March 27, 2023

Hope you all had a great wknd! Last week, the banking crisis alternated between the US and Europe, causing investors to be on edge. This nervousness led to Deutsche Bank's share price faltering for no apparent reason on Friday (March 24). However, over the weekend, there were no further incidents, which came as a relief.

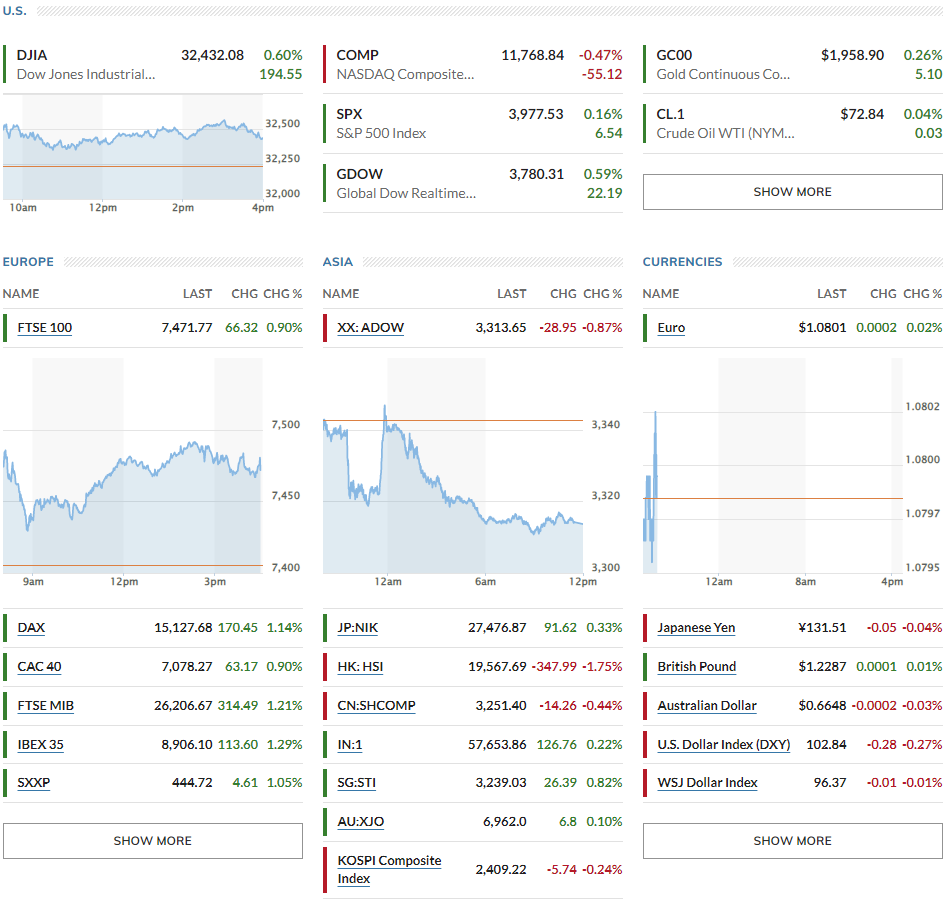

▶US Stocks mixed = S&P500 +0.16%, Nasdaq -0.47%, Dow +0.60% // European equities were up: Stoxx 600 +1.05 %, Germany’s Dax +1.14%, Paris' CAC 40 +0.90%, London’s FTSE 100 +1.21% // Asian stocks were mixed: Japan’s Topix +0.33%, Australia’s S&P/ASX 200 +0.10%, Hong Kong’s Hang Seng index -1.75%, China’s CSI 300 -0.44% and South Korea’s Kospi -0.24%.

▶US rates down = 10-year U.S. Treasury note 3.537% (+ 16 bps), Germany 10Y at 2.230% (+10.1 bps), Italy 10Y at 4.067% (+5.3 bps), UK 10Y at 3.364% (+7.8 bps), Japan 10Y at 0.295% (+1.9 bps)

▶Oil prices up= $73.08 per barrel of WTI (+5.1%), Brent crude up +4.21% $78.15 // USD -0.27% at 102.84// Gold -0.21% at $1,957.90

*Key points

1. Calming markets - Deutsche Bank, First Citizens Bank...and flight to MMF

2. Too soon to relax

3. Continued disagreement between stock vs. bond on market outlooks

4. Global markets snapshots

1. Calming markets - Deutsche Bank, First Citizens Bank...and flight to MMF

🏈Bottom line: During European trading hours, Deutsche Bank's share price increased by 6.15%. Deutsche Bank issued a press release stating that it is a highly diversified bank, with half of its depositors being individuals and 45% being corporations, distinguishing it from the collapsed Silicon Valley Bank (SVB). BNP Paribas and Commerzbank also experienced a 2-3% rise. Major European indices closed the day up approximately 1%. Ammar al-Qudairi, the chairman of Saudi Arabia's National Bank, which was involved in the Credit Suisse crisis, announced his resignation from the board of directors for personal reasons.

In the United States, it was announced on Monday morning that First Citizens Bank would acquire the assets of the failed Silicon Valley Bank, including deposits, loans, and stores. The US Federal Deposit Insurance Corporation (FDIC) has agreed to absorb the $20 billion in losses. According to Bloomberg, US financial regulators are considering expanding the Bank Term Funding Program (BTFB) for banks, which could give First Republic Bank additional time.

Following the apparent end of the banking crisis, interest rates in the New York bond market experienced a surge. The two-year Treasury yield increased by more than 20 basis points after rising by 10 basis points in the morning. By 5 pm EST., the two-year was trading at 4.006%, a rise of 22.6 basis points from the previous session, while the 10-year was up 16.3 basis points at 3.539%. The weak demand at a Treasury auction of two-year notes at 1 pm EST led to two-year rates being above 4%. This was interpreted by some as a sign of normalization of rates, which had fallen sharply due to technical factors, recession fears, and expectations of slower inflation in the previous week. As a result, it was speculated that rates could retrace sharply.

Oil prices surged as banking fears faded and worries of an economic slowdown diminished. West Texas Intermediate (WTI) crude oil settled at $73.08 per barrel. Today's 5.1% gain is the biggest in six months, since October 3 last year. Meanwhile, "safe-haven" gold, which at one point last week topped $2000 an ounce, fell -0.21% to 1957.90.

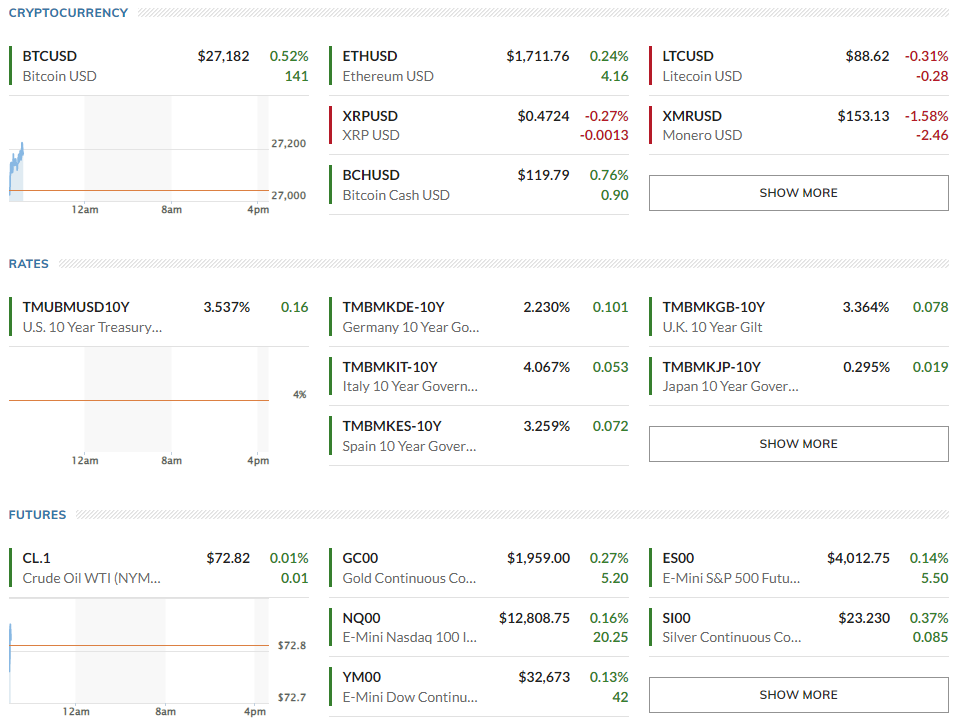

Goldman Sachs, JPMorgan Chase, and Fidelity have emerged as the top beneficiaries of the surge of cash inflows into US money market funds in the last two weeks, as the recent collapse of two regional US banks and the Credit Suisse bailout sparked worries about the security of bank deposits. EPFR, a data provider, reported that March has seen over $286 billion pour into money market funds, marking the highest inflows since the height of the Covid-19 pandemic. Check out FT article.

2. Too soon to relax

🏈Bottom line: Although banking concerns have eased slightly, it's difficult to say that everything is back to normal.

- According to Deutsche Bank, commercial real estate accounts for 7% of the $52.6 billion worth of loans. Termination is a high-risk loan, making up about 1% of total loans, half of which are related to the U.S. Meanwhile, the resolution for First Republic Bank, which is at the center of the U.S. regional banking crisis, is far from clear.

- Eric Rosengreen, former president of the Federal Bank of Boston, listed five headwinds that regional banks still face, including holding bonds with yields well below short-term interest rates, deposit outflows to larger banks, more non-performing assets tied to commercial real estate, increased regulation, and the potential for a recession.

- The bond markets are still frozen with no new investment grade corporate bond issuance from March 10th - 17th, 2023. This is the first time this has happened since 2013. The junk bond market has also been quiet in March, and there have been no new listings on the New York Stock Exchange in more than two weeks.

3. Continued disagreement between stock vs. bond on market outlooks

🏈Bottom line: Currently, the stock and bond markets hold contrasting views regarding the banking crisis, the economy, and the overall market situation.

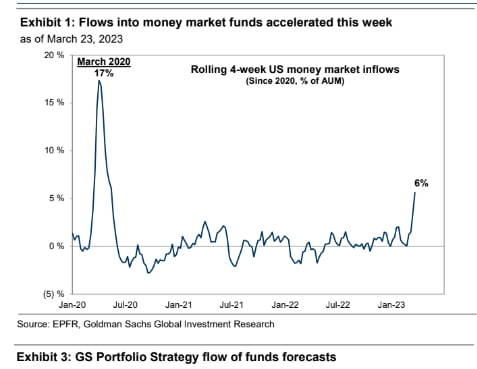

The two-year rate has increased today, but it still remains below the fed funds rate of 4.75-5%. The Fed Watch market on the Chicago Board of Trade indicates that there is only a 45% probability of a rate hike in May. Moreover, the prevailing belief is that the Fed will commence reducing rates in July, leading to a decrease in the fed funds rate to 4-4.25% by year-end. Prior to the banking crisis, the forecast was that the final rate would be 5.8%.

- Jeffrey Gundlach, CEO of DoubleLine Capital, known as the "bond king," maintained his recession forecast and expects the Fed to cut rates a couple of times this year. If the Fed raises rates further in May, the gap between short- and long-term interest rates will widen even more, which could cause more problems as liquidity in the banking system shrinks further and unrealized securities losses grow.

- Goldman Sachs noted the stock market is not reflecting the probability of a downturn, with the S&P500 down about 2-3% from just before the banking crisis began. In contrast, the bond market suggests a much different outlook. The turbulence at small and mid-sized U.S. banks is slowing the economy and increasing the likelihood of a recession, but the stock and bond markets are giving different signals about whether the U.S. will hit a hard landing.

There is speculation that the tightening of lending by regional banks could spill over into a commercial real estate crash, but views are mixed.

- Capital Economics pointed out that commercial real estate is different from housing: the market is very diverse, covering everything from offices to malls. While malls are declining and office buildings are being hit by the pandemic, industrial warehouses are benefiting from structural changes in the economy. While small and medium-sized banks tightening their money lines could put downward pressure on real estate values, the risk is very different from 15 years ago in 2008, and the damage to the real economy is likely to be much smaller.

- JPMorgan has stated that the events are negative for the market and economic outlook, but "this is not 2008" for three reasons. First, financial authorities have the tools to address the banking crisis, and the big banks are much healthier than they were in 2008. Second, the U.S. economy is in a much different place than it was in 2008. In 2008, unemployment was skyrocketing and there was a huge oversupply of housing, with 15% of homes sitting empty. Households and businesses were also in a much weaker financial position: mortgage debt was 65% of GDP; now it's around 45%, and housing inventories are at historically low levels. And third, the size or intensity of the problem is much smaller. They also noted that the USD has fallen even amid growing banking turmoil, indicating a more optimistic liquidity environment.

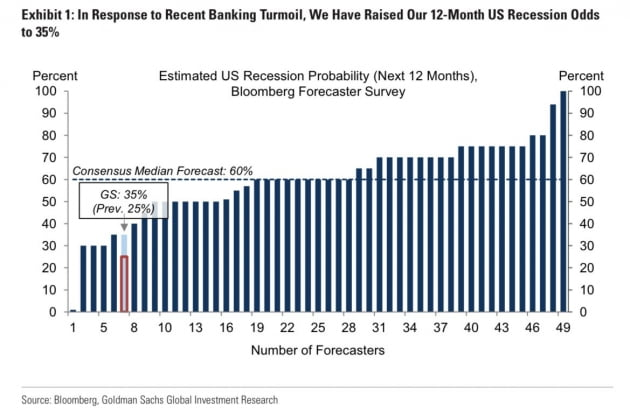

- Goldman Sachs raised their 12-month recession probability to 35% from 25% recently but maintained that tighter lending standards are a headwind for the economy rather than a hurricane that pushes the economy into recession.

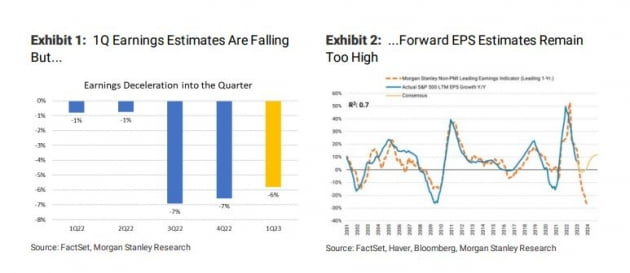

- Michael Wilson, the Chief Investment Officer of Morgan Stanley, remains pessimistic about the stock market and predicts that it will fall due to declining corporate profits. Check out his 4 min podcast or his Bloomberg TV interview. Wilson believes that the banking crisis will only worsen the decline. He argues that Wall Street's projections for corporate profits assume an unrealistic profitability recovery, and recent events have made it clear that the estimates are not viable. Wilson suggests that most bear markets end with an event that becomes too significant to ignore, and the recent banking stress and its potential negative impact on credit availability is a risk that the market should price more appropriately.

- Wilson observes that the bond market appears to have decided that the recent banking turmoil marks the beginning of the end of the economic cycle. The yield curve inversion steepened 60 basis points within a few days, and this is the first time in his memory that the bond market has traded so far away from the Fed's dot plot. This development is essential because it shows that the bond market is ignoring the Fed's guidance. Wilson believes that the stock market should consider these risks next.

4. Global markets snapshots