Global Markets Recap - Week of April 3, 2023

Hi All,

Hope you guys are having a great Passover/Easter/Ramadan weekend. Apparently, this year, Easter, Ramadan, and Passover were all overlapping, which typically only happens three times a century. Easter commemorates the resurrection of Jesus, Passover celebrates freedom and liberation from slavery in Egypt, and Ramadan is a commemoration of Muhammad's first revelation. I wrote another post re: Easter traditions around the world. So, please check that out!

I had a great peaceful weekend - sharing a couple of photos from Seven Sisters for some raw nature time from my end. I have been digging into the rabbit hole of the world of AI and ChatGPT over the past couple of months and finally ready to share some thoughts and contents, so please keep an eye out for those! Hope you have a great start of the week!

1. What Moved the Markets?

Europe

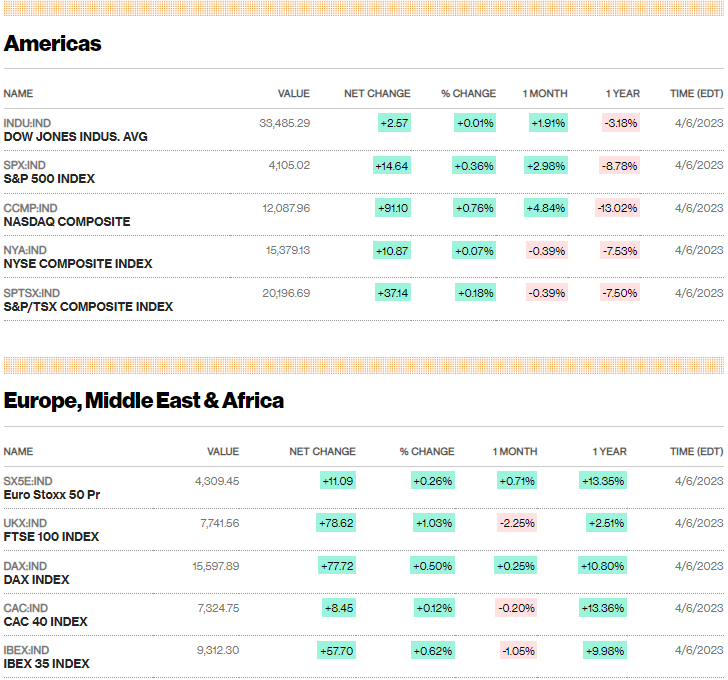

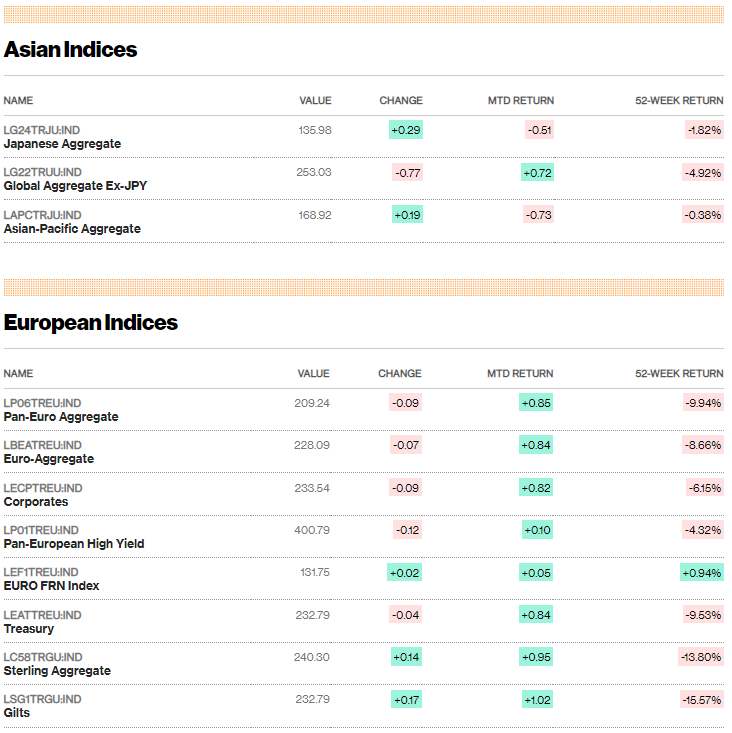

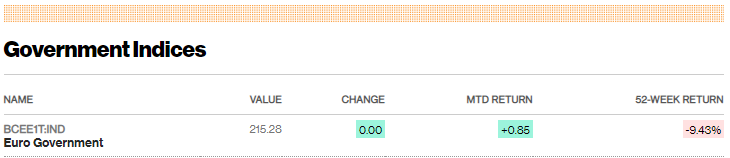

Shares in Europe closed higher as concerns about a banking crisis subsided, and the pan-European STOXX Europe 600 Index gained 0.90% for the week ended April 6. The European Central Bank's (ECB) President, Christine Lagarde, Vice President Luis de Guindos, and Chief Economist Philip Lane hinted at further interest rate hikes due to inflationary pressures, while other policymakers believed that rates were nearing a peak. EU house prices fell for the first time in eight years, while eurozone producer prices dropped for the fifth consecutive month, primarily due to lower energy prices. However, an unexpected increase in Germany's industrial production of 2.0% in February, fueled by strong demand for heavy vehicles and automobiles, prompted Germany's economics ministry to announce signs of economic recovery. Bank of England's (BoE) Chief Economist Huw Pill indicated that the May rate decision could be a close call, suggesting that the monetary policy tightening in the UK might be near an end.

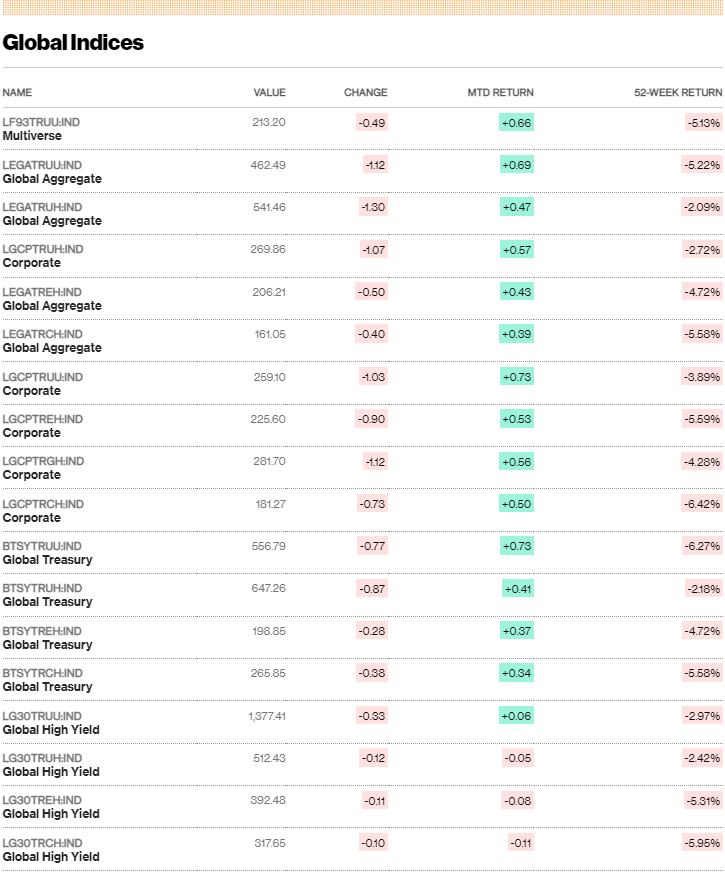

US

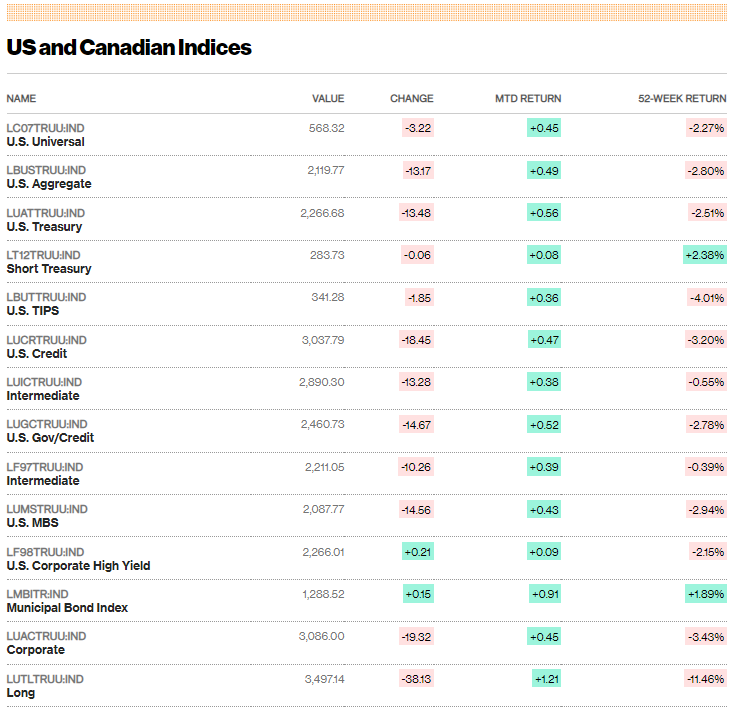

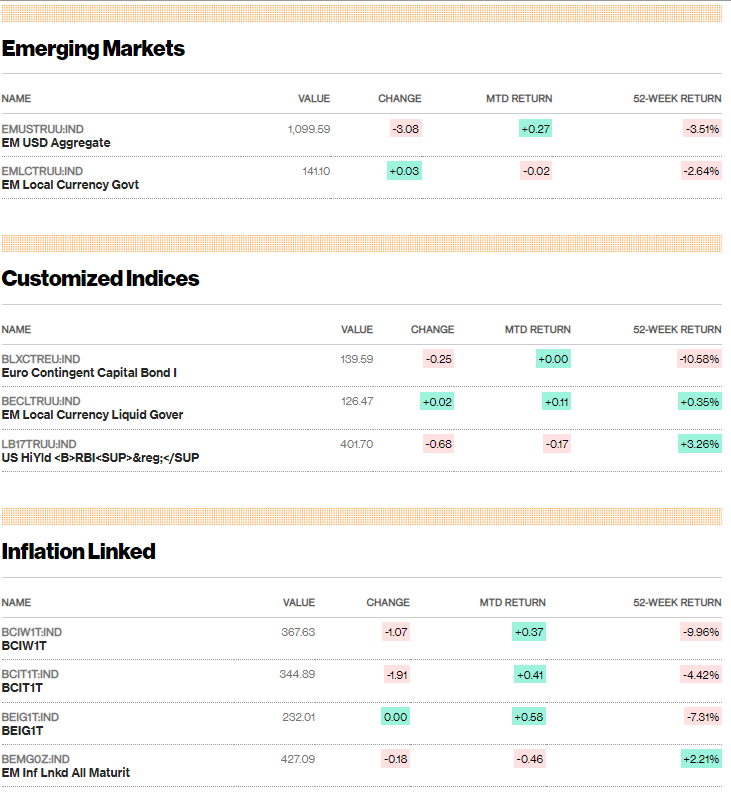

During a holiday-shortened week, major benchmarks mostly closed lower in light and choppy trading. Investors appeared to pause after institutional investors adjusted their holdings before their quarterly public disclosure. Economic releases affected sentiment, with the Institute for Supply Management's gauge of March factory activity falling to a three-year low, and ADP's tally indicating that the job market continued to expand but at a slower pace. US Treasury yields fell due to weak economic data, while technical conditions supported the municipal bond market. The high-yield bond market mainly focused on issuance, and the loan market saw steady demand.

Japan

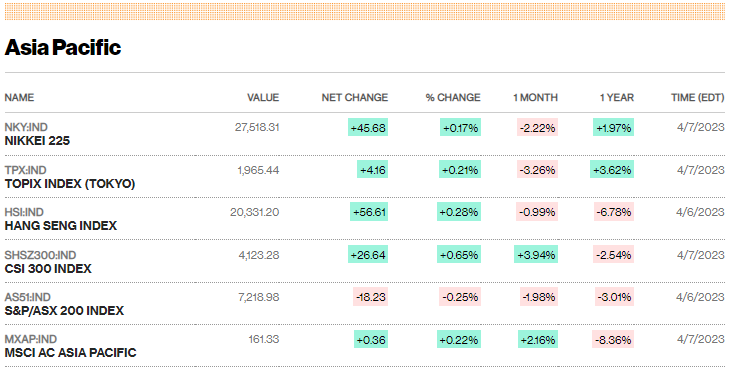

Japanese stocks fell over the week, with the Nikkei 225 and TOPIX indices down by 1.9% and 2.1%, respectively. The announcement of export restrictions on some types of semiconductor manufacturing equipment raised concerns about the impact on Japan's relationship with China. There was also speculation about a change in the Bank of Japan's ultra-loose monetary policy under incoming Governor Kazuo Ueda. Business sentiment among Japan's big manufacturers continued to deteriorate in the first quarter, while non-manufacturing enterprises benefited from rising inbound consumption. Additionally, G7 economies agreed to cooperate on imposing export controls for some leading-edge technologies to address potential misuse.

China

Chinese stocks rose in a shortened week as positive news from the services sector and property market boosted investor confidence. The Shanghai Stock Exchange Index and the CSI 300 index gained 1.22% and 1.13%, respectively, in local currency terms. Markets were closed on Wednesday for the Qingming festival. The Caixin/S&P Global survey of services activity showed growth in March for the third consecutive month since pandemic restrictions were lifted in December. Meanwhile, the manufacturing gauge slowed to 50.0 in March, matching the official manufacturing PMI. The property sector also showed signs of recovery with new home sales rising 55.7% in March. China Evergrande Group, which was declared in default in late 2021, signed a deal with creditors to restructure its debt, potentially serving as a reference for other defaulted developers.

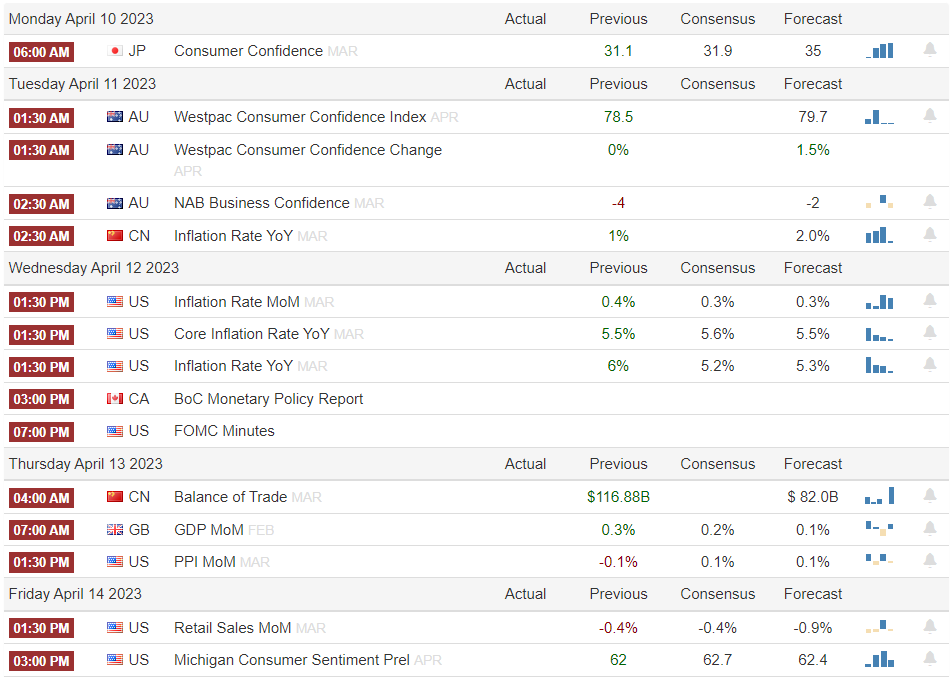

2. Week Ahead