May 2023 FOMC Key Takeaways

Hi All,

Today, I wanted to cover the much anticipated Fed's May FOMC meeting statement, key takeaways, market reaction, and what to expect going forward.

Fed's statement can be found here. Chair Jerome Powell's press conference. Press conference transcript.

🏈 Bottom line:

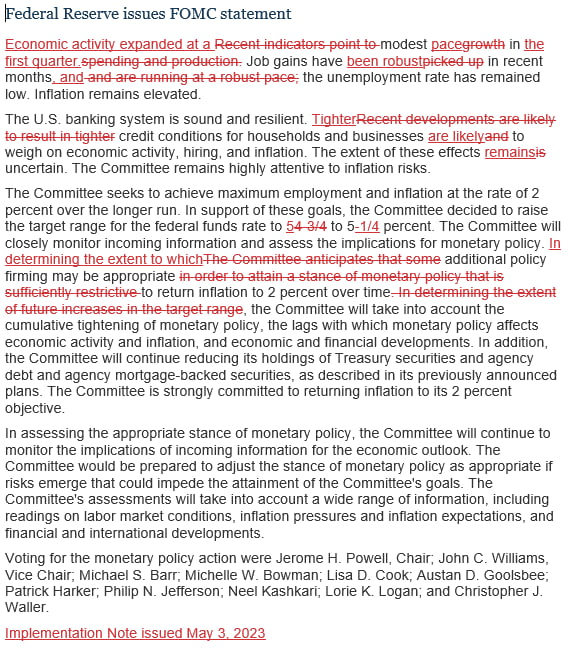

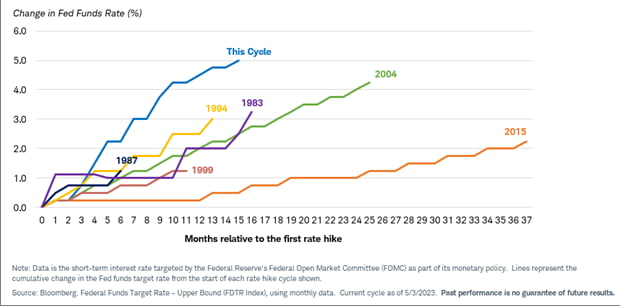

- 25 bps hike: The Federal Reserve raised interest rates by 25 bps in line with expectations, bringing the benchmark funds rate to 5% to 5.25%. This is the 10th hike since March of last year. The last time rates reached this level was during the housing bubble in 2006, just before the financial crisis.

- Unanimous decision: The decision was unanimous. Chicago Federal Reserve President Austan Goolsbee, who recently said that "at moments like this, of financial stress, the right monetary approach calls for prudence and patience - for assessing the potential impact of financial stress on the real economy," voted in favor. Analysts had thought there could be at least one dissenting vote, including Goolsbee.

- Hawkish pause: The statement's language was softened on future rate increases, removing a line on “additional policy firming.” Taken together, the message was that the Fed already tightened considerably and that rates are at, or close to, a sufficiently restrictive level; they don't need to hike further; but they've left the door open for further hikes, relying on data and considering policy delays and tighter credit conditions - a so-called hawkish pause, which means they've signaled a possible pause, but they've also left the door open for a hike. And with today's ADP data, ISM PMIs, and more, the possibility of a June hike is clearly alive and well.

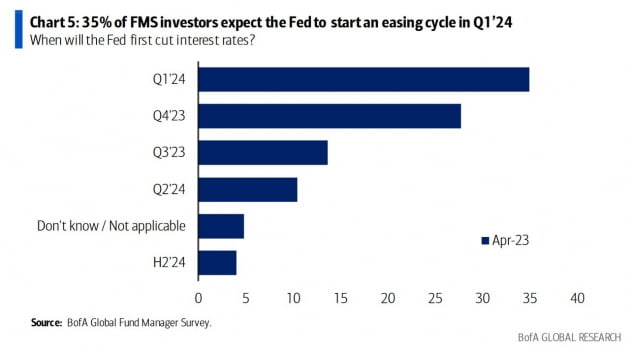

- No prospect of a rate cut in 2023: In his press conference, however, Chair Jerome Powell noted that the policy-setting committee thinks it will take time for inflation to come down and it would not be appropriate to cut rates.

- Banks are fine...the austerity effect: "The US banking system is sound and resilient. Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain."

- Chair Jerome Powell said, "Banking conditions have improved significantly since early March. We will work to prevent a repeat of these events."

Market Reaction:

- The major stock market indexes traded up and down in the days leading up to Powell's press conference before turning lower towards the end of the press conference. In the end, the Dow closed down 0.8%, the S&P500 down 0.7%, and the Nasdaq down 0.46%.

- The market's disappointment was evident in the KBW Regional Bank Index. Regional bank stocks, which had risen modestly, turned lower as Powell's press conference unfolded, ending the day down 1.89%. PacWest was down 2.0% and Western Alliance was down 4.4%. The prospect of further rate hikes will only make things more difficult for regional banks.

- In the bond market, Treasury rates extended their declines following the FOMC announcement. At 5 pm EST, the 2-year Treasury note was down 14.4 basis points to 3.838%, while the 10-year was down 8.5 basis points to 3.343%. The big drop is attributed to a combination of the pause in rate hikes and recession worries.

- In the Chicago Mercantile Exchange's (CME) FedWatch market, bets that the Fed will keep rates unchanged in June jumped to 99.6%, up sharply from 82.8% yesterday, while also maintaining the view that it will cut rates at least twice before the end of the year.

Key takeaways:

Banking turmoil, tightening effects

"In addition, the economy is likely to face further headwinds from tighter credit conditions. Credit conditions had already been tightening over the past year or so in response to our policy actions and a softer economic outlook. But the strains that emerged in the banking sector in early March appear to be resulting in even tighter credit conditions for households and businesses. In turn, these tighter credit conditions are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain."

Data dependency

"Looking ahead, we will take a data-dependent approach in determining the extent to which additional policy firming may be appropriate. I will have more to say about today’s monetary policy actions after briefly reviewing economic developments."

Why did they raise instead of pause this time?

"We always have to balance the risk of not doing enough and not getting inflation under control against the risk of maybe slowing down economic activity too much. And we thought that this rate hike, along with the meaningful change in our policy statement, was the right way to balance that."

"Today our decision was to raise the federal funds rate by 25 basis points. A decision on a pause was not made today. You will have noticed that, in the statement from March, we had a sentence that said the Committee anticipates that some additional policy firming may be appropriate. That sentence is not in the statement anymore. We took that out and, instead, we're saying that, in determining the extent to which additional policy firming may be appropriate to return inflation to 2 percent over time, the Committee will take into account certain factors. So that's a meaningful change that we're no longer saying that we anticipate and so we'll be driven by incoming data meeting by meeting."

Data assessments take longer than six weeks (between FOMC meetings).

"I would just point out we've raised rates by five percentage points. We are shrinking the balance sheet. And now we have credit conditions tightening, not just in the normal way but perhaps a little bit more due to what's happened. And we have to factor all of that in and make our assessment of whether our policy stance is sufficiently restrictive. And we have to do that in a world where policy works with long and variable legs. So this is challenging. But, we will make our best assessment, and that's what we think."

Fed staff predicts recession, can it be avoided?

"So the -- the staff's forecast is - - so let me say -- start by saying that that's not my own most likely case, which is really that the economy will continue to grow at a modest rate this year. And I think that's -- so different people on the Committee have different forecasts. That's my own assessment of the most likely path. Staff produces its own forecast, and it's independent of the forecasts of the participants, which include the governors and the Reserve Bank presidents, of course. And we think this is a healthy thing, that the staff is writing down what they really think. They're not especially influenced by what the governors think and vice versa. The governors are not taking what the staff says and just writing that down. So, it's actually good that the staff and individual participants can have different perspectives. So, broadly, the forecast was for a mild recession, and by that I would characterize as one in which the rising unemployment is smaller than is has been typical in modern-era recessions. I wouldn't want to characterize the staff's forecast for this meeting. We'll leave that to the minutes but broadly -- broadly similar to that."

No rate cut

"So we -- on the Committee, have a view that inflation is going to come down, not so quickly, but it'll take some time. And in that world, if that forecast is broadly right, it would not be appropriate to cut rates, and we won't cut rates. If you have a different forecast and, you know, markets -- or have been from time to time pricing in, you know, quite rapid reductions in inflation, you know, we'd factor that in. But that's not our forecast. And, of course, the history of the last two years has been very much that inflation moves down. Particularly now, if you look at non-housing services, it really, really hasn't moved much. And it's quite stable. And, you know, so we think we'll have to -- demand will have to weaken a little bit, and labor market conditions -- conditions may have to soften a bit more to begin to see progress there. And, again, in that world, it wouldn't be -- it wouldn't be appropriate for us to cut rates."

On the debt ceiling, even though it's not the Fed's job

"So, I wouldn't want to speculate specifically, but I will say this: These are fiscal policy matters, for starters, and they're -- they're for Congress and the administration, for the elected parts of the government to deal with. And they're really consigned to them. From our standpoint, I would just say this: It's essential that the debt ceiling be raised in a timely way so that the US government can pay all of its bills when they're due. A failure to do that would be unprecedented. We'd be in uncharted territory, and the consequences to the US economy would be highly uncertain and could be quite averse. So, I'll just leave it there. We don't give advice to either side. We just would point out that it's very important that this be done. And the other point I'll make about that, though, is that no one should assume that the Fed can protect the economy from the potential, you know, short- and long-term effects of a failure to pay our bills on time. We -- it would be so uncertain that it's just as important that this -- we never get to a place where we're actually talking about or even having a situation where the US government's not paying its bills."

What to expect going forward

Ned Davis Research: The change in statement was closer to our expectations of a pause in rate hikes. The Fed left the option of a hike open. Further action will be determined by data at each meeting.

RSM: We view the June FOMC meeting as a live event (a rate hike is possible). A rate hike remains an option given wage growth, a solid labor market and subdued inflation.

Renaissance Macro: At this point, the Fed's case depends on the evolution of the data. While the Fed could skip a rate hike in June, we ultimately expect another hike (or two) this year.

ING: The Fed has signaled that the threshold to justify future rate hikes is higher than before. With lending conditions tightening sharply in the aftermath of the recent banking turmoil, we believe this hike will mark a peak in rates.

Capital Economics: We expect the tightening of credit conditions to drive a much sharper slowdown than the Fed realizes. The Fed's next move will be a rate cut later this year. We think it will be sharper than the market expects.

In fact, over the past 50 years, once the Fed has finished raising rates, it has taken only six months to cut rates. This means that if today's hike is the last rate hike in a typical tightening cycle, we should expect a rate cut by November.

![Obsidian Brief] When Money Becomes Software: AI, Stablecoins & Bitcoin — Implications for Sustainable and Impact Investing](/content/images/size/w720/2025/12/Gemini_Generated_Image_dppem0dppem0dppe.png)

![Leadership] AI Is Changing Everything — How a CEO Managing $1.6 Trillion Stays Ahead, ft. Jenny Johnson from Franklin Templeton](/content/images/size/w720/2025/12/Screenshot-2025-12-03-060128.png)

![AI] The Future of Work, Robotics & AI Infrastructure (Elon's bold predictions: work will be optional & currency could be irrelevant)](/content/images/size/w720/2025/11/Screenshot-2025-11-22-074621.png)