March 28, 2023

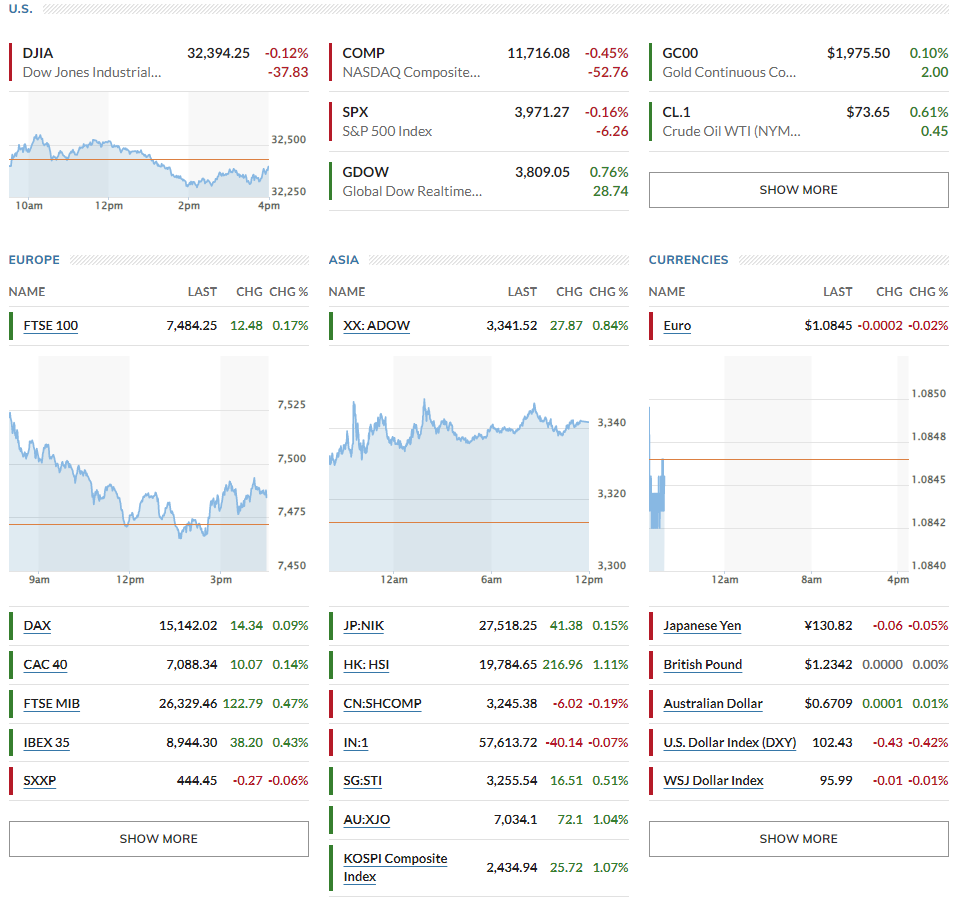

▶US Stocks down = S&P500 -0.16%, Nasdaq -0.45%, Dow -0.12% // European equities were mixed: Stoxx 600 -0.06 %, Germany’s Dax +0.09%, Paris' CAC 40 +0.14%, London’s FTSE 100 +0.17% // Asian stocks were mixed: Japan’s Topix +0.15%, Australia’s S&P/ASX 200 +1.04%, Hong Kong’s Hang Seng index +1.11%, China’s CSI 300 -0.19% and South Korea’s Kospi +1.07%.

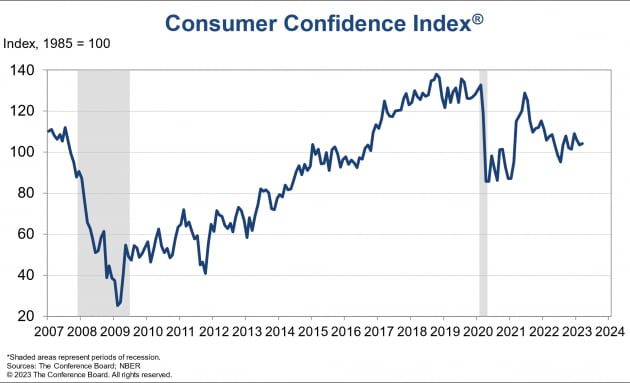

▶US rates down = 10-year U.S. Treasury note 3.567% (+1.6 bps), Germany 10Y at 2.286% (+5.7 bps), Italy 10Y at 4.129% (+6.2 bps), UK 10Y at 3.455% (+9.1 bps), Japan 10Y at 0.314% (+2 bps)

▶Oil prices down= $73.71 per barrel of WTI (+0.7%), Brent crude up +1.01% $78.91 // USD -0.42% at 102.43// Gold +0.08% at $1,975.0

*Key points

1. SVB Senate hearing

2. Single bet on DB's CDS was behind Friday's sell-off

3. US Economic data

4. Global Markets snapshots

There have been no recent banking-related disturbances since last weekend. Deutsche Bank's shares, which had rebounded strongly in European trading the day before, fell 1.5%, which is relatively insignificant compared to the reports that French prosecutors have carried out raids on Societe Generale, BNP Paribas, and other institutions over suspicions of tax evasion and money laundering. Additionally, deposit outflows from U.S. regional banks seem to have slowed.

As such, bond yields, which had been decreasing sharply, are now increasing. In the New York bond market, the 2-year Treasury note has gone up by 22 basis points, and the 10-year has gone up by 16 basis points this morning, following yesterday's gains of approximately 5 basis points.

Last week, tech stocks performed exceptionally well. Despite the ongoing banking crisis, investors injected more funds into stocks than in any other five-month period since October of last year, with Bank of America reporting $3.7 billion in net inflows into stocks and exchange-traded funds. All types of investors, including hedge funds, individuals, and institutions, were buying stocks, with the majority of the funds being poured into technology stocks, which saw a total of $808 million in investments.

1. SVB Senate hearing

🏈Bottom line: The U.S. Federal Reserve's Vice Chairman, Michael Barr, was under pressure to testify at a Senate hearing at 10 am EST regarding the failure of Silicon Valley Bank (SVB). Barr referred to SVB's failure as a classic example of mismanagement, stating that it occurred due to the inadequate management of interest rate and liquidity risks. Despite the failure, Barr reassured that the U.S. banking system is secure, resilient, and well-capitalized. He noted that the failure of SVB is not a systemic crisis but an isolated incident.

On the ninth, customers withdrew $42 billion, and an outflow of over $100 billion was expected the next day. As a result, SVB was closed before it could open on the 10th. Vice Chairman Barr mentioned that capital and liquidity standards for banks with over $100 billion in assets may require tightening.

Meanwhile, Martin Gruenberg, the President of the U.S. Deposit Insurance Corporation (FDIC), expressed that the risk of contagion to other banks was significant. Other banks were under severe stress that weekend. Gruenberg proposed a new rule to introduce a special fee for banks to ensure all deposits, which would be presented in May. The U.S. Treasury's Deputy Secretary, Nellie Liang, highlighted that without emergency measures, the outflow of uninsured deposits could have caused significant issues.

- Market reaction: They all agreed that deposit outflows were stabilizing, but their testimony did not have a positive impact on investor sentiment. In fact, it further fueled concerns that more banks could be at risk, and more regulation could be implemented. As a result, bank stocks that had previously risen began to decline. For instance, First Republic had initially increased by 2.5%, but later fell by as much as 9%. Regional Bancorp also experienced a 1% decline in afternoon trading.

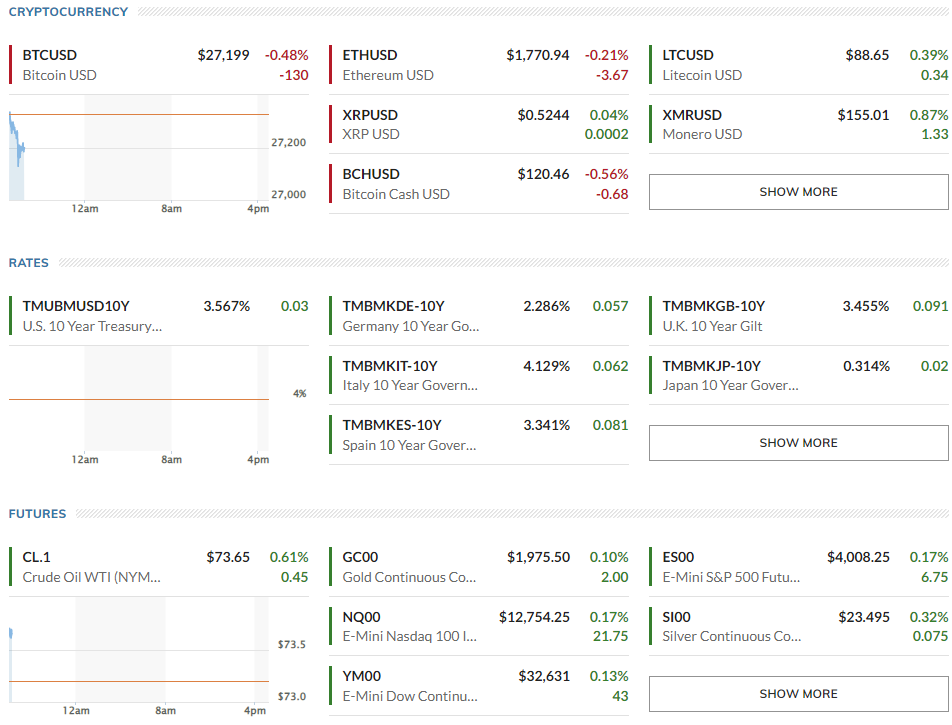

2. Single bet on DB's CDS was behind Friday's sell-off

🏈Bottom line: Bloomberg published an article titled "A Single Bet on Deutsche Bank’s Credit Default Swaps Is Seen Behind Friday’s Rout," which suggests that a single bet on Deutsche Bank's credit default swaps (CDS) for its subordinated bonds was the cause of last Friday's chaos. Someone had placed a bet of 5 million euros that the CDS for the bonds would increase, causing the CDS to surge and resulting in a stock market crash that wiped out 30 billion euros of market capitalization last Friday. This incident highlights how a large-scale single bet like this can create significant market movements in a situation where there is already market uncertainty. The article had a negative impact on the market as it suggested that similar unsettling movements could occur at any time.

3. US Economic data

🏈Bottom line: The economic data released today showed mixed results across several indicators.

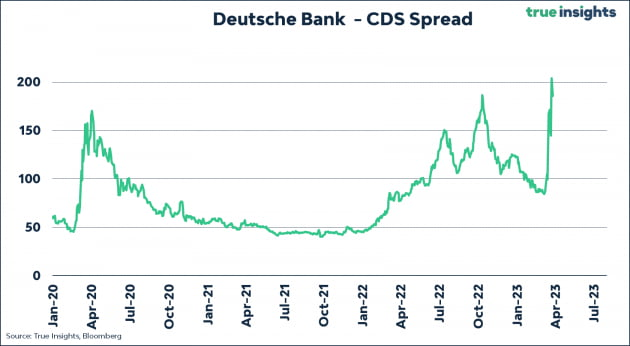

- The Consumer Confidence Index from The Conference Board for March rose to 104.2 from 103.4 in the previous month, beating Wall Street expectations of 100.7. However, the current conditions index decreased to 151.1 from 153.0 in the previous month, although it was higher than 70.4 the month before due to an expectations index of 73.0. The Conference Board reported that consumers were more optimistic about future conditions but less confident about the current situation, and inflation expectations for the next 12 months remained high at 6.3%.

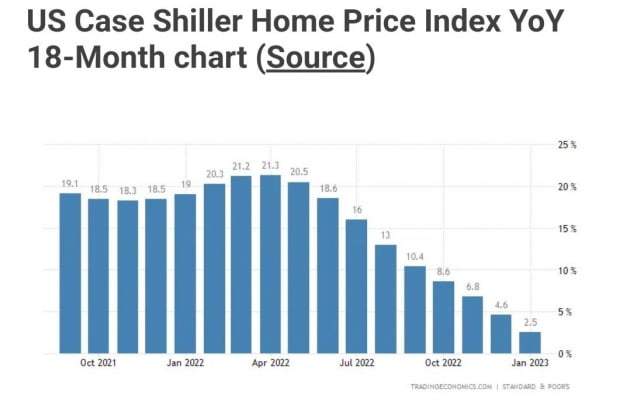

- The S&P CoreLogic Case-Shiller Home Price Index, which is used as a proxy for U.S. home prices, declined 0.2% in January from the previous month. The index increased by 3.8% on a year-over-year basis, down from 5.6% in December, and has been trending downwards since peaking in June. S&P noted that home prices have fallen for seven consecutive months, and the decline has been widespread.

- Additionally, a consumer survey from the Federal Reserve Bank of New York revealed that while expectations for home price appreciation have fallen, rents are expected to remain high. The survey found that respondents expected home prices to rise by 2.6% over the next 12 months, the lowest since the survey began in 2014. However, rents are expected to rise by 8.2%, down from 11.5% in February of last year, but well above the five-year forecast of a 5% increase. This suggests that rent growth may not be declining anytime soon. Bank of America also reported that rent payments among its banking customers rose by 8% year-over-year on a median basis in February.

4. Global Markets snapshots