Global Markets Recap - Week of Aug 28, 2023

1. What Moved the Markets?

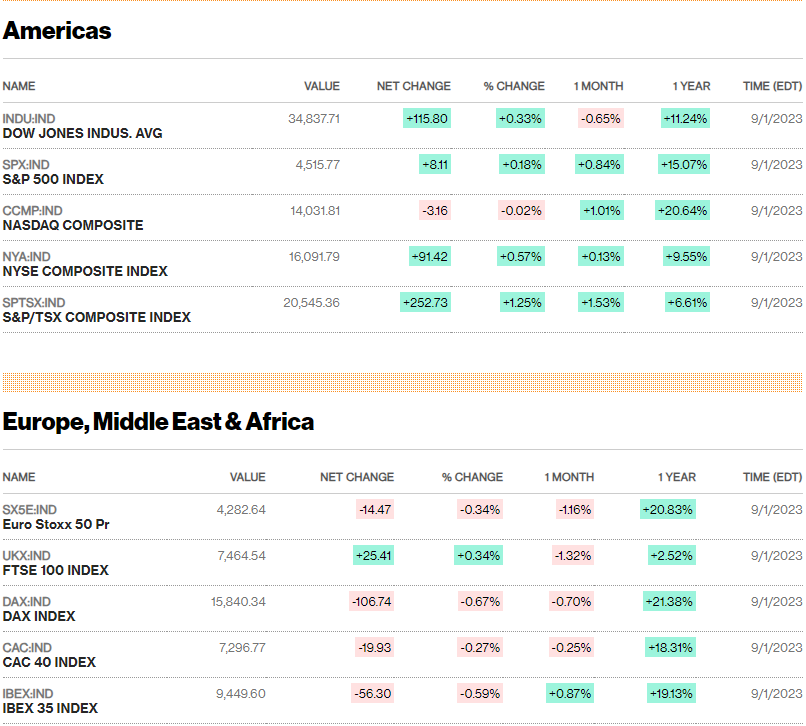

Europe

- STOXX Europe 600 Index ended 1.49% higher on hopes of peaking interest rates and a short-lived recession. European markets closed positively with Italy's FTSE MIB (+1.61%), France’s CAC 40 (+0.91%), Germany's DAX (+0.37%), and the UK’s FTSE 100 (+1.05%) on China's economic support.

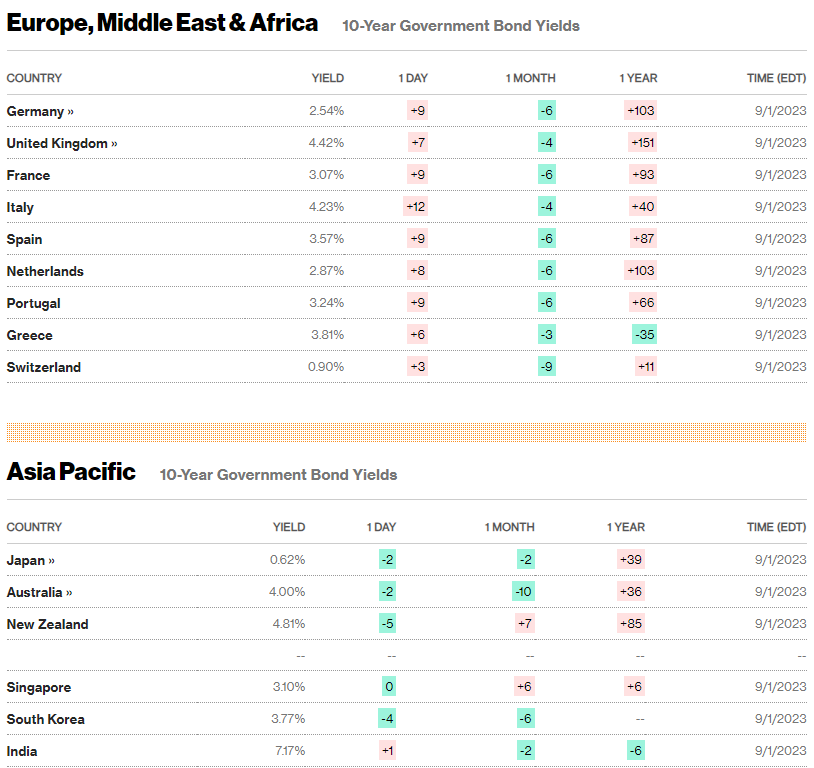

- European Government Bonds: Core inflation and policymakers' comments suggested ECB nearing the end of monetary tightening cycle. France and Germany's 10-year bond yields ticked lower, UK's 10-year sovereign bonds near one-month lows due to softer economic data.

- Steady Inflation and Unemployment: Eurozone's annual inflation at 5.3% in August, slightly higher than expected. Core inflation at 5.3%, matching projections, improved 20 basis points from July.

- ECB's Soft Landing Speculation: July's ECB meeting minutes highlighted strong labor market, hinted at soft

landing for slowing eurozone economy. Unemployment rate remained at record low 6.4% in July. - German Inflation Moderates; Retail Sales Fall: August's consumer price inflation at 6.1%, matching 14-month low in May. July's retail sales fell 0.8% sequentially, larger than the expected 0.5% decline.

- UK Mortgage Approvals and House Prices: July saw 10% drop in approved but uncompleted home loans. UK house prices fell 5.3% in August, largest decline since July 2009, according to Nationwide.

US

- Stocks Rose Amid Easing Inflation Fears: Positive inflation signals boosted major benchmarks despite the first negative month close since February. Lower long-term rates lifted growth shares by reducing future earnings discounts. Smaller-cap stocks performed well, narrowing the year-to-date gap with large-caps.

- Trading Volumes and Market Activity: Trading volumes rose towards month-end, yet market activity remained muted as summer vacations came to an end. Markets were closed for the Labor Day holiday.

- Paradoxical Economic Reaction: Economic downturn was viewed as positive for stocks due to rate implications. The S&P 500 recorded its best one-day gain after July's unexpected drop in job openings and quits, indicating a decline in the strength of the labor market.

- Unemployment and Job Market: The nonfarm payrolls report showed 187K jobs added in August, with previous months' gains revised lower by 110K. The unemployment rate reached 3.8%, the highest since February 2022. The labor force participation rate rose to 62.8%.

- Economic Hope Amid Slowdown: Hopes rose for the economy to avoid a significant slowdown in 2023, known as the "no landing" scenario. July's personal spending exceeded expectations, manufacturing activity improved unexpectedly, as well as overall business activity in the Chicago region.

- Fed's Rate Outlook: Atlanta Fed President's comments indicated the Fed might hold rates, boosting hopes of no further rate increase. The probability of the Fed remaining on hold for the year rose from 44.5% to 59.8% according to the CME FedWatch tool.

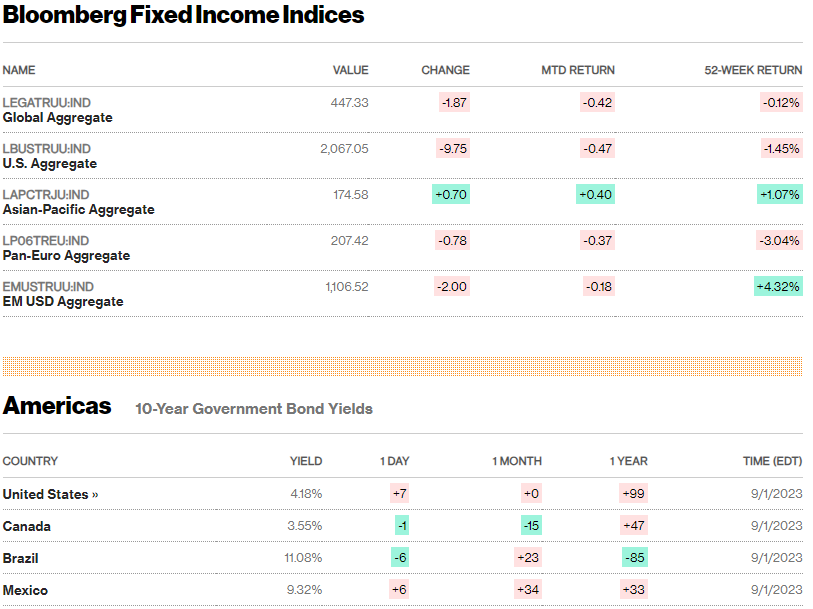

- Treasury Yields: Short-term Treasury yields dropped, the 10-year U.S. Treasury note's yield increased on Friday but ended modestly lower for the week. The fixed income market experienced a quiet week, with minimal corporate bond market activity.

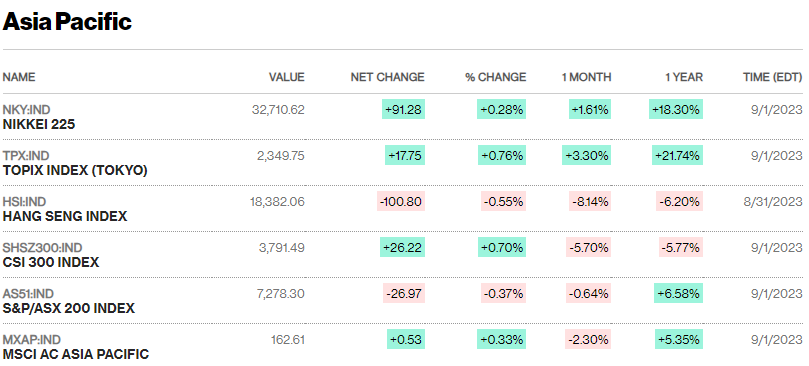

Japan

- Nikkei 225 Index and TOPIX Index rose 3.4% and 3.7% respectively. Weaker U.S. data hinted at Fed's rate hike pause, while China's measures for markets and economy boosted sentiment.

- 10-year Japanese government bond yield fell to 0.63% from 0.64%. BoJ's bond-buying operation before 10-year note auction weighed on yields.

- Yen strengthened to JPY 145.4 vs. USD, historic weakness sparked intervention speculation.

- Government Eases Fuel Costs: Japan pledged measures to ease record-high fuel prices, extending subsidies for oil wholesalers till year-end to curb inflation.

- Unemployment Rises, Capital Expenditures Dip: Unemployment unexpectedly rose to 2.7% in July. Global growth fears impacted Japanese firms' capital expenditures, lowest gain in five quarters.

China

Chinese stocks climbed on stimulus measures to revive economy. CSI 300 and Shanghai Composite Index rose. Hang Seng Index rose as typhoon closed markets.

- China's central bank cut foreign currency deposit reserves to 4% from 6%, freeing up foreign currency. Regulator reduced homebuyer down payments, urged lower mortgage rates.

- Policy Actions Reflect Concerns: Beijing's actions addressed economic concerns amid deflation, youth unemployment, and property sector slump.

- Developer Defaults and Contagion Worries: Country Garden and Evergrande reported potential debt defaults, raising fears of property sector impact on broader financial system.

- Economic Outlook and Policy: China's growth at 0.8% in June, trade slowing. Below-trend growth expected, property sector closely monitored. Room for further monetary policy easing due to weak growth and low inflation.

2. Week Ahead