March 23, 2023

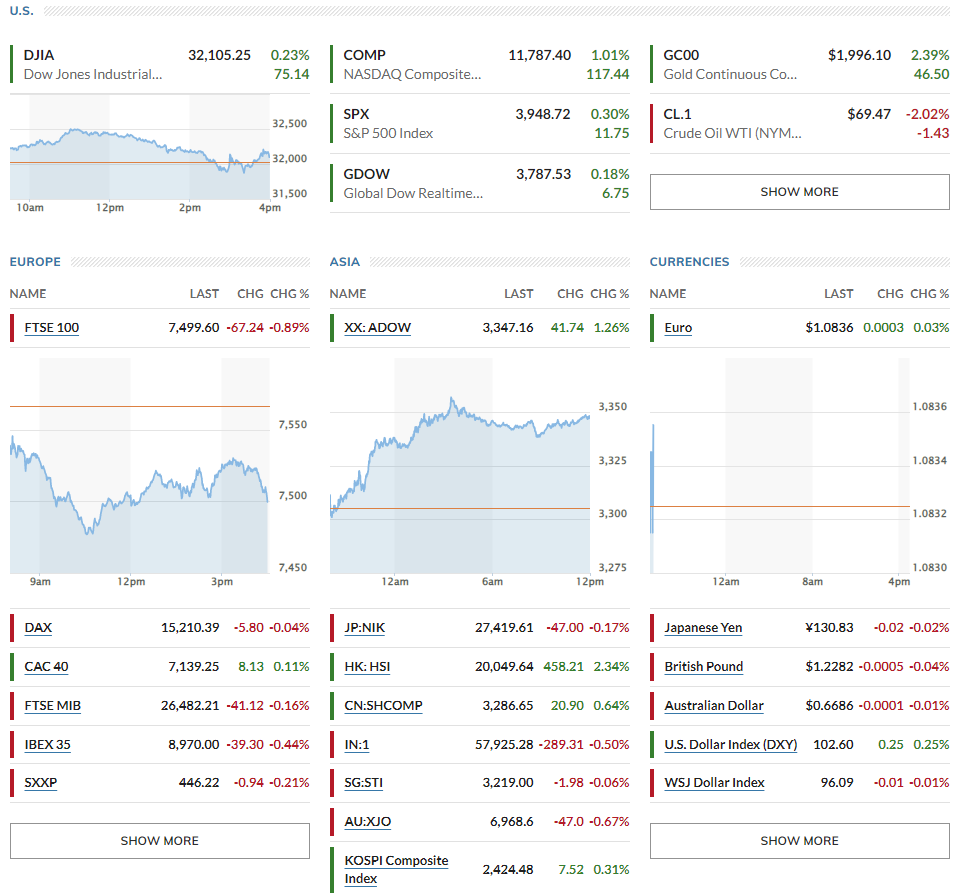

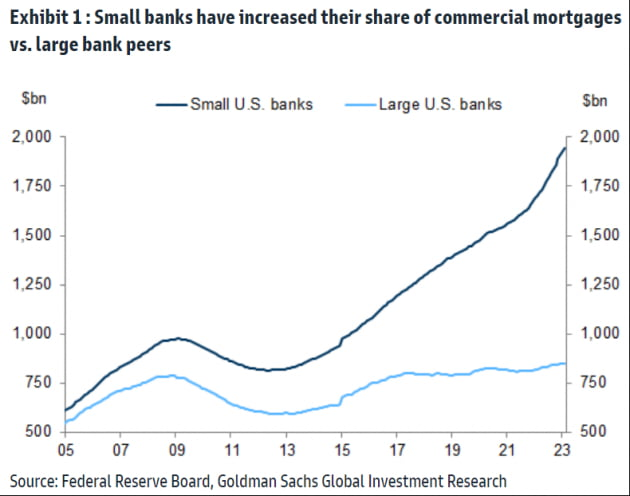

▶US Stocks up = S&P500 +0.30%, Nasdaq +1.01%, Dow +0.23% // European equities were mixed: Stoxx 600 -0.21 %, Germany’s Dax -0.04%, Paris' CAC 40 +0.11%, London’s FTSE 100 -0.89% // Asian stocks were mixed: Japan’s Topix -0.17%, Australia’s S&P/ASX 200 -0.67%, Hong Kong’s Hang Seng index +2.34%, China’s CSI 300 +0.64% and South Korea’s Kospi +0.3%.

▶US rates down = 10-year U.S. Treasury note 3.422% (-2.2 bps), Germany 10Y at 2.193% (-1.4 bps), Italy 10Y at 4.056% (-1.2 bps), UK 10Y at 3.357% (-9.4 bps), Japan 10Y at 0.306% (-2.8 bps)

▶Oil prices down= $69.96 per barrel of WTI (-1.33%), Brent crude fell 0.6% $69.50 // USD +0.24%

U.S. Treasury Secretary Janet Yellen's comments made Wall Street cry and laugh. The major US indexes opened weak on Thursday before closing higher in the final minutes of trading. Bank stocks were still down.

*Key points

1. BOE raises rates by 25bps to 4.25% as expected

2. Janet Yellen clarifies

3. Commercial property debt - Next credit crunch origin?

4. US Macro data

5. TikTok's Congress showdown gone wrong

6. Global Markets snapshots

1. BOE raises rates by 25bps to 4.25% as expected

🏈Bottom line: The BOE has raised interest rates to 4.25%, which is the 11th consecutive increase since December 2021. However, the Bank has left the possibility of further rate increases open, depending on the emerging evidence and the uncertain financial and economic outlook.

- The Bank also stated that UK banks are resilient and well-placed to support the economy even with higher interest rates. The Bank will monitor any effect of market tensions on credit conditions faced by households and businesses.

- Seven out of nine members of the MPC voted for the rate increase, citing a stronger outlook for GDP and employment. The Bank expects consumer price inflation to fall significantly in Q2 2023 due to declines in energy prices and the UK government's decision to maintain a support scheme. The Bank no longer expects a technical recession in the UK this year and predicts a slight increase in GDP in Q2 2023.

- Market reaction: After the BoE's announcement, the pound increased slightly against the dollar, with its earlier gains extending to trade 0.5% higher on the day at $1.2323. The yield on gilts also moved up slightly, as the two-year yield sensitive to interest rates rose by 0.02% to 3.38%. The Bank of England mentioned that the current market pricing suggested one more rate increase by the end of summer, with the peak rate slightly above 4.5% in August.

2. Janet Yellen clarifies

🏈Bottom line: Yellen seemed to have recognized the explosive market reaction to her remarks yesterday and offered a clarification. She deliberately avoided saying that she would expand deposit insurance limits, and explained that she would do so on a "case-by-case" basis.

- Yellen said, "As I have said, we have used important tools to act quickly to prevent contagion. And they are tools we could use again...The strong actions we have taken ensure that Americans’ deposits are safe. Certainly, we would be prepared to take additional actions if warranted."

- Market reaction: The markets responded positively. In the final hour of trading, the indexes rallied. Of course, that's not the end of the banking woes; bank stocks, including regional banks, still closed lower today. First Republic was down 6%, and PacWest continued its weakness, falling 8.55%.

- There are some discussions in Congress to increase deposit protection limits. A hearing on the subject will be held next week. Senate Democratic Leader Chuck Schumer said at the US Capitol, "Raising the $250,000 FDIC limit is a serious proposal and should be carefully studied. It's important because it will strengthen smaller banks and prevent depositors from putting their money into larger banks." Republicans opposed, citing moral hazard.

3. Commercial property debt - Next credit crunch origin?

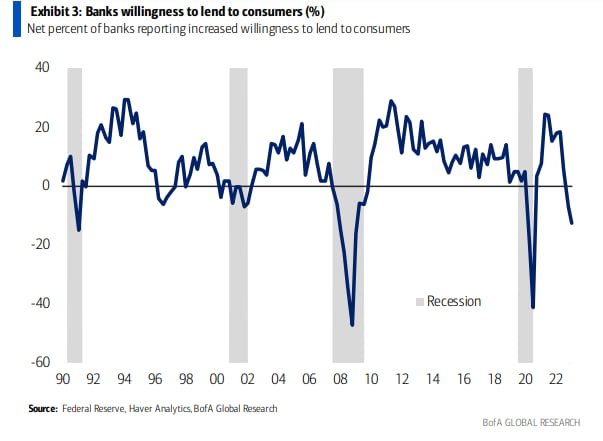

🏈Bottom line: Nervousness about regional banks remains. If a credit crunch originating from local banks is in full swing, many have suggested that the commercial real estate market could be the epicenter of the next crisis.

- Aaryn Siganovich, Citi: suggested that there are three options for First Republic: sale, recapitalization, and downsizing. All three are "challenging to accomplish." After all, "government intervention looks increasingly likely" because the unrealized losses are so large.

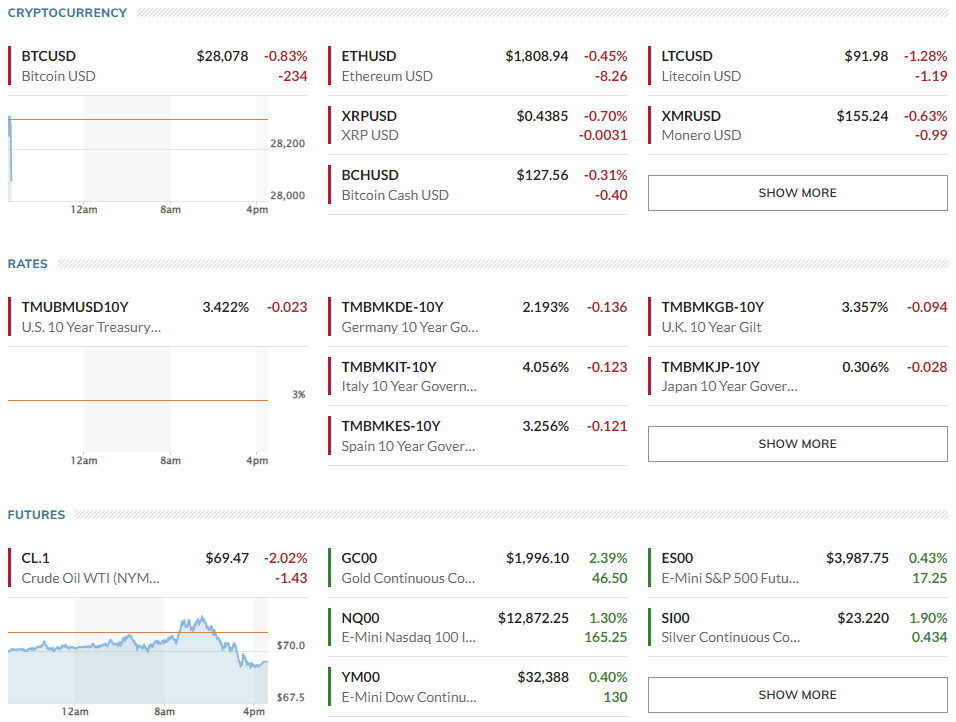

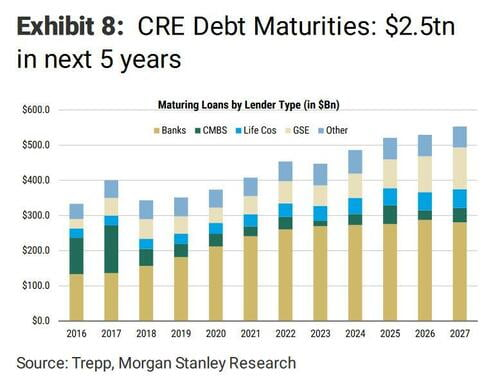

- The Wall Street Journal (WSJ) reported that small and mid-sized banks in the United States hold approximately $2.3 trillion in commercial real estate loans, which represent almost 80% of all commercial mortgages held by banks. Due to the impact of rising interest rates and increased vacancies after the pandemic, these properties are believed to have decreased in value. If banks tighten their lending standards during refinancing, there may be a significant number of defaults, which would further harm the banks. Bloomberg has reported that this year, $400 billion in commercial mortgages will mature, followed by $500 billion next year. As a result, real estate companies that need to refinance are facing declining property values and rising borrowing costs. Furthermore, the collapse of Silicon Valley Bank and Signature Bank has led regional banks to tighten their risk controls, making refinancing negotiations even more challenging. According to Jim Costello, an economist at MSCI Real Assets (MSCI podcast), last week's banking turmoil has affected the banks that originated the most commercial mortgages last year, and existing problems are exacerbating the situation.

- Oxford Economics: Banking turmoil is raising lending standards for commercial real estate, dampening the outlook for property values. They expect all real estate values to fall by 10% in 2023 and 5% in 2024. U.S. commercial real estate prices are sensitive to changes in bank lending conditions. They believe refinancing risk is greatest for office buildings and retail. The combination of weak yields over the past few years and falling loan-to-value (LTV) ratios over the next few quarters could lead to forced sales.

- If the crisis spills over into the commercial real estate market, for example, the likelihood of a recession would increase. That's why Powell cautions that "there is still a way to go to achieve a soft landing or lower inflation without a recession," but that it's "too early to tell whether the recent banking turmoil will affect that outlook."

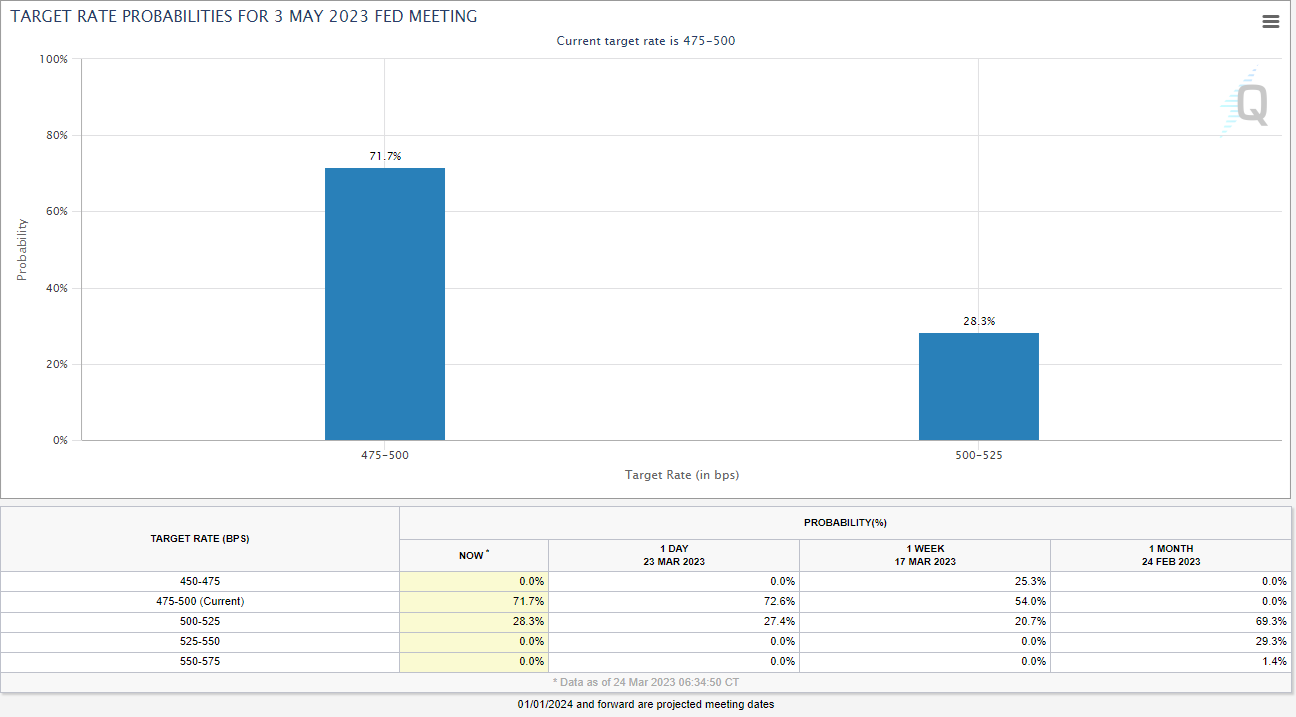

- Bond markets are pricing in a crisis-spreading, recessionary scenario. The Chicago Mercantile Exchange's FedWatch market puts the probability of a 25 basis point hike in May at 28.3% with bets on a final rate of 4.9% and the fed funds rate falling to 4.36% in December. Without addressing the potential for a crisis stemming from regional banking issues, it sees no choice but to raise rates in May and cut rates three times in the second half of the year. This means the market is more skeptical that the Fed can stabilize the financial system while maintaining high rates.

- Ellen Zentner, Morgan Stanley: If the banking problems remain confined to the banking sector, they see a mild recession later this year as lending standards tighten and credit creation slows. But if it spreads, a hard landing is likely. MS has already been expecting a meaningful slowdown in growth and employment over the next few months, and the prospect of significantly tighter credit conditions raises the risk of a soft landing turning into something more difficult (a hard landing).

4. US Macro data

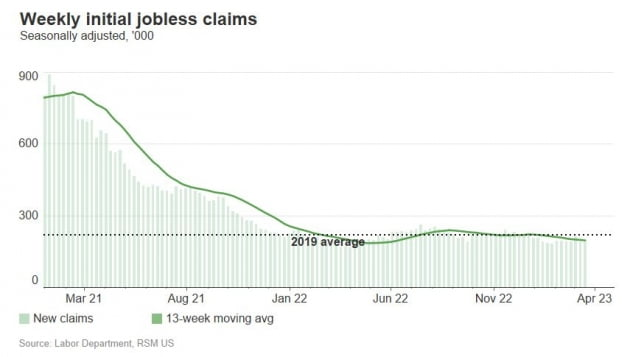

🏈Bottom line: Banking turmoil can have the positive effect of cooling a hot labor market and lowering inflation. This could lead to a faster end to tightening and reducing recession fears, but today's data didn't help.

- Initial jobless claims for last week (~18 days) came in at 191k, down 1000 from the previous week. The number remained below 200,000, missing Wall Street expectations (197,000).

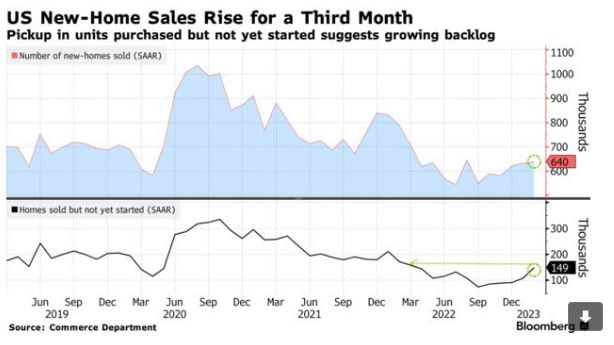

- February new home sales were up 1.1% MoM to 640,000 units. This was less than Wall Street expectations (650,000 homes). The increase came despite a rise in mortgage rates from early February to early March, according to Freddie Mac. The median new home sales price in February was $438,200, up 2.5% from a year ago. New home sales rose to a six-month high, a sign that the housing market may be finding a bottom after being battered by rising interest rates.

- Market reaction: Following the release of these data, rates in the New York bond market rose, but jitters took hold, including a drop in regional bank stocks, they began to fall around 11 am. Eventually, by the market close, the 10-year yield was down 3.2 basis points to 3.411%, and the 2-year was down 10.6 basis points to 3.829%.

- The stock market was held up by tech stocks. Big tech stocks rose sharply today, including Apple (0.7%), Microsoft (1.97%), Alphabet (1.96%), Meta (2.24%), and Nvidia (2.73%). The fact that interest rates are falling as the Fed moves toward the end of its tightening is having a positive impact on tech stocks.

5. TikTok's Congress showdown gone wrong

🏈Bottom line: Analysts summarized it as disastrous. TikTok CEO Shou Zi Chew failed to convince Congress the app is safe. Stocks were up for Meta-alphabet and Snap (3.08%) thanks to the possibility of a ban on Chinese social media TikTok grows.

Today, TikTok CEO Shou Zi Chew appeared before the US House of Representatives, where he was criticized for failing to answer lawmakers' questions about security threats. He responded in principle by saying that "parent company Bytedance is not a spy for China or any other country" and that "where the ownership is located is not a key point in responding to security concerns."

6. Global Markets snapshots