Global Markets Recap - Week of Sep 4, 2023

1. What Moved the Markets?

Europe

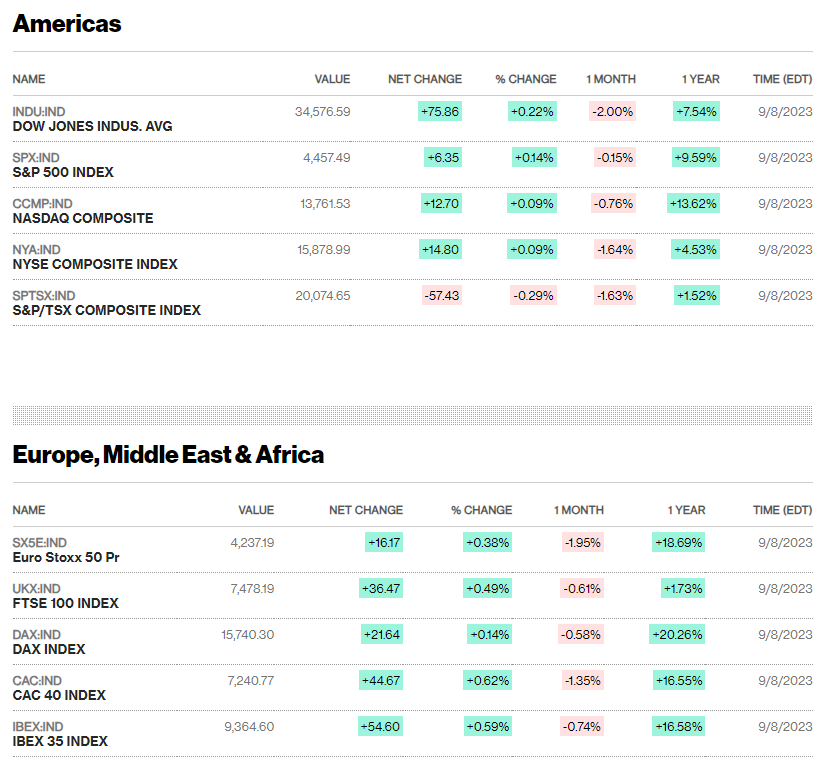

- European Market Decline: In Europe, the STOXX Europe 600 Index closed down by 0.76%, driven by fears that elevated interest rates could be pushing the economy into a slowdown.

- Mixed Performance in Major Indexes: Germany's DAX (-0.63%), France's CAC 40 (-0.77%), and Italy's FTSE MIB (-1.46%). On the other hand, the UK's FTSE 100 Index (+0.18%).

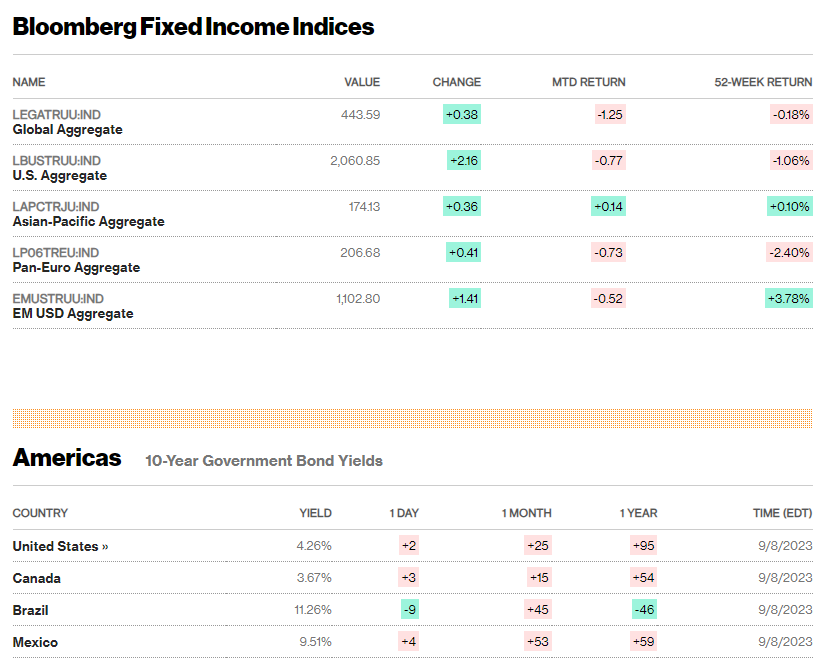

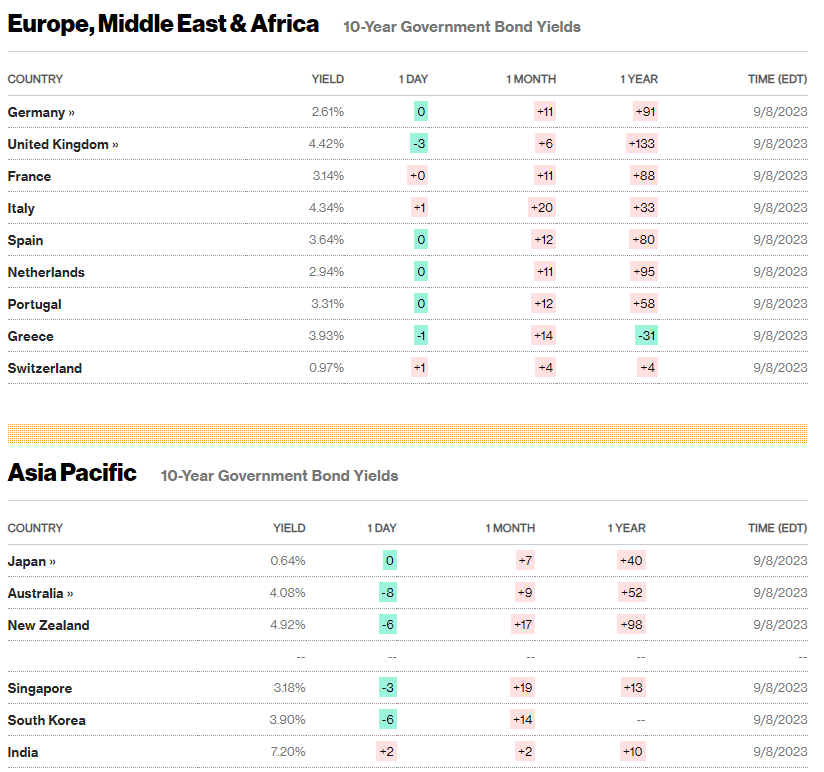

- Rising Yields on Sovereign Bonds: Yields on 10-year German (2.61%)and Italian sovereign bonds (4.34%) ticked higher, reflecting concerns about the overall eurozone economy.

- Weak Eurozone Economic Indicators: Eurozone economic indicators were less than optimistic, with Q2 GDP growth at a mere 0.1% due to a drop in exports, resulting in Eurostat revising down its initial estimate of a 0.3% expansion.

- Retail Sales Contraction: Retail sales volumes in the eurozone contracted by 0.2% sequentially in July, particularly affected by weaker automotive fuel purchases, with a year-over-year decline of 1.0%.

- Decline in Investor Morale: Investor morale in the eurozone saw a significant dip, with Sentix's index falling to -21.5 from -18.9 in August, largely attributed to a deepening slowdown in Germany, especially in the industrial sector.

- Persistent Decline in German Industrial Production: Germany's industrial production fell for the third consecutive month in July, experiencing a more significant-than-expected decline of 0.8%, primarily driven by a 9% drop in auto manufacturing.

- BOE's Rate Outlook: Bank of England (BoE) Governor Andrew Bailey indicated that a peak in UK interest rates might be approaching, casting doubt on a possible rate hike at the upcoming September 21 policy meeting. Bailey emphasized that the decisions regarding interest rates have become more intricate.

- Diminished Price Pressures: The BoE's August business survey suggested that underlying price pressures in the UK may be diminishing, with companies expecting to raise prices by 4.9% over the coming year, down from 5.2% in the previous three months. Wage growth expectations remained steady at 5.0% over the coming year.

US

- YTD (%): DJIA (+4.31%), S&P 500 (+16.10%), Nasdaq Composite (+31.48%), S&P MidCap 400 (+5.93%), and Russell 2000 (+5.13%).

- Stocks Closed Lower as Positive Economic Signals Drive Higher Interest Rates: Stocks in the U.S. closed lower during the holiday-shortened week due to positive economic signals driving an increase in interest rates, with growth stocks outperforming value shares, and large-caps surpassing small-caps, while decline in Apple, partly due to Chinese government employees no longer being able to use iPhones and news of the pricier iPhone 15, contributed to the declines, along with declines in chipmakers like NVIDIA.

- Positive Economic Data Influences Sentiment: Economic sentiment was influenced by the week's economic calendar, which had some surprising positive reports, notably the Institute for Supply Management's report on August services sector activity, unexpectedly reaching its highest level since February. The report showed faster growth in new orders, but also a sharp drop in order backlogs and a considerable rise in inventories. However, concerns remain about a sharp slowdown in the Chinese economy.

- Jobless Claims Fall to Lowest Level t0 216k Since February: In the labor market, Thursday's jobless claims report showed lower-than-expected claims, indicating continued labor demand strength despite the unemployment rate increasing from 3.5% to 3.8% in August. The number of Americans applying for unemployment in the previous week fell to 216,000, the lowest in six months, and continuing claims dropped to 1.68 million, the lowest since mid-July.

- Rise in Short-Term Bond Yields to 5% Following Jobless Numbers: The jobless numbers led to a rise in short-term bond yields, with the two-year U.S. Treasury note briefly crossing back above the 5% threshold on Thursday.

- Mixed Performance in the Bond Market: The tax-exempt municipal bond market had a quiet start as participants awaited large new issues from California and the Port Authority of NY/NJ. These new deals came on Wednesday and affected the secondary market, causing yields on intermediate AAA municipal bonds to rise.

- Resilient Credit Spreads and Lighter Issuance in IG Corporate Bonds: Credit spreads only slightly widened on Tuesday despite a large amount of issuance after the holiday weekend, but spreads tightened later in the week amid lighter issuance, which was oversubscribed.

- Quiet Week in the HY Market: Below-average volumes following the long weekend, with higher-quality bonds underperforming due to higher rates. Only a few new deals were announced during the week.

- Firm Sentiment in Bank Loan Market: The bank loan market had firm sentiment and steady demand for discount paper, with expectations of additional deals coming in the next few weeks to take advantage of favorable conditions for the asset class.

Japan

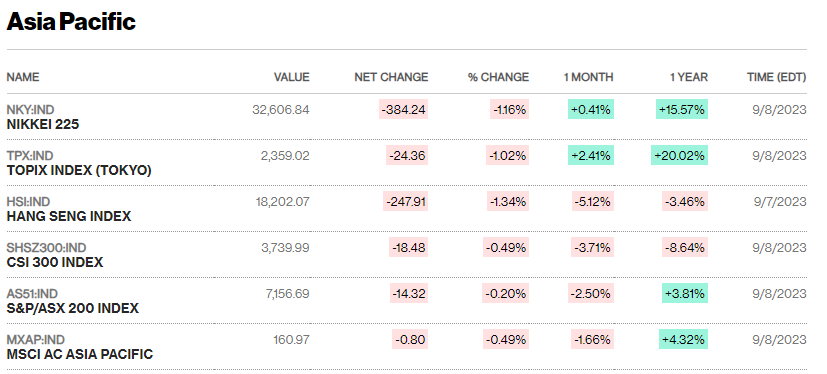

- Mixed Stock Market Performance: Japan's stock markets had mixed performance last week. The Nikkei 225 Index (-0.3%), TOPIX Index (+0.4%). Concerns about China's economic slowdown and its impact on global demand affected investor sentiment.

- Weaker Economic Data: Weak economic data releases indicated that Japan's economy might not be as robust as previously thought. Q2 2023 GDP growth was revised down to 4.8% QoQ, weaker than the preliminary estimate of 6.0%. Capital spending, private consumption, and public investment all underperformed expectations.

- Low yields on Japanese Government Bonds: The yield on the 10-year Japanese government bond (JGB) remained around 0.6%. Weak demand at JGB auctions suggested that investors were waiting for higher yields, despite the Bank of Japan's low-rate policy.

- Warnings on Currency Intervention: The yen weakened to JPY 147 against the U.S. dollar, its lowest level in over 10 months. Japan's Ministry of Finance issued stern warnings, emphasizing their vigilance and preparedness to intervene in the foreign exchange market to bolster the yen if speculative currency fluctuations persisted.

- Political Reshuffle Speculation: Speculation grew about Prime Minister Fumio Kishida potentially reshuffling the Liberal Democratic Party (LDP) leadership and cabinet, with reports indicating it might happen as early as the week of September 11, as Kishida seeks to maintain LDP stability and prepare for his party leader reelection bid next year.

China

- Chinese Equities Decline Amid Economic Concerns: Shanghai Composite Index (-0.53%), CSI 300 Index (-1.36%). Hang Seng Index in Hong Kong faces a weekly decline due to heavy rainstorm disruptions.

- Services Sector Growth Slows Significantly: Caixin/S&P Global services activity index drops to 51.8 in August, the slowest expansion since December. Sluggish growth persists for the eighth consecutive month.

- Export and Import Figures Show Mixed Results: China's August exports contract by 8.8% YoY, following July's 14.5% decrease. Imports shrink by 7.3%, defying expectations.

- Renminbi Hits Record Low Against USD: Chinese yuan reaches a historic low of 7.36 against the U.S. dollar. Pessimism surrounding China's economic outlook and U.S. economic resilience contribute to downward pressure on the currency.

2. Week Ahead