Education | Ultimate Fixed Income 101: What are Credit Spread, Spread Duration, and DxS?

Explore key credit risk metrics every fixed-income investor should know—credit spread, spread duration, and DxS. Learn how they impact bond pricing, portfolio risk, and investment strategy in changing market conditions.

Why I Started This Series

I was inspired to create this series after more than a decade working in global finance—on Wall Street and in the City of London—as a multi-asset portfolio manager and asset allocator. My career began at BlackRock as a member of the 2013 Analyst Class in NYC, which itself was founded as a mortgage and fixed income house in NYC, so it’s fair to say that my own “bone structure” in investing was built on fixed income. My humble beginning started out in the fixed income portfolio management internship in New York and later moved to London to join the multi-asset allocation team as a portfolio manager, where I worked across fixed income, equities, and private assets.

Looking back, there are concepts I wish I had understood earlier in my career—principles that would have saved me time, confusion, and mistakes. This series is my way of sharing those lessons in a way I hope is practical, clear, and encouraging.

I dedicate these posts to my mentees, and also to one moment that has always stayed with me: during my internship in investment banking (M&A) on Wall Street, I watched a colleague who was a DCF model expert explain the mechanics of valuation to another banker over a sandwich at lunch. His passion was contagious. I barely knew anything about finance at the time, but I remember thinking: one day, I’d like to be able to share knowledge with the same kind of joy and generosity.

This series is a small step in fulfilling that promise.

Hi All,

Today, I wanted to talk about the common credit risk metrics used by investors. Namely, credit spread, spread duration and DxS.

Today's Key Concepts

- Understanding Credit Spread and Spread Duration

- DxS: Understanding the Relationship between Credit Spread and Spread Duration

☘️ 1. Understanding Credit Spread and Spread Duration

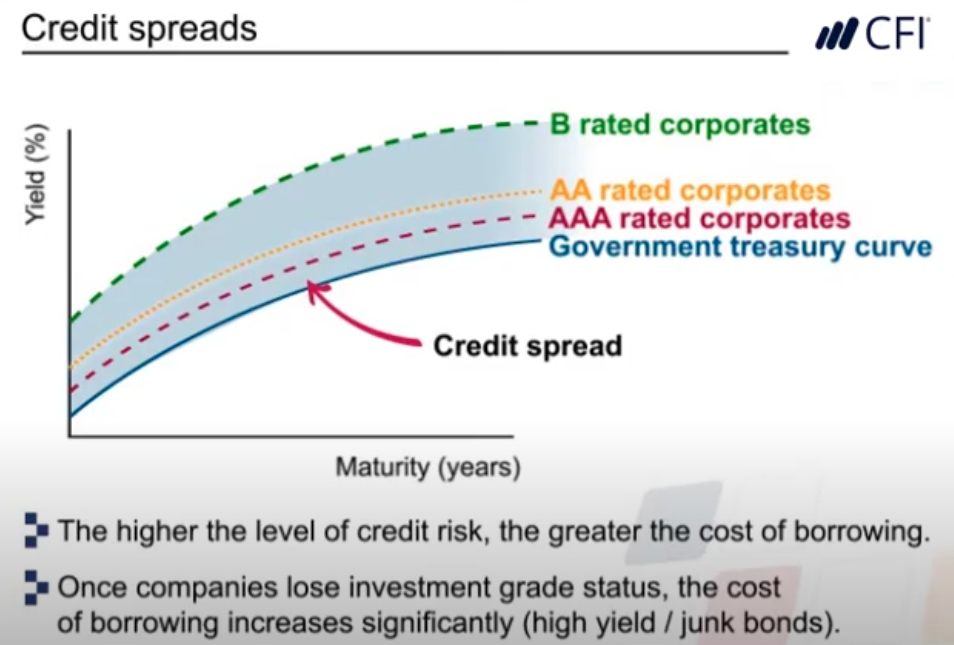

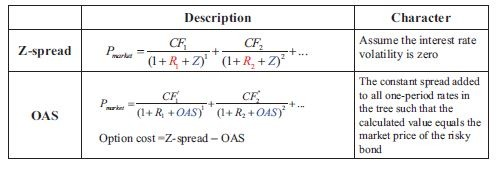

Credit spread is a measure of the difference between the yield of a corporate bond and a benchmark interest rate, such as the Treasury bond. It is the premium that investors require to invest in a corporate bond rather than a risk-free government bond. If there are embedded options (many corporate bonds and structured products such as mortgage-backed securities do), typically credit spread is expressed as Option Adjusted Spread (OAS). Credit spread is an important factor to consider when investing in corporate bonds because it reflects the level of credit risk associated with the bond. The higher the credit spread, the higher the perceived credit risk of the bond (i.e. default risk = a bond issuer may fail to make payment when requested).

As an investor, you want credit spreads to tighten upon buying a bond, which means a lower yield (i.e. a higher bond price) so that the value of your bond increases (buy low and sell high granted you are not holding until maturity).

As you can see in the below chart, as the credit risk of companies increases the yield curve for those companies gets higher and higher. Once a company loses investment grade status, the cost of borrowing increases significantly companies that don't have investment grade status are called high yield or junk bonds.

Credit spreads change as economic conditions change. When the economy is deteriorating as we saw in late 2007 and 2008 credit spreads widen and this reflects the added risk in lending to these companies. As economic conditions improve, credit spreads narrow because of an improvement in the credit quality of the companies. As credit spreads narrow, bond yields fall which means the prices of these bonds are increasing!

Note) Option-adjusted spread (OAS) is a measure of the spread of a bond over a benchmark rate, adjusted for any embedded options in the bond. It is calculated by subtracting the value of the embedded option from the bond's yield, and then comparing the result to the yield of a benchmark bond with the same credit rating and maturity. The difference between the two yields is the OAS. Bonds with embedded options can be complex and require careful analysis to determine their true value. OAS provides a more accurate measure of the credit risk and compensation associated with these bonds, and helps investors to compare bonds with different types of options.

*OAS = Z-spread - Option Cost

Spread duration is a measure of the sensitivity of a bond's price to changes in its credit spread. It is a key component of the bond's overall duration and is an important risk factor to consider when investing in bonds.

Spread duration is particularly relevant for investors who hold corporate bonds as part of their portfolio, as changes in credit spreads can have a significant impact on the bond's price.

Credit spread duration is a useful indicator to measure the portfolio beta and this is one of the key instruments to assess the sensitivity of a bond or a portfolio to market moves. For example, if credit spreads widen by 100 bps for example a portfolio with a spread duration of 2.5 years, it will result in a - 2.5 % return assuming all else equal.

There are two things that affect spread duration:

1) Coupon: A smaller coupon means a lower cash flow and hence a higher sensitivity to price changes.

2) Duration: The longer the lifetime of a bond, the bigger the sensitivity to changes in the underlying price.

For example, if a bond pays a lower coupon and has a longer lifetime compared to the other bond (all else being equal), it has a higher spread duration and thus a higher price sensitivity to credit spreads movements in the market.

☘️ 2. DxS: Understanding the Relationship between Credit Spread and Spread Duration

DxS (Duration Times Spread duration a.k.a. DTS), is a market standard for measuring the credit volatility of a corporate bond. It is calculated by simply multiplying two readily available bond characteristics: the spread durations and the credit spread. This measure helps investors understand the impact of changes in credit spread on a bond's price. The formula for calculating DxS is:

*DxS = Spread Duration x Credit Spread

Let's consider the scenario where we need to compare two bonds that differ significantly in their spread durations. For instance, bond A has a spread duration of one year, and its credit spread is 500 basis points, while bond B has a spread duration of 10 years, and its credit spread is 50 basis points. Despite the vast differences in these bond's characteristics, they both have a DxS of 500. As a result, they are expected to exhibit the same level of credit volatility.

What is the reason behind using the multiplication of duration and spread, rather than another formula?

The answer lies in the assumption that credit spreads move in a relative fashion, rather than in a parallel fashion. By using DxS as the risk measure, we acknowledge this fact. For instance, if the credit spread of bond A increases from 500 to 550 basis points (a 10% increase), then the credit spread of bond B will also increase from 50 to 55 basis points (also a 10% increase), rather than from 50 to 100 basis points. The empirical research has demonstrated that relative spread changes provide a more accurate reflection of the credit markets than parallel spread changes. Hence, the DxS formula is a more reliable risk measure for credit portfolios.

What does this mean for investors?

When a bond's credit spread increases, its DxS also increases. This means that the bond's price will be more sensitive to changes in credit spreads, which can lead to greater price volatility. Similarly, when a bond's credit spread decreases, its DxS decreases, which means that the bond's price will be less sensitive to changes in credit spreads, leading to lower price volatility.

Investors can use DxS to manage the risk of their bond portfolio. For example, if an investor wants to reduce the impact of credit spread changes on their portfolio, they may choose to invest in bonds with lower DxS values. Conversely, if an investor is willing to take on more risk, they may choose to invest in bonds with higher DxS values.

A bond with a high DxS will provide a higher return than a bond with a lower DxS in a falling interest rate environment.

Conclusion

Credit spread, spread duration, and DxS are important concepts to understand for anyone investing in fixed-income securities. Credit spread measures the difference between a bond's yield and a benchmark interest rate and is an indicator of the bond's credit risk. Spread duration measures the sensitivity of a bond's price to changes in its credit spread. DxS is a measure of the product of a bond's spread duration and its credit spread and helps investors understand the impact of credit spread changes on a bond's price. By understanding these concepts, investors can better manage the risks associated with their bond portfolios.

![Finance Education] Breaking into Finance: A Real-World Guide for Students and Future Leaders (technical and behavioral tips) - Part 5/5: Analyst level Deep-dive career guides](https://images.unsplash.com/photo-1537211568975-f95f2101c8f5?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDE1fHxtb250JTIwYmxhbmN8ZW58MHx8fHwxNzY0NTU3NzQ1fDA&ixlib=rb-4.1.0&q=80&w=720)

![Finance Education] Breaking into Finance: A Real-World Guide for Students and Future Leaders (technical and behavioral tips): Part 4/5: Interview Prep Tips](https://images.unsplash.com/photo-1605128005752-d1714260611e?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDF8fG1vbnQlMjBibGFuY3xlbnwwfHx8fDE3NjQ1NTc3NDV8MA&ixlib=rb-4.1.0&q=80&w=720)

![Finance Education] Breaking into Finance: A Real-World Guide for Students and Future Leaders (technical and behavioral tips): Part 3/5: On Being a Woman & Minority in Finance](https://images.unsplash.com/flagged/photo-1549874491-97ed9de96e1a?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDMwfHxtb3VudGFpbiUyMGV2ZXJlc3R8ZW58MHx8fHwxNzY0MDU4MjIwfDA&ixlib=rb-4.1.0&q=80&w=720)