March 24, 2023

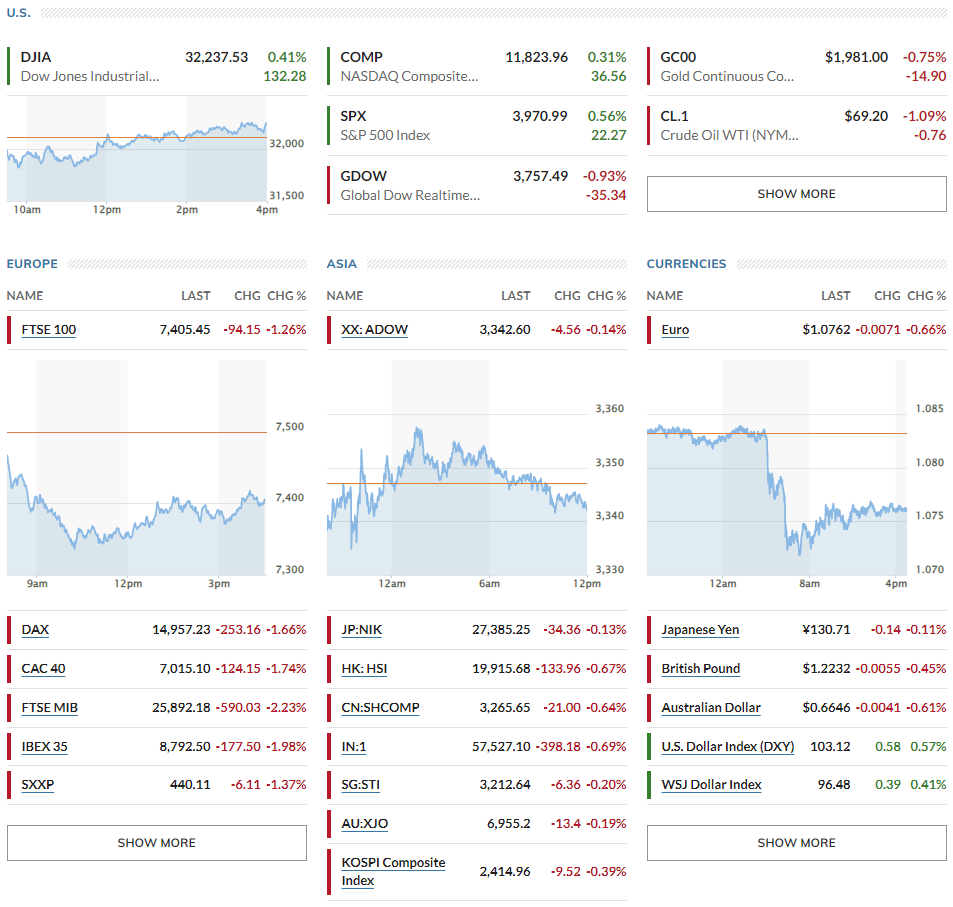

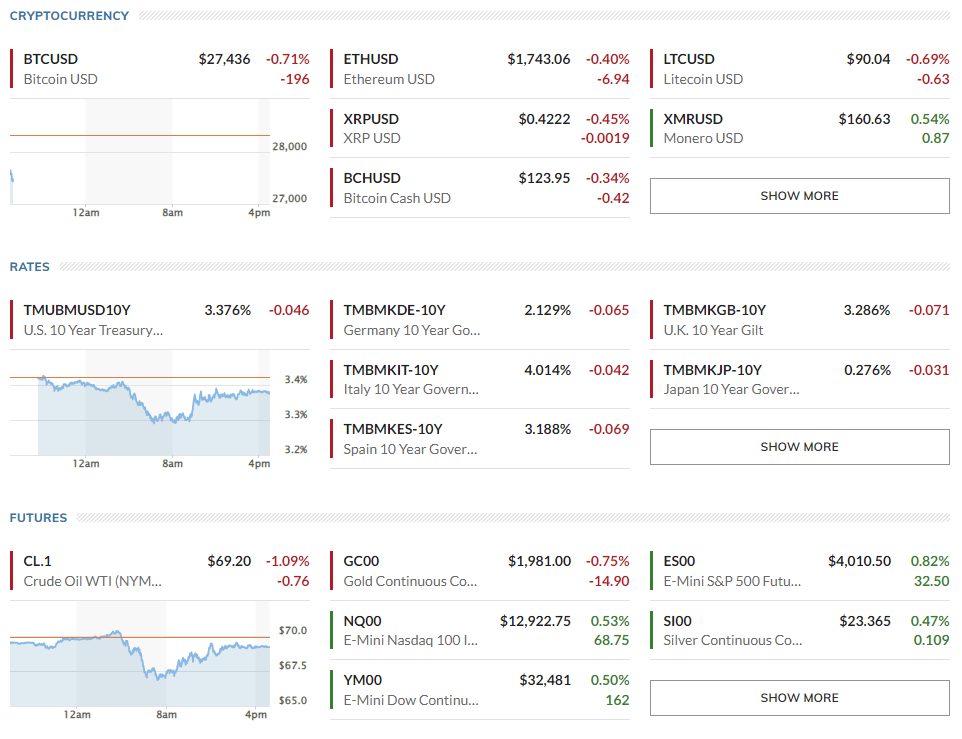

▶US Stocks up = S&P500 +0.56%, Nasdaq +0.31%, Dow +0.41% // European equities were down: Stoxx 600 -1.37 %, Germany’s Dax -1.66%, Paris' CAC 40 -1.74%, London’s FTSE 100 -1.26% // Asian stocks were down: Japan’s Topix -0.13%, Australia’s S&P/ASX 200 -0.19%, Hong Kong’s Hang Seng index -0.67%, China’s CSI 300 -0.64% and South Korea’s Kospi -0.39%.

▶US rates down = 10-year U.S. Treasury note 3.376% (-4.6 bps), Germany 10Y at 2.129% (-6.5 bps), Italy 10Y at 4.014% (-4.2 bps), UK 10Y at 3.286% (-7.1 bps), Japan 10Y at 0.276% (-3.1 bps)

▶Oil prices down = $69.20 per barrel of WTI (-1.09%), Brent crude fell -1.21% $74.99 // USD +0.57% at 103.12// Gold -0.75% at $1,981.0

*Key points

- Bankademic - Next: Deutsche Bank?

- Nearly $100 billion in deposits pulled from US banks

- US Macro data

- Fed members spoke out

- Stock or Bond Markets - who's right about the recession risk?

- Global Markets snapshots

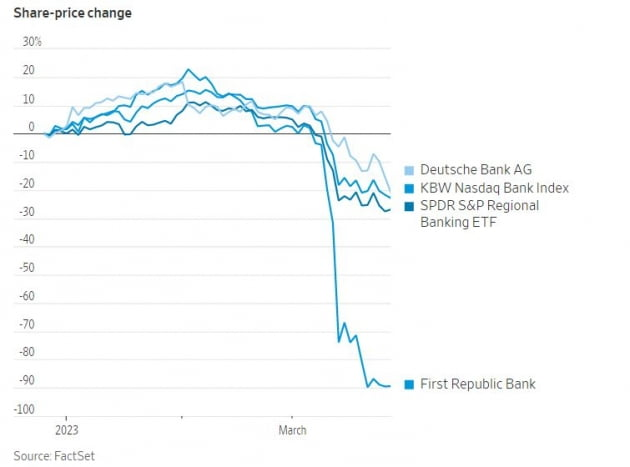

1. Bankdemic - Next: Deutsche Bank?

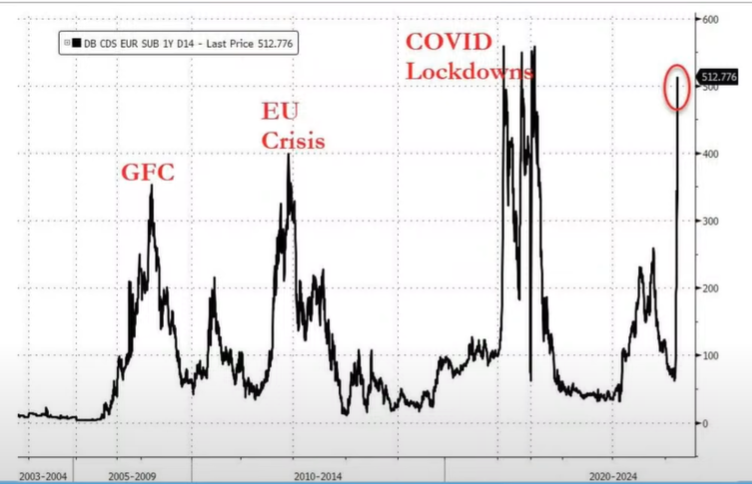

🏈Bottom line: Shortly after the European markets opened, Deutsche Bank (DB) shares plummeted 15% for no apparent reason and its credit default swap (CDS) rates spiked to 220bps, which is equivalent to a 16% chance that the bank's bonds will default. Note) CDS is used to hedge the default risk. In the end, DB's shares got out of the hole and closed at -8.5%, and European banking stocks led the sell-off. German Chancellor Olaf Schulz and Christine Lagarde reassured the liquidity of the euro area financial system.

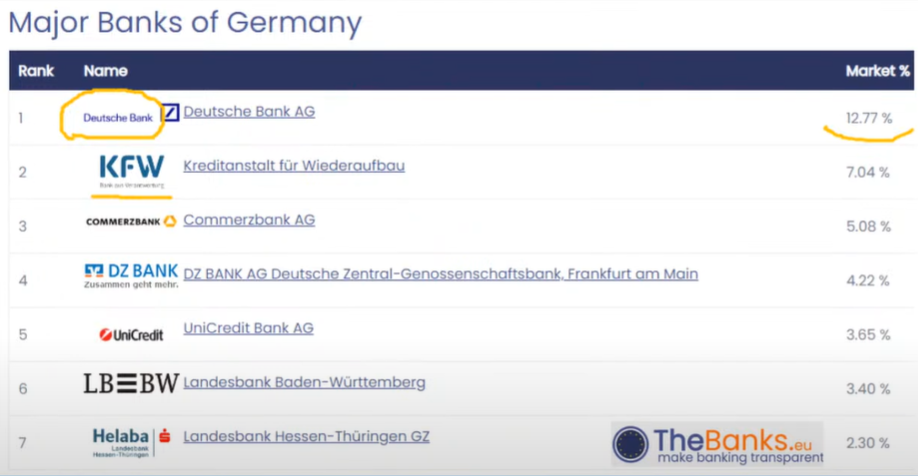

Deutsche Bank is a globally systemically important bank (G-SIB) with $1.4 trillion in assets. That's nearly three times bigger than Credit Suisse's $530 billion.

What's puzzling to investors is that there was no particular event that triggered this Deutsche Bank meltdown - in fact, Deutsche Bank is doing just fine financially, with profits of $6 billion last year. There were no reports of deposit outflows either.

*DB's default risks reflected in 1yr CDS premium

*DB is the largest bank in Germany (12.8% market share)

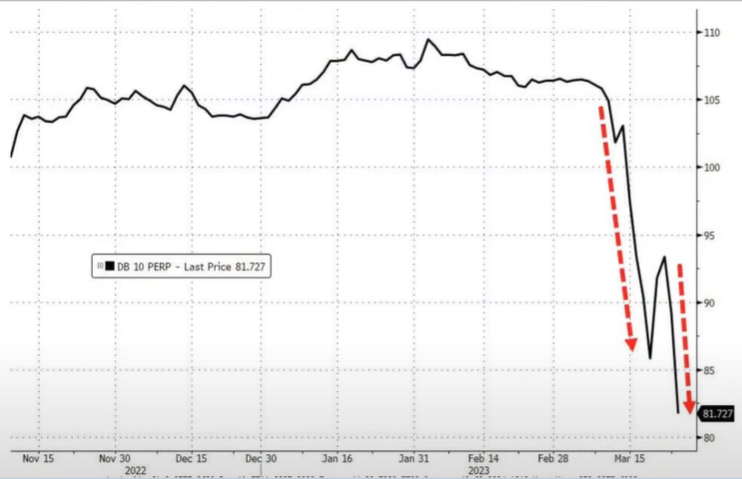

*DB's AT1 bond prices plummeted

Of course, there are some negative factors.

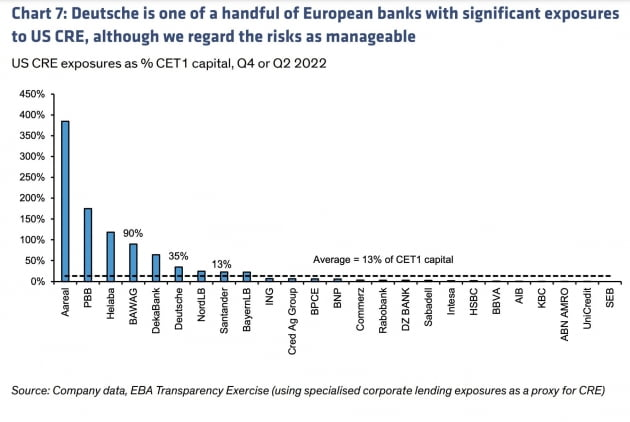

- 1) Deutsche Bank has a relatively large exposure to US commercial real estate. With the recent faltering of US regional banks, there's been some speculation that a crisis could be brewing in commercial real estate. Goldman Sachs said, "We believe the Deutsche Bank decline is simply a function of the market selling off a leveraged and opaque business model. There will also be discomfort with Q1 results, which will come out after the explosion in interest rate volatility. Another is that 7% of the loans are commercial real estate loans (€33 billion), 51% of which are concentrated in the US, and 34% are office buildings. This is where the market is most concerned. We estimate the exposure to US office buildings to be between €5.5 billion and €11 billion."

- 2) The Swiss financial regulator wrote off the AT1s ahead of the shares in UBS's acquisition of Credit Suisse. This has had a negative impact, with analysts suggesting that future AT1 issuance could become more difficult, making it harder for Deutsche Bank and others to raise capital. "With banks' funding costs rising and profitability expected to deteriorate, stress on AT1 bonds is emerging as a risk," Saxo Bank noted. Deutsche Bank's AT1 bonds, issued in 2014, were trading at 70 cents on the dollar today, down significantly from 95 cents earlier this month.

- 3) We're heading into the weekend, and there are investors who are worried that something could blow up over the weekend, so they've decided to liquidate their Deutsche Bank shares, which have been embroiled in scandals over the years, including the Russian money laundering case, like Credit Suisse. Credit Suisse was liquidated over the weekend, and investors barely got anything out of it. So maybe the biggest reason is that there's so much investor anxiety that we're seeing these outrageous (?) estimates. When bank stocks go down, there are a lot of traders who just want to sell and see what happens before they ask why.

- Market reaction: Deutsche Bank ended the day down 8.5%. Other major European banking stocks also were down: Commerzbank (-5.45%), Societe Generale (-5.27%), and BNP Paribas (-5.28%) also erased about half of the day's losses. If Deutsche Bank faltered, so would its many trading relationships. Banking stocks led the sell-off, with the main European stock market indexes lost around 2%. Shares of UBS, which acquired Credit Suisse, also fell more than 8% at one point. Reports that the bank is under investigation by the U.S. Department of Justice for allegedly helping Russian politicians under U.S. sanctions avoid paying taxes on their wealth are also having an impact.

- JPMorgan maintained its Overweight rating on Deutsche Bank: "Deutsche Bank's common equity capital ratio is strong at 13.4% and legal risk is not significant. We believe the widening of Deutsche Bank's CDS spreads is related to unilateral de-risking by all market participants." + Citi: "Deutsche Bank is a victim of irrational markets."

- Politicians also lent their support, with German Chancellor Olaf Schulz saying, "Deutsche Bank has fundamentally modernized and reorganized its business model and is a very profitable bank." + European Central Bank (ECB) President Christine Lagarde also backed it up saying "The ECB toolkit is fully equipped to provide liquidity to the euro area financial system, if needed,"

- Some are still skeptical: The idea that banks are capitalized and profitable, and that the government and central banks are going to support their liquidity, is something investors heard over and over again during the Credit Suisse and First Republic bank failures.

- US regional banking stocks, which were lower earlier in the day, were stronger. First Republic Bank closed down 1.36%, but KeyBank (+5.24%) and Zion Bank (+2.91%) were higher. JPMorgan (-1.52%) and Citigroup (-0.79%) also trimmed losses, while Bank of America is up 0.6%. The S&P Bank Index (KBE) is up 2.25%.

2. Nearly $100 billion in deposits pulled from US banks

🏈Bottom line: This morning, Treasury Secretary Yellen convened the Financial Stability Oversight Council behind closed doors. "Members noted that institutions have come under stress, the U.S. banking system remains sound and resilient," the Treasury Department said after the meeting.

Data released by the Fed today showed that in the week ending the 15th, Americans found $98.4 billion in their bank accounts. That's 0.6% of the $17.5 trillion in total deposits. By size, small banks saw $120 billion in outflows, while the 25 largest banks saw $67 billion in inflows. Money is flowing out of money market funds (MMFs), confirming that large banks are benefiting from the crisis. MMFs saw net inflows of $117 billion this week (~22 days).

3. US Macro data

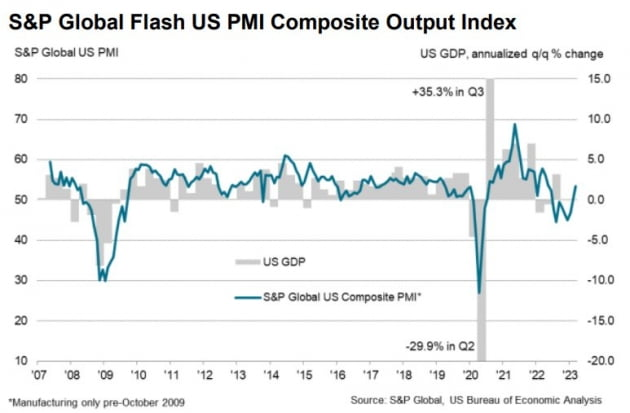

🏈Bottom line: Economic data released today suggested that the US economy was not slowing down in March. Just last month, the market might have reacted negatively, but now that recession fears are widespread, investors have been reassured that the US economy is not slipping into a rapid downturn.

- The preliminary manufacturing purchasing managers' index (PMI) for March, released by S&P Global, came in at 49.3, an improvement from February (47.3). The services PMI also came in at 53.8, higher than February (50.6), both of which were higher than expected. The composite PMI added together came in at 53.3. This was up from February (50.1) and a 10-month high. Chris Williamson, S&P Global Economist, said: "March showed very encouraging signs for growth. The services sector showed more welcome signs, with demand picking up in the spring. We'll have to see if this demand can be sustained amid the recent austerity and banking turmoil, but so far the impact appears to be minimal."

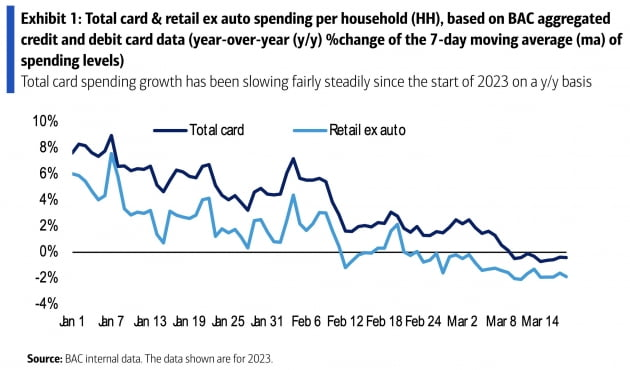

- Durable goods orders fell in February, contrary to expectations (+0.2%), with demand falling 1% in February following a 5% decline in January. However, excluding the volatile aircraft and military equipment, core capital goods rose 0.2% in February, following a 0.3% increase in January. Despite increasing forecasts of a hard landing, consumers do not seem to stop spending until they can't.

- Credit card usage over the past week was also solid for each bank in today's report. "While recent banking turmoil has raised questions about U.S. consumption, Chase Bank's card transactions (credit + debit) through the past 19 days show no meaningful impact on consumer spending after the first week of banking turmoil," JPMorgan said. Bank of America also reported that "credit card spending has been slowing slightly since January, but clearly has not been impacted by regional bank stress."

4. Fed members spoke out

🏈Bottom line: After the blackout (the period of silence surrounding the FOMC), Fed members spoke out, but they didn't have much of an impact on the markets.

- Atlanta Federal Bank President Rafael Bostic said of the March rate hike, "There was a lot of debate, this wasn't a straight-forward decision but at the end of the day, what we decided was there's clear signs that the banking system is sound and resilient."

- Richmond Fed President Thomas Barkin said, "Inflation is high. Demand hadn’t seemed to come down. And so, the case for raising was pretty clear."

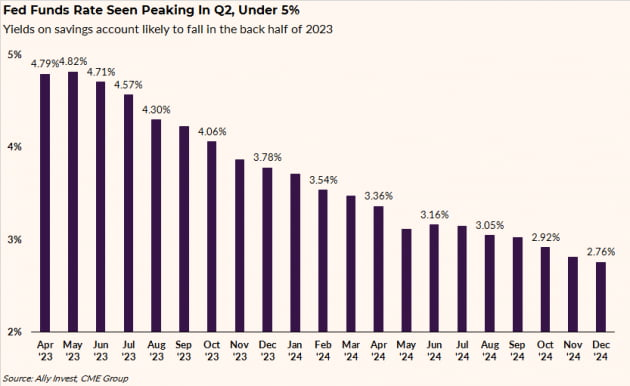

- St. Louis President James Bullard said, "There could be a downside scenario where financial stress worsens, but that's not the base case. "Assuming financial stress eases in the coming weeks and months, we were previously projecting 5.325%, and now we're at 5.625%," he said, explaining that he was one of only two members of the FOMC to put 5.625% on the dot plot. Their comments are a little bit negative, but the market hasn't reacted too negatively, basically because they think it's hard to go higher.

If you look at the Fed Watch market on the Chicago Mercantile Exchange (CME) today, we're seeing 92.3% of the bets on a hike in May, and for June, the bets are split 73.3% for a hike and 20.7% for a cut. So by the end of the year, we're looking at a rate as low as 4.25%.

5. Stock or Bond Markets - who's right about the recession risk?

🏈Bottom line: The S&P500 gained 1.4% for the week, marking its second straight week of gains, erasing nearly all of its losses since the banking crisis erupted in earnest on October 10. The Nasdaq, which gained 1.6% for the week, is up even more since the banking crisis erupted. The Nasdaq 100 is about 5% above its pre-crisis level. That's a lot of resilience. But the situation in the bond market, especially corporate bonds, is different from the stock market.

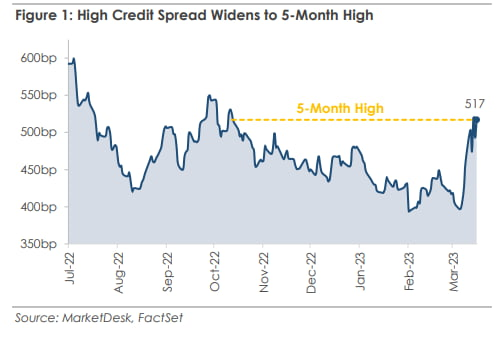

The spread between B- and CCC-rated bonds, the ratings that distinguish the riskiest companies, has widened sharply this month. According to Bloomberg, issuing a CCC-rated corporate bond requires paying an average of 531 basis points more than a B-rated bond.

Why the difference?: Stocks are cheering for the Fed to stop tightening and cut rates because of the banking crisis. From the 10th to the 23rd of this month, when the regional banking crisis erupted, bitcoin (+41%), FAANGs (+11%), gold (5%), and tech stocks excluding FAANGs (5%) surged - a flight to safety, meaning tech stocks are the new safe haven.

The bond market, on the other hand, is more reflective of a possible recession. Jeffrey Gundlach, CEO of DoubleLine Capital, aka the bond king, said: "The 2-year Treasury yield is well below the Fed Funds rate, and the yield curve inversion between the 2-year and 10-year yields has narrowed from a record 107 basis points a few weeks ago to 40 basis points today." An inverted Treasury yield curve is usually a sign of a recession, and it's often the case that the yield curve steepening after the inverted curve is reversed. "I predict the Federal Reserve will be cutting rates substantially soon" Gundlach concluded. In other words, a recession is coming, and the Fed will cut rates.

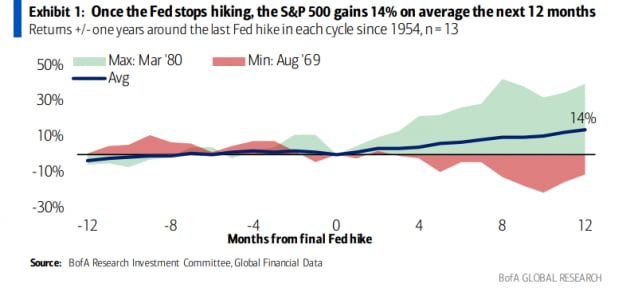

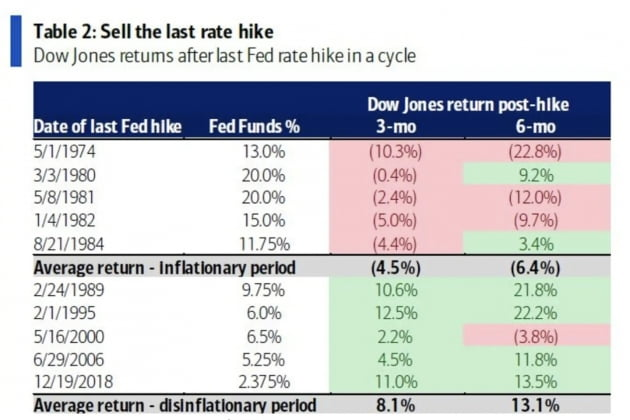

On average, when the Fed cuts rates - or even just stops raising rates - stocks go up. Bank of America analyzed that the S&P500 is up 14% in the average 12 months after the Fed stops raising rates. But that's an average; if you separate out periods when inflation was high and low, the results are different. Strategist Michael Harnett pointed out that you shouldn't buy stocks when the Fed stops raising rates during periods of high inflation because it's a sign of a recession or crisis. "In inflationary times, sell stocks at the last rate hike, and in disinflationary times, get out at the last hike," he said.

6. Global Markets snapshots

![Obsidian Brief] When Money Becomes Software: AI, Stablecoins & Bitcoin — Implications for Sustainable and Impact Investing](/content/images/size/w720/2025/12/Gemini_Generated_Image_dppem0dppem0dppe.png)

![Leadership] AI Is Changing Everything — How a CEO Managing $1.6 Trillion Stays Ahead, ft. Jenny Johnson from Franklin Templeton](/content/images/size/w720/2025/12/Screenshot-2025-12-03-060128.png)

![AI] The Future of Work, Robotics & AI Infrastructure (Elon's bold predictions: work will be optional & currency could be irrelevant)](/content/images/size/w720/2025/11/Screenshot-2025-11-22-074621.png)