Newsletter - Week of Oct 2, 2023

Hi All,

This week's theme is 'kindness.' This week's prompt was inspired by the mindfulness class led by my dear friend Daniela (website) @womenmakestories. This week was the second week of her 10-week series and I am glad that I was able to carve out some time for mindfulness to stay disciplined. Otherwise, I can easily forgo my meditation and breathing exercise as day becomes hectic. I don't know about you, but I am the harshest critque of my own and after many years of self-torture, I am learning to be kind to myself. I suppose highly competitive and goal-oriented people cannot help but drive ourselves to the edge. If you are like me, ask yourself: (besides how can you calm the f*%k down) How can you be kinder to yourself and what is one thing you can forgive about yourself today? Would you treat others the way you treat yourself? - probably not. What can you do more - one small thing - love yourself more?

Hope you enjoy this week's newsletter! As always, welcome your feedback and suggestions.

❤️ If you liked our newsletter - subscribe and share this newsletter with your friends, colleagues, and family! :)

📈Markets & Investing

- My weekly global market recap can be found here.

- This week's favorite market/investing podcasts:

🏈 Bottom line: Because she is the first female co-CIO at Bridgewater and we can all use some empowered female role models! :)

🏈 Bottom line: Because he is Howard Marks the legend :)

🏈 Bottom line: Because Ray Dalio is my hero. The five forces, which Ray lays out in his book Principles for Dealing with the Changing World Order, are: 1) the financial and economic force, including the dynamic of massive debt accumulation; 2) the internal domestic order; 3) the international world order in terms of the relations between great powers; 4) acts of nature; and 5) technology.

• Ray Dalio discusses the escalating U.S-China rivalry, envisioning it as a shift from a unipolar to a multipolar world order, indicating a potential move towards conflict, possibly reminiscent of historical precedents like the economic sanctions before World War II. The tensions are underscored by irreconcilable differences on topics like Taiwan, Russia, and capital movement, with both nations preparing for various forms of war including technology, trade, and capital wars.

• China is grappling with significant economic challenges including a debt crisis, with Dalio suggesting a necessity for a "beautiful deleveraging" which has been delayed, exacerbating the financial problems. The debt crisis has political implications, impacting wealth distribution, and creating internal tensions.

• The geopolitical landscape is also being altered with the rising prominence of India, which Dalio sees as an increasingly important player due to its economic potential and strategic position. India's potential is further enhanced by reforms under Modi, likening him to Deng Xiaoping in driving necessary changes.

• The ongoing U.S-China conflict presents risks for investors, especially those with assets in the conflicting countries. This reallocation of resources and capital induces a form of deglobalization, with countries choosing sides or attempting to navigate the turbulence, further complicating the global order.

• Dalio hints at a broader global shift with some regions like the ASEAN countries and the Middle East potentially benefiting from the U.S-China rivalry, as they could attract investments and partnerships diverging from the conflict zones, indicating a complex, evolving geopolitical and economic scenario.

🏈 Bottom line: Because Larry is my role model - I always follow his words and deeds! He discusses the outlook for bond markets, merger and acquisition opportunities, the US economy and the presidential election (Sep 29, 2023).

- He discusses the transitioning markets, highlighting a shift from deflation to inflation amidst geopolitical changes, and the beginning of supply chain fragmentation. These transitions may lead to higher interest rates and emphasizes the structural inflation being deeper than before.

- The need for better political explanation to the public regarding these market transitions + the lack of preparedness for potential interest rate hikes, as echoed by Jamie Dimon's statement about rates potentially reaching 7% in the U.S.

- Fink mentions the impacts of restricted immigration in the U.S. and Germany, associating it with wage pressures and job needs, especially as the U.S. injected significant fiscal stimulus, which acts as a huge job creator.

- There's a focus on reshaping globalization, with supply chains moving out of China to other regions like Vietnam, Philippines, Eastern Europe, and Mexico. The shift aims at reducing dependencies and adapting to higher costs, while progressively moving towards technology to boost productivity, including the use of robotics and AI.

- Lastly, expresses concern over growing fiscal deficits and too much debt in democracies, urging for a re-imagination of financing growth through more public-private investing in infrastructure, sustainability, and other sectors. He stresses the importance of long-term optimism and adapting to changes, while providing long-term investment opportunities for a dignified future.

🏈 Bottom line: Because Jamie Dimon is a wall street hero. He comments on the health of the technology IPO pipeline, calls AI “a living, breathing thing,” and explains his confidence in the firm being prepared to handle a potential worst-case scenario of interest rates rising to 8% (Oct 2, 2023).

• JPMorgan's expanding tech footprint and its goal to become a preferred bank for startups and venture capitals, emphasizing on improving client services by learning from Silicon Valley Bank's client engagement model.

• Dimon explored the application of AI in various processes within JPMorgan, hinting at its potential to significantly alter jobs, yet also acknowledging the broader societal benefits of technology while expressing concerns over misuse of AI by malicious actors.

• On the broader economy, he conveyed concerns over potential stagflation, geopolitical tensions, and the effects of rising interest rates, stressing the importance of preparedness for varying economic scenarios.

• He also delved into the regulatory landscape, expressing reservations over some aspects of the Basel III framework and how it impacts international banking, and briefly touched on the competitive threat posed by tech companies like Apple venturing into financial services.

🌍 Sustainability

- PRI summary - key five takeaways from the UN Principles for Responsible Investment’s PRI in Person 2023 event held in Tokyo (exerpt from ESG Investor):

- Making the Future:

- Japan's Prime Minister, Fumio Kishida, showcased his four-point plan to leverage Japan’s vast savings for a sustainable future. His presence, along with senior executives from Japan's financial sector, underscored the country's aspiration to transition towards sustainability, despite challenges like its reliance on fossil fuels and lagging progress in electric vehicle adoption.

2. Follow the Leader:

- Kishida announced that seven public pension funds, with a total AUM of US$600 billion, will become PRI signatories to bolster sustainable finance and spread this initiative across the financial market. This move follows the Government Pension Investment Fund’s (GPIF) analysis of its stewardship impact, emphasizing the importance of asset managers' engagement activities.

3. Great LEAPs Forward:

- The event highlighted the adoption of the Taskforce for Nature-related Financial Disclosures’ (TNFD) LEAP (Leverage, Engage, Assess, Preserve) approach in assessing nature-related risks. Case studies from Kirin and MS&AD Insurance Group showcased how LEAP helps in understanding and managing the impact of business models on nature and biodiversity.

4. A Big Ask:

- Professor Jim Skea, Chair of the Intergovernmental Panel on Climate Change, emphasized the urgency of climate action to restrict global warming to 1.5°C. Jan Rasmussen from PensionDanmark reflected on the challenges pension funds face in meeting decarbonization targets by 2030, especially with policy shortfalls hindering the transition to renewable energy.

5. People and Planet:

- The summit put a spotlight on human and workers’ rights alongside environmental themes. The PRI launched a framework to monitor performance in its Advance stewardship initiative. Discussions also touched on the convergence of environmental and social goals, with emphasis on the just transition and concerns regarding transparency and human rights abuses in renewable energy supply chains.

- Green bonds issuance to decline in the US? - GS says (Bloomberg, Oct 6, 2023): This year is likely to see just $40 billion of ESG corporate investment-grade issuance in the US dollar market, according to the Goldman analysts. That's half the amount issued by US companies last year, and just 40% of the level reached in 2021, they said.

- Here are some climate-related podcasts you should check out:

🧘🏽 Conscious living

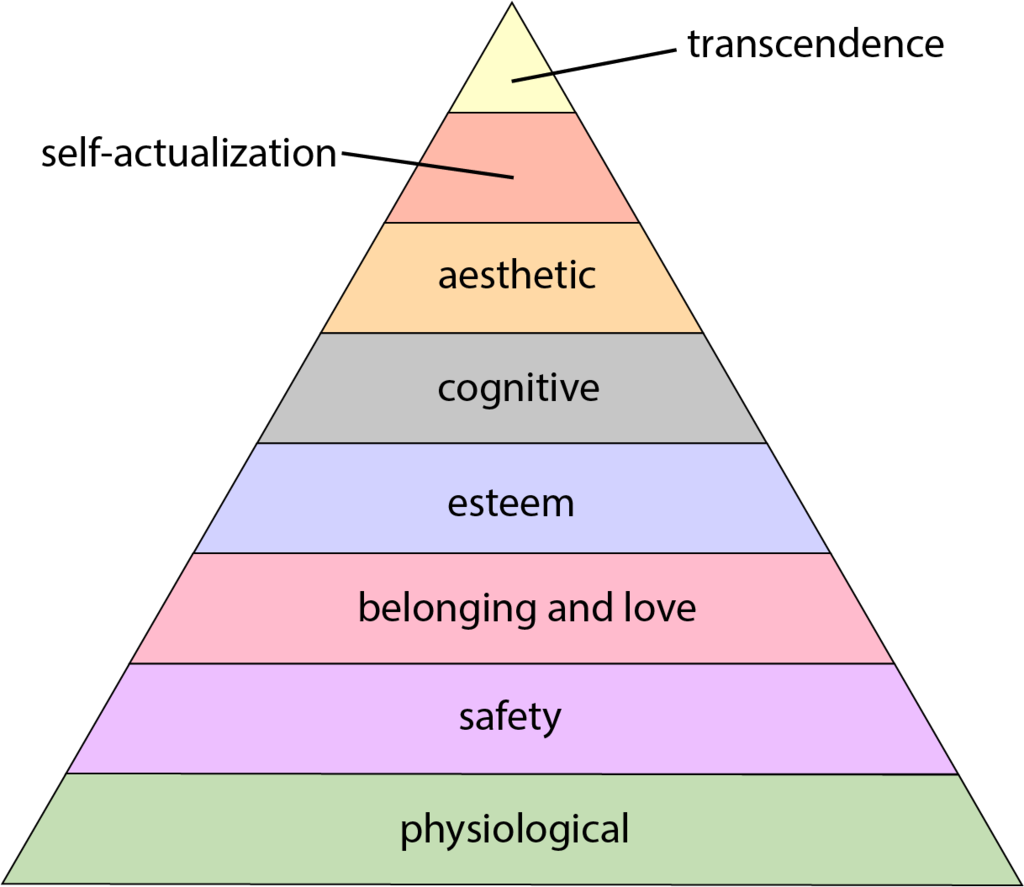

- Maslow's hierarchy of needs. Maslow's hierarchy of needs is a psychological theory that outlines human needs in a hierarchical manner, with basic physiological and safety needs at the bottom and self-actualization needs at the top. In today's world, where the pursuit of power and status often takes precedence, this hierarchy of needs can become distorted. People may prioritize individual success and recognition over the common good, even if it means neglecting urgent global issues like climate change and biodiversity loss.

- The interconnectedness of these pursuits with the common good is evident in the global challenges we face. Climate change, for instance, is exacerbated by the relentless pursuit of economic growth and industrialization, often at the expense of environmental sustainability. The consequences of these actions disproportionately affect vulnerable populations in equatorial and southern regions, who bear the brunt of climate-related disasters and ecological degradation. This stark disparity highlights the urgent need to shift our priorities towards collective well-being.

- To make people care about the collective good, we must foster a sense of global citizenship and empathy. This involves raising awareness about the interconnectedness of our actions and their far-reaching consequences. Education, advocacy, and policy changes can play crucial roles in promoting sustainable practices and addressing issues such as poverty, climate change, and conflict. Additionally, fostering a sense of responsibility among wealthier nations to support less privileged regions is vital for achieving a more equitable and sustainable world. By recognizing our shared humanity and the impact of our choices, we can work towards a future where collective well-being takes precedence over individual pursuits of power and status.

- In the spirit of 'interconnectedness' - facny listening to Marcus Aurelius' meditations in modern language? He talked a lot about 'finite quality of life' and 'interconnected of everything, incl. man and nature.'

😍 My Favorites

- Andrew Ng: Opportunities in AI (Sep 2023)

Key takeaways:

- AI is a general-purpose technology with a broad impact akin to electricity, with supervised learning and generative AI being its critical tools for varied applications across sectors.

- Large language models serve as both consumer and developer tools, significantly reducing the development time for certain applications and initiating a wave of custom AI applications.

- Despite the concentration of AI value in consumer software internet, there's an identified lag in AI adoption in other sectors, presenting opportunities for various industries to harness AI with the right tools.

- AI Fund, led by Andrew Ng, facilitates the realization of AI projects by providing necessary technical validation and resources, aiding in the transition from idea validation to securing external funding for promising ventures.

- Ethical considerations are vital in AI development, ensuring the well-being of individuals potentially affected by automation, and addressing overhyped concerns around AI posing existential risks to humanity.

- Borough market: I had a friend visiting me this week, and this gave me an excuse to visit Borough Market. It is one of my favorite places in London for fun and dynamic human warmth. I noticed it has changed a lot since the pandemic lockdown, but the classics are still there! :D Did you know that Borough Market has been serving Londoners with delicious food and unique finds for over 1,000 years? Check out my IG reel post for more.

- Movie: Did you watch Barbie? Here is my reflection on it from the feminist movement and female's life journey p.o.v.

👍 Quote of the week

Morgan Housel in his latest podcast said: 'being known as a winner is not the same thing as being talented.' I thought Dante's quote resonates well with what he said.