Great Minds | Market Comments: Ray Dalio + Roubini + Summers.

Hi All,

Today, I wanted to create a separate special 'great minds' edition re: commentary on recent markets - namely, Ray Dalio, Nouriel Roubini, and Larry Summers.

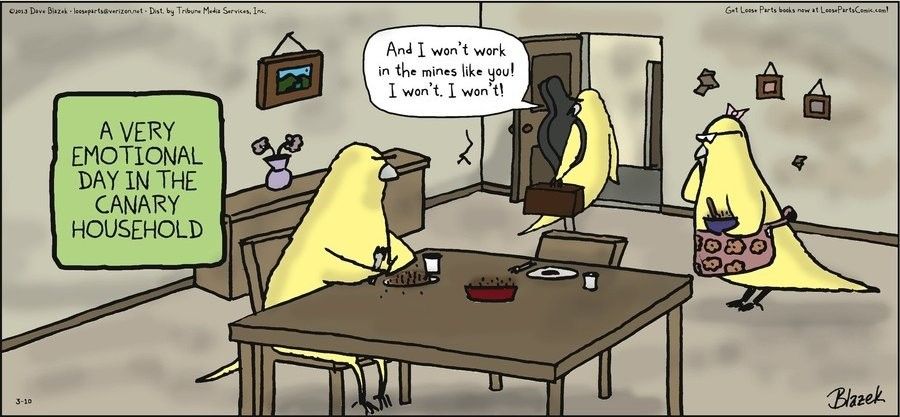

*Ray Dalio posted 'What I Think About the Silicon Valley Bank Situation' on LinkedIn today. He compares the SVB's failure to a "canary in the coal mine" early-sign dynamic that will have knock-on effects in the venture world and beyond. He also recommended that people check out 'Principles for Navigating Big Debt Crises'. Be warned; it's a 480-page read.

Key takeaways:

- Silicon Valley Bank's failure is an early-sign dynamic that will have knock-on effects in the venture world and beyond.

- The failure is part of a classic event in the short-term debt cycle, in which a self-reinforcing debt-credit contraction takes place via a domino-falling-like contagion process.

- This bank failure will likely be followed by many more problems before the contraction phase of the cycle runs its course.

- Eventually, the Fed will ease and bank regulators will provide money, credit, and guarantees because the problem becomes system-threatening.

- The US government's large outstanding debts, which are being monetized by central banks, pose a much bigger longer-term problem.

- The really big problem will come when there is too much money printing to provide creditors with adequate real returns, leading them to start selling their debt assets and substantially worsening the supply/demand balance.

*Nouriel Roubini, chairman and CEO at Roubini Macro Associates, also commented on the Credit Suisse crisis, inflation, and monetary policy. He noted that compared to 2008, while the crisis is not yet a credit risk, it could have systemic effects on the global financial system due to the size of Credit Suisse's assets. Roubini also expressed concern about the dilemma facing central bankers in balancing the need for financial stability with the need to address inflation, which is still too high in the US and Europe. He warned that backdoor quantitative easing and cutting rates could risk further inflation and inflation expectations. Furthermore, he noted that there is a contradiction between achieving economic stability and lower inflation and maintaining financial stability.

He did talk about these back in Oct 2022 in the 'Markets Odd Lots' podcast. Transcript here.

*Larry Summers, former US Treasury Secretary and current Harvard professor, also commented. Re: Credit Suisse, the complexity and extent of the solutions required are going up and there may be a financial stability problem at this point. Summers suggested that there needs to be a fundamental look at how banks are capitalized, especially in relation to how they treat direct, longer-duration assets. He also discussed the need for central banks to focus on their inflation mandate, stating that if they do not, they will be making a serious mistake. Finally, he suggested that the central banks in Europe and the US need to judge the scale of the disinflationary impulse and coordinate with each other on their decisions.

![Obsidian Brief] When Money Becomes Software: AI, Stablecoins & Bitcoin — Implications for Sustainable and Impact Investing](https://images.unsplash.com/photo-1657408056887-c8c627f7574a?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDF8fHN0YWJsZWNvaW58ZW58MHx8fHwxNzY0NzM0MTExfDA&ixlib=rb-4.1.0&q=80&w=720)

![Finance | Leadership] Breaking into Finance: A Real-World Guide for Students and Future Leaders (technical and behavioral tips: lessons learned from a 15-year journey in Wall Street & City of London) - Part 5/5: Analyst level Deep-dive career guides](https://images.unsplash.com/photo-1537211568975-f95f2101c8f5?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDE1fHxtb250JTIwYmxhbmN8ZW58MHx8fHwxNzY0NTU3NzQ1fDA&ixlib=rb-4.1.0&q=80&w=720)

![Finance | Leadership] Breaking into Finance: A Real-World Guide for Students and Future Leaders (technical and behavioral tips: lessons learned from a 15-year journey in Wall Street & City of London) - Part 4/5: Interview Prep Tips](https://images.unsplash.com/photo-1605128005752-d1714260611e?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDF8fG1vbnQlMjBibGFuY3xlbnwwfHx8fDE3NjQ1NTc3NDV8MA&ixlib=rb-4.1.0&q=80&w=720)