March 29, 2023

The Sun has risen again! Five days had passed since the weekend and there had been no unsettling banking news. Today, investors around the world breathed a collective sigh of relief. Yet, the headlines around AI and ESG continue to stir up the nerves. What an interesting time we live in!

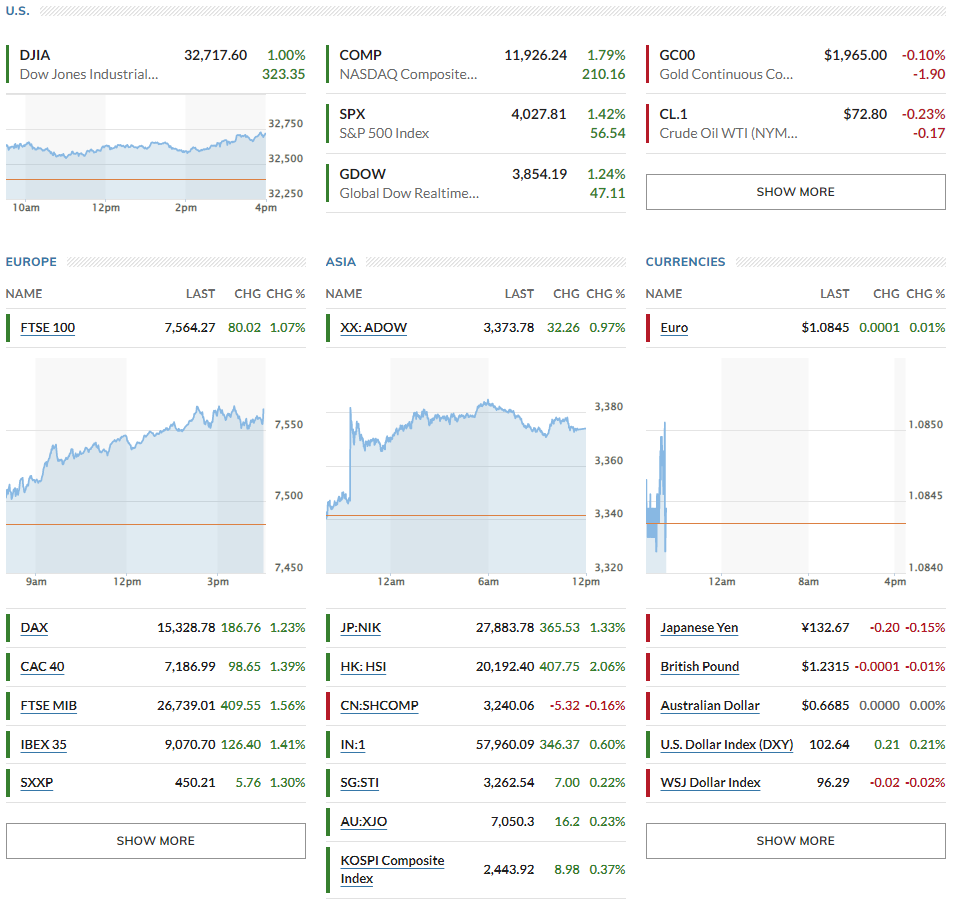

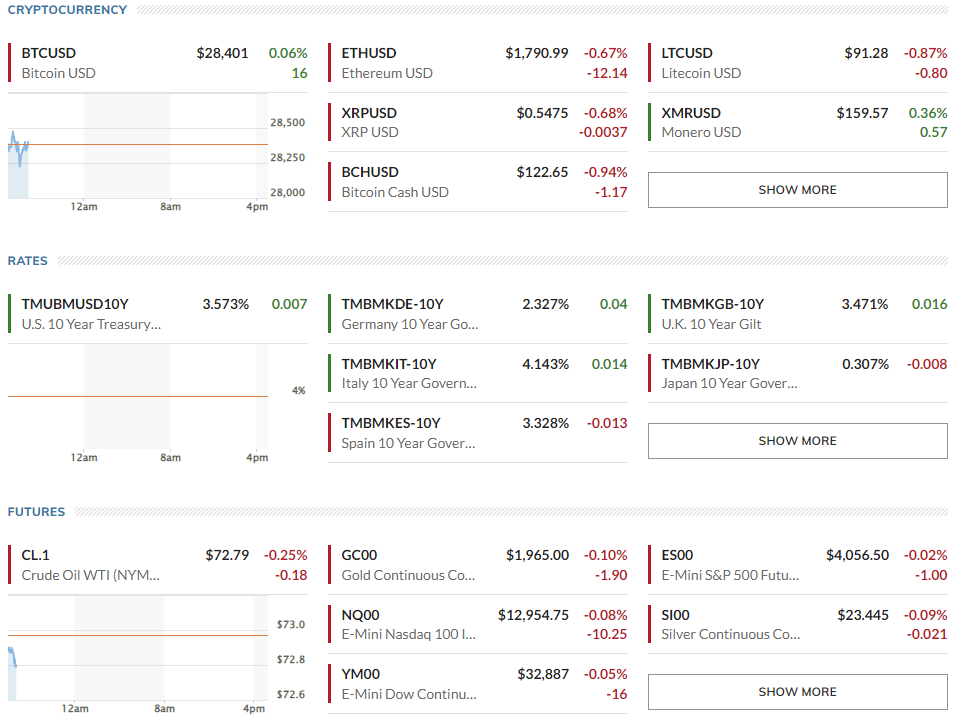

▶US Stocks up = S&P500 +1.42%, Nasdaq +1.79%, Dow +1.00% // European equities were up: Stoxx 600 -0.06 %, Germany’s Dax +0.09%, Paris' CAC 40 +0.14%, London’s FTSE 100 +0.17% // Asian stocks were mixed: Japan’s Topix +1.33%, Australia’s S&P/ASX 200 +0.23%, Hong Kong’s Hang Seng index +2.06%, China’s CSI 300 -0.16% and South Korea’s Kospi +0.37%.

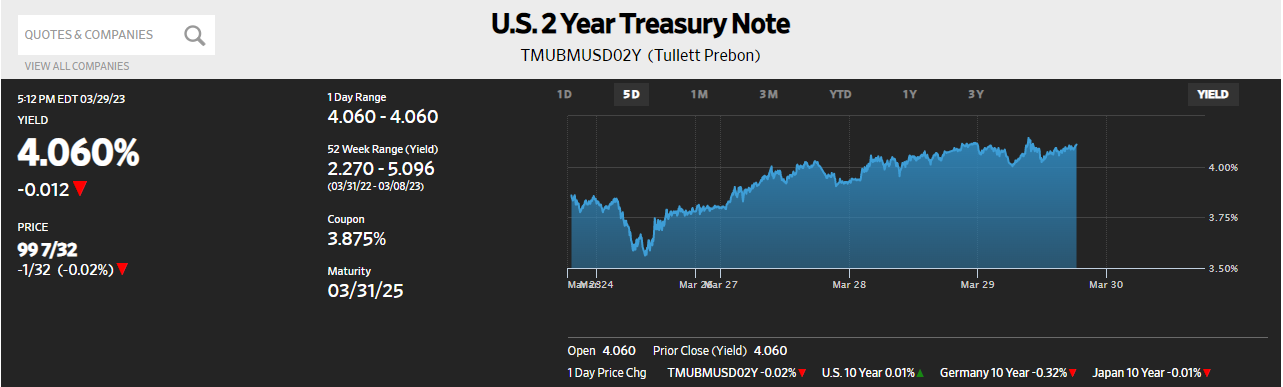

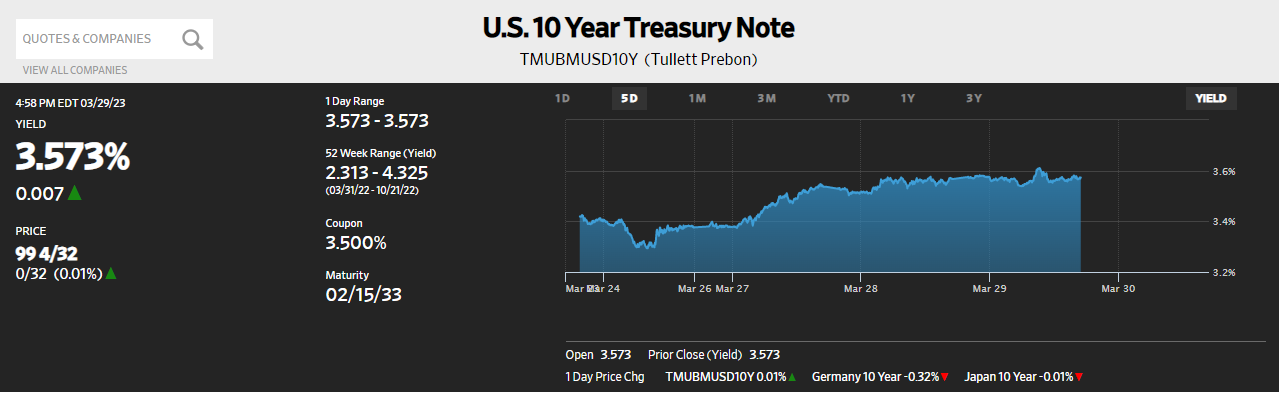

▶US rates down = 10-year U.S. Treasury note 3.573% (+7 bps), Germany 10Y at 2.327% (+4 bps), Italy 10Y at 4.143% (+1.4 bps), UK 10Y at 3.471% (+1.6 bps), Japan 10Y at 0.307% (-0.8 bps)

▶Oil prices down= $72.79 per barrel of WTI (-0.25%), Brent crude -0.08% $77.53 // USD +0.21% at 102.64// Gold -0.1% at $1,965.0

*Key points

1. Ermotti's return to UBS - a historic comeback story

2. Tech Rally to continue? + Elon's time-out request on advanced AI

3. US Economic data was mixed

4. Is it safe to say that the banking crisis, commercial real estate crisis, etc. are behind us?

5. ESG news

6. Global Markets snapshots

1. Ermotti's return to UBS - a historic comeback story

🏈Bottom line: In Europe, European banking stocks rallied on the news that UBS has hired Sergio Ermotti, the current chairman of Swiss Re, as its new CEO. Ermotti was CEO of UBS from 2011-2020 and led the bank's restructuring. The former Merrill Lynch investment banker was seen as a better fit to take over Credit Suisse than current CEO Ralph Hammers, who specializes in retail banking. FT article noted Ermotti pitched the idea of acquiring Credit Suisse 3-4 times during his tenure, but the board was not interested in a deal. Check out the FT's deep-dive on this. While the sudden change of CEO was met with speculation about Swiss authorities backing the move (Hammers is Dutch, Ermotti is Swiss), investors responded positively. On the Swiss stock market, UBS shares rose 4%.

2. Tech Rally to continue? + Elon's time-out request on advanced AI

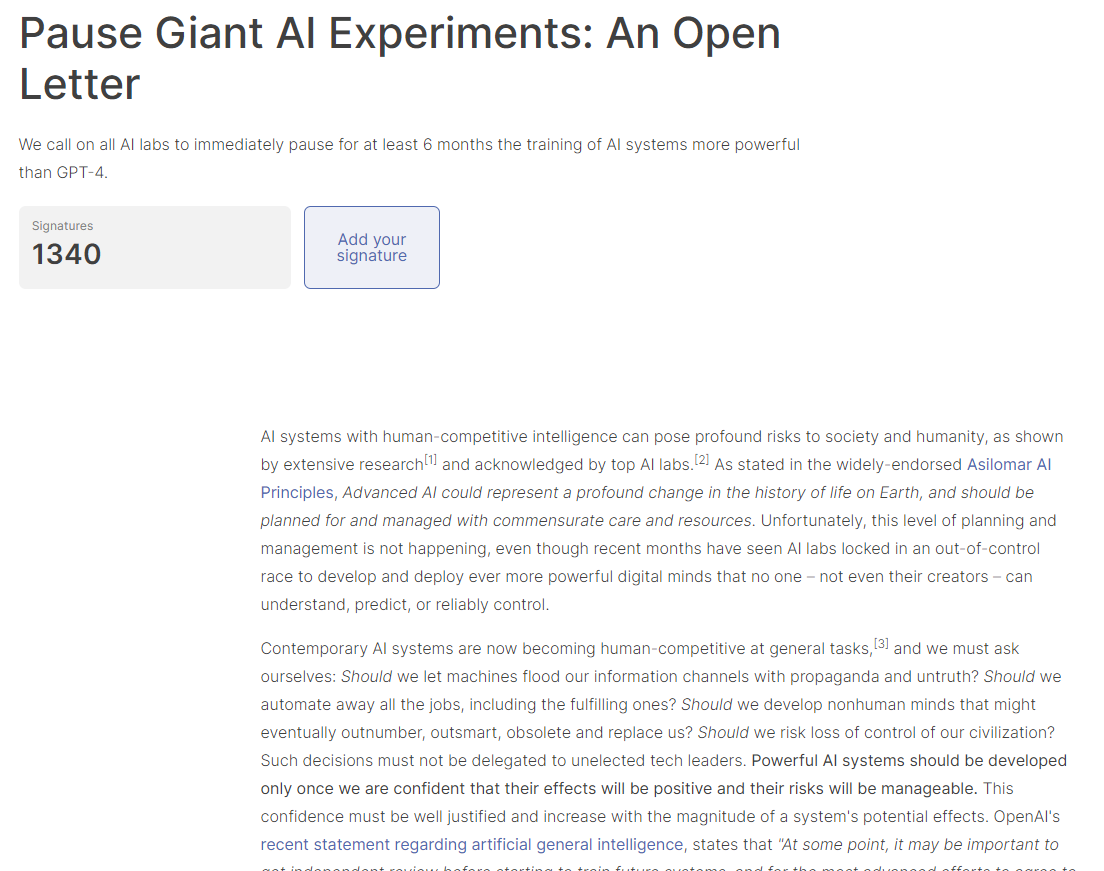

🏈Bottom line: In New York, tech and banking stocks led gains as well. Yet, Elon Musk and other tech experts call for ‘pause’ on advanced AI systems. More than 1,000 researchers and executives sign open letter to halt what they describe as a ‘dangerous’ arms race.

re: AI - you probably have seen the headline that Goldman Sach has started to use ChatGPT-style AI in-house. There have been many new updates since the introduction of ChatGPT-4 on March 25 (I will have a separate blog post on this now that the markets have calmed down a bit) and things are changing a lot faster than expected. So, Elon and 1000 experts are asking for at least 6 months of pause to ChatGPT to establish proper risk management and check and balance boundaries before having AI rampage around running over humanity. The open letter states “Recent months have seen AI labs locked in an out-of-control race to develop and deploy ever more powerful digital minds that no one — not even their creators — can understand, predict or reliably control.” You can add your signature here.

Back to the markets,

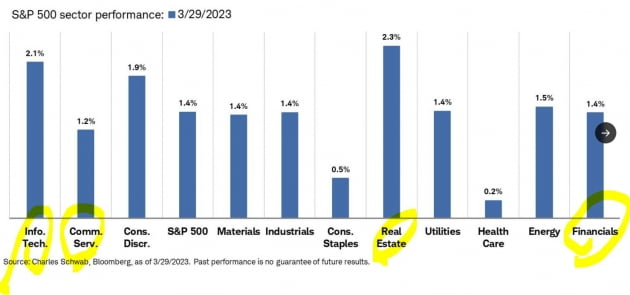

Big tech did it again - Amazon 3.10%, Meta 2.33% Nvidia 2.17% Apple 1.98%, Microsoft 1.92% - and semiconductor stocks joined in. Intel soared 7.61% after saying new servers with advanced chips will be available in the first half of 2024, earlier than expected, and Micron, which reported earnings the day before, surged 7.19%. While earnings were a mess, the positive was that the company said business is starting to improve. The optimistic outlook that growth is still in its early stages due to the spread of AI has also fueled an upward trend.

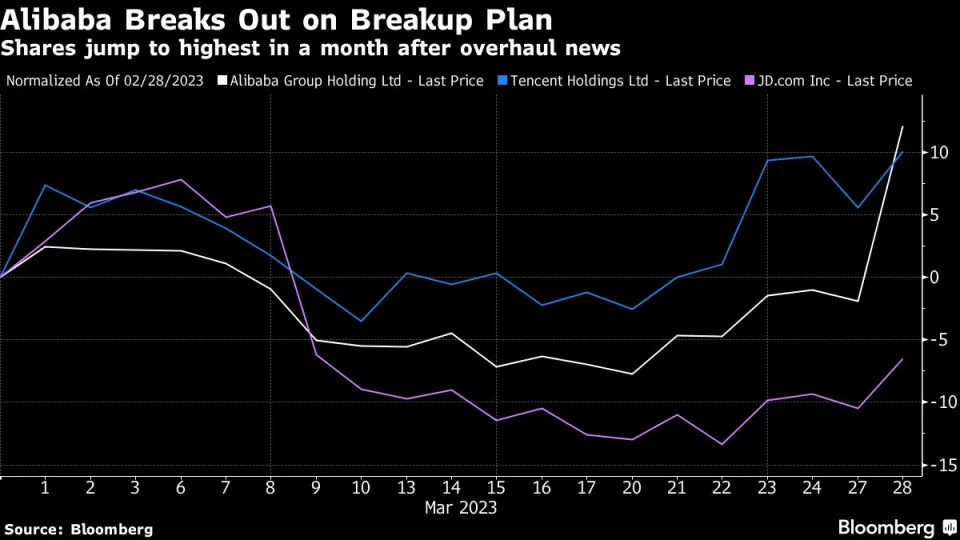

The surge in tech stocks following Alibaba's announcement of its split plan (split its $220 billion empire into six units) also had a positive impact. It was interpreted as a signal that the Chinese government is ending its crackdown on tech companies. There is no possibility that Alibaba made such a significant decision without government approval. In fact, President Xi Jinping's crackdown on tech companies began after Alibaba's Ma Yun criticized the government. Ma Yun returned to China after more than a year on March 27. Some also expect Tencent and JD.com to embark on business restructuring through split plans similar to Alibaba's.

Bank stocks surged amid signs of crisis easing. Regional bank stocks such as First Republic rose by 5.63%, Western Alliance by 6.62%, and Customers Bancorp by 4.14%. Large bank stocks such as Wells Fargo and Bank of America also rose significantly, by 2.13% and 1.96%, respectively.

Energy stocks also saw a surge. Bloomberg reported that "Republicans are floating legislation that would ease energy permitting in exchange for raising the US debt ceiling, creating a potential path to avoid a default." House Speaker Kevin McCarthy sent a letter to the White House proposing to add "measures to lower energy costs and promote energy independence in America" to the debt limit bill. The drop in energy prices could benefit both sides, as it could help President Joe Biden's re-election campaign. Bloomberg noted that it is an attractive deal for both sides.

Real estate stocks, which had been shrinking due to the theory of a commercial real estate crisis, also saw a sudden surge. This excited financial market sentiment can be seen in the volatility index (VIX). The VIX, which had surpassed 30 immediately after the banking turmoil, fell by 4% today to 19.12. It fell below 20 for the first time in about a month, indicating that investors are becoming more comfortable.

The technology stock rally is frightening. According to Johns Trading, while the S&P500 index has risen 3.4% so far this year, if we look at the seven big tech stocks, such as Apple (+22%), Microsoft (+15%), Amazon (+16%), Alphabet (+14%), Meta (67%), Nvidia (80%), and Tesla (53%), their combined increase should have been 5%. In other words, the remaining 493 stocks, excluding these stocks, contributed to a negative impact on the S&P500 index.

On Wall Street, there are positive evaluations such as "the return of tech stock leadership" (Bank of America), but there are also comments that the market is too narrow (Yardeni Research). The fact that the market is narrow means that there is a limit to the overall market growth. This is because tech stocks have dominated the market. The ChatGPT fever has also contributed significantly to the rise of these tech stocks.

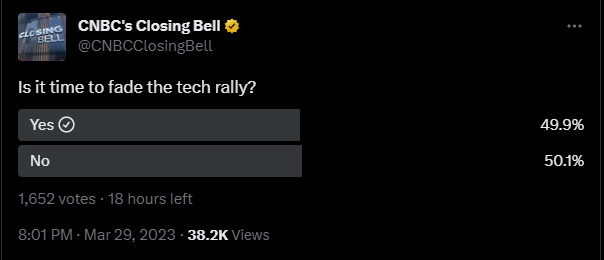

CNBC conducted a Twitter survey today asking investors, "Is it time for the technology stock rally to fade?" 49.9% answered "yes" and 50.1% answered "no" at the time of writing this March 30 @ 1:14am UK time.

3. US Economic data was mixed

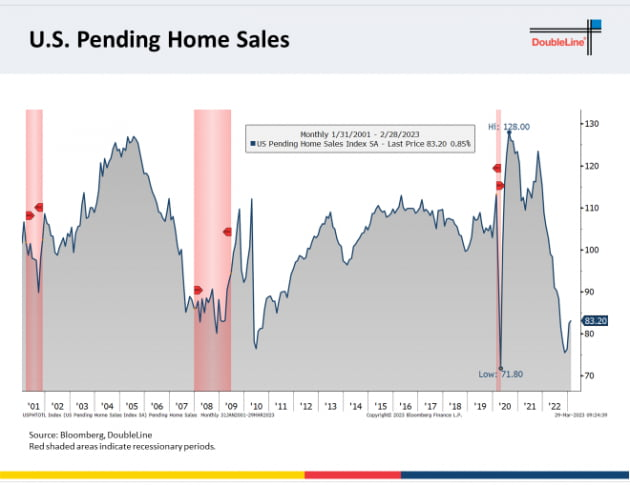

- February's pending home sales were announced as up 0.8% from the prior month. This beat Wall Street expectations (down 3.0%) and is 21.1% less than the same period last year. Bank of America said, "We expect mortgage rates to fall to 5.25% by year-end from over 6.5% today. If mortgage rates fall below 6%, housing demand could rebound very quickly. Historically low housing inventory is a positive. There is a lot of pent-up demand in the market. There are 3 million renters with household incomes above $150,000 per year (1.3 million housing completions per year), and more than 5 million millennials entering the housing market over the next 5-10 years."

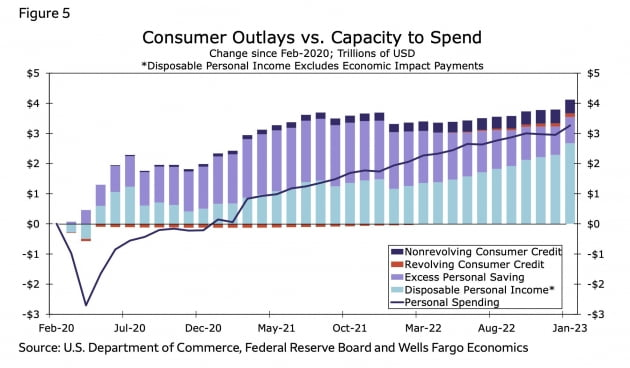

- Consumption shows signs of slowing slightly. "Consumers are increasingly relying on credit (borrowing) as their surplus savings decline," Wells Fargo said, adding that "borrowing will overtake saving as a source of funding in the coming months. Moreover, in the aftermath of the banking crisis, loans are likely to become more expensive and more difficult to access." Visa's Spending Momentum Index (which tracks the momentum of consumer spending, whether it's rising or falling) was 98.0 in February, down 2.8 points from 100.8 in January.

4. Is it safe to say that the banking crisis, commercial real estate crisis, etc. are behind us?

BCA Research has released several reports on the subject.

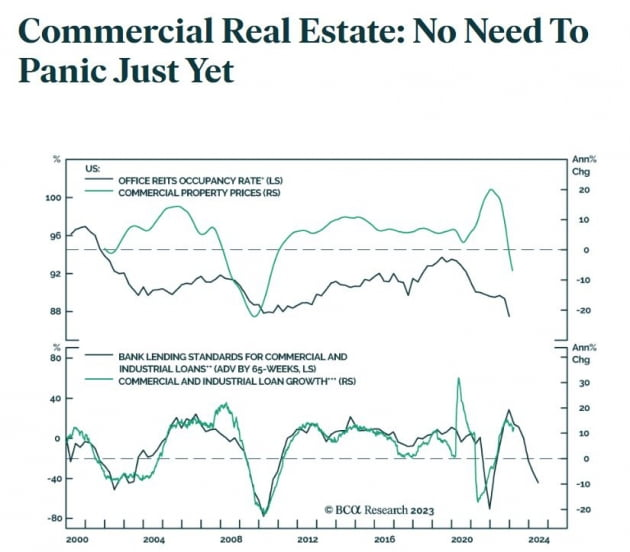

▶Commercial real estate crisis brewing?

- The commercial real estate market is causing concern due to small and mid-sized banks holding 80% of the banking system's commercial real estate loans, or $2.3 trillion.

- However, problems in the commercial real estate market do not necessarily mean a banking disruption is inevitable.

- Vacancy rates in office buildings are decreasing as many companies cut back on working from home, which means building owners can pay their bank loans and interest.

- The decline in the value of commercial real estate loans is currently only a book loss and may remain so unless banks are forced to liquidate this portfolio.

- While the value of many commercial buildings has decreased due to higher interest rates and rising vacancy rates, they are still worth more than the size of the mortgage loan.

- Investors should monitor the commercial real estate market, but there's no need to panic at this time.

▶Is the Fed's bank liquidity support quantitative easing (QE) or not?

- The Fed's balance sheet increased by $392 billion between March 8-22.

- Since starting its quantitative tightening (QT) program, the Fed has unwound 69% of the assets it had reduced prior to the Silicon Valley banking crisis.

- The Fed's balance sheet growth is similar to quantitative easing (QE) in that it expands the overall supply of bank reserves.

- However, this liquidity injection differs from typical QE because it was not accomplished through bond purchases. The Fed's bond holdings have continued to decline over the past two weeks.

- Instead, the Fed has been lending directly to banks through the Fed's rediscount window and the newly established Bank Term Funding Program (BTFP).

- Additionally, the Fed has lent $180 billion to bridge banks set up by the Deposit Insurance Corporation (FDIC) to shore up failing banks.

- Bank reserves will decrease if no other regional banks have problems, but they will grow if more banks fail or need the BTFP.

- If deposits continue to leave small and medium-sized banks, more liquidity support may be needed.

- The Fed may stop its bond purchases or QT program to prevent the entire banking system from losing reserves.

▶The labor market is still hot. When will the "long and variable lag" of tightening have an impact?

- Historically, after the Fed's first rate hike, the unemployment rate remains low for an average of 9 months.

- January's unemployment rate of 3.4% may be the bottom of the current cycle, but the trough came a month later than the historical average.

- A 0.5 percentage point increase in the unemployment rate has always signaled a recession, but a 0.2 percentage point increase between January and February does not necessarily mean a recession is imminent.

- On average, it took about two and a half years after the Fed's first rate hike for the unemployment rate to rise 0.5 percentage points from its low.

- However, the lag was shorter during the most aggressive periods of rate hikes, such as in 1980, 1972, and 1977.

- With the current tightening cycle being the second most aggressive in history, the lag time to a spike in unemployment may be shorter than average again.

5. ESG news

🏈Bottom line: On Wednesday, Net Zero Asset Owners Alliance set out new guidance for members to publish oil and gas policies within 12 months on a comply or explain basis. Under the new rules, investors 'who are committed to net zero' should introduce new fossil fuel financing restrictions that include a ban on investments in new oilfields and gas fields, and in new baseload gas-fired power generation without carbon capture technology. However, it has not set a deadline. Members “are expected to follow this guidance” or risk having to leave the alliance, said Günther Thallinger, the alliance’s chair.

🏈Bottom line: Britain and the EU are boosting coordination of efforts to tackle climate change and respond to a massive US green subsidy program*, in a sign of warming relations between the two sides. On Thursday, the government will launch a consultation on whether to introduce a UK “carbon border adjustment mechanism” as part of a broader net zero strategy. The consultation would address the risk of future “carbon leakage”, where businesses move production to a country with weaker climate regulations in order to avoid paying a carbon levy. Note) *The US’s Inflation Reduction Act, passed last year, includes $369bn worth of tax credits, loans and grants designed to stimulate clean technology investment and meet President Joe Biden’s goal of halving US carbon emissions by 2030.

🏈Bottom line: The Climate Change Committee identified multiple failures, including limited progress on reducing water consumption and leakage and the absence of a clear strategy to protect the productivity of agriculture as weather conditions change per 'lack of urgency' on climate resilience. Note) The CCC’s biennial adaptation progress report is the latest in a series of critical assessments of the government’s performance in tackling climate change. These included a warning earlier this month by the National Audit Office that the UK was at risk of missing its goal to decarbonize the power sector by 2035.

6. Global Markets snapshots