Newsletter - Week of Aug 14, 2023

Hi All,

Hope all has been well with you! It's been a while and I am restarting my newsletter series. Always looking for your feedback! Let me know if you would like to collaborate!

If you find these contents useful, please subscribe and share them with your friends! ❤️

🌍 Sustainable investing

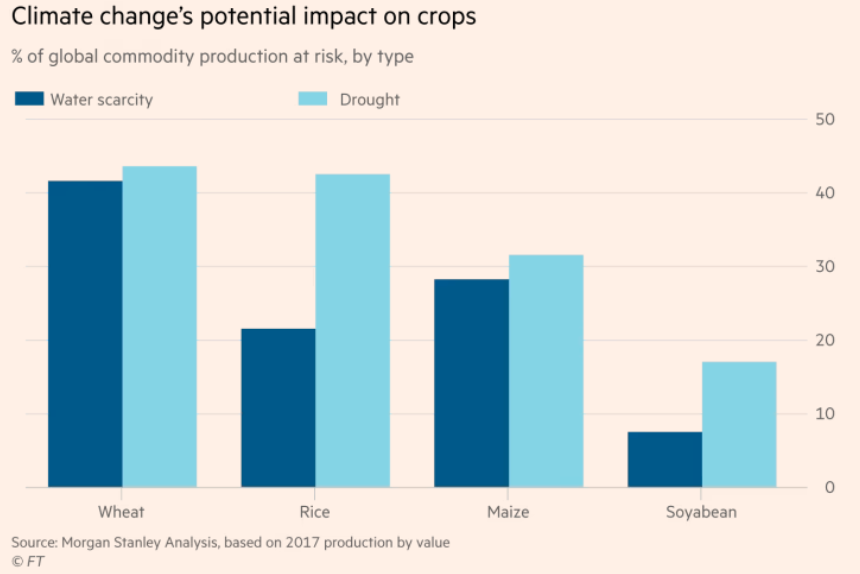

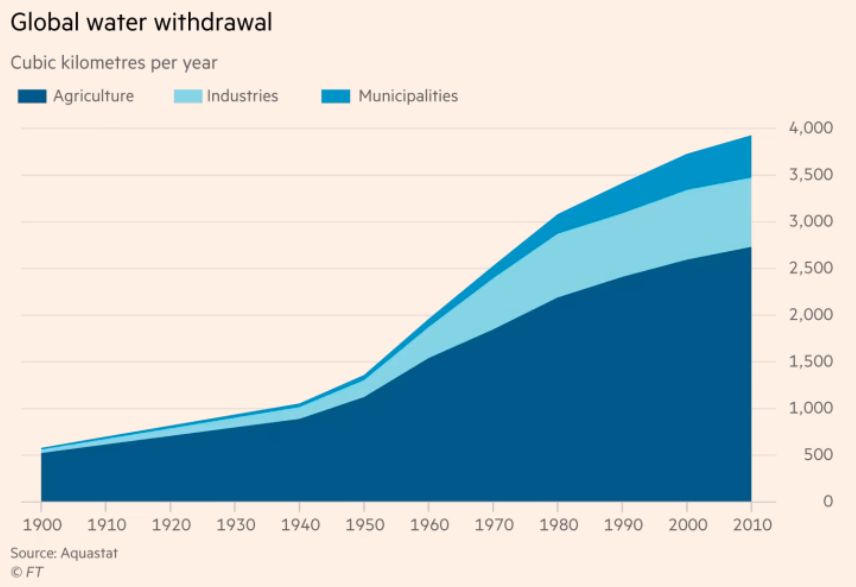

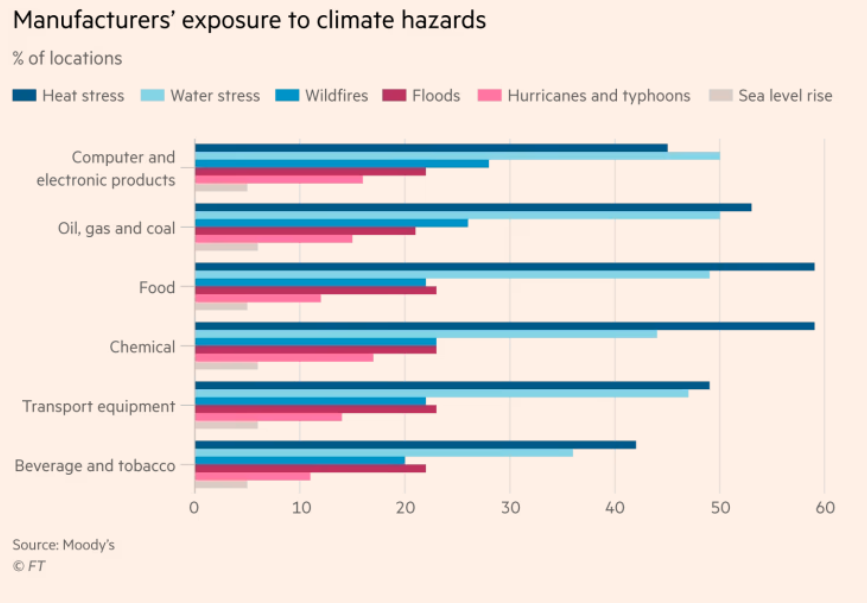

- Big Read - Lex in depth: how investors are underpricing climate risks - The costs of inaction on global warming are potentially vast and often not sufficiently factored into asset values (FT, Aug 17, 2023)

So far, businesses and investors have paid less attention to the physical effects of climate change and more to the costs and risks of decarbonising, as the world tries to limit the rise in average global temperatures. The former is discussed half as frequently as the latter in US corporate disclosures, according to the Brookings think-tank.

Equities have not priced in climate change risks, research by the IMF and others has repeatedly shown.

There is growing unease that existing climate models may be providing a false sense of security. The UK Pensions Regulator recently raised concerns over scenario impacts that “seem relatively benign and appears to be at odds with established science”. Last November the Financial Stability Board warned that the scenarios used to assess risks to the financial system may understate climate vulnerability. An abrupt correction of asset values is possible once markets recalibrate the likely impacts of climate change, says the Carbon Tracker think-tank founder Mark Campanale. University College London professor Steve Keen also predicts such a “Minsky moment” and warns it will be “unpleasant, abrupt and wealth-destroying”. There are powerful arguments why financial institutions should pay closer attention to the physical risks of climate change. Doing so might reduce the chance of sudden shocks and reinforce the case for mitigation. Moreover, it would improve the allocation of resources, deter building in flood zones and incentivise spending on climate-resilient infrastructure.

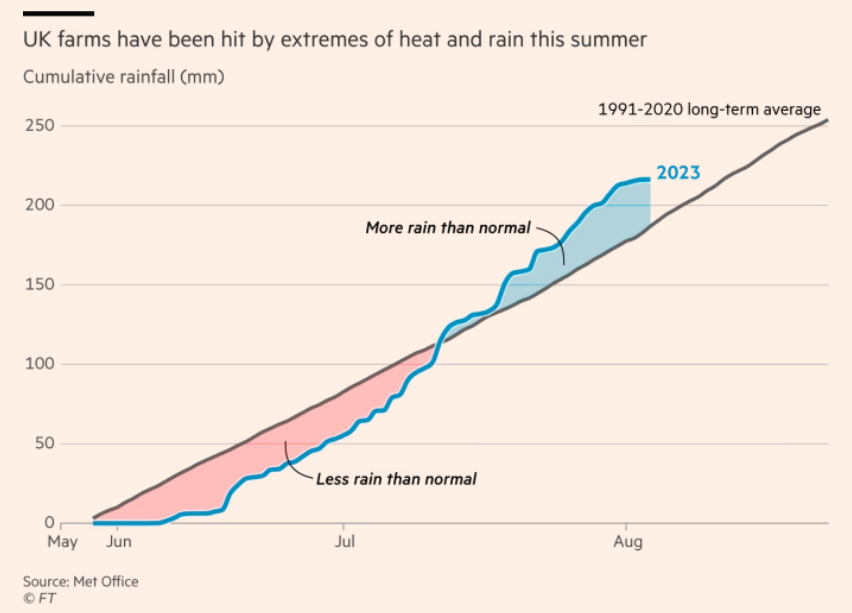

- We’re in the lap of the gods’: UK farmers contend with extreme weather - Food supply chains are coming under threat because of climate change (FT, Aug 20, 2023)

Blenkiron feels strongly that farms should tackle climate change, and has earmarked 10 per cent of the estate’s arable land for solar panelling to help curb emissions. But as a result, the farm produces less food. “We need some mechanisms where we are encouraged to grow the crops, and our cost of production is kept low,” he said. “If we lower our production then [the UK has] to bring loads of food in. That’s the dilemma I face all the time.”

- China to set up solar, wind recycling system as waste volumes surge (Reuters, Aug 17, 2023)

China has ramped up its wind and solar manufacturing capabilities in a bid to decarbonise its economy and ease its dependence on coal, and it is now on track to meet its goal to bring total wind and solar capacity to 1,200 gigawatts (GW) by 2030, up from 758 GW at the end of last year.

Photovoltaic (PV) panels have a lifespan of around 25 years, and many of China's projects are already showing significant signs of wear and tear, China's official Science and Technology Daily newspaper said in June.

The paper cited experts as saying that China would need to recycle 1.5 million metric tons of PV modules by 2030, rising to around 20 million tons in 2050.

The problem of waste from the renewable energy sector has become a growing global concern. Total waste from solar projects alone could reach 212 million tons a year by 2050, according to one scenario drawn up by the International Renewable Energy Agency (IRENA) last year.

- A Year Into Biden’s Climate Agenda, the Price Tag Remains Mysterious - The uncapped incentives of the Inflation Reduction Act mean spending sparked by the historic US climate law could triple initial estimates and push past $1 trillion. (Bloomberg, Aug 16, 2023)

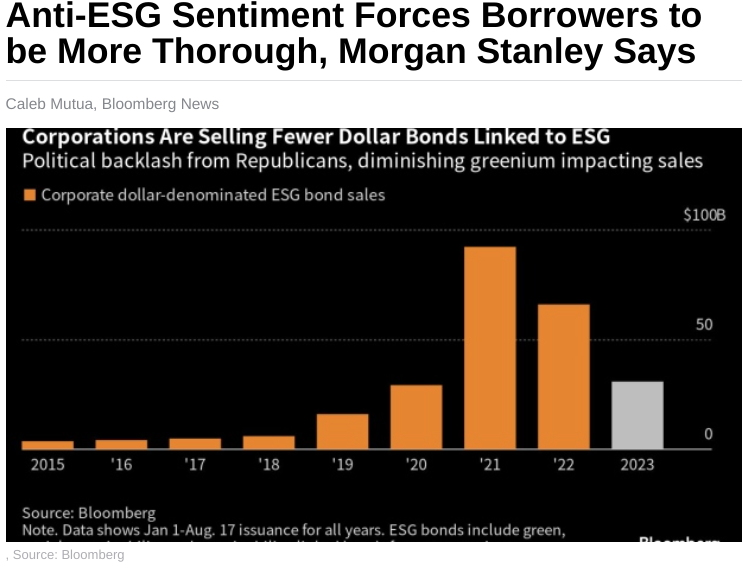

- Anti-ESG Sentiment Forces Borrowers to be More Thorough, Morgan Stanley Says (BNN Bloomberg, Aug 16, 2023)

The so-called greenium, which refers to the price advantage that companies can reap when borrowing in the ESG market, has largely evaporated amid the political pressure, hurting sales of the bonds in the US. Corporations have raised about $31 billion in dollar-denominated ESG bonds this year through August 17, a 53% slump from the same period last year, according to data compiled by Bloomberg.

“The greenium is pretty modest but we’re still seeing very strong interest in ESG labeled debt that’s well structured,” James said.

“Some of them could come this year and there’s a stronger pipeline going further out looking at 2024,” said James, who oversees the ESG efforts of the global capital markets division.

Global sales of green bonds, the largest category of sustainable debt by amount, are booming this year. BNP Paribas SA, the biggest underwriter of the bonds, is predicting a record year for the label, which James says is a possibility.

🧘🏽Conscious living

Joe Dispenza has earned my deep respect as a conscious living enthusiast due to his unwavering commitment to empowering individuals to take charge of their minds and reshape their destinies. Through his transformative teachings and research, he guides us on a journey of self-discovery, showing that our thoughts and intentions can shape our reality. His dedication to merging science with spirituality and his emphasis on the power of meditation and mindfulness inspire me to explore the profound connections between consciousness and personal growth. Hope you enjoy!

😍 My Favourite Things

- Introducing our project Euaimonia! Please find more information here and also follow us on @eudaimonic.life. In Greek, Eudaimonia literally means 'happiness,' 'well-being,' and 'success.' One of my 2023 goals is to become more of me and to explore 'conscious living' as a way of life that is kind, inclusive, and sustainable to ourselves, animals, and the planet. This starts with discovering 'who I really am' first and that is a hefty question to answer. The point is to study various schools of thought, philosophy, and religious texts/practices with curiosity in a secular way and apply learned lessons to our daily lives for growth and soul evolution. The project is composed of four elements. 1) Book club, 2) 5-minute philosophy, 3) mindfulness/meditation tips, and 4) leadership.

2. Podcast: BlackRock’s Rick Rieder on his career, the markets, and investing in the current environment (Aug 17, 2023) - Rick Rieder is one of my market mentors I admire the most in the industry today. I learned about fixed income from him and through his world perspective in my early years in NYC and always such a pleasure to learn about how he goes about things. I highly recommend you check out the podcast along with his reading list! He's reading 'How to Invest' by David Rubenstein, my other hero.

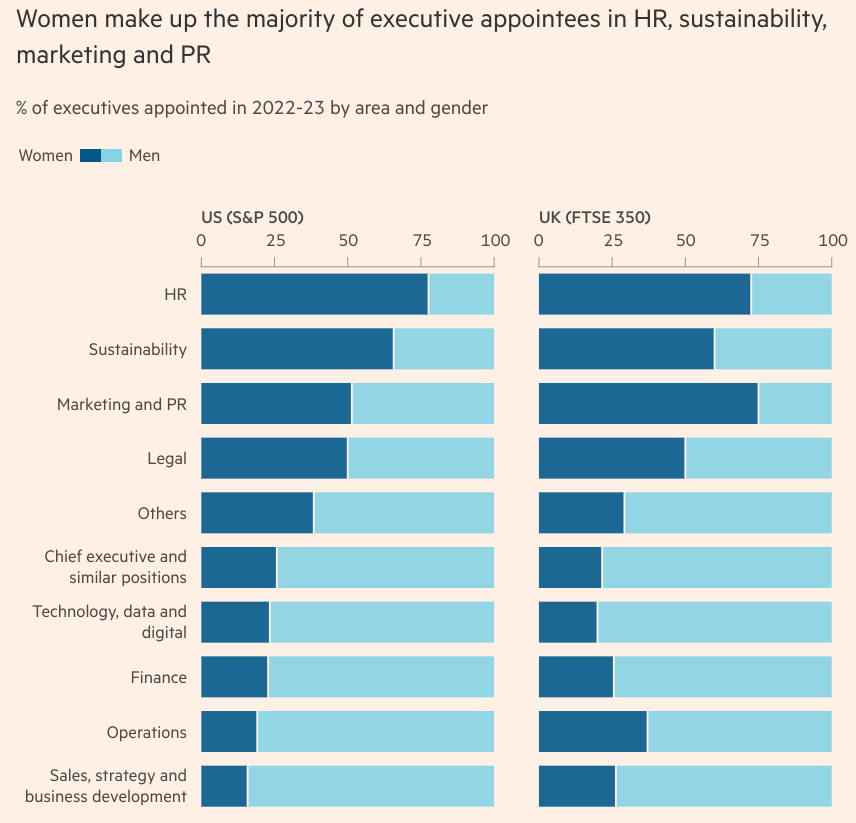

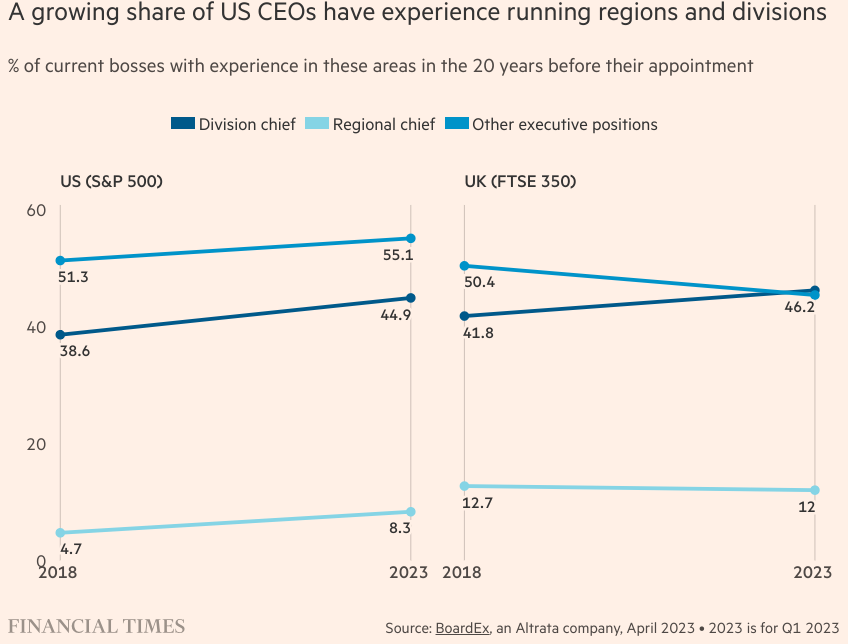

3. Article: Female CEOs in the making? (FT, Aug 2023) - As a female in sustainable investing, I believe I fit right into the stats! :)

👍🏽 Quote of the week