March 30, 2023

There was no uneasy news about the bank today, and the good sentiment continued. US economic data were mixed and had little impact on the market.

*Key points

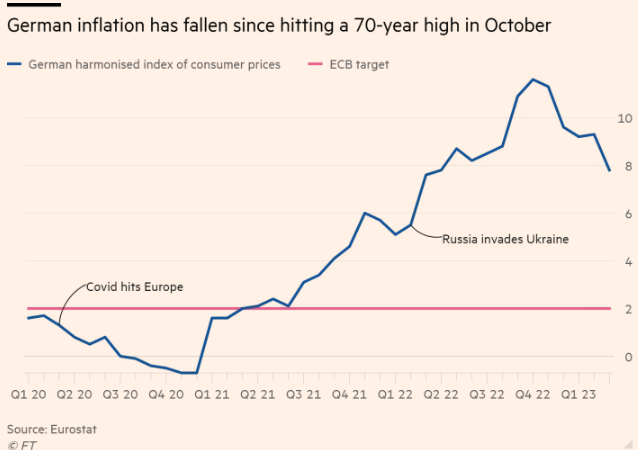

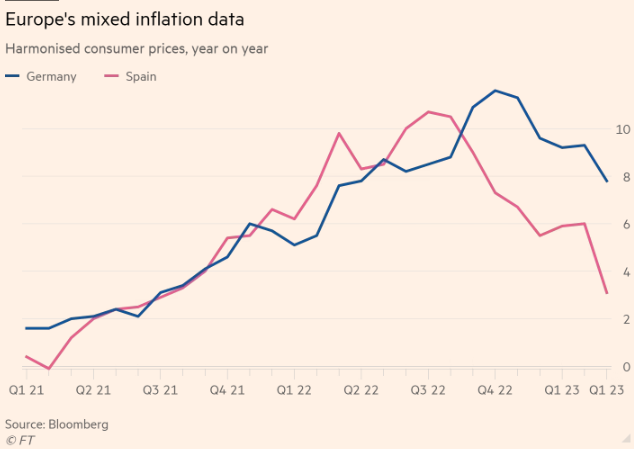

1. German and Spanish inflation dropped per energy price fall, but core inflations remain high and sticky

2. Fed's balance sheet has decreased a bit and US Money Market Funds touch $5.2 Tril record

3. US Macroecon data

4. With the banking crisis behind, investors' attention is back on the Fed

5. ESG News

6. Global Markets snapshots

1. German and Spanish inflation dropped per energy price fall, but core inflations remain high and sticky

🏈Bottom line: German fresh headline CPI decreased to 7.8% YoY in March on a harmonized basis, higher than the economists' forecast of 7.5%. Meanwhile, Spain's headline CPI has halved to an annual rate of 3.1% from Feb's 6%, which is lower than the 4% predicted by economists.

The German CPI's decrease can be attributed to the exclusion of the surge in energy costs from last year's index. Compared to February's 9.3%, this was a significant decline and is the lowest level since August 2022. Nevertheless, the core CPI rose by 5.9%, which is higher than the 5.7% in February.

The Spanish CPI decline was largely due to the significant decrease in energy prices following Russia's invasion of Ukraine a year ago. Although the figure was much lower than the expected 4.2%, the market response was lukewarm, because the core inflation remained stubbornly high at 7.5% YoY, which is almost the same level as February's 7.6% YoY. This indicates that the pressure on underlying inflation, such as service prices, continues to persist.

- Market reaction: Euro area government bonds sold off after Germany’s inflation figures were published. Yields on German two-year debt rose 0.13 percentage points to 2.8% as investors bet that borrowing costs in the eurozone would rise further.

- What does this mean for ECB's rate hike?: The conflicting inflation data presents a challenge for the European Central Bank's decision-makers. In the previous month, the bank increased its benchmark deposit rate from 2.5% to 3%, and there is a general anticipation for another 0.25% increase when the ECB convenes again.

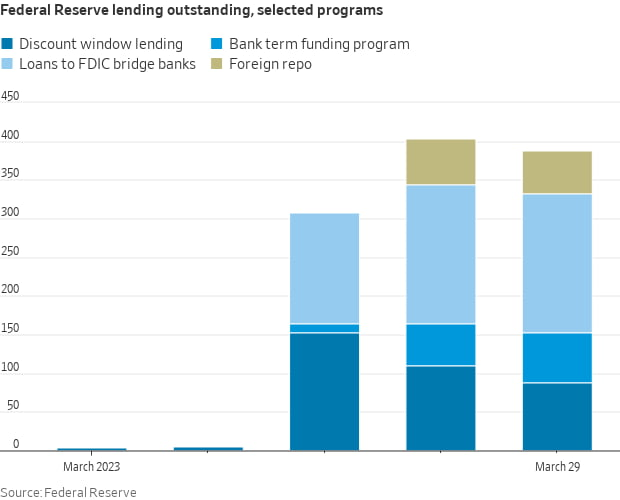

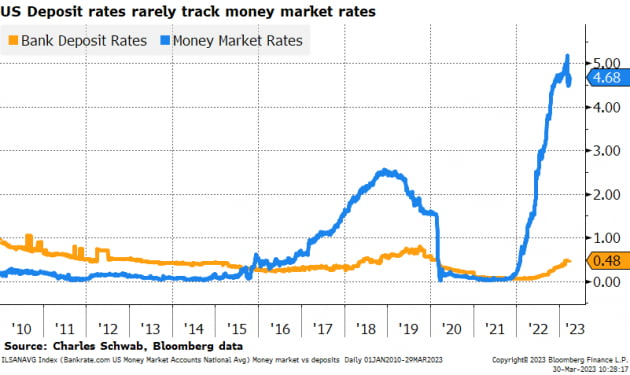

2. Fed's balance sheet has decreased a bit and US Money Market Funds touch $5.2 Tril record

Today, the Fed released its balance sheet (as of March 29th). The balance decreased by $27.8 billion over the past week, with bank borrowing dropping from $163.9 billion to $152.6 billion, indicating a decrease in bank liquidity demand. Borrowing from the discount window decreased by $22 billion, while the Bank Term Funding Program (BTFP) saw an additional $10.7 billion being lent out. Additionally, funds taken by foreign central banks through currency swaps decreased by $5 billion.

US deposit outflows from banks seem to continue. According to ICI data, money market funds set a new record today, reaching about $5.2 Trillion. This week, $66 billion were also added to the funds. Although this is only half compared to $117.4 billion dollars a week ago, it can be seen that the movement of funds from deposits to money market funds is continuing. Tomorrow at 4:15 pm EST, the balance sheet of commercial banks will be released. This will show how much money has been withdrawn from small and medium-sized banks and how much has been transferred to large banks.

3. US Macroecon data

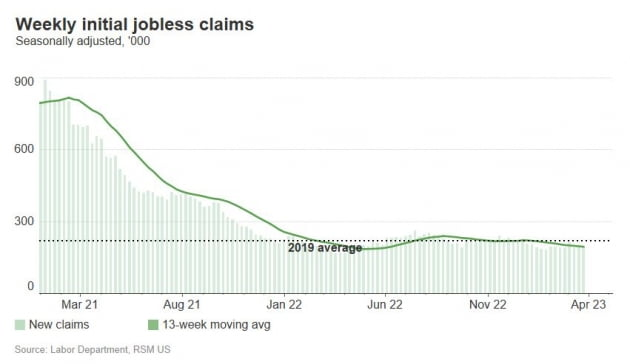

🏈Bottom line: During the previous week (ending on the 25th), the number of individuals filing for new unemployment benefits increased by 7,000 to a total of 198,000. This figure remains at a historically low level of less than 200,000, which is noteworthy considering that in 2019, a year of robust job growth, the weekly average was 220,000. The number of ongoing jobless claims also rose slightly, increasing by 4,000 to reach a total of 1,689,000.

Although the initial claims data suggests that employment levels are being sustained, the rise in new layoffs is not a major cause for concern. However, there has been a slight increase in the number of ongoing jobless claims, which is up by 20% compared to six months ago. This indicates that finding new employment opportunities may be somewhat more challenging.

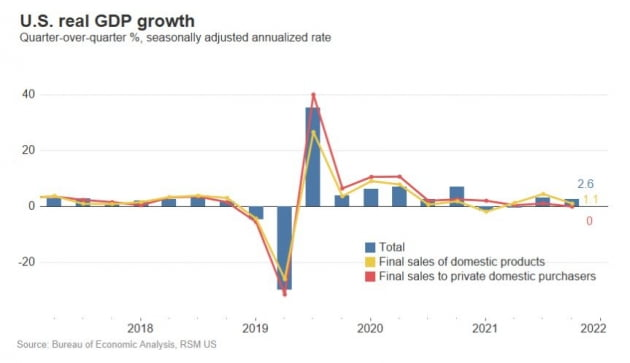

🏈Bottom line: The final Q4 US GDP was 2.6%, which is slightly lower than the initial estimate of 2.7%. Additionally, the Personal Consumption Expenditure (PCE) figure was revised down from a 1.4% increase to a 1.0% increase. It's important to note that the US government announces GDP figures three times, with the preliminary figure followed by two subsequent revisions.

4. With the banking crisis behind, investors' attention is back on the Fed

🏈Bottom line: Although the markets have stabilized, there are lingering concerns about the potential for Fed tightening. According to Bank of America, once fears about deposit outflows have subsided, investors may refocus on the risk of reacceleration that existed before the recent banking turmoil. The Fed's market watch on the Chicago Mercantile Exchange (CME) indicates a decrease in bets that the Federal Open Market Committee (FOMC) will 'freeze interest rates' in May, falling to 50.9% from 72.6% a week ago and 59.4% just a day ago. Meanwhile, the probability of a 25 basis point raise has increased from 27.4% to 40.6% and now 49.1%. Betting on a rate cut in the second half of the year is also decreasing. Last week, the expected benchmark rate by the end of the year was 3.7%, but it has now risen to 4.3%.

5. ESG News

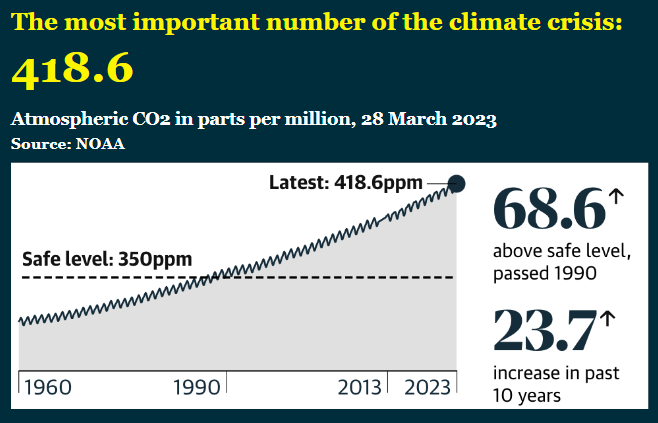

Note) To understand what this 418.6 means, pls check out my other post here.

*TNFD releases 4th and final beta framework (link)

🏈Bottom line: The Taskforce for Nature-Related Financial Disclosures (TNFD) is looking at companies’ impacts on nature. A new framework is being written to guide action, and their latest update has just been released, TNFD is the sister organization of the Taskforce for Climate-Related Financial Disclosures (TCFD) whose focus is climate disclosure and reporting. TNFD wants companies to look at biodiversity impacts in the same way. The UN says that companies should be disclosing their impacts on nature by 2030. The TNFD's final recommendations will be published in September 2023, following a final 60-day consultation process from 30 March to 1 June 2023.

The three tiers of proposed disclosure metrics are:

- Core Global Disclosure Metrics – that are relevant broadly to organisations across sectors and are reflected in global policy priorities, including the Global Biodiversity Framework;

- Core Sector Disclosure Metrics – to enable capital providers to make comparable assessments of businesses within a sector; and

- Additional Disclosure Metrics – to enable report preparers to include metrics that might be particularly relevant to their business model and nature-related issues.

*Top UN court to assess countries’ climate obligations after resolution passes (Bloomberg)

🏈Bottom line: The United Nations (UN) has adopted a resolution that could make it easier to hold polluting countries legally accountable for failing to address climate change. The resolution, spearheaded by Vanuatu - a small island nation - and youth activists, seeks to secure a legal opinion from the International Court of Justice to clarify countries' obligations to tackle the climate crisis and specify consequences for inaction. The resolution was co-sponsored by over 120 countries, including the UK, but not the US. The legal opinion will not be binding, but it could help establish international legal rules to influence judges and governments in climate-related litigation.

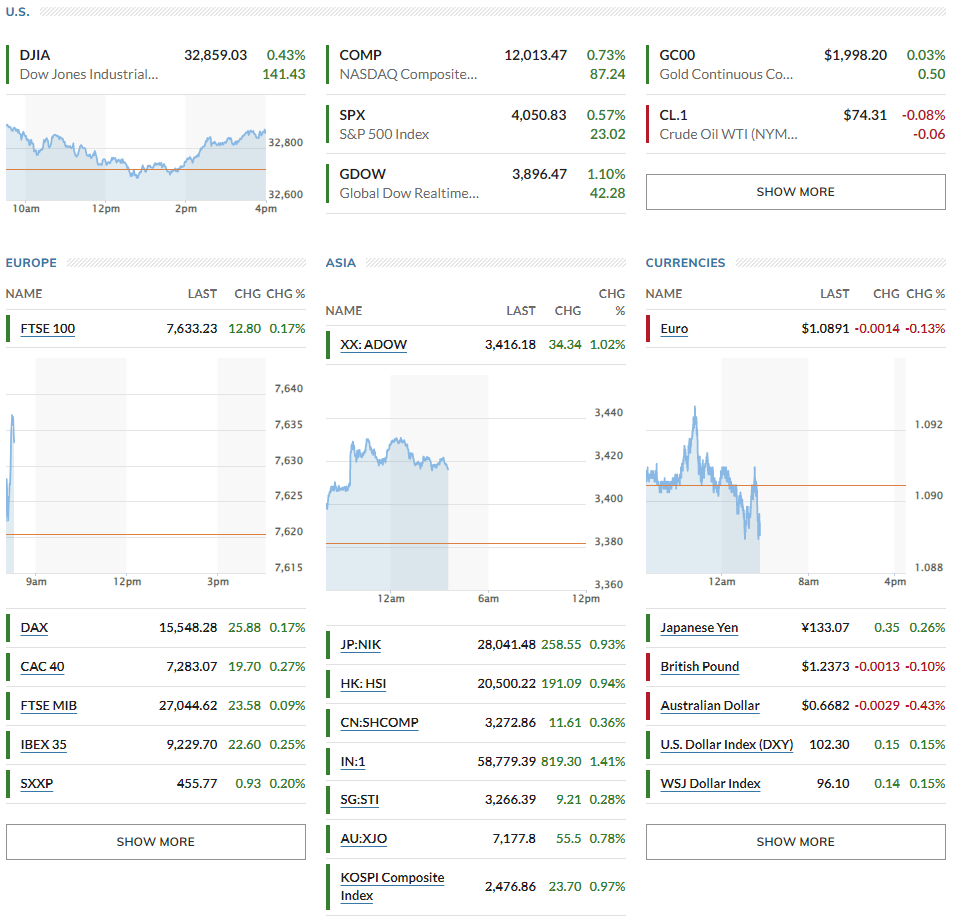

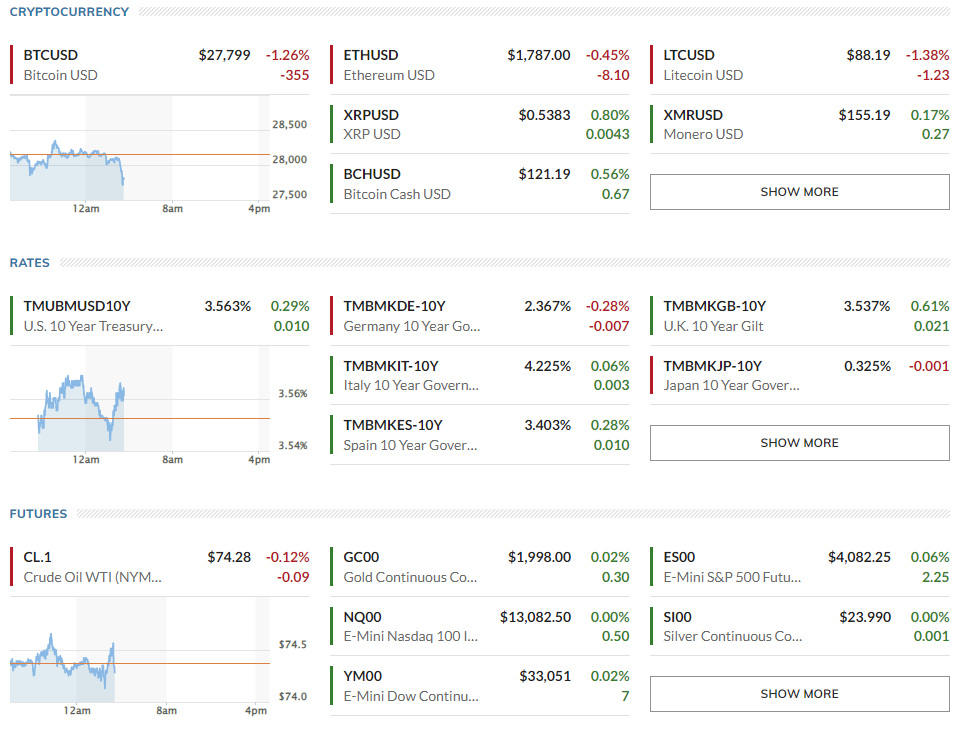

6. Global Markets snapshots

![Obsidian Brief] When Money Becomes Software: AI, Stablecoins & Bitcoin — Implications for Sustainable and Impact Investing](/content/images/size/w720/2025/12/Gemini_Generated_Image_dppem0dppem0dppe.png)

![Leadership] AI Is Changing Everything — How a CEO Managing $1.6 Trillion Stays Ahead, ft. Jenny Johnson from Franklin Templeton](/content/images/size/w720/2025/12/Screenshot-2025-12-03-060128.png)

![AI] The Future of Work, Robotics & AI Infrastructure (Elon's bold predictions: work will be optional & currency could be irrelevant)](/content/images/size/w720/2025/11/Screenshot-2025-11-22-074621.png)