March 31, 2023

Global markets rallied across the board and wrapped the eventful Q1 strong today!

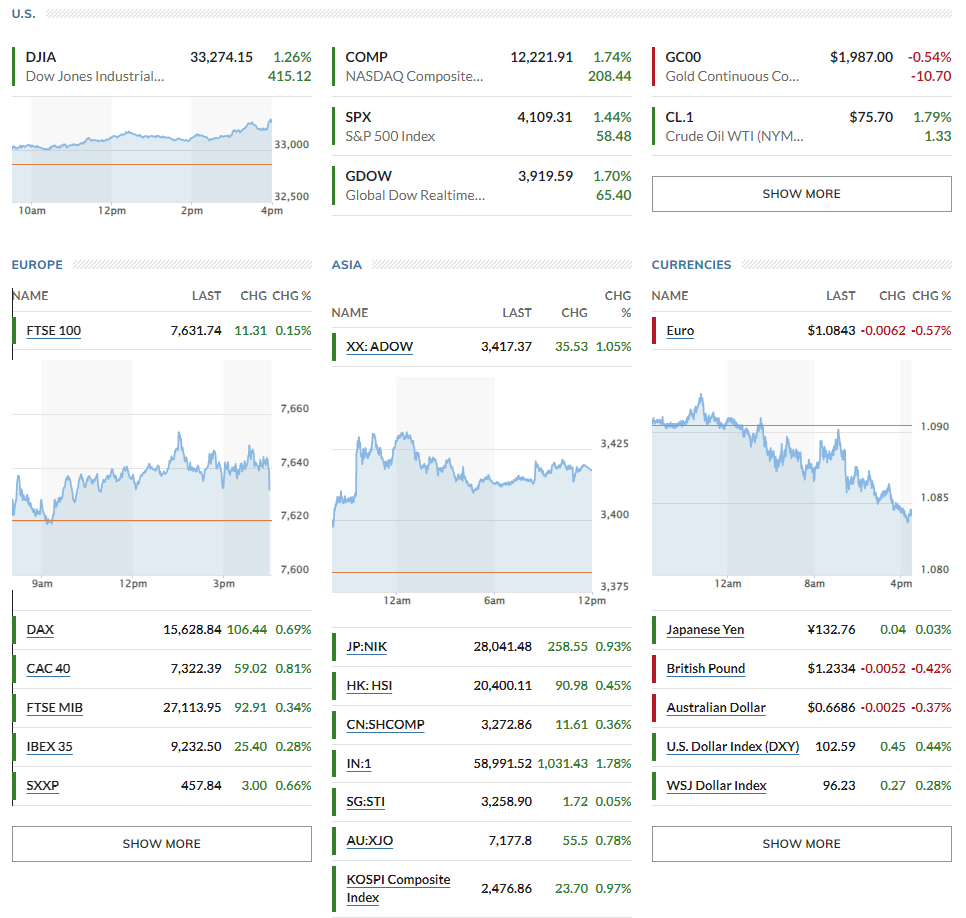

▶US Stocks up = Dow +1.26%, Nasdaq +1.74%, S&P500 +1.44% // European stocks were up: London’s FTSE 100 +0.15%, Germany’s Dax +0.69%, Paris' CAC 40 +0.81%, Stoxx 600 +0.66 % // Asian stocks were up: Japan’s Topix +0.93%, Hong Kong’s Hang Seng index +0.45%, China’s CSI 300 +0.36%, Australia’s S&P/ASX 200 +0.78%, and South Korea’s Kospi +0.97%.

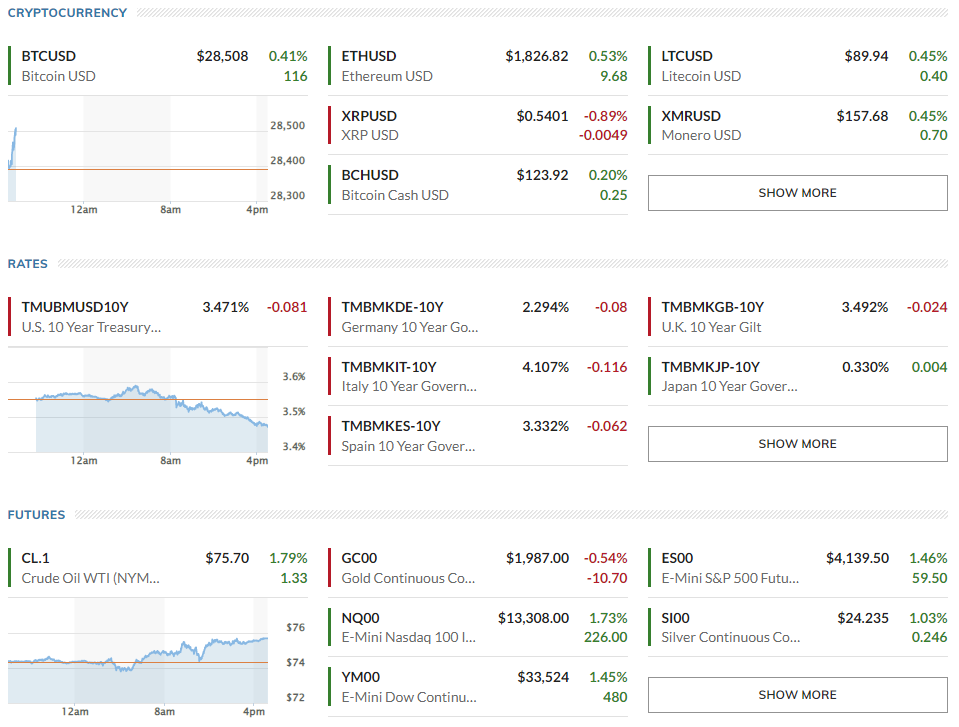

▶US rates down = 10-year U.S. Treasury note 3.471% (-8.1 bps), Germany 10Y at 2.294% (-8 bps), Italy 10Y at 4.107% (-11.6 bps), UK 10Y at 3.492% (-2.4 bps), Japan 10Y at 0.330% (+0.4 bps)

▶Oil prices up= $75.70 per barrel of WTI (+1.79%), Brent crude +0.59% $79.74 // USD +0.44% at 102.59// Gold -0.53% at $1,969.80

*Key points

1. Lower than-expected February PCE + Michigan consumer confidence & Mixed March Eurozone inflation

2. The Fed's balance sheet

3. April is a strong month

4. ESG News

5. Global Markets snapshots

1. Lower than-expected February PCE + Michigan consumer confidence & Mixed March Eurozone inflation

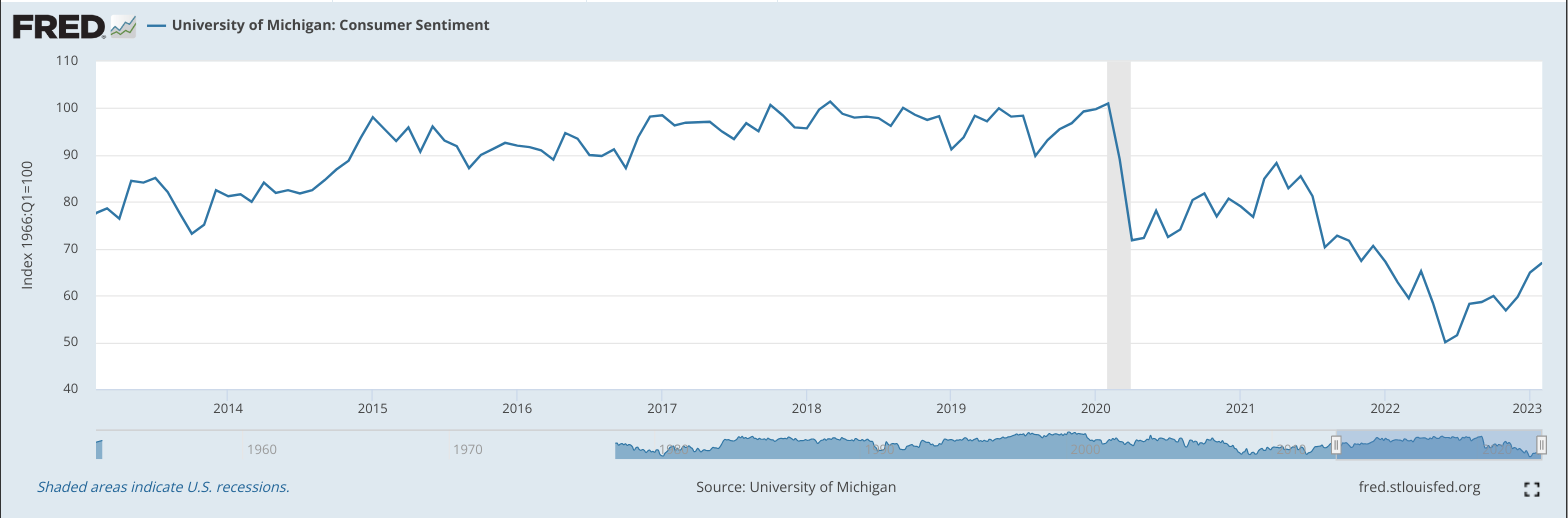

🏈Bottom line: In February, the personal consumption expenditures (PCE) has risen less than expected. Also, the University of Michigan's Consumer Sentiment Index for March came in at 62.0, lower than expected MoM.

① Lower-than-expected inflation

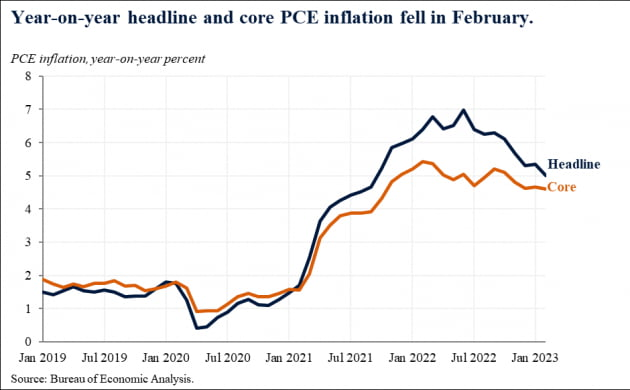

The headline number for inflation rose by 5.0% compared to a year ago and by 0.3% from the previous month, which was lower than the market estimate of 5.1% and 0.4%, respectively. It also showed a significant decline from January's figures (5.4% and 0.6%). The biggest factor contributing to this was a decrease in energy prices, which fell by 0.4% after increasing by 2.0% in January.

Excluding food and energy, the core inflation rate rose by 4.6% and 0.3%, respectively, which was also lower than the market estimate of 4.7% and 0.4%. However, market analysts were relieved that the core inflation rate only increased by 0.3% from the previous month, as they had been concerned that it would rise more than expected.

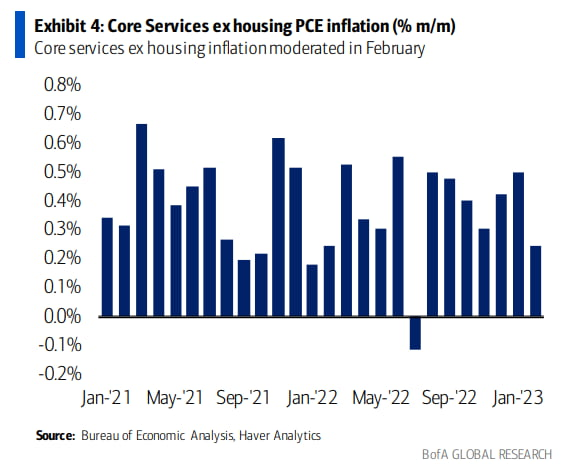

Jerome Powell is closely monitoring the super core inflation, which excludes housing prices, and it only increased by 0.3% in February, lower than January's 0.5%.

PCE inflation is currently lower than recent Consumer Price Index (CPI) numbers, mainly due to housing costs having much less weight in PCE.

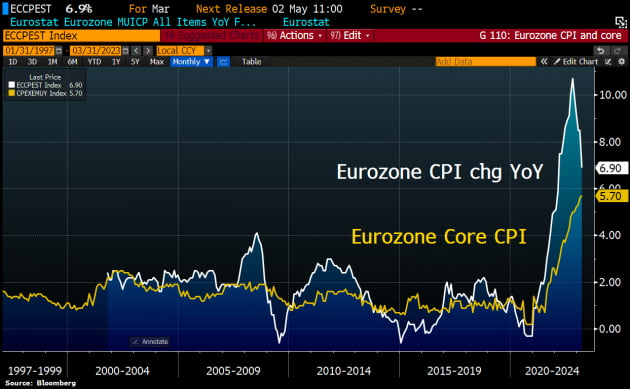

In Europe, the headline consumer price inflation for March showed an increase of 6.9% YoY, which was a significant decline from February's figure of 8.5%. However, excluding food and energy, the core inflation rate rose by 5.7%, which was higher than February's figure of 5.6%. This set a new record for the Eurozone. Despite a sharp drop in energy prices compared to a year ago when Russia invaded Ukraine, the increase in service prices led to a widening trend of inflation.

② Decreased Consumer Spending

In February, personal consumption expenditures (PCE) increased by 0.2%, but it was significantly slower than January's 2.0% and lower than expected at 0.3%. It was also lower than the pre-pandemic average of 0.3% growth. In particular, when considering inflation, spending actually decreased by 0.1% last month. In fact, one indicator that represents consumer spending, the March auto sales figures (preliminary), is not looking good.

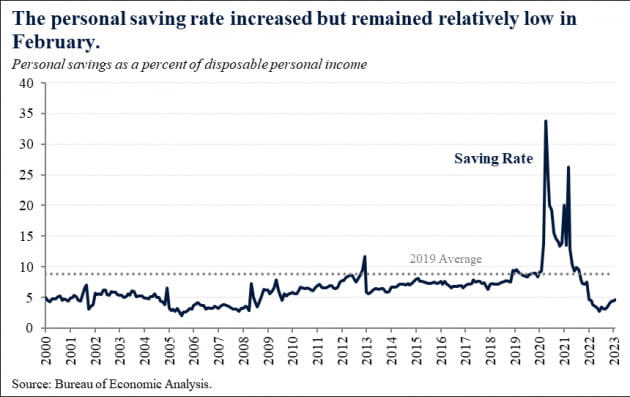

In February, personal income increased by 0.3%. The total nominal compensation, which takes into account both the number of workers and average wages, also increased by 0.3%. The savings rate slightly increased from 4.4% in the previous month to 4.6% in February.

③ Still, 25 bps rate hike in May expected

Overall, the tone was positive, but it does not mean that the Fed will stop tightening. Looking at the core PCE inflation over the last three months, it has remained almost unchanged at 4.6% to 4.7%, which is well above the Fed's target of 2%. Therefore, it is likely that the Fed will maintain its plan to raise interest rates by 25 basis points in May.

Also, the University of Michigan's Consumer Sentiment Index for March came in at 62.0, lower than expected and the previous month. Professor Joanne Xu stated that consumer sentiment fell for the first time in four months and the banking sector's turmoil had a limited impact on it. Inflation expectations also decreased, with short-term expectations dropping to 3.6% and five-year expectations remaining unchanged at 2.9%.

- Market reaction: Treasury yields plunged as expectations of tame inflation intensified. Stocks rallied.

2. The Fed's balance sheet

🏈Bottom line: The positive impact of the stability of banks' funding demand, as confirmed by the Federal Reserve's balance sheet released on March 29, had a positive effect on the rally.

Banks' balances decreased by $27.8 billion over the past week, indicating a decrease in their emergency liquidity demand. However, the commercial bank balance sheet released by the Fed after the market closed showed that $1.31 trillion in bank deposits was withdrawn last week, with most of the outflows occurring at the top 25 banks. This is believed to have been influenced by the fact that large financial institutions such as JPMorgan Chase deposited $30 billion with First Republic Bank. Bank deposits are continuing to flow into money market funds and bond funds that offer higher interest rates.

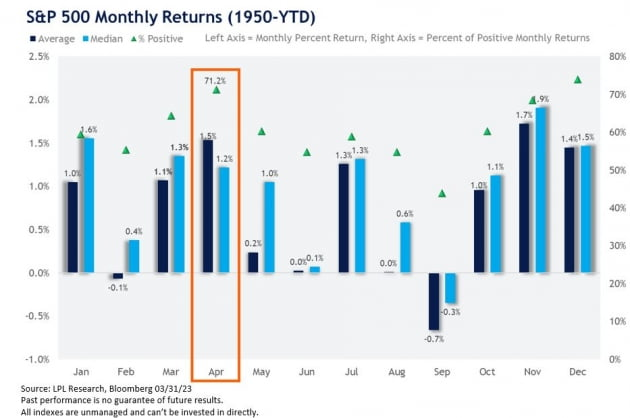

3. April is a strong month

🏈Bottom line: According to LPL Research, there are high expectations for the market in April. Since 1950, the S&P500 index has risen by an average of 1.5% and a median of 1.2% in April, making it the second most profitable month after November. In the past 20 years, it has been the most profitable month. In particular, during the first 12 trading days of April, the market has typically risen by 1.4%, capturing most of the month's gains.

4. ESG News

*IIGCC announced final net zero infrastructure guidance for investors + new physical climate risk assessment methodology (PCRAM 2.0) plan

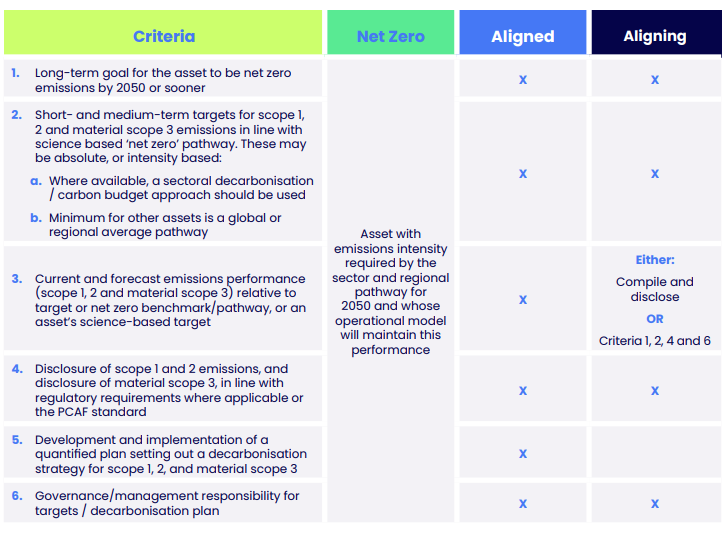

🏈Bottom line: 1) The Institutional Investors Group on Climate Change (IIGCC) has launched new guidance to help investors align their infrastructure portfolios with the goal of achieving global net-zero emissions by 2050 or sooner. The guidance has already been used by some investors as part of the Net Zero Asset Managers initiative. The guidance released for consultation in June 2022 – stakeholder feedback received during the consultation can be seen here. 2) The IIGCC has also announced that it will lead the second phase of the development of the Physical Climate Risk Assessment Methodology for infrastructure, which aims to evaluate physical climate risks to infrastructure and analyse their long-term impact on asset performance.

re: 1), The guidance includes a number of different ways for investors to set targets for their infrastructure assets, so that it is useful for both multi-asset and specialist infrastructure investors.

It includes a step-by-step approach to:

- Assessing asset alignment based on six criteria including the timeframe of aligning an asset with net zero, whether targets cover all scopes of emissions and how this will be addressed via a comprehensive decarbonization strategy.

- Setting portfolio coverage targets and indicating how the % of AUM aligned towards the goal of net zero will increase over time.

- Actions to increase alignment of portfolio with net zero goals, covering engagement and stewardship which includes the recommendation that 100% of carbon-based energy and transport infrastructure assets should immediately be the subject of engagement, or management interventions.

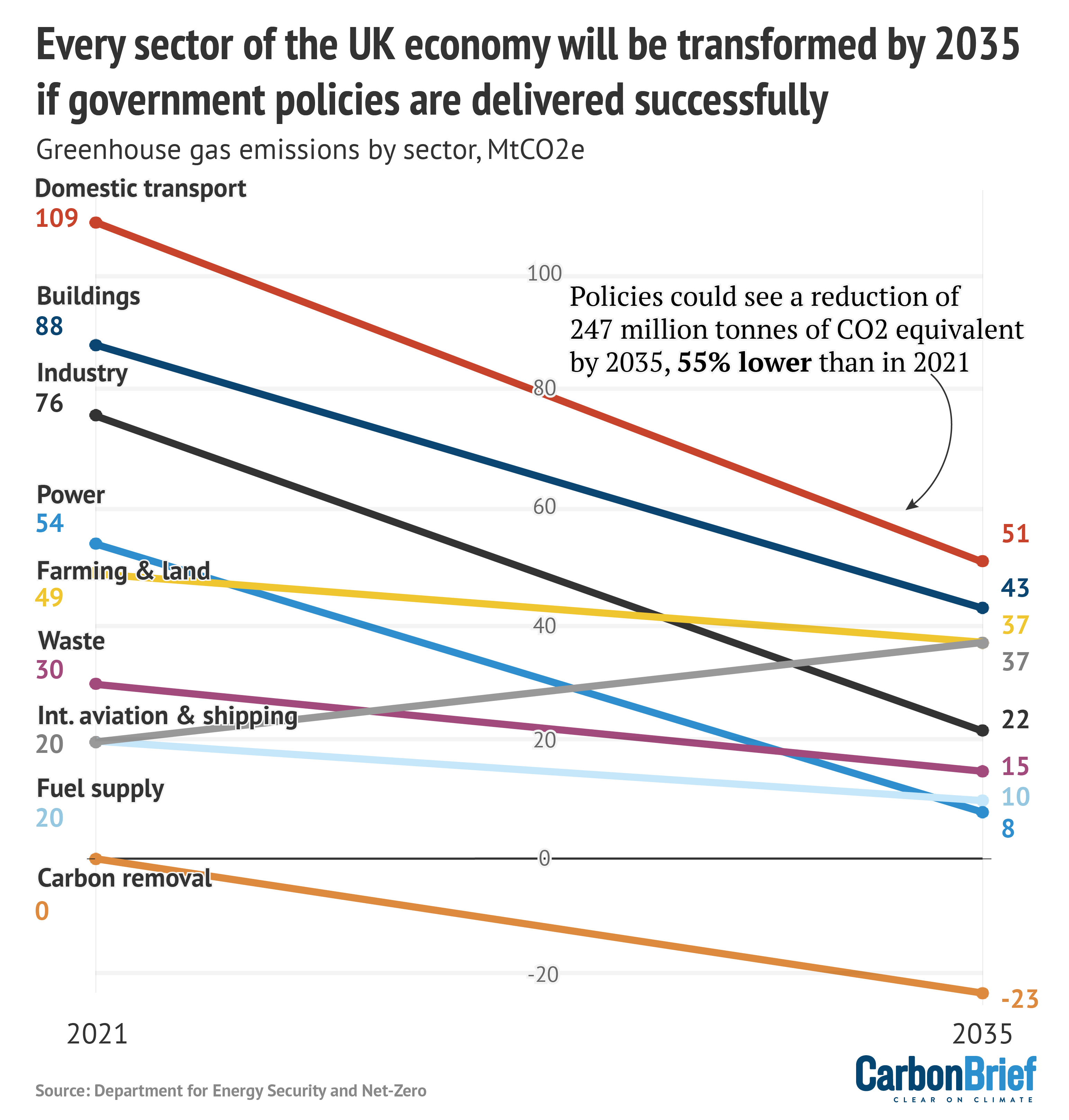

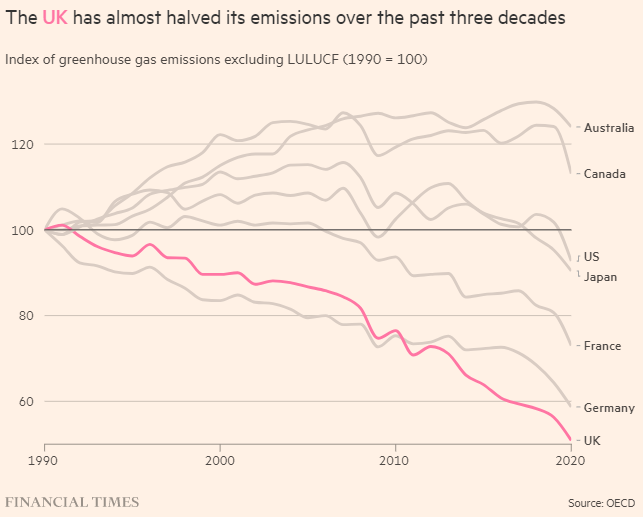

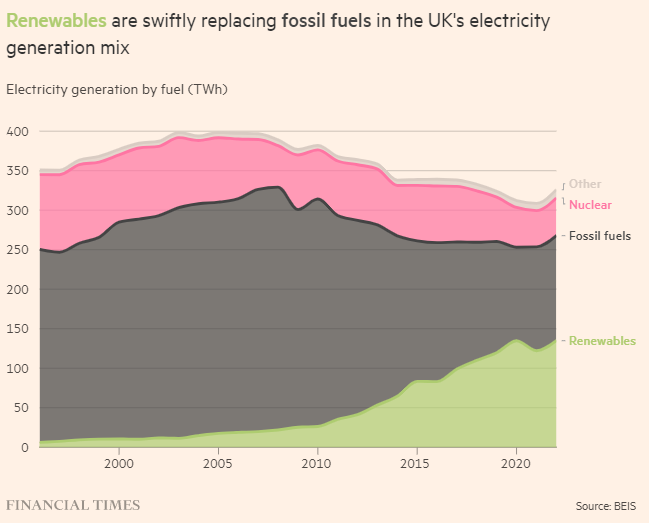

*UK published climate and energy transition plans - showing that the UK is not on track to deliver on its international climate pledge for 2030 under the Paris Agreement

🏈Bottom line: The UK government recently published new measures to tackle emissions, such as a zero-emission vehicle mandate and funding to cut pollution from industry. However, closer inspection of the documents reveals that the UK is not on track to meet its international climate pledge for 2030 and will continue to expand fossil fuel production in the North Sea. The government denied that the day was a "green day" and called it an "energy security day." Carbon Brief has published an in-depth analysis of the documents. FT article here.

5. Global Markets snapshots

![Obsidian Brief] When Money Becomes Software: AI, Stablecoins & Bitcoin — Implications for Sustainable and Impact Investing](https://images.unsplash.com/photo-1657408056887-c8c627f7574a?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDF8fHN0YWJsZWNvaW58ZW58MHx8fHwxNzY0NzM0MTExfDA&ixlib=rb-4.1.0&q=80&w=720)

![Finance | Leadership] Breaking into Finance: A Real-World Guide for Students and Future Leaders (technical and behavioral tips: lessons learned from a 15-year journey in Wall Street & City of London) - Part 5/5: Analyst level Deep-dive career guides](https://images.unsplash.com/photo-1537211568975-f95f2101c8f5?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDE1fHxtb250JTIwYmxhbmN8ZW58MHx8fHwxNzY0NTU3NzQ1fDA&ixlib=rb-4.1.0&q=80&w=720)

![Finance | Leadership] Breaking into Finance: A Real-World Guide for Students and Future Leaders (technical and behavioral tips: lessons learned from a 15-year journey in Wall Street & City of London) - Part 4/5: Interview Prep Tips](https://images.unsplash.com/photo-1605128005752-d1714260611e?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDF8fG1vbnQlMjBibGFuY3xlbnwwfHx8fDE3NjQ1NTc3NDV8MA&ixlib=rb-4.1.0&q=80&w=720)