Global Markets Recap - Week of April 10, 2023

1. What Moved the Markets?

Europe

European stocks experienced gains as concerns over a possible recession lessened. The pan-European STOXX Europe 600 Index rose by 1.74% in local currency terms during the five trading days that ended on April 14th. Major stock indexes also saw increases, with Germany's DAX climbing by 1.34%, Italy's FTSE MIB increasing by 2.42%, France's CAC 40 Index gaining 2.66%, and the UK's FTSE 100 Index rising by 1.68%.

Investors in European government bonds saw gains as they assessed the possibility of more policy tightening by the European Central Bank. Yields on 10-year German government debt increased, with some policymakers supporting a half-percentage-point rate hike if inflation data warrants it. Meanwhile, yields on 10-year UK and French sovereign bonds also rose.

Eurozone industrial production rose by 1.5% sequentially and 2.0% year over year on a seasonally adjusted basis in February, exceeding expectations. This growth was driven by higher output of capital goods and nondurable consumer goods. However, retail sales volumes fell by 0.8% sequentially in March, matching forecasts. In other news, the Sentix index of investor morale rose in April, after being interrupted in March.

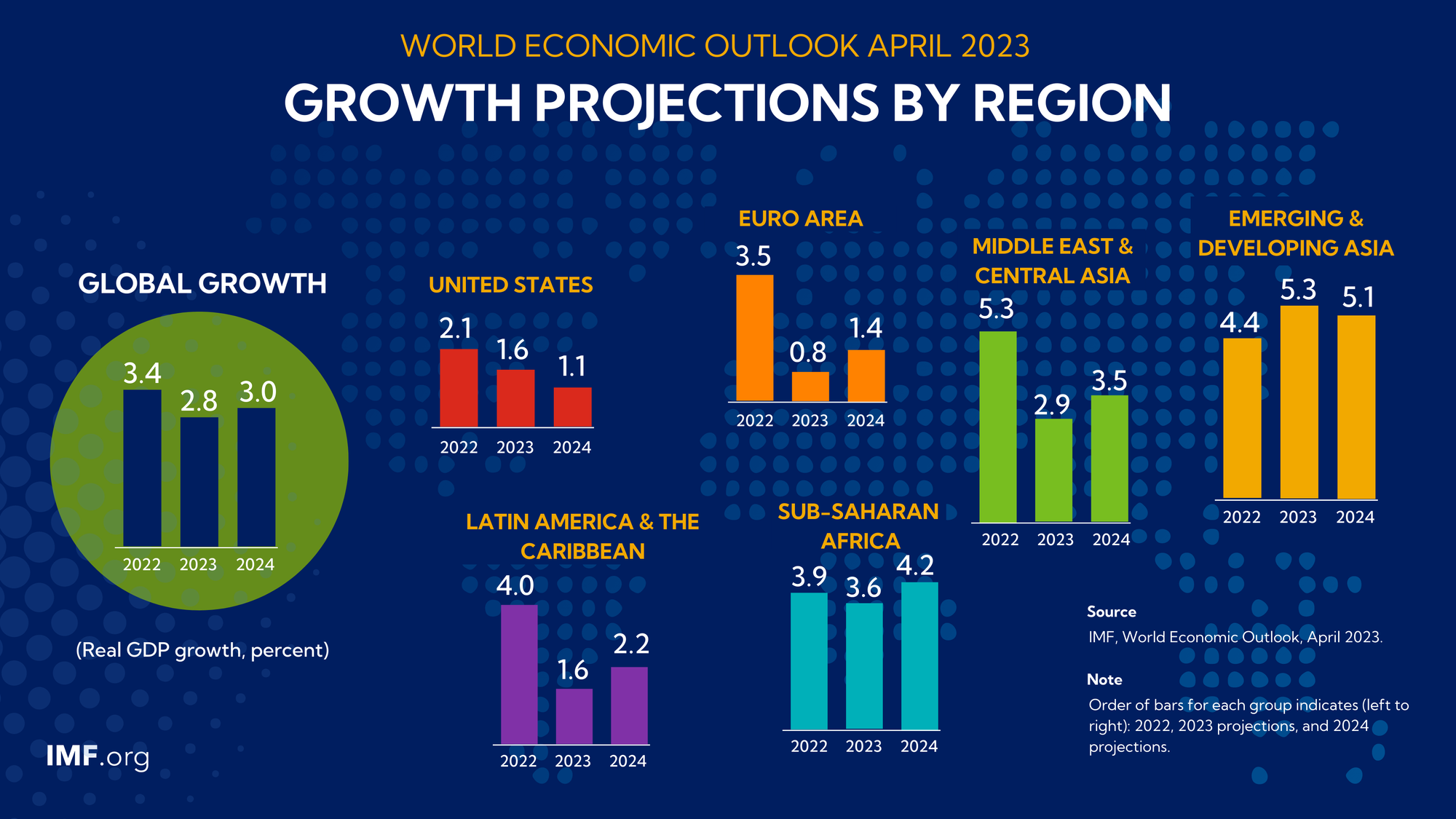

Official data showed that the UK economy is likely to avoid the first-quarter recession that the Bank of England (BoE) predicted. Gross domestic product (GDP) remained flat month over month in February, slightly below expectations due to public service strikes. However, the revision to January's GDP figure indicated that the economy expanded by 0.4% that month. The International Monetary Fund (IMF) still projected that the UK's economy would shrink by 0.3% in 2023, although this was a less pessimistic forecast than the IMF's previous one.

France's Constitutional Council validated a law to increase the pension age, potentially leading to more public protests. The council is the equivalent of the US Supreme Court.

US

Stocks saw gains despite concerns over slowing growth and inflation pressures. The S&P 500 Index saw strong performance from materials and industrials shares, but technology shares lagged due to a decline in chipmaker NVIDIA. Trading was thin early in the week, possibly due to closed markets in Europe following the Easter holiday. Investors waited for the start of quarterly earnings season, which began with reports from JPMorgan Chase, Wells Fargo, and Citigroup. All three beat consensus estimates, though earnings for the S&P 500 were expected to have contracted 6.5% year-over-year in Q1. The Labor Department's release of the consumer price index (CPI) for March was a highly anticipated event, with the CPI rising only 0.1% and the year-over-year rate at 5.0%, the slowest pace since May 2021. Despite this, the indexes fell back later in the day due in part to comments from Federal Reserve Bank of Richmond President Thomas Barkin.

On the producer side, the core producer price index declined 0.1% in March, marking the first decrease in prices since April 2020. Economists believe that while the recent inflation data is encouraging, it is not yet consistent with the Fed being able to significantly cut rates by the end of the year. The recent banking turmoil may cause the Fed to pause its rate-hiking cycle, but policymakers would only consider cutting rates after seeing a dramatic deterioration in the labor market and signs of an imminent recession. Bond investors expect at least one further rate hike, leading to a rise in longer-term U.S. Treasury yields. Trading remained subdued in both the investment-grade and high yield corporate bond markets, with technical conditions characterized by relatively light dealer inventories and below-average supply continuing to support the municipal market.

Japan

Japanese stocks posted gains over the week, with the Nikkei 225 Index rising by 3.54% and the broader TOPIX Index up 2.71%. Investor sentiment was boosted by Warren Buffett's announcement that his company, Berkshire Hathaway, would increase its investments in Japan. Additionally, the new Bank of Japan (BoJ) Governor Kazuo Ueda's dovish comments and subsequent yen weakness supported risk assets. Although Ueda dampened expectations of a sudden major monetary policy change, he signaled that the central bank's large-scale easing stance could be reviewed in the near future. The yen weakened to around JPY 132.5 against the U.S. dollar, and the yield on the 10-year Japanese government bond was broadly unchanged at 0.46%, reflecting anticipated monetary policy continuity under Ueda.

Ueda made a series of dovish remarks at his first press conference, stating that the current policy of negative interest rates should continue until the central bank's 2% inflation target is achieved. However, he also asserted that the side effects of ultra-easy policy need to be considered and reviewed from a long-term perspective. The IMF revised downward its projection for Japan's 2023 economic growth to 1.3% from 1.8% in January, attributing it to weak economic performance over the final quarter of last year and currency volatility.

China

Following a week of volatility, Chinese stocks had mixed performance as investor sentiment was dampened by softer-than-anticipated inflation. While new loans and trade data exceeded expectations, concerns about the overall strength of economic recovery persisted. In local currency terms, the Shanghai Stock Exchange Index increased by 0.32%, whereas the blue-chip CSI 300 declined by 0.76%. Meanwhile, Hong Kong's benchmark Hang Seng Index rose by 0.53%.

In March, inflation in China decreased for the second consecutive month, with the consumer price index rising by 0.7% YoY, down from a 1% increase in the previous month. The core inflation rate, which excludes volatile food and energy prices, rose to 0.7% from 0.6% in February. The producer price index also fell by 2.5%, the lowest since June 2020, marking its sixth straight monthly decline, according to Reuters.

The latest data missed the government's target of around 3% growth in the consumer price index this year, raising expectations that the People's Bank of China (PBOC) would implement additional stimulus measures to bolster the economy. China's 10-year government bond yield dropped to its lowest level since November 2021, as traders factored in the possibility of further monetary easing. Many economists anticipate that the PBOC may reduce the policy rate for its short- and medium-term lending facilities to boost loan growth and investment, according to Bloomberg. According to PBOC data, new bank loans amounted to RMB 3.89 trillion in March, more than double February's RMB 1.81 trillion, reflecting a surge in credit demand following the relaxation of COVID restrictions by Beijing, resulting in a rebound in economic activity. New loans amounted to an all-time high of RMB 10.6 trillion in the first quarter of the year.

On the trade front, China's exports unexpectedly rose by 14.8% YoY in March, confounding analysts' expectations of a decline, marking the first increase since September, while imports fell by a lower-than-anticipated 1.4%.

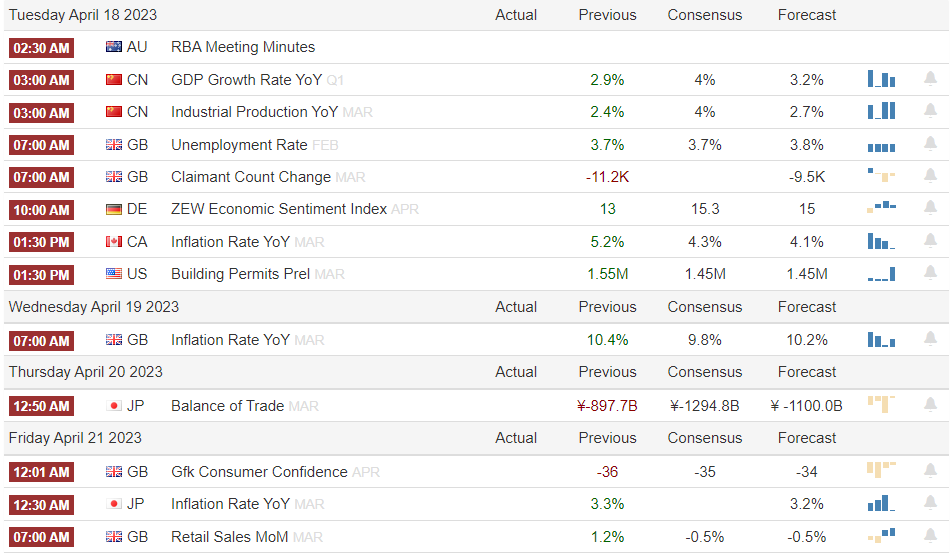

2. Week Ahead

Q1 Earnings season kicked off last Friday with major banks releasing their earnings outcome. It would be important to watch the impact on margins across the board to gauge the recessionary pressure.