Education | Ultimate Fixed Income 101: What is a Bond? & Bond Valuation

Bonds 101 from an investing practioner—what they are, how prices are set, and how the bond market works. Covers bond types, pricing factors, liquidity, and key Bloomberg functions for students and aspiring finance professionals.

Why I Started This Series

I was inspired to create this series after more than a decade working in global finance—on Wall Street and in the City of London—as a multi-asset portfolio manager and asset allocator. My career began at BlackRock, which itself was founded as a mortgage and fixed income house in NYC, so it’s fair to say that my own “bone structure” in investing was built on fixed income. My humble beginning started out in the fixed income portfolio management internship in New York and later moved to London to join the multi-asset allocation team as a portfolio manager, where I worked across fixed income, equities, and private assets.

Looking back, there are concepts I wish I had understood earlier in my career—principles that would have saved me time, confusion, and mistakes. This series is my way of sharing those lessons in a way I hope is practical, clear, and encouraging.

I dedicate these posts to my mentees, and also to one moment that has always stayed with me: during my internship in investment banking (M&A) on Wall Street, I watched a colleague who was a DCF model expert explain the mechanics of valuation to another banker over a sandwich at lunch. His passion was contagious. I barely knew anything about finance at the time, but I remember thinking: one day, I’d like to be able to share knowledge with the same kind of joy and generosity.

This series is a small step in fulfilling that promise.

Today’s Key Concepts

- What is a bond?

- What Determines the Price of a Bond?

- Understanding Bond Market Prices

☘️ 1. What is a bond?

A bond is a type of fixed income investment that represents a loan made by an investor to a borrower, typically a corporation or government entity. Here are some expanded explanations for each bullet point:

*Definition of a Bond:

A bond is a fixed income security that represents a loan made by an investor to a borrower, usually a corporation or government entity. In return for the loan, the borrower agrees to pay interest on the principal and to repay the principal at the end of the loan term, known as the maturity date.

*Characteristics of a Bond:

- Principal: The amount of money borrowed by the issuer of the bond that is repaid to the bondholder at the end of the loan term.

- Coupon rate: The annual interest rate paid to the bondholder by the issuer of the bond, calculated as a percentage of the bond's face value.

- Maturity date: The date on which the bond's principal is due to be repaid to the bondholder.

- Yield to maturity: The total return an investor can expect to earn on a bond if the bond is held until maturity and all interest payments are reinvested at the same rate.

*Types of Bonds:

- Government Bonds: These are bonds issued by national governments and are considered to be among the safest investments because they are backed by the full faith and credit of the issuing government. Examples include Treasury bonds issued by the U.S. government.

- Corporate Bonds: These are bonds issued by corporations and are generally considered to be riskier than government bonds because they are subject to credit risk, which is the risk that the issuer will default on the bond payments (coupon and/or principal).

- Emerging Market Bonds: These are bonds issued by governments or corporations in developing countries. They are generally considered to be riskier than government or corporate bonds issued in developed countries.

- Mortgage-Backed Securities: These are bonds that are backed by a pool of mortgage loans, typically issued by a government-sponsored entity such as Fannie Mae or Freddie Mac in the case of the US.

- Asset-Backed Securities: These are bonds that are backed by a pool of financial assets, such as auto loans, credit card receivables, or student loans.

- Municipal Bonds: These are bonds issued by state and local governments to finance public projects such as schools, highways, and hospitals.

☘️ 2. What Determines the Price of a Bond?

*Bond Pricing and Yield:

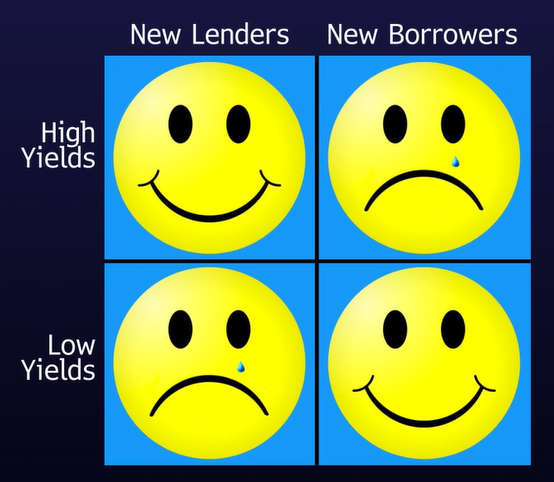

The price of a bond in the open market is determined by the bond's yield and other market factors. The yield on a bond is the effective interest rate earned by the investor, and it is determined by the bond's coupon rate, its maturity, and the price paid for the bond. As interest rates in the broader economy rise or fall, the yield on a bond may also rise or fall.

*Relationship between Bond Price and Yield:

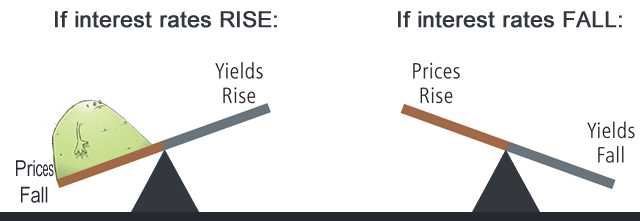

There is an ‘inverse’ relationship between bond prices and bond yields. When interest rates in the broader economy rise, the yield on existing bonds becomes less attractive, causing the price of those bonds to fall. Conversely, when interest rates in the broader economy fall, the yield on existing bonds becomes more attractive, causing the price of those bonds to rise.

*Factors Affecting Bond Prices:

- Interest Rates: Changes in interest rates are a major factor affecting bond prices. When interest rates rise, the yield on existing bonds becomes less attractive, causing the price of those bonds to fall. Conversely, when interest rates fall, the yield on existing bonds becomes more attractive, causing the price of those bonds to rise.

- Credit Risk: The creditworthiness of the bond issuer is another factor that can affect the price of a bond. If the creditworthiness of the issuer is in doubt, the bond will be considered riskier and investors will demand a higher yield to compensate for the additional risk, which will lower the price of the bond.

- Inflation: Changes in inflation can also affect the price of a bond. If inflation is expected to rise, investors will demand a higher yield to compensate for the loss of purchasing power caused by inflation. This will cause the price of existing bonds to fall, as their fixed coupon payments will be worth less in real terms.

- Time to Maturity: The length of time until a bond's maturity can also affect its price. Bonds with longer maturities are generally more sensitive to changes in interest rates, so they tend to have higher yields to compensate for this risk. This can make them more volatile in price than bonds with shorter maturities.

- Supply and Demand: The supply and demand for a particular bond can also affect its price. If there is high demand for a bond, its price will be bid up, and the yield will decrease. Conversely, if there is low demand for a bond, its price will fall, and the yield will increase.

☘️ 3. Understanding Bond Market Prices

*Bond Market Participants:

The bond market is a large and diverse market that includes a variety of participants. Some of the key participants in the bond market include:

- Issuers: These are entities that sell bonds to raise funds, such as corporations, governments, and municipalities.

- Investors: These are individuals or institutions that buy bonds for investment purposes.

- Dealers: These are firms that buy and sell bonds for their own account or on behalf of clients.

- Market Makers: These are firms that provide liquidity to the market by offering to buy and sell bonds at quoted prices.

- Regulators: These are government agencies that oversee the bond market to ensure that it operates fairly and efficiently.

*Bond Market Structure:

The bond market is generally divided into two main markets: the primary market and the secondary market.

- Primary Market: The primary market is where new bonds are issued and sold for the first time. The issuer typically works with an investment bank or underwriter to determine the terms of the bond issue, such as the coupon rate, maturity, and other features. The underwriter then sells the bonds to investors and other buyers.

- Secondary Market: The secondary market is where existing bonds are traded between investors. The secondary market is typically more liquid than the primary market, and it allows investors to buy and sell bonds without having to hold them until maturity.

*Bond Market Liquidity:

Liquidity is an important consideration in the bond market, as it can affect the price at which bonds are bought and sold. A liquid bond market is one in which there are many buyers and sellers, and transactions can be executed quickly and at a fair price. A less liquid bond market is one in which there are few buyers and sellers, and transactions may take longer to execute and be subject to wider bid-ask spreads.

*Factors that can affect bond market liquidity include:

- Market Conditions: The overall state of the economy can affect bond market liquidity. During periods of economic uncertainty or volatility, investors may be less willing to buy and sell bonds, which can reduce liquidity.

- Creditworthiness of the Issuer: The creditworthiness of the bond issuer can affect bond market liquidity. If the issuer's creditworthiness is in doubt, investors may be less willing to buy the bond, which can reduce liquidity.

- Time to Maturity: Bonds with longer maturities are generally less liquid than those with shorter maturities, as they are more sensitive to changes in interest rates and may be subject to more volatility.

- Size of the Issue: The size of the bond issue can also affect liquidity. Large bond issues are generally more liquid than small issues, as there are more buyers and sellers in the market.

🍭Bloomberg Functions:

To find yield on a bond: YAS

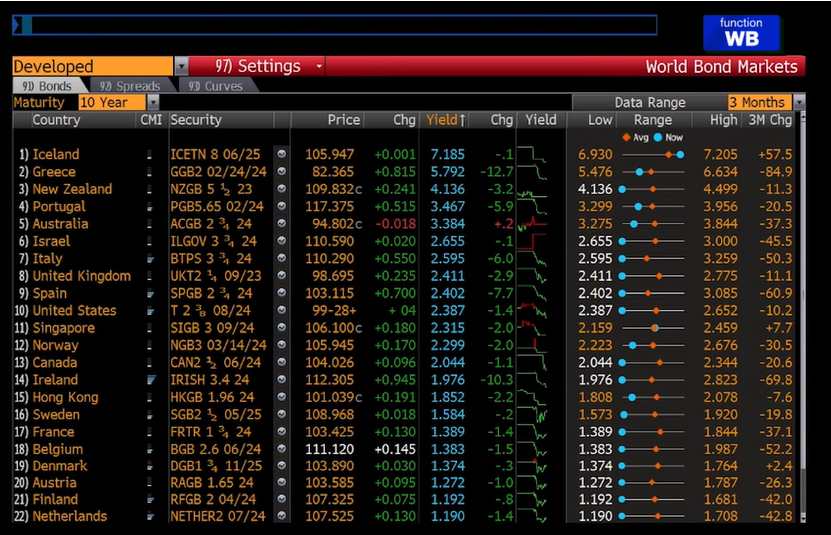

To find yield on a developing mkt bond: WB // Yield = advertised deposit rates for govies of the world were you to buy their bonds.

To check credit risk factors: World Countries Debt Monitor (WCDM). note) Debt/GDP ⇒ bigger the debt, the more drag on the economy ****

To check repayment schedule: DDIS

![Finance Education] Breaking into Finance: A Real-World Guide for Students and Future Leaders (technical and behavioral tips) - Part 5/5: Analyst level Deep-dive career guides](https://images.unsplash.com/photo-1537211568975-f95f2101c8f5?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDE1fHxtb250JTIwYmxhbmN8ZW58MHx8fHwxNzY0NTU3NzQ1fDA&ixlib=rb-4.1.0&q=80&w=720)

![Finance Education] Breaking into Finance: A Real-World Guide for Students and Future Leaders (technical and behavioral tips): Part 4/5: Interview Prep Tips](https://images.unsplash.com/photo-1605128005752-d1714260611e?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDF8fG1vbnQlMjBibGFuY3xlbnwwfHx8fDE3NjQ1NTc3NDV8MA&ixlib=rb-4.1.0&q=80&w=720)

![Finance Education] Breaking into Finance: A Real-World Guide for Students and Future Leaders (technical and behavioral tips): Part 3/5: On Being a Woman & Minority in Finance](https://images.unsplash.com/flagged/photo-1549874491-97ed9de96e1a?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDMwfHxtb3VudGFpbiUyMGV2ZXJlc3R8ZW58MHx8fHwxNzY0MDU4MjIwfDA&ixlib=rb-4.1.0&q=80&w=720)