March 9, 2023 - US Market

Today’s US market

Employment data was released this morning. Investors were on high alert for hints on February employment.

By midday, both bonds and stocks were holding firm, but by the afternoon session, stocks began to falter. The problem wasn't the employment data. Bank stocks, especially regional banks, which had been falling since the morning, began to tumble as the day wore on, and risk aversion began to show across the market.

In the end, the Dow was down 1.66%, the S&P500 was down 1.85%, and the Nasdaq was down 2.05%. As stocks plunged, demand flocked to "safe haven" bonds. By 4:50 p.m., the two-year Treasury note plunged 19.4 basis points to 4.876%, while the 10-year fell 8.3 basis points to 3.909%.

Macro data

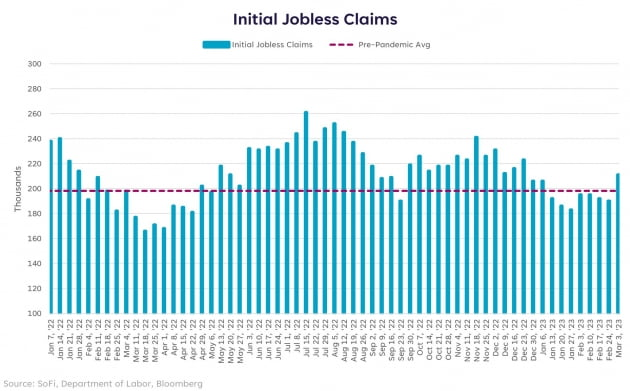

1) Jobless claims over 200,000

- Weekly jobless claims (~March 4) released every Thursday, came in at 211k, up 21k from the previous week. This was above Wall Street expectations (195K) and marked the first time in eight weeks that the number of claims exceeded 200K, the highest since December of last year. While still below the pre-pandemic 2019 average of 218K, it has been interpreted as a sign of a cooling labor market. Continuing claims came in at 1.78M, up 69K from the previous week. It was above expectations (1.66M) and the most since November 2021.

- Goldman Sachs said seasonal adjustments have been pushing the numbers down, but now they'll be pushing them up.

- "Seasonal adjustment issues have put more and more downward pressure on jobless claims over the past few months, and we expect this to start to reverse in the coming weeks”

- However, some have pointed out that New York State's spring break may have temporarily boosted the numbers. In fact, New York and California accounted for three-quarters of the increase.

- Santander economist Stephen Stanley said, "The numbers may have been boosted because workers in New York City schools, including bus drivers and janitorial staff, have contracts that allow them to file for unemployment benefits when they are on vacation. This week's tally is inflated by the New York City vacation.”

- Also, these are early March numbers. It has little to do with February employment, which comes out Friday.

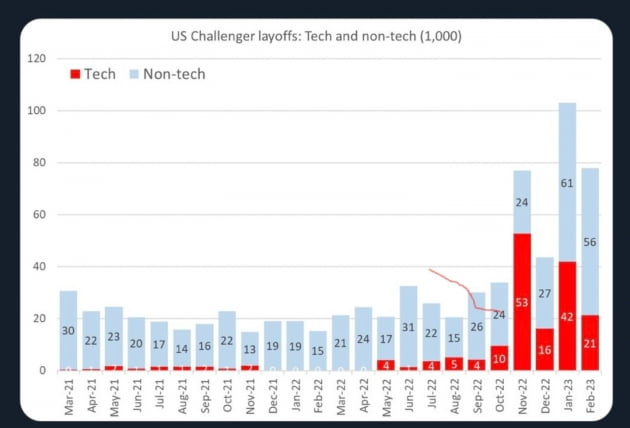

2) Corporate layoffs on the rise

- The number of corporate layoffs in February, released ahead of unemployment benefits, was 77,770, down 24% from the previous month (102,943). However, this was the largest number of February layoffs since 2009, during the global financial crisis, and a 410% increase from the year-ago period (15,245). Furthermore, while layoffs have been largely confined to technology companies, they spread to other industries in February, including manufacturing, healthcare, finance, and food and hospitality.

- Andrew Challenger, CG&C vice president, said: "Employers are certainly taking note of the Fed's rate hike. Many have been preparing for a downturn for months by cutting costs. As the economy continues to cool, layoffs are usually the last part of a cost-cutting strategy." "The largest layoffs are in the tech industry, with retail and financials also cutting back. In February, we saw layoffs in all 30 industries we track.”

- While the numbers themselves weren't bad, both sets of data showed signs of a slowing labor market. "Challenger layoff announcement, rising jobless claims show labor market is less robust than a few months ago," said Ned Davis Research. "A small glimmer of hope that the labor market may not be as tight as other data suggest," said Citigroup analyst Fiona Chincotta. After the data was released, interest rates edged lower in the New York bond market, and the major stock market indexes opened higher.

Other upcoming key data tomorrow

- US: the February jobs report tomorrow

- BOJ: the Bank of Japan's March monetary policy meeting - the last to be presided over by Haruhiko Kuroda, who is stepping down after 10 years as governor. Almost all Wall Street financial firms, including Goldman Sachs, expect no changes to monetary policy. Traditionally, Bank of Japan governors don't change policy at their last meeting, but Kuroda has a reputation for shocking the market. Last December, he surprised markets by suddenly widening the range of the 10-year Japanese government bond yield.

Silvergate Capital & Financial Sector

- After the market close yesterday, Silvergate Capital (SI) announced that it was ceasing operations and liquidating its subsidiary Silvergate Bank, which had been providing cryptocurrency payment services. This follows continued bank run concerns in the aftermath of the FTX bankruptcy.

- Silvergate Capital’s stock opened today down over 20% and closed the day down 42.16%. Signature Bank (-12.18%) and Bankcorp (-5.29%), which also had cryptocurrency-related operations, were also down significantly.

- In fact, just this morning, Santa Clara, California-based SVB Financial (SVB), a Silicon Valley bank, announced a $1.8 billion loss after selling securities in response to declining deposits from startups, a key customer. SVB's stock price plunged 60% after it announced plans to raise $2.25 billion by issuing new shares, and trading was halted several times. Shares of fellow Silicon Valley-based First Republic Bank plunged 16%.

- The Wall Street Journal (WSJ) noted that "Silvergate Capital's problem isn't just its cryptocurrency business, it's that the resulting deposit outflows have forced it to sell its holdings of Treasury and mortgage bonds at a time when prices have plummeted...This is a very old banking problem and could rattle those invested in other traditional lenders." The WSJ went on to report that the Federal Deposit Insurance Corporation (FDIC) has more than $600 billion in unrealized losses on securities held by the banking industry. They invested in bonds when interest rates were low, and now that rates have risen, bond prices have fallen significantly.

Big US banks sink

- JPMorgan was ordered by the U.S. District Court in Manhattan to provide the Virgin Islands with additional documents related to CEO Jamie Dimon in connection with the Jeffrey Epstein case, which has become infamous for sexual exploitation of minors. JPMorgan has maintained that "Mr. Dimon had no connection to the Epstein accounts."

- Credit Suisse, which has been the subject of ongoing liquidity crisis speculation, fell more than 4% after announcing that it had delayed the filing of its 2022 year-end results after being cited by the SEC. The sell-off in banking stocks, particularly regional banks, came as a result of a confluence of bad news, amid recent weakness in bank stocks amid growing recession fears. JPMorgan plunged 5.41%, Bank of America fell 6.2%, and Wells Fargo fell 6.18%.

- Jonathan Krinsky, technical analyst at BTIG:"Banks and semiconductors are two groups that have historically been very good leading indicators," said Usually, if one of them deteriorates, the market can be fine. But if either one makes a big move, it's usually wise to pay attention. Right now, the big move is banks crashing.”

- Some have argued that the plunge in bank stocks could lead to an unexpected financial crisis. Debraco Lacos-Bujas, global strategist at JPMorgan: "There is an unknown risk when the cost of capital increases sharply, and I think that risk is as high now as it was during the global financial crisis. I think what we're seeing today with regional banks is one of the potential side effects of that. We don't know specifically where the crisis will erupt. Bottom line, I think what happened today is that we are in a very constrained financial environment (due to austerity)." He added: "We are worried about the possibility of a crisis, and commercial real estate securities (CMBS), leveraged loans are also candidates. We're seeing signs pointing in the wrong direction."

- However, the consensus is that the regional banking problem is limited to a few banks that have run out of deposits due to their crypto businesses or excessive startup investments, and is unlikely to turn into a systemic crisis.

- Mike Mayo, a top banking analyst at Wells Fargo:"Interest rates are rising faster than at any time in the last 40 years, so there will be casualties, but they will be outside the largest banks. Banks have been regulated, regulated and regulated since the global financial crisis. They've been stress-tested every year for the equivalent of the last three recessions combined. The big banks are fine. Silicon Valley banks are the worst case today. It's a warning sign that a crisis is coming for these small banks. But how much do you worry about a bank of that size? I think what happened today shows that the big banks are more resilient in the financial system right now."

How many new jobs will be needed for the Fed to hike by just 25 basis points?

- Part of this is likely due to anxiety about the February jobs report, which will be released tomorrow morning at 8:30 a.m. ET. February employment is really important. How much employment grew, according to JPMorgan, will likely have an impact on February CPI, which comes out next Tuesday.

- The Wall Street consensus is around 225,000.

- Deutsche Bank and Santander are calling the most at 300,000, followed by Jefferies at 290,000, UBS at 275,000, Wells Fargo at 275,000, Citi at 255,000, Goldman at 250,000, Bank of America at 230,000, JPMorgan at 200,000, Morgan Stanley and HSBC at 190,000, and Standard Chartered at 150,000.

- Economist Gregory Darko at Ernst & Young: "the Fed would need a job gain of 150k or less for a 25bp hike," while ING said, "If Friday's jobs report comes in below 150k, we could see the pendulum swing back to a 25bp hike. Especially if wage growth cools off a bit."

- Bloomberg economist Anna Wong: "If we get less than 200,000 jobs and underlying CPI rises less than 0.4% month-over-month, we'll hike 25 basis points, but if we get more than 300,000, that alone will push us to 50 basis points."

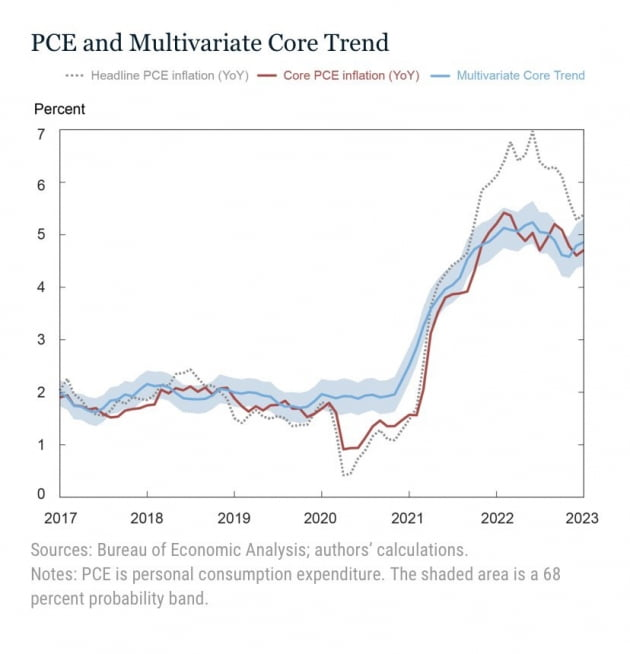

- We'll also have to wait for February CPI, which comes out next Tuesday. Goldman Sachs sees February core CPI rising 0.45% from January (consensus 0.4%). On a year-over-year basis, it sees it at 5.56% (consensus 5.4%).

- Goldman: "We see the core CPI reading remaining in the 0.3-0.4% range over the next few months, given higher used car prices and housing cost inflation. We expect it to slow to a 0.2% gain only in the second half of the year."

- The Federal Reserve Bank of New York today analyzed personal consumption expenditures (PCE) prices using its multivariate core model (which filters out transitory inflation factors) and found that underlying trend inflation rose to 4.9% in January of this year, up from about 3.7% at the end of 2022. Much of the increase is due to the Labor Department changing its seasonal adjustment methodology and benchmarks. Incorporating these changes pushes the December figure to 4.3% instead of 3.7%, with the remaining 0.6 percentage points coming from the January price surge.

- Bottom line: PCE inflation in January demonstrated broad resilience to the persistence of inflation - the New York Fed concluded. This means that the January price spike was not caused by a temporary shock, but by a persistent component of inflation.

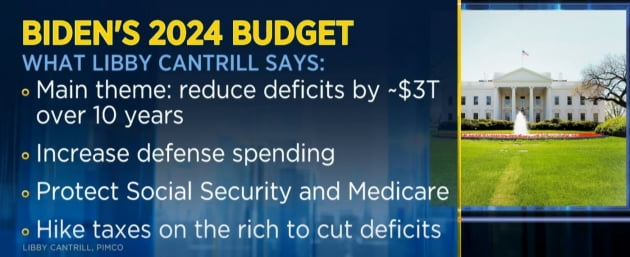

On US Budget

- Today, President Joe Biden unveiled his budget blueprint to reduce the federal deficit by $2.9 trillion over the next decade. But next year's budget proposal is much larger than this year's (estimated at $6.9 trillion), and it doesn't plan to spend more money on things like Social Security and Medicare. Instead, the White House says it will reduce the deficit by taxing the rich and big corporations: raising the top individual income tax rate from 37% to 39.6%, increasing the corporate tax rate from 21% to 28%, and imposing a minimum 25% tax rate on the top 0.01% of billionaires.

- This is in response to Republican demands for budget cuts in exchange for support for raising the debt limit. It's the Democrats' version of a deal. Of course, there's no way the GOP would support a plan that includes tax increases. House Speaker Kevin McCarthy, a Republican, dismissed the idea, saying, "I don't think tax increases are the answer," and Senate Majority Leader Mitch McConnell said, "Biden's tax plan will never see the light of day."

- ING: "This budget has no chance of seeing the light of day with the Republicans in control of the House. We expect the debt ceiling crisis to peak in July or August when the federal government runs out of money."

- Morgan Stanley estimates that the "X-date" for default without a debt limit increase is early August. It laid out a range of scenarios with increasing risk around that date.

- The least risky scenario for the economy and markets is a bipartisan agreement to raise the debt limit before the X-date.

- The riskiest scenario would be for an agreement to be reached after the X-date, which would cause medium- to long-term damage to the U.S. economy and markets.

- Bottom line: The actual outcome could be somewhere along the spectrum between these two. Despite the high stakes, an initial compromise seems unlikely without some sort of catalyst that galvanizes one or both Republicans and Democrats. Fear of default could provide such an incentive, but Congress still may not be sufficiently motivated until the X-date is very close or past.