Global Markets Recap - Week of April 24, 2023

1. What Moved the Markets?

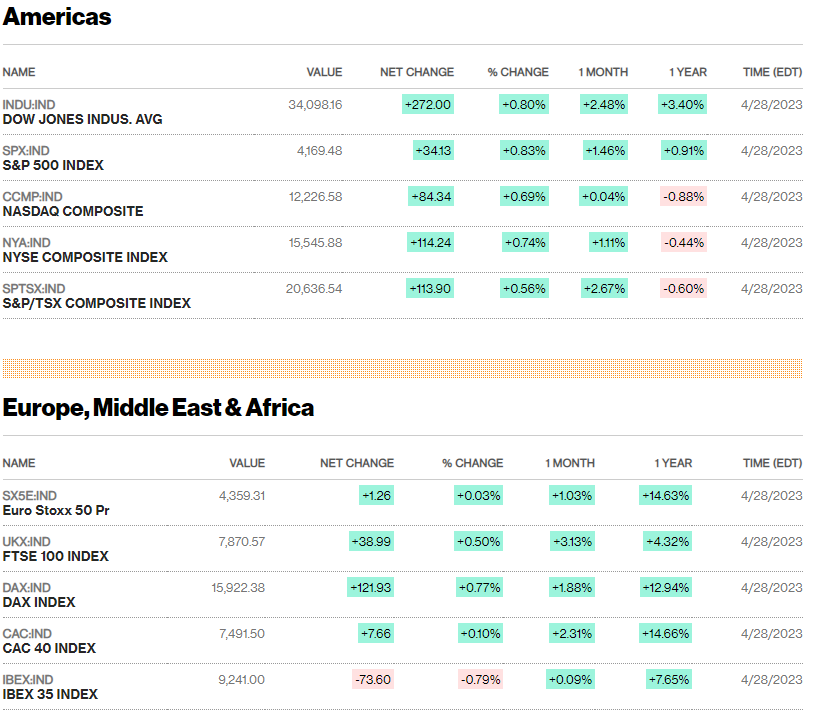

Europe

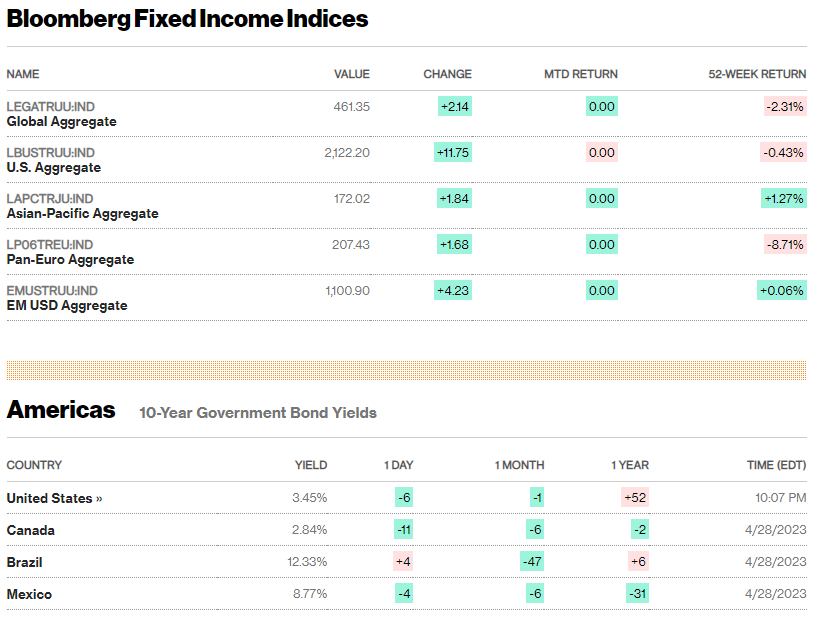

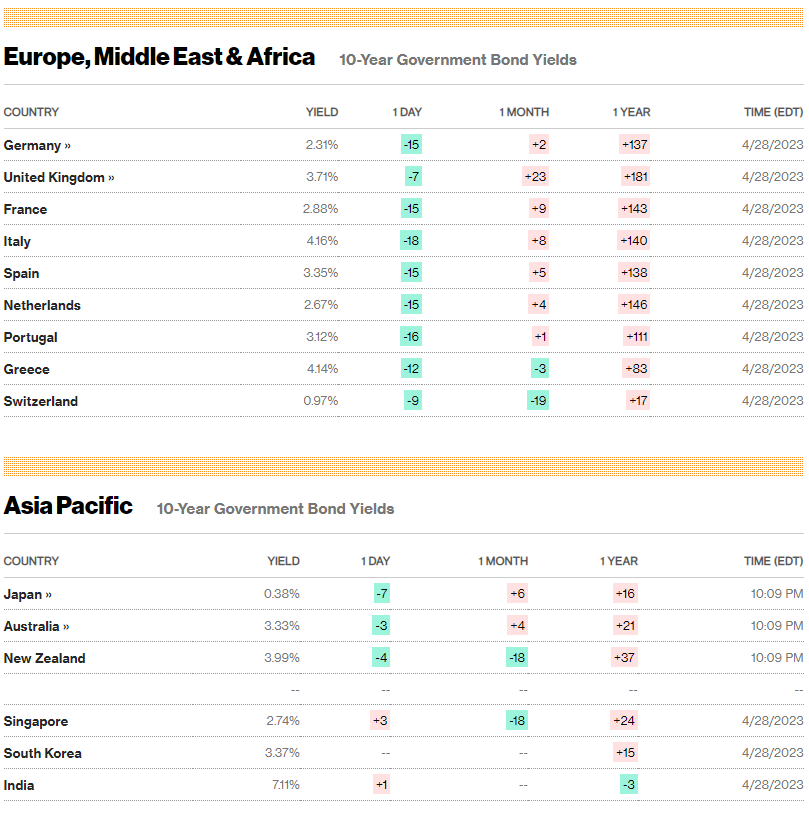

European shares fell as concerns about potential interest rate hikes triggering an economic recession intensified. The pan-European STOXX Europe 600 Index ended 0.50% lower, with major stock indexes mixed to lower. France's CAC 40 Index fell 1.13%, Italy's FTSE MIB dropped 2.41%, Germany's DAX advanced 0.26%, and the UK's FTSE 100 Index lost 0.55%. Core eurozone government bonds experienced a volatile week due to several factors, including worries about the US banking industry and unexpected declines in Spanish producer price inflation. Meanwhile, the eurozone economy showed weak growth in the first quarter, expanding less than expected. However, economic sentiment in the eurozone held steady in April. In the UK, the budget deficit grew to a record level of GBP 139 billion, while business confidence increased to its highest level in almost a year. Finally, Sweden's central bank raised its key interest rate to 3.5% and signaled another increase may follow in June or September.

US

The stock market had mixed results last week, with mega-cap stocks outperforming cyclicals and small-caps. Four stocks, Microsoft, Apple, Amazon.com, and Meta Platforms, contributed to almost half of the S&P 500's gains, while cyclical sectors performed poorly due to signs of an economic slowdown, particularly in the manufacturing sector. S&P 500 and Nasdaq and Dow were up 0.9% and Nasdaq by 1.3%. Durable goods data showed an increase in March orders, but orders excluding aircraft and defense fell, and retail inventories rose more than expected, indicating the need for cutbacks in production and spending. The advance estimate of annualized growth in gross domestic product (GDP) in the first quarter was well below expectations. The banking industry also experienced renewed turmoil, with First Republic Bank suffering significant deposit outflows and potentially being taken into receivership by the Federal Deposit Insurance Corporation. The corporate bond market was weak due to disappointing economic conditions and concerns about the banking industry, but rallied later in the week due to some encouraging corporate earnings reports and an uptick in secondary trading volumes. The high yield and bank loan markets also had subdued volumes due to the Fed blackout period and weak economic data.

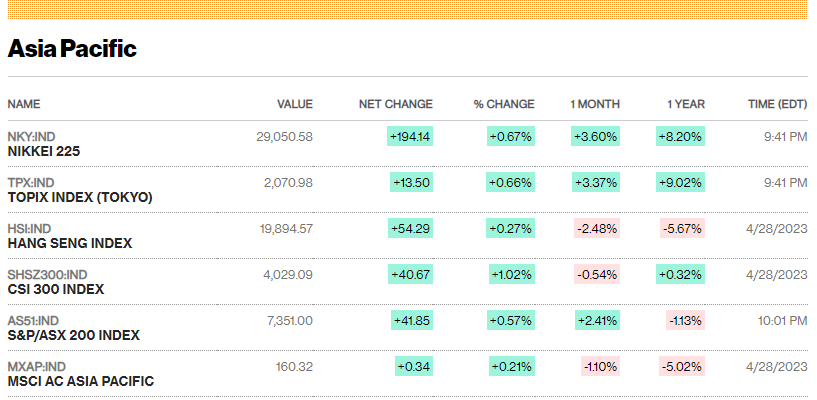

Japan

Japan's stock markets experienced gains for the week, with the Nikkei 225 Index rising 1.02% and the broader TOPIX Index up 1.10%. The Bank of Japan's (BoJ) dovish stance, which included leaving monetary policy and its yield curve control framework unchanged, contributed to the positive market sentiment. Additionally, Japan's government eased border controls ahead of the Golden Week holidays, increasing anticipated arrivals, particularly from China. The yield on the 10-year Japanese government bond fell to 0.41% from 0.46% at the previous week's end due to the BoJ's dovish stance, causing the yen to weaken against the US dollar.

The BoJ's April 27-28 meeting, led by new Governor Kazuo Ueda, signaled policy continuity, with the central bank maintaining its short-term policy interest rate at -0.1% and its yield curve control framework. However, given the challenges in achieving price stability over the past 25 years, the BoJ announced plans to conduct a broad review of monetary policy over the next year and a half. The BoJ's statement removed forward guidance on interest rates and the need to monitor the impact of COVID-19, while still committing to easing.

The BoJ upgraded its forecast for Japan's core inflation slightly, with the FY2023 forecast at 1.8%, up from 1.6%, and the FY2024 forecast at 2.0%, up from 1.8%. However, the BoJ expects price growth to slow down through the FY2025 forecast of 1.6%. Despite Tokyo-area inflation rising 3.5% YoY in April, Ueda stated that the BoJ has not met its 2% inflation target.

China

Chinese stocks had a mixed ending ahead of a five-day holiday, as the Shanghai Stock Exchange Index increased by 0.67%, while the blue chip CSI 300 pulled back 0.09%. The Politburo vowed to continue its "forceful" fiscal and monetary policy stance to support the economy, which faces obstacles in economic transformation and insufficient domestic demand. China's cabinet, the State Council, announced measures to encourage growth in the trade sector amid weakening global demand. Industrial profits in China fell 21.4% in Q1 from a year earlier, slightly better than the 22.9% drop recorded in the first two months of 2023, according to the National Bureau of Statistics.

2. Market Movements

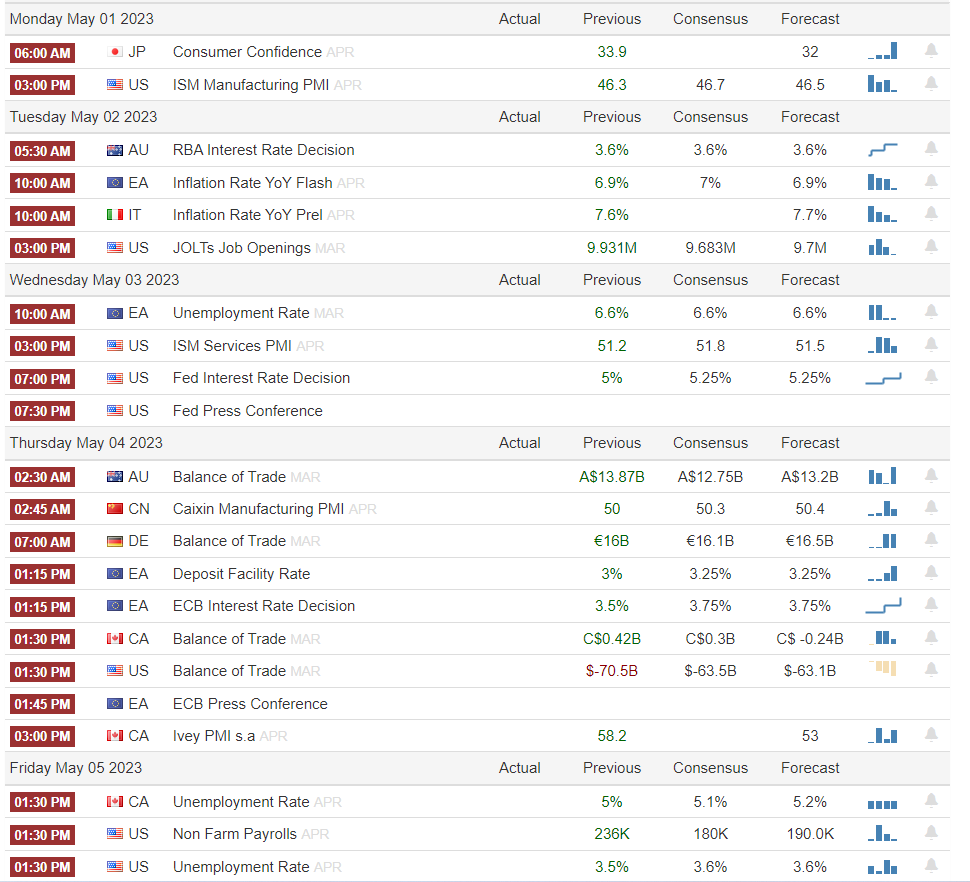

3. Week Ahead

All eyes are on the Fed's rate hike decision. 25bps raise expected.