Explainer | SVB Collapse Explained

Hi All,

Today, I wanted to have a special edition on SVB as I am sure you've been inundated with related news.

I. Executive Summary: What happened?

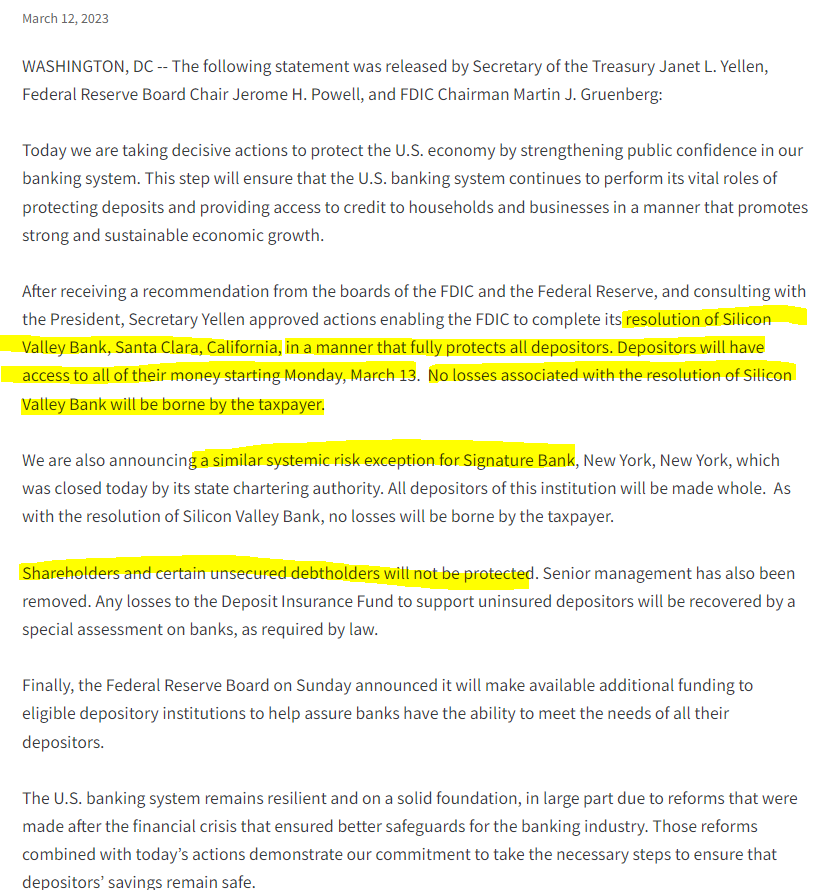

SVB, a US bank specialized in venture capital and startups, collapsed after failing to raise $2.25Bn to finance its balance sheet. The bank invested 55% of its deposits in securities, and suffered a loss of $1.8Bn from the sale of $21Bn securities (Available-For-Sale securities (AFS) in long-dated bonds) in Q1 2023 due to rising interest rates. This triggered a bank run, leading to the shutdown of the bank and transfer of its assets to the FDIC. Most deposits were uninsured, and the govt confirmed there will be no bail out. Analysts say the risk of contagion is manageable, but there are concerns of a domino effect if SVB's operations in Europe and China falter. A crisis at banks with high real estate loans or large European banks is possible but unlikely to turn into a systemic financial crisis. Regulators are stepping in to contain the situation. On March 12, Janet Yellen confirmed the govt’s intention to protect the savers’ money and prevent contagion, but there will be no bailout in her interview with ‘Face the Nation.’ Around 7:52pm EST, the official statement came out for a $25Bn support for the uninsured deposits to backstop the contagion. It can be found here. Jeremy Hunt, UK Finance chancellor, also said on Sunday there was “a serious risk” to tech and life sciences companies that used SVB’s UK bank, with senior founders warning of “carnage” if they are unable to pay wages and bills in the coming week. Now, he is preparing cash lifeline for tech companies hit by SVB collapse. Quick additional update: as of 7am UK time March 13, HSBC confirmed its purchase of SVB's UK bank for £1.

II. Deep-dive

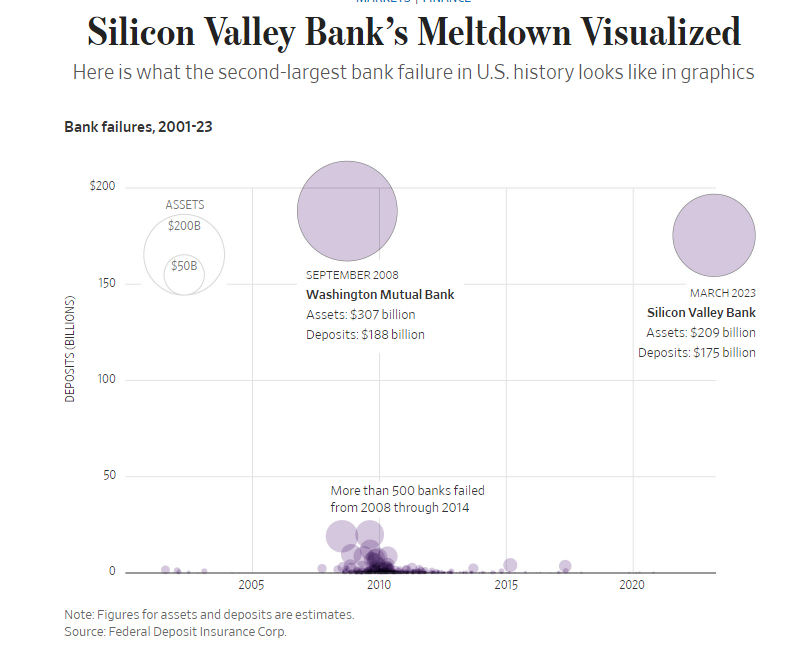

SVB is the 16th largest bank out of 5000 banks in the US. Its collapse marks the second-largest bank to fail and the largest since the 2008 financial crisis.

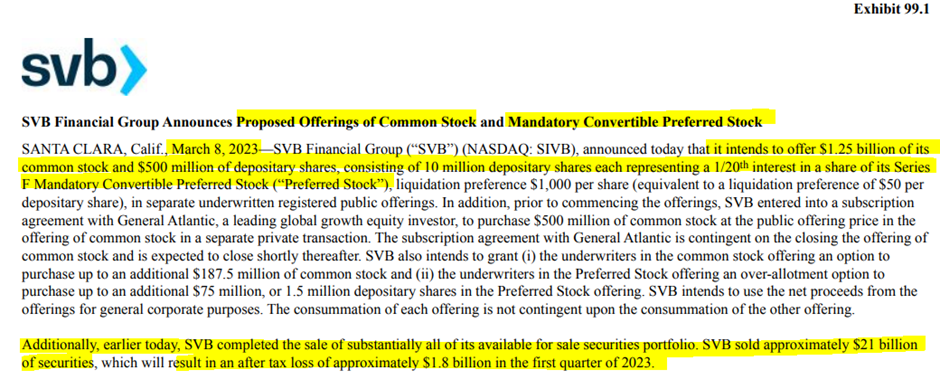

It all started with their capital-raising attempt

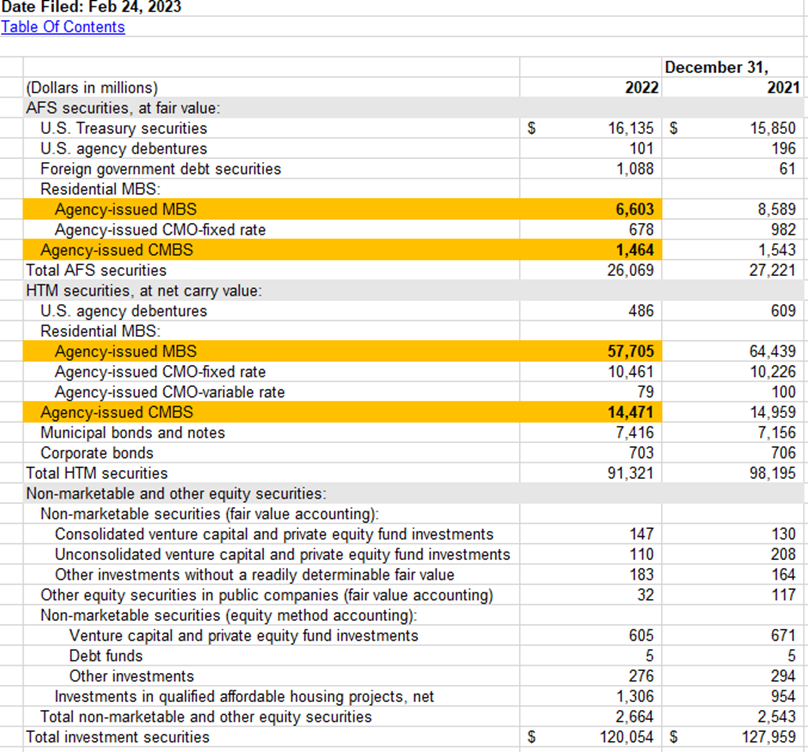

On March 8, SVB announced its intention to raise a capital of $2.25Bn to finance its balance sheet. The filing report also noted they made a loss of $1.8Bn from the sale of $21Bn AFS securities (long-term treasuries, MBS, etc.) in Q1, 2023.

Why did they need to raise the money?

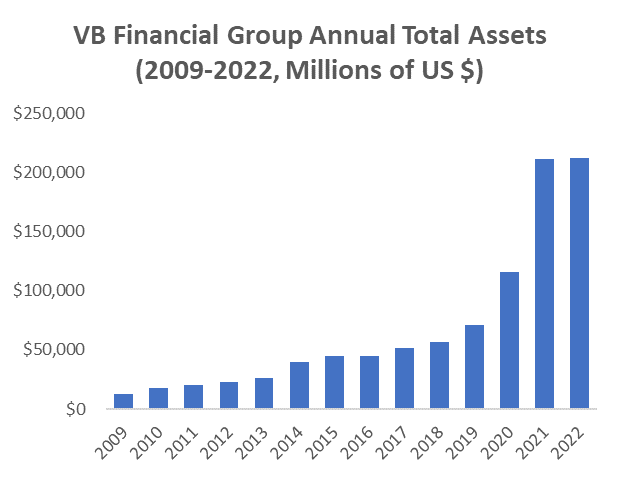

During the pandemic, with the VC boom, the bank’s balance sheet grew 3x (to $210Bn from $71Bn between 2019 and 2022). As a way to manage the money, the bank had been investing 55% of its deposits in securities (stocks and bonds), but without any hedging against the interest rate and those assets went under when interest rates rose with the Fed’s aggressive rate-hiking cycle (i.e. value of their assets are a lot cheaper than what they bought them for a couple of years back).

However, as the venture capital industry began to experience difficulties in 2022 and 2023, the balance sheet started to get a hit. When customers wanted to pull out their cash, the bank was making a sale of their securities to provide cash, making a loss.

A bank run kicks in...

This news about the balance sheet loss on March 8 catalyzed a bank run as a number of alarmed venture capitalists, incl. Peter Thiel’s Founders Fund, Coatue Management and Union Square Ventures tried to pull out their deposits from the bank simultaneously. A bank run occurs when many customers try to withdraw their money from a bank, because they believe the bank may fall in the near future (Source: Wikipedia).

Between March 8 and 9, out of some $175 billion in deposits, customers withdraw about $42 billion, a quarter of all deposits.

and the collapse ensued.

On March 10, after failing to raise capital, California financial regulators took over SVB, shut it down, and turned over its assets to the Federal Deposit Insurance Corporation (FDIC). It collapsed in exactly 44 hours. It was a lightning-fast bankruptcy.

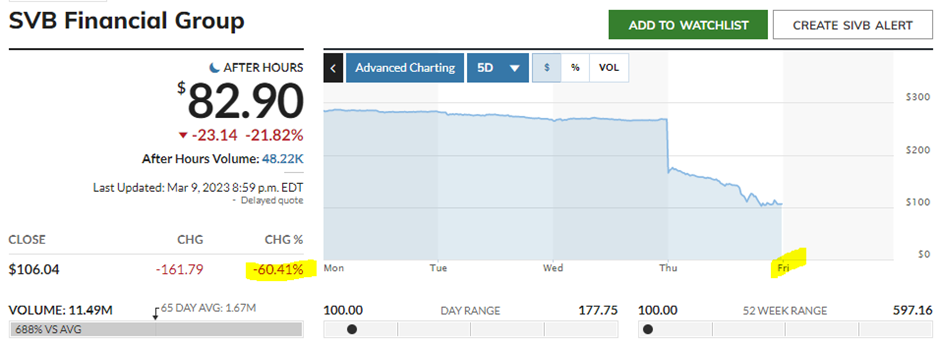

SVB Financial Group (SIVB), 5-Day Stock Performance. Closed on Friday with a -60.41% down.

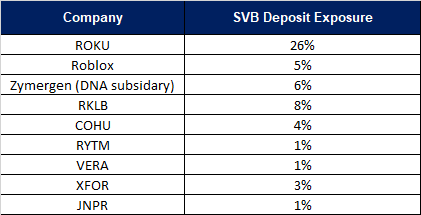

Out of $161Bn in deposits, the vast majority of deposits (93%) in SVB were uninsured and not reimbursable from the FDIC i.e. only 2.7% of customers holding less than $250k.

So, governments stepped in...

On March 12, Janet Yellen confirmed the govt’s intention to protect the savers’ money and prevent contagion, but there will be no bailout in her interview with ‘Face the Nation.’ As shown below, the official statement came out for a $25Bn support for the uninsured deposits. It can be found here or below. Jeremy Hunt, UK Finance chancellor, also said on Sunday there was “a serious risk” to tech and life sciences companies that used SVB’s UK bank, with senior founders warning of “carnage” if they are unable to pay wages and bills in the coming week. Now, he is preparing cash lifeline for tech companies hit by SVB collapse.

Who's going to buy SVB?

SVB also has franchises globally in Europe, Canada, China, etc.

Some are open to the idea of purchasing SVB – Elon Musk said it but Tesla’s shareholders didn’t like the idea. For SVB’s UK bank, a Middle Eastern buyer is one of the leading bidders along with HSBC and JPM. SVB UK has 3,300 UK clients, including start-ups, venture backed companies and funds, according to FT although many have deposits under the £85,000 threshold covered by the financial insurance scheme. *Quick additional update: as of 7am UK time March 13, HSBC confirmed its purchase of SVB's UK bank for £1.

*Bottom line - what analysts are saying: Concern of a contagion effect, but would be a manageable idiosyncratic risk. To be seen.

Some say it was a symbolic case of Silicon Valley-style finance, the epitome of big tech and finance, falling victim to Powell-style high-speed austerity. The market fears a domino effect of startups with money tied up in SVB. If SVB's European and Chinese operations also falter, it could be a global crisis.

There is also the possibility of a crisis at banks with a high proportion of real estate loans or large European banks, but the consensus is that this is unlikely to turn into a systemic financial crisis as the U.S. government is moving quickly to intervene and contain the situation.

III. Some Additional Questions

Q: Why did they have a large loss on the sale of available-for-sale securities (AFS)?

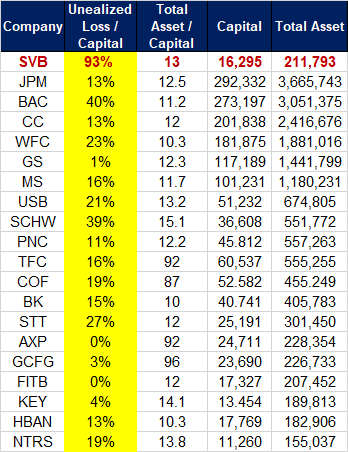

A: First of all, the majority of customers were start-up VCs and PEs (about 80%), and SVB’s ‘Unrealized losses on held-to-maturity (HTM) financial assets’ were 93% of capital

It boils down to bad balance sheet risk management. $1.8 billion loss on the sale of $21 billion in bonds. SVB had zero ‘Interest rate swap derivatives’ to cover the interest rate risk of their bond exposures, which is quite remarkable in this aggressive Powell’s rising rate cycle.

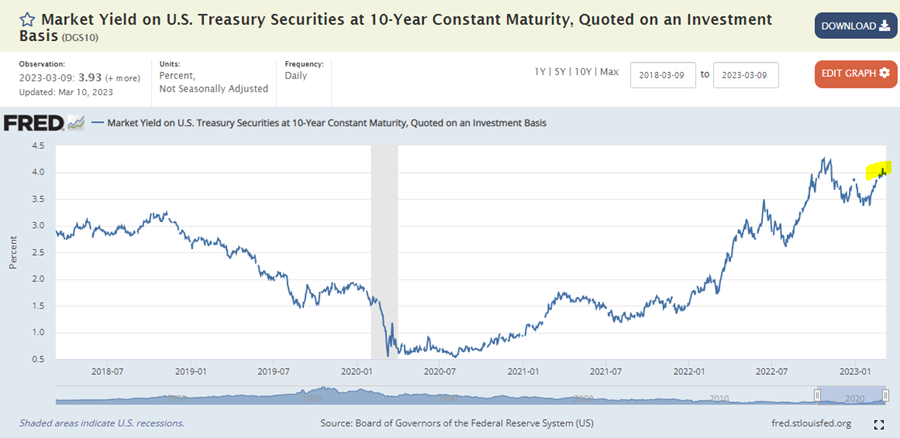

They had about $80Bn in long-dated MBS and CMBS with an expected return of 1-2% whereas the current US Tsy 10Y is at about 4%.

Q. What investors are worried about...

1. Are VCs safe?

A: In traditional banks (JPM, BoA, WellFarg, etc.), bank loan accounts for 40% of the business followed by 10% of real-estate collateralized loans, 20% of retail real estate mortgages, and 10% credit card loans.

However, in the case of SVB, roughly 80% of its clients were related to PE & VC. VC accounted for 56% and tech and life science start-up related loans accounted for 24%. As of 2022, 50% of tech and life science VCs banked with SVB.

Lastly, payroll payment is a serious issue as many start-ups and VCs have their cash tied up, preventing them from paying their employees.

2. Other bank runs? What if they can’t cover the unrealized loss?

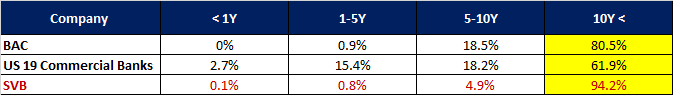

A: Capital adequacy ratio (i.e. Asset/Equity ratio) was around 30.0 before the GFC, but nowadays, the leverage ratio looks a lot better across the board. Look at Exhibit 1. Some analysts say the ratio might be not too high to trigger a systematic risk that can occur on the back of too much leverage. In this rate hiking cycle, the timing is the key as the majority of banks' balance sheets are exposed to the 10Y+ long-dated AFS and HTM securities as shown in Exhibit 2.

Exhibit 1. US Top 20 banks’ soundness

Exhibit 2. Maturity breakdown of AFS & HTM securities

IV. Conclusion

One of SVB Bank's notable activities was its involvement in the tech sector. The bank provided financial services to technology startups and was known for its specialization in this industry. It also purchased long-term Treasury bonds to help fund its operations. However, this specialization also made the bank vulnerable to the ups and downs of the technology industry, and when the industry took a hit, the bank suffered as well.

The situation continues to evolve and requires a continuous monitoring, but hope you found this blog post helpful in understanding the situation in more in-depth.