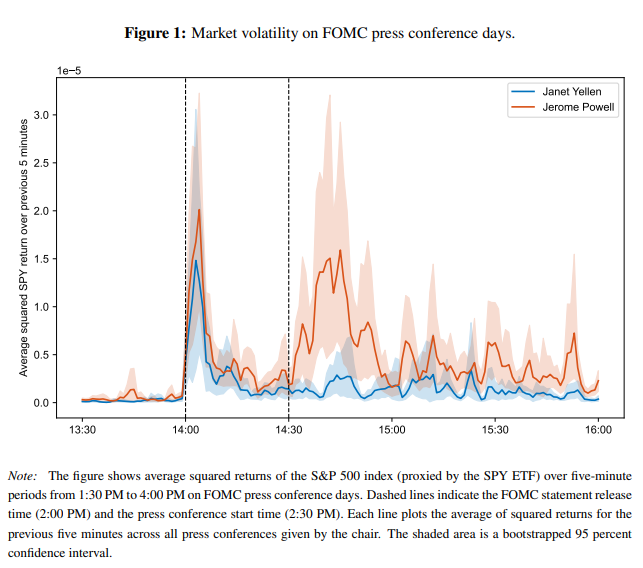

5. Fun Fact: What is the market impact of the FOMC meeting?

There's no doubt that these FOMC meeting results and press conferences are very volatile. A paper entitled "The Market Impact of Fed Press Conferences" by Dr. Namrata Narain and colleagues at Harvard University came out in Feb 2023, and found that not only was the market volatility around Powell's press conferences more than three times higher than under previous chairmen like Ben Bernanke and Yellen, but also that the market tended to reverse its initial reaction after the monetary policy statement was released. That was confirmed today, and it usually takes a few days for markets to interpret FOMC results. Here is an article version of the paper.