Global Markets Recap - Week of Aug 21, 2023

1. What Moved the Markets?

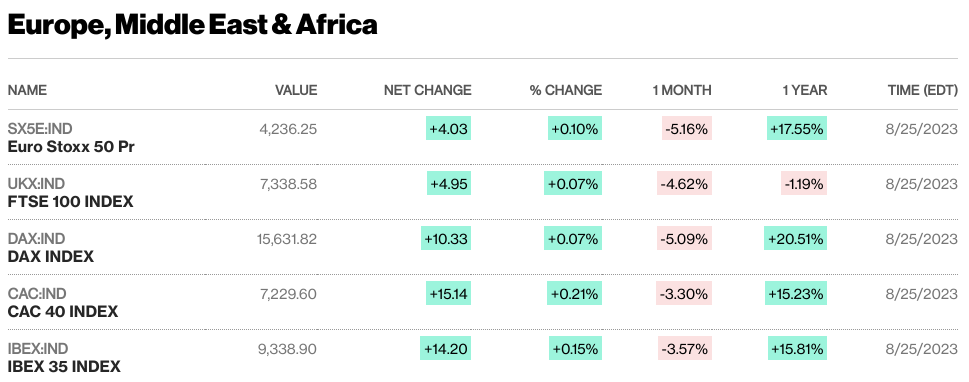

Europe

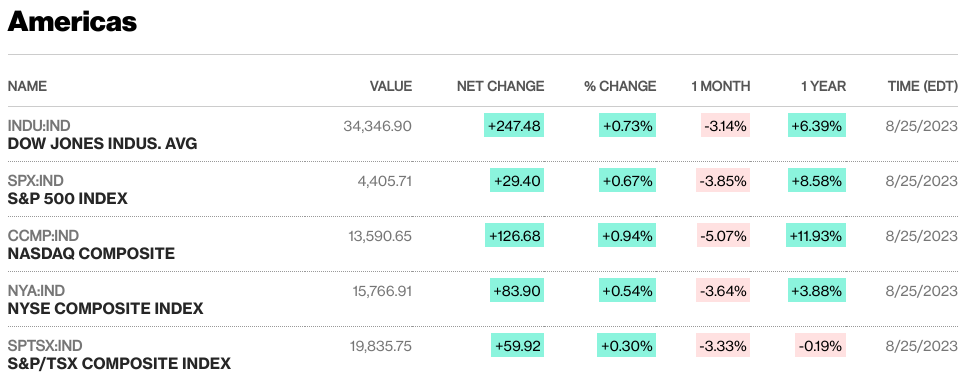

Indices Performance: The STOXX Europe 600 Index closed up 0.66%. Leading the charge were Italy's FTSE MIB (+1.61%), France’s CAC 40 (+0.91%), Germany's DAX (+0.37%), and the UK’s FTSE 100 (+1.05%).

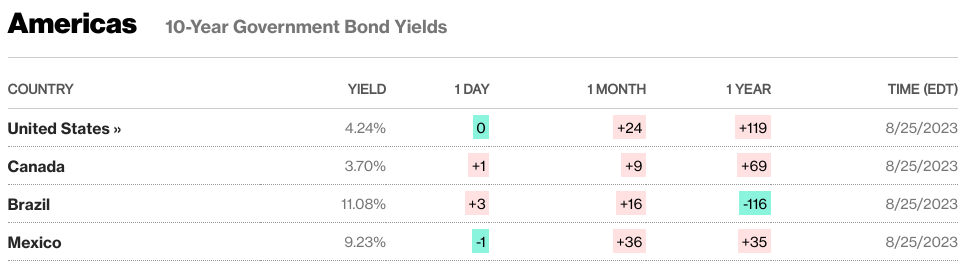

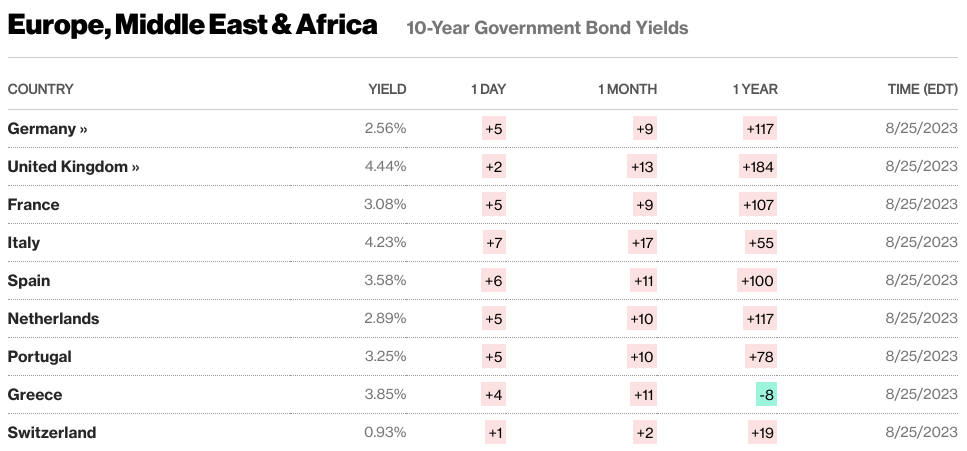

Eurozone Bonds: Yields, especially the 10-year German sovereign, dipped, suggesting a potential cooling of the European economy and revising future interest rate hike expectations.

Business Activity: Eurozone's contraction persisted. The Manufacturing PMI was 43.7, while the HCOB Flash Eurozone Composite PMI Output Index hit a 33-month low at 47.0.

German Economic Forecast: The Bundesbank hinted at a stagnant Q3, potentially marking two straight quarters of zero growth. The Ifo Institute’s index dropped for the fourth month, reaching its lowest at 85.7 since October 2022.

UK Business Health: August saw the UK's weakest business activity since January 2021, with the Flash UK PMI Composite Output Index at 47.9.

US

On Fed - 'higher for longer': Jerome Powell, during his speech at the annual symposium in Jackson Hole, acknowledged the influence of higher rates on slowing industrial production and wages. However, he maintained an optimistic tone on the economic growth trajectory and noted the rejuvenation of the housing sector after its recent stagnation.

Stocks: We are getting to the end of the earnings season. The stock market displayed varied benchmark returns this week as mixed cues on the economy and monetary policy affected investors. Growth stocks, particularly due to NVIDIA's earnings success, outperformed value stocks. Notably, S&P Global’s downgrading of five regional banks, primarily due to tensions in commercial real estate lending, saw financials retreat.

Retail Landscape: A cautious overview of the U.S. consumer’s health was seen as several retailers unveiled their Q2 results. Macy’s shares tumbled post their declining earnings announcement, paired with concerns over increasing consumer caution and mounting credit card delinquencies. Nordstrom, although surpassing revenue and earnings predictions, signaled a wary outlook, highlighting escalating late credit card payments. Additionally, Nordstrom, Dollar Tree, and Dick’s Sporting Goods lamented substantial store theft levels, impacting earnings.

Consumer Sentiment and Job Market: Despite August's consumer sentiment showing a slight dip from July's peak, according to the University of Michigan, strong income expectations, especially among the lower-income bracket, appear positive. Reinforcing the labor market's resilience was the jobless claims report with a notable 320,000 - a three-week low.

Business and Manufacturing: Durable goods orders hinted at rising business caution. Even though business investment in July (excluding defense and transportation) marked a 0.1% increase, June's revised 0.4% drop somewhat overshadowed it. S&P Global's manufacturing activity index for August also decreased, dipping further into contraction.

Housing: Despite soaring mortgage rates, July saw new home sales peak, the highest since early 2022. In contrast, the existing home sales regressed and missed projections.

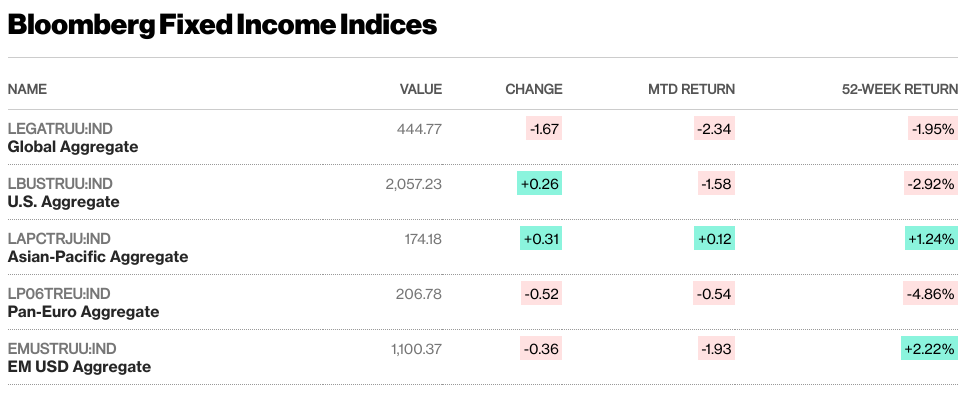

Yields: Equity and bond markets experienced significant fluctuations post-Powell's address. The benchmark 10-year U.S. Treasury note, which reached an intraday peak of 4.36% on Tuesday (its highest since 2007), settled roughly unchanged at 4.24% for the week.

Bond Market: The week was marked by limited issuance in the investment-grade corporate bond market in anticipation of Powell's address. Nevertheless, the few that made it to the market saw an oversubscription. The high yield and bank loan sectors seemed to hit pause ahead of the Jackson Hole conference.

Japan

While Japan witnessed a mixed bag of encouraging domestic data and global pressures, its bond and currency market developments remain key areas to watch.

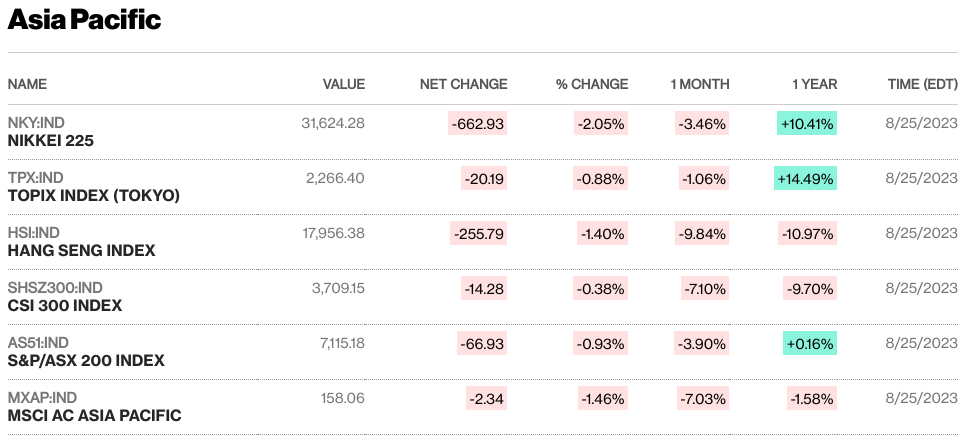

Equities: The Nikkei 225 closed the week with a modest 0.6% gain, while the TOPIX rose by 1.3%.

Economic Data: Positive domestic signals came as the August Flash composite PMI rose slightly to 52.6. However, factory activity continued its decline, albeit at a slowing pace. Core consumer prices in July jumped by 3.1%.

Global Factors: Early optimism from soft U.S. PMI data was overshadowed by concerns about China's economic slowdown and tensions regarding the Fukushima water release decision.

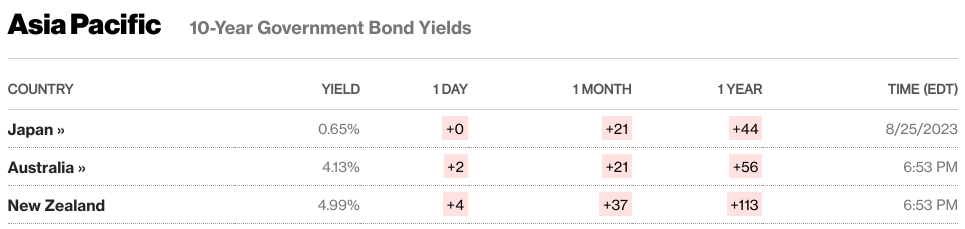

Bonds: The 10-year Japanese government bond yield touched a near-decade peak of 0.68% but retreated to 0.65% by the week's end, influenced by global economic cues.

Currency: The yen weakened, hovering around the low JPY 146 range against the U.S. dollar, reminiscent of its late 2022 levels.

China

Stocks Decline: The CSI 300 and Shanghai Composite Indexes dropped, hitting their lowest points since November 2022 and December, respectively. Despite a marginal uptick, Hong Kong's Hang Seng is also at its nadir since November.

Economic Woes: Concerns deepen due to unsatisfactory data, rising deflation, and an unprecedented youth unemployment rate. The property sector's liquidity crisis is exacerbating the situation.

Capital Flight: A net withdrawal of around USD 10.7 billion from the mainland market took place over 13 days, marking the longest streak since 2016, per Bloomberg data.

Property Sector: In light of declining home prices and developers defaulting, Beijing suggested allowing those with repaid mortgages to qualify as first-time homebuyers in major cities.

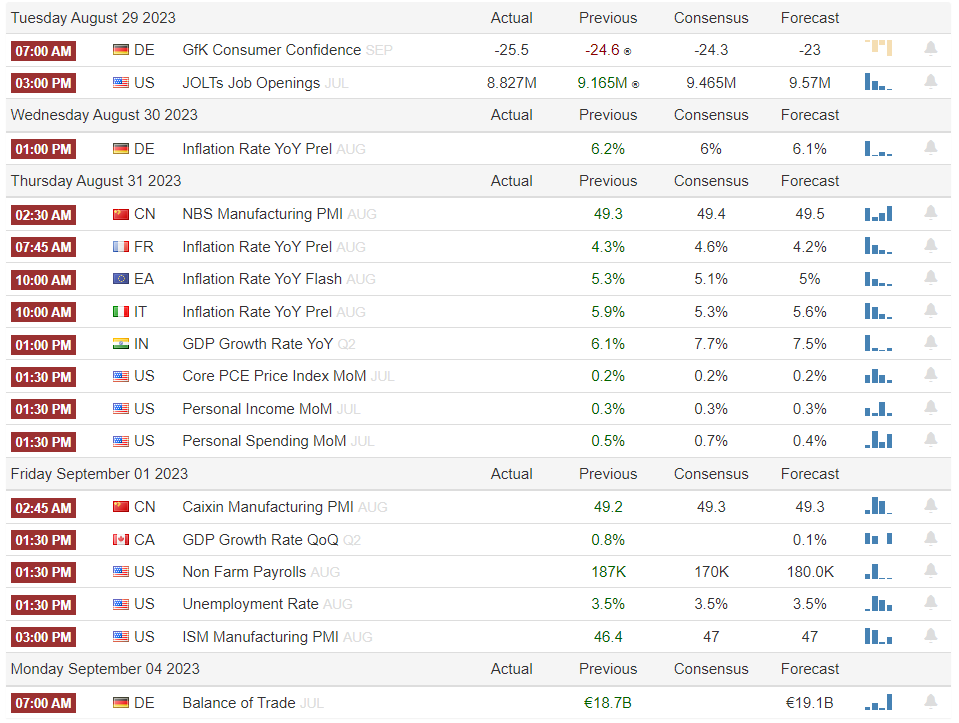

2. Week Ahead

![Obsidian Brief] When Money Becomes Software: AI, Stablecoins & Bitcoin — Implications for Sustainable and Impact Investing](/content/images/size/w720/2025/12/Gemini_Generated_Image_dppem0dppem0dppe.png)

![Leadership] AI Is Changing Everything — How a CEO Managing $1.6 Trillion Stays Ahead, ft. Jenny Johnson from Franklin Templeton](/content/images/size/w720/2025/12/Screenshot-2025-12-03-060128.png)

![AI] The Future of Work, Robotics & AI Infrastructure (Elon's bold predictions: work will be optional & currency could be irrelevant)](/content/images/size/w720/2025/11/Screenshot-2025-11-22-074621.png)